|

Table of Contents

COAL – U.S.

• EPA Approves Expanded Cleanup Plan for the NIPSCO Bailly Generating Facility in Chesterton, Indiana

• New Tests Can Detect Tiny but Toxic Particles of Coal Ash in Soil

• Mitsubishi Power and the University of Central Florida Develop NOx Tracking Tool

COAL – WORLD

• Canada Rejects Metallurgical Coal Mine in Alberta

• Thousands Protest Against Expansion of German Coal Mine

• Adani Wins Three of Eight Available Mines at Indian Coal Auctions

• South Korea Outlines Three Scenarios For Decarbonization

• ANDRITZ Has Decades of SCR Experience

• ANDRITZ FGD Plus Provides an Argument for the Bubble Bath Approach

GAS TURBINES

• BKV Corporation and Banpu Power US Corporation to Buy Texas Natural Gas Power Plant for $430 Million

RECIPROCATING ENGINES

• Wärtsilä Power Plant Will Support Export Growth and Job Creation in Bangladeshi Export Processing Zone

BIOMASS

• BECCS With BHCCS Provides Carbon Negative Electricity and Storage

HYDROGEN

• McDermott's CB&I Storage Solutions Completes Conceptual Design for World's Largest Liquid Hydrogen Sphere

• Hydropower to Green Hydrogen

• Cost of Green Hydrogen Could Reach Parity With Blue Hydrogen Within a Decade

• Green Hydrogen for Ukraine

• Burckhardt Supplying Hydrogen Compressor for Underground Storage In Hungary

• Howden Has Supplied Three Hydrogen Compressors For Use in a Hydrogen Refueling Station (HRS) For Hypower: The Beijing Daxing HRS in China

• H2 from Plastics

• Nel and SFC Energy to Jointly Develop Integrated Electrolyzer and Hydrogen Fuel Cell

• Nel ASA: Receives Contract for a 1.25 MW Containerized PEM Electrolyzer for DOE H2@Scale Project in the US

• Valves For Hydrogen Service Need Special Materials

• Offshore Wind as Energy Source For Hydrogen

• Wastewater Treatment Plants in the EU Will be a Good Hydrogen Source

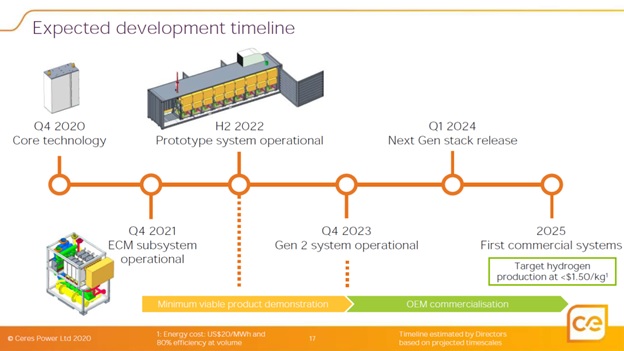

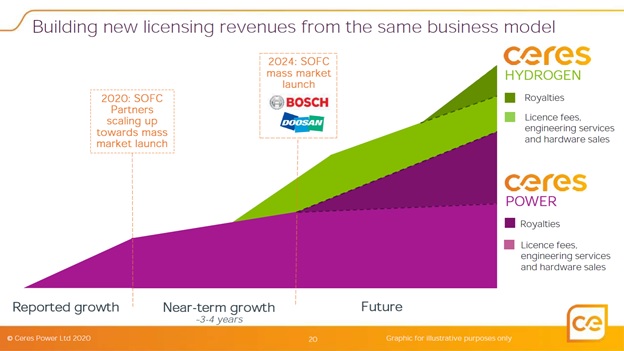

• Ceres Targeting Hydrogen Production at $1.50/Kg by 2025

• American Hydrogen Launches with Strategic Partnerships

NUCLEAR

• Bilfinger Wins Additional Order at Hinkley Point C Nuclear Power Plant

• Vattenfall and Westinghouse Extend Valued Partnership

• NuScale Power Signs Memorandum of Understanding With Xcel Energy to Explore Potential Plant Operations

• Burloak Technologies and Kinectrics to Develop Additively Manufactured Parts for the Nuclear Power Industry

• BWXT Awarded CA$40 Million Contract to Supply Heat Exchangers for Bruce Power

• Jacobs Selected to support South Africa Nuclear Power Plant Life Extension Program

BUSINESS

• B&W Reports Improved Revenues in the Second Quarter and Progress on Carbon Capture and Hydrogen

• Wood Pellet Exports are a Billion Dollar Industry

• Fuel Tech Second Quarter Revenues Up 18.6%

• PSEG Agrees to Sell PSEG Fossil Generating Portfolio to Arclight Capital

COAL – U.S.

EPA Approves Expanded Cleanup Plan for the NIPSCO Bailly Generating Facility in Chesterton, Indiana

The U.S. Environmental Protection Agency has issued the final cleanup plan for Area C of the NIPSCO Bailly Generating Facility in Chesterton, Indiana, to prevent coal ash contamination from affecting the nearby Indiana Dunes National Park.

After extensive review and consideration of public comments on NIPSCO’s proposed plan, EPA expanded the cleanup to include the area known as Solid Waste Management Unit 14. The Agency has also added a provision to establish a stakeholder group to continue public engagement on cleanup progress.

NIPSCO will remove dry coal ash from SWMU 15 and dispose of it at an off-site location. The company must also stabilize and solidify wet ash in SWMU 15, which is buried about 25 feet underground, exposing groundwater to contaminants.

SWMU 14 was used to relocate sand from another part of the NIPSCO facility. The small amount of ash there is not in contact with groundwater, but EPA is requiring a “hot spot” removal with off-site disposal.

An area in the Greenbelt portion of the site, north of SWMU 15, will also be excavated to remove a small amount of coal ash.

The plan also requires NIPSCO to monitor the natural attenuation of the groundwater, establish institutional controls, and provide long-term stewardship to ensure the property remains safe into the future. Groundwater in the area is not used as a source of drinking water.

In the 1960s and 1970s, NIPSCO used SWMU 15 to dispose of ash created from burning coal to generate electricity. Coal ash contains various hazardous metals. The primary contaminant of concern at this site is the metal boron.

New Tests Can Detect Tiny but Toxic Particles of Coal Ash in Soil

Scientists at Duke University have developed a suite of four new tests that can be used to detect coal ash contamination in soil with unprecedented sensitivity.

The tests are specifically designed to analyze soil for the presence of fly ash particles so small other tests might miss them.

Fly ash is part of coal combustion residuals (CCRs) that are generated when a power plant burns pulverized coal. The tiny fly ash particles, which are often microscopic in size, contain high concentrations of arsenic, selenium, and other toxic elements, many of which have been enriched through the combustion process.

While the majority of fly ash is captured by traps in the power plant and disposed to coal ash impoundments and landfills, some escapes and is emitted into the environment. Over time, these particles can accumulate in soil downwind from the plant, potentially posing risks to environment and human health.

“Because of the size of these particles, it’s been challenging to detect them and measure how much fly ash has accumulated,” said Avner Vengosh, Distinguished Professor of Environmental Quality at Duke’s Nicholas School of the Environment. “Our new methods give us the ability to do that – with high level of certainty.”

Coal combustion residuals are the largest industrial solid wastes produced in the United States. When soil contaminated with fly ash is disturbed or dug up, dust containing the ash can be transported through the air into nearby homes and other indoor environments. Inhaling dust that contains fly ash particles with high levels of toxic metals has been linked to lung and heart disease, cancer, nervous system disorders and other ill effects.

“Being able to trace the contamination back to its source location is essential for protecting public health and identifying where remediation efforts should be focused,” said Zhen Wang, a doctoral student in Vengosh’s lab at Duke, who led the study. “These new methods complement tests we’ve already developed for tracing coal ash in the environment and expand our range of investigation.”

The new tests are designed to be used together to provide independent corroborations of whether fly ash particles are present in a soil sample and if so, at what proportion to the total soil.

“First, we measure the abundance of certain metals, such as arsenic, selenium and antimony, that we know are more enriched in coal ash than in normal soil,” Wang said. “If these metals are present at higher-than-normal levels, we test the sample using two other geochemical indicators, radium nuclides and lead stable isotopes, which are more sensitive than trace metals and can be used to detect low occurrence of fly ash in soils. We also examine the soil under a microscope to test if we can physically identify fly ash particles and estimate what proportion of the soil they comprise.”

Each method has its own strengths and weaknesses, and if used solely could lead to overestimates or underestimates of the occurrence of fly ash in soil, Vengosh said. “By using all four together, we are able to verify the forensic investigation of fly ash presence in soils.”

To assess the reliability of the new tests, the researchers analyzed surface soil from 21 sites downwind of the Tennessee Valley Authority’s Bull Run Fossil Plant in Claxton, Tennessee, and 20 sites downwind of Duke Energy’s Marshall Steam Station on Lake Norman, NC. The North Carolina samples came from Mooresville, a town located across the lake from the Marshall plant. Control samples were also collected at sites upwind of each plant.

The tests consistently showed that most of the samples collected downwind of both plants contained fly ash contamination, but because the proportion of the fly ash was low, the concentrations of toxic elements did not exceed human health guidelines for metals occurrence in soil.

The tests also showed that soil samples near Bull Run Fossil Plant in Tennessee generally contained significantly higher levels of fly ash than those from North Carolina, and that the highest concentration was in soil from the Claxton Community Park, a playground and recreational site located outside the Bull Run plant.

What does this all tell us?

“First, it confirms that our new tools perform consistently and, when used together, provide a reliable method for detecting contamination that other tests might miss,” Vengosh said.

“Second, it underscores the need to regularly monitor sites in close downwind proximity to a coal-fired power plant, even if levels of contamination are below current safety thresholds. Fly ash accumulates over time, and risks can grow with repeat exposures to playground dust or home dust,” Vengosh said.

“Low concentrations of toxic metals in soil does not equal to no risk,” Vengosh said. “We need to understand how the presence of fly ash in soils near coal plants could affect the health of people who live there. Even if coal plants in the United States are shutting down or replaced by natural gas, the environmental legacy of coal ash in these areas will remain for decades to come.”

The peer-reviewed study was published in July 20 in Environmental Science & Technology.

The study was co-authored by Ellen Cowan of Appalachian State University, and by Rachel Coyte, Heather Stapleton, and Gary Dwyer, all of Duke. Support came from the National Science Foundation and from Mooresville, NC., community funding, led by Susan Wind, a former resident.

Mitsubishi Power and the University of Central Florida Develop NOx Tracking Tool

Mitsubishi Power Americas and the University of Central Florida have formed an industry-education partnership to establish a reliable and accessible source of information that tracks nitrogen oxide (NOx) emissions as the U.S. power generation industry undergoes an energy transformation to decarbonize.

The online Power Generation NOx Tracker (https://www.cecs.ucf.edu/nox/) uses data from the U.S. Environmental Protection Agency database as analyzed by UCF’s Center for Advanced Turbomachinery and Energy Research (CATER) to show trends over time. The NOx Tracker is accessible at no cost to the public and interested parties such as industry, research, government, and non-government organizations. This is the second tracker Mitsubishi Power has helped launch in its efforts to inform the public and industry about progress toward decarbonization. The Carnegie Mellon University Power Sector Carbon Index, which estimates the carbon dioxide intensity of the U.S. power sector using publicly available data sources, launched in 2017.

Experts at UCF’s CATER are evaluating and developing technology to address nitrogen oxides as well as other pollutants regulated by the U.S. Clean Air Act and monitored by

the EPA. UCF engineers developed the NOx Tracker with the support of Mitsubishi Power to not only track the cumulative percent change in nitrogen oxide emissions, but also to follow the cumulative change in sulfur dioxide and overall power generated. This helps researchers and industry better understand and solve complex technological challenges as they work toward a more reliable, secure and cleaner energy future. Kapat and UCF post-doctoral scholar Dr. Ladislav Vesely will be updating the tracker every quarter.

Paul Browning, President and CEO of Mitsubishi Power Americas, said, “Reducing power generation emissions, not only from carbon dioxide but also from nitrogen oxides and sulfur oxides, is essential in the overall energy transition path our industry is on. Mitsubishi Power is addressing all of these emissions while developing a variety of decarbonization technologies.

The NOx Tracker is yet another effort by Mitsubishi Power to bring transparency to air quality issues during this energy transition and to highlight the industry’s progress. It complements our overall mission of providing power generation and energy storage solutions to our customers, empowering them to affordably, and reliably, combat climate change and advance human prosperity. Together with our partner UCF, we are enabling and informing a Change in Power.”

COAL – WORLD

Canada Rejects Metallurgical Coal Mine in Alberta

Canada’s Minister for the Environment, Jonathan Wilkinson, has rejected Benga Mining’s proposed Grassy Mountain metallurgical coal mine in Alberta. In June, a joint provincial and federal review panel concluded the project was “not in the public interest” and denied the required provincial permits. The assessment report found the impacts on Indigenous rights and the environment outweighed the economic benefits. It also rejected Benga Mining’s claims it would be able to capture 98 percent of selenium emissions from its waste rock dumps as “overly optimistic.”

In a decision under the Canadian Environmental Assessment Act, Wilkinson said the project would damage the physical and cultural heritage of three First Nations groups, would reduce surface water quality and adversely affect the threatened west slope cutthroat trout and the endangered white bark pine. Benga Mining is a subsidiary of the Australia-based Riversdale Resources, a company owned by Australia’s richest woman, Gina Rinehart.

Thousands Protest Against Expansion of German Coal Mine

About 2,500 people demonstrated against the proposed expansion of energy company RWE’s Garzweiler lignite mine, which threatens the village of Luetzerath in North-Rhine Westphalia. The protest included a four kilometer long human chain between Luetzerath and the nearby town of Keyenberg, which is also threatened by the expansion of the mine. The Garzweiler mine supplies over 30 million tons of lignite a year to the nearby 4,424 MW Neurath and 3,248 MW Niederaussem power stations.

Adani Wins Three of Eight Available Mines at Indian Coal Auctions

The Ministry of Coal’s hopes of auctioning 67 coal allocations in its second round auction for commercial mining companies resulted in only eight mines ultimately being sold. Of the eight, Adani subsidiary CG Natural Resources won the bidding for the Khargaon, and mines in Chhattisgarh with Adani Power gaining the Gondkhari block in Maharashtra. The eight blocks are estimated to contain about 849 million tons of coal though the economic resource is likely to be far smaller.

South Korea Outlines Three Scenarios For Decarbonization

South Korea’s presidential committee on carbon neutrality, co-chaired by Prime Minister Kim Boo-kyum, has published a draft plan setting out three potential scenarios to achieving carbon neutrality by 2050. One relies on retrofitting carbon capture and storage to seven coal plants still operating in 2050 with another scenario phasing out coal generation but retaining LPG plants. The final scenario is based on substituting hydrogen for coal and gas generation. A level of nuclear generation is included in all three scenarios. The scenarios come as the Dutch pension fund administrator APG Asset Management has warned the South Korean government that its failure to scrap three major coal plants under construction is a “significant risk factor” to its willingness to invest in the country.

ANDRITZ Has Decades of SCR Experience

ANDRITZ Air Pollution Control was among the first companies in Europe to successfully employ Selective Catalytic Reduction (SCR) technology. The company now has numerous references in the DeNOx/SCR sector, which encompass a variety of applications. In addition to use in power plants (high dust configuration), they also have successfully employed selective catalytic reduction (SCR) technology for waste incineration and other industrial processes.

In 2017, ANDRITZ had received an order from Currenta GmbH & Co. OHG to deliver a SCR DeNOx plant (Selective Catalytic Reduction) for the hazardous waste incineration plant in Bürrig at its CHEMPARK site in Leverkusen, Germany.

The DeNOx plant was built to treat the flue gases from the sewage sludge incineration line with multiple-hearth furnace VA3 and the two lime kilns VA1 and VA2. Completion of the project occurred in 2018.

By modernizing the plant, Currenta can ensure that the NOx limit, which was lowered from 200 to <100°mg/Nm³ on January 1, 2019 in accordance with 17.BImSchV (Federal Immission Protection Act), is met, and even generate significantly lower flue gas emissions than the limits required by the European regulations thanks to the new ANDRITZ DeNOx plant.

Currenta manages and operates one of the largest chemical complexes in Europe – the CHEMPARK, with its sites in Leverkusen, Dormagen, and Krefeld-Uerdingen. As a modern service company with around 3,400 employees, Currenta’s service portfolio includes supply of materials and utilities on-site, a wide range of analytical services, modern environmental management, comprehensive infrastructure services, and reliable safety concepts.

McIlvaine has been reporting on Andritz SCR activity since 1986.

SCR technology for NOx control - McIlvaine Company

https://www.mcilvainecompany.com › Tree › SCR...

ANDRITZ`s first reference for Selective Catalytic Reduction (SCR) of. NOx was

started up in the year 1986 at the coal-fired power plant. Mellach/ Austria. ? ... 37 pages

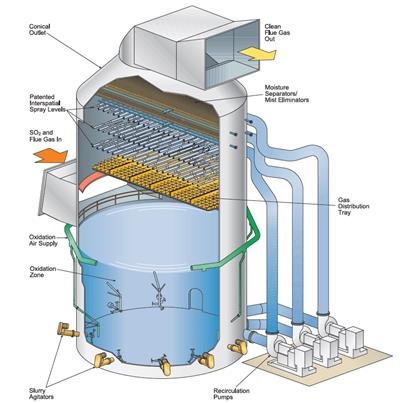

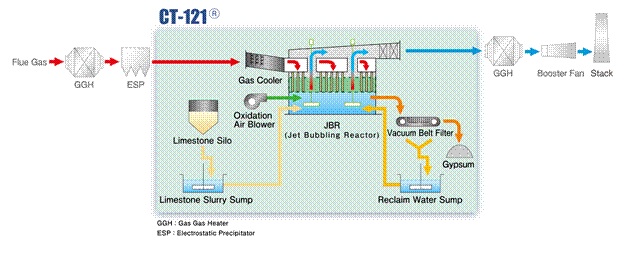

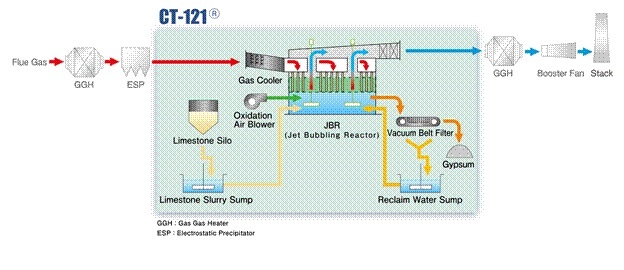

Andritz FGD Plus Provides an Argument for the Bubble Bath Approach

With the acquisition of APC technology from GE Andritz has a number of different FGD scrubber designs.

Andritz says a very robust and reliable FGD system was introduced with the FGDplus design. Based on long term investigations on lab and pilot scale, but especially with an industrial size pilot plant at a lignite-fired power plant in Germany, a new and innovative design was developed. The first applications and long-term experience in Germany and Asia confirm these findings and show a clear advantage over comparable designs on the market.

· Optimized combination of favorable mass transfer regimes from inlet to outlet of absorber

· Easy to implement and update existing systems

· implementation time

· Robust design, absolutely blocking resistant

· Minimized operation and maintenance costs

· Designed for optimized removal of SOx , dust, and aerosol

http://www.mcilvainecompany.com/Decision_Tree/subscriber/Tree/ANDRITZ%20PART%202.pdf

The Shower Versus the Bubble Bath Principle for FGD

The scrubbing choices can be likened to a bubble bath versus a shower. It takes a lot more water for the same level of cleanliness with the shower.

The original FGD scrubbers used the bubble bath principle. Marbles or ping-pong balls were supported by a screen or perforated plate. A turbulent or foamy zone created in this matrix provides a large liquid-gas interface area. The energy required to form this matrix can be varied from 2 in to over 6 in. w.g.

The original suppliers of the fluid sphere scrubbers were UOP and Environeering. B&W partnered with UOP and Combustion Engineering partnered with Environeering to supply the world’s first limestone scrubbing systems for power plants.

The coal-fired power plant temperature excursions resulted in shattered glass marbles and melted ping-pong balls. The solution taken by B&W was to take out the balls and rely on the turbulent layer created above the perforated support tray. Presently, the company offers one or two tray designs. B&W has been a leading FGD supplier over the years.

The bubble bath approach is also used by Chiyoda. The flue gas blasts into the sub surface of the pool and creates a foamy zone. There are large numbers of these scrubbers in operation in Japan and the U.S.

Environeering switched from marbles to rod decks in either a downflow or upflow mode. In the compact downflow mode both particulate and acid gas are captured. A number of companies offer rod deck designs.

The choice between a spray tower and these turbulent zone designs is a choice between increased fan or pump horsepower. The spray tower requires large amounts of slurry to be pumped to the top of a tower. The Chiyoda scrubber does not require any pumping but does require increased fan horsepower to overcome an extra 4-6 in. w.g. pressure drop.

It is likely that too much emphasis has been placed on the shower approach and not enough on the bubble bath. Andritz with the FGDplus is now providing more evidence of the bubble bath advantages.

The Rod Deck scrubbers, such as those operating for decades at Duck Creek and Mississippi Power and Philadelphia Electric, have the advantages of high SO2 removal, small footprint, and low maintenance. It may be possible that some of the spray tower advances over the years have made this alternative a better choice. But it would seem that the bubble bath approach is superior. It is conceded that mist elimination becomes more of a problem. When you tear droplets apart you have smaller droplets. So, you have to have better mist elimination. Fan horsepower is increased but pump horsepower is decreased.

Control of the operation may be a bigger challenge for the bubble bath type scrubbers. The Chiyoda 121 is clearly the simplest design. The question is whether maintenance is higher than in a spray tower design and whether control is more difficult.

There is also a hybrid mode for spray towers. Researchers have found that accelerating the gas flow through the spray tower increases SO2 efficiency. So even though contact time is less, there may be more liquid-gas surface area due to liquid holdup and droplet fragmentation.”

GAS TURBINES

BKV Corporation and Banpu Power US Corporation to Buy Texas Natural Gas Power Plant for $430 Million

BKV Corporation, in partnership with Banpu Power US Corporation, has signed a purchase and sale agreement to purchase all of the equity interests in Temple Generation Intermediate Holdings II, LLC, the entity that owns, through its subsidiary Temple Generation I, LLC, the Temple 1 power plant in Temple, Texas. The transaction, valued at $430 million and subject to customary closing conditions, is expected to close in the fourth quarter of 2021.

Built in 2014 and equipped with modern, flexible, and efficient combined cycle turbines, the power generation facility features advanced emissions-control technology, making it one of the cleanest natural gas-fueled power plants in the U.S. Temple 1 was one of the few power plants that operated throughout Storm Uri, providing desperately needed power to the ERCOT grid during the peak of the storm in February. The plant provides enough energy to power 750,000 homes across central Texas and is strategically located on 250 acres adjacent to the Interstate-35 corridor.

Temple Generation I, LLC has operated the facility since it entered service in 2014. In 2018, the company successfully reorganized in partnership with prominent financial institutions including funds managed by affiliates of Fortress Investment Group LLC, Kennedy Lewis Investment

BKV is a top-20 natural gas producer in the U.S. Currently, BKV has natural gas operating assets in the northeast Marcellus Shale in Pennsylvania and in the Barnett Shale in North Texas.

RECIPROCATING ENGINES

Wärtsilä Power Plant Will Support Export Growth and Job Creation in Bangladeshi Export Processing Zone

The technology group Wärtsilä will supply a 40 MW power plant to provide a reliable and efficient electricity supply to an Export Processing Zone (EPZ) in Bangladesh. The plant is expected to encourage industrial investments in the zone, which in turn will create employment and future growth for the area. The plant has been ordered by Sigma Powertech, and will be located in Adamjee EPZ, close to Dhaka, the capital of Bangladesh. The contract with Wärtsilä comprises orders placed in Q1 and Q2, 2021.

The plant will operate with four Wärtsilä 34SG engines operating on natural gas fuel. Delivery of the engines is being made on a fast-track basis with all equipment scheduled to be delivered before the end of 2021. Commissioning and commencement of operations is expected before the end of June 2022.

This will be the fourth Bangladeshi EPZ project for which Wärtsilä has supplied power generating capacity. Wärtsilä currently has 5,000 MW of installed capacity in Bangladesh with over 200 company personnel employed.

BIOMASS

BECCS With BHCCS Provides Carbon Negative Electricity and Storage

Biomass can be converted into a range of different end-products; and when combined with carbon capture and storage (CCS), these processes can provide negative CO2 emissions. Biomass conversion technologies differ in terms of costs, system efficiency and system value, e.g. services provided, market demand and product price. The aim of this study is to comparatively assess a combination of BECCS pathways to identify the applications which offer the most valuable outcome, i.e. maximum CO2 removal at minimum cost, ensuring that resources of sustainable biomass are utilized efficiently.

Three bioenergy conversion pathways are evaluated in this study: (i) pulverized biomass-fired power plants which generate electricity (BECCS), (ii) biomass-fueled combined heat and power plants (BE-CHP-CCS) which provide both heat and electricity, and (iii) biomass-derived hydrogen production with CCS (BHCCS). The design and optimization of the BECCS supply chain network is evaluated using the Modelling and Optimization of Negative Emissions Technology framework for the UK (MONET-UK), which integrates bio geophysical constraints and a wide range of biomass feedstocks. The results show that indigenous sources of biomass in the UK can remove up to 56 MtCO2/yr from the atmosphere without the need to import biomass. Regardless of the pathway, Bio-CCS deployment could materially contribute towards meeting a national CO2 removal target and provide a substantial contribution to a national-scale energy system. Finally, it was more cost-effective to deploy all three technologies (BECCS, BE-CHP-CCS and BHCCS) in combination rather than individually.

• Indigenous sources of biomass in the UK could generate up to 56 MtCO2 of negative emissions per year.

• All three pathways (electricity, heat, hydrogen) provides a substantial energy supply for the UK.

• It is more cost-effective to deploy technologies in combination, BE-CHP-CCS with BECCS and BHCCS.

• The cost-optimal combination of technologies is a function of the H2, electricity and heat price.

• Capital cost savings (e.g. retrofit existing plants) and high capture rates enhance deployment.

https://www.sciencedirect.com/science/article/abs/pii/S0360319921005267

HYDROGEN

McDermott's CB&I Storage Solutions Completes Conceptual Design for World's Largest Liquid Hydrogen Sphere

McDermott International, Ltd announced that its CB&I Storage Solutions business has completed the design of a 40,000 cubic meter liquid hydrogen sphere as part of a study awarded by a leading natural gas producer earlier this year.

"Viable storage solutions play a critical role in supporting a large-scale hydrogen economy," said Cesar Canals, Senior Vice President, CB&I Storage Solutions. "This study confirms the feasibility of scaling up liquid hydrogen solutions beyond what was previously thought possible and positions us to better serve our customers in this growing industry."

The conceptual design for a double-wall liquid hydrogen sphere with a storage capacity of 40,000 cubic meters is approximately eight times larger than the world's largest liquid hydrogen sphere currently under construction by CB&I Storage Solutions for NASA.

Hydropower to Green Hydrogen

The International Hydropower Association (IHA) has released a research and policy paper that outlines how hydropower could be pivotal in supporting growth in green hydrogen.

Green hydrogen is produced through electrolysis using decarbonized electricity and water, and it is set to be an important component of the transition to net-zero carbon economies, IHA said.

Most hydrogen is produced from fossil fuels, but projections suggest renewable and low-carbon green hydrogen could grow dramatically and play a key role on the path to net zero. In its Transforming Energy Scenario published in its Global Renewables Outlook in 2020, the International Renewable Energy Agency (IRENA) said green hydrogen could supply up to 8% of overall global energy demand by 2050. More recent studies suggest it could be even higher.

The business-led Hydrogen Council says hydrogen could supply up to 18% of overall global energy demand by 2050, saving 6 gigatons of annual emissions and potentially creating a US$2.5 trillion per annum industry.

As the leading source of renewable electricity globally, hydropower is well-suited to producing green hydrogen and has played a leading role in this over the past 100 years, IHA said.

“Ambitious growth in green hydrogen will significantly increase global demand for clean electricity sources such as hydropower,” said Alex Campbell, IHA’s head of policy and research. “Looking ahead hydropower could potentially supply at least 1,000 TWh of the additional electricity demand required in IRENA’s 2050 scenario. For even more ambitious scenarios that seek to limit the increase in global temperatures below 1.5C, the likely demand on hydropower would be greater.

“To realize this potential, policy?and regulatory frameworks must be updated to deploy hydrogen services and infrastructure at the scale now required. In “The Green Hydrogen Revolution: Hydropower’s Transformative Role,” IHA calls on governments and industry to:

• Develop enabling policies and financial incentives to stimulate demand for green hydrogen, scale-up projects and reduce technology costs.

• Support decarbonization of power grids and establish global certification systems that credit green hydrogen produced from clean electricity sources, including hydropower.

• Recognize and support the role of hydropower capacity, alongside other renewables, for green hydrogen production. A balanced portfolio leads to a more secure and sustainable energy mix and helps ensure high utilization factors for H2 electrolysis plants.

• Create markets and policy frameworks that reward flexible electricity supply and demand on the grid.

• Scale up investment

Cost of Green Hydrogen Could Reach Parity With Blue Hydrogen Within a Decade

Hydrogen is increasingly being viewed as a potential energy storage solution for difficult-to-decarbonize sectors of the economy, including heavy-duty transportation and industrial uses.

A new analysis by the ICF Climate Center, shared exclusively with Axios, shows that the cost of zero-carbon, green hydrogen could reach parity with more greenhouse-gas intensive ways of making the gas in as little as the next decade.

Why it matters: Hydrogen's environmental impacts are largely determined by how it is manufactured. Currently, most hydrogen for power use is produced using a methane source.

• However, green hydrogen, which is generated using renewable energy like solar and wind power, is drawing increasing interest from electricity producers, manufacturers, trucking companies, investors, and the federal government as a clean method of energy storage on the horizon.

How it works: Green hydrogen is a zero-carbon hydrogen production method, but currently costs more than steam methane reforming ("gray hydrogen") and so-called "blue hydrogen," which combines steam methane reforming with carbon capture and storage.

• "Green hydrogen is really energy storage and dispatchable electricity. So basically when your solar panel's not generating, wind turbines not turning, you're going to turn to hydrogen to produce that energy," study coauthor Mike McCurdy, a managing director for fuels and power at ICF, told Axios.

Yes, but: A new study published this week finds that blue hydrogen emits more greenhouse gases than previously thought.

• While blue hydrogen is currently the least expensive option for low-carbon hydrogen production, ICF’s analysis shows that green hydrogen could become cost-competitive with it within a decade, depending on the deployment of inexpensive renewable power.

• Green hydrogen involves using electrolyzer technology, powered by renewables, that takes in water and splits it up into hydrogen and oxygen, said study co-author Nima Simon.

Details: One advantage that hydrogen has over other forms of renewable energy is that existing infrastructure, including natural gas turbines, storage facilities and pipelines, can potentially be adapted for hydrogen storage and transport, rather than having to first build an entire system for storing and moving the gas.

• For example, ICF points out that salt caverns can be used to store large quantities of hydrogen.

The bottom line: The rate at which the cost of green hydrogen comes down could depend considerably on government incentives, such as a tax credit, to incentivize this technology. The Energy Department, for example, has announced a hydrogen "moonshot" program to invest in new technologies.

• Currently, the U.S. is behind Europe and Japan in investing in green hydrogen technologies.

• That could change quickly, Simon and McCurdy said.

• "Because we can reutilize our existing natural gas infrastructure, we may end up leapfrogging in front of them," McCurdy said.

Green Hydrogen for Ukraine

The Gas Transmission Operator of Ukraine (GTSOU) has signed an agreement with the European Bank for Reconstruction and Development (EBRD) to collaborate on the development of green hydrogen production, storage, and distribution infrastructure across Ukraine.

The partnership is expected to help enable the multi-scale production and use of green hydrogen in the country and ensure a secure energy supply as Ukraine transitions to a renewable energy-based economy.

Harry Boyd-Carpenter, EBRD Managing Director, Green Economy and Climate Action, said: “The EBRD and GTSOU are cooperating to support each other’s activities regarding hydrogen. Ukraine relies heavily on fossil fuels across all sectors of its economy and hydrogen can represent a good alternative for decarbonization, and reduce reliance on fossil fuels…”

The agreement will help Ukraine to scale up its green hydrogen production in line with a target set by the European Commission of producing up to one million tons of the gas through facilities to be built in the next four years.

With the lack of infrastructure identified as the biggest hurdle to increased adoption of green hydrogen, cooperation between various stakeholders within the energy landscape is vital.

Sergiy Makogon, CEO of GTSOU, adds: “The challenge, therefore, is to develop technology to scale up hydrogen use, to create the necessary conditions and infrastructure for its production, transportation, and consumption. All this requires time, effort, and cooperation by all stakeholders. We recognize the role of natural gas as one of the key energy sources and transition fuel on the path to a carbon-free economy, which will remain significant for this transition period.”

The signing of the deal follows EBRD’s release of a study on the potential for developing different segments of the hydrogen supply chain across its investment territories including Ukraine. In April 2020, the EBRD and GTSOU also inked an agreement to collaborate on sustainable energy investments and reducing greenhouse gas emissions.

Burckhardt Supplying Hydrogen Compressor for Underground Storage In Hungary

Burckhardt Compression will deliver a diaphragm compressor as part of a project to build a long-term storage facility for hydrogen in an underground gas storage system. Hungarian Gas Storage Ltd. won a tender from the Hungarian government to build a hydrogen plant near an underground gas storage facility it currently owns.

The produced hydrogen will be mixed into natural gas and utilized for its own gas engines and furnaces, reducing CO2 emissions in the process. The project will require a diaphragm compressor to pump hydrogen into the underground storage facility, where it will be held at pressures above 100 bar to reduce storage volume.

The diaphragm compressor system designed by Burckhardt is capable of compressing hydrogen from 30 to at least 250 bar, the company announced. Burckhardt will manufacture the diaphragm compressor at a facility in Shenyang, China before it will be shipped as a skidded compression unit to GanzAir Compressortechnics in Hungary.

The compressor skid will include a lube oil system, motor, gas cooler, instrumentation and control system and a closed cooling water loop with air cooler. Burckhardt’s MD10-L compressor system is specifically designed for hydrogen applications and capable of compressing hydrogen at a high pressure while ensuring high purity.

GanzAir is a Hungarian manufacturer and system integrators in the field of compressor technology, with over 30 years of experience.

Howden Has Supplied Three Hydrogen Compressors For Use in a Hydrogen Refueling Station (HRS) For Hypower: The Beijing Daxing HRS in China

The Daxing HRS has the capacity to produce 4.8 tons per day of hydrogen and refuel up to 600 hydrogen fuel cell vehicles, including large vehicles such as trucks and buses. The Daxing HRS is part of the 200,000 square-meter Beijing International Hydrogen Energy Demonstration Zone.

“The Howden team is proud to be part of a project which supports the world’s largest hydrogen refueling station,” comments Salah Mahdy, Howden’s global director of environmental hydrogen. “The project demonstrates Howden’s strengths in quality, reliability, reputation for excellence in customer service and our leadership in the hydrogen compression market.

Hydrogen from Plastics

Plastic wastes represent a largely untapped resource for manufacturing chemicals and fuels, particularly considering their environmental and biological threats. Here we report electrocatalytic upcycling of polyethylene terephthalate (PET) plastic to valuable commodity chemicals (potassium diformate and terephthalic acid) and H2 fuel. Preliminary techno-economic analysis suggests the profitability of this process when the ethylene glycol (EG) component of PET is selectively electrooxidized to formate (>80% selectivity) at high current density (>100?mA?cm-2). A nickel-modified cobalt phosphide (CoNi0.25P) electrocatalyst is developed to achieve a current density of 500?mA?cm-2 at 1.8?V in a membrane-electrode assembly reactor with >80% of Faradaic efficiency and selectivity to formate. Detailed characterizations reveal the in-situ evolution of CoNi0.25P catalyst into a low-crystalline metal oxy(hydroxide) as an active state during EG oxidation, which might be responsible for its advantageous performances. This work demonstrates a sustainable way to implement waste PET upcycling to value-added products. https://www.nature.com/articles/s41467-021-25048-x

Nel and SFC Energy to Jointly Develop Integrated Electrolyzer and Hydrogen Fuel Cell

Nel has entered into a development partnership with SFC Energy AG to jointly develop the world’s first integrated electrolyzer and hydrogen fuel cell system for decentralized energy generation and storage. The development will be accelerated through using already mature products and proven technology from each respective party as basis for the integrated offering.

“We are very excited to be joining forces with SFC Energy to jointly extend our industrial offering for environmentally friendly, decentralized energy generation and storage. With their proven track record and years of experience, we see a significant potential in developing solutions together to serve the distributed power generation market, where we see good growth prospects” says Jon André Løkke, CEO of Nel ASA.

The partnership will focus on developing industrial solutions to replace less efficient diesel generators with more efficient systems based on hydrogen fuel cells in combination with green hydrogen production through electrolysis. Initially, SFC Energy and Nel will address applications in a power range of up to 50kW with a daily operating time of two to ten hours, which can be used as reliable emergency power generators for critical power applications. In the medium-term, the partnership is aiming to develop systems in the power range of up to 500 kW for telecom, data center and auxiliary power unit (APU) markets. The parties aim to introduce the first products to the market during the second half of 2022.

By using renewable energies such as solar or wind power, Nel's electrolyzers will produce the green hydrogen required for the entire system. This is stored in a tank. The SFC Energy hydrogen fuel cell will then convert the gas reliably and climate neutrally back into electrical energy when needed. The integrated offering has potential to replace diesel generators with a high CO2-emissions, therefore making a significant contribution to the race-to-zero and decarbonization of the global economy.

“Through this development partnership, we aim to tap into the major market opportunities in environmentally friendly energy generation systems based on hydrogen and fuel cells. This brings together two market and technology leaders to focus their strengths and provide a viable response to the major challenges of climate change. With the world's first integrated electrolyzer and hydrogen fuel cell system, we are addressing a wide range of applications such as critical and communication infrastructure as well as smart grid applications” says Dr. Peter Podesser, CEO of SFC Energy

SFC Energy AG is a leading provider of hydrogen and methanol fuel cells for stationary and mobile hybrid power solutions and has delivered more than 50,000 fuel cells to date. The company is headquartered in Brunntal/Munich and operates production facilities in Germany, The Netherlands, Romania, and Canada. SFC Energy is listed on the Deutsche Boerse Prime Standard.

Nel ASA: Receives Contract for a 1.25 MW Containerized PEM Electrolyzer for DOE H2@Scale Project in the US

Nel Hydrogen US, a subsidiary of Nel ASA has received a contract for a 1.25 megawatt (MW) containerized PEM electrolyzer from a leading utility in the US.

Nel Hydrogen US has received a purchase order for a 1.25 MW PEM electrolyzer for installation at a nuclear power plant in the US, a groundbreaking project for carbon-free hydrogen production. "This project represents an important first step toward developing a regional supply of zero carbon hydrogen, while supporting clean baseload electricity resources on the grid," says Stephen Szymanski, Vice President Sales and Marketing at Nel Hydrogen US.

The client will be installing an MC250 electrolyzer at a nuclear power plant for self-supply of hydrogen to meet their turbine cooling and chemistry control requirements. A primary project outcome includes the successful operation and control of what will be the first PEM electrolyzer at a nuclear generating plant in the US configured for dynamic dispatch. In addition, the project will demonstrate the economic feasibility of hydrogen production at nuclear sites and provide a blueprint for large scale carbon-free hydrogen export in support of DOE's H2@Scale program objectives.

The purchase order has a value of approximately USD 2.6 million, and the electrolyzer will be delivered in 2022. The project is funded by the Department of Energy's Hydrogen and Fuel Cell Technologies Office, through the H2@Scale Program.

Valves For Hydrogen Service Need Special Materials

Here is an older article on valves for hydrogen service by Greg Johnson of United Valve. It appeared in Valve Magazine. He covered applications and materials such as the following.

All API 6D valves in hydrogen pipeline service are required to be pressure tested with helium in accordance with API 6D, Annex C, Para. C4. Non-6D valves must meet the test criteria of API 598, also with helium as the test medium.

Another concern with valves in hydrogen service is the possibility of stem and gasket leaks. High-temperature hydrogen seals are difficult to achieve and require the highest quality graphitic packing along with exacting tolerances in the stem and stuffing box. Sometimes this is not enough, and bellows seal valves are required.

Gaskets also must be carefully chosen and installed. The best solution for a 100% effective gasket is no gasket at all, which is why welded bonnet valves are well suited for hydrogen service. The best choice to eliminate all potential hydrogen leak paths is a socket-weld or buttweld-end, bellows-seal, welded-bonnet valve. However, this configuration is usually limited to sizes NPS 2 and smaller.

https://www.valvemagazine.com/magazine/sections/where-valves-are-used/5264-the-boom-of-hydrogen-service.html

Offshore Wind as Energy Source For Hydrogen

The Norwegian government has agreed to help underwrite a pilot project for an offshore wind energy storage system based on hydrogen.

A new grant from Innovation Norway announced it will support the $11 million cost of the "Deep Purple" project, led by oil and gas EPC contractor TechnipFMC. Deep Purple would couple an offshore wind farm with a hydrogen electrolysis system, seabed hydrogen storage tanks and a hydrogen fuel cell. Electricity from wind power would be converted into hydrogen, which would be compressed, stored, and then used to power fuel cells when more electricity is needed.

In converting electricity to hydrogen, the nominal efficiency of an electrolysis plant is typically in the range of 70 percent. From hydrogen back to electricity, solid-oxide and PEM fuel cells typically have an efficiency in the range of 60 percent, according to a recent study by CIMAC. The combined energy losses from these two conversion steps are seen as a limitation for hydrogen as a storage medium for electrical power; by comparison, lithium-ion batteries are about 99 percent efficient, though their energy density is low. As another option, the hydrogen produced by Deep Purple's electrolysis plant could be piped to shore and used as a fuel, TechnipFMC said.

TechnipFMC is working with hydrogen systems consultancy HYON, utility Vattenfall, oil firm Repsol, technology firm ABB, class society DNV GL and others on the project. The total cost of the pilot is about $11 million.

“Securing the approvals and funding to proceed with a scale pilot is a critical step in the path to commercialization," said Jonathan Landes, president of subsea at TechnipFMC. “We are grateful to our partners and to Innovation Norway for collaborating with us as we advance sustainable renewables production. Deep Purple is another example of our commitment to working with clients and industry to develop transformative technologies, leveraging our industry know-how and subsea expertise to serve the Energy Transition."

Wastewater Treatment Plants in the EU Will be a Good Hydrogen Source

In his Andritz blog, Lukas Strohmeier weighed in on hydrogen prospects in the EU and specifically wastewater treatment plants.

Until 2024 the installation of at least 6 GW of renewable hydrogen electrolyzers in the EU with a combined production of up to 1 million tons of hydrogen is planned. Between 2025 and 2030, the production capacity is subject to be increased to 10 million tons of renewable hydrogen with at least 40-GW of hydrogen electrolyzers integrated within the energy system. From 2030 onwards, deployment of renewable hydrogen across all “hard-to-decarbonize” sectors shall be accomplished.

Hydrogen produced through electrolysis costs between $100 and $200 per MWh, roughly three times the cost of SMR (steam-methane reformation), according to a report by the Hydrogen Council. Coal power was averaged to $65-$159 per MWh and natural gas to $44-$73 per MWh by a Lazard study in 2020. Therefore, the major obstacle to overcome for the hydrogen industry is to ramp up its production to the point, where it starts to pay off. Economies of scale are essential to reduce the manufacturing cost of green hydrogen. This will ultimately increase the demand.

Another focal point is retrofitting infrastructure to accommodate hydrogen use, such as adapting car engines and repurposing gas pipes to fuel growth in the hydrogen industry.

As large-scale projects of 100 MW/year and even up to a GW scale have been announced recently, the industry should soon begin to benefit from economies of scale, cutting cost by 40% in the short term while analyses predict up to 80% in the long run. An increasing number of governments are pursuing a shift away from fossil fuels towards decarbonization targets, thus paving the way for alternative energy sources to establish themselves. However, fossil fuels are not the only competitor that hydrogen must displace — it must also outcompete other renewable alternatives on the market. This is where its storage capability comes into play, making it a serious contender against electric batteries, which currently dominate many sectors due to their high efficiency.

As the global political agenda is shifting more and more towards sustainability and clean energy — the transportation industry of course offers attractive potential for innovative technologies. Battery storage will be a crucial technology for the security of supply during the transition to a CO2-free energy world. Hydrogen’s outstanding storage capability will play an important role, although electric batteries will probably be dominating the passenger cars market due to the already existing infrastructure. Hydrogen fuels will more likely be applied in heavy-duty vehicles like buses, trains, or aircraft — the Russian Transport Ministry for example is expecting hydrogen fuels in aviation by 2035.

Currently mainly overlooked in the public debate, wastewater treatment plants might prove to be the most practical place to start producing blue or green hydrogen with their existing infrastructure and the available abundance of purified water and biogas generated in anaerobic digestion processes (utilization in SMR production of hydrogen). Other advantages include their proximity to urban areas and pre-existing supply-chains.

The idea of using seawater as a feedstock for electrolysis offshore is being tested through the OYSTER project, funded by The Fuel Cells and Hydrogen Joint Undertaking under the European Commission. This project investigates the potential of combining an offshore wind turbine with an electrolyzer, integrating desalination and water treatment processes in the electrolyzer, and transporting renewable hydrogen to shore. Countries such as Denmark and the UK, whose water sectors are under significant pressure to be climate-neutral by the end of the decade, may well look to this type of project to fuel their own vehicle fleets as well as public transport, helping achieve decarbonization targets.

The technological overlap of green hydrogen production with the water sector creates yet another promising route for companies to enter this field. Particularly within electrochemical separation synergies with fuel cell technology and hydrogen production arise. This is the case for electrode technology, which has led to some electrode-producing companies seizing the opportunity to offer their products and expertise to the hydrogen sector like Evoqua (key player in electrochemical separation market), De Nora (background in electrolytic chlorine production) or ThyssenKrupp.

The TOSYN-FUEL project (Germany) is currently under construction and expected to be operational in 2021. It is based on thermo-catalytic reforming with hydrogen separation through pressure swing adsorption. 2.100 tonnes of dried sewage sludge per year will be transformed into 210.000 liters of liquid biofuels and up to 30.000 kg of hydrogen.

https://medium.com/delphidata?p=3c930b4426c3

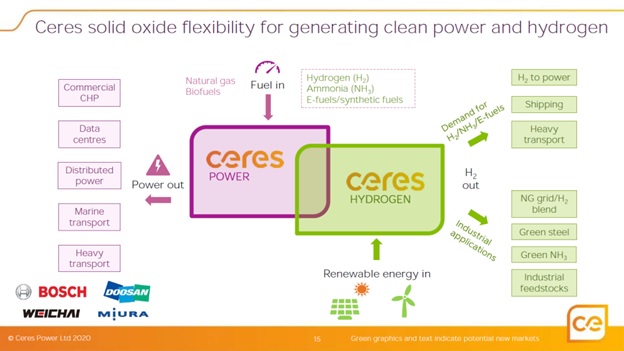

Ceres Targeting Hydrogen Production at $1.50/Kg by 2025

The same cell and stack technology used for power is also being developed for hydrogen.

Mark Selby, Chief Technology Officer for Ceres addressed the role of hydrogen in a recent blog. To paraphrase the old Heineken advertisement, “Hydrogen decarbonizes the parts other technologies cannot reach.”

“There is a lot of debate about hydrogen versus batteries because we gravitate to the familiar when we think about these new technologies. In practice, the biggest users of hydrogen won’t be consumers, it will be industry where batteries don’t provide any solution. Looking at the energy system, zero carbon hydrogen will have to be produced in huge quantities to meet the needs where it is only the solution. If this is true, it is likely that some of that hydrogen will find its way to some of those other applications where it is only second best, but it is convenient to solve problems like use in heating or running some vehicles.”

“In these second best solution situations, my view is that these applications will vary regionally because some countries will decide it makes sense in their situation. For example, the UK considering it for domestic heating fits into this bucket because the alternative in the UK (heat pumps in very old housing stock) is also really challenging. Trying to balance these issues all together sounds vague and uncertain but there is a different perspective and this, to me, is the important point – whilst a perfect prediction of hydrogen adoption is not yet possible, there is a wide range of applications that need it and it creates options for a long list of other applications – this makes it a commercially robust technology choice for investors, technology developers and industrialists alike. What this means in practice is, maybe it won’t be cars, but it will be ammonia, maybe it won’t be planes but it will be ships. Having looked at this long and hard, I’m personally convinced there are enough industrial users with an imperative to make hydrogen production a hugely exciting proposition.”

American Hydrogen Launches with Strategic Partnerships

Rapid growth in the clean energy economy has precipitated the need for experienced and capable consortiums of technical professionals to service the burgeoning demand for hydrogen. In response to this growth, Lone Cypress Energy Services, LLC. (“Lone Cypress”), a preeminent project management and EPC firm, has partnered with Reset Energy (“Reset”), a leading manufacturer of highly engineered clean energy technologies, to form American Hydrogen, LLC. (“American Hydrogen”).

American Hydrogen brings together a 100+ year track record of successful engineering design, manufacturing, and implementation experience across the broader energy sector. Leveraging this experience, the American Hydrogen team has created a suite of proprietary hydrogen generation, storage, and distribution technologies that represent the most robust and lowest cost product solutions on the market.

In addition to these technologies, American Hydrogen offers fully integrated, end-to-end implementation solutions for hydrogen generation, storage, and distribution facilities. From front end engineering through asset commissioning and operations, American Hydrogen provides a single-source solution for hydrogen and carbon management facilities of any size.

As a provider of steam methane reforming (SMR) generation and carbon management technologies, American Hydrogen offers modular 1-ton, 5-ton, and 10-ton scalable solutions in addition to larger 30-ton+ turnkey plant designs. This scalability allows us to furnish solutions for developers and operators of hydrogen facilities at any point in their development cycle.

As part of this inaugural event, American Hydrogen is pleased to announce strategic partnerships with Matrix Service Company, Saulsbury Industries, Neuman & Esser, and Tulsa Heaters Midstream, Inc. Formalized under executed Memorandums of Understanding (“MOU”), these strategic partnerships represent synergistic relationships meant to cover all aspects of the hydrogen value chain. These MOUs expand on the hydrogen strategies for each of the respective companies, which are to utilize existing commercial arrangements, international networks, and geographical diversity to provide strong, integrated, and competitive solutions for the development of hydrogen-related infrastructure.

NUCLEAR

Bilfinger Wins Additional Order at Hinkley Point C Nuclear Power Plant

EDF Energy has commissioned Bilfinger to carry out inspection services for the Hinkley Point C nuclear power plant, currently under construction in Somerset. Over the course of the next five years, Bilfinger will apply various non-destructive testing methods to monitor the integrity of safety-critical systems at the power plant, which is currently under construction in the southwest of England. The order, with a volume of more than €20 million, will be booked in tranches in the Engineering & Maintenance Europe segment.

“Our work on Hinkley Point C is one of our most important projects. We are proud to once again expand our scope of services with this inspection contract,” says Christina Johansson, Bilfinger’s Interim CEO and CFO. "We are bundling our competences across several units so that we can deliver a comprehensive range of services for our customer EDF. This integrated service offering and our expertise in the technologically demanding field of nuclear power open up significant growth opportunities for us.”

Bilfinger focuses on non-destructive testing (NDT) and advanced non-destructive testing (ANDT) methods for the inspection services at Hinkley Point C. The contract will be getting underway immediately and will create more than 80 new jobs at Bilfinger Salamis UK sites in Somerset, Bristol, and Humberside.

Bilfinger was selected by EDF as a strategic supplier (Tier 1) for the Hinkley Point C project and was initially awarded contracts from 2018 for preparatory and design work as well as waste treatment. In 2020, Bilfinger was also awarded numerous services for NSSS (Nuclear Steam Supply System), BNI (Balance of Nuclear Island) and BoP (Balance of Plant). As a result, the order volume generated at Bilfinger for Hinkley Point C had increased to over €450 million.

To be able to provide plant operators with comprehensive inspection services, Bilfinger recently developed the Bilfinger Inspection Concept (BIC). It is based on the industrial services provider's decades of experience in the inspection of plants and brings together a number of different inspection services. Plant operators have access to all the necessary inspections - from prefabrication and routine inspections during operation through to decommissioning and dismantling - from a single source and as part of a fully-integrated package. Bilfinger has the necessary certifications for all relevant inspection activities.

Hinkley Point C is the first new nuclear power plant to be built in the UK in over 25 years. It is expected to provide roughly 6 million households with low-carbon electricity.

Vattenfall and Westinghouse Extend Valued Partnership

Westinghouse Electric Company and Vattenfall are extending their long-standing nuclear energy partnership into decommissioning activities through a new agreement. As part of the arrangement, Westinghouse will segment and dispose of the reactor internals and pressure vessels at Ringhals 1, a Boiling Water Reactor, and Ringhals 2, a Pressurized Water Reactor. The two reactors were built by Westinghouse and have delivered carbon-free energy to Sweden and northern Europe for more than four decades.

"Westinghouse has an extensive track record of safely dismantling reactor internals and we look forward to bringing our specialized knowledge of complex decommissioning projects and proven advanced technologies to our long-standing partner Vattenfall," said Sam Shakir, President, Westinghouse Environmental Services. "Our Swedish legacy organization ASEA Atom built Ringhals 1, and today's Westinghouse built Ringhals 2. With this agreement, we close the circle and showcase our life cycle capabilities."

"Vattenfall's mission is to dismantle and dispose of end-of-life reactors and other components in the same way that they have been operated: safe and efficient. The agreement with Westinghouse means that it is clear how the large radioactive components of Ringhals 1 and 2 will be taken care of," says Christopher Eckerberg, Vattenfall's Head of Decommissioning Nuclear Facilities. "I am proud that Vattenfall takes responsibility for the entire life cycle of nuclear power, and I welcome Westinghouse as a partner."

Westinghouse engineers will start the dismantling process digitally with 3D modeling of all the cutting and packaging that will be performed onsite. The onsite work is executed by a team of highly skilled Westinghouse technicians who have been involved in dismantling many nuclear reactors in Europe. For the reactor internals, they will use mechanical underwater remote-controlled equipment to ensure the highest degree of safety and efficiency. For the reactor pressure vessels, dry thermal cutting technologies will be used for most of the parts. When the process is complete, all materials will be packed and safely disposed of in approved containers.

NuScale Power Signs Memorandum of Understanding With Xcel Energy to Explore Potential Plant Operations

NuScale Power, LLC (NuScale) is pleased to announce it has signed a memorandum of understanding (MOU) with Xcel Energy Inc. (Xcel Energy), a leading energy utility provider, to explore the feasibility of Xcel Energy serving as a plant operator at NuScale Plants.

NuScale is a leader in developing advanced small modular reactors that are considered the next generation of carbon-free nuclear plants. NuScale is seeking an experienced nuclear plant operator to provide potential customers with the operational support needed to generate carbon-free energy using advanced reactor technology.

Under the MOU, the two parties will examine the potential for Xcel Energy to become NuScale’s preferred partner to provide a suite of operational power plant services to NuScale customers based on Xcel Energy’s exceptional nuclear operational management systems. The MOU does not include a formal operating agreement, but it creates a framework for negotiating definitive agreements for Xcel Energy and NuScale to work together.

“As demand for carbon-free, reliable energy grows, NuScale continues to lead the pack as the most innovative, game-changing technology solution that can make a real difference for generations,” said NuScale Chairman and Chief Executive Officer John Hopkins. “This agreement underscores NuScale’s ability to provide our customers not just with technology but also with the world-class operational support needed to ensure that countries, governments, utilities, and customers can provide the clean energy solution our communities need to thrive.”

Xcel Energy, which has more than 50 years’ experience operating nuclear plants, is the owner and operator of two of the highest performing nuclear plants in the country, both located in Minnesota.

“As the first major energy provider to announce a 100% carbon-free vision, we understand the need for new technologies to meet the need for always on, carbon-free electricity,” said Pete Gardner, senior vice president and chief nuclear officer, Xcel Energy. “We’re excited to explore a potential partnership with NuScale that advances the next generation of nuclear energy, a technology that has the potential to provide the reliable, carbon-free electricity needed for a clean energy future.”

NuScale made history in August 2020 as the first and only SMR design to ever receive approval from the U.S. Nuclear Regulatory Commission, and in July 2021 the NRC published the proposed final rule certifying the NuScale Plant design. NuScale maintains strong momentum towards the commercialization of its SMR technology by the end of this decade. NuScale and Fluor are currently working for Utah Associated Municipal Power Systems (UAMPS) to bring the world’s first clean energy, carbon-free SMR project to commercialization.

Burloak Technologies and Kinectrics to Develop Additively Manufactured Parts for the Nuclear Power Industry

Burloak Technologies Inc., a division of Samuel, Son & Co., Limited, and Kinectrics are pleased to announce a collaboration agreement to develop additively manufactured parts for the global nuclear power generation industry.

Under the terms of the agreement, Burloak and Kinectrics will join forces to optimize the design and manufacturability of a range of components and replacement parts for a range of applications used in the nuclear power generating process. The two companies will jointly qualify all components developed under the partnership and work together to accelerate adoption of additive manufacturing within the nuclear power industry.

"The nuclear power generation industry has exacting performance and reliability requirements because reactors simply cannot fail," stated Martin Baxendale, Vice President of Operations at Burloak. "We look forward to working with Kinectrics to leverage our collective knowledge to offer performance and cost benefits to nuclear operators."

"Kinectrics looks forward to working with Burloak to bring additively manufactured safety-critical parts to the global nuclear power generation industry with increased quality, shorter lead times, complex geometries, and a lower overall cost of ownership," said David Harris, President and CEO of Kinectrics. "Burloak's experience in the global additive manufacturing industry, coupled with Kinectrics' extensive nuclear experience and deep understanding of materials, testing, codes and standards, nuclear regulation, and safety critical applications, will offer its clients innovative solutions for plant obsolescence issues and new options for Small Modular Reactors."

Kinectrics is a leading international provider of life cycle management services for the power generation and electricity industries.

BWXT Awarded CA$40 Million Contract to Supply Heat Exchangers for Bruce Power

BWX Technologies, Inc. announced a contract from Bruce Power valued at approximately CA$40 million to supply four moderator heat exchangers.

The contract, which will be executed by subsidiary BWXT Canada Ltd. at its Cambridge, Ontario facility, involves engineering and fabrication of these specialized components. Moderator heat exchangers are large components that remove heat from the moderator system of CANDU® nuclear reactors.

Engineering work associated with the contract has commenced, with fabrication expected to start later this year. The first two moderator heat exchangers will be delivered in 2024, with the remaining two units scheduled for delivery in 2025.

“These components are designed for reliable, long-term operation to help Bruce Power continue to provide Ontario with non-emitting, stable and cost-effective electricity for many years to come,” said John MacQuarrie, president of BWXT’s Nuclear Power Group. “This contract, along with several others we have with Bruce Power, is sustaining a very significant number of highly skilled jobs for our Cambridge operations.”

BWXT Canada Ltd. has over 60 years of expertise and experience in the design, manufacturing, commissioning, and service of nuclear power generation equipment. This includes steam generators, nuclear fuel and fuel components, critical plant components, parts, and related plant services.

Jacobs Selected to support South Africa Nuclear Power Plant Life Extension Program

Jacobs was selected to carry out essential engineering modifications as part of a $1.2 billion (ZAR 20 billion) program to extend the operating life of the Koeberg Nuclear Power Plant near Cape Town, South Africa. Koeberg is South Africa's sole nuclear power plant and generates 5% of the country's electricity.

The project is in preparation for the installation of six replacement steam generators, each weighing about 380 tons and about 20 meters long, at the two-reactor plant operated by Eskom.

"This project is vital to maintain the pivotal role of nuclear power in South Africa's energy mix," said Jacobs Energy Security and Technology Senior Vice President Karen Wiemelt. "To date, this is the largest single contract for our nuclear team in South Africa, which has successfully completed numerous engineering, procurement and construction projects to support operations at Koeberg over the past 30 years."

Jacobs will be responsible for construction management related to modifications to the secondary turbine system. The scope of work includes prefabrication of piping, pipe supports and modification, and piping replacement; installation of on-site scaffolding, rigging, and lagging; vessel modifications and strengthening; and replacement of forced air cooler units.

Work on replacing the steam generators for the first of Koeberg's two units is scheduled to start during a planned outage in January 2022, with the overall project taking two years to complete.

The current steam generators have been in service since the plant was connected to the national grid in 1984. Their replacement is an essential part of the plan to extend the operational life of Koeberg by approximately 20 years, from 40 to 60 years.

At Jacobs, we're challenging today to reinvent tomorrow by solving the world's most critical problems for thriving cities, resilient environments, mission-critical outcomes, operational advancement, scientific discovery, and cutting-edge manufacturing, turning abstract ideas into realities that transform the world for good. With $14 billion in revenue and a talent force of approximately 55,000, Jacobs provides a full spectrum of professional services including consulting, technical, scientific and project delivery for the government and private sector.

BUSINESS

B&W Reports Improved Revenues in the Second Quarter and Progress on Carbon Capture and Hydrogen Combustion

Consolidated revenues in the second quarter of 2021 were $202.9 million, a 49.8% improvement compared to the second quarter of 2020, primarily due to a higher level of construction activity in the quarter. Revenues in all segments were adversely impacted by COVID-19 as customers delayed projects and travel restrictions limited the ability of the company's workforce to visit job sites.

GAAP operating income in the second quarter of 2021 improved to $2.8 million, inclusive of restructuring and settlement costs and advisory fees of $6.9 million, compared to an operating loss of $7.7 million in the second quarter of 2020. The improvement was primarily due to the higher construction volume as described above, improved project execution and the benefits of cost savings and restructuring initiatives. Adjusted EBITDA was $15.1 million compared to $1.7 million in the second quarter of 2020. Bookings in the second quarter of 2021 were $168 million, with backlog of $500 million on June 30, 2021. All amounts referred to in this release are on a continuing operations basis, unless otherwise noted. Reconciliations of net income, the most directly comparable GAAP measure, to adjusted EBITDA, and to adjusted gross profit for the company's segments, are provided in the exhibits to this release.

Babcock & Wilcox Renewable segment revenues were $38.3 million for the second quarter of 2021, compared to $43.5 million in the second quarter of 2020. The reduction in revenue is primarily driven by large project start delays due to the adverse global effects of COVID-19 in the second quarter of 2021 coupled with the completion of prior-year large service and licensing projects and loss contracts that have not been replaced. Adjusted EBITDA in the quarter improved to $3.4 million compared to negative $0.1 million in the second quarter of 2020, primarily due to the benefits of cost savings and restructuring initiatives, offset partially by the decrease in volume. Adjusted gross profit was $9.8 million in the second quarter of 2021, compared to $9.4 million in the prior-year period; gross profit margin improved to 25.6% in the second quarter of 2021, compared to 21.6% in the second quarter of 2020 as a result of the benefits of cost savings initiatives.

Babcock & Wilcox Environmental segment revenues were $28.4 million in the second quarter of 2021, an increase of 12.7% compared to $25.2 million in the second quarter of 2020, primarily due to higher project activity. Adjusted EBITDA was $2.7 million, compared to negative $1.1 million in the same period last year, primarily driven by the higher volume and the benefits of cost savings and restructuring initiatives. Adjusted gross profit was $6.7 million in the second quarter of 2021, compared to $4.5 million in the prior-year period.

Babcock & Wilcox Thermal segment revenues were $136.3 million in the second quarter of 2021, an increase of 102.8% compared to $67.2 million in the prior-year period, primarily due to a higher level of activity on construction projects during the second quarter of 2021. Adjusted EBITDA in the second quarter of 2021 was $12.4 million, an increase of 55.0% compared to $8.0 million in last year's quarter, primarily due to the increase in volume as described above, partially offset by product mix; adjusted EBITDA margin was 9.1% in the quarter compared to 11.9% in the same period last year. Adjusted gross profit in the second quarter of 2021 improved to $29.3 million, compared to $20.0 million in the prior-year period, primarily due to the increase in volume.

Our results for the second quarter of 2021 demonstrate our steady progress towards achieving our adjusted EBITDA targets of $70-$80 million and $95-$105 million, in 2021 and 2022, respectively1," said Kenneth Young, B&W's Chairman and Chief Executive Officer. "This momentum is driven by our ongoing growth strategies, including our clean energy initiatives and cost reduction actions, despite the continued adverse effects of COVID-19 across our segments."

"With the launch of our ClimateBright™ platform in May, we are building an exciting pipeline of potential carbon capture and hydrogen combustion opportunities, as our customers seek solutions to address some of the world's most urgent climate objectives such as carbon dioxide and methane reductions," Young added. "We are pursuing an overall pipeline of more than $6 billion of identified project opportunities through 2024 and continue to make progress in converting our pipeline to bookings. We anticipate booking three to five renewable new-build opportunities in 2021, as we are seeing increasing demand for our technologies."

Part of B&W’s complete suite of ClimateBright™ decarbonization technologies, the carbon capture process can be flexible with a variety of solvents, or optimized to a specific solvent, depending on a customers’ needs.

Commenting on its latest development, Kenneth Young, Chairman and CEO of B&W, said, “B&W is focused on providing leadership and advocacy for decarbonization and providing effective solutions to help our customers reduce greenhouse gases.”

“Our SolveBright™ technology is an efficient and economical way to combat CO2 emissions from industrial and utility processes and we’re excited about its potential application in a wide variety of industries.”

As well as the SolveBright™, the ClimateBright™ technology line includes solutions for hydrogen production. The full line of solutions include:

• BrightLoop™ technology to produce hydrogen, steam, or syngas from a variety of fuels or feedstocks while isolating CO2 for storage or other industrial purposes.

• SolveBright™ regenerable solvent technology for post combustion carbon capture.

• OxyBright™ combustion process using oxygen instead of air, which is applicable for new and retrofit applications.

• BrightGen™ hydrogen combustion technology.

Young, added, “B&W’s diverse ClimateBright™ suite of technologies has a wide range of applications across many industries, such as carbon black manufacturing, cement, energy production, food manufacturing, oil and gas, petrochemical, pharmaceutical, pulp and paper, and steel.”

Electric Fluid Bed Particle Heater Has Advantages Over Molten Salt

Last week we wrote about the B&W energy storage with a particle heater. Here are the advantages of the approach over molten salt

Advantages of particle TES vs. molten-salt or rock bed TES:

• No freezing at low temperature and no stability issue at high temperature.

• No corrosion issues.

• Low cost containment and storage materials.

• Flexible configuration due to broad temperature range for cycle selection and optimization.

Wood Pellet Exports are a Billion Dollar Industry

The U.S. exported 603,752.2 metric tons of wood pellets in June, up from 513,608 metric tons in May, but down from 684,030.2 metric tons in June 2020, according to data released by the USDA Foreign Agricultural Service on August 5.

The U.S. exported wood pellets to approximately 16 countries in June. The U.K. was the top destination at 420,412.6 metric tons, followed by the Netherlands at 108,717.3 metric tons and Belgium-Luxembourg at 49,122.3 metric tons.

The value of U.S. wood pellet exports was at $82.96 million in June, up from $75.46 million in May but down from $94.53 million in June 2020.

Total wood pellet exports for the first half of 2021 reached 3.58 million metric tons at a value of $514.83 million, compared to 3.57 million metric tons at a value of $483.57 million exported during the same period of 2020. Additional data is available on the USDA FAS website.

Fuel Tech Second Quarter Revenues Up 18.6%