PUMPS: WORLD MARKET

UPDATE

March 2019

McIlvaine Company

Hydraulic Fracturing Presents a Most

Profitable Market Opportunity for Pump

Manufacturers

The hydraulic fracturing pump market is

one of the Most Profitable Markets (MPM) for

pump suppliers. It is large and will grow at

close to double digit rates in the next few

years. The application is extremely challenging.

This creates a situation where a better designed

pump can be sold at a much higher price.

The repair part market is bigger than the new

equipment market. So this creates a large

combined market.

There are a few major purchasers each of whom

will spend more than $50 million per year on

pump hardware, repairs and services. This

makes direct sales possible. Without sales

commissions or distributor markup the gross

profit will be higher.

It is recommended that pump companies invest in

very detailed market forecasting which is

focused on increasing profits and not just

revenues. This forecast can be described

as the “Most Profitable Market” (MPM). The $70

billion industrial pump market is the Total

Available Market (TAM).

The Serviceable Obtainable Market (SOM) is the

market which can be addressed with the lowest

priced product at even small unit margins. The

Most Profitable Market (MPM) is the one for

which the supplier can most profitably supply

its products and services given its capital and

knowledge resources.

Hydraulic fracturing offers a large and fast

growing MPM for pump manufacturers. New

developments in the last month will cause a

large increase in fracking pump sales. It

now is a good bet that the U.S. could be

producing 25 million bbl/day of liquids by 2025.

The oil companies are saying that OPEC and IEA’s

more pessimistic forecasts are wrong. They are

setting their capital budgets on this premise.

Largest Coal Fired Power Pump Market is

in the RCEP

Most of the new coal fired power plants will be

built in Asia. The region already operates more

coal fired power plants than the rest of the

world. The U.S. has willingly given up its quest

through the Trans Pacific Partnership to be a

major player in the Asian coal fired power

combust, flow, and treat (CFT) market.

International CFT suppliers are unwillingly

losing an advantage which will be difficult to

overcome. A new trading group in Asia includes

Chinese financing for plants throughout the

region. The plant suppliers include a number of

large Chinese companies.

The Trans-Pacific Partnership (TPP), which has

now been rechristened the Comprehensive and

Progressive Agreement for the Trans-Pacific

Partnership (CPTPP) includes the Regional

Comprehensive Economic Partnership (RCEP) – a

free trade deal involving the ten members of

ASEAN plus its six dialogue partners. If it

succeeds, RCEP will become the world’s largest

trading bloc, accounting for 3.4 billion people

with a total Gross Domestic Product (GDP) of

$49.5 trillion.

China has more than 40 percent of the existing

coal fired boiler fleet. It has 80 percent of

all the coal fired power plants less than 20

years old. This means that much of the

experience with newer pump designs resides in

China.

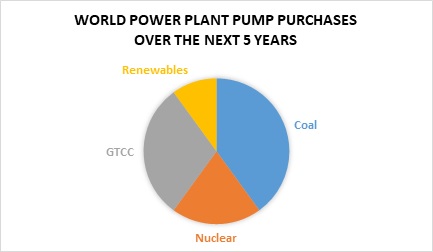

Coal fired power will remain the largest

purchasing segment in the world power industry

over the next five years.

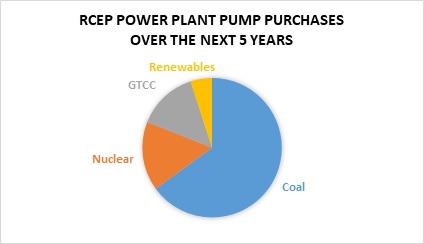

Most of the pump purchases in RCEP power plants

will be for coal fired generation. The new coal

fired capacity will exceed the new gas turbine

capacity. Coal fired power plants spend 3.5

times as much for pumps as do gas fired plants.

Solar and wind pump purchases are small.

Outside of the RCEP the two most active

constructors of coal fired power plants are

Turkey and Pakistan. Due to the China-Pakistan

Economic Corridor plan and billions of dollars

of Chinese funding for seventeen coal fired

power plants, Pakistan is nominally part of this

larger endeavor. China and Turkey have

strengthened relationships and China is

investing in Turkish power plants. So China is

involved in all the regions with coal fired

boiler construction activity.

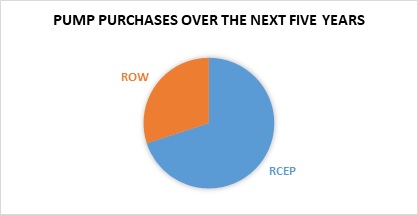

RCEP will be the major purchaser of power plant

pumps over the next five years.

Environmental upgrades have been a good source

of pump business. For example a limestone

scrubbing system for a coal fired plant requires

an investment of more than $100 million. Of this

total over $2 million is for pumps. The addition

of 200,000 MW of FGD systems in the U.S. spread

out over three decades resulted in less than $1

billion of dollars of revenue for pump

companies. China has now installed over 900,000

MW of FGD systems. Other countries in RCEP will

need another 400,000 MW of new and retrofit

systems. India is presently retrofitting more

than 50,000 MW of FGD.

Repair parts and maintenance for pumps used for

recycling limestone slurry is substantial and

represents a larger expenditure over the pump

life than does the original investment. So the

combined market for new pumps and repairs in the

power industry will exceed $3 billion in 2019.

PUMP DISLAYS AT OTC

A number of pumps will be exhibited May 6-9 at

the Offshore Technology Conference. There will

be Exhibiting Companies: 2,000+ representing 40+

countries (including divisions and subsidiaries)

and 23 international pavilions Exhibit net

square feet: is 500,000+ sq. ft., including

outdoor exhibits. Attendance is expected to be

60,000+

representing 100+ countries (includes

exhibit personnel) There will be

350+ technical presentations, 22 topical

breakfast and luncheons, and 11 panel sessions.

Boerger Pumps:

Headquartered in Germany with subsidiaries

around the world, Börger develops, manufactures

and sells rotary lobe pumps, macerating

technology and feeding technology for the

conveyance of low to high viscous and abrasive

materials.

http://www.boerger.com

Cat Pumps®:

is a

supplier of triplex, reciprocating,

oilfield-process pumps. Their rugged triplex

design delivers high energy-efficiency, smooth,

low pulsation flow, field-proven long-life and

low maintenance. Flows .03 to 240 gpm. Pressures

100-10,000 psi. Designed for continuous-duty,

high pressure liquid applications.

http://www.catpumps.com

CheckPoint

is a solution driven design and manufacturer of

metering pumps, control systems, and solar

systems for Chemical Injection. CheckPoint can

assist you in the design and engineering of the

processes that will optimize your production at

the best ROI. Learn more about their diverse

range of pumps at

www.cppumps.com

Discflo Corporation

provides engineering pump solutions for

hard-to-pump applications. The company has built

a world-wide reputation since 1982

in the Oil & Petrochemical industries for

Non Emulsifying*Low Pulsation*Low

impingement*Laminar flow*High

viscosity*low-to-no-maintenance.

www.discflo.com

Eddy Pumps:

Mud Pumps and Drill Cutting transport pumps.

They are

replacing excavators in drill cuttings

processing. EDDY Pump is a pump and dredge

equipment manufacturer, established in 1984.

R&D, engineering and production are done in San

Diego. All of the pump equipment is 100%

American made, utilizing patented EDDY Pump

technology, which harnesses the power of a

tornado into fluid dynamics, creating an eddy

current.

https://eddypump.com

Fonda

Pump

specializes in design, manufacture, and service

of API 610 standard industrial centrifugal

pumps, auxiliary equipment, spare parts and

other liquid handling applications.

www.fondapump.com

Gardner Denver

is a

global manufacturer of pumps, parts and

service to the upstream oil and gas market.

www.gardnerdenverpumps.com

Gorman-Rupp

manufactures pumps and pumping equipment that

supply large quantities of water for hydraulic

fracturing operations, as well as centrifugal

pumps used on blending and hydration rigs. They

also manufacture a line of solids handling

self-priming trash pumps for drilling rig cellar

pump out, transferring drilling mud slurries and

tank loading

http://www.grpumps.com

Hengli Hydraulics

utilizes

advanced manufacturing and R&D centers,

located in China, Japan, and Germany in

developing hydraulic cylinders, piston pumps,

and valves.

www.hengliamerica.com

Hercules Pumps

is a Sino-German JV pumps company in China with

50 years experience in producing pumps. Due to

the policy of Designed in German, Made in China

the pumps are exported to many countries with

high quality and reasonable price and comply

with the latest version API and other

international standards. www.herculespumps.com

ITT Bornemann

has a worldwide

position in Twin Screw Pumps. Pumps &

Systems are the ideal solution for Tank

Terminals, Oil Production & Processing. Core

applications are served in Multiphase,

Petrochemical, Marine & General Industry as well

as in Food & Pharmaceutical markets

www.bornemann.com

LobePro, Inc.

offers PD rotary lobe pumps in standard &

API-676 compliant: S-Series: Sludge, Mud, &

Slurries; C-Series: Corrosives & Chemicals; and

D-Series: Abrasives & Corrosives. Some oil & gas

applications are pumping clean drilling fluid,

feeding decanting centrifuges, booster pumps in

pipelines for waste oil with abrasives, and

pumping from tanks requiring a suction lift.

www.lobepro.com

Monkey Pumps

offers chemical injection pumps; pneumatic

pumps; metering pumps, related packages, parts &

accessories.

http://www.monkeypumps.com

Netzsch Pumpen $ Systeme GmbH

http://www.netzsch.com

Northern Pumps

High pressure custom gear pumps since 1929.

The rugged design and adaptability of the 4000

series gear pump allow customers to operate

safely and efficiently at discharge pressures up

to 2000 PSI in crude oil and other liquids

including high temperature and high viscosity

liquids.

https://www.northern-pump.com/

Odessa Pumps and Equipment,

a distribution NOW company offers the most

comprehensive pump solutions in the industry.

From centrifugal, plunger, gear, and diaphragm

pumps to chemical injection and progressive

cavity pumps, there are very few requirements

that can't be met. Odessa Pumps offers exp pump

application engineering, fabrication, and

service to our valued customers.

http://www.odessapumps.com

Peroni Pumps America

is the North American subsidiary of Peroni

Pompe. Founded in 1895, Peroni has been helping

operators run reliable topside production

facilities,

manufacturing API 674

reciprocating pumps (up to 2500 kW) and API 675

metering pumps. Typical services: HP

methanol/glycol injection, slop oil reinjection,

well service.

http://www.peronipompe.com

Reliable Pumps Consultants

is a high pressure pump manufacturing company

that specializes in wellhead test equipment,

water blasters, and subsea flushing units.

http://www.reliablepumps.com

SPX FLOW

is a leading global supplier of highly

engineered flow components, process equipment

and turn-key systems, along with the related

aftermarket parts and services. Visit them at

Booth 409 to view our hydraulic equipment,

industrial pumps, valves, dehydration and

aftermarket services.

http://www.spxflow.com

Titan BOP Rubber Products,

Inc is an elastomer company which markets:

Pulsation Dampeners bladders and parts, Pipe

Wipers, Ram Packers, Packing Elements, Test Cups

and Assemblies, Oil saver rubbers, Stripper

Rubbers, Door seals, Seal Kits, Swab Cups, Ram

blocks, BOP's.

Titan offers Pump products: Ansi 4196,

Self-Priming Trash, Gear, Diaphragm, and

... Materials: DI,CI,316SS,CD4,Austemper.

http://www.titanbopinc.com

INTELLIGENCE SYSTEM UPDATES

Here are selected entries to the intelligence

system in the last month. All entries are

displayed in the following link

http://www.mcilvainecompany.com/pumps/subscriber/default.htm

Exxon Mobil Corp. plans to reduce the cost of

pumping oil in the Permian to about $15 a barrel

The scale of Exxon’s drilling means that it can

spread its costs over such a big operation that

the basin will become competitive with almost

anywhere in the world, Staale Gjervik, president

of XTO Energy, the supermajor’s shale division,

said in an interview with Bloomberg.

Black Sand's Permian mines are designed to

maximize water usage throughout the frac sand

manufacturing process. Two 1-million-gallon

freshwater holding tanks feed the system in a

closed-loop to wash and sort sand, which results

in a continual source of used turbid water.

Instead of routing the used, turbid water into

settling ponds, our system captures it in a

settling tank where solids are concentrated into

a mud containing anywhere from 25 to 35 percent

solids. Next, this mud is pumped at high

pressures into filter press membranes where

filter press technology squeezes water out of

the solids. Thus, instead of losing water to

evaporation and ground seepage, our system feeds

this recovered water back into the holding tanks

to be used again and again. In addition, our wet

sand is stored in a specially-designed decant

building while awaiting final processing in the

dryers. This step helps prevent water

evaporation while promoting efficient draining;

as water drains from the sand, that water is

funneled through a drainage system in the floor

directly back into the holding tanks. And, by

promoting better drainage before the drying

process, we save energy because our sand

requires less energy to be dried.

Shurco rubber lined slurry pumps used in frac

sand wet plants

Heavy-duty rubber

lined Schurco Slurry pumps are designed to

deliver long-lasting service life in frac sand

plants. Large impeller diameters with

high-efficiency designs coupled with dry-gland

expeller seals that eliminate the need for

costly seal water make Schurco Slurry the

optimal choice for processing frac sand says the

company. Schurco pumps have been employed in

cyclone feeds, ultra-fines recovery (UFR),

recessed plate and frame filter press feeds,

belt-press feeds, tailings disposal (clarifier

or thickener underflow), and even process water

pumps. If hydrotransport is required in a frac

sand plant, there is a Schurco Slurry pump to do

the job. Schurco understands the importance of

continuous production, and how costly and

damaging to frac sand production metrics

downtime can be. Schurco Slurry pumps are

designed to offer the longest service life,

while also employing a simple to maintain

design. The company claims “If you can turn a

wrench, you can work on a Schurco pump”

Lithium project in Chile is being fast

tracked by Lithium Power International

LPI is

fast-tracking the development of Maricunga and

has submitted its Environmental Impact

Assessment (EIA) Report in September 2018. This

was followed by a Definitive Feasibility Study

(DFS) submitted in 1Q19. The first lithium

carbonate sample has been produced from Salar de

Maricunga (Feb 18) at GEA facilities in Germany.

The brine was concentrated at the pilot plant

solar evaporation ponds at the Maricunga site

for almost 12 months, and subsequently treated

at the GEA lab in Duisburg, Germany, to purify

it and precipitate lithium carbonate suitable

for battery grade specification similar to those

produced in Chile by Albemarle and SQM. The

process route is based on conventional

technology and comes with the know-how that

enables the process to scale up to commercial

production. The purity of the product is above

99.4%. The project has the potential for a

multi-decade mine life in its currently defined

resource to 200m depth, with the possibility for

substantial resource expansion in an exploration

target at 200-400m depth. Permitting and

government approvals are expected by 3Q19, with

the Chilean Nuclear Energy Commission Export

licence (CCHEN) awarded in March 2018. Project

financing is targeted in 2019 and the start of

construction in 2020. The site contains a link

to a complete investor presentaion

Veolia supplies process system to Argentine

lithium producer

Veolia has

supplied several process systems to leading

lithium suppliers worldwide as well as having

performed analytical, bench and pilot-scale

testing. Veolia designed and supplied a lithium

producer in Argentina with a complete, modular,

skidded HPD® Crystallization system comprised of

an evaporator to concentrate the brine solution,

a forced circulation cooling crystallizer to

precipitate and remove sodium chloride

impurities, and forced circulation crystallizer

to produce high-purity lithium chloride. Solids

handling equipment, including a centrifuge and

dryer, were integrated into the overall process

design.

Andritz has order

for two 350 MW pump turbines for ZhenAn

Andritz has

secured an order from China’s Shaanxi ZhenAn

Pumped Storage Co Ltd to supply four 350 MW

reversible pump-turbines and motor-generators,

along with auxiliary equipment, for the ZhenAn

pumped storage hydropower plant in Shaanxi

province. The four 350 MW reversible

pump-turbine units will operate with a water

head of 440 m. The first unit will be

commissioned by the end of March 2023, and all

units will be put into commercial operation by

the end of December 2023. The contract is valued

at more than €100 million. ZhenAn, with a total

installed hydropower capacity of 1400 MW, will

be the first pumped storage power station in

northwest China. Shaanxi ZhenAn Pumped Storage

Co is a subsidiary of State Grid Corporation of

China (SGCC)

Metso horizontal slurry pumps for frac sand

and other aggregate applications

Metso offers a

wide range of sizes and capability for every

slurry pump application. We understand that

there is no such thing as a one-size-fits-all

solution in increasingly complex mining

operations. Metso works with customers to

understand their challenges, process conditions

and variables to select the equipment and

service regimen to maximize efficiency and

minimize the total cost of ownership. Features

are • Robust construction and design to maximize

wear life • Modular pump design for full life

cycle efficiency • Innovative design reduces

cost and simplifies pump maintenance and servic

Pumps for Fracking Sand Plants

Manufactured sand

plants convert local sands into a high quality

fracturing proppant. The clays and other

impurities are removed in a wet process which

requires pumps. Wet excavation utilizes pumps.

Separation processes involve pumps for

transporting slurries to thickeners and screens.

Pumps are used in the slurry feed to filter

presses. Smaller pumps are used for introduction

of flocculants. IAC is a supplier of frac sand

plants. Mclanahan and Eddy Pumps are suppliers

of pumps for these plants.

Liquid Treatment Market for Shale Fracturing

Sand is Growing Rapidly

The use of

centrifuges, filter presses, belt presses,

screens, hydrocyclones, thickeners, pumps,

valves, cross flow membranes and treatment

chemicals in manufactured sand plants producing

proppants for shale fracturing is growing

rapidly. The techniques developed in the U.S. to

fracture shale for the purpose of extracting oil

and gas are the foundation of the success of the

U.S. economy in the last decade. Developers have

continually reduced costs with new techniques

such as horizontal drilling. The transport of

sand with the correct fracking features from

Wisconsin and Minnesota to West Texas has been

very costly. One of the most recent cost

reductions is to manufacture high quality sand

from the lower quality resources available in

the region. The West Texas Permian Basin is

relatively arid. Freshwater supplies are

limited. The new fracking sand mining plants in

the basin add to the large water demand already

caused by the fracking process. One solution for

the fracking sites is the use of treated

municipal wastewater. Another potential is the

treatment and use of brackish water.

Nevertheless fresh water will remain the main

source for the foreseeable future. As a result

conservation becomes a high priority. Fracking

sand plant suppliers have risen to this

challenge by designing systems which reuse as

much as 98 percent of the process water needed.

Fracking’s water footprint could grow by up to

fiftyfold in some regions of the U.S. by the

year 2030. The U.S. demand for water management

services associated with the acquisition,

transport, transfer, storage, flowback,

treatment and disposal of water increased by

nearly 50 percent over the last year at a cost

of nearly $20 billion. Water management spending

for hydraulic fracturing services in the U.S. is

expected to total $150 billion over the next

decade. Sand mining plants are tasked with

minimizing water use. There were at least five

sand mines opened in the Permian Basin by

Hi-Crush, Black Mountain Sand and U.S. Silica in

2018 with a proppant supply of 35 billion pounds

per year. Many more mines are expected to be

opened soon.

Nucor planning $1.35 billion plate-steel mill

for 2022 startup

Nucor Corp. is

scouting locations in the Midwest for a $1.35

billion plate-steel mill. Nucor (NYSE: NUE) says

the plant will employ 400 and be capable of

producing 1.2 million tons of steel a year. The

Charlotte-based steel company expects the plant

to start operating in 2022. With investments

already announced, this puts Nucor’s total

construction and expansion plans at more than

$3.5 billion.The company says it is looking at

sites in Indiana, Kentucky, Ohio and West

Virginia.

Terex provides a wide variety of sand washing

plants

From sand used in

Dubai’s most audacious construction projects to

aggregates supplied to the London Olympic

preparations, Terex Washing Systems are relied

upon by World leading contractors and building

materials suppliers to provide the highest

quality in-spec. products. Bringing more than 60

years of washing sector experience spanning the

widest range of raw material types, final

product requirements and geographical

variations, TWS provides the complete portfolio

of products and services to suit an application.

While materials and output requirements vary

with each project all aggregate sector clients

have the same core needs: high quality, low cost

per ton materials. TWS provides versatile

modular systems, designed to be installed as

quickly as possible and as easily as possible.

From the T150 bucket wheel dewaterer, one of the

most widely distributed sand washing machines in

the World, to the sector defining AggreSand –

the World’s first chassis mounted integrated

system offering 5 washed products, TWS is always

innovating. Terex will be an exhibitor at North

American Frac Sands 2019

Weir will supply

pumps and other products for Phoenix frac sand

systems

Phoenix Process

Equipment Co. and Weir Slurry Group Inc. entered

into a formalized partnership for the supply of

process systems to the frac sand industry.

Phoenix has significant experience in the design

and supply of sand classification, scrubbing,

dewatering, water reuse and waste fines

management systems for frac sand producers. With

this agreement, Phoenix and Weir will work

together to identify sales opportunities and

incorporate Weir Minerals’ slurry and process

equipment into Phoenix system designs. Weir is

an exhibitor at North American Frac Sands 2019.

“We are excited to work more closely with Weir

Minerals. Combining Weir products, technical

knowledge and support with our capabilities and

experience truly enhances our already strong

position in the frac sand industry,” said

Phoenix’s President Gary Drake. Phoenix designs

and supplies process equipment and systems to

the mining, aggregate, frac and industrial

sands, general industrial, municipal and

commercial water and waste water treatment

markets. Headquartered in Louisville, Ky., the

company was established in 1984.

New Pulsafeeder

diaphragm metering pump actuator reduces total

cost of ownership

A new XAE Actuator

brings a higher level of precision and remote

control to the PulsaPro family of diaphragm

pumps. PulsaPro metering pumps are used to dose

specific volume of chemicals for numerous

applications in refineries, chemical &

petrochemical plants, and throughout the

upstream oil & gas industry. The API compliant

XAE Actuator is an electromechanical servo

controller that provides remote control of

PulsaPro hydraulic diaphragm pumps, to alter

flow rates as required by the process. Alarm

relays alert users to unintended changes in flow

rates, including stop conditions. The

fault-tolerant and self-recovering XAE is

designed for reliability and minimal

maintenance, with metal gearing and an

explosion-proof enclosure. Simple calibration

capabilities and an intuitive user interface

facilitate ease-of-use. The XAE is purpose-built

for PulsaPro pumps, and it is designed to meet

the needs of international industrial markets.

“In the past, we have provided third-party valve

actuators, but after soliciting customer and

distributor feedback, we’ve designed and built a

true metering pump actuator that provides a

better fit, and tighter controls for the

PulsaPro pump series,” said Erik Van Bork,

Manager of Controls Engineering for Pulsafeeder.

“The XAE is manufactured in the same plant as

the PulsaPro pumps. This shortens delivery

times, and we provide a common warranty for both

products that further simplifies things for our

customers.”

The case for actuators vs VSD for diaphragm

metering pumps

With the actuator

the flow range adjustment is 0 to 100% but is

much less so with the VSD. Dosing is

proportional to stroke length and can be more

precise with the actuator. The actuator approach

eliminates some potential problems with viscous

fluids which could cause problems at low VSD

speeds.

Doosan Lentjes supplying 2 wet FGD systems in

Romania

In 2018, Doosan

Lentjes in a consortium with Elsaco Electronic

was awarded the turnkey contract to deliver a

modern flue gas desulphurisation system for a

lignite-fired power plant located in Romania.

CET Govora S.A. owns and operates a 2 x 345 MWth

lignite-fired power plant located in Ramnicu

Valcea, Romania. Against the background of

stringent European emissions legislation as per

the 2010/75/ EU on industrial emissions (IED),

the plant owner is required to install modern

environmental equipment. With this in mind,

Doosan Lentjes and Elsaco Electronic, a

consortium of companies, were awarded a turnkey

contract to retrofit the two existing boilers C5

& C6 with an advanced flue gas desulphurisation

(FGD) system. In order to deliver on both

environmental and economic objectives, the

proven wet limestone FGD method being defined as

BAT (Best Available Technology) will be applied.

The project will help the customer to secure

ongoing operation permissions for their two

boilers. Doosan Lentjes’ scope of work in the

consortium will include engineering, the

delivery of key equipment, as well as, advisory

services for erection and supervision of

commissioning.

Pump purchasers

conservatism should not limit the innovation and

the imagination of equipment manufacturers.

According to Axel Bokiba of Index Pulsafeeder

this conservatism results from success. He

points out that “When your mobile phone prompts

you to upgrade your operating system, why is it

that you almost always select “upgrade later?”.

The reason is that it is working well and you

don’t see the benefits of an upgrade. But there

is lots of potential for improvement. One

example is the pump total cost of ownership in

offshore oil and gas. Today, many of the

constraints that pump manufacturers seek to

overcome relate to footprint (size and weight)

because real estate on a platform or floating

production, storage and offloading (FPSO) vessel

topside is crowded, and total costs on these

vessels can exceed $40,000 per ton. So

innovations which reduce foot print and weight

can substantially reduce total cost of ownership

(TCO). Axel concludes “Pump manufacturers need

to see beyond the expectations of conservative

customers and find new ways to improve the

efficiency of their equipment in the industrial

processes: new materials, higher power density,

metal 3-D printing, augmented reality assisted

system conception, energy efficient

micro-controlled drives, closed loop electronic

control, diagnostic and automation, wireless

communication, IIoT or digital transformation

and many other enhancements that we have not

even thought of yet.”

Tags:

221113 - Nuclear Electric Power Generation * ,

IDEX Corporation, Pump, Metering

Diaphragm metering pumps should provide

1,000-to-1 turndown capabilities with

steady-state accuracy down to +/- 0.5 percent.

Most chemicals are procured in concentration,

and they must be metered accurately — not just

to save money but to ensure that overdosing is

prevented. For example: Sulfuric acid, which is

used to lower pH, is harsh on plant equipment,

and injecting too much acid results in an

improper pH and can damage a boiler or cooling

tower — just like injecting too much medicine

would not serve a patient properly. Corrosion

resistance — In many plants, metering pumps must

be API 675 compliant. They must be able to

deliver a wide range of harsh and corrosive

chemicals, such as biocides, cleaning compounds,

coagulants, corrosion inhibitors, defoamers,

oxygen scavengers, polyelectrolytes, scale

inhibitors, emulsion breakers and many other

chemicals. Pumps must be able to handle the

diverse characteristics of these chemicals, and

they must be able to pump chemicals at different

concentrations and temperature levels. To

accommodate this diversity, all the wetted parts

of the pumps’ liquid end should be available in

316 stainless steel, alloy 20, PVDF or PTFE. The

ability to leverage a single pump family that

can be configured with different materials not

only adds flexibility but it also helps

suppliers meet a plant’s delivery deadlines.

One of the biggest

issues for offshore production is the formation

of hydrates. Hydrates form when light

hydrocarbons and water mix under high pressures

and low temperatures. Hydrates restrict flow and

can form solid plugs that block production and

damage equipment. Low-dose hydrate inhibitors (LDHIs)

metered directly from the sea floor could

perform just as well as traditional topside flow

assurance practices—with substantial cost

savings and efficiency benefits. But pumps used

to deliver chemicals must adhere to certain

criteria to withstand the unique challenges of

the sea floor environment. LDHIs require far

lower injection rates (of 0.5 to 2.0 percent by

volume) and are much more cost-effective and

practical when used properly. Removing a single

ton of pumping equipment enables engineering,

procurement and construction (EPC) providers to

reduce the weight of the entire platform by up

to 4 tons. If an offshore platform costs $30,000

per ton to build, then removing a metering pump

from the deck surface can save up to $120,000

for each pump. The same equation holds true for

the weight of the tanks required to store the

vast quantities of methanol or other TI

flow-assurance chemicals, illustrating a further

savings that can be extracted by switching to

LDHIs.

Chemical companies can reduce total cost of

ownership with the right mix of metering pumps

The four most

common chemical metering pump applications in

chemical manufacturing plants include: • Dosing

precise volumes of chemicals to make products •

Pretreating the process water to boost quality

and efficiency • Dosing antiscaling chemicals to

clean and protect plant infrastructure •

Post-treatment of the wastewater prior to

disposal. Each of these applications can be

addressed by reciprocating pumps, which work by

using a piston or a diaphragm to dose a precise

volume of fluid with each stroke. Reciprocating

pumps are highly engineered to provide extreme

accuracy at high pressures and relatively low

flows. Rotary gear pumps provide a

cost-effective alternative for some

applications. They work by moving fluid in a

circular fashion between gears. Rotary pumps

pick up fluid at the suction port between the

gear teeth, and they carry the fluid around the

outer diameter of the gears to the discharge

port. Rotary pumps are best utilized in

high-volume, low-pressure applications, and

their flow rates can be controlled with variable

speed drives. Each pump type has advantages, and

they both come at different price points. By

incorporating the right mix of chemical metering

pumps, DowDuPont, BASF and other chemical

companies have been able to save money without

compromising on performance.

Tags:

325110 - Petrochemical Manufacturing

石化产品生产,

IDEX Corporation, Pump, Metering

Disinfection, pH adjustment are ways to

facilitate greater water reuse in power plants

The effective management of water and wastewater

investments can save power plants 1 to 2 percent

annually, which adds up to millions of dollars

each year. While these benefits may never equal

the financial advantages of once-through cooling

processes, they do enable power plants to use

significantly less water. The criteria for

selecting metering pumps typically includes flow

rates, pressures and corrosion resistance

(depending on what chemicals are pumped).