Frac Sand Plant

McAlert

No. 1

January 10, 2018

|

|

Frac Sand Plant

McAlert |

|

|

No. 1

January 10, 2018 |

·

Frac Sand Plant Optimization

·

Recent additions to the Frac Sand Plant Decisions intelligence system

·

Markets

·

North American Frac Sand Conference

2019 Exhibitors

·

North American Frac Sand Conference 2019 Speakers

Frac Sand Plant Optimization

The objective of

The North American Frac Sand Conference 2019 will be to bring

the frac sand supply chain industry together to evaluate solutions for

overcoming the current market and logistical challenges of supplying frac sand

to well sites. A number of exhibitors and speakers will be addressing the

optimization of the frac sand

plants. The Mcilvaine company is collaborating with the organizers to provide

visitors with optimization

insights. A website entitled Frac Sand

Plant Decisions will be accessible

by all attendees. The conference

will be held at the George Brown Convention Center on February 26-27, 2019. A

list of speakers and exhibitors are

displayed at the end of this issue of Insights

https://www.frac-sand-conference.com/

The manufactured frac sand industry is booming and like other growing industries

is faced with new challenges regarding equipment selection, product quality and

regulations. Locating plants in the

Permian and other arid basins dictates water conservation. Minimization of

silica dust is another environmental driver.

Due to the fact that the raw sand quality varies continually and that sand

plants are required to alter processes to meet

different proppant demands there is

a need for instant application of high level expertise. The way to serve

this demand is explained at

Subject Matter Ultra-Experts become the Foundation

of the CFT Industry

The thesis is that sand plants in the future will be mostly operated and

maintained with remote expertise which is available from around the world 24-7.

There are three types of companies which need to adapt to this new business

environment

·

Companies with both the systems and components

·

Component companies

·

System companies

Andritz is a company which has both the systems and many key components such as

filter presses, belt filters, centrifuges, pumps, dryers, and controls.

Their challenge will to be to select subject matter ultra experts from

within the corporation and allow them to be effective

Hillenbrand is mostly a component company with

frackng sand screens, crushers, pumps, and valves. Their challenge will

be to acquire or collaborate with companies capable of providing the system

expertise

IAC is a systems company. They have a unique dryer and dust filter but they are

mainly buying the wet plant

components.

Their challenge is to extract the component expertise through

collaboration.

The collaborative potential in many corporations is relatively untapped due to

the size and history. Two of the

exhibitors at Frac Sand 2019 are

examples.

HAZEMAG will be displaying its Tertiary Impact Crushers HTI series designed for

the economic tertiary crushing of hard rock.

This company is part of the

Schmidt and Kranz which

also owns Fest (supplying automation) and Maximator who supplies high pressure

valves and pumps. Hazemag is also

partially owned by Sinoma. This leading engineering and design firm in China

supplies complete cement plants and has expanded internationally into multiple

industries. The challenge is for the

various entities in this web of companies to

effectively collaborate.

SWECO will be displaying its

various screens both for frac sands and for resin coating. SWECO is part of

M-I SWACO which in turn is a unit

of Schlumberger. This group has a

great deal of knowledge relative to needed frac sand properties as well as

knowledge about the operation and maintenance of pumps, valves, screens

and other eqiuipment used throughout the oil and gas processes

One of the biggest advantages for a large entity will be to share process

management and data analytics programs and knowledge

Collaboration among divisions is difficult.

However the access to common

decision systems and data eases the problem.

Frac Sand Plant Decisions

is being created to

facilitate this sharing among divisions, collaborating companies as well as the

consultants and end users. Here are

some sample entries

Recent additions to the Frac Sand Plant Decisions intelligence system

·

Black Mountain Sand Minimizes Water Use

(Market Dated: 1/2/2019)

·

Water Expenditures for Fracking Are Soaring

(Market Dated: 1/2/2019)

·

BJM Submersible Slurry Pump for Frac Sand Plants.

(Market Dated: 1/2/2019)

·

Midwest Frac Sand Producer Extends Pump Life with KSB

Parts

(Market Dated: 12/31/2018)

·

IAC Optimizes Frac Sand Dryer Operation

(Market Dated: 12/31/2018)

·

Superior Arland Facility Rotary Dryer Upgraded to 400

tph

(Market Dated: 12/27/2018)

·

Rotary and Fluid Bed Dryer Changes at Chieftain Sand

(Market Dated: 12/27/2018)

·

Frac Sand Drying Methods: Rotary vs. Fluid Bed

(Market Dated: 12/27/2018)

·

IAC Completes 2 frac Sand Plants in Poteet and

Monahans Texas

(Market Dated: 12/27/2018)

·

IAC Dual Feed Rotary Dryer Provides the Precise Frac

Sand Parameters Need and Saves Energy

(Market Dated: 12/27/2018)

Markets

Manufactured Frac Sand Transforming the Combust, Flow, and Treat Markets for

Granular Materials

Sand, gravel, crushed stone and sediment production and treatment generate

billions of dollars of annual revenue for suppliers of combust, flow, and treat

(CFT) worldwide. The market in the U.S. is changing considerably due to the

rapid growth in manufactured shale frac sand. CFT expenditures for manufactured

frac sand plants in the U.S. will exceed CFT expenditures for all the other

granular related activities.

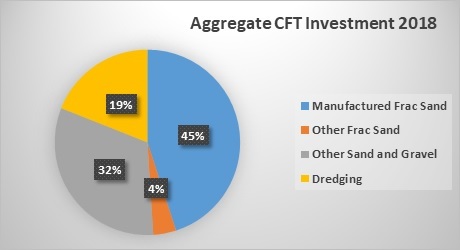

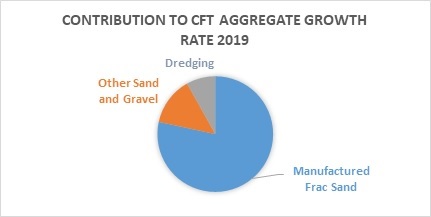

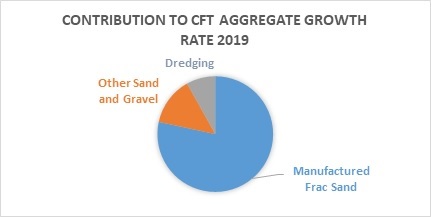

The importance of the manufactured frac sand on the U.S. CFT market is shown in

the following chart. The tons of manufactured frac sand is small but the CFT

expense per ton is high. Also the growth rate will be much higher than other

granular categories. As a result most of the revenue growth in 2019 will be in

manufactured sands.

|

U.S. CFT Expenditures for

Aggregate Production |

||||||

|

Granular Type |

2018 |

CFT Expense Ratio |

Factor |

% |

Growth Rate % |

Total Growth |

|

Manufactured Frac Sand |

50 |

20 |

1000 |

45 |

13 |

5.8 |

|

Other Frac Sand |

50 |

2 |

100 |

4 |

-1 |

0 |

|

Other Sand And Gravel |

700 |

1 |

700 |

32 |

3 |

1 |

|

Dredging |

400 |

1 |

400 |

19 |

3 |

0.6 |

|

Total |

1200 |

|

2200 |

100 |

|

7.4 |

The total production of frac sands in the U.S. will exceed 100 million tons this

year at an average selling price of over $60 ton creating a $6 billion market.

The revenues for CFT suppliers are much higher per ton of product because much

of the production is shifting to local manufactured sands. So the big cost is in

the processing and not the freight.

This fundamental shift in U.S. frac sand production is away from the Midwest,

home to the highest quality Northern White, to lesser-grade sands which are then

upgraded (manufactured). As a result, Northern White’s market share is expected

to be 43 percent in 2019, down from 75 percent in 2014,

Various granular products require dry or wet processes. Some require both. These

involve some combination of pneumatic or mechanical conveyors, pumps, valves,

scrubbers, fabric filters, precipitators, filter presses, centrifuges, dryers,

classifiers, fans, controls, and instrumentation.

In 2017, 890 million tons of construction sand and gravel valued at more than

$7.7 billion was produced by an estimated 3,600 companies operating 9,400 pits

and 360 sales/distribution yards in 50 States. Leading producing States were, in

order of decreasing tonnage, California, Texas, Minnesota, Michigan, Arizona,

Colorado, Washington, Ohio, Wisconsin, and New York, which together accounted

for about 52% of total output. It is estimated that about 44% of construction

sand and gravel was used as concrete aggregates; 25% for road base and coverings

and road stabilization; 13% as asphaltic concrete aggregates and other

bituminous mixtures; 12% as construction fill; 1% each for concrete products,

such as blocks, bricks, and pipes; plaster and gunite sands; and snow and ice

control; and the remaining 3% for filtration, golf courses, railroad ballast,

roofing granules, and other miscellaneous uses.

Crushed stone, the other major construction aggregate, is often substituted for

natural sand and gravel, especially in more densely populated areas of the

Eastern United States. Crushed stone remains the dominant choice for

construction aggregate use. Increasingly, recycled asphalt and Portland cement

concretes are being substituted for virgin aggregate, although the percentage of

total aggregate supplied by recycled materials remained very small in 2017.

Dredging may or may not involve more than just controls, pumps and valves. In

many cases sediment is contaminated and must be cleaned with filters and

separators. In the U.S. the amount of dredged material is around 200 million m3

or 400 million tons.

|

Region |

Percent of Global Dredging

Revenue |

Revenue |

Amount Dredged (Million m3) |

|

Europe |

0.12 |

1,284

|

265.29

|

|

Middle East |

0.11 |

1,177

|

364.40

|

|

China |

0.29 |

3,103

|

960.68

|

|

India |

0.04 |

428

|

132.51

|

|

Other Asia |

0.12 |

1,284

|

397.52

|

|

Africa |

0.07 |

749

|

231.89

|

|

North America |

0.09 |

963

|

198.97

|

|

Latin America |

0.10 |

1,070

|

331.27

|

|

Australia |

0.06 |

642

|

132.64

|

|

TOTAL |

1.00 |

10,700

|

3,015.17

|

The following market related articles have been extracted from the

Frac Sand Plant Decisions Intelligence System

Frac Sand in the United States—A Geological and

Industry Overview

There is a growing demand from the public, government agencies, and the energy

and mineral resource industries for credible information about frac sand and the

frac sand resource industry. More than 40 United States (U.S.) companies

(enclosed in this overview) are involved in mining, transporting, processing,

and distributing frac sands to a robust market that is fast-growing in the

United States and throughout the world. The need to reduce costs and ensure

continued and consistent supplies of frac sand has resulted in the acquisition

of frac sand mines by several petroleum producers and in collaborative

agreements between several frac sand suppliers and rail lines. A new mineral

rush is underway in the upper Midwest of the United States, especially in

Wisconsin and Minnesota, for deposits of high-quality frac sand that the mining

industry calls “Northern White” sand or “Ottawa” sand. Frac sand is a

specialized type of sand that is added to fracking fluids that are injected into

unconventional oil and gas wells during hydraulic fracturing (fracking or

hydrofracking), a process that enhances petroleum extraction from tight (low

permeability) reservoirs. Frac sand consists of natural sand grains with strict

mineralogical and textural specifications that act as a proppant (keeping

induced fractures open), extending the time of release and the flow rate of

hydrocarbons from fractured rock surfaces in contact with the wellbore. The

current sand mining surge has been driven by the boom in unconventional oil and

gas production that has been largely spurred by advancements in technology

promoting the expansion of hydraulic fracturing and horizontal drilling over the

past decade. Because of its superior quality, the sand of the upper Midwest not

only supports the majority of domestic oil and gas production, but it also

supplies frac sand to some of Canada’s western shale basins.

Revision Date:

12/20/2018

Tags:

211111 - Crude Petroleum and Natural Gas Extraction

原油和天然气开采,

211111 - Crude Petroleum and Natural Gas Extraction

原油和天然气开采,

Frac Sand, USA

The Early Dates of Shale Fracking in Argentina

The Vaca Muerta has gone “from a great opportunity to a fact.” The fact is that

the giant shale formation is beginning to deliver on high expectations,

according to German Macchi, Argentine country manager for PlusPetrol. The

equipment available for drilling and completions “needs to improve

significantly,” said Javier Gutierrez, global operations manager for Tecpetrol.

If not, “new operators coming into the Vaca Muerta will stretch those resources

to the breaking point.” The cost of drilling a well there is down by 50% or

more, but it is lagging behind the costs of the Permian Basin, where there have

been similar reductions from a lower base cost. “We are in a position within our

company where we are competing for capital,” said James Blaine, project

executive for international projects for ExxonMobil, adding that while the cost

of the Argentine operations run by its XTO division are high compared with the

Permian, “these are early days. Finding a low-cost local source of sand for

proppant is another unsolved problem. YPF reduced that expense from astronomical

levels by building a sand processing plant in the Vaca Muerta. The cost is still

relatively high, though, because the sand mined is on the other side of

Argentina. Astie said YPF is still looking for a sand source nearby that meets

its standards. In comparison, mines in the Permian now provide 25% of the sand

used there

Revision Date:

12/19/2018

Tags:

211111 - Crude Petroleum and Natural Gas Extraction

原油和天然气开采,

211111 - Crude Petroleum and Natural Gas Extraction

原油和天然气开采,

Techpetrol, Techpetrol, ExxonMobil, YPF, Pluspetrol

New Frac Sand Sources for Argentina

Argentina has been relying on frac sand imports coming from China, Brazil, and

the US, which has been extremely costly and makes hydrocarbon production at a

competitive price a challenge. Finding a more affordable sand source closer to

home has been, and continues to remain, a key focus in the country’s shale

development efforts. Fortunately, recent discoveries of sand suitable for

fracking have made domestic supply a reality. As a result, YPF built a frac sand

plant near the Vaca Muerta that mines local sand, reducing costs. And while the

frac sand source is domestic, but still far away enough to not be ideal; for

this reason, the company is still looking for a closer source that will reduce

costs even further. Other domestic sand projects are being sought as well “We

have been supplying frac sand dryers to the industry since hydraulic fracturing

started using frac sand in wells, but they’ve all gone toward the shale

revolution in North America,” says FEECO Process Sales Engineer Shane Le

Capitaine. “Now we’re getting an increasing number of inquiries in Argentina

from producers looking to set up plants. A lot of people are expecting the frac

sand industry to really take off down there and we’re ready for it.”

Revision Date:

12/19/2018

Tags:

211111 - Crude Petroleum and Natural Gas Extraction

原油和天然气开采,

211111 - Crude Petroleum and Natural Gas Extraction

原油和天然气开采,

Feeco, Manufactured Sand, Dryers, Argentina

Sand Transport Costs for Argentine Shale

Freight costs are significant: Chubut (Argentina) properties are within 1-day

trucking distance from: • Vaca Muerta (550 mi x $0.16/t/mi) = $90/t by road; •

San Jorge basin (300 mi x $0.16/t/mi) = $50/t by road; • Uruguay properties to

Vaca Muerta: • Container by sea ~1,000 mi (1,500Km): $25/t • Road transport (300

mi x $0.16/t/mi) $50/t • Total transport / tonne $75/t • Comparison: • China -

Puerto Madryn $2,500 - $3,000 per container of 25t = $100/t • ~55 day delivery.

Revision Date:

12/19/2018

Tags:

211111 - Crude Petroleum and Natural Gas Extraction

原油和天然气开采,

211111 - Crude Petroleum and Natural Gas Extraction

原油和天然气开采,

SA Silica Corp, Manufactured Sand, Argentina

Currency Problems may Slow Down Development of Vaca

Muerta

When Argentina’s currency plummeted by 50% this year, the oil sector started to

worry about a slowdown in the development of Vaca Muerta, the country’s biggest

shale play. The peso’s crash led the central bank to hike the benchmark interest

rate to 40% from 27.25%, pushing up corporate borrowing rates to as much as 70%.

The result? The 2,000 small and midsize services companies in Vaca Muerta are

facing hard times. “There are not many companies that can handle such a high

financing cost,” said Federico MacDougall, a director at First Corporate Finance

Advisors. The currency crisis, fueled largely by capital flight from emerging

markets after a hike in US interest rates in April, comes as field operators

seek to ramp up the development of Vaca Muerta. Argentina’s Pampa Energia

recently said it will lead a $520 million, five-year pilot project in the play

with ExxonMobil and Total. “There are a ton of opportunities for services

companies because the operators are demanding more and more all the time,”

MacDougall said. “But the service companies don’t have the capital and they are

worried about losing their current contracts and those that are to come.” Many

of these companies borrowed in 2016 as conditions improved in Argentina. The

right-of-center administration of President Mauricio Macri removed the capital,

currency and trade controls of its populist predecessors of 2003 to 2015.

Interest rates fell, funding became abundant and the economy revived. On the

other hand, operators have been trimming their well costs. YPF, the busiest

player in Vaca Muerta, has slashed its development costs per horizontal well to

below $12 million from nearly $30 million in 2015. Most of the operators are

large locals or multinationals with easier access to capital, meaning that,

despite the financial problems, they can still borrow in the single digits. With

the hike in financing costs for services suppliers, however, the progress in

bringing down overall costs to a target of US levels may take longer. How long?

The government has suggested the first signs of economic recovery will be seen

in the fourth quarter, but MacDougall said it could stretch well into 2019, a

presidential election year when investment traditionally is put on hold.

Revision Date:

12/19/2018

Tags:

211111 - Crude Petroleum and Natural Gas Extraction

原油和天然气开采,

211111 - Crude Petroleum and Natural Gas Extraction

原油和天然气开采,

ExxonMobil, Total, YPF, Investment, Argentina

Fast Growing Frac Sand Market and Shift to Local Sand

Michael Lawson, vice president of investor relations and corporate

communications at U.S. Silica, a producer of sand proppants and industrial

minerals. says “With oil prices hovering around $70 [per barrel], we’re on a run

rate [of frac sand demand] around 110 million tons [this year],” Lawson says.

“We expect to end the year around 120 million tons” Predictions are also made by

CDE and Mclanahan relative to the shift to local brown sand as opposed to

northern white sand which is costly to ship to sites in Texas

Revision Date:

12/19/2018

Tags:

211111 - Crude Petroleum and Natural Gas Extraction

原油和天然气开采,

211111 - Crude Petroleum and Natural Gas Extraction

原油和天然气开采,

McLanahan Corporation, CDE Resources, Inc., U.S. Silica, Sand

Frac Sand CFT purchasers include oil field operators, conglomerates and

privately held sand companies

There are essentially three categories of companies that supply sand: turnkey

oilfield operators like Halliburton, Schlumberger, and Mammoth Energy Services

that include frac sand as part of their offerings; privately held sand companies

including Vista Sand, Atlas Sand, Black Mountain Sand, Preferred Sands, and

Alpine Silica; and then there are the publicly traded sand companies. US Silica

was the longtime industry leader, with a market cap of $2.1B, and other

companies include Hi-Crush Partners LP (NYSE:

HCLP)

(market cap: $1B), CARBO Ceramics Inc. (NYSE:

CRR)

($272M), Smart Sand Inc. (NASDAQ:

SND)

($227M), and Emerge Energy Services (NYSE:

EMES)

($223.5M). A new frac sand leader

was born out of a merger of Unimin and Fairmount Santrol called Covia

Holdings Corp (NYSE:

CVIA),

with a market cap of $2.27B.

Liquid Treatment Market for Shale Fracturing Sand is Growing Rapidly

The use of centrifuges, filter presses, belt presses, screens, hydrocyclones,

thickeners, pumps, valves, cross flow membranes and treatment chemicals in

manufactured sand plants producing proppants for shale fracturing is growing

rapidly.

The techniques developed in the U.S. to fracture shale for the purpose of

extracting oil and gas are the foundation of the success of the U.S. economy in

the last decade. Developers have continually reduced costs with new techniques

such as horizontal drilling. The

transport of sand with the correct fracking features from Wisconsin and

Minnesota to West Texas has been very costly.

One of the most recent cost reductions is to manufacture high quality

sand from the lower quality resources available in the region.

The West Texas Permian Basin is relatively arid. Freshwater supplies are

limited. The new fracking sand mining plants in the basin add to the large water

demand already caused by the fracking process.

One solution for the fracking sites is the use of treated municipal

wastewater. Another potential is

the treatment and use of brackish water. Nevertheless fresh water will remain

the main source for the foreseeable future. As a result conservation becomes a

high priority. Fracking sand plant

suppliers have risen to this challenge by designing systems which

reuse as much as 98 percent of the process water needed.

Fracking’s water footprint could grow by up to fiftyfold in some regions of the

U.S. by the year 2030. The U.S. demand for water management services associated

with the acquisition, transport, transfer, storage, flowback, treatment and

disposal of water increased by nearly 50 percent over the last year at a cost of

nearly $20 billion. Water management spending for hydraulic fracturing services

in the U.S. is expected to total $150 billion over the next decade.

Sand mining plants are tasked with

minimizing water use.

There were at least five sand mines opened in the Permian Basin by Hi-Crush,

Black Mountain Sand and U.S. Silica in 2018 with a proppant supply of 35 billion

pounds per year. Many more mines are expected to be opened soon.

These mining plants can be designed to reuse nearly all the water with

technology such as filter presses instead of settling ponds. Various treatment

chemicals such as flocculants can result in very dry waste solids and little

water loss.

Black Mountain Sand provides an example of how water use can be minimized at its

Permian Basin mines.

Instead of routing the used, turbid water into settling ponds, the system

captures it in a settling tank where solids are concentrated into a mud

containing anywhere from 25 to 35 percent solids. Next, this mud is pumped at

high pressures into filter press membranes where filter press technology

squeezes water out of the solids. Thus, instead of losing water to evaporation

and ground seepage, the system feeds

this recovered water back into the holding tanks to be used again and again. In

addition, the wet sand is stored in a

specially-designed decant building while awaiting final processing in the

dryers. This step helps prevent water evaporation while promoting efficient

draining; as water drains from the sand, that water is funneled through a

drainage system in the floor directly back into the holding tanks. All told,

Black Mountain Sand recycles and reuses up to 98 percent of the water used in

its operations.

The challenge for designers of these sand plants is that both the parameters of

the incoming sand and the proppant end use change continually.

The control system and each of the CFT components

has to be integrated with the changing

production needs.

Manufactured Frac Sand Plant Courtesy of IAC

Bob Carter, president of IAC, a supplier of sand plants for the region, was

asked how his company addressed the

challenge of process variations.

Bob explained, “IAC introduced the concept of optimizing a plant performance

including components at every point in

time based on the various control points of a plant. A given plant may have

multiple control points that become a limiting factor to the amount of feed that

can be sustained. A plant that is designed to run at 250 TPH at a given feed

gradation may be limited to 125 TPH with heavy clays, 205 TPH with excess fines

or 180 TPH with heavy 40/70. Modeling the effect of each control point allows

for the optimal sustained feed rate to be identified for a given area of the

mine or mine blend ratio. The optimization of the plant prevents unplanned

shutdowns and minimizes the amount of water wasted due to not operating the wet

plant in its optimal state. It is just like a car, if you push it to high speeds

up hill, the miles per gallon of the vehicle drops. If you run a wet plant

inefficiently based on its mine reserve, you waste more water than is required.”

The market for specific CFT

components for manufactured frac sand for the U.S., Argentina, China and other

countries is shown at

N008

Scrubber/Adsorber/Biofilter World Markets

N021

World Fabric Filter and Element Market

N031

Industrial IOT and Remote O&M

N028

Industrial Valves: World Market

N024

Cartridge Filters: World Market

N006

Liquid Filtration and Media World Markets

N005

Sedimentation and Centrifugation World Markets

N026

Water and Wastewater Treatment Chemicals: World Market

North American Frac Sand 2019 Exhibitors

·

Tarmac International, Inc.

·

SWECO

·

Turnkey Processing Solutions

·

Ecofab Covers International Inc.

·

Kahler Automation

·

Industrial Accessories Company

·

Hazemag

·

Warrior Mfg L.L.C.

·

Market & Johnson

·

AIRIS Wellsite Services

·

Technos, Inc.

·

Elgin Separation Solutions

·

MoistTech Corp.

·

Site Solar

·

ASM Engineering Consultants

·

Cintasa Americas

·

Vertical Software Inc.

·

ASI Industrial Inc

·

Louisville Dryer Co

·

AGI Industrial

·

Sinto

·

Derrick Corporation

·

Timpte, Inc.

·

Hayes & Stolz Ind. Mfg. Co., LLC

·

RTD Enterprises

·

W.S. Tyler

·

CDE Global Inc.

·

ShaleApps

·

TMT Solutions

·

Shuttlewagon

·

Agra Industries

·

Gerard Daniel Worldwide, Inc.

·

Sierra Dust Control, LLC

·

Dragon Products

·

J&H Equipment, Inc

·

Kennametal, Inc.

·

Advantage Industrial Systems

·

Sensortech Systems, Inc.

·

Astec, Inc

·

RRIG Water Solutions

·

Fontaine Trailer Company

·

EnDeCo Engineers, Inc.

·

Tinsley Company

·

Presto Geosystems

·

Detechtion Technologies

·

Maxi-Lift, Inc

·

Catapult

·

Lonquist Frac Sand Services

·

Preferred Process Solutions

·

ROMCO Equipment Co.

·

S-M Enterprises Inc.

·

TechStar

·

Terex Washing Systems

·

Jingkun Chemistry Company

·

Industrial Project Solutions

·

Seed Technologies Corp

North American Frac Sand 2019

Speakers

§

Steve Sashihara

Princeton Consultants

§

John Allegretti

Arrows Up, Inc

§

Brandon Hodges

TMW Systems Inc

§

John Hinesley

Meritor Heavy Vehicle Systems LLC

§

Steve Robins

§

Pressure Systems International

§

Mike Flinn

Solaris Oilfield

§

Christopher Robart

IHS Energy

§

Adam Borden

Gulf Winds International

§

Jeff Kralowetz

Argus Media Inc

§

Todd Bush

Energent Group

§

Tony Little

Fortress Proppants

§

Tim Leshchyshyn

Frac Knowledge

§

David Boardman

Stockpile Reports

§

Tim Sheehan

Eriez Flotation

§

Chris Favors

Maalt LP

§

Bob Carter

§

IAC