|

|

|

|

|

RO, UF, MF Insights |

|

|

|||

|

|

|

|

|||||||

|

|

|

|

|

RO, UF, MF Insights |

|

|

|||

|

|

|

|

|||||||

· 4 Lane Knowledge Bridge to the End User

· Boost Sales by Convincing the Prospect You Can Solve His Specific Problem

· $2 Billion Market for Cross-flow Membranes and Equipment to Purify Drinking Water

· GDP Update Headlines – July 2013

· Sales Leads for Oil & Gas – July 2013

· North American Municipal Wastewater Treatment Plants Update Headlines – June 2013

· Do You Have A Lower Life Cycle Cost Product For The Chinese Market?

4 Lane Knowledge Bridge is the route to increased sales. In the digital age it is very desirable to place your vehicles on the knowledge bridge. Learn more at:

4 Lane Knowledge Bridge to the End User

Boost Sales by Convincing the Prospect You Can Solve His Specific Problem

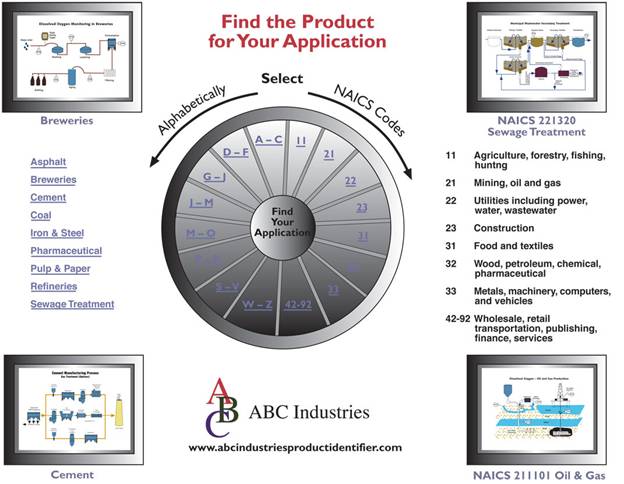

Customers are looking for suppliers who have already solved a problem identical to their own. Their industry has an NAICS code. So, if they can click on that code on your website and can be convinced that you have the experience, you are very likely to create an active prospect.

McIlvaine can help you create a child web to display these as shown below. We can also link your success stories and relevant product information in the Global Decisions Orchard which is drawing heavy internet traffic.

More details on the entire program are found at:

4 Lane Knowledge

Bridge to the End User

$2 Billion Market for Cross-flow Membranes and Equipment to Purify Drinking Water

Next year municipal drinking water plants around the world will spend just under $2 billion for cross-flow membrane equipment and systems. This is in addition to an expenditure of $3 billion to desalinate seawater. These are the conclusions reached in RO, UF, MF World Markets published by the McIlvaine Company. (www.mcilvainecompany.com)

Cross-flow Membrane Sales for Drinking Water ($ Millions)

|

World Region |

2014 |

|

Total |

1,973 |

|

Africa |

77 |

|

CIS |

80 |

|

East Asia |

798 |

|

Eastern Europe |

35 |

|

Middle East |

74 |

|

NAFTA |

257 |

|

South & Central America |

140 |

|

West Asia |

336 |

|

Western Europe |

176 |

Prior to 1990 most drinking water plants used sand filters to purify drinking water. However, since that time there has been a trend toward use of microfiltration and ultrafiltration membrane systems. The reason is that the cross flow membranes can remove more of the disease causing organisms than can the sand filters.

The most efficient selection would be reverse osmosis (RO). However, the capital cost and energy consumption is considerably greater than ultrafiltration, so the use of RO is confined to situations where there is significant contamination of the water to be consumed.

East Asia is the largest market. It is also growing the fastest. The migration of the rural population to the cities has increased drinking water demand. Since the source water is likely to be more contaminated than in other regions, cross-flow membrane filtration with its higher efficiency is the best choice.

For more information on RO, UF, MF World Market, click on:

http://home.mcilvainecompany.com/index.php/component/content/article?id=71#n020

GDP UPDATE HEADLINES – July 2013

AMERICAS

ASIA

EUROPE / AFRICA / MIDDLE EAST

AMERICAS

(1.) Barclays has cut its second-quarter GDP trading estimate to 1.0% from 1.6% after the trade deficit widened in May. In a note to clients, Barclays blamed the larger-than-expected increase in imports in the month for the downward revision. A higher trade deficit is a drag on GDP. Earlier, the Commerce Department reported that the May trade gap rose 12% to $45 billion in May, well above economists' forecast of a deficit of $40.3 billion.

(2.) The U.S. economy suddenly looks weaker, after the government revised its data for the first quarter. Gross domestic product -- the broadest measure of economic activity -- rose at a mere 1.8% annual pace between January and March, marking a sharp downward revision from the 2.4% pace reported by the Commerce Department last month.

The government revises its GDP figures several times, but economists weren't expecting such a dramatic change from the third estimate.

"This was certainly unexpected and, I believe, rare," said Jennifer Lee, senior economist with BMO Capital Markets, referring to the revision.

The weaker figures came primarily from revisions to consumer spending, exports and commercial real estate.

Consumer spending, which alone accounts for roughly two-thirds of the GDP measure, rose at a 2.6% annualized pace in the first quarter, according to the revisions. That's down from the 3.4% pace the Commerce Department estimated in its prior report.

Meanwhile, spending on nonresidential buildings shrunk 8.3% in the first quarter, offsetting some of the economic boost from the ongoing housing recovery.

U.S. exports to other countries contracted, and government spending cuts continued to be the largest drag on economic growth.

Economists have already turned their attention to studying how the economy fared in the spring. Their estimates point to more of the same slow growth. (The remaining text is not included in this sample.)

ASIA

CHINA

A Chinese think tank has opined economic growth will be steady in the second half of the year, with a GDP growth rate of 7.6 percent.

In a report by the State Information Center, it cited the government's "stabilizing economic growth" measures will have a positive effect.

However, the report cited risks of bad local government loans, slowing growth of central government revenue, diminished export competitiveness and industrial capacity are growing.

Chinese markets are recovering from a crunch in the domestic financial markets that saw short-term money rates spike to record highs and stock markets swoon in recent weeks.

An analyst in China has suggested the Chinese government will map out changes to policy in July to December, with reform as a key economic agenda fuel present and future growth.

During this process, new investment opportunities will be scheduled providing momentum for economic recovery, a series of reforms concerning resource product prices, land expropriation, medical and health care system, private investment, and a VAT scheme……(The remaining text is not included in this sample.)

EUROPE / AFRICA / MIDDLE EAST

The National Statistics Committee of Belarus has carried out the second evaluation of Belarus’ gross domestic product in the first quarter of 2013. The evaluation has revealed that GDP made up Br129 trillion in current prices, up by 3.8% in comparable prices over the first quarter of 2012, BelTA learned from the National Statistics Committee.

The first evaluation estimated Belarus’ GDP at Br123.3 trillion, up by 3.5% compared to January-March 2012. The previous evaluation was tentative, because it was based on the data obtained via statistical surveys, expert analysis and indirect calculations, the National Statistics Committee informed.……(The remaining text is not included in this sample.)

A complete analysis of GDP and monthly updates for individual countries are included as part of RO, UF, MF World Market.

For more information on RO, UF, MF Markets click on: http://home.mcilvainecompany.com/index.php/component/content/article?id=71#n020

SALES LEADS FOR OIL & GAS – July 2013

(Listed by most current date)

These sales leads are part of Oil, Gas, Shale and Refining Markets and Projects and are issued bi-weekly. As a subscriber to RO, UF, MF World Markets you receive a 30 percent discount

for this service.

For more information on Oil, Gas, Shale and Refining Markets and Projects, click on:

http://home.mcilvainecompany.com/index.php/component/content/article?id=72#n049

For more information on: RO, UF, MF World Markets click on:

http://home.mcilvainecompany.com/index.php/component/content/article?id=71#n020

NORTH AMERICAN MUNICIPAL WASTEWATER TREATMENT PLANTS UPDATE HEADLINES- June 2013

ALASKA

ARIZONA

ARKANSAS

CALIFORNIA

FLORIDA

GEORGIA

ILLINOIS

INDIANA

IOWA

KENTUCKY

MARYLAND

MASSACHUSETTS

MICHIGAN

MINNESOTA

MISSISSIPPI

MISSOURI

MONTANA

NEBRASKA

NEW HAMPSHIRE

NEW JERSEY

NEW YORK

NORTH CAROLINA

OHIO

OKLAHOMA

PENNSYLVANIA

RHODE ISLAND

SOUTH DAKOTA

TEXAS

WASHINGTON

CANADA

BUSINESS NEWS

RECENT CHEMICAL BID REPORTS

For more information on North America Municipal Wastewater Treatment Facilities and People click on:

http://home.mcilvainecompany.com/index.php?option=com_content&view=article&id=71#62ei

For more information on: RO, UF, MF World Markets click on:

http://home.mcilvainecompany.com/index.php/component/content/article?id=71#n020

Do You Have A Lower Life Cycle Cost Product For The Chinese Market?

If you have a product or service which may be higher priced but will be a better value for the Chinese purchaser, then you should be moving forward to carve out a slice of the world’s largest market. If you have not yet acted because of any of the following false assumptions, you need to rethink your strategy.

|

False Assumption |

Actual Opportunity |

|

Cannot afford the investment |

There are Chinese companies eager to partner if the product is superior. |

|

Cannot trust Chinese partners |

There are Chinese companies who are relying on distribution of international products and would not develop their own. |

|

Too much financial risk |

There are Chinese companies with deep pockets who will buy F.O.B. your shop and take all financial risk. |

|

Lose intellectual property |

Why are Thermo Fisher and all the major drug companies setting up research centers in China? |

|

Create a competitor |

The only way to avoid Chinese competition in your international market is to be a big player in China. |

|

Chinese language will be a problem |

McIlvaine Decisive Classification in Chinese, 4 Lane Knowledge Bridge, and Global Decisions Orchard eliminate this problem. |

If you want to learn more about these opportunities contact Bob McIlvaine at rmcilvaine@mcilvainecompany.com or 847-784-0012 ext 112.

----------

You can register for our free McIlvaine Newsletters at: http://www.mcilvainecompany.com/brochures/Free_Newsletter_Registration_Form.htm.

Bob

McIlvaine

President

847 784 0012 ext 112

rmcilvaine@mcilvainecompany.com

191 Waukegan Road Suite 208 | Northfield | IL 60093

Ph: 847-784-0012 | Fax; 847-784-0061