|

|||||||

|

|

|||||||

|

· Mercury Control Market Could Be $1 Billion Per Year, But When?

· Renewable Energy Briefs

· Boost Sales by Convincing the Prospect You Can Solve His Specific Problem

· Headlines for the July 12, 2013 - Utility E-Alert

· “GHG Compliance Strategies, Reduction Technologies and Measurement” is the Hot Topic Hour on Thursday, July 25, 2013

· McIlvaine Hot Topic Hour Registration

Mercury Control Market Could Be $1 Billion Per Year, But When?

The market for hardware and consumables to reduce mercury from power plant stacks is likely to exceed $1 billion/yr but the timing keeps changing. This is reflected in the continually updated Utility Mercury Air Reduction Markets published by the McIlvaine Company. (www.mcilvainecompany.com)

The most recent variable to be introduced is the granting of one year extensions for compliance. The Mercury and Air Toxics Standards (MATS), published in the Federal Register on February 16, 2012, calls for a three-year compliance period for existing sources, with a deadline of April 16, 2015, but provides for an extra year, upon request, for sources that need additional time to comply. There have been 60 extension requests, of which 56 have been granted so far.

At this point, the extensions cover less than ten percent of the capacity. The additional number of extensions which will be granted is unclear. In one of the states with the largest number of coal-fired power plants, officials are of the opinion that there will not be many extensions because the three years is ample time.

Another new variable is activity relative to lawsuits by downwind states. On July 12, the U.S. Court of Appeals for the third Circuit upheld EPA on a ruling which will force Portland Generating Station in PA to reduce SO2 emissions in order to prevent downwind contamination in New Jersey. What is involved is the SO2 ambient standard and not mercury, but the two are tied together. The more stringent the SO2 limits, the more likely the plant is to adopt wet scrubbing and bromine oxidation of mercury rather than activated carbon.

Another potential interstate problem is the discovery that the amount of particulate mercury emissions are potentially significant and unmeasured. The MATS only requires measurement of the gaseous phase mercury. This was based on the fact that uncontrolled power plants emit almost no mercury in the particulate form. However, the regulation failed to anticipate that once activated carbon is injected to control the mercury, the potential amount of particulate mercury could substantially increase.

This result is an unlikely but theoretically possible situation where instead of capturing the gaseous mercury the power plant only converts it to particulate mercury. It would then meet its regulatory requirement. However, the downwind state would likely take action to prevent this type of operation. The capture of particulate mercury is easily accomplished in fabric filters and possibly with precipitators. But this whole issue has only recently been discovered and, therefore, needs further analysis.

The discovery of the particulate mercury was a result of tests using both sorbent traps and mercury CEMS. Higher readings in the sorbent traps were caused by the particulate mercury capture.

For more information on Utility Mercury Air Reduction Markets, click on:

http://home.mcilvainecompany.com/index.php/component/content/article?id=48#n056

Renewable Energy Briefs

Wells Fargo Targets Investing More Than $100 Million in SunEdison Distributed Generation Solar Projects

SunEdison, Inc. and Wells Fargo & Company, announced that Wells Fargo subsidiaries plan to invest more than $100 million of tax equity financing in 2013 and 2014 combined to fund U.S. solar photovoltaic distributed generation power projects developed by SunEdison. These new investments build on the relationship that first began between Wells Fargo and SunEdison in 2007. Since 2007, Wells Fargo has provided more than $950 million of tax equity and construction financing for more than 200 utility and distributed generation solar projects developed by SunEdison. The projects are located in thirteen U.S. states and in Puerto Rico.

Under the power purchase agreement (PPA) model, SunEdison builds, manages and operates the solar systems while its customers buy the energy produced for a fixed rate for a term of approximately 20 years. This allows customers to avoid upfront costs typically associated with solar projects and protects them from the fluctuating costs of fossil fuels.

JinkoSolar Supplies 25.8 MW of Solar Modules to First Private Solar Park in India

JinkoSolar Holding Co., Ltd, a leading global solar PV power product manufacturer, announced that it has supplied 25.8 MW of high-efficient solar PV modules to the first private solar park in India.

Located in Mandrup Village, Solapur District, Maharashtra State, India, the project was developed by Enrich Energy Pvt Ltd. on a turnkey basis, a pioneer in India focused on developing large scale private solar parks.

"JinkoSolar's high-efficient polycrystalline modules were used in our first private PV solar park as they will help us to minimize the use of land and maximize the amount of reliable, emission-free solar power generated per dollar invested — which is one of our priorities" said Mr. Ankit Kanchal, Enrich Energy Pvt. Ltd's Director — Commercial. "This is the first project of its kind in Maharashtra State developed under the Average Pooled Purchase Cost (APPC) / Open Access Mechanism & Solar Renewable Energy Certificates (REC) Mechanism."

GE’s Heat to Power Technology and PHG Energy Produce Kilowatts from Wood Chips

GE Power & Water and PHG Energy, a Nashville-based alternative energy equipment company, have successfully collaborated on an innovative project to produce electricity from waste material by employing gasification technology to power GE's Clean Cycle heat-to-power generator.

The Clean Cycle heat-to-power generator, a product manufactured by GE Power & Water, is used worldwide to convert waste heat into electricity. The new system PHG Energy (PHGE) developed starts with gasification of waste wood chips or other biomass to provide a clean-burning producer gas. That fuel is then combusted in a heating unit which supplies the Organic Rankine Cycle (ORC) with the thermal source it needs to operate efficiently, producing enough electricity to supply approximately 50 homes.

The combined GE and PHGE project is being conducted in Gleason, TN, at a facility owned by Boral Brick Corporation. Six industrial grade PHGE biomass fueled gasifiers, which were used to offset natural gas consumption in kiln firing, are currently being tasked for research and development by PHGE until the plant re-opens with recovery of the housing industry.

Electricity produced with GE's heat-to-power generator unit is added to the grid through an agreement with the Tennessee Valley Authority.

Alterra Power and EDC Finalize Joint Venture for Geothermal Assets in Chile and Peru

Alterra Power Corp. announced that Energy Development Corporation (EDC) has issued notice to proceed for the development of Alterra's Mariposa geothermal project in Chile and the Crucero, Loriscota, and Tutupaca Norte concessions in Peru. Definitive shareholders agreements have been executed by the parties, and due diligence has been completed. The JV terms call for EDC to earn a 70 percent interest by funding 100 percent of the next $58.3 million in project expenditures at Mariposa, and $8.0 million in project expenditures at the Peruvian concessions. Under the agreed work plan at Mariposa, the JV will further develop infrastructure over the next 18 months, including new roads and drill pads, and production-scale drilling will commence in late 2014. Next activities at the Peruvian concessions will include advanced exploration activities designed to identify the best locations for power plant development and construction. John Carson, Alterra's CEO said "We're pleased to be partnering with EDC, who brings significant new capital and expertise to these assets. We expect the Mariposa project to be the flagship geothermal power production area in Chile, which continues to have a strong need for power."

Minnesota Power is Moving Forward with Flood Repairs to Strengthen Renewable Resource Asset for the Next Hundred Years

Minnesota Power, a division of ALLETE Inc., said recently it expects to have its largest hydro station, which has been out of commission due to flooding one year ago, partially back in operation by the end of this year and fully restored in 2014.

Major repairs are underway at the company’s Thomson Hydro Station on the lower St. Louis River in Jay Cooke Park. The 106-year-old hydroelectric plant has been out of service since June 20, 2012, after as much as 10 inches of rain fell in the region, causing flash floods in some areas and longer-term flooding in others.

“The significance of this localized event was striking,” said Minnesota Power Chief Operating Officer Brad Oachs. “We saw peak river flows of 56,000 cubic feet per second which was 40 percent above previous record flows. Our employees performed admirably under extremely challenging circumstances.”

While the integrity of the company’s hydro dams was maintained during the unprecedented event, the sheer volume of water and speed at which the flow of the river changed flooded the six turbines at Thomson, overtopped the Thomson reservoir and breached a portion of an earthen dike at the forebay, a small reservoir that feeds water into the Thomson power station. The flood washed out roads and caused mudslides in Jay Cooke State Park, limiting access to the powerhouse by foot or on all-terrain vehicles for months.

For more information on Renewable Energy Projects and Update please visit

Boost Sales by Convincing the Prospect You Can Solve His Specific Problem

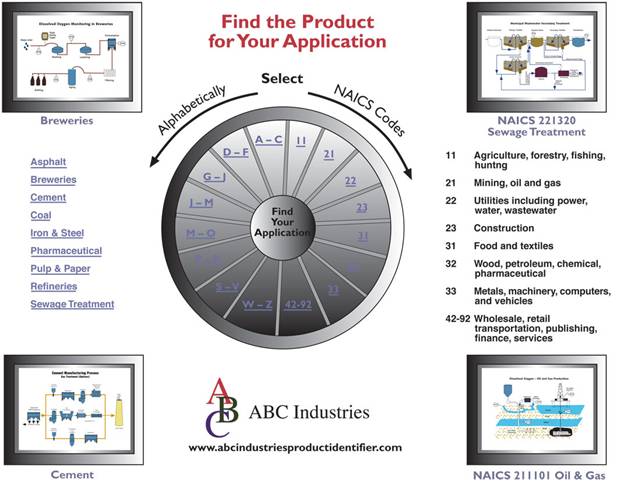

Customers are looking for suppliers who have already solved a problem identical to their own. Their industry has an NAICS code. So, if they can click on that code on your website and can be convinced that you have the experience, you are very likely to create an active prospect.

McIlvaine can help you create a child web to display these as shown below. We can also link your success stories and relevant product information in the Global Decisions Orchard which is drawing heavy internet traffic.

More details on the entire program are found at:

4 Lane Knowledge Bridge to the End User

Headlines for the July 12, 2013 – Utility E-Alert

UTILITY E-ALERT

#1133 – July 12, 2013

Table of Contents

COAL – US

COAL – WORLD

§ Nigeria wants 4000 MW More Power from Coal

§ Alstom to supply Electrical Balance of Plant for 3x660 MW Supercritical Lalitpur in Uttar Pradesh, India

§ BGR Energy has Balance of Plant Contract for 2x660 MW OPGC Power project in Orissa, India

§ NTPC progressing on 1600 MW Darlipali Supercritical Project in Orissa, India

GAS/OIL – US

GAS/OIL – WORLD

§ Trianel/MiRO Refinery to build 800-1200 MW Karlsruhe Combined Cycle Power Plant in Germany

§ Rio Tinto to use GE Gas Turbines for Power to Expand Mining Capacity in Western Australia

COMBUSTION TECHNOLOGIES/BOILER EFFICIENCY

NUCLEAR

§ Four Japanese Nuclear Power Companies want to Restart 10 Nuclear Power Plants in Japan

§ Energy Northwest Consortium proposes Modular Reactors in Western US

§ Fennovoima negotiating with Rusatom Overseas for Hanhikivi 1 in Finland

§ Loan Guarantee for New Vogtle Units in Georgia still under Negotiation

§ Czech Republic wants to see Completed Third Generation Projects from Temelin Nuclear Power Project Bidders

§ Kudankulam 1 (Tamil Nadu, India) set to go Critical

§ Environmental Clearance for 6,000 MW Mithivairdi in Gujarat, India

BUSINESS

HOT TOPIC HOUR

§ “New Developments in Air Pollution Control Technology” -- the Hot Topic Hour on July 11, 2013

§ “Measurement and Control of HCl” is the Subject of the Hot Topic Hour on Thursday July 18, 2013 at 10:00 a.m. CDT

§ Upcoming Hot Topic Hours

For more information on the Utility Tracking System, click on: http://home.mcilvainecompany.com/index.php?option=com_content&view=article&id=72

“GHG Compliance Strategies, Reduction Technologies and Measurement” is the Hot Topic Hour on July 25, 2013

In early May 2013, researchers from Scripps Research Institute studying atmospheric levels at the Mauna Loa Observatory in Hawaii recorded the milestone 400 ppm CO2 concentration in the atmosphere. This is a level that has not been measured previously and CO2 concentrations are projected to continue increasing.

A recent report by Nicholas Bianco, Franz Litz, Kristin Meek and Rebecca Gasper of the World Resources Institute concluded, “Without new action by the U.S. Administration, greenhouse gas (GHG) emissions will increase over time. The United States will fail to make the deep emissions reductions needed in coming decades and will not meet its international commitment (made by President Obama in 2009) to reduce GHG emissions by 17 percent below 2005 levels by 2020.” The same reports cited power plants as the greatest potential source of GHG reductions and recommended that the EPA immediately establish GHG emission standards for existing power plants and finalize standards for new power plants.

Interestingly, just prior to the Scripps observation, the U.S. EPA said April 12, 2013 that it would delay issuance of a new rule limiting greenhouse gas emissions from new power plants. The rule, proposed a year ago, was scheduled to be finalized on April 13. However, the delay was caused primarily by the fact that the EPA did not believe that the rule would withstand court challenges. Although the EPA did not announce a new date for issuing the rule, it is certain that new rules covering both new and existing fossil-fueled power plants will be forthcoming in the foreseeable future.

In spite of the EPA’s action or inaction, the states are moving forward on their own with 29 states now having renewable energy standards, 20 with energy efficiency standards and 10 with GHG cap and trade regulations.

With the handwriting on wall, prudent operators of power plants must develop plans and strategies to meet the challenges of reducing GHGs. The following speakers will help us understand the overall economic, political, regulatory and societal situation relative to GHG reduction and discuss the development of various GHG mitigation strategies and technologies, the economics, the potential GHG reductions achievable and the advantages or disadvantages of the various options.

Dr. James (Jim) E. Staudt PhD, President Andover Technology Partners, will provide a brief status of where power plant GHG requirements are and what may be possible scenarios for future GHG standards. In addition, he will review the status of various technologies for GHG mitigation in the power and cement sectors to include the status of CCS, its cost and viability and some thoughts on possible disruptive technologies that could change the picture for GHG mitigation and the forecasts for various energy sources.

Andrew D. Shroads, QEP, Regional Director for Sanford Cohen & Associates (SC&A, Inc.) The Obama Administration has proposed a nation-wide greenhouse gas (GHG) reduction strategy. A key component is GHG emissions limits for electric generating utilities through new regulation from the U.S. EPA. Although the regulation currently focuses on GHG emissions limits for new electric generating facilities, the regulation will have a much broader impact on the federal operating permit program and requirements for untested control technologies and existing electric generating facilities.

Roger Martella, partner in the Environmental Practice Group at Sidley Austin LLP, will discuss the rapidly changing regulatory framework for greenhouse gases in the United States. Recently, the President announced a definitive schedule for controlling greenhouse gases from new and existing power plants before the end of the administration that will fundamentally change the dynamics of the nation's fossil-fuel utility fleet. Such standards and rules are also likely to be applied to other sectors such as petroleum refining, chemical manufacturing, and cement production. This discussion will focus on the schedule for upcoming rules, the scope and nature of standards that are likely to be proposed, and the impacts on such standards on energy and manufacturing.

John Winkler, Siemens Environmental Systems & Services

Michael Obeiter, Senior Associate, and Kristin Meek, Associate, in the Climate and Energy Program at the World Resources Institute will discuss the current situation for greenhouse gases in the U.S. Despite recent press reports highlighting the drop in energy-related CO2 emissions in the last five years, the U.S. is not on track to meet its international commitment of reducing its greenhouse gas emissions by 17 percent below 2005 levels by 2020. Last month, President Obama announced a national climate action plan designed to put the country on a trajectory to meet that commitment. Our presentation will focus on what the plan must include in order to make the President's goal a reality and some of the compliance mechanisms available for the power sector to meet forthcoming emissions standards.

To register for the July 25h “Hot Topic Hour” on “GHG Compliance Strategies, Reduction Technologies and Measurement” at 10 a.m. DST, click on: http://www.mcilvainecompany.com/brochures/hot_topic_hour_registration.htm.

McIlvaine Hot Topic Hour Registration

On Thursday at 10 a.m. Central time, McIlvaine hosts a 90 minute web meeting on important energy and pollution control subjects. Power webinars are free for subscribers to either Power Plant Air Quality Decisions or Utility Tracking System. The cost is $125.00 for non-subscribers. Market Intelligence webinars are free to McIlvaine market report subscribers and are $400.00 for non-subscribers.

|

|

2013 |

|

|

DATE |

SUBJECT |

|

|

July 25 |

GHG Compliance Strategies, Reduction Technologies and Measurement |

Power |

|

August 1 |

New Developments in Power Plant Air Pollution Control – Part 2 |

Power |

|

August 8 |

Improving Power Plant Efficiency and Power Generation |

Power |

|

August 15 |

Control and Treatment Technology for FGD Wastewater |

Power |

|

August 22 |

Pumps for Power Plant Cooling Water and Water Treatment Applications |

Power |

|

August 29 |

Status of Carbon Capture and Storage Programs and Technology |

Power |

|

Sept. 5 |

Fabric Selection for Particulate Control

|

Power |

|

Sept. 19 |

Air Pollution Control for Gas Turbines |

Power |

|

Sept. 26 |

Multi-Pollutant Control Technology

|

Power |

|

Oct. 3 |

Update on Coal Ash and CCP Issues and Standards |

Power |

To register for the “Hot Topic Hour”, click on:

http://www.mcilvainecompany.com/brochures/hot_topic_hour_registration.htm.

----------

You can register for our free McIlvaine Newsletters at: http://www.mcilvainecompany.com/brochures/Free_Newsletter_Registration_Form.htm.

Bob McIlvaine

President

847 784 0012 ext 112

rmcilvaine@mcilvainecompany.com

191 Waukegan Road Suite 208 | Northfield | IL 60093

Ph: 847-784-0012 | Fax; 847-784-0061