Three Webinars to assist PacifiCorp in selection of NOx reduction

Technology

PacifiCorp

now has to install equipment to meet regional haze requirements impacting 4 x

350 MW coal-fired boilers in Utah. The company is investigating the possibility

of installing alternative technology rather than conventional SCR to meet the

0.06 lbs./MMBtu NOx target. The utility personnel have been

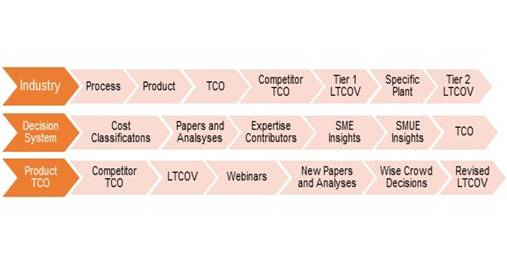

utilizing the McIlvaine Power Plant Air Quality Decisions (PPAQD) to help

determine a course of action. They have determined that a number of alternatives

outlined in PPAQD could be applicable.

PacifiCorp has assembled a very knowledgeable group of researchers and

consultants in this endeavor. There is some potential research funding available

to help them validate some of their conclusions as they move forward in the

decision process.

McIlvaine is providing free services to coal-fired power plants to help them

make air, water, combustion and other decisions. McIlvaine will be conducting

three webinars for PacifiCorp.

The first webinar on July 14 will identify the range of opportunities with the

goal of reducing in furnace NOx to 0.22-0.15 lbs./MMBtu and then use

back end technologies to reduce outlet emissions to 0.06 lbs./MMBtu.

The second webinar on July 19 will include in-furnace technologies such as

neural networks and combustion modifications to reach the 0.l22-15 lbs./MMBtu NOx

levels.

The third webinar on August 2 will explore ways to obtain the additional

reduction to .06-.07 lbs./ MMBtu NOx.

The webinars will be open to anyone. Already a large number of people designated

by PacifiCorp are registered. The format will be a review of information posted

in the PPAQD. McIlvaine welcomes contributions to the PPAQD prior to any of the

three webinars and then at any time in the future. Utilities and subscribers

have continuing access to the system and receive weekly Alerts relative to new

content.

PacifiCorp would prefer proven methods. However, McIlvaine contends that the

best solution may have been proven in some manner other than installation on

similar coal-fired power plants.

McIlvaine was president of Environeering in 1970 when it partnered

with United Engineers to provide an MgO sulfuric acid recovery

system to Philadelphia Electric. This system was based on

Environeering MgO systems already operating in pulp mills. The conditions were

identical and so it was not deemed necessary to conduct pilot plant studies. The

system was successful and followed by additional systems at other Philadelphia

Electric plants.

In 1965, Environeering partnered with Combustion Engineering to

develop limestone scrubbing for coal-fired power plants. A $ 25 million R&D

program resulted in the world’s first large scale demo plant (125 MW) at

Union Electric Merrimac Station in 1968. Even after all the R&D and

pilot work there were many unforeseen problems which developed in the scale up

from pilot to 125 MW. The contrast between the successful MgO installation and

the problem plagued first limestone installation can serve as a guide.

One option for PacifiCorp is to use SNCR and in duct SCR as has been applied by

LP Amina in coal-fired power plants in China and by Fuel Tech in

plants elsewhere. How identical are the conditions to these installations?

Catalytic filters from FLSmidth are now being sold for cement

plant applications. They use fiberglass bags with embedded catalyst. Several

other companies including W.L. Gore and Filtration Group also

offer catalytic filter elements. There are hundreds of installations in biomass,

glass, and small coal-fired boilers. Is there enough experience and are the

conditions similar enough to extrapolate bag life? There is some time for the

installation of some catalytic filter units in the existing baghouse to help

determine life expectancy.

LoTOx and Pernoxide are attractive because the cost per ton of NOx

removed is the same whether you are moving from 0-20 percent removal or 70-90

percent removal. DuPont has sold 30 LoTOx systems for refinery

catalytic cracking processes. Is this experience sufficient?

You can register for the three webinars at

Click here to Register for the Webinars

$600 Million Market for Gas Turbine Air Filters

The market for air filters for gas turbines will climb to $600 million per year

by 2021. This is the conclusion reached by the McIlvaine Company in

N022 Air Filtration and Purification World Market.

Much of the growth will be for installations located in coastal environments.

Each of these planned projects is tracked in

59EI Gas Turbine and Combined Cycle Supplier Program.

The high growth regions have a greater ratio of plants located on sea coasts.

This environment with salt and humidity requires special filter design.

McIlvaine has created a gas turbine air filter Decision Guide to help end users

select the right air filter for specific conditions. The key is the use of

filter media which can withstand the humidity and prevent the carryover of salts

to the turbine. It is also necessary to design the balance of the inlet filter

house to resist corrosion.

Many utilities are focusing on the coastal problem. Israel Electric has 31 gas

turbine systems, all of which are located on coasts. Victor Litinetski,

senior gas turbine specialist with the company discussed a successful

installation in a coastal environment using advanced air filtration last month

at PowerGen Europe.

There will be a number of new coastal gas turbine installations in the U.S.

California has a number of plants slated for operation in the next few years.

|

Location |

Title |

Start |

|

Ventura County |

2020 |

|

|

Ventura County |

2020 |

|

|

San Bernardino County |

2018 |

|

|

Orange County |

2020 |

For more information, click on

N022 Air

Filtration and Purification World Market

For more information, click on

59EI Gas

Turbine and Combined Cycle Supplier Program

India Flow Control and Treatment Revenues will reach $12 billion in 2017

Flow control and treatment revenues in India will grow by more than 8 percent

this year and reach $12 billion in 2017. The Indian economy is now the

world’s 9th largest. GDP growth is forecast to exceed 7 percent.

In the air segment, revenues of $2.7 billion will be achieved in 2017. The

leading product will be fabric filters which are used in air pollution control

in many industries. Most of the revenues of $801 million for electrostatic

precipitators will be generated in the power industry. However, the power

sector will spend little on flue gas desulfurization (FGD) and NOx

reduction.

Industrial valve and pump revenues will be widely spread across industries such

as power, refining, municipal water and wastewater, chemicals, food, mining and

pharmaceuticals.

Liquid treatment revenues will reach $2.6 billion in 2017 with each of the four

segments sharing the market fairly equally. The big change over the last few

years has been the increased market share for cross-flow membranes.

For more information on the

Gas Turbine and Combined Cycle Supplier Program, click on:

http://home.mcilvainecompany.com/index.php/markets/28-energy/610-59ei

For more information on the individual reports click on:

|

|

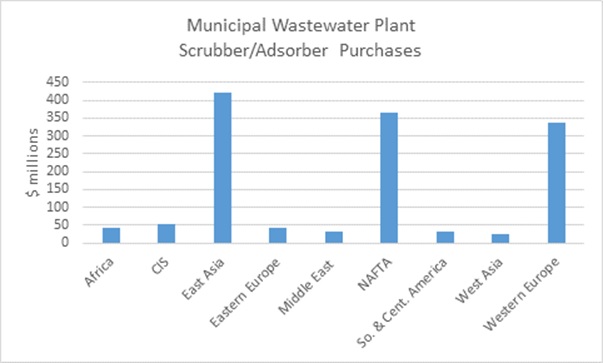

Municipal Wastewater Treatment Plants will spend $1.3 billion for Odor Control

Scrubbers Next Year

Municipal wastewater plants invest heavily in odor control scrubbers. Worldwide

purchases next year will exceed $1.3 billion. The largest regional

purchaser will be East Asia followed by NAFTA.

In East Asia the biggest expenditures will be for odor control at new plants. In

Western Europe and NAFTA, the biggest expenses will be to upgrade and repair

odor control systems at existing plants. Here are some examples from

recent McIlvaine North American Wastewater Treatment plant updates.

·

In Bangor, Auburn-based T Buck Construction will begin a $2.3 million project to

replace the Bangor Wastewater Treatment Plant’s biofilter media system and

repair the tower that contains the system. The projected lifespan of the

biofilter is about 12 years, but most layers in the Bangor tower have been

working nearly around the clock for 23 years. Only the top layer has been

replaced — twice in the past two decades. That top layer suffers the most wear

and tear because it’s exposed to the sun and elements.

·

Ludington, Michigan is purchasing a vapor phase odor control system as a result

of odor complaints from neighbors.

·

Short Elliot Hendrickson is engineering the odor control project for the Osage

Pre-treatment facility in Mitchell County. Odor control equipment has been

installed and should be operational as of July 5, 2016.

·

The Fresno-Clovis plant in Fresno, California just issued bids for an odor

control upgrade.

·

Norwalk, Connecticut has a $4.5 million capital budget to solve the odor control

problems from its South Smith Street plant. ARCADIS is working on the

project.

For more information on

N008

Scrubber/Adsorber/Biofilter World Markets

For more information on

62EI

North American Municipal Wastewater Treatment Facilities and People Database

Utility E-Alert Tracks Billions of Dollars of New Coal-fired Power Plants on a

Weekly Basis

Here are some headlines from the Utility E-Alert.

UTILITY E-ALERT

#1279 – July 1, 2016

Table of Contents

COAL – US

·

Three Webinars to assist PacificCorp in selection of NOx reduction

Technology

·

EthosEnergy uses Innovative Solution to complete Coal-Fired Plant Repairs in

North Dakota

·

Groundwater at Plant Yates contaminated

COAL – WORLD

·

Joint Venture SEPCO and Power Development Board of Bangladesh sign MoU for

Coal-fired Power Plant in Maheshkhali, Bangladesh

·

Egat reaffirms Coal-fired Power Plants for Thailand

·

Supporting renewables with Coal-fired Power Plants

·

GE agrees with Harbin to establish Coal-fired Power Station for $8 Billion in

Egypt

The

41F

Utility E-Alert

is issued weekly and covers the coal-fired projects, regulations and other

information important to the suppliers. It is $950/yr. but is included in the

$3020

42EI

Utility Tracking System

which has data on every plant and project plus networking directories and

many other features.

HOT

TOPIC HOUR (HTH) SCHEDULE

|

DATE |

HOT TOPIC HOUR

AND DECISION

GUIDE SCHEDULE

The opportunity

to interact on

important issues |

|

July 14, 2016 |

Desalination

Thermal vs. Membrane; energy

recovery, pump, valve,

compressor and chemicals

options; power/desalination

combinations. |

|

July 14, 2016 |

NOx Control for

PacifiCorp: Overview and Summary

of Low NOx Options

Discussion of options for

PacifiCorp to comply with new NOx

removal requirements for four

350 MW coal-fired generators

operating in Utah. The first

webinar will consider the range

of both in-furnace and back end

options. |

|

July 19, 2016 |

NOx Control for

PacifiCorp: Combustion

Modifications and Neural

Networks

Discussion of options for

PacifiCorp to comply with new NOx

removal requirements for four

350 MW coal-fired generators

operating in Utah. This second

webinar will consider the range

of both in-furnace options to

reduce NOx to between

0.15- 0.22 lbs./MMBtu. |

|

August 2, 2016 |

NOx Control for PacifiCorp: Back

end NOx Control

Discussion of options for

PacifiCorp to comply with new NOx

removal requirements for four

350 MW coal-fired generators

operating in Utah. This third

webinar will consider the range

of options such as peroxide,

ozone, and catalysis to reduce

emissions to 0.06 lbs./MMBtu. |

|

August 25, 2016

Markets |

Oil, Gas, Refining

-

Supply and demand; impact on

flow control and treatment

products; regional impacts

e.g. subsea in North Atlantic

vs. shale in the US vs. Oil

Sands in Canada. |

|

TBA

Markets |

Food

- Analysis

of 12 separate

applications within food and

beverage with analysis of valve,

pump, compressor, filter,

analyzer and chemical options;

impact of new technologies such

as forward osmosis. |

|

TBA

Markets |

Municipal Wastewater

-

Quality of pumps, valves,

filters, and analyzers in

Chinese and Asian plants; new

pollutant challenges; water

purification for reuse. |

|

TBA

Markets |

Mobile Emissions

-

Reduction in CO, VOCs, and

particulate in fuels, oils, and

air used in on and off road

vehicles; impact of RDE and

failure of NOx traps

and the crisis in Europe created

by the focus on clean diesel. |

Click here to Register for the Webinars

Details on Webinars

McIlvaine conducts periodic webinars which are in a discussion format and are

free of charge to all participants. The displayed material and recordings are

free to purchasers of the products and services and by subscription to others.

Format: 50-90-minute recorded discussion using McIlvaine display material.

The session will be free of charge to all participants but registration is

required.

Approach: There are two types of webinars. One is focused on Markets and

directed to suppliers. The other is focused on aiding purchasers make the best

Decisions relative to purchases of flow control and treatment equipment and

services.

Markets HTH

General overviews of the market including size and major variables will be

discussed with heavy emphasis on technology and regulatory drivers. The

presentation will be based on the latest information appearing in McIlvaine

multi-client reports. Questions and views from both subscribers and

non-subscribers are encouraged.

Decisions HTH

McIlvaine has been publishing information systems on pollution control since

1974. Each subject is organized by the pollutant control technology e.g. fabric

filter, scrubber etc. There are search capabilities to retrieve information on

any application. The newest addition has been slide deck systems displaying the

issues and options relative to specific applications. Coal-fired power, cement,

steel, and waste combustion decision slide decks are continually updated.

The continually updated slide decks are displayed on the applicable Decision

System. It is recommended that participants view the slide deck in advance

of the session and be prepared with questions and views.

Value to purchasers and specifiers: Your questions and interests will be

prioritized in the discussion. You will get a monthly newsletter and have

continuing access to the system and multiple ways to interface in the future

along with a networking directory of suppliers.

Value to Suppliers: You have the opportunity to provide data to be

considered at no charge. If you are also a subscriber you will see the summaries

in advance and be able to shed light on issues and options not properly covered

in the slide deck. If you are a subscriber you will receive the monthly

newsletter and continuing yearly access to the system including networking

directories.

44I Power

Plant Air Quality Decisions

includes 1ABC, 3ABC, 4ABC, 9ABC decision services but not 2ABC. So those with

multiple technologies and at least partial focus on power will find this

combination most cost effective.

|

Applicable Services for Hot

Topic Hours** |

|||||||

|

Pollutant |

Industry |

Fabric Filter

(1ABC) |

Scrubber

(2ABC) |

Precipitator

(4ABC) |

FGD & DeNOx

(3ABC) |

Air Pollution

(9ABC) |

Gas |

|

FGD and Acid Gas |

Coal |

|

|

|

X |

X |

|

|

Sewage |

|

X |

|

|

X |

|

|

|

WTE |

|

X |

|

|

X |

|

|

|

Cement |

|

X |

|

|

X |

|

|

|

Steel |

|

X |

|

|

X |

|

|

|

*Included in custom system |

|

Sponsored Webinars

allow suppliers to take

advantage of all the valuable

information on their power point

presentations. Click

here for details |

Free Sponsored Webinars

·

Albemarle

- Cement MACT

·

Aquatech

·

NVISTA

·

Midwesco - Bagfilter Performance

Analyzer

·

Pavilion

·

Sick Maihak

- Cement MACT

·

Tekran Instruments

- Cement MACT |

You can register for our free McIlvaine Newsletters at:

http://home.mcilvainecompany.com/index.php?option=com_rsform&formId=5.

Bob McIlvaine

President

847-784-0012 ext. 112

rmcilvaine@mcilvainecompany.com

www.mcilvainecompany.com