|

||||||||||||||

|

||||||||||||||

· Lots of Merger Activity in the $6 Billion Liquid Filtration and Media Market

· Water and Wastewater Chemical Revenues in Asia to Approach $12 Billion Next Year

· Boost Sales by Convincing the Prospect You Can Solve His Specific Problem

· Headlines for the July 12, 2013 – Utility E-Alert

· McIlvaine Hot Topic Hour Registration

Lots of Merger Activity in the $6 Billion Liquid Filtration and Media Market

McIlvaine has identified a distinct liquid macrofiltration market which will generate revenues of $6 billion this year. The market is undergoing transformation due to a number of acquisitions. Here are some of them as identified in the continuous online McIlvaine report, Liquid Filtration and Media: World Markets. (www.mcilvainecompany.com)

Filtration Group acquired Clear Edge: Effective May 3rd Clear Edge was acquired by Filtration Group Corporation, a Chicago based filtration company owned by Madison Capital Partners. Filtration Group, a collection of over ten specialized growing filtration companies, will have revenues in excess of $700 MM including Clear Edge. Clear Edge will be part of the Liquid Process Division within Filtration Group which also includes Global Filter and Jonell both specialized industrial process filtration companies. Clear Edge will continue to be headquartered in Tulsa, Oklahoma and operate throughout the world focused on mining and minerals, chemical processing, wastewater treatment and bulk food and beverage markets among other specialized markets and applications. Rick Von Drehle, Clear Edge CEO, commented “We look forward to the future as part of Filtration Group. This certainly positions Clear Edge to continue to grow within its existing markets and with new products and into new geographic regions.”

Passavant-Geiger Acquired Johnson Screens: Passavant-Geiger GmbH, a wholly-owned subsidiary of Bilfinger SE, has acquired Johnson Screens. The two companies will form the Bilfinger Water Technologies Group, to be headquartered in Aarbergen, Germany. Minnesota-based Johnson Screens manufactures mechanical components for the separation of solids from liquids and gases, and offers related services from eleven locations around the world. The products are used for drinking water treatment, wastewater treatment and in oil and gas and refining applications. Johnson Screens has revenues of approximately €160 million (US$210 million).

As a result of the take-over, Passavant-Geiger will double its revenue to over

€300 million (US$390 million). The newly formed Bilfinger Water Technologies

will include Passavant Water Technologies (wastewater purification and sludge

treatment), Roediger (vacuum technologies), Airvac Water Technologies, Johnson

Screens, Bilfinger (filter presses, formerly Diemme) and China’s Bilfinger

Passavant Water Technologies (Hangzhou). The new group will have about 1,750

employees at 31 locations in 17 countries.

Vance Street Capital Acquired Micronics: Vance Street Capital LLC, a Los Angeles-based private equity firm, has acquired a majority interest in Micronics Inc., a global provider of aftermarket filtration products and OEM custom filter presses. Micronics’ management team will also have a significant ownership stake in the business. Terms of the transaction were not disclosed.

Headquartered in Portsmouth, New Hampshire, Micronics provides filtration products to varied industries worldwide including mining, chemical, wastewater, metals and food and beverage. The Micronics transaction represents Vance Street’s seventh platform acquisition in its current fund.

Siemens

Water Technologies

acquired IPM:

Siemens has expanded its dewatering product line with the acquisition of

Industrial Process Machinery (IPM), a leading provider of filter presses for the

mining industry for over 20 years.

Siemens Water will offer IPM’s high-capacity filter

presses for slurry dewatering worldwide. Dave Spyker, executive vice president

of the Industrial Segment for Siemens Water Technologies, said: “IPM has a

strong reputation in the mining market with their filter presses. The

acquisition expands our filter press line of products and related services

further into the global mining market and into other industries as well,

including chemical and remediation.”

IPM provides a unique line of filter presses that are robust and highly automated, offering shorter filter press cycle times and high speed shifting, resulting in reduced cost. IPM filter presses provide such high cake dryness that thermal drying equipment may not be needed, further reducing operating expenses. The IPM filter press will be incorporated into the existing Siemens dewatering product portfolio, which includes the J-Press line of filter presses.

CECO Environment Acquired Met-Pro Corporation: Cincinnati-based CECO Environmental Corp., acquired Met-Pro Corp. in a deal valued at approximately $210 million. Met-Pro makes pumps, filters and water-treatment equipment. The company was founded in 1966 and is headquartered in Harleysville, Pennsylvania.

CECO said the acquisition creates a company that would have a leading share in the global market for air pollution control, product recovery and fluid handling technology. It also expands the company's product lineup and worldwide customer base.

WesTech Relaunches Microfloc, General Filter Brands: WesTech Engineering, Inc. is reintroducing the Microfloc and General Filter brands to the municipal water treatment market. WesTech acquired the product lines from Siemens in September 2012 and believes the brand names went under-promoted under Siemens. The brand reintroduction initiative recognizes the solid reputation the brands hold and honors their successful legacy.

Microfloc was founded in 1961 by engineers who developed an innovative method for electronic control of coagulation chemical addition. Microfloc has continued to innovate, developing the mixed media filter bed, the first commercially viable tube settler, the upflow Adsorption Clarifier System and, more recently, the Trident HS system, a sophisticated package treatment system.

General Filter was founded in 1935 and manufactures water treatment equipment such as pressure filters, clarifiers and aerators. The company’s innovations have included the ATOMERATOR™ system (an innovative way of introducing oxygen into process streams without breaking system pressure), the MULTICELL® common-underdrain filter system, the AERALATER® package treatment system, Laser Shield direct-retention underdrain caps, and the MULTIWASH® backwash system.

Nederman Acquired Environmental Filtration Technologies: Nederman has strengthened its position in the filtration sector by acquiring Environmental Filtration Technologies (EFT). EFT markets filtration products under the well-known brand names of MikroPul, Menardi, Filtrex, LCI and Pneumafil. The EFT group has the majority of its sales in North America with subsidiaries in Australia, Germany and France. EFT is a major supplier of filter cloths.

The acquisition will significantly strengthen Nederman’s position in North American and Australia. EFT also exports to growth markets where Nederman is already present, which can be utilized for further expansion. The purchase price was approximately MSEK 249 (US$39 million). EFT had sales of MSEK 834 (US$130 million) in 2011, with a workforce of 385.

Alfa Laval Acquired Ashbrook Simon-Hartley: Alfa Laval has expanded in wastewater treatment portfolio with the acquisition of belt filter press manufacturer Ashbrook Simon-Hartley. Headquartered in Houston, Texas, Ashbrook Simon-Hartley has offices in the UK, Chile and Brazil and a worldwide installed base. The company had sales of approximately US$75 million in 2011 and employs about 250 people.

The Ashbrook Simon-Hartley product range, including belt filter presses, decanter centrifuges, rotary drum thickeners and disc filters, complements Alfa Laval’s dewatering product portfolio. Alfa Laval president and CEO, Lars Renström, said: “With this acquisition we are adding a complementary and expanded range of products and solutions further strengthening our offer for municipal and industrial wastewater treatment applications.

Trojan Technologies Acquired Norway's Salsnes Filter: Salsnes Filter AS of Namsos, Norway, will join the group of businesses owned by Ontario-based Trojan Technologies. Salsnes Filter’s patented technology uses a fine mesh sieve to filter process and wastewaters and operates like an inclined gravity belt thickener. The fully automated filter is used in the food, paper, cruise line and aquaculture sectors. The technology is also used as an alternative to the primary settling stage for traditional chemical/biological treatment facilities and to prevent membrane bioreactor fouling.

For more information on Liquid Filtration and Media World Market: click on:

http://home.mcilvainecompany.com/index.php/component/content/article?id=71#n006.

Water and Wastewater Chemical Revenues in Asia to Approach $12 Billion Next Year

Producers of treatment chemicals will generate revenues of $11.9 billion next year in Asia. This is the latest forecast in the continually updated McIlvaine publication: Water and Wastewater Treatment Chemicals: World Market. (www.mcilvainecompany.com)

Water and Wastewater Chemical Revenues, Asia, $ Millions

|

Industry |

2014 |

|

Total |

11,864 |

|

Chemical |

296 |

|

Electronics |

239 |

|

Food |

341 |

|

Metals |

429 |

|

Mining |

298 |

|

Oil & Gas |

418 |

|

Other Industries |

568 |

|

Pharmaceutical |

101 |

|

Power |

3,119 |

|

Pulp & Paper |

754 |

|

Refining |

1,012 |

|

Wastewater |

1,596 |

|

Water |

2,693 |

The power industry will lead the way due in a large part to the many new coal-fired power plants which will be operating in China and other Asian countries. China is adding more coal-fired power plants each year than the total fleet in any European country except Germany. The German total fleet is only slightly above the yearly average of 50,000 MW being added in China. Power plants are large purchasers of corrosion inhibitors as well as scale inhibitors. These two chemicals groups alone will account for purchases of $2.2 billion by Asian power plants.

Municipal water and wastewater plants in Asia will purchase chemicals totaling $4.3 billion in 2014. In China, secondary municipal wastewater treatment flow is now 30,000 million gallons per day (mgd) up from just a few thousand mgd in the early 1990s. These plants will be major purchasers of polymers. Organic flocculant purchases by wastewater plants in 2014 will exceed $600 million.

For more information on Water and Wastewater Treatment Chemicals: World Market, click on:

Boost Sales by Convincing the Prospect You Can Solve His Specific Problem

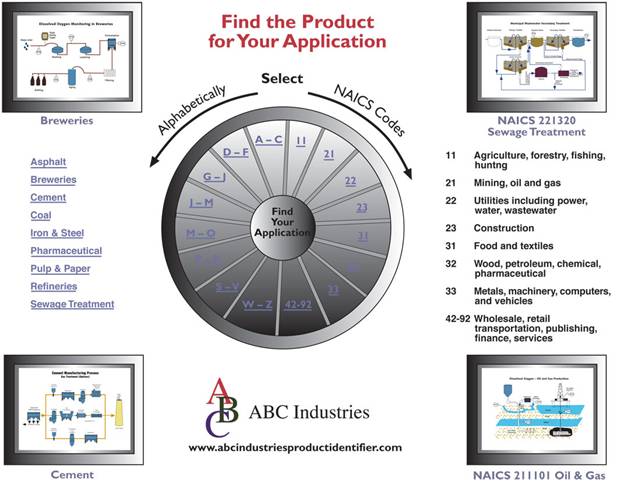

Customers are looking for suppliers who have already solved a problem identical to their own. Their industry has an NAICS code. So, if they can click on that code on your website and can be convinced that you have the experience, you are very likely to create an active prospect.

McIlvaine can help you create a child web to display these as shown below. We can also link your success stories and relevant product information in the Global Decisions Orchard which is drawing heavy internet traffic.

More details on the entire program are found at:

4 Lane Knowledge Bridge to the End User

Headlines for the July 12, 2013 – Utility E-Alert

UTILITY E-ALERT

#1133 – July 12, 2013

Table of Contents

COAL – US

COAL – WORLD

§ Nigeria wants 4000 MW More Power from Coal

§ Alstom to supply Electrical Balance of Plant for 3x660 MW Supercritical Lalitpur in Uttar Pradesh, India

§ BGR Energy has Balance of Plant Contract for 2x660 MW OPGC Power project in Orissa, India

§ NTPC progressing on 1600 MW Darlipali Supercritical Project in Orissa, India

GAS/OIL – US

GAS/OIL – WORLD

§ Trianel/MiRO Refinery to build 800-1200 MW Karlsruhe Combined Cycle Power Plant in Germany

§ Rio Tinto to use GE Gas Turbines for Power to Expand Mining Capacity in Western Australia

COMBUSTION TECHNOLOGIES/BOILER EFFICIENCY

NUCLEAR

§ Four Japanese Nuclear Power Companies want to Restart 10 Nuclear Power Plants in Japan

§ Energy Northwest Consortium proposes Modular Reactors in Western US

§ Fennovoima negotiating with Rusatom Overseas for Hanhikivi 1 in Finland

§ Loan Guarantee for New Vogtle Units in Georgia still under Negotiation

§ Czech Republic wants to see Completed Third Generation Projects from Temelin Nuclear Power Project Bidders

§ Kudankulam 1 (Tamil Nadu, India) set to go Critical

§ Environmental Clearance for 6,000 MW Mithivairdi in Gujarat, India

BUSINESS

HOT TOPIC HOUR

§ “New Developments in Air Pollution Control Technology” -- the Hot Topic Hour on July 11, 2013

§ “Measurement and Control of HCl” is the Subject of the Hot Topic Hour on Thursday July 18, 2013 at 10:00 a.m. CDT

§ Upcoming Hot Topic Hours

For more information on the Utility Tracking System, click on: http://home.mcilvainecompany.com/index.php?option=com_content&view=article&id=72

McIlvaine Hot Topic Hour Registration

On Thursday at 10 a.m. Central time, McIlvaine hosts a 90 minute web meeting on important energy and pollution control subjects. Power webinars are free for subscribers to either Power Plant Air Quality Decisions or Utility Tracking System. The cost is $125.00 for non-subscribers. Market Intelligence webinars are free to McIlvaine market report subscribers and are $400.00 for non-subscribers.

|

|

2013 |

|

|

DATE |

SUBJECT |

|

|

July 25 |

GHG Compliance Strategies, Reduction Technologies and Measurement |

Power |

|

August 1 |

New Developments in Power Plant Air Pollution Control – Part 2 |

Power |

|

August 8 |

Improving Power Plant Efficiency and Power Generation |

Power |

|

August 15 |

Control and Treatment Technology for FGD Wastewater |

Power |

|

August 22 |

Pumps for Power Plant Cooling Water and Water Treatment Applications |

Power |

|

August 29 |

Status of Carbon Capture and Storage Programs and Technology |

Power |

|

Sept. 5 |

Fabric Selection for Particulate Control

|

Power |

|

Sept. 19 |

Air Pollution Control for Gas Turbines |

Power |

|

Sept. 26 |

Multi-Pollutant Control Technology

|

Power |

|

Oct. 3 |

Update on Coal Ash and CCP Issues and Standards |

Power |

To register for the Hot Topic Hour, click on:

http://www.mcilvainecompany.com/brochures/hot_topic_hour_registration.htm.

----------

You can register for our free McIlvaine Newsletters at: http://www.mcilvainecompany.com/brochures/Free_Newsletter_Registration_Form.htm.

Bob McIlvaine

President

847 784 0012 ext 112

rmcilvaine@mcilvainecompany.com

191 Waukegan Road Suite 208 | Northfield | IL 60093

Ph: 847-784-0012 | Fax; 847-784-0061