Industrial Valves World Markets Update

March 2019

McIlvaine Company

Achieving the Most Profit from Valve Sales

Management of valve companies continually

analyze and predict future profitability. Unit

margins have to be sufficient to exceed cost of

goods sold by an amount sufficient to cover

selling and administrative expense by the

targeted operating margin. In 2018 Crane cost of

goods sold was 64% of sales, gross profit was

36%. Income before taxes was 12%.

|

Category |

Crane |

Flowserve |

IMI |

Metso Flow |

||||

|

|

$ |

% |

$ |

% |

$ |

% |

$ |

% |

|

Net Sales |

3345 |

100 |

3832 |

100 |

1907 |

100 |

720 |

100 |

|

Cost of Sales |

2156 |

64 |

2644 |

69 |

|

|

|

|

|

Gross Profit |

1189 |

36 |

1187 |

31 |

|

|

|

|

|

Selling and General Expense |

721 |

22 |

943 |

25 |

|

|

|

|

|

Income before Tax |

411 |

12 |

176 |

5 |

251 (OP} |

13 |

117 (OP) |

16 |

|

Taxes |

76 |

2 |

51 |

1 |

|

|

|

|

|

Net Income |

335 |

10 |

119 |

3 |

|

|

|

|

Flowserve COGS and selling and general expenses

were higher than Crane. IMI income was 13% of

sales

Metso income in their flow division was $117

million which is 16% of sales.

In 2018 the Flowserve income before taxes was 5%

which is significantly lower than that of Crane.

This is an example of how profitability per

sales dollar can vary considerably company to

company. Flowserve has a history of innovation

which should result in high profit margins. The

company has focused on oil and gas to a greater

extent than Crane. Flowserve has suffered from

the downturn in several of its key markets.

The net margins for Flowserve in the next

several years should be much higher due to the

expanding oil and gas market and the amount of

infrastructure Flowserve has created to address

it. So some of the expenses in 2018 and prior

years will put Flowserve in a position to supply

products with a Lower Total Cost of Ownership

(LTCO) advantage.

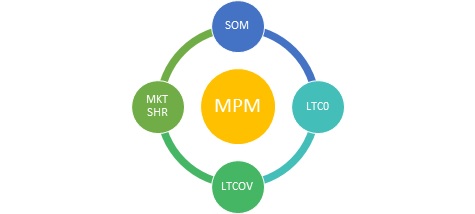

Companies spend much more time and effort

predicting various expenses than on analyzing

profitable markets. Income is a direct result of

profitable sales. The connection between the two

needs to be quantified. This is being achieved

with a new tool: Most Profitable Market (MPM).

The goal of valve companies is to maximize

profits. Market forecasts should be the

foundation of the business strategy. Instead

they are usually treated as a peripheral tool.

The reason is that market forecasts typically

quantify the Total Available Market (TAM) which

includes geographies and product requirements

which cannot be served. The reports are

customized at some expense to provide the

Serviceable Obtainable Market (SOM) which

reflects a market which can be served at some

profit margin even if meager.

Management does not want to be chasing orders

which have meager unit margins when there are

opportunities with high margins. By creating the

Most Profitable Market (MPM) forecast they

create a very valuable foundation for the whole

business program.

The MPM is defined as the market which yields

the highest profit given the resources and

knowledge available.

This market is some fraction of the SOM. The MPM

can further be defined as the market where the

company has the lowest total cost of ownership

(LTCO) at an attractive profit margin. The MPM

is further restricted to those opportunities

where Lowest Total Cost of Ownership Validation

(LTCOV) can be demonstrated.

The MPM is calculated based on the targeted

market share. The biggest potential target in

the U.S. oil and gas industry is light tight oil

(LTO) extracted through hydraulic fracturing of

shale. The 2018 forecast for Light Tight Oil

production in 2023 by IEA was 7 million bl/d.

The latest estimate by McIlvaine for light tight

oil production is 15 million b/d.

|

U.S. Valve Sales in the Oil and Gas Industry in 2023 |

||

|

Liquid Source |

mb/d |

SOM Valve Sales 2023 |

|

LTO ( hydraulic fracturing) |

15 |

1852 |

|

Gulf of Mexico |

1 |

123 |

|

Natural gas liquids |

6 |

741 |

|

Alaska |

0.3 |

37 |

|

Other |

2 |

247 |

|

Total |

24.3 |

3000 |

The $1.8 billion Light Tight Oil valve

opportunity involves mostly critical and severe

service applications. Cameron claims that its

frac sand gate valves have three times the

uptime of competitor designs. When you consider

downtime, labor, and repair part costs the

difference in total cost of ownership could be

substantial. Prices can be raised to reflect the

LTCO. Cameron has an easy route to LTCOV as a

division of Schlumberger, one of the largest oil

field suppliers.

Flowserve has been preparing for a big light

tight oil market and the related oil and gas

transport for more than a decade. In 2012 John

Lenander, vice president of oil and gas valves

(now President of Flow Control for

Flowserve) said timing depends on the level of

specialization, the amount of valves needed, and

pipe size. For example, 10 valves for 200 miles

of 42-inch pipe could be supplied in six to

eight months. But 60 valves for 1,200 miles of

42-inch pipe would more likely be quoted with

partial deliveries starting in six months, with

everything completed in about a year.

“We’ve been putting a lot of additional

resources into supply-chain management, project

management and engineering,” he said. At the

time Flowserve also was expanding plant

capacity. So by identifying the MPM market but

being off in timing Flowserve likely depressed

profit margins over last few years but could

more than compensate in the next decade.

Valve companies will want to use the MPM tool to

address both the current and future market. This

iterative process starts with management

establishing profit goals. MPM is then

established to achieve these goals based on

market penetration and unit margins. This is an

interactive process which involves assessment of

product capabilities in comparison to

competitors. It involves analysis of the MPM for

individual large customers. Chevron and

ExxonMobil have announced very large investments

in light tight oil recently. The valve company

has to assess its ability to achieve LTCOV for

its products with each of the major oil

companies. This requires input from the sales

people dealing with these companies. It also

involves detailed process knowledge. With the

completion of iterative process the MPM becomes

the foundation of the company business program.

N028 Industrial Valves: World Market provides

the Total Available Market. MPM will be derived

from TAM. This report has details by valve type,

industry and country. It also has TAM forecasts

for the largest 200 purchasers. This detailed

TAM information can be then used to construct

the MPM. McIlvaine can work with valve suppliers

to help them create the optimum MPM using the

TAM information in the valve report but also the

TAM information appearing in industry market

reports such as N049

Oil, Gas, Shale and Refining Markets and

Projects, Hydraulic

Fracturing MPM, N6F

World Cleanroom Markets, N027

FGD Market and Strategies and

other market reports listed at http://home.mcilvainecompany.com/index.php/markets

The MPM for individual prospects can be created

with use of N032

Industrial Plants and Projects, 62EI

North American Municipal Wastewater Treatment

Facilities and People Database, 67EI

North American Public Water Plants and People, 42EI

Utility Tracking System, 31I

Renewable Energy Update and Projects, 80A

World Cleanroom Projects, 59EI

Gas Turbine and Reciprocating Engine Supplier

Program,

and 44I

Coal Fired Power Plant Decisions

Forecasting Valve Purchases by each Major Owner

Most valves are purchased by large multi-plant

companies. It is more important to predict the

purchases by these companies than it is to

forecast purchases by country. These forecasts

are included in N028

Industrial Valves: World Market.

Sixteen companies home based in France and

Germany each spend more than $50 million per

year for valves. Five spend over $100 million

per year.

|

Valve Purchases by Large Companies Home Based in France and Germany - 2019 |

|||

|

Company |

Home |

Industry |

$ millions |

|

Air Liquide |

France |

Chemical |

84 |

|

EDF |

France |

Power |

583 |

|

Engie |

France |

Oil & Gas |

143 |

|

LaFarge Holcim |

France |

Stone |

72 |

|

Sanofi |

France |

Pharma |

50 |

|

Schlumberger |

France |

Oil & Gas |

57 |

|

Total Refineries |

France |

Refinery |

235 |

|

Total SA |

France |

Oil & Gas |

339 |

|

BASF |

Germany |

Chemical |

311 |

|

Covestro |

Germany |

Chemical |

65 |

|

Evonik |

Germany |

Chemical |

73 |

|

Heidelberg |

Germany |

Stone |

36 |

|

Linde |

Germany |

Chemical |

82 |

|

Merck |

Germany |

Pharma |

50 |

|

Uniper |

Germany |

Power |

51 |

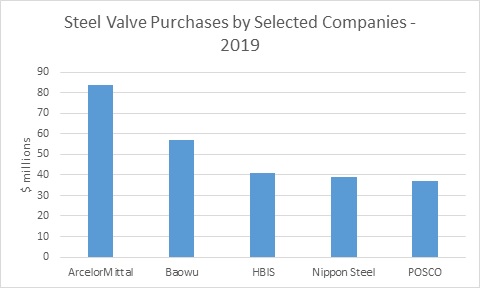

The steel industry is a good example of both

offshore ownership and centralized purchasing.

The world steel industry will spend over $1.7

billion this year for valves, parts, and

service. In the case of ArcelorMittal, the

majority ownership is by an Indian individual

but the decisions regarding valve purchases may

be made in Luxembourg which is the company

headquarters. ArcelorMittal is a major valve

purchaser. Its valve purchases for steel and

mining applications are just under $100 million

per year of which $84 million is for steel

applications.

Detailed Valve Market Share Forecasting

Detailed forecasting of market shares by valve

type and industry are available. Valve forecasts

are first segmented by control vs on/off and

then by eight valve types and then by fifteen

industries. This results in 240 forecasts for

each supplier.

There are no authoritative sources for valve

sales and certainly not for market shares. In

fact since many valves are sold through

distributors the supplier may not know how many

of his valves are being purchased by a

particular industry. However, it is well

worthwhile to create approximate segmentations.

A detailed analysis is much more valuable for

decisions relative to R&D, sales, and

manufacturing than a general forecast. Here is

an example showing estimated 2018 Metso globe

control valve sales.

|

Metso |

|

|

|

|

Globe - $ mil |

|

|

Industry |

On/Off |

Control |

|

Total |

|

|

|

Chemical |

|

35 |

|

Electronics |

|

|

|

Food |

|

|

|

Iron & Steel |

|

|

|

Metals |

|

|

|

Mining |

|

|

|

Oil & Gas |

|

43 |

|

Other Electronics |

|

|

|

Other Industries |

|

|

|

Pharmaceutical |

|

|

|

Power |

|

40 |

|

Pulp & Paper |

|

|

|

Refining |

|

39 |

|

Wastewater |

|

14 |

|

Water |

|

|

|

Metso 2018 Globe Control Valve Sales and Market Shares for Selected Industries |

|||

|

Industry |

Estimates of Metso 2018 Sales $ millions |

World Valve Sales $ millions |

% of total valve market |

|

Chemical |

35 |

1162 |

2.0 |

|

Power |

40 |

1739 |

2.3 |

|

Refining |

39 |

1606 |

2.4 |

|

Wastewater |

14 |

789 |

1.7 |

Estimated Metso sales range between 1.7% to 2.3

% for control globe valves in selected

industries. Market shares in some other

industry/valve type categories are just a

fraction of 1%. Metso is the 7th largest

valve supplier. Its total market share is 1.4%.

Its share in control valves is higher than in on

off valves.

Similar forecasts are available for the valve

types shown in the following chart.

|

Valve Type |

On/Off |

Control |

|

Ball |

x |

x |

|

Butterfly |

x |

x |

|

Check |

x |

x |

|

Gate |

x |

x |

|

Globe |

x |

x |

|

Plug |

x |

x |

|

Other |

x |

x |

|

Safety Relief |

x |

x |

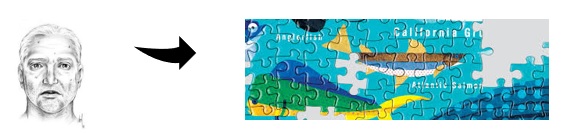

The accuracy of the forecasts and value are a

function of the amount of effort needed to make

the forecasts.

The output can be viewed as a range from a

police sketch through a 240 piece puzzle. The

least expensive is the police sketch. Some

details are known but the rest have to be

guesstimated. A victim is more likely to

identify a perpetrator if shown a sketch that

expands upon known details. The same is true of

valve market analysis. The total market share

estimate is best determined by aggregating the

240 components even if some of them are

uncertain but minor.

The ideal output is the 240 piece puzzle where

each of the components is known. This ideal is

rarely achieved. One of the challenges is that

each one of the 240 pieces is in turn something

between a police sketch and a clear picture. The

contours of the piece are created by drawing on

knowledge of each industry, each purchaser in

that industry, each process operated by each

purchaser, valve type preferences, and other

factors. For example there are component

listings for power plants in the McIlvaine’s 42EI

Utility Tracking System.

|

Knife Gate Valves supplier: |

|

|

startup |

plant name |

unit id |

utility name |

state |

reagent |

process |

size MW |

|

2006 |

Mitchell-AEP |

2 |

American Electric Power |

WV |

limestone |

wet |

816.3 |

|

2007 |

Mitchell-AEP |

1 |

American Electric Power |

WV |

limestone |

wet |

816 |

|

2008 |

Mountaineer |

1 |

American Electric Power |

WV |

limestone |

wet |

1300 |

Case histories and bidder specifications are

provided in the valve intelligence system which

is part of N028

Industrial Valves: World Market.

|

Article: |

|

|

Article: |

Metso metal

seated flanged

butterfly valve

for molecular

sieve switching |

|

Article |

Eliminating

Feedwater

Control Valve

Damage with

Multi-stage,

Multi-path

Flowserve

Control Valves |

Since many valve supplier decisions rest on

assumptions about the market and market share it

is well worthwhile to invest in market share

analyses even if it is only the equivalent of a

police sketch. The more accurate analysis can be

part of a program which also tracks purchases by

each major prospect.

VALVE DISPLAYS AT OTC

A number of valves

will be

exhibited May 6-9 at the Offshore Technology

Conference.

There will be

2000 exhibiting Companies representing 40+

countries (including divisions and subsidiaries)

and 23 international pavilions Exhibit net

square feet is 500,000+ sq. ft., including

outdoor exhibits Attendance is expected to be

60,000+

representing 100+ countries (includes

exhibit personnel) There will be

350+ technical presentations, 22 topical

breakfast and luncheons, and 11 panel sessions

ATV

supplies a full range of valves to API 6A, 17D,

6D and 6DSS for offshore applications such as

deep and ultradeep water, HPHT, HIPPS, highly

sour services. High tech, high quality and

State-Of-Art Manufacturing Equipment.

Italy

http://www.atvspa.com

Alco Valves Group,

for almost 40 years, have manufactured and

supplied an impressive range of valves to many

of the leading names in the Oil and Gas industry

both onshore and offshore; as well as supporting

other markets such as petrochemicals,

automotive, nuclear and defense. United States.

Asahi/America

manufactures customized electric actuator and

valve assemblies for the oil and gas industry.

United States

http://www.asahi-america.com

AUMA,

a leading company manufacturing electric

actuators, actuator controls and manual gear

operators for industrial valve application. AUMA

is the specialist for electric part- and

multi-turn actuators with more than 50 years

experience in valve automation. The company

manufactures it's products at two plants and

supports the products from three service

centers.

Germany

http://www.auma.com

Control Flow, Inc.,

Design, Manufacture, Repair, Service of Pressure

Control, Motion Compensation & Tensioner Equip

for Drilling, Production, Geothermal & Offshore

Pipe Laying industry. WesTech Tensioning/Pipe

Handling Equip; Flocon Valves, Wellhead,

Manifolds, BOPs; Mo-Comp Equip (OEM for Mo-Comp

Equip ABB Vetco Gray Design Purchased 1998) &

RETSCO Mo-Comp Products.

United States

http://www.controlflow.com

Dixon Valve and Coupling Co.,

manufactures and supplies hose fittings and

accessories spanning a range of industrial uses

including products for fire protection, food

processing, tankers, construction, chemical

processing, petroleum, oilfields, refining and

manufacturing.

United

States

http://www.dixonvalve.com

Dongsan Valve Co., Ltd.,

is one of the Korean leading manufacturers of

industrial steel valves. The valves are supplied

for a broad range of applications in the oil,

gas, chemical, petrochemical and ship-building

industries. The products include various types

of valves in different materials. They are

manufactured according to some internationally

accepted standards such as API, ANSI, ASME, DIN

BS, JIS and KS.

Korea

(South)

http://www.force-valves.com

ERREESSE Valves srl,

production range includes very versatile top

entry and side entry ball valves up to 72”

supporting extreme temperatures and pressures,

designed to handle severe service applications,

whether they are corrosive with acid solutions

or have higher cycle frequencies, they are an

excellent choice for shutoff applications and

processes in the Oil & Gas, LNG, Petrochemical

Industries. Italy

http://www.erreesse-valves.com/

Frontier Valve International,

is located in Edmonton, Alberta, Canada & is

recognized internationally for high quality

custom valves, ball valves, pig valves, inline

chokes, debris catcher and more.

http://www.frontiervalve.com

IVI

is a leading Indian manufacturers and Exporters

of Block and Bleed Valves, High Pressure Needle

Valves and Fittings, Instrumentation Valves,

Valve Manifolds and Instrumentation Fittings. We

are ISO 9001:2015 Certified and hold PED

2014/68/EU, ATEX 2014/34/EU, MSS-SP-99 and ASTM

F-1387.

India

http://www.ivimanifolds.com

YDF Valves,

was established in year 1978 and specializes in

the development of innovative design, through

intensive R&D programs. YDF’s main product lines

include Ball, Gate, Globe, Check, Butterfly and

Power Station valves, designed in accordance to

standard of ASTM, ANSI, API, BS, JIS and DIN.

China

http://www.ydfvalve.com

KCM Valve Co.,

Ltd, is one of oldest Chinese valve

manufacturers found in 1983,KCM has more than 34

years' experience making all range of industrial

valves. Especially for SS, DSS, SDSS, Exotic

alloy valves, like ball valve, gate valve, globe

valve, check valve, butterfly valves and plug

valve. KCM is one of suppliers of Sinopec, CNPC,

CNOOC, PEMEX, Petrofac etc.

China

http://www.kcmvalve.com

Leser GmbH & Co KG,

with 950 employees and 130,000 safety

valves produced per year, LESER is the largest

manufacturer in Europe and is a leading company

in its industry worldwide.

Germany

http://www.leser.com

Master Flo Valve,

established in 1979, Master Flo partners with

customers around the world to design and

manufacture surface and subsea choke valves,

control valves, actuation and complete flow

management solutions that lower costs and

optimize production over the life of their

field. Privately-owned, Master Flo is part of

the Stream-Flo Group of Companies.

United States

http://www.masterflo.com

Online Valves &

Online Cables are stockists & distributors of

pipeline valves, flanges, fittings, pipe,

gaskets, stud bolts, hubs, clamps & all types of

cables; for onshore & offshore, both topside and

subsea applications. We offer fast track

deliveries & considerable savings. We proudly

exclusively represent KentIntrol in the USA;

providing severe service control, surface chokes

& subsea valves.

United Kingdom

http://www.online-valves.com / online-cables.com

/ kentintrol.com

Parker Hannifin

is the world's leading diversified manufacturer

of motion and control technologies and systems,

providing precision-engineered solutions to the

offshore market. Together we can control your

systems in deeper waters, at higher temperatures

and pressures, in the harshest environments with

industry leading efficiency and reliability.

United

States

http://www.parker.com/otc

PBM

manufactures up to 12" reduced port, 150# class,

nickel aluminum bronze for ballast valves. They

are utilized for Bilge, Utility Seawater,

Sea-Chest, Injection Water, Pump Skids, & Water

Flood. PBM instrument, double block and bleed, &

transmitter isolation valves feature no gauge

ports, 2500# class, exotic alloys, & are API 607

Ed. qualified.

United States

https://www.pbmvalve.com

PJ Valves

Group offers the complete scope of valves and

piping to suit every project’s requirements. It

can source an array of valves, pipes, fitting

and flanges from its wide network of global

stockists and manufacturers. This includes

providing made-to-order product via third

parties for its piping range or direct from its

own manufacturing facilities for valves.

United Kingdom

http://pjvalves.com

RR Valve,

Inc designs and manufactures the industry's

finest Reset Relief Valves. With over 17 years

of continuous service to the Oil & Gas industry,

RR Valve's products are field proven to be more

reliable and cost effective than the

competition. New fully automated solutions are

available on multiple customizable platforms.

United States

http://www.rrvalve.com

Sesto Valves

Srl specializes in custom designed ball valve

solutions for the chemical, petrochemical and

energy industries. The philosophy is to make

valves that fit your application, not the other

way around. Sesto valves match materials and

trims to maximize performance and reliability,

with ready access to special coatings and exotic

or super alloys.

United States

https://www.sestovalves.com/

Shanghai Valve Factory Co.,

Ltd locates in Shanghai of China. The product

has been widely used in Oil, Natural Gas,

Chemical, Electrical Power, Steel, Construction,

and Lab Industries etc. Including gate valve,

globe valve, ball valve, butterfly valve, safety

valve, self-control valve and fittings with

ANSI, API, ASME, BS, JIS, DIN etc.

United

States

http://www.svf.com.cn

Shanxi Goodwill

was found in 2004. In the past 10 years, the

focus on manufacturing different types of open

die, close die forging, qualified chemical &

mechanical test, NDT, and fully precision CNC

machining. The products cover from forged valve

bodies, flanges, pipe fitting.

United

States

http://www.Goodwill-valve-fitting.com

SPX Flow

is a leading global supplier of highly

engineered flow components, process equipment

and turn-key systems, along with the related

after marked parts and services. Visit us at

Booth 409 to view our hydraulic equipment,

industrial pumps, valves, dehydration and

aftermarket services. United

States

http://www.spxflow.com

Suzhou Med Valves Co., Ltd,

MED is one professional valve manufacturer with

more than 20 years’ experience and obtained ISO,

CE, API 6D certificates. Our main product

includes ASTM, ANSI, API, BS, DIN standard ball

valve, gate valve, globe valve, check valve. MED

equip with most advance CNC machines and full

sets of in-house quality control system.

China

http://www.medvalve.cn

Valvitalia is a global leading designer,

manufacturer and supplier of all type of valves,

actuators, fittings, MIJ's, gas systems,

firefighting systems. Its products are installed

in 109 Countries all over the world.

Italy

http://www.valvitalia.com

Wenzhou Carol Valve Co., Ltd,

are a high qualified manufacturer of

valves-specializing in ball valves, gate valves,

globe valves, swing check valves, available in a

wide range of size and materials, and these

valves are used widely in petroleum, chemical

industry, electric station metallurgy, water

supply and municipal engineering and certified

O9001:2008,CE,ISO14001:2004,TS.

China

http://www.crolbv.com

Wenzhou Kasin Valve Pipe Fitting Co. Ltd.,

Kasin-Jie Erdun is a Professional Manufacturer

of RTJ Gaskets in China and certified by

API(NO.6A-1913). Main Products are BX Series, RX

Series, R Series, IX Series, and other Metallic

Gaskets.

China

http://www.kasinrtj.com

Zhejiang Fangdun Instrument Valve Co., Ltd,

established in 1990’s, a professional

manufacturer of tube fittings and

instrumentation valves with the brand FD-LOK.

China

http://www.fd-lok.com

Zhejiang Victory Valve Co., Ltd,

Victory Valve specializes in high pressure and

precision valves. Ball valve conform to ANSI,

DIN etc., and got ISO, API 6A,6D and API Q1

certificates. Victory has more than 100 sets of

imported CNC, matching center and has material

laboratory with imported equipment. Management

is safety in production and offer high quality

products and OTD.

China

http://www.victoryvalve.cn

Zhejiang Zhengqiu Valve Co. Ltd,

over 20 years industrial valves for oilfield,

gas, chemistry. API 6D & PED/97 and ISO9001

Approved. Also offering Oilfield Ball Valves,

Thread End Check valve, Forged Steel high

pressure Ball Valves, Flanged Ball Valves

(Floating and Trunnion type), Metal seat ball

valves. Size:1/2” to 42” Pressure:150LB to

2500LB.

China

http://www.goodballvalves.com

INTELLIGENCE SYSTEM UPDATES

Here are selected entries to the intelligence

system in the last month. All entries are

displayed in the following link

http://www.mcilvainecompany.com/valves/Subscriber/default.htm

Exxon Mobil Corp. plans to reduce the cost of

pumping oil in the Permian to about $15 a barrel

The scale of Exxon’s drilling means that it can

spread its costs over such a big operation that

the basin will become competitive with almost

anywhere in the world, Staale Gjervik, president

of XTO Energy, the supermajor’s shale division,

said in an interview with Bloomberg.

Black Sand recycles water

Black Sand's Permian mines are designed to

maximize water usage throughout the frac sand

manufacturing process. Two 1-million-gallon

freshwater holding tanks feed the system in a

closed-loop to wash and sort sand, which results

in a continual source of used turbid water.

Instead of routing the used, turbid water into

settling ponds, our system captures it in a

settling tank where solids are concentrated into

a mud containing anywhere from 25 to 35 percent

solids. Next, this mud is pumped at high

pressures into filter press membranes where

filter press technology squeezes water out of

the solids. Thus, instead of losing water to

evaporation and ground seepage, our system feeds

this recovered water back into the holding tanks

to be used again and again. In addition, our wet

sand is stored in a specially-designed decant

building while awaiting final processing in the

dryers. This step helps prevent water

evaporation while promoting efficient draining;

as water drains from the sand, that water is

funneled through a drainage system in the floor

directly back into the holding tanks. And, by

promoting better drainage before the drying

process, we save energy because our sand

requires less energy to be dried.

Lithium project in Chile is being fast tracked

by Lithium Power International

LPI is fast-tracking the development of

Maricunga and has submitted its Environmental

Impact Assessment (EIA) Report in September

2018. This was followed by a Definitive

Feasibility Study (DFS) submitted in 1Q19. The

first lithium carbonate sample has been produced

from Salar de Maricunga (Feb 18) at GEA

facilities in Germany. The brine was

concentrated at the pilot plant solar

evaporation ponds at the Maricunga site for

almost 12 months, and subsequently treated at

the GEA lab in Duisburg, Germany, to purify it

and precipitate lithium carbonate suitable for

battery grade specification similar to those

produced in Chile by Albemarle and SQM. The

process route is based on conventional

technology and comes with the know-how that

enables the process to scale up to commercial

production. The purity of the product is above

99.4%. The project has the potential for a

multi-decade mine life in its currently defined

resource to 200m depth, with the possibility for

substantial resource expansion in an exploration

target at 200-400m depth. Permitting and

government approvals are expected by 3Q19, with

the Chilean Nuclear Energy Commission Export

licence (CCHEN) awarded in March 2018. Project

financing is targeted in 2019 and the start of

construction in 2020. The site contains a link

to a complete investor presentation

Metso valves for lithium processing

In lithium

production, valves face challenges, such as high

temperatures, abrasive particles and

significantly high acidity levels In typical

flotation equipment, valves control the slurry

feed and discharge, reagent addition and water

flow. Knife gate valves are used extensively in

this application. For more demanding valve

installations, segment valves are a top choice.

Due to the segment design, there are

considerably fewer cavities in the valve

compared to ball valves, for example. As fewer

solid particles have a chance to settle within

the valve’s construction, the lifetime of these

valves is longer The natural gas feed for the

calcination process can be controlled with

different valve solutions, ball valves are among

the most typical ones. A mechanical filter press

is one option for the dewatering service. The

machine contains several valves: pinch valves

are typically used in the slurry inlet feed,

other valves used for water and air service are

often butterfly valves.

IAC tip for locating misfiring pulse jet

valve

A pulse valve

should give off a loud sound similar to that of

a gunshot. The valve should be exerting

compressed air in the range of 80-90 psi in

order to effectively clean the filters of excess

dust in the collector. The pulse should also be

short, as this reflects the released compressed

air. Locating a misfiring valve in a larger

system can be tricky as there may be hundreds of

pulse valves. The trick to finding the

problematic valve is very simple. Each pulse

valve has a breather hole located at the top of

the valve. The compressed air is released from

the breather hole of the valve. If the valve is

misfiring then it will not be exerting a

sufficient amount of pressure from the breather.

Cover all the breathers with tape and check them

the next day. If any breathers still have the

tape intact over the hole, this indicates that

the valve is not operating correctly. If the

pulse valve is indeed misfiring then the part

may need to be rebuilt or replaced. Keeping all

of the valves firing at the appropriate psi will

reward you with optimum performance from your

pulse-jet dust collector

Metso supplies life cycle equipment support

services for frac sand plants

The program

provides: 1. Scheduled equipment inspections

with Metso-trained and certified technicians,

plus parts and maintenance recommendations 2.

Equipment Protection Plan (EPP), providing you

an extended warranty on applicable equipment 3.

Wear and spare parts supply, with guaranteed

lead times and delivery plans 4. Metso Metrics

Services

Automation for hot mix asphalt plants needed

to make a high quality mix

“Systems control

centers --- are designed specifically for the

asphalt industry with an emphasis on rugged

construction, operator comfort and logical

integration of the plant controls” says Kenneth

Cardy, president of Libra Systems. “These

systems run and monitor all plant functions from

a standard PC, including blending operations,

plant motors, motor currents, mix and plant

temperatures, material inventory, silo levels,

energy usage and alarm status.” The latest

innovations in asphalt plant automation can be

attributed to the demand for more mixes using

more types of ingredients that need to be

carefully blended together in the process. "A

reliable controls system is an absolutely

necessary component in producing high quality

mix today," says Lien Gangte, controls engineer

at Astec . "It is not sufficient by itself but

without it quality becomes a dicey game at

best." Since some of these mixes are being

designed for government agencies that require

strict compliance, automation systems assist the

plant operator in keeping the plant running; and

also for the company owner to combine all the

ingredients and to ensure the mix meets the

required specs.

Death of the field sales person

There is a

requirement for field salespeople in some (but

definitely not all) markets now – and there will

always be circumstances where face-to-face

selling is indispensable. What are on their way

to extinction are environments where sales is

essentially an outside activity. Even in

engineer-to-order environments today (think

JSG), only a tiny percentage of the total volume

of activities required to originate and

prosecute a sales opportunity are performed in

the field. And those important field activities

would simply not occur if it were not for the

volume of work performed inside. The fact is,

sales today is an inside endeavor, supported, in

some cases, with discrete field activities.

Today, customers are no longer isolated from

their vendors. Vendors’ organizations are as

close as the nearest web browser. And fax

machines, private lines, email and instant

messaging have made it easier for customers to

communicate with representatives in

organization’s head offices than it is to

communicate with their salespeople.

China and India are leading cement producers

World cement production was 4.1 billion tons in

2017 with China producing 2.4 billion tons.

India clinker capacity was 280 million tons but

production fell 10 million tons from the

previous year to 270 million tons. But this is

still 3 x the U.S. production

Lafarge Holcim reports increased volume and

benefits from digitalization in 3rd quarter 2018

CEO reported Excellent progress in volume of

5.1% and topline of 6.5% for Q3 2018 › Improving

pricing trends › Better capacity utilization ›

Increasing benefit from alternative fuels and

raw materials mitigating rising energy costs ›

First benefits on maintenance and efficiencies

from digitalization of factories › Selected

investments in Growth Plus markets

CFS provides water and wastewater design

including frac sand plants

CFS provides solutions that meet current and

expected future environmental requirements. From

treatment plants to waterline restorations, CFS’

experience includes project development from

funding through construction of specific

facilities. Specific Utility Services CFS offers

include: Wastewater/Water Collection, Biosolids

Management, Manhole/Sewer Rehabilitation,

Sanitary Sewer Design, Lift Stations and Force

Mains, Power Facilities, Facility Plans, Water

Storage Reservoirs, Residuals Management, System

Modeling, Master Planning, Pump Stations, Water

Supply/Distribution, Hydrology/Hydraulics,

Breach Hydrographs, Safety Inspections and

Permitting.

The U.S.

manufactured frac sand combust, flow, and treat

(cft) purchases increased 13% and contibuted

most of the purchases of CFT products by the

entire aggregate industry in 2018. Other sand

and gravel accounted for 10 times the tonnage

but the ratio of CFT purchases for manufactured

sand is 20 x greater than other aggregate

categories on a per ton basis. Use of sand per

gallon of oil recovered has risen by an order of

magnitude. This is one reason that continued

growth for the manufactured frac sand CFT is

predicted.

Wet Frac Sand Processing by Mclanahan

The flow sheet for

wet processing typically begins with either a

horizontal or inclined primary vibratory screen

in either a two or three-deck design. While

making the coarse-end separation required, the

vibratory screen also provides the introduction

point for the addition of water into the

process. Water addition begins in the sluicing

feedbox and continues with spray bars as the

material crosses the screens. The introduction

of water in this manner completely hydrates the

sand. After exiting the screening process,

hydrated sand in slurry form enters a sump and

pump arrangement. The pumps used in this process

are typically rubber lined due to the abrasive

nature of silica sand. The sump and pump

arrangement typically provides the slurry to a

large-diameter hydrocyclone, the primary

function of which is to provide feed material to

a hydraulic classifier at an ideal density and

in a manner that provides even distribution of

the slurry into a stilling feed well.

Red Valve says its pinch valves for frac sand

plants last 3 times longer than all metal valves

Red Valve products

are used extensively in handling cement, sand

and silica, due to the highly abrasive nature of

these materials. Red Valve Pinch Valves feature

a 100% full-port opening for maximum flow, wet

or dry. The high-quality elastomer pinch sleeve

can last up to three times longer than an

all-metal valve, and it is the only replacement

part. There are no crevices or dead spaces in a

pinch valve where material can collect, and the

flexibility of the sleeve allows it to close

drop-tight.

Nucor is expanding DRI plant in LA

Nucor will take

its Louisiana direct-reduced iron (DRI) plant

offline for 60 days in 2019 as part of a $200mn

investment designed to boost reliability

following multiple unplanned outages in recent

years. Planned improvements include $90mn in

upgrades to the plant's raw materials handling

and storage operation and an $85mn investment to

repair and re-engineer the process gas heater at

the facility. The two areas accounted for 90pc

of the failures at the plant, Nucor chief

executive John Ferriola said on an earnings

call. The projects are expected to be completed

by the end of 2019. Nucor will take the 2.5mn

t/yr facility offline for 60 days in the second

half of the year to complete some of the work.

Maximator high pressure pumps and valves used

in mining and other industries

MAXIMATOR GmbH is

a leading supplier of high-pressure, testing,

hydraulic and pneumatic systems. It is part of

Schmidt and Kranz HAZEMAG & EPR Bergbau und

Bohrtechnik (mining and drilling equipment) as

well as Fest Automatisierungstechnik (automation

engineering). The compact, low-cost MAXIMATOR

High-pressure Pumps are driven by air or noble

gas pressures between 1 bar and 10 bar. There

are numerous potential applications for

MAXIMATOR Pumps in machine engineering, oil and

gas industries, chemical and pharmaceutical

industries, defence, mining and the construction

industry as well as in aviation and

aeronautics.---- The MAXIMATOR valves, fittings

and tubing are suitable for different media and

operating pressures up to 10,500 bar.

Detailed

forecasting of market shares by valve type and

industry are available. Valve forecasts are

first segmented by control vs on/off and then by

eight valve types and then by fifteen

industries. This results in 240 forecasts for

each supplier. There are no authoritative

sources for valve sales and certainly not for

market shares. In fact since many valves are

sold through distributors the supplier may not

know how many of his valves are being purchased

by a particular industry. However, it is well

worthwhile to create approximate segmentations.

A detailed analysis is much more valuable for

decisions relative to R&D, sales, and

manufacturing than a general forecast. Here is

an example showing estimated 2018 Metso globe

control valve sales. This shows that control

globe valve market share for power can be

determined and then the average market share

applied to each purchaser. So in this case Metso

has a 2% market share so they should generate

revenue of $ 80,000 at J Power to meet their

average