|

WELCOME

Weekly selected highlights in flow

control, treatment and combustion from the many McIlvaine publications.

·

WEFTEC 2919 MBR and

Aeration Blower True Costs

·

Dry Scrubber

Pre-conference Webinar and Program

·

Does McKinsey Report on Flow Control Consider Asian

Suppliers?

·

Utility E Alert

Headlines for Last Week

·

LNG is a Most

Profitable Market for CFT Suppliers

WEFTEC 2919 MBR and Aeration Blower True Costs

Aeration Blower True Costs.

The exhibition stands and speeches will provide

substantial insights into the true costs of aeration blowers. A guide to each relevant exhibit and

speech has been prepared. A networking

directory to insure the most efficient interface with knowledge sources is

also provided. This guide is being

continually updated.

WEFTEC 2919 Municipal Wastewater

True Cost Guide

In order to facilitate the discussions an extensive

analysis Municipal

Wastewater Blower True Costs is being made available to

attendees. Feel free to submit case

histories and comments to add to the analysis.

Important questions are

· Which

blower type is best fitted for a specific application? high speed turbo,

screw compressor, rotary blower, or single stage centrifugal?

· Choice

of magnetic or air foil bearing design

· Drives,

controls

· Application

developments such as nitrification, process control

· Multiple

vs single blower

· Site

specific variables such as electricity cost, flow variation, plant life

To

contribute to the analysis and guide

contact Bob McIlvaine 847 226 2391 email rmcilvaine@mcilvainecompany.com

WEFTEC Municipal Wastewater Membrane Bioreactor True Cost Guide

The exhibition stands and speeches will provide

substantial insights into the true costs of

membrane bioreactors and components. A guide to each relevant

exhibit and speech has been prepared.

A networking directory to insure the most efficient interface with

knowledge sources is also provided.

This guide is being continually updated To view the contents

Click Here

To contribute to this guide contact Bob McIlvaine 847 226

2391 email rmcilvaine@mcilvainecompany.com

A market

report on membrane bioreactors is also available. For Details on the

report Click Here

The

very substantial body of information from WEFTEC 2018 is shared

at

Municipal Wastewater Treatment Update

Dry Scrubber Pre-conference Webinar and

Program

If you are involved with dry scrubbers. Here are four

knowledge sources

· DSUA

pre-conference webinar August 29th at 11:AM EDT

· Dry

Scrubber Users Conference September 10-12 in Kansas City

· SOx-NOx

2019, September 11-13 New Delhi India

· Coal

Fired Power Plant Decisions

DSUA Pre Conference Webinar

On August 29th at 10:AM central time, there

will be a preview of the DSUA conference with a presentation by Gerald

Hunt, DSUA president followed by discussions with panelists, Bob McIlvaine

and Paul Brandt of Burns & McDonnell. The question posed to the

audience will be how to leverage the conference and archives on a

continuing basis to assist in dry scrubber decision making worldwide.

An hour has been allotted to this discussion which is

free to anyone. To register for the meeting just email Ross Ardell at rardell@mcilvainecompany.com. Address questions to Bob

McIlvaine at 847 226 2391 email rmcilvaine@mcilvainecompany.com

Dry Scrubber Users Conference

This conference is unique due to the frank and in depth

discussions which take place. The focus is semi dry and dry scrubbers used

in a number of different industries. There are tours of dry scrubber

installations in the Kansas City area, speeches by end users and suppliers,

exhibits, and most importantly lots of opportunities to talk to the other

attendees. Details on the conference

are found at http://www.dryscrubberusers.org/

SOx-NOx 2019

Government and

industry leaders will be participating in this annual conference addressing

air pollution control needs for power plants. This market is the world’s

most active for FGD presently with utilities expected to install systems on

160,000 MW of capacity. Details are

found at http://soxnox2019.missionenergy.org/

Coal fired Power Plant

Decisions

Dry

scrubbing is one of the options used by coal fired power plant operators to

capture SO2, sulfuric acid mist and other acid gases. 44I

Coal Fired Power Plant Decisions provides

a forum for end users and suppliers to determine which pollution control

options are best for a specific plant. Because of lack of water, low SO2

concentrations, weak gypsum market demand, and other factors a dry

rather than wet scrubbing solution may be the best choice.

The

choice is made more complex by the need to address multiple pollutants. Dry

scrubbing is effective in removing SO3 whereas this is not

true of wet scrubbers. With the addition of activated carbon, dry scrubbers

can also remove mercury. There are multiple dry scrubber designs. Some are

better with higher sulfur levels. So the fuel becomes one variable in the

pursuit of the lowest total cost of ownership solution.

There

are multiple dry scrubbing technologies. One is the spray dryer absorber

(SDA). This utilizes the same principle used in manufacturing instant

coffee or powdered soft drinks. A slurry is sprayed into a vessel through

which the hot gas flows. The liquid evaporates. The acid gas reacts with

the absorbing particles. The particles are then captured in a fabric

filter.

The

circulating fluid bed (CFB) scrubber functions by passing the acid gas

through a fluidized bed of lime particles. Circulating Dry Scrubbers (CDS)

entrain and then separate the particles. Lime or sodium particles are

injected into the flue gas duct with Dry Sorbent Injection (DSI) systems.

The catalytic filter uses the DSI principle ahead of a ceramic filter

medium with embedded catalyst for both particulate control and NOx

reduction.

There

are a number of materials, fibers, media configurations and element designs

which are utilized. The collection media in the fabric filter has a major

impact on cost. The optimum gas velocity can vary depending on the media

selected. If the velocity can be doubled then the size of the unit can be

halved. Instead of 4000 bags for a big installation maybe only 2000 would

be needed.

On

the other hand, the cost of ownership is significantly affected by the bag

life. If bags last one year rather than four or five years, then bag costs become

a significant part of the total expense. The energy cost is also a factor.

Energy consumption increases in direct proportion to velocity. It also

increases in direct proportion to the thickness of the dust cake on the

filter media.

In

the case where only particulate is to be captured it is best to establish a

semi-permanent cake on the bags and then pulse off the new cake. In

accounting terms this is LIFO (last in first out). However, for dry

scrubbing it is best to remove the reacted gypsum and retain the fresh lime

(FIFO). The industry has not formally addressed FIFO vs LIFO and needs to

do so.

The

need to maximize acid gas capture and the resultant substantial increase in

particulate loading affects the choice of fibers and filter media. The type

of cleaning (reverse air or pulsing with compressed air) also determines

the selection of the lowest true cost medium.

The

fuel or product being calcined or treated also impacts the medium. If a

high sulfur fuel is burned, the costs of dry scrubbing are comparatively

higher than if a low sulfur fuel is burned. Various fibers react

differently to various combinations of acid gases, temperature and

humidity. One fiber may handle SO2 and HF in relatively

humid conditions at 300 F whereas another cannot.

Temperature

resistance is important for several reasons. One is that a fiber which can

withstand the temperature excursions will have a longer life than one which

is dependent on more perfect operation of the system. Another consideration

is the potential to recover heat.

An

alternative to glass and polymeric resins is a ceramic fiber matrix.

Elements can contain embedded catalysts. Dry sorbent injection ahead of the

ceramic media can be utilized to provide removal of dust and acid gases

while reducing NOx. The resultant clean hot gas at 600 F or

higher can then be directed to an efficient heat exchanger and most of the

potential energy recovered.

The

material, fiber design, media construction and filter element shape all

have to be designed to address the unique requirements of the application

and the technology being employed.

The

two major fiber types are glass and polymers.

|

Type of Fiber

|

Glass

|

Polymers

|

|

Construction

|

Woven generally but also some

non-woven

|

Non-woven

·

Laminates

·

Laminate with Membrane

|

Performance

varies both in terms of temperature, abrasion and chemical resistance.

|

Fiber

|

Type

|

Max Continuous

Temperature

|

Chemical

Resistance

|

Abrasion Resistance

|

|

PPS

|

Felted

|

375

|

Excellent

|

Excellent

|

|

PTFE

|

Woven

|

450

|

Excellent

|

Fair

|

|

Fiberglass

|

Woven

|

450

|

Good

|

Fair

|

|

P84

|

Felted

|

500

|

Very Good

|

Excellent

|

There

are differences in laminates with multiple non-woven layers being employed

with varying support materials and designs. Fiber shape is also a variable.

How

complex are the decisions? There are at least 1500 combinations to assess.

But

there are also site specific considerations such as cost of electricity,

reagents, pollution limits, plant life, existing equipment. So these can

present another 100 variables resulting in 150,000 factors.

There

are mountains of information available on all the different variables.

Determining which information will help select the lowest total cost of

ownership product is a daunting task. The answer is “shared responsibility

and collaboration”. Organizations focused on components such as filter

media or reagents can contribute but only if there is a clear path on how

to do so. The Dry Scrubber Users Group which is focused on the subject in

the broadest terms can be the catalyst to help bring other organizations

into what can be titled a True Cost Program. The program can provide access

to the needed evidence for validation of lowest total cost of ownership.

Conferences and exhibitions can provide a forum for actual validation of

supplier claims. The categories include component related conferences as

well as industry conferences.

Shared

responsibility and collaboration are best driven by suppliers who are

convinced that their product has the lowest true cost and are willing to

help provide all the evidence pro & con to support their position. Coal Fired Boiler Decisions has a

Dry Scrubber Decision Guide, a monthly FGD newsletter and another

newsletter just on Fabric Filters. Information has been compiled for this

service for 45 years. Collaboration with publishers and conference

organizers includes dry scrubbing tour maps and networking at exhibitions.

Coal

Fired Power Plant Decisions is being offered free of charge to utility

operators. Suppliers are able to participate with just a $1600/yr

subscription. For more information click on 44I

Coal Fired Power Plant Decisions

Bob

McIlvaine can answer your questions at 847 784 0013 email rmcilvaine@mcilvainecompany.com

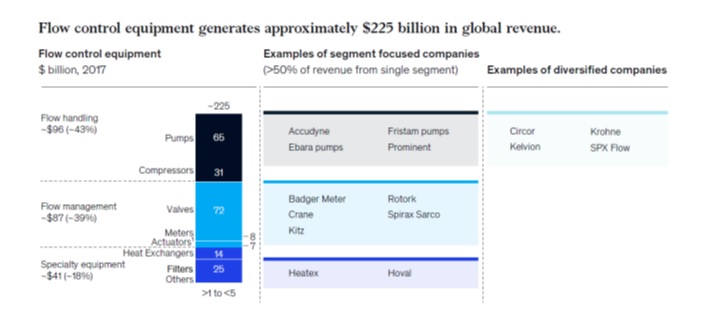

Does McKinsey Report on Flow Control

Consider Asian Suppliers?

A

new report by McKinsey, Flow

Control-Sector at a Cross Roads analyzes industry performance based on

Japanese, U.S. and European companies.

It considers a $225 million market which McIlvaine pegs at more than

$400 million.

If

the industry is at a cross roads it is likely to be based on the rise of Chinese,

Indian and other suppliers in the fastest growing parts of the globe. Larsen & Toubro is a major valve

supplier based in India. Neway is a major valve supplier based in

China. Sinopec, based in China, is the world’s largest flow and treat purchaser

but also a major supplier of pumps.

The

crossroads which McIlvaine maps is between regional and world focus. It is

from orientation around countries to orientation around worldwide users.

The oil, chemical, mining and other industries are using remote monitoring,

process management software, and data analytics to specify flow and treat

products for all their plants around the world. Suppliers need to adapt these developments. The following recent news releases

address the question in one way or another

Selling to

the 500 Coal Plant Owners who make 99 percent of the Purchases

Oil, Gas,

Refining Daily Project Tracking and Monthly Analysis

Factors

Shaping the Combust, Flow and Treat (CFT) Market

Innovation

in the Combust, Flow and Treat Industry is a Product of Wisdom through

Interconnection

Pump

Companies Continuing to Change Strategy and Ownership

Flow and

Treat Purchases by TSMC and Other Chip Producers

Flow and

Treat Acquisition Choices Shaped by Most Profitable Market Program

Bottoms Up

Collaboration Around Each Major Flow and Treat Prospect

Eliminating

Silos can Increase Profits in Air, Water and Energy

LNG is a

Most Profitable Market for CFT Suppliers

Most

Profitable Petrochemical Markets for CFT Suppliers

Treatment

Chemicals Most Profitable Market Analyses based on Knowledge

Utility E Alert Headlines for Last Week

Here are the headlines in the Utility E-Alert for last week. This service is available separately or

as part of a package Power Generation Markets and Projects

#1434 – August 16, 2019 Table of Contents

COAL – U.S.

·

How ACE affects today’s Utility Plants

·

Coalition of US States and Cities

challenges Trump Coal Pollution Wind-back

·

Coal Unit Trump wanted saved set to close

19 Months Early

·

TVA seeking Public input on expansion of

Coal Reserves

COAL – WORLD

·

Australian Utility flags early closure of

Brown Coal Plant

·

Russian Coal Company seeking change to Big

Arctic Reserve Boundary

·

Vietnam’s Prime Minister urges

construction of Two Coal Plants

·

CEZ Group turns to Gore to reduce Mercury

Emissions from Melnik I

·

36,000 Hours of operation for P84+PPS

Bags at Eskom

NUCLEAR

·

NRC approves Sale of last Nuclear Plant in Massachusetts

INDIA

·

Analysis of Indian FGD Suppliers

·

Indian Coal Ash Dam collapses

·

Indian Power Lobby presses for further

delay in Pollution Standards

·

Doosan is active in India and Around the

World in the Full Range of APC Equipment

·

Indure is a large Indian EPC Company with

APC Licenses

·

BHEL is the leading Supplier of Power

Plants and FGD Systems in India

·

ISGEC has Licenses from Multiple

International APC Suppliers

·

GE is the Second largest FGD Supplier in

India

·

Hamon Indian Subsidiary selling Cooling

Towers, Chimneys and Air Pollution Control Equipment in India

·

Rieco offers a Limestone FGD System with a

Venturi Scrubber for Particulate removal

·

Andritz offers Wet and Dry FGD Systems in

India

·

Larsen and Toubro designs Plants, Air

Pollution Control Systems and manufactures Components such as Valves

·

Circulating Fluid Bed Scrubber could be

the best choice for many Indian Power Plants

·

Adage Automation supplies 127 CEMS for

Reliance Industries

·

Bids close for DSI for 4 x 210 MW of

DSI systems at Punjab State Power Roopnagar in September 2019

·

Tata Power March 2019 bid request

for 1 x 67.5 MW DSI FGD System

·

Carmeuse exporting Lime to India from Oman

·

Valmet uses the Condensing Scrubber

Technology to recover Heat

LNG is a Most Profitable Market for CFT Suppliers

Combust, flow, and treat (CFT) products are important

components in liquefaction of natural gas, the transport of those liquids

by ship or land and their regasification prior to use. It is desirable for

a CFT supplier to assess this opportunity based on the basis of the profit

which can be obtained by pursuing it. This Most Profitable Market (MPM) can

be defined as the market which yields the highest profit given the

resources available.

The LNG market creates high profit opportunities for CFT

companies due to

· High growth

· Challenging applications

· Relative few decision makers

· Purchaser desire to buy based on lowest total cost of

ownership

·

Ability to validate lowest total cost of

ownership

High Growth: High growth markets have less competition

and a bigger profit opportunity. LNG will be experiencing rapid growth.

Over the next few years the U.S. will lead in liquefaction construction.

Regasification facilities will be constructed in many countries. LNG

represents just under 10 percent of the global gas supply. LNG continues to

be the fastest-growing gas supply source. The expected world compound

annual growth rate is 4 percent a year between now and 2035. However growth

in the next 5 years will exceed 7 percent.

2018 liquefaction capacity was 370 million tons per annum

(mtpa). 875 mtpa of new liquefaction capacity is proposed. 92 mtpa is under

construction. Global regasification capacity is 851 mtpa. There are 478 LNG

vessels with more than 20 new vessels per year being commissioned. In 2023

Australian capacity will exceed 80 mtpa compared to 100 mtpa in Qatar and

65 million mtpa in the U.S. The U.S. will experience the fastest growth

from a base of 20 mtpa in 2017.

This

extract from the LNG analysis is similar to one on each oil, gas, refining,

and petrochemical sector in N049 Oil, Gas, Shale

and Refining Markets and Projects

|