Valve

Acquisitions and Market

Shares

August 2022

Acquisitions

·

Recent Acquisitions

·

Harbour Group Acquires Specialty Valve Group,

LLC

·

IR Acquired Indian Pump, Filter and Systems

Companies

·

HIG-United Flow Technology buys Shape to add to

Southwest Valve

Market Share

·

Kitz Projecting Valve Sales of Over $ 900

Million in 2022

·

Emerson is the World Market Leader in Valves

with a 5% Share

_________________________________________________________________________

Acquisitions

Recent Acquisitions

The McIlvaine valve acquisition database with

data as far back as 2004 will be posted soon in

the report. Here are some of the more recent

additions.

|

Acquirer |

Acquired |

Driver |

Rationale |

|

IDEX |

KZV Valve |

Application |

Provides entrée to agricultural applications |

|

ITT |

Habonim |

Application |

Cryogenic applications |

|

Allied |

Great Lakes Process |

Distribution |

Coverage of 13 States in the Mid-West |

|

Wynchurch |

Ladish |

Product |

Complementary to Smith and AIT |

|

Neles |

Flowrox |

Application |

Mining and metals and also pumps |

|

Floworks |

SemiTorr |

Distribution |

This ClearLake backed group now has 40 global locations |

|

Severn |

ValvTechnologies |

Product |

Metal-seated, zero-leakage isolation valve solutions for demanding applications |

|

Fairbanks Morse |

Hunt Valve |

Product |

Valves for naval applications. So it adds new products as well as new applications |

|

United Valve |

Global Service |

Service |

Repair and modification services on rising/rotating metallic plug valves and other tapered plug valve designs |

|

Baker Hughes |

Q12 Elements |

Solutions |

Detect, characterize, locate, and size defects that can compromise pipeline integrity |

|

EGC Holding |

Slade Inc |

Components |

Fluid sealing solutions |

|

IMI |

PBM |

Applications |

Pharmaceutical and biotechnology |

|

Hunt Valve |

Pima Valve |

Product |

Severe-duty bronze marine valves. |

|

VAG |

RTS |

Markets |

Brazil-based manufacturer of valve solutions used in water, wastewater, and other industries |

Harbour Group Acquires Specialty Valve Group,

LLC

Marshall Excelsior Company (together with

subsidiaries, “MEC”), a Harbour Group company,

has acquired Specialty Valve Group, LLC (“SVG”),

SVG, based in Houston and founded in 2010, is

the exclusive distributor of Xanik products in

the U.S. Xanik, based in Mexico City, is a

leading manufacturer of specialty valves used in

severe service applications and, since this past

February, has been owned by MEC.

IR Acquired Indian Pump, Filter and Systems

Companies

Holtec and Hanye expand Ingersoll Rand’s air

treatment capabilities and enhance the breadth

of solutions provided for the larger compressor

ecosystem. They will both join the Industrial

Technologies and Services segment.

Based in Saint Charles, Missouri, Holtec is an

internationally recognized nitrogen generator

manufacturer, and the recipient of the 2022

President’s “E” Award. Holtec offers expertly

designed onsite nitrogen generation systems for

industrial, food & beverage and manufacturing

applications and has annual revenue of

approximately $10 million.

Based in Shanghai, China, Hanye is an OEM

supplier of air treatment products with several

unique patents in China around desiccant and

refrigerated compressed air dryers and air

filters. Hanye has annual revenue of

approximately $4 million.

Based in Coimbatore, India, Hydro Prokav

manufactures and sells progressive cavity pumps

with more than 80% of its approximately $6

million in annual revenue coming from

aftermarket parts. Hydro Prokav expands

Ingersoll Rand’s presence in progressive cavity

pumps and serves as a complementary addition to

the recent Seepex acquisition to further

penetrate the growing market in India and

southeast Asia. Hydro Prokav will join the

Precision and Science Technologies segment.

“Through the use of Ingersoll Rand Execution

Excellence (IRX), we continue to execute on our

robust M&A funnel. The acquisitions of Holtec,

Hanye and Hydro Prokav demonstrate our

commitment to finding highly adjacent bolt-ons

which add products, capabilities and

technologies that enhance the quality of our

overall portfolio while expanding our

addressable market,” remarked Vicente Reynal,

chairman and chief executive officer of

Ingersoll Rand. “All three of these acquisitions

are directly aligned with our stated M&A

strategy, and we see

meaningful opportunity to drive incremental

synergies across our global businesses to

generate shareholder value.”

The acquisitions of Holtec and Hydro Prokav are

expected to be completed during the third

quarter of 2022. The acquisition of Hanye is

expected to be completed during the fourth

quarter of 2022.

HIG-United Flow Technology Buys Shape to Add to

Southwest Valve

H.I.G. Capital, a leading global alternative

investment firm with $50 billion of equity

capital under management,

announce that its portfolio company,

United Flow Technologies (“UFT”), a platform

established to invest in the municipal and

industrial water and wastewater market, has

completed the acquisitions of Shape, Inc.,

Engineered Equipment Solutions (“EES”), Newman

Regency Group and Southwest Valve & Equipment.

UFT has completed seven acquisitions since its

formation in July 2021.

These acquisitions represent four leading

providers of best-in-class products and

value-added services to the municipal water and

wastewater markets throughout the United States,

and accelerate UFT’s strategic entry into new

territories, product categories and OEM

partnerships.

As part of the transactions, UFT will partner

with the leadership teams of each business to

support their growth initiatives within an

integrated and operationally cohesive UFT, with

each business’ leadership team and brand

remaining in place. Additionally, each of the

key principals from each acquired company will

become shareholders of UFT. Terms of the

transactions were not disclosed.

Founded in 1979 and headquartered in Pleasanton,

CA, Shape is a provider of pumps and process

equipment to the municipal water and wastewater

markets. Shape provides industry-leading

products and repair services to its customers

via multiple offices throughout California. For

more information, visit

Founded in 2003 and headquartered in State

Center, IA, EES is a provider of process

equipment products and services to the municipal

water and wastewater markets. EES offers high

quality, innovative solutions to its customers

via multiple offices across Iowa, Colorado and

Nebraska..

Founded in 1999 and headquartered in Stafford,

TX, Newman Regency is a provider of process

equipment products and services to the municipal

water and wastewater markets. Newman Regency

provides market-leading products from top-tier

manufacturers to its customers via multiple

offices across Texas and Oklahoma..

Founded in 2001 and headquartered in Fresno, CA,

Southwest Valve is a provider of flow control

products and services to the municipal water and

wastewater markets. Southwest Valve offers its

customers the most up-to-date sustainable custom

manufacturing solutions via multiple offices

across California, Nevada, Arizona and New

Mexico.

United Flow Technologies is a platform

established in July 2021 to invest in the

municipal and industrial water and wastewater

market. UFT partners with leading equipment

providers to provide world class products,

efficient solutions, and valuable services to

municipalities and industrial customers across

the United States.

H.I.G. is a leading global alternative assets

investment firm with $50 billion of equity

capital under management. Based in Miami, and

with offices in New York, Boston, Chicago,

Dallas, Los Angeles, San Francisco, and Atlanta

in the U.S., as well as international affiliate

offices in London, Hamburg, Madrid, Milan,

Paris, Bogotá, Rio de Janeiro and São Paulo,

H.I.G. specializes in providing both debt and

equity capital to small and mid-sized companies,

utilizing a flexible and operationally focused/

value-added approach:

1.

H.I.G.’s equity funds invest in management

buyouts, recapitalizations and corporate

carve-outs of both profitable as well as

underperforming manufacturing and service

businesses.

2.

H.I.G.’s debt funds invest in senior, unitranche

and junior debt financing to companies across

the size spectrum, both on a primary (direct

origination) basis, as well as in the secondary

markets. H.I.G. is also a leading CLO manager,

through its WhiteHorse family of vehicles, and

manages a publicly traded BDC, WhiteHorse

Finance.

3.

H.I.G.’s real estate funds invest in value-added

properties, which can benefit from improved

asset management practices.

4.

H.I.G. Infrastructure focuses on making

value-add and core plus investments in the

infrastructure sector.

Since its founding in 1993, H.I.G. has invested

in and managed more than 300 companies

worldwide. The firm's current portfolio includes

more than 100 companies with combined sales in

excess of $30 billion.

Market Share

Kitz Projecting Valve Sales of Over $ 900

Million in 2022

Kitz is projecting 2022 fiscal year sales of 158

billion yen, and operating income of 11 billion

yen.

Valve sales are forecast at 123 billion

yen. Brass bar manufacturing accounts for most

of the other sales revenue.

The valve segment includes fittings and some

industrial water purifiers.

The company is an integrated manufacturer with

its own foundries and manufacturing

plants

in various locations around the world.

It has an 80% market share for bronze and brass

valves in the Japanese market. It claims a 50%

share of the market for stainless valves in

Japan.

It is active in building heating and cooling,

oil and gas including LNG and refining and

petrochemicals.

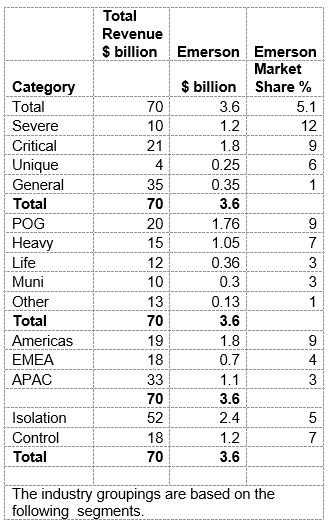

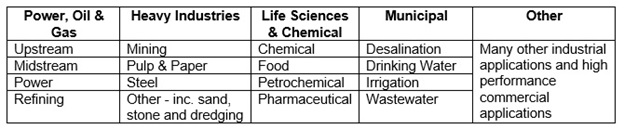

Emerson is the World Market Leader in Valves

with a 5% Share

Emerson is the world’s largest valve supplier

with a market share exceeding 5%. It has a 12%

market share in severe service valves but only a

1% share for general purpose valves.

Acquisitions which boost total EBITDA % rather

than just EBITDA revenue should be pursued.

McIlvaine is continually updating an

acquisition database along with market shares.