New Route to Reach Prospects in Flow Control and Treatment Applications

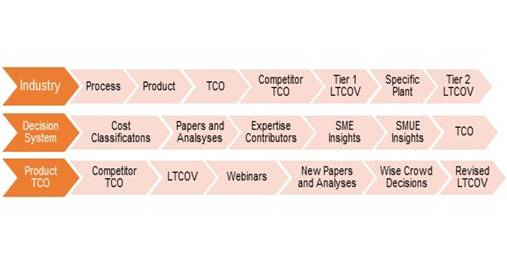

The sales process for air, water, liquid and gas flow control and treatment

equipment can be likened to a trip using GPS with a series of zoom steps.

It is all possible because of digital technology. There was a time when the

national road atlas was the major tool for a trip across country. To find

local information you had to stop and ask questions.

This older system can be likened to the most common market approach to flow

control and treatment: a general market report and a continuous flow of sales

leads. The general market report is used by senior management to set the course

but is not detailed enough to help set targets for individual sales people.

The deficiencies in this approach are:

·

A general report may not provide the best forecasts,

·

A report which is not continually updated is obsolete,

·

The specific relevant market segments may not follow general trends.

A general report may not provide the best forecasts.

A top-down general forecast is suspect. McIlvaine reports contain many

thousands of individual forecasts which aggregate to a general forecast.

How do you reliably determine the aggregate without determining the components?

The suppliers of these general reports claim to interview the experts and

analyze all the financial information. Any expert who does not have access

to all the individual forecasts is hampered in making a general forecast.

General reports typically rely on data provided by governments and associations.

These sources are good for determining the past but not the future. The most

useful data is very detailed. Use of government data which assess the

mining activity in each country is of questionable value compared to the use of

specific coal, iron ore, bauxite, potash, copper, gold and other mineral

production data. McIlvaine uses individual mineral forecasts. An approach which

tries to assess the mining opportunities generally in a region without a

specific breakout for each ore is flawed because mining activity varies widely

depending on the ore. Chile is a leading copper producer, whereas Canada

is a leading potash producer.

A report which is not continually updated is obsolete.

The sudden drop in oil prices resulted in an immediate need to evaluate and

change many flow control and treatment forecasts. The magnitude of the

drop and the remaining political uncertainties require continuous adjustment of

forecasts. It is desirable for management to set a flexible course for the

year but also to make periodic adjustments in advertising, promotion and

manufacturing based on revised forecasts.

The specific relevant market segments may not follow the general trends.

Flow control and treatment markets are frequently impacted by environmental or

other regulations. So the general industry trends do not reflect the markets.

The huge flue gas desulfurization (FGD) expenditures for pumps, valves,

scrubbers, monitors and belt filters are a function of regulations which impact

not only new plants but existing ones as well.

SALES LEADS: A large amount of money is spent on sales leads. They are

often too late if you are selling based on the best product rather than the

lowest cost. Since they are also provided simultaneously to competitors,

the unique value is diminished. Much of this expense can be avoided with

the new McIlvaine program:

Detailed Forecasting of Markets, Prospects and Projects

This program can be likened to the road trip with several zoom steps on the GPS.

The first step is to identify the markets which should be prioritized. McIlvaine

provides a number of standard reports on air, water, contamination and energy

markets:

MARKETS

The second step is to zoom in on the most relevant markets. Customized

segmentation provides forecasts which can be used at the individual salesman

level.

The next zoom step is to identify the large users and decision makers. The large

oil and gas, power, cement, food and mining companies buy the majority of the

flow control and treatment products. These companies should be a continuous

focus for the supplier.

The final zoom step is to focus on the projects being developed by the large

users, OEMs, and A/Es. The systems to provide this data are shown at:

Databases

Utility E-Alert Tracks Billions of Dollars of New Coal-fired Power Plants on a

Weekly Basis

Here are some headlines from the Utility E-Alert.

UTILITY E-ALERT

#1269 – April 22, 2016

Table of Contents

COAL – US

§

Dominion has One Year extension for MATS Compliance at Yorktown

§

Seven US Coal-fired Power Units get 1-year extension for MATS Compliance

§

Duke Energy shuts down Wabash River Coal-fired Power Plant in Indiana

§

James De Young Power Plant Holland, Michigan stops burning Coal

COAL – WORLD

The

41F

Utility E-Alert

is issued weekly and covers the coal-fired projects, regulations and other

information important to the suppliers. It is $950/yr. but is included in the

$3020

42EI

Utility Tracking System

which has data on every plant and project plus networking directories and

many other features.

McIlvaine

Hot Topic Hours (HTH) and Recordings

Explanation

Applicable

Services

Schedule

& Registration

Sponsored

Webinars

McIlvaine conducts periodic webinars which are in a discussion format and are

free of charge to all participants. The displayed material and recordings are

free to purchasers of the products and services and by subscription to others.

Format: 50-90 minute recorded discussion using McIlvaine display material.

The session will be free of charge to all participants but registration is

required.

Approach: There are two types of webinars. One is focused on Markets and

directed to suppliers. The other is focused on aiding purchasers make the best

Decisions relative to purchases of flow control and treatment equipment and

services.

Markets HTH

The general overviews of the market including size and major variables will be

discussed with heavy emphasis on technology and regulatory drivers. The

presentation will be based on the latest information appearing in McIlvaine

multi-client reports. Questions and views from both subscribers and

non-subscribers are encouraged.

Decisions HTH

McIlvaine has been publishing information systems on pollution control since

1974. Each subject is organized by the pollutant control technology e.g. fabric

filter, scrubber, etc. There are search capabilities to retrieve information on

any application. The newest addition has been slide deck systems

displaying the issues and options relative to a specific applications.

Coal-fired power, cement, steel and waste combustion decision slide decks are

continually updated.

The continually updated slide decks are displayed on the applicable decision

system. It is recommended that participants view the slide deck in advance

of the session and be prepared with questions and views.

Value to purchasers and specifiers: Your questions and interests will be

prioritized in the discussion. You will get a monthly newsletter and have

continuing access to the system and multiple ways to interface in the future

along with a networking directory of suppliers.

Value to Suppliers: You have the opportunity to provide data to be

considered at no charge. If you are also a subscriber you will see the summaries

in advance and be able to shed light on issues and options not properly covered

in the slide deck. If you are a subscriber you will receive the monthly

newsletter and continuing yearly access to the system including networking

directories.

44I Power Plant Air Quality Decisions

includes 1ABC, 3ABC, 4ABC, 9ABC decision services but not 2ABC. So those with

multiple technologies and at least partial focus on power will find this

combination most cost effective.

|

Applicable Services for Hot

Topic Hours** |

|||||||

|

Pollutant |

Industry |

Fabric Filter

(1ABC) |

Scrubber

(2ABC) |

Precipitator

(4ABC) |

FGD & DeNOx

(3ABC) |

Air Pollution

(9ABC) |

Gas |

|

Mercury

February |

Coal |

|

|

|

X |

X |

|

|

WTE |

X |

X |

|

|

X |

|

|

|

Sewage |

|

X |

X |

|

X |

|

|

|

Cement |

X |

|

|

|

X |

|

|

|

Natural Gas* |

|

|

|

|

|

|

|

|

DeNOx

March 24, 2016 |

Coal |

|

|

|

X |

X |

|

|

Incineration |

|

|

|

X |

X |

|

|

|

Steel |

|

|

|

X |

X |

|

|

|

Cement |

|

|

|

X |

X |

|

|

|

Diesel* |

|

|

|

|

|

|

|

|

|

Gas Turbine |

|

|

|

X |

|

X |

|

Hot Gas |

Coal |

X |

X |

X |

|

X |

|

|

WTE |

X |

X |

X |

|

X |

|

|

|

Cement |

X |

X |

X |

|

X |

|

|

|

Steel |

X |

X |

X |

|

X |

|

|

|

Incineration |

X |

X |

X |

|

X |

|

|

|

Coal Gas |

X |

X |

|

|

X |

|

|

|

GT Intake |

|

|

|

|

|

X |

|

|

FGD and Acid Gas

June 16, 2016 |

Coal |

|

|

|

X |

X |

|

|

Sewage |

|

X |

|

|

X |

|

|

|

WTE |

|

X |

|

|

X |

|

|

|

Cement |

|

X |

|

|

X |

|

|

|

Steel |

|

X |

|

|

X |

|

|

|

*Included in custom system |

Dates for the next 6 meetings are firm; the others will be held in sequence at

approximately two week intervals. Unforeseen developments could dictate

the insertion of new subjects.

|

DATE |

SUBJECT |

|

June

16, 2016

Decisions |

FGD and Acid Gas Separation

- Issue

and options for SO2 and other

acid gas separation from coal

fired power, cement, steel, and

waste incineration plants.

Click

Here to Register |

|

TBA

Markets |

Desalination

-

Thermal vs. Membrane; energy

recovery, pump, valve,

compressor and chemicals

options; power/desalination

combinations. |

|

TBA

Markets |

Oil, Gas, Refining

-

Supply and demand; impact on

flow control and treatment

products; regional impacts

e.g. subsea in North Atlantic

vs. shale in the US vs. Oil

Sands in Canada. |

|

TBA

Markets |

Food

- Analysis

of 12 separate

applications within food and

beverage with analysis of valve,

pump, compressor, filter,

analyzer and chemical options;

impact of new technologies such

as forward osmosis. |

|

TBA

Markets |

Municipal Wastewater

-

Quality of pumps, valves,

filters, and analyzers in

Chinese and Asian plants; new

pollutant challenges; water

purification for reuse. |

|

TBA

Markets |

Mobile Emissions -

Reduction in CO, VOCs, and

particulate in fuels, oils, and

air used in on and off road

vehicles; impact of RDE

and failure of NOx

traps and the crisis in Europe

created by the focus on diesels. |

Click here to Register for the Webinars

|

Sponsored Webinars

allow suppliers to take

advantage of all the valuable

information on their power point

presentations. Click

here for details |

Free Sponsored Webinars

·

Albemarle

- Cement MACT

·

Aquatech

·

NVISTA

·

Midwesco - Bagfilter Performance

Analyzer

·

Pavilion

·

Sick Maihak

- Cement MACT

·

Tekran Instruments

- Cement MACT |

----------

You can register for our free McIlvaine Newsletters at:

http://home.mcilvainecompany.com/index.php?option=com_rsform&formId=5.

Click

here to un-subscribe from this mailing

list