FABRIC

FILTER

NEWSLETTER

MAY, 2021

No. 547

$55

Billion Market for Pharmaceutical Air and Water Flow and Treat

Products and Services

The Number of Cleanroom Projects Increasing at a Double Digit

Rates

COAL FIRED BOILERS

P84 Bags Are Proving to Have Lower Total Cost

of Ownership Results Than Alternatives

ESKOM Modifications Still Don’t Improve Bag

Life to 3 Years

China Will Modify its Coal Expansion Plan

BIOMASS

DENTAL OFFICE

COMPANY NEWS

Camfil Expanding Chinese Operations

$55

Billion Market for Pharmaceutical Air and Water Flow and Treat Products and

Services

The market for pharmaceutical air and water flow and treat

products and services will grow to $55 billion in 2025 according to the latest

forecast in Pharmaceutical

Prospects.

2020 was an unusual year with big growth in vaccines but

slowdown in many pharmaceutical projects. However, the industry is returning to

normal, and the market has been strong in the first half of 2021. The pandemic

surge in India and other countries without vaccines is likely to result in

continued expansion of vaccination production for the next several years.

Certain segments of the market will grow more rapidly than

others. Cell and gene therapy projects are a small portion of the total. But

this segment is growing three times faster than the average.

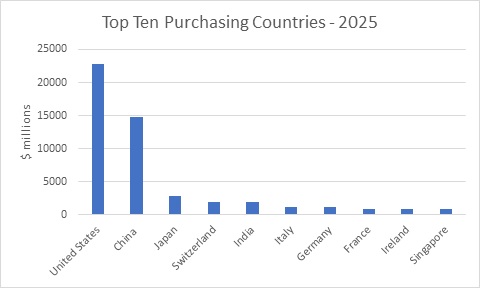

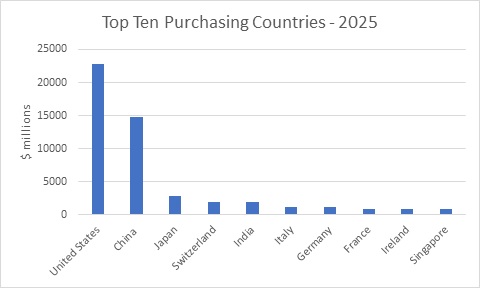

The top ten purchasing countries in 2025 will account for 90%

of the market.

The air and water flow and treat expenditure will equal 3.9%

of the pharmaceutical revenues in 2025. The volumes of air and water being

treated are modest compared to the chemical or mining industry. On the

other hand the potency and sensitivity of the products result in very high

investments per unit of fluid moved or treated. This ratio is at its highest in

cell and gene therapy. This potency and sensitivity has also resulted in

single use systems which are converting one time into continual equipment

investments

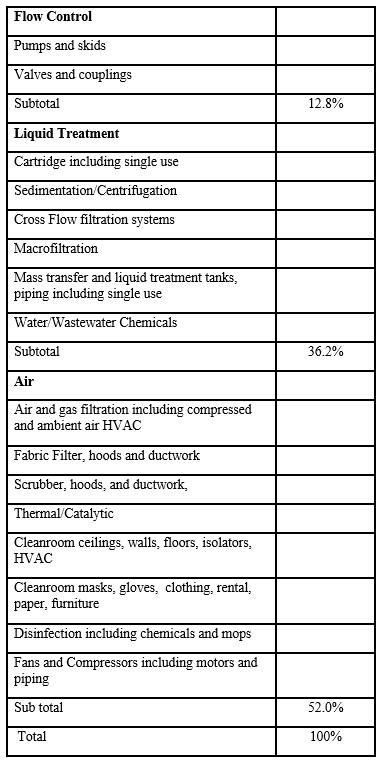

Here is a segmentation of the purchases by product. The

categories include associated flow control instruments, software and hardware. Service

and repair parts are also included.

The Number of Cleanroom Projects Increasing at a Double Digit Rates

Not only are the numbers of cleanroom projects increasing

rapidly but the investment per project is increasing as well.

All of these projects are tracked on a weekly basis in World

Cleanroom Projects.

Many of the semiconductor, photovoltaic, and flat panel

projects are in Asia while the pharmaceutical projects are in the U.S. and

Europe.

Cleanrooms are increasingly needed for products relying on

nanotechnology. But there are other growing markets such as Cannabis.

When a large semiconductor fab is built, there will be

additional cleanrooms to supply the equipment for the fab and others built to

provide the gowns, gloves, mops, filters, valves, instruments and products

needed to operate the fab.

Taiwan Semiconductor Manufacturing Corp. (TSMC) is investing

some $35 billion in a U.S. manufacturing facility, almost tripling the original

$12 billion it originally committed. There will be very large cleanrooms on the

site, but hundreds of additional cleanrooms built to service this Arizona

operation.

The Coronavirus accelerated rather than slowed cleanroom

construction. The world trend toward a digital economy was positively impacted

by home bound businesspeople who needed better digital tools. There was a brief

slowdown in automotive chip demand but now demand is exceeding supply.

The biopharmaceutical industry has been expanding to meet the

vaccine and therapy needs created by the pandemic. A considerable increase in

investment will be needed before India and many of the poorer countries have the

biopharmaceuticals which they need.

Cell and gene therapy project growth is outstripping all

other applications on a percentage basis but not in cleanroom area. Many of

these projects involve extracting the cells from a patient and creating an

injectable just for him. The result is the need for many small cleanrooms.

With weekly in depth reporting of the projects around the

world plus the ability to easily search all projects in the last decade this

service has great value for the local salesman as well as for management.

For more information on World

Cleanroom Projects click on http://home.mcilvainecompany.com/index.php/databases/80a-world-cleanroom-projects

Bob McIlvaine can answer your questions at 847 226 2391 or rmcilvaine@mcilvainecompany.com

COAL FIRED BOILERS

P84 Bags Are Proving to Have Lower Total Cost of Ownership

Results Than Alternatives

According to Nathan Schindler of Evonik writing in

Power, three case studies

illustrate the operating cost and reliability advantages of using P84 in

baghouses installed on coal-fired power plants. They include Nebraska Public

Power District’s 225-MW Sheldon Station in Hallam, Nebraska; and Eskom’s Arnot

(2,100 MW) and Duvha (3,600 MW) power plants, both in Mpumalanga, South Africa.

The Sheldon

Station consists of two Babcock & Wilcox cyclone boilers burning Powder River

Basin coal. Baghouses for each unit were constructed in 1999 and 2000,

respectively, replacing ESPs. The bags are built to operate at 310F with a 3.5:1

cfm/ft 2 gas-to-cloth ratio. The dust loading is 0.97 grains per actual cubic

foot (gr/acf) at the inlet and 0.005 gr/acf at the outlet.

Several alternative media configurations were evaluated

during the initial startup of the baghouses. After six months of testing, P84

and P84 scrim were determined to be the most cost-effective configuration based

on the plant’s particle size distribution, temperature at the bag, and level of

acid products in the exhaust gas. PPS (polyphenylene sulfide) filter bags were

among those tested but filter bag life was only 24 months. Since the testing,

the P84 bag life has averaged five years for Unit 1 and seven years for Unit 2

over the past 17 years. Over the operating life of the bags, average system

pressure drop of 6 inches water column has been maintained with seven cleaning

pulses of compressed air per hour.

Sheldon Station reports significant cost savings using P84

filter material in its baghouses over the past 17 years. The cost savings fall

into two categories: increased energy sales and decreased replacement bag cost.

Reduced pressure drop through the P84 media reduced ancillary loads, principally

reducing induced draft fan power by 87,000 MWh, saving $6.1 million. Extended

bag life when using P84 media also reduced the cost of replacement bags by $1.5

million.

South Africa’s Eskom owns and operates more than 40 GW of

installed capacity and is the largest utility in Africa. The Arnot Power Station

consists of six nominally rated 350-MW coal-fired units originally installed

between 1968 and 1975. The station burns a relatively poor South African

bituminous coal composed of 25% ash with a heating value of 26 to 27 megajoules

per kilogram (MJ/kg). The plant has posted 92.07% average availability over the

past three years.

Arnot Power Station was upgraded from ESPs to baghouses in

the 1990s as part of a project to increase plant capacity. Phase 1 added

baghouses to Boilers 4, 5, and 6 (each containing 11,000 bags) with a maximum

gas-to-cloth ratio of 3.5 cfm/ft2.

Phase 2 added baghouses (each with 14,000 bags) to the remaining three boilers

with a maximum gas-to-cloth ration of 2.8 cfm/ft2.

Potential baghouse suppliers were invited to demonstrate

their collection technology with a pilot project. PPS bags were initially

specified due to the high temperature gradient after the air preheater. However,

during operation of the pilot plants, the suppliers learned that the specified

baghouse pressure drop could not be maintained. The flue gas contained fine dust

with a smooth surface that characterizes South African coal.

This dust had penetrated the PPS filter material down to the

scrim, which led to depth filtration and bag blinding. The problem was solved

when a fabric supplier proposed using a P84 filter media with a fine-fiber P84

cap on top of the standard PPS substrate. The composite bags were then installed

on Boilers 4, 5, and 6, followed by the remaining boilers as part of Phase 2

project. Since installation, filter bag life has ranged from 30,000 to 52,000

hours. The guaranteed filter life was 28,000 hours.

Eskom’s Duvha Power Station consists of six 600-MW units

with once-through Benson boilers, built between 1975 and 1984. In 1993, Duvha

was the first power station in the world to be retrofitted with pulse jet fabric

filters, which were added to the first three of its units. Each baghouse has

26,928 bags, each with a 4.0 cfm/ft2 gas-to-cloth

ratio. The coal burned is similar to that burned by Arnot Power Station,

although with 30% ash. The filter bags used low temperature PAN (polyacrylonitrile)

material with an upstream air attemperation system on each unit. The bag life

was guaranteed for 28,000 hours.

Premature failure of the PAN bags began after 8,000 hours of

operation due to acid degradation. The cause was determined to be the acid dew

point of the 3% sulfur heavy oil used for boiler startup. Switching to a light

oil reduced the rate of degradation but did require the pressure drop setpoint

to be adjusted from 0.9 kilopascal (kPa) upward to 1.4 kPa. The majority of the

PAN bags lasted about 18,500 hours, but some failed with less than 5,000 hours.

Because Duvha was Eskom’s first station with bag filters and

Eskom was simultaneously occupied with fabric filter installation programs at

other stations (including Arnot), the experience forced the company to establish

an in-house capability of understanding polymers and filtration media, which led

to the creation of a full-fledged textile laboratory. This eventually resulted

in a switch to PPS bags, which extended bag life to 22,000 to 24,000 hours,

although many bag failures after 15,000 hours of operation were experienced.

The PPS and PAN failure modes occurred because of the

limited alkaline capacity of the coal dust to neutralize the sulfuric acid

formed in the flue gas when cooled below the acid dewpoint. In addition, the

attemperation air that was added to the air ducts upstream of each baghouse

created localized SO3 condensation

zones. The sulfuric acid formed from these two sources was not being totally

neutralized by the alkaline dust cake and attacked the PAN and PPS filter

fibers.

Once Eskom understood that blinding was the predominant bag

failure mechanism across the various plants, it embarked on research aimed at

retarding the blinding rate, hence extending bag life and performance. After a

number of trials, and in collaborative effort with fiber and fabric suppliers

(including the full-scale evaluation at Arnot), the solution chosen was to

install composite bags with a P84 cap applied to a PPS substrate, which ensured

the formation of a porous and stable dust cake that promoted complete acid

neutralization and surface filtration. The service life of the latest sets of

P84+PPS bags is more than 36,000 hours, with less than 10% failure of the 27,000

bags installed per unit.

The switch to P84+PPS bags has resulted in significant

savings for Eskom, about $500,000 annually. That figure does not include reduced

costs for labor, or production losses, which can be significant. In one

instance, prior to the switch to P84+PPS bags, two boilers were shuttered for

four months waiting for replacement bags.

User-led collaboration with suppliers has led to a

proliferation of composite fabric constructions with fine denier surface layers,

not only by Eskom, but also other utilities.

ESKOM Modifications Still Don’t Improve Bag Life to 3 Years

The Medupi and Kusile projects involve the construction of

two 4,800 MW, coal-fired, direct dry-cooled power stations. The Medupi site is

close to Eskom’s Matimba power station in the Lephalale district of Limpopo

Province. The Kusile site is close to Eskom’s existing Kendal power station in

the Nkangala District of Mpumalanga Province.

An article in Engineering News on

February 1, 2019, summarized a number of technical defects identified by Eskom

at Medupi and Kusile that were resulting in serious underperformance at the

power stations. The generation units handed over for commercial service were

unable to operate at full load and were experiencing frequent planned and

unplanned outages.

Thereafter, an open letter written by Alex Ham, a former

Eskom Chief Engineer: Power Station Design, and later, Director of Technology,

who had worked for the utility for 30 years, was published by

EE Publishers on May 12, 2019.

The letter spelt out the background to the boiler and mill problems at Medupi

and Kusile in further detail.

In order to rectify these defects, Eskom and the boiler

works contractor, Mitsubishi Hitachi Power Systems Africa (MHPSA) are now

undertaking significant rework of all 12 units at Medupi and Kusile. This

requires that each unit be shut down for about 75 days in sequence to affect the

necessary rework, with the associated costs shared 50/50 between Eskom and

MHPSA, pending resolution of the contractual matters between them.

The planned modifications required on each of the 12

units at Medupi and Kusile include:

Mills: Eleven modifications were agreed to be implemented –

initially in a matrix across the five mills of Medupi Unit 3 in order to

determine the performance of the modifications and their interdependencies.

Pulse jet fabric filter (PJFF) plant: The modifications

include redirecting the flue gas inlet to the bag filter, and equipment changes

to the pulsing systems used for cleaning the fabric filter bags during

operation. A new set of fabric filter bags are also to be installed after the

modification.

Gas air heater (GAH): Modifications to the gas air heaters

include internal erosion protection and modifications to the pin rack driving

the rotation of the gas air heaters.

Hot air duct erosion: Solutions for erosion protection in the

various hot air ducts include fitting of ceramic tiles and combinations of

ceramic tiles and wear-resistant metal plates in the hot air ducts.

The first unit of the six units at Medupi to be reworked was

Unit 3 during a 10-week shut down from the last week in January 2020 to the

first week in April 2020. Although Unit 3 at Medupi was intended as a “proof of

concept”, work on the design modifications of further units at Medupi commenced

even before performance testing of the modifications on Unit 3 was completed.

One of the five mills on Medupi Unit 3 was used as the

reference mill without any modifications and one mill as the reference mill for

all the modifications. Modifications on the other mills included combinations of

items that could be manufactured quickly in combination with off-the-shelf

equipment and long manufacturing lead-time items that needed to be cast.

Tests on Medupi Unit 3 indicated positive results for all

mill modifications, and the implementation of the items with short manufacturing

and procurement lead-times were rolled out. Manufacturing of the mill items with

long manufacturing lead-times was started immediately after the rollout decision

and will be rolled out during upcoming unit and mill outages.

A year after the project started, there is still a

significant amount of modification work to be done on all the remaining five

units at Medupi. These include the manufacturing of long lead-time items on the

mills, the gas air heater operational modifications, and the boiler low load

modifications. No work has yet commenced on the design modifications of the six

units at Kusile.

However, the week-on-week EAF for Medupi Unit 3 is still

erratic, with ongoing high levels of planned (PCLF – Planned Capability Loss

Factor) and unplanned (UCLF- Unplanned Capacity Loss Factor) outages, and

certainly not what one would expect from a properly functioning, relatively new,

base-supply unit that underwent a major 10-week rework outage a year earlier.

One may expect the average EAF in such a case to be more like 85% to 90%, which

is still below the 92% “use requirement specification” target set for the units.

Eskom indicates that this continuing sub-par performance can

either be due to sub-systems for which the design modifications were done, or

due to other plant systems – of which there are many – on which no modifications

were done. Eskom says that although the availability of the systems on which

design modifications were done did improve, this improvement was negated by

unforeseen once-off events in other unrelated sub-systems.

Furthermore, Eskom explains that the EAF of Unit 3 was pushed

down by increased planned outages after the shutdown due to extra-ordinary

planned maintenance in preparation for performance verification tests of the

modifications done. “Typically, you would need a longer period to evaluate

performance, in order to even out the impact of such unforeseen events”, says

Eskom.

However, Eskom has acknowledged that performance of the pulse

jet fabric filter plant after the rework has been disappointing. The lifetime of

the fabric filter bags before replacement has only increased from nine months to

13 months, instead of the 36 months expected in the “use requirement

specification”.

What has become clear, though, is that there is still a long

way to go before the Medupi and Kusile coal-fired power stations will operate at

the level of performance originally intended. Indeed, it is becoming apparent

that this performance will likely never be achieved.

The direct costs of the efforts to improve the performance of

Medupi and Kusile, the indirect costs of their poor performance on lost

production and lost sales, and the cost to the economy due to load shedding, is

truly enormous and still to be calculated.

The

year by year forecast for every country is included as part of Pharmaceutical

Prospects.

More details on this service are shown at http://home.mcilvainecompany.com/index.php/databases/83ai-pharma-prospects

Bob

McIlvaine can answer your questions at 847 226 2391 or rmcilvaine@mcilvainecompany.com

The Centre for Science and Environment (CSE) estimates the

latest Ministry of Environment, Forest and Climate Change pollution compliance

deadline will see 72 per cent of the coal capacity continue to pollute for

another two to three years. CSE estimates 89,500 megawatts (MW) of coal capacity

at 82 plants, accounting for 44 per cent of the country’s coal capacity, will

not have to comply until 2024-2025. Another 28 per cent of capacity within 10

kilometres radius of critically polluted areas or cities in breach of air

quality standards will not have to meet the standards until 2023. CSE

researchers estimate only 28 per cent of total coal capacity is within the

category requiring plants within 10 kilometre radius of Delhi’s National Capital

Region (NCR) or cities with a population of over one million to meet the

standards by December 2022.

China Will Modify its Coal Expansion Plan

China, the world's biggest coal user, said that fossil fuel

will play a less dominant role in its energy mix and that, despite plans to

build new coal-fired power plants, the country won't use it on a wide scale.

The comments by Li Gao, the director general of the

Department of Climate Change in China's Environment Ministry, follow pledges

at last week's climate summit by Chinese President Xi Jinping to work with the

United States in cutting emissions.

“In the past, it (coal) was the main source of power. In

the future it will play the role of providing flexibility for the power grid,”

Li said at a press conference.

And now we still need a certain amount of coal ... but we

will not develop coal on a wide-scale basis, that's very clear and that's

strictly regulated," he added.

Li acknowledged that China was still building new

coal-fired power plants, but he emphasized that they were unlike traditional

coal-fired power plants and would not emit as much as plants did previously.

Climate experts have long advocated for a ban on new coal-fired power plants,

which would be a significant step.

China obtains roughly 60% of its power from coal and is the

world’s biggest source of greenhouse gases. During the Trump administration, the

U.S. used China’s emissions as an excuse not to act, and in the past China

pointed to U.S. historical emissions as a reason to resist action.

Beijing has previously set a target for non-fossil fuel

energy to account for 20% of the country's total energy consumption by 2025,

which will require further investment in solar and wind energy.

Germany and China agreed Monday to step up their cooperation

in combating climate change, with the two discussing coal use and how to reduce

it.

Xi announced last year that China would be carbon-neutral by

2060 and aims to reach a peak in its emissions by 2030.

•

More

power output for the same fuel consumption

•

Extended

filter lifetime

•

Less time

and effort required for filter replacement

• Higher engine protection and availability

The sites are located in coastal to land-based conditions,

where air quality can be challenging. Relative humidity is moderate to high with

an average of 73%, and Camfil ‘s Air Analysis team estimated 45μg/m3 PM10 dust

concentrations. This is 77% higher than the recommended annual WHO standard.

Camfil conducted several site surveys to recommend the

optimal air filter solution to enhance the performance of the engines. The

shortest possible installation time during scheduled maintenance was a

fundamental prerequisite. Based on environmental and operational conditions, the

OEM and customer decided to upgrade the existing system to a 2-stage static

filter solution.

This System Has The Following Advantages:

• Low and stable dP, even under wet and humid conditions: prefilter life time expectation > 1 year · final filter EPA Class

life time expectation > 3 years

•

Greater

engine protection due to EPA efficiency and efficient water drainage

• Flexible design This solution has produced additional savings for the end user in terms of maintenance and operating

costs, as well as superior engine protection and air cleanliness.

Additionally, since pressure drop and efficiency class has

improved, fuel consumption has also decreased per megawatt hour produced. This

means that the carbon intensity is impacted positively by approximately 2% as a

result of filtration.

BIOMASS

Valmet will deliver a multifuel boiler plant to Veolia Energie ČR, a.s. in

Prerov in the Czech Republic. The new boiler will replace an old coal-fired unit

and strengthen Veolia’s strategy to move toward more environmentally friendly

production of district heat and electricity.

The order was included in Valmet’s orders received of the first quarter 2021.

Typically, the value of this kind of order is EUR 35-40 million. The boiler

plant will be taken over by the customer in January 2023.

“We chose Valmet based on the criteria of public procurement, in other words, on the combination of price and operational costs for 15 years. Valmet has a high number of running references and long experience with boilers. That is why we trust Valmet and already cherish our future relationship,” says Jaromir Novak, Head of Technical Department, Veolia Energie ČR.

Valmet’s delivery scope includes a 40 MWth Valmet BFB Boiler utilizing bubbling

fluidized bed combustion technology. The boiler steam production is 52 t/h

at 4.2 MPa(g) and 420°C. The multifuel boiler is designed to run from 0 to 100%

on refuse-derived fuel (RDF) and/or biomass.

Additionally, the delivery includes a flue gas cleaning system, refurbishment of

an existing steel structure and its modification, electrification and inst

rumentation as well as an upgrade of an existing automation system.

Veolia Energie ČR, a.s. is one of the largest independent producers of electricity and district heat in cogeneration in the Czech Republic. The company is part of Veolia Group, the global leader in optimized resource management. With nearly 178,780 employees worldwide, the group designs and provides water, waste and energy management solutions that contribute to the sustainable development of communities and industries.

DENTAL OFFICE

Chu Crew Orthodontics in Racine, WI decided to make the

safety of their patients and staff a top priority during the COVID-19 pandemic.

Their investment in Nederman’s FX2 aerosol control solution helped them win an

award through the Wisconsin Economic Development Corporation (WEDC), “We’re All

Innovating Contest”, as a “Technology Innovation to Address COVID-19 Impacts on

Health.”

Orthodontists, orthodontic assistants, technicians, and other

staff members are frequently involved in aerosol generating procedures that

require close contact with human mouths. For this reason, individuals within

this practice setting are at increased risk of exposure to infectious diseases -

not only COVID-19 but also the common cold and seasonal flu, all of which are

viral-based infections that spread via respiratory droplets.

The risk of exposure within orthodontists' offices remains

even with best-practice hygiene and social distance measures, simply as a

consequence of the very nature of orthodontics. High-speed drilling, cleaning,

grinding, polishing, and other techniques essential to quality care can easily

produce and spread infectious aerosolized particles.

Clearly, a safe and long-term solution is essential for

orthodontists who are looking to remain competitive. It was this very desire to

keep his staff and patients safe that inspired Racine orthodontist Dr. Gary W.

Chu to make a major investment in his practice this year: the FX2

Extraction Arm from Nederman. This industry-leading, innovative aerosol

extraction technology is helping Dr. Chu and his staff serve their community

safer than ever.

Dr. Chu heard about the FX2 solution through a

colleague. He was so interested in its unique benefits that he applied for

Wisconsin's We're All In Grant and used the funding to purchase an FX2 arm

for his own practice.

The Nederman FX2 Extraction is currently used in

dental settings, as well as other industries, such as manufacturing plants,

cleanrooms and laboratories. Dr. Chu found many aspects of the FX2 solution

appealing for his specific office needs.

For one, there is no air filter maintenance required. This

means the impact on his office's workflow is minimal to none. Dr. Chu also

worked with a certified Nederman dealer Summit Filtration who installed the FX2

equipment based on the Chu Crew's unique office layout. The professional

support, Dr. Chu says, “Made the process even easier and more cost-effective.

The FX2 arm is designed to take up minimal space and is lightweight and ergonomic, making it easy to use for the staff. It's also quiet and blends in seamlessly with their existing equipment. This lends the FX2 a degree of aesthetic appeal that isn't frightening nor off-putting to patients—patients who already may be on edge due to the pandemic.

And unlike conventional HEPA/HVAC ambient air solutions found

in most orthodontist settings, the FX2 captures and filters air

directly at the source. This significantly reduces the number of aerosolized

particles and other debris circulating into the air, thereby dramatically

minimizing exposure to the people in the office.

COMPANY NEWS

Babcock & Wilcox First Quarter

Sales up 13%

·

Preliminary First Quarter 2021 Highlights:

·

Revenues

of $168.2 million, a 13.3% improvement compared to first quarter 2020

·

Net loss

of $(15.5) million, compared to $(31.5) million in first quarter 2020

·

Earnings

per share of $(0.22), compared to $(0.68) in first quarter 2020

·

Consolidated adjusted EBITDA of $8.5 million, compared to $1.0 million in first

quarter 2020

·

Strong

bookings of $171 million

· Minimum required pension funding contributions reduced by $26 million, in addition to the $107 million reduction

previously disclosed

"Our preliminary results for the first quarter of 2021

reflect the ongoing positive impacts of our turnaround efforts and growth

strategies, despite the adverse effects of COVID-19 across our segments," said

Kenneth Young, B&W's Chairman and Chief Executive Officer. "Our first quarter

performance positions us well to achieve our adjusted EBITDA targets of $70-$80

million and $95-$105 million, in 2021 and 2022, respectively, taking into

account the typical seasonal impacts of cold weather and customers’ reduced

maintenance outages on first quarter performance, and our normal cyclical

performance increase from the first quarter through the fourth quarter each

year. We ended the first quarter well, with roughly $171 million in bookings and

about $538 million in backlog on March 31, 2021."

"Our strategic actions in the last year, including launching

new segments, expanding internationally, implementing additional cost savings

initiatives and significantly reducing our secured debt, have provided a strong

foundation for the continued execution of our growth strategy," Young continued.

"As we pursue a robust pipeline of more than $5 billion of identified project

opportunities over the next three years, in addition to our high-margin parts

and services business, our leading-edge waste-to-energy and carbon capture

technologies are well-positioned to meet the critical global demand for carbon

dioxide and methane reductions."

"We are also seeing a significant number of attractive

targets for investments or acquisitions in both emerging technology and mature

markets, including small add-ons and transformative opportunities," Young added.

"We are establishing capital-raising mechanisms to enable us to pursue such

opportunities as they arise, including our $150 million at-the-market ("ATM")

senior note offering that commenced on April 1, 2021, and a $350 million

universal shelf registration statement filed today. We are focused on

opportunities that generate strong cash flow, leverage the strength of our

proven management team to improve margins and generate synergies, or expand our

clean energy technology portfolio, all of which we expect to drive shareholder

value."

For the first quarter of 2021 net loss is expected to be

$(15.5) million. Adjusted EBITDA is expected to be $8.5 million. Bookings in the

first quarter of 2021 are expected to be $171 million, with backlog of $538

million on March 31, 2021.

Camfil Expanding Chinese

Operations

Camfil Group is expanding its

operations globally and a new state-of-the-art facility in China is in

construction. This advanced facility will be one of the largest Camfil Group’s

manufactory in the world, built on a total area of 40,467 square meters in

Taicang city, Jiangsu province, China. There is a growing demand for Camfil's

air filtrations solutions to safeguard and protect the people, processes, and

the environment from the impact of poor air quality. The new plant will meet

this growing demand and will be fully operational in the year 2021.

This Taicang city facility will

be loaded with a superior research & development center that will be equipped

with advanced technology and have an ability to design custom specific products

for the Asia Pacific market. A new laboratory in the R&D center will enable

filter testing according to ISO 16890 that defines testing procedures and a

classification system for air filters used in general ventilation equipment.

This new facility is also the first integrated factory for Camfil Group that

will include four production lines: general ventilation filter, turbomachinery

filter, molecular contamination control filter, and a new series for air

pollution control along with a metal works center for housing, air cleaner, dust

collector and more.

Donaldson Company, Inc. announced its iCue™ connected

filtration service will be a standard feature on its most popular industrial

dust collector models. Connected collectors allow maintenance teams, on-site or

via a partner, to monitor and manage operational performance in real-time.

The iCue service will be standard on specific Donaldson

industrial dust collectors purchased after March 22, 2021, including DFO and DFE

Cartridge Collector models and RP, LP and RF Baghouse models. Additional models

will also be included later this year. The hardware, standard monitoring sensors

and a free iCue service trial subscription are included with the purchase.

The subscription-based iCue service provides maintenance

teams with automated reports, an online interface for more detailed analysis,

and real-time alerts for assessment and action if the dust collection system

shifts outside of set parameters. Teams can also purchase additional sensors to

meet specific facility and industry needs for dust collection system performance

and reporting, such as HEPA filter and outflow particulate emissions monitoring.