See you in Chicago next week at Filtration 2015

The Filtration 2015 is scheduled for November 17-19, 2015.

McIlvaine will be one of a very large number of exhibitors this year.

More than 20 Chinese companies are among the exhibitors. Bob McIlvaine and

Ross Ardell will be on the exhibit floor and look forward to discussions with

you. The list of exhibitors is

displayed at:

http://www.inda.org/events/filt15/exhibitor-list.html

Speakers include:

CONFERENCE SPEAKERS

ARMANDO BRUNETTI

Who Are Our Customers and What Do They Really Need? A Camfil View of Filtration

Media Requirements of the Future.

Learn More »

JACK CLEMENTS

Pleated Filter Media as a Direct Replacement for Filter Bags.

Learn More »

STEVEN DULIN

A Novel Application for Pleated Cartridge Filters with Nonwoven Media.

Learn More »

MATT GESSNER

Filter Media & Filter Laboratory Tests As It Relates to Industrial Use.

Learn More »

BRAD KALIL

The State of the North American Filtration Market.

Learn More »

HYUN LIM, PH.D.

High Flux Tyvek® for Filtration.

Learn More »

FRED LYBRAND

Nanofibers in Filtration: Beyond F9, Beyond MERV 15, Beyond Surface-Load and

Pulsing.

Learn More »

BRUCE MCDONALD

PM-Based Filter Efficiencies and Ratings.

Learn More »

DAVID PUI, PH.D.

Filter Loading by PM2.5 and Bimodal Aerosols.

Learn More »

ANDREAS SCOPE

New Developments and Future Requirements in Cabin Air Filtration.

Learn More »

MCLEOD STEPHENS, JR.

Nonwoven Media Approaches for Air Inlet Filtration on Gas Turbines.

Learn More »

CHRISTINE SUN, PH.D.,

Filter Media Training Course.

Learn More »

300 Large Oil and Gas Projects Account For 80 Percent of the Flow Control and

Treatment Purchases

Some oil and gas projects include hundreds of millions of dollars of pumps,

valves, filters, compressors and other flow control and treatment equipment.

The top 300 projects each year account for more than 80 percent of the

purchases. McIlvaine tracks these in the bi-weekly

Oil, Gas, Shale, Refining E-Alert.

|

October 30 Oil and Gas E

Alert covering two week period |

||||

|

Project Name |

Description |

Total Amount

$ Millions |

Flow

Control

Treat

$ Millions |

Order

Yr

20+ |

|

Enbridge |

Canadian pipeline |

38,000 |

300 |

16-19 |

|

Odebrecht |

Pipeline in Peru |

4,000 |

40 |

17-19 |

|

Golar |

FLNG off Cameroon |

8,000 |

90 |

17 |

|

Saudi Arabia's PetroRabigh |

Petrochemical and refining

complexes |

10,000 |

200 |

16-18 |

|

Dung Quat Refinery |

New refinery in Vietnam |

4,000 |

90 |

16 |

|

Rosneft |

New refining and petrochemical

complexes in Eastern Russia |

10.000 |

200 |

17-19 |

|

10 additional large projects |

LNG, refining, extraction |

50,000 |

1,000 |

16-19 |

|

Total |

|

124,000 |

1,920 |

|

Sixteen projects reported in the latest bi-weekly issue account for close to $2

billion of purchases of flow control and treatment equipment. The scope

includes oil and gas extraction, LNG, gas-to-liquids processing, and tar sands

processing.

The Alert is available separately but is also available as part of

N049 Oil,

Gas, Shale and Refining Markets and Projects, which

provides a complete program for detailed market, prospect and project

forecasting. For more information on

Oil, Gas, Shale, Refining E-Alert: click on:

http://home.mcilvainecompany.com/index.php/databases/28-energy/991-71ei.

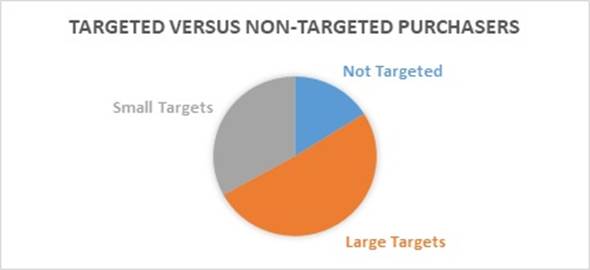

430 Companies and Projects Will Account For 41 Percent of Industrial Scrubber

Purchases

Sales of industrial scrubbers will be $6.8 billion in 2015.

Suppliers who focus on 433 purchasers, engineering firms and large

projects will be addressing 41 percent of the total potential.

This is the conclusion reached by the McIlvaine Company in

N008 Scrubber/Adsorber/Biofilter World Markets.

The scope of the report includes both wet and dry scrubbers as well as carbon

adsorbers and biofilters. More than 40 percent of the market totaling $3 billion

is concentrated in a few industries.

Of a total scrubber market of $500 million in oil and gas, $300 million

can be identified with 40 companies and projects.

There are thousands of purchases of scrubbers.

Many of the projects are quite small.

However, 60 large companies and projects will address 20 percent of the

chemical industry market of $80 million.

Average purchases for the 50 will be $2.7 million creating an opportunity

of $160 million.

In the “other industry” sector, 205 companies/projects have been identified

whose purchases will average more than $9 million each.

This includes large mining projects and steel complexes as well as the

companies who own them.

There is a concentration among purchasers.

For example, BASF will account for 1.8 percent of the scrubber purchases

in the chemical sector. The top 10

chemical companies will account for 10 percent of the purchases.

In the electronics sector, Samsung will be the leading purchaser.

In the metals sector, ArcelorMittal which produces 6 percent of the

world’s steel will be the leader.

In the oil and gas sector, five companies will account for 50 percent of the

scrubber purchases. Ten engineering

companies will be specifying or buying 30 percent of the scrubbers.

There are some very large gas-to-liquids and refinery projects which will

account for 20 percent of the scrubbers purchased for the sector.

In many cases, the large purchasers are using the engineering firms who

are designing the large projects, so there is an overlap.

The result is that 40 companies and projects will account for scrubber

purchases of $300 million.

Large prospects, OEMs and large projects comprise a big share of the market.

It varies by industry. In the oil and gas industry, the large purchasers

account for 50 percent of the market. The large OEMs are addressing 30

percent. The large projects also address 30 percent. There is

overlap with some large projects also involving large OEMs and large purchasers.

The result is that the combination addresses an adjusted 60 percent of the

total. By contrast, pulp and paper

is 40 percent.

It is recommended that scrubber suppliers create specific programs to address

this combination of companies and projects.

The relatively small number of large opportunities makes a proactive

approach possible. McIlvaine has

created a unique route to market by combining the detailed forecasting in

N008

Scrubber/Adsorber/Biofilter World Markets

with McIlvaine project tracking services.

For more information on contact Bob McIlvaine at

rmcilvaine@mcilvainecompany.com.

DETAILED FORECASTING OF MARKETS, PROSPECTS AND PROJECTS

It is now possible to precisely segment and predict markets, identify the

prospects, and track the most important projects.

A few hundred companies make most of the flow control and treatment purchasing

decisions. McIlvaine is identifying them and reporting on their

activities.

Detailed forecasting of markets, prospects and projects provides the following

benefits:

Improve decisions on allocation of direct sales, promotion and development

expenditures

Increase orders cost effectively

Review strategy with better insights as to improvement

Find out the details with:

Power

Point Presentation

Review Your Product Listings

The

53DI OEM Networking Directory

lists many thousands of companies who buy filtration and centrifuges.

It is important that we list your products correctly. There is no

charge. So please review your present listings and send us any corrections. You

can view your current listing at:

View and Correct Your Product Listings

----------

You can register for our free McIlvaine Newsletters at:

http://www.mcilvainecompany.com/brochures/Free_Newsletter_Registration_Form.htm.

Bob McIlvaine

President

847-784-0012 ext. 112

rmcilvaine@mcilvainecompany.com

www.mcilvainecompany.com