|

WELCOME

Weekly selected highlights in flow

control, treatment and combustion from the many McIlvaine publications.

·

Conference Briefs

·

Combust, Flow, and Treat (CFT) Market in Oil and

Gas is Large but Volatile

Conference

Briefs

WEFTEC: September 22-27 -Chicago

McIlvaine

has created route maps for Membrane Bioreactors, sludge dryers and aeration

blowers. If you are interested in

these three subjects and will be an attendee you will find these analyses

helpful http://home.mcilvainecompany.com/index.php/other-services/27-water/1517-weftec-2019-mbr-and-aeration

SOX-NOX

2019 and DSUA Users Conferences last week in India and the U.S.

Attendees

report that both conferences were informative and well attended. Report and

support information about them was published in the last few weeks in

Insights - September 4, 2019

Insights - August 27, 2019

Insights - August 20, 2019

Combust,

Flow, and Treat (CFT) Market in Oil and Gas is Large but Volatile

The

drone attack on Saudi oil fields last week is just one of a number of

indicators that the CFT oil and gas market will be very volatile. The basis

of the volatility is

· The CFT

investment per unit of gas or oil

produced varies by 1000% depending on the source

· Political events such as the tariffs,

embargoes, and terrorist bombing of production facilities have considerable

impact on the source and quantity of oil and gas

· China has the potential to convert

coal to syngas and chemicals and to fracture shale to produce enough oil and gas to eventually become self sufficient

· Hydraulic

fracturing is creating oil and gas at costs much lower and quantities

larger than anticipated

· Gas must be liquefied in order to be

an international commodity

The

CFT investment per unit of gas or oil varies by 1000% depending on the source

The

investment in CFT equipment, consumables and service varies greatly. Here

is a comparison using conventional extraction as the base.

|

Technology

|

Cost Ratio

|

|

Oil or gas

extraction under natural pressure

|

1

|

|

Hydraulic

fracturing - U.S.

|

3

|

|

Hydraulic

fracturing - China

|

4

unless Sinopec is too optimistic

|

|

LNG

|

5

|

|

Gas to

liquids

|

7

|

|

Coal to

syngas

|

10

(direct liquefaction would be less)

|

Political

events such as the tariffs, embargoes and terrorist bombing of production facilities have considerable impact on the source

and quantity of oil and gas

The amount of

gas and oil which can be extracted at low cost is finite and shrinking. The

nations with the most available resources would be economically best served

by a strategy which maximizes revenues over 20 or 50 years and not one

which maximizes revenue year to year.

Production can be curtailed to raise prices and profits over the

long term. It can also be curtailed due to embargoes as demonstrated by the

U.S. sanctions against Iran.

As

witnessed by the drone strike last week, production can be curtailed.

Houthi rebels in neighboring Yemen claimed responsibility for what would be

one of their largest-ever attacks in Saudi Arabia. The production shutdown

amounts to a loss of about five million barrels a day and close to 5

percent of the world’s daily production of crude oil. The kingdom produces

9.8 million barrels a day.

The

attackers created large fires at Hijra Khurais, one of Saudi Arabia’s

largest oil fields, and at Abqaiq, the world’s biggest crude stabilization

facility. Khurais produces 1.5 million barrels a day while Abqaiq helps

produce up to 7 million barrels a day. As the world’s biggest exporter of

oil, Saudi officials are discussing drawing down their oil stocks to sell

to foreign customers to ensure that world oil supplies aren’t disrupted.

China

has the potential to convert coal to syngas and chemicals and to fracture

shale to produce enough oil and gas to eventually become self-sufficient.

The U.S. initiatives to prevent flow

of oil from Iran have spurred action

by oil importers. Chinese oil industry executives said this past week that

China’s oil industry must have a contingency plan in case the trade war

takes another turn for the worse - China’s oil import dependence is at 70

percent currently, this makes it very vulnerable. However, it has the

capability to develop its coal and shale reserves and become

self-sufficient. Most of the fuel

will come from coal which requires the most CFT investment. China has shale

reserves which are greater than those in the U.S. The geology of the

reserves makes it more difficult and expensive but Sinopec is confident that it has

developed the technology for economic extraction.

China

Petroleum & Chemical (Sinopec) several years ago received Beijing's

approval for a mega project to turn coal into natural gas as part of the

mainland's strategy to increase energy efficiency and cut reliance on oil

and gas imports.

The total

cost of the pipeline would exceed 100 billion yuan. Sinopec would lead the

project and be responsible for investing in 8 billion cubic meters of

annual gas production and transmission capacity. Total capacity will be 30

billion to 36 billion cubic meters (bcm).

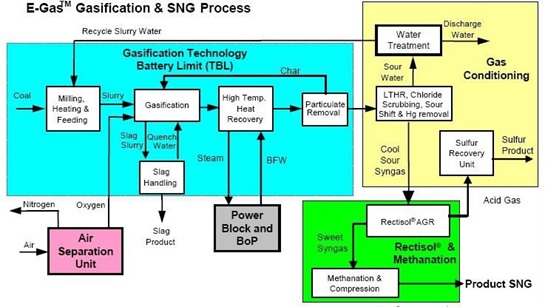

The amount

of CFT products and services needed to gasify coal is apparent from the

process schematic.

McIlvaine

believes this process can be more economical with the extraction of rare

earths. This can be done at very little cost by combining the particulate

removal and chloride scrubbing steps as shown in the above the process. The

technology is discussed at Join the Debate on Insitu Rare Earth Recovery

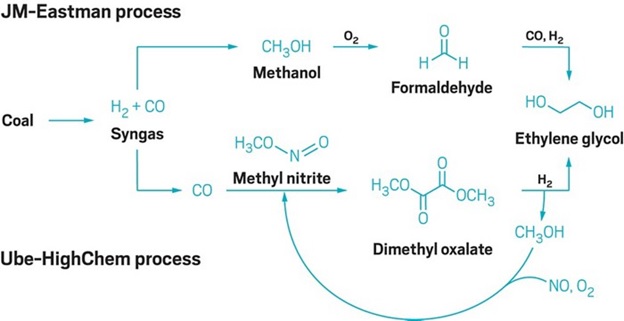

The cost of gasification is low enough that chemicals can be economically

produced. Most of the world’s ethylene glycol is produced from ethylene, a

basic chemical that is typically made by cracking oil or natural gas in a

petrochemical plant.

But the pace at which coal-based production is being

implemented in China is spectacular. “From nothing in 2011, China now has

3.5 million tons of coal-based ethylene glycol capacity”, says Cao

Mengting, a polyester consultant at CCFGroup, which is focused on the

Chinese fiber industry. By 2022, this capacity will have doubled, she

expects. Today, coal-based facilities represent about 40 percent of China’s

ethylene glycol production capacity and 14 percent of actual output,

according to Michael Zhao, another CCFGroup consultant. In five years, he

expects coal-based facilities will account for 20 percent of the country’s

output, while production capacity will be half of the country’s total.

Hydraulic

fracturing is creating oil and gas at costs much lower and quantities

larger than anticipated.

The

oversupply of the natural gas will be reinforced by a new surge in

associated gas production from the Permian Basin. Even the increase in

demand will not be able to increase the price of natural gas. The domestic

demand has increased by 14 billion cubic feet per day (BCF/d) since 2017

and is expected to increase by an additional 3 BCF/d of liquefied natural

gas (LNG) in 2020.

Natural

gas production in the US has also grown by more than 14 BCF/d since January

2018 to more than 90 billion cubic feet per day in 2019 and 2020. Drillers

are now able to increase supply faster than domestic or global markets can

consume it. Nearly all the growth in U.S. natural gas demand over the next

few years will come from LNG exported to other countries. The added supply

from the Permian will match—if not exceed—those volumes.

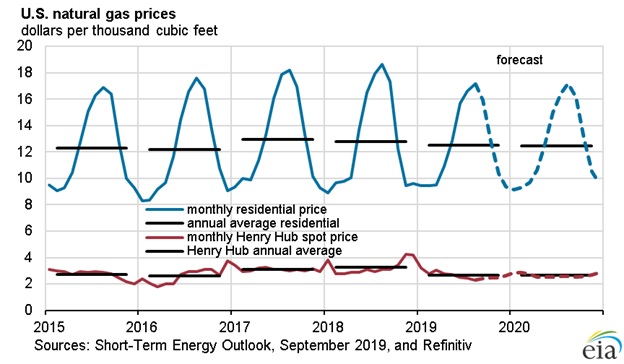

The

Henry Hub natural gas spot price averaged $2.22 per million British thermal

units (MMBtu) in August, down 15 cents/MMBtu from July. Based on recent

price movements and EIA’s assessment that natural gas production will be

sufficient to meet expected demand and export levels at a lower price than

previously forecasted, EIA lowered its Henry Hub spot price forecast for

2020 to an average of $2.55/MMBtu, 20 cents/MMBtu lower than the August

forecast.

EIA

forecasts that U.S. dry natural gas production will average 91.4 billion

cubic feet per day (Bcf/d) in 2019, up 8.0 Bcf/d from 2018. EIA expects monthly average natural gas

production to grow in late 2019 and then decline slightly during the first

quarter of 2020 as the lagged effect of low prices in the second half of

2019 reduces natural gas-directed drilling. However, EIA forecasts that

growth will resume in the second quarter of 2020.

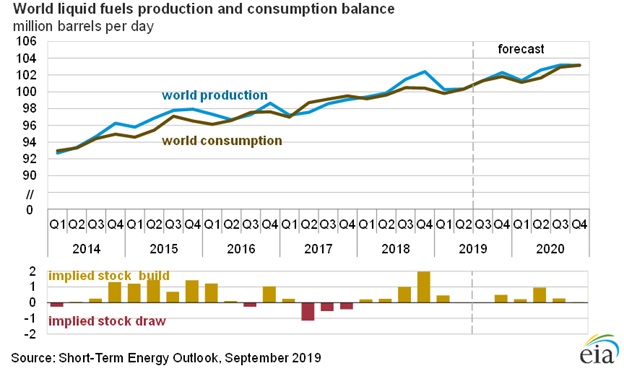

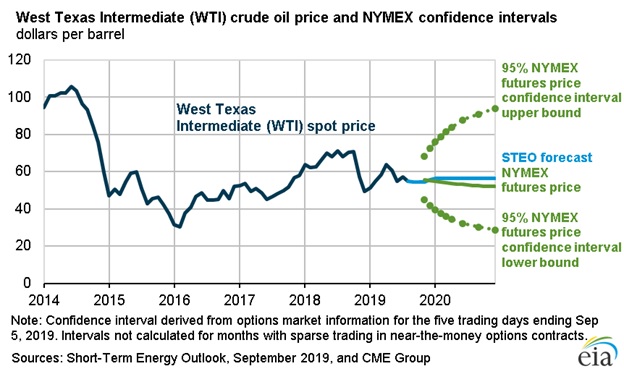

World

liquids production is anticipated to match demand over the next 16 months.

WTI crude prices are likely to hover in the $50-60/barrel range

throughout the next 16 months. The

drone strike on the Saudi facilities could cause price increases. However, the amount which would be made

available from reserves could mitigate any price rise

Gas

must be liquefied in order to be an international commodity.

The

U.S needs to accelerate LNG plant construction to take advantage of the low

cost gas and to compensate for production problems caused by political

activities in the Middle East.

U.S.

exports of liquefied natural gas (LNG) have been growing steadily and

reached 4.7 billion cubic feet per

day (Bcf/d) in May 2019. This year, the United States became the world’s

third-largest LNG exporter, averaging 4.2 Bcf/d in the first five months of

the year, exceeding Malaysia’s LNG exports of 3.6 Bcf/d during the same

period. The United States is expected to remain the third-largest LNG

exporter in the world, behind Australia and Qatar, in 2019–20.

U.S.

LNG exports have increased as four new liquefaction units (trains) with a

combined capacity of 2.4 Bcf/d—Sabine Pass Train 5, Corpus

Christi Trains 1 and 2, and Cameron Train 1—came

online since November 2018. Although Asian countries have continued to

account for a large share of U.S. LNG exports, shipments to Europe have

increased significantly since October 2018 and accounted for almost 40

percent of U.S. LNG exports in the first five months of 2019. LNG exports

to Europe surpassed exports to Asia for the first time in January 2019.

LNG from the United States accounted for 7 percent of

China’s total LNG imports in the first six months of 2018. In September

2018, China imposed a 10 percent tariff on LNG imports from the

United States, and in the months since then (October 2018 through

May 2019), U.S. LNG has accounted for 1 percent of China’s LNG imports.

Because no long-term contracts between suppliers of U.S. LNG and Chinese buyers

exist, LNG from the United States is supplied to China on a spot basis.

Spot LNG shipments are dispatched based on the prevailing global spot LNG

and natural gas prices, and the tariff made LNG imports from the United

States to China less competitive.

By 2021,

six U.S. liquefaction projects are expected to be fully operational.

Another two new U.S. liquefaction projects (Golden Pass in

Texas and Calcasieu Pass in Louisiana) that started construction this year

are expected to come online by 2025. By that time, EIA projects that the

United States will have the world’s largest LNG export capacity, surpassing

both Qatar and Australia.

Summary

CFT suppliers have the opportunity to substantially

increase their revenues with the proper pursuit of the international

opportunities. A larger percentage

of the fuel demand will be met with products which require up to 10 x the

investment in CFT products and services.

So a fuel demand growing at

3percent can result in a CFT market growing at a CAGR of 10 percent. On the other hand the political factors

make any projection uncertain.

There is a big opportunity for

CFT suppliers to be technology leaders. This includes components which can

withstand the erosive and corrosive and extreme physical conditions occurring

in hydraulic fracturing, LNG, gas to liquids, coal to gas and liquids. New opportunities such as solving the

fracturing challenges in Argentina and China and extracting rare earths

from syn gas can pay big dividends.

Manufacturing fracturing sands from low quality Texas sources has

been achieved only with the ingenuity of the CFT industry. Where would the U.S. be if its citizens

had not developed hydraulic fracturing and the country was paying $150/bbl

for oil?

Click here to un-subscribe from this

mailing list

|