|

Most the major producers of

flow and treat equipment and services are headquartered in developed

countries. The major exception is

China. Domestic companies such as

Neway have become international producers.

Neway is supplying high performance valves for critical applications

around the world. The big growth

markets are in India and other Asian countries along with Africa. The challenge for international suppliers

relying on the U.S. market is to adjust to the new reality and capture a

higher market share than they have in China.

The U.S. has an advantage

which is likely to be temporary. It is the largest combined producer of oil

and natural gas. This not due to having the largest reserves but to the

American technology which perfected hydraulic fracturing. The flow and

treat industry benefited with purchases for extraction, gas processing,

transmission, refining and petrochemical expansions.

The problem is that China has

more potential in shale oil and gas than the U.S. Other countries such as

Argentina are moving forward to develop shale potential. The economies of

China and India are growing faster than the U.S. Their combined population

is more than six times that of the U.S. When their per capita GDP reaches

just half of that in the U.S. their GDP will be three times that of the

U.S.

Africa will experience

economic growth as will developing countries in Asia and elsewhere in the

world. As a result, flow and treat

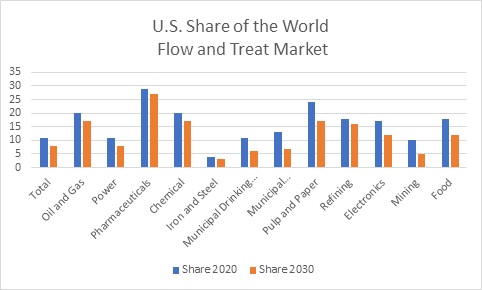

purchases in the U.S. are likely to drop from an 11 percent share in 2020

to an 8 percent share in 2030.

The biggest

loss of share will be in municipal wastewater. The U.S. has been slow to

invest in infrastructure whereas the rest of the world is investing in

treatment facilities which in some cases will exceed the quality of those

in the U.S.

The

developing countries will continue to invest in coal fired power over the

next ten years. China is upgrading

its plants so that they will be as clean as natural gas combined cycle

generators. The expenditure for flow

and treat products per MW of coal fired power is more than 40 times that

for wind or solar. As a result, the U.S. power plant flow and treat

revenues will represent just 8 percent of the total in 2030.

The

U.S. will benefit from the rapid growth of the biopharmaceutical industry.

Even though the world market share percent will drop the year to year

growth will be significant. However, the trend is away from stainless steel

products to those made from polymers for single use. Semiconductor and flat panel display manufacturing

will continue to grow in Asia. The U.S. mining flow and treat market share

will drop from 10 percent to just 5 percent as both coal and iron ore

production fall.

The

food industry has been a strong market for U.S. flow and treat

manufacturers. However, food processors are moving to where the people

are. Raw materials such as palm oil

will continue to gain market share over other vegetable oils grown in the

U.S. cane will be a greater source of sugar than beets. The economics continue to favor sugar

cane as ways have been found to produce ethanol from the bagasse as well as

from the sugar itself.

Flow

and treat suppliers have to devise strategies around the slower growth in

the U.S. market compared to the rest of the world. Many of the purchasers

such as BASF and Arcelor Mittal are international companies. They will

increasingly centralize purchasing for plants around the world. Fortunately, for U.S. based suppliers,

many of the international purchasers are home based in the U.S. This

includes, food, oil and gas, and chemical companies.

Sales

strategies centered around companies rather than geographies will be more

cost effective. The development of

products which have lower total cost of ownership will be desirable in

order to meet local competition in the rest of the world. The initiative underway at Power-Gen this

week is an example of how companies can validate lowest true cost to local

purchasers.

Power-Gen

and the Most Profitable Markets

Power-Gen International (November 18-21 in New Orleans) will

include lots of flow and treat activity. There are a number of pump, valve,

instrumentation and pollution control stands and relevant speeches. A new

feature is the personal meeting program which helps set up meetings between

individuals.

The McIlvaine Company assists suppliers with the Most

Profitable Market Program www.mcilvainecompany.com. This

includes quantifying applications where the supplier has the lowest true

cost and can therefore generate the most profit. As a result, McIlvaine is

working with conference organizers, associations, media, end users and

others on True Cost Investigations.

This effort is continuous. The true cost data gathered for the

Dry Scrubber Users Group, INDA, the association of non-woven

producers, or Mission Energy (representing Indian power plants) is then

made available and expanded at exhibitions such as

Power-Gen. Much of the data is linked to articles in magazines

such as Power Engineering. One magazine, International

Filtration News, is taking a proactive approach with True Cost

Investigations as feature articles in each issue. This can be expanded with

true cost webinars for direct validation of cost claims.

McIlvaine was a scheduled speaker at the Power-Gen workshop on

the 18th relative to helping companies pursue the

international market. The workshop was canceled due to low

registration. On the other hand, there are Power-Gen events

all over the world where access will be available to international suppliers

through True Cost Investigations.

The Most Profitable Market is not only one where the supplier

has competitive true costs but where he can validate

them. Exhibitions such as Power-Gen and magazines such as Power

Engineering are vehicles for reaching the purchasers and

communicating the true costs. The investigations become some of the

evidence needed for the effort. The available Investigations for Power-Gen

include:

Updates: Contact information and

arrangements are being continuously revised. So, keep checking

this document.

Overview: This provides the schedule of

speeches, details on relevant exhibitors, and contacts for relevant

personnel.

Electrostatic

Precipitator Power Supplies True Cost Investigation

Gas Turbine Inlet

Filter True Cost Investigation

Turbine Bypass

Valve True Cost Investigation

Dry Scrubbing True

Cost Investigation

CCR True Cost

Investigation

FGD Recycle

Pumps

Improving

Limestone Scrubber Efficiency

This Power-Gen initiative is part of a collaborative program.

The program is a collaborative effort

involving associations, media, suppliers, consultants and the

power plant operators.

|

Effort

|

McIlvaine

|

Magazines

|

Conferences

|

Associations

|

Supplier

|

|

True Cost Investigation

|

|

x

|

x

|

x

|

x

|

|

Most Profitable Market Forecast

|

x

|

|

|

|

x

|

|

Lowest True Cost Claims

|

|

|

|

|

x

|

|

Indirect Validation

|

|

x

|

|

|

x

|

|

Direct Validation

|

|

|

x

|

x

|

x

|

Suppliers use the true cost validation and most profitable

market forecast to initiate a sales program which will validate their

claims of lowest true cost and result in high margin sales. From the

customer perspective the payment of the higher product prices is more than

offset by life cycle cost reductions and more efficient operations.

Bob McIlvaine can answer questions prior to and during the

show. You can reach him by cell phone at 847 226 2391 or email rmcilvaine@mcilvainecompany.com.

Activities

at the show are updated continually at

http://www.mcilvainecompany.com/PowerGen_2019/MPM/powergen_and_the_most_profitable.htm

Click here to un-subscribe from this

mailing list

|