UTILITY E-ALERT

#1522– June 4, 2021

Table of Contents

COAL – U.S.

·

PSEG Power Becomes 100% Coal-Free on Long-Term Path to Net-Zero Carbon

Emissions

COAL – WORLD

·

World's Coal Producers Now Planning More Than 400 New Mines

·

Aspire Awards Ovoot Coking Coal FEED Contract to Sedgman

CO2

·

Navigator Announces Momentum Building Larger Carbon Capture Project

GAS TURBINE

·

NorthWestern Energy to Build a New 175-Megawatt Natural Gas Plant

·

Mitsubishi Power Developing 40 MW Turbine Fueled With Ammonia

·

Parker Coalescer Filter Solves Gas Turbine Inlet Fog Problems

·

The Value of Condition Monitoring and Predictive Maintenance for Cycling

GTCC Plants

·

Parker Launches New Gas Turbine Inlet Filter

·

Gas Turbine Intake Filter Lowest Total Cost of Ownership Validation ( LTCOV)

·

Mitsubishi Power Aero Delivers Vital Power Project to Mexico

·

Sulzer Speed Control Solution Minimizes Boiler Feedwater Pump Efficiency

Loss

NUCLEAR

·

Matching Nuclear Pumps to the Task is Critical

·

Williams Announces Additional Work at Indian Point

BUSINESS

·

Flowserve Monitors Conditions at UK Power Plant and Solves Boiler Feedwater

Pump Problems Before They are Magnified

·

Donaldson Sales to the Stationary Power Industry Are Around $130 Million/Yr

·

DSUA Will Be in Live Event in September

·

Nederman 2020 Results Were Impacted by Coronavirus

·

Global Energy Investment is Set to Rebound by Around 10% in 2021

·

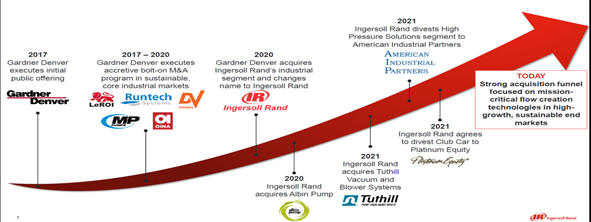

Ingersoll Rand Has Multiple Pump Blower and Compressor

Companies With Power Plant Products

___________________________________________

COAL – U.S.

PSEG Power Becomes 100% Coal-Free on Long-Term Path to

Net-Zero Carbon Emissions

PSEG Power

has retired its Bridgeport Harbor Station Unit 3 power plant, effective May

31, marking the completion of the company's long-term coal exit strategy as

the company pursues a path to net-zero carbon emissions. BHS 3 was the last

remaining coal-fired power plant in PSEG Power's generation fleet.

Originally designed to be fueled with either oil or coal when placed in

service in 1968, Unit 3 was converted to a full-time coal unit in 2002. BHS

3 provided 400-megawatts of peaking capacity to southern Connecticut,

operating only when called upon during times of peak energy demand, such as

extreme heat or extreme cold. In conjunction with the opening of Bridgeport

Harbor Station Unit 5 (BHS 5), a highly efficient 485-megawatt natural gas

power plant, in June 2019, Unit 3 was scheduled for retirement in mid-2021.

"The retirement of Bridgeport Harbor Station Unit 3 marks the end of an era

for the City of Bridgeport and the citizens who relied on its power," PSEG

Chairman, President and CEO Ralph Izzo said. "I'm grateful to the

generations of employees who operated this unit safely and reliably for more

than 50 years, and to the entire Bridgeport community for their support."

"For PSEG, the retirement of BHS 3 marks the end of our company's coal era,

reflecting a nationwide trend toward the use of cleaner fuels to generate

the electricity we need to power our lives. Newer, more economic and highly

efficient power plants like BHS 5 will play a critical role in shrinking our

carbon footprint as we address the challenges of climate change and help set

Connecticut on a path toward its cleaner energy future," Izzo said.

BHS 3 did not ease quietly into retirement. After being called upon to

operate for just two days in 2020, and not at all in 2019, the unit ran for

nearly two uninterrupted months to supply additional power to the grid

during a stretch of unusually cold weather in January and February of 2021.

"That remarkable run, even as the unit was just weeks from retiring

permanently, reflects the readiness and determination of the entire

Bridgeport Harbor 3 team, with support from BHS 5, New Haven and the entire

PSEG Fossil organization," Izzo said. "The team should be proud of its

performance during this stretch, during which it maintained all safety and

environmental standards without a single forced outage, injury or COVID

19-related issue."

BHS 3 also was instrumental in providing electrical generating capability

for the Bridgeport region during Superstorm Sandy in 2012 and during the

prolonged and extreme cold weather during the polar vortex in the winter of

2014.

Bridgeport Harbor Station was originally owned and operated by United

Illuminating Co. and began providing energy to the industrial factories and

businesses in southwestern Connecticut in 1957. In 1999, Bridgeport Harbor

Station was purchased by WISVEST, which owned and operated the station until

it was purchased by PSEG Power Connecticut in 2002.

As the nation transitions to new generation technologies, the long and

important history of BHS 3 illustrates how critical coal generation has been

over the decades in powering lives and fueling the economy.

In addition to its exit from coal, PSEG Power's remaining fossil generation

units – including BHS 5 – are part of the company's ongoing Strategic

Alternatives process to explore divestiture options for PSEG Power's fossil

and Solar Source assets. The company expects this process to be completed by

the end of 2021. Following this process, PSEG Power's fleet will consist

almost entirely of carbon-free energy, including nuclear plants in New

Jersey and Pennsylvania and new investments in offshore wind generation.

COAL – WORLD

World's Coal Producers Now Planning More Than 400

New Mines

The world's coal producers are currently planning as many as 432 new mine

projects with 2.28 billion tons of annual output capacity, research

published on Thursday showed, putting targets for slowing global climate

change at risk.

China, Australia, India, and Russia account for more than three quarters of

the new projects, according to a study by U.S. think-tank Global Energy

Monitor. China alone is now building another 452 million tons of annual

production capacity, it said.

"While the IEA (International Energy Agency) has just called

for a giant leap toward net zero emissions, coal producers' plans to expand

capacity 30% by 2030 would be a leap backward," said Ryan Driskell Tate,

Global Energy Monitor research analyst and lead author of the report.

The report said four Chinese provinces and regions alone - Inner Mongolia,

Xinjiang, Shaanxi and Shanxi - account for nearly a quarter of all the

proposed new coal mine capacity.

China has pledged to bring its emissions to a peak by 2030 and to net zero

by 2060. President Xi Jinping said earlier this year that the country would

start to cut coal production, but not until 2026.

Global Energy Monitor

said the new projects not only jeopardize efforts to combat global warming

but could risk saddling companies with as much as $91 billion in stranded

assets.

"Demand for coal is plummeting and financing for new coal projects is drying

up," said Driskell Tate. "New mines and expansions of existing mines will be

producing coal for a world in which coal is unviable economically, and

untenable for the environment."

Aspire Awards Ovoot Coking Coal FEED Contract

to Sedgman

Aspire Mining Ltd

is focused on the development of metallurgical coal assets in Mongolia,

principally the wholly owned Ovoot Coking Coal Project (OCCP). The company

has provided an update regarding the coal handling and preparation plant

(CHPP) required to establish operations at the OCCP.

·

Contract for preparation of a FEED study on CHPP infrastructure to support

commencement of operations at the OCCP has been awarded to CIMIC Group’s

minerals processing company, Sedgman Pty Limited.

·

Sedgman is the leading provider of integrated minerals processing solutions

with experience delivering world class processing solutions. Sedgman is an

industry leader in the fields of design, construction, commissioning, and

operations of minerals processing facilities, and has provided technical

input and various studies supporting the economics of the OCCP from

discovery of the deposit in 2010.

Following a thorough tendering process, which evaluated proposals from

numerous reputable firms, the company has advised that Sedgman has been

selected to prepare a FEED study on CHPP infrastructure to support

commencement of operations at the OCCP. Sedgman is a wholly owned subsidiary

of CIMIC.

A global leader in the design, construction, and operation of minerals

processing facilities, Sedgman also has Mongolian specific experience.

Sedgman plans to draw from this experience and engage local Mongolian

subcontractor(s) to deliver the FEED Study with appropriate consideration of

in country requirements.

Sedgman Managing Director, Grant Fraser, said: “Sedgman appreciated the

opportunity to work with Aspire and is focused on delivering value through

progressing an innovative solution for the project.”

“This study is a great opportunity to work with one of our longstanding

clients to support the future development of the OCCP.”

The FEED Study will be conducted in a phased approach, over a period of

approximately five months. Stage 1 will comprise trade-off analyses to

identify the most appropriate concepts and technologies which will take

approximately 8 weeks. Stage 2 will then focus on the agreed path and will

produce accurate estimates of capital and operating costs and designs to

enable tendering for construction. The work will be completed under schedule

of rates arrangement, with total cost of AUS$600 000 estimated.

The intended CHPP infrastructure to be investigated will be based on

existing modular designs and will enable low impact processing of

approximately 1.5 million tpy of run-of-mine (ROM) coal, with capability for

later expansion. Important criteria for the design include low energy and

water consumption, and stringent dust control.

CO2

Navigator Announces Momentum Building Larger Carbon

Capture Project

Navigator CO2 Ventures

("Navigator") announced the successful conclusion of the non-binding open

season of its carbon capture pipeline system ("CCS"). The proposed CCS

project seeks to provide biorefineries and other industrial participants a

long-term, economic path to materially reduce their carbon footprint by

capturing and transporting CO2 through 1,200 miles of pipeline

across five Midwest states to a permanent sequestration site. Based on

extensive feedback from potential customers representing diverse emissions

sources, and in an effort to provide a holistic solution for multiple

industries, Navigator is actively looking to expand the capacity of the

pipeline and proceed with multiple sequestration sites, creating an

injection capacity of up to 12 million metric tonnes per year.

Navigator previously announced its

partnership with BlackRock Global Energy & Power Infrastructure Fund

to develop the CCS in Nebraska, Iowa, South

Dakota, Minnesota, and Illinois; Valero Energy Corporation

is the anchor customer. The proposed system plans to transport liquefied

carbon dioxide through the pipeline to a sequestration site. At full

capacity, the CCS will have the ability to capture and store enough CO2 to

be the equivalent of removing approximately 2.6 million cars from the road

per year or planting 550 million trees per year or eliminating carbon

footprint of Kansas City 1.5 times

over. According to the International Energy Agency, carbon

capture and storage projects have the ability to reduce global CO2 emissions

by almost one fifth and lower the cost of addressing climate change by 70%.

Navigator will use the information

received during the non-binding open season to continue working with

interested shippers on binding commercial agreements. The framework of these

agreements will form the basis to launch the binding open season, expected

early June 2021. This CCS project is one of

the first large-scale, commercially viable, carbon pipelines to be developed

in the United States. Plans are underway to

further expand the scope of the project as needed to accommodate future

incremental customer demand. Navigator anticipates the CCS project to begin

operations in-phases beginning in late 2024.

For more information regarding the

open season, please contact Laura McGlothlin,

Chief Commercial Officer, at lmcglothlin@navigatorco2.com or

visit www.navigatorco2.com

Bechtel and Drax Partner to Explore Global Opportunities for New Build

Bioenergy With Carbon Capture and Storage (BECCS)

Bechtel has entered

into a partnership with renewable energy company Drax to

identify opportunities to construct new Bioenergy with Carbon Capture and

Storage (BECCS) power plants around the world.

·

Bechtel, a world leader in engineering,

construction and project management has entered into a strategic partnership

with renewable energy company Drax, to explore options and locations to

construct new Bioenergy with Carbon Capture and Storage (BECCS) plants

globally.

·

Scaling up BECCS sustainably over the coming decades will be critical to

delivering the Paris Agreement climate targets and keeping the world on a

pathway of limiting warming to 1.5 degrees.

·

The companies will also work together to identify how the design of a new

build BECCS plant can be optimized using the latest technology and best

practice in engineering design.

Drax is the largest decarbonization

project in Europe having converted its power station near Selby in North

Yorkshire to use sustainable biomass instead of coal.

By deploying BECCs' vital negative

emissions technology, Drax aims to go further, by becoming a carbon negative

company by 2030.

Analysis by independent experts

including the United Nations Intergovernmental Panel on Climate Change

and International Energy Agency has identified that

BECCS and other technologies that can remove emissions from the atmosphere

will need to be developed at a global scale over the coming years to limit

climate change to 1.5 degrees of warming.

Bechtel will focus its study on

strategically important regions for new build BECCS plants, including North

America and Western Europe, as well as reviewing how to optimize the design

of a BECCS plant using state-of-the-art engineering to maximize efficiency,

performance, and cost.

Jamie Cochrane, Bechtel Manager of

Energy Transition said: "Technological advancements have created new

opportunities to improve how we bring power to communities worldwide. We are

resolved to work with our customers on projects that deliver effective ways

to contribute to a clean energy future. Tackling the big global challenges

related to climate change is key to meeting aggressive environmental targets

and we are proud to partner with Drax to optimize design and explore

locations for the new generation of BECCS facilities."

Jason Shipstone, Drax Group Chief

Innovation Officer, said: "Negative emissions technologies such as BECCS are

crucial in tackling the global climate crisis and at Drax we're planning to

retrofit this to our UK power station, demonstrating global climate

leadership in the transformation of a former coal-fired power station."

"We're interested in potential

opportunities for exporting BECCS overseas, where Drax could help other

countries take positive action to address the climate crisis and meet the

Paris climate commitments by using innovative carbon capture technology to

permanently remove CO2 from the atmosphere."

Negative emissions technologies

remove more carbon dioxide from the atmosphere than they emit and are widely

accepted by the world's leading authorities on climate change as being

essential in the fight against climate change.

GAS TURBINE

NorthWestern Energy to Build

a New 175-Megawatt Natural Gas Plant

NorthWestern Energy

submitted an application to the Montana Public Service Commission

last week to build a new 175-megawatt natural gas-fired power plant and move

forward with Montana’s first utility-scale battery project.

NorthWestern’s application

asks for commission approval to recover $54 million for the natural

gas-fired power plant in the supply rates paid by its 700,000-plus customers

in Montana. The company argues that the natural gas-fired power plant it

proposes is the best and cheapest option for a new high-capacity resource

that could be online by January 2024.

The total cost of the plant,

factoring in land, construction costs, property taxes and capitalized

interest incurred during construction, is expected to top $286 million, and

NorthWestern is seeking a 10% return on equity for the project, for an

overall rate of return of 7%.

The company is also seeking

to enter a 20-year agreement with Beartooth Energy Storage, LLC,

for a 50-megawatt energy storage project near Billings. Beartooth would

build and own the facility, and NorthWestern would control its charging and

discharging functions.

The idea behind that project

is to direct excess electrons on the grid to the battery when supply is high

and demand and energy prices are down, and release electricity back onto

transmission lines when demand surges and intermittent energy sources fall

off. NorthWestern says this will keep the company from having to make more

expensive market purchases for energy.

The company argues the

acquisitions are in the public’s best interest because they’ll provide

customers with reliable, cost-effective service and protect them from risks

associated with volatility and unreliable service when demand for energy

peaks. It says the portfolio it landed on through this process is the “least

risk, most diverse, and most flexible option at a cost-effective price in

comparison to the other evaluated portfolios.”

According to its calculations, the average residential customer in Montana

who consumes about 750 kilowatt-hours of electricity per month, would see

their monthly bill increase by $6.64 if the PSC approves the application.

NorthWestern Energy spokesperson Jo Dee Black said the fuel portion of the

equation, the price of natural gas, is evaluated through a different process

that’s not reflected in the application before the PSC.

Alan Olson, executive director of the Montana Petroleum Association,

said natural gas is plentiful, and that’s part of the reason it’s been so

cheap recently. He also said there’s some uncertainty about the country’s

energy future that makes natural gas-fired power plants, like the one

NorthWestern is proposing, particularly attractive to the oil refineries his

group represents.

A natural gas-fired power plant will introduce certainty to not just

NorthWestern’s portfolio, but to the Pacific Northwest’s energy-thirsty grid

more broadly, he said.

“The climate agenda, even before President Biden [entered office], is going

to create some serious concerns on the ability to generate electricity,”

Olson said. “You look at the recent retirement of Colstrip Units 1 and 2.

You look at the closure of the Boardman [coal-fired power plant] in Oregon

and the upcoming closure of the Centralia Power Plant in Washington

state. That’s going to create a lot of unknowns and potential problems

because we’re losing that baseload generation. … We’re going to need natural

gas generation to firm up the resource as more and more renewable resources

come online.”

According to the U.S. Energy Information Association’s 2021

Annual Energy Outlook, natural gas consumption in the U.S. is expected to

fall slightly in the near term and then climb steadily for three more

decades.

A new natural gas-fired power plant has been on NorthWestern’s forecast for

a while. In its 2019

Electricity Supply Resource Procurement Plan,

it indicated its interest in a natural gas-fired power plant and outlined

the capacity and transmission ceiling it bumps up against when demand on the

grid is high.

The company says the battery storage and natural gas-fired power plant are

good complements to the wind and solar resources it’s acquired in recent

years. It also plans to secure 100 megawatts of capacity from primarily

hydroelectric resources per a five-year agreement it signed with

Powerex Corp. That agreement is not part of the application before

the PSC, but it is referenced in the document as part of the overall

portfolio the company is pursuing.

In the application, NorthWestern touched on the electricity challenges Texas

faced during an unusually long cold snap this February that wreaked havoc

on electricity

demand and supply for millions of Texans and

led to a fervor of political commentary on the country’s energy dynamics.

“Recent events in Texas have tragically demonstrated the risk and

consequences of over-reliance on generation in the market to meet customers’

need for electric capacity especially at times of peak demand,” NorthWestern

Energy CEO Robert Rowe said in the application.

Rowe also notes that most of the company’s recent acquisitions and

agreements involve hydro, wind, or solar energy, and that its last

acquisition of a thermal asset, like a coal-fired power plant or a natural

gas plant, was 10 years ago when it brought the Dave Gates Generating

Station online. That facility is a 150-megawatt natural gas-fired power

plant located near Anaconda that’s owned by NorthWestern.

Several executives supplying testimony in the document echo

Olson’s statement that there’s a need for more capacity in the Pacific

Northwest generally, and that NorthWestern is an outlier among regional

utility companies in its dependence on market purchases for power. While

virtually all utility companies purchase energy from the grid at some point,

NorthWestern does so more often than most utilities, Black said. During

periods of peak demand, about 40-50% of the company’s energy comes from

market purchases.

Colstrip’s

coal-fired power plant is by far the company’s largest existing capacity

resource, providing up to 222 megawatts of energy. Second is the Dave Gates

Generating Station, followed by the Judith Gap Wind Station with 135

megawatts.

THE LAUREL GENERATING STATION PROPOSAL

If the application is approved by the PSC, the Laurel Generating Station

natural gas-fired power plant would be built by Burns & McDonnell

Engineering Company, operated by Caterpillar Power Generation

Systems, LLC, and owned by NorthWestern Energy. At peak

construction, between 250 and 300 jobs would be created, Black said. Once

built, about 10 workers would be required to run the plant.

The plant itself would use 18 reciprocating internal combustion engine, or

RICE, units. Black said there’s a fair bit of flexibility created by this

model. The units could be turned off when wind and solar energy production

is up and toggled back on as those resources fall off and demand spikes.

The company said it landed on the Laurel location due to its proximity to

both natural gas and uncongested transmission lines. It anticipates using a

similar process it already employs to acquire natural gas for customers to

procure supply for their plant. It will use a combination of daily, monthly

and fixed-price natural gas purchases to mitigate market volatility. If the

plant is approved, a new pipeline to service the Laurel Generating Station

would need to be constructed.

The application also includes plans for carbon offsets, as required by a law

passed by the Montana Legislature in 2007. To meet that need, NorthWestern

would make a one-time investment of $327,000 in a carbon offset plan focused

on carbon reduction and absorption to be implemented by nonprofit, The

Climate Trust, which acquires and manages carbon offset programs.

Investment preference would be given to Montana-based projects.

THE BIDDING PROCESS

As part of the request-for-proposal process the company launched last

January, 21 bidders offered more than 180 proposals to contribute capacity

to NorthWestern. Most of those proposals were for energy storage systems —

batteries — or a battery storage system paired with a solar project.

Monica Tranel, a former staff attorney for the PSC and Montana Consumer

Counsel, who has worked in the energy industry for 20 years, said she’s glad

that NorthWestern is pursuing energy storage, but doesn’t think a natural

gas-fired power plant is in Montana’s best interest.

“I think those resources have significant risk in terms of carbon emission

pricing, cost of gas and stranded costs,” she said. “I would hope that …

careful thought is given to long-term ownership and the potential stranded

costs [so] those risks aren’t offloaded to customers.”

She said she’d rather see more investment in renewable energy projects like

wind, solar and hydroelectric — “not just the typical run-of-the-mill hydro,

but both pumped hydro at the large level like the Gordon Butte project, but

also micro pumped storage all over Montana.”

The Gordon Butte project was first proposed more than a decade ago. If

built, it would create

a large energy storage system in

Meagher County. It would pull energy from the grid when supply exceeds

demand, to pump water to a reservoir on Gordon Butte, a geographic feature

near Martinsdale. When demand for energy trends upward, the water would be

released through turbines into a lower reservoir, generating up to 400

megawatts of electricity.

Black said NorthWestern couldn’t offer comment on the project proposals it

received that it decided not to move forward with but said that the RFP did

give the company a good sampling of the proposals that are out there and the

technology that’s being developed.

Even if all three projects it is planning to move forward with are given a

green light, she said NorthWestern anticipates that it will need to secure

additional capacity in the not-too-distant future.

“Now we have an idea what’s out there. It’s exciting. The energy industry is

transitioning,” she said, “We’re looking forward to working with some

technology we haven’t worked with before and meeting our customers’ desires

and needs while continuing to provide service that’s reliable and

affordable.”

In addition to Gordon Butte, bids came in for several other high-capacity

projects, according to reporting by the Billings Gazette. Those

include proposals from NextEra, which is developing a

750-megawatt wind farm for a three-county area in eastern Montana;

Broadview Solar II, a 300-megawatt solar farm planned west of

Billings; and Mitsubishi Power America, which proposed

building a green hydrogen production and storage facility that would

incorporate solar power, a gas-fired peaking power plant, and a combined

cycle gas generator.

The future of Colstrip is still one of the big unknowns hanging over the

company’s future. In a recent

call with NorthWestern shareholders Rowe said

that without some key pieces of legislation passing this session, the

company doesn’t plan to acquire additional shares in Colstrip.

There’s also some question as to whether renewable energy advocates will

intervene on the application and ask for a more careful consideration of

projects that NorthWestern opted not to pursue.

“The application certainly brings up questions about resource selection,” NW

Energy Coalition senior policy associate Diego Rivas wrote in an email to

Montana Free Press. “The NW Energy Coalition will be digging through the

filing to determine if a 175 MW gas-fired power plant is the right option to

meet customers’ needs. Serious questions remain regarding the risk of gas,

including price spikes of the volatile commodity, the ability to transport

gas to the plant during critical peak times due to lack of pipeline

transmission availability, and potential carbon regulation. While

NorthWestern may have some capacity needs, the utility has not been

aggressive at addressing demand through energy efficiency and conservation,

or looking to demand response, all of which address capacity issues at a

fraction of the cost.”

The Public Service Commission has 270 days to evaluate the application. That

process includes opportunities for public comment.

Abu Dhabi National Oil Company (ADNOC)

Announced That it Will Advance a World-Scale “Blue” Ammonia Production

Facility i Ruwais, Abu Dhabi, in the United Arab Emirates (UAE)

ADNOC

is an early pioneer in the emerging hydrogen market, driving the UAE’s

leadership in creating local and international hydrogen value chains, while

contributing to economic growth and diversification in the UAE. The

facility, which has moved to the design phase, will be developed at the new

TA’ZIZ industrial ecosystem and chemicals hub in Ruwais.

Blue ammonia is made from nitrogen and “blue” hydrogen derived from natural

gas feedstocks, with the carbon dioxide by-product from hydrogen production

captured and stored. Ammonia can be used as a low-carbon fuel across a wide

range of industrial applications, including transportation, power generation

and industries including steel, cement, and fertilizer production. The

facility’s capacity will be 1,000,000 tons per year.

In recent months, ADNOC has signed a number of agreements to explore

hydrogen supply opportunities with customers in key demand centers including

the Ministry of Economy, Trade and Industry of Japan and

Korea’s GS Energy. This builds on the mandate given to ADNOC

from the Supreme Petroleum Council in November 2020, to

explore opportunities in hydrogen and hydrogen carrier fuels such as blue

ammonia, with the ambition to position the UAE as a hydrogen leader. ADNOC

is already a major producer of hydrogen and ammonia, with over 300,000 tons

of hydrogen produced per annum at the Ruwais Industrial Complex.

His Excellency Dr. Sultan Ahmed Al Jaber, UAE Minister of Industry and

Advanced Technology and ADNOC Managing Director and Group CEO, said: “This

is a significant milestone in the development of our blue hydrogen and

ammonia business, building on the UAE’s strong position as a producer of

competitive, low carbon natural gas and our leadership role in carbon

capture and underground storage. As we collectively navigate the global

energy transition, we believe hydrogen, and its carrier fuels, such as

ammonia, offer promise and potential as zero carbon energy sources.

“The development also signals that the TA’ZIZ industrial ecosystem is moving

ahead at speed in Ruwais. With TA’ZIZ as a key catalyst, we are well placed

to further strengthen our position as a leading destination for local and

international investment, leveraging technology to further grow the UAE’s

advanced manufacturing and industrial base’’.

The project will build on the UAE’s position as a major producer and

reserves holder of natural gas and leadership in Carbon Capture Utilization

and Storage (CCUS). CCUS is the use of advanced technology to prevent CO2

from entering the atmosphere after it is expended as a by-product of

industrial processes. ADNOC today operates, Al Reyadah, the world’s first

fully commercial CO2 facility for the iron and steel industry,

and the first commercial-scale carbon capture, utilization, and storage

facility in the Middle East. Each year, Al Reyadah captures up to

800,000 tons of CO2 from local UAE steel production.

Design contracts have been awarded for the initial Front-End Engineering and

Design (Pre-FEED) work for the ammonia project and the six additional TA’ZIZ

chemicals projects to Wood. In parallel, ADNOC will undertake

a feasibility study on the supply of blue hydrogen to the project from its

operations in Ruwais. The final investment decision for the project is

expected in 2022, and start-up is targeted for 2025.

Since its launch in November 2020, TA’ZIZ has made significant progress.

Development activities at the site have moved forward, with land and marine

surveys already completed. Considerable interest has been received

from local and international investors in opportunities across the entire

ecosystem and value chain, and agreements with the first phase of investors

are nearing finalization.

Mitsubishi Power Developing 40 MW Turbine

Fueled With Ammonia

Mitsubishi Power, a subsidiary of Mitsubishi Heavy Industries (MHI) Group, has commenced development of a 40-megawatt (MW) class gas turbine that is fueled by 100% ammonia (NH3). The project was started in response to the increasing global focus on decarbonization. As firing of ammonia produces no carbon dioxide (CO2), carbon-free power generation is achieved. Going forward, after combustion and other testing, Mitsubishi Power is targeting commercialization in or around 2025. When achieved, it will mark the world’s first commercialized gas turbine to make exclusive use of ammonia as fuel in a system of this scale, and will aid in the promotion of decarbonization of small to medium-scale power stations for industrial applications, on remote islands, etc.

MHI is working to commercialize a gas turbine system that combines selective

catalytic reduction (SCR) with a newly developed combustor that reduces NOx

emissions, for installation in the Company’s H-25 Series gas turbines

(Source: MHI)

Mitsubishi Power is working to reduce environmental impact through the

development of high-efficiency power generation technologies. Until now, the

Company has pursued technological developments enabling a transition from

natural gas fuel used in gas turbine combined cycle (GTCC) systems, which

currently emit the lowest amount of CO2 among thermal power

generation systems, to hydrogen, which emits no CO2. In tandem

with pursuing active use of ammonia, the Company has also been developing a

system in which the waste heat from a gas turbine reconverts ammonia into

hydrogen and nitrogen for use in hydrogen gas turbines. This development is

carried out as part of a program by Japan’s New Energy and Industrial

Technology Development Organization (NEDO) “Technology Development

Project for Building a Hydrogen-based Society: JPNP14026.”

Developing a method for directly combusting ammonia will further expand

Mitsubishi Power’s lineup of carbon-free power generation systems. A

challenge needing to be addressed with direct combustion of ammonia is the

production of nitrogen oxide (NOx) caused by oxidation resulting

from the combustion of the nitrogen component of the fuel. Mitsubishi Power

is aiming to resolve this issue through commercialization of a gas turbine

system that combines selective catalytic reduction (SCR) with a newly

developed combustor that reduces NOx emissions, for installation

in the Company’s H-25 Series gas turbines (output: 40 MW class), which has a

rich operational track record spanning the globe.

Ammonia, which is a compound consisting of hydrogen and nitrogen, is a

highly efficient hydrogen carrier, and it can also be directly combusted as

fuel. In recent years, attention has begun to focus on ammonia from two

perspectives: achieving carbon neutrality through transition to a hydrogen

society, and minimizing environmental impact caused by existing energy

modes. Expectations are held that early introduction of ammonia-based power

generation equipment at power companies and independent power providers

(IPPs) will promote ammonia’s future use as a carbon-free fuel.

Going forward, Mitsubishi Power will work to advance the energy transition

as a member of MHI Group. By prioritizing its resources into expanding its

gas turbine power generation and other efficient, environmentally friendly

generation technologies, the Company will contribute to the stable supply of

power, indispensable to global economic development, and the protection of

the environment through the promotion decarbonization.

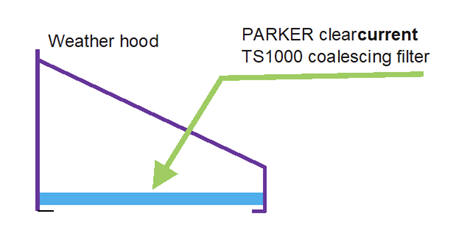

Parker Coalescer Filter Solves Gas Turbine

Inlet Fog Problems

Parker

says that coalescers on the market today exhibit problems such as:

-

They require frequent replacement, resulting in extensive downtime.

-

They are very difficult to clean and do not return to their original

efficiency and pressure loss.

-

Often the dust and sand deposits become so great, they increase the

pressure loss across the coalescer. When that happens, it triggers a

pressure release mechanism, and the coalescer pops up. This allows air

to pass through without being coalesced—removing the protection against

fine droplets.

Whether the trouble stems from dust, fog or sand, power plants operating in

harsh environments need an effective solution with coalescers to protect

both the life of the high-efficiency filters and the performance of the gas

turbine. The clearcurrent TS1000 coalescer panel filter from Parker, for

example, uses a new technology to provide fine mist/fog removal

effectiveness combined with significantly low dust removal efficiency.

Unlike traditional coalescers, the TS1000 coalescer panel uses 100 percent

synthetic high-performance woven mesh that catches small liquid droplets,

combines them with larger ones, then drops them out of the airstream while

allowing bypass of sand and dust particles.

“The clearcurrent TS1000 has excellent fine mist/fog removal effectiveness

with significantly low dust removal efficiency ... It provides superb

performance during the fog season with low risk of clogging during a sand

storm. In the end, it requires much less attention from the operator and

helps reduce the maintenance to a minimum.”

— Tim Nicholas, Powergen Market Manager, Parker Hannifin

Other features and benefits include:

-

Coalesces 99% of water droplets down to 10 microns.

-

Pressure drop remains steady and not affected by dust deposits.

-

Can be easily cleaned in place, dramatically decreasing maintenance

time.

-

Excellent service life performance.

Three comprehensive field tests were conducted to demonstrate the

effectiveness of the TS1000 over competitive coalescers. The results showed

the clearcurrent TS1000 coalescer panel filter went about three times longer

than other products tested before needing to be cleaned, and when it did

need cleaning, the work was quicker and extended the life of the coalescer

for up to 12 months.

The clearcurrent TS1000 coalescer panel filter helps maintain gas turbine

inlet air quality, whether the harsh environment produces dust, fog or sand.

Not only does it improve the overall coalescing performance, but it also

delivers low pressure drop, requires low maintenance and extends service

life to achieve better gas turbine operation.

http://blog.parker.com/new-coalescer-technology-improves-performance-and-protects-gas-turbines

The Value of Condition Monitoring and Predictive

Maintenance for Cycling GTCC Plants

Gas turbines will always be needed because more renewable energy sources,

such as wind and solar, are not capable of producing energy 100% of the

time. The challenge, however, is to develop flexible operations that can

quickly respond to rapid changes in the grid. When more power is demanded,

however, the industry most frequently turns to gas turbines to fill the

void. The ongoing need to turn off the engines and start them up again

presents its own set of challenges.

“These engines are designed to operate continuously at certain ranges. When

they don’t run continuously, they are less efficient, and emissions

increase. Turning them off and on is hard on the various moving components

and causes more wear and tear on such things as start systems, fuel control

valves, actuators, and the like. Since cycling is a harder mode of

operation, there is a greater need to monitor components with sensors that

can watch trending performance, efficiency decreases, and filter life” says

Evan Berry, global account manager, Parker Hannifin

Gas turbines are only as good as their individual components. Today there is

a greater understanding of the value of keeping components in prime

condition and monitoring their performance in order to conduct maintenance

before catastrophic failures occur. Yet, it’s not merely about preventing

failures and scheduling maintenance during non-peak times. As a result,

there has been a transformative shift from preventative maintenance to

predictive maintenance. So instead of scheduling maintenance at

predetermined times, regardless of remaining component life, today’s savvy

maintenance managers are using sophisticated sensors and analytics to

accurately measure service life and predict when worn components or

contaminated fluids are at a point of adversely affecting turbine

performance.

In recent years there have been major strides made in developing more

sophisticated, remote condition monitoring and fault diagnostic systems.

Some of the more critical areas of focus for monitoring include:

·

Blade integrity

·

Vibration analysis

·

Proper filtration

http://blog.parker.com/challenged-by-gas-turbine-inefficiency-consider-ways-to-increase-output

Parker Launches New Gas Turbine Inlet Filter

The Gas Turbine Filtration Division of Parker Hannifin Corporation

has announced the launch of its clearcurrent ASSURE filters for

high-performance gas turbines

The Clearcurrent ASSURE Cartridge. (Image source: Parker Hannifin)

Leveraging decades of filtration engineering experience and direct feedback

from customers, Parker designed every detail of the new clearcurrent ASSURE

filters to ensure they support predictable, reliable, and optimized gas

turbine performance. All components within the latest advanced gas turbines

must be able to withstand the harsh environments and multiple contaminates

that these systems are continuously exposed to.

Tim Nicholas, power generation market manager, Gas Turbine Filtration

Division, commented, “The efficiency we see from today’s advanced gas

turbines, such as the H-class, is far superior to that of previous machines.

The precise engineering involved to achieve these output levels requires a

conditioned, consistent and reliable air flow through the inlet house, and

our new line of filters helps to protect turbine health and performance.”

Parker’s new clearcurrent ASSURE filters feature durable hydrophobic and

oleophobic properties, which remove problematic contaminants carried through

to the turbine in liquid forms. Their unique design provides effective

filtration across a range of models including high-performance self-cleaning

units. Construction practices and materials are selected for extended

service life to enable longer maintenance intervals and reduced lifetime

cost while sustaining performance.

“The lower efficiency of legacy turbines means that particles adhering to

the blades have less impact on performance. However, to maintain the

efficiency of the advanced performance turbines entering the market today,

internal components need better protection from sticky particles in the

inlet airflow which can impact aerodynamic and thermal performance. Our

clearcurrent ASSURE filters are designed with housing materials and

filtration media that is precision-engineered to set a new benchmark in

protecting these incredible machines,” Nicholas added.

The measured and consistent performance of the clearcurrent ASSURE filters

through all filtration stages, equates to predictable differential pressure.

This is essential to avoid sudden pressure spikes that lead to unplanned

turbine outage or damage to the system. They are designed to an exact fit in

the inlet house to prevent them being bypassed, significantly reducing the

risk of accelerated degradation of turbine components and helping to

optimise maintenance over the life of the system.

http://blog.parker.com/new-coalescer-technology-improves-performance-and-protects-gas-turbines

Gas Turbine Intake Filter Lowest Total Cost of

Ownership Validation ( LTCOV)

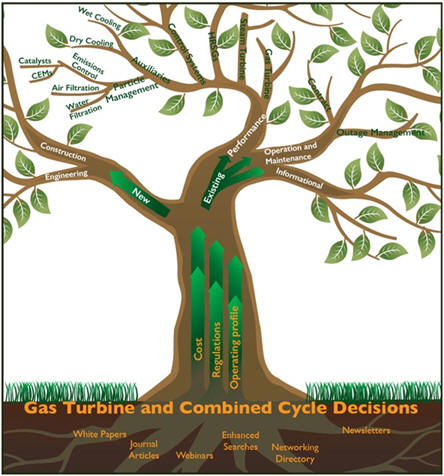

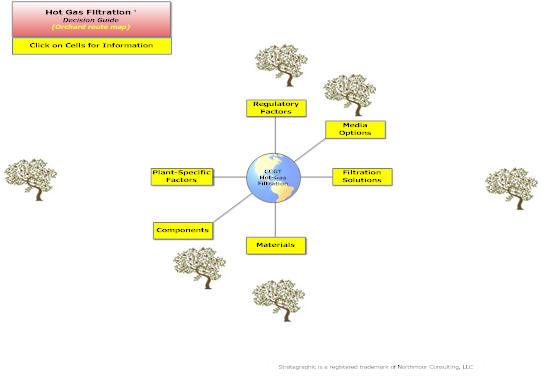

McIlvaine is now offering a program to help suppliers validate to customers

that they have the lowest total cost of ownership product. It is explained

at

http://home.mcilvainecompany.com/index.php/47-news/1655-nr2643

To support the effort, we are providing links to the background knowledge.

One analysis is on intake filters. It is part of a larger system on

all gas turbine flow and treat. Here is the link

to

Gas Turbine And Combined Cycle Decisions (mcilvainecompany.com)

You can click on any primary or secondary locator.

Gas Turbine Intake Filter Child Web

Go to Decision Guides and click under gas turbine air treatment for a

website devoted just to the intake filters.

Click on filters and media on the left side for a complete route map. This

provides the process variables and competitive options on which a total cost

of ownership validation can be created

Click on Title to see the latest entries.

This site provides background data which a supplier can reference in his

content marketing program to validate that his product has the lowest total

cost of ownership based on the turbine type, environmental conditions,

method of operation and other factors which impact filter life and

performance.

Site Specific Factors Impacting LTCO for Intake Filter

The market is a function not only of units but pricing. To the extent the

supplier can persuade the customer of a larger cost of ownership

differential the greater the price he can charge. So the market forecasts

have to take into account the higher potential pricing and margins as well

as market share.

McIlvaine can provide the forecasts needed to guide the marketing initiative

and assist with white papers, webinars, and other venues needed for Lowest

Total Cost of Ownership Validation.

Mitsubishi Power Aero Delivers Vital Power Project to Mexico

Mitsubishi Power Aero LLC

and Mitsubishi Power de Mexico, both subsidiaries of

Mitsubishi Power Americas, Inc., executed a fast-track, turnkey

contract to install and commission five 30-megawatt FT8® MOBILEPAC® aero-derivative,

dual-fuel gas turbines for CFEnergia SA de CV (CFEN), a

subsidiary of Mexico’s Federal Electricity Commission (CFE).

The project, located in Mexicali, Baja California, delivers critical power

in time for peak season. A sixth gas turbine will be added later to expand

capacity and support next summer’s requirements.

The

additional power from these units offers peace of mind and energy security

to the people and industries in Mexicali. Additionally, as Mexico works

toward integrating intermittent renewable energy generation, these gas

turbines will play an important role in supplying flexible, reliable, and

mobile energy to bolster grid reliability and resilience.

Mitsubishi Power Aero President and CEO Raul Pereda noted, “We are pleased

that we were able to deliver critical power for CFEnergia on such a tight

timeline. The

FT8®

MOBILEPAC units are essential assets for Mexico. A compact footprint,

minimal site prep, and no permanent foundations give CFE the flexibility to

relocate them to other locations to support demand. With the addition of the

MOBILEPAC units, CFE operates one of the largest FT8 fleets in the world, an

expansion spurred by reliable operational performance and Mitsubishi Power

Aero’s strong aftermarket service and support.”

Sulzer Speed Control Solution Minimizes Boiler Feedwater Pump Efficiency

Loss

A

gas-fired, cogeneration plant located within a refinery in Germany used a

boiler feedwater pump to provide 1,000 m3/h (4,400 USGPM) of

water, with a head of 1,355 m (4,450 ft). The pump was set up at a fixed

speed operating at 2,980 rpm and required a 4.1 MW (5,500 hp) motor to power

it. Since the original installation of the pump, the customer’s production

cycle had changed significantly, and the pump needed to run on partial load

due to changes in power demand.

In

order to meet the required variable flow of between 500 m3/h (2,200 USGPM)

and 1,000 m3/h (4,400 USGPM), the power plant was using a valve

at the discharge to throttle the flow. This meant that the generated head

was being throttled and the energy and cost for creating it was wasted. This

incurred inefficiency could be avoided. In order to improve the efficiency

of the feed pump, it was necessary to modify its operating range by

configuring a speed control mechanism.

Initially, the customer considered two more conventional options: a variable

frequency drive and a hydro dynamic speed coupling. However, both of these

alternatives had a number of disadvantages: chiefly the size, inconvenience,

and cost of installation for the medium voltage variable speed drive (VSD)

and the inherent efficiency losses of the coupling. These two options did

have advantages though, the VSD offered good energy efficiency and the

coupling was compact and relatively easy to fit, sitting between the main

motor and pump.

Sulzer proposed the use of an innovative third option, one that was

developed for the renewable power industry and delivered the benefits of

both alternatives and none of the negatives. The variable speed

electro-mechanical drive (CONTRON®) offered a compact, convenient solution

that could be installed between the motor and pump and was extremely energy

efficient, even more so than the large VSD.

For

this particular application, the combination of a variable speed drive and a

mechanical geared assembly would prove to be the ideal solution. The CONTRON®

electro-mechanical drive train allows the main motor to remain mounted in

line with the pump but uses a planetary gear arrangement driven by a high

power servo motor and variable speed drive system as an override that takes

over progressively as the required operating speed drops.

The

real headline here is that the addition of the CONTRON® makes the

entire power transmission system supplying motive power to the pump up to

95% efficient.

Savings:

Original arrangement:

Shaft power at low operating point with fixed speed arrangement

1,700m @ 500m3/h at 71.0% efficiency

(5,580 ft @ 2,200 USGPM at 71.0%)

Power: 2,944 kW (3,950 hp)

Electro-mechanical drive:

Shaft power at low operating point with controlled speed

1,143m @ 500m3/h at 75.8% efficiency

(3,750 ft @ 2,200 USGPM at 75.8%)

Power: 1,854 kW (2,485 hp)

The

new arrangement provided a power saving of 1,090 kW which translates into a

considerable saving every year that has been estimated between €218,000

($237,000) and €436,000 ($475,000) depending on the annual operating hours.

Furthermore, the initial installation costs are lower than those for a

variable speed drive and the overall efficiency is higher.

As

with all control technologies there are both advantages and constraints that

must be considered when implementing this type of system. The overall

footprint of the solution can be a major factor, especially on retrofit

situations. In this case, the electro-mechanical drivetrain enables the main

drive motor to be connected directly to the grid, removing the need for

bulky speed control equipment.

However, this solution does have limitations and can currently only be used

with equipment drawing up to 20 MW (26,800 hp) of power and with a maximum

speed of 14,500 rpm. Nevertheless, these constraints still allow for a

considerable amount of equipment to benefit from the latest innovation in

speed control for large scale pumps.

https://empoweringpumps.com/sulzer-optimizing-gas-turbine-performance-through-planned-maintenance-and-repairs/

|

Market and TCO Factors |

||

|

Market |

Better drive |

Does not impact pump market revenues |

|

TCO Factor |

Lower cost of operation |

Reduces electricity costs |

|

LTCO |

Sulzer has unique offering |

Increases TCO differential to competitors |

|

Pump profits |

Sulzer can charge more |

Should increase pump prov fits |

NUCLEAR

Matching Nuclear Pumps to

the Task is Critical

At POWER-GEN+ on April 29

there was a presentation “Repair,

Replace, Re-Engineer: What’s the Solution for Optimizing your Pumping

System?” The

session featured Loyal Fischer, USA regional director of retrofits and

nuclear power for KSB SupremeServ.

KSB has about 5,000 pumps

and 150,000 values in use at approximately 200 nuclear power plants around

the world. The KSB SupremeServ unit is opening a new facility and training

center at Port Arthur, Texas this year.

Most common pumps and

systems issues are due to not being ideally matched for the job, causing

high-power consumption and pump wear. Oversized pumps, too small low-cost

pumps, system upgrades where your pumps no longer have the correct

performance, can all be contributing factors to costly issues, outages, and

diminished performance.

Williams Announces Additional Work at Indian Point

Williams Industrial Services Group Inc.,

a construction and maintenance services company, announced that, with the

recent transfer in ownership of the Indian Point Energy Center

(“IPEC”) in Buchanan, New York to Holtec International

(“Holtec”), the company has been granted an expansion of its nuclear

decommissioning scope with Holtec from two units to five. Williams will

provide supervision and skilled craft labor from the local union halls near

IPEC to support both Holtec and its subsidiary, Comprehensive

Decommissioning International (“CDI”), across a wide array of

activities. Williams’ work is expected to begin in the third quarter of

2021.

“We

are pleased to announce this increase in scope with our longstanding

partners, Holtec and CDI,” said Kelly Powers, President, Operations &

Business Development of Williams. “We believe we were awarded this

additional, important decommissioning work as a result of our unwavering

commitment to meet and exceed customer expectations on a daily basis in

safety, quality, and overall value. We’re honored to serve Holtec and CDI

over the coming decade and are dedicated to completing this project in a

professional manner that leverages our expertise and helps ensure a safe and

efficient decommissioning for the people of New York.”

BUSINESS

Flowserve Monitors Conditions at UK Power Plant and Solves Boiler Feedwater

Pump Problems Before They are Magnified

RedRaven is a complete end-to-end solution says Francesco Gasparri, Global

IoT Commercial Manager, Marketing & Technology for Flowserve.

“We are no longer talking only about sensors, or only about predictive

analytics, or only about remote monitoring. Many companies can do this, but

they are focused only on one aspect,” Gasparri explains. “Flowserve supports

our customers, and we can define for them the best technology to get data

from the field. Then we build a secure network to transfer the data to the

Flowserve cloud-based platform. Then we add our expertise of 200 years of

experience.”

Flowserve has created a monitoring center which includes a team of

specialists to support customers in understanding the information they

collect so they can take valuable and informed actions. Before its official

launch, RedRaven was tested in the field for the past two years and has many

examples of its success.

“At a small power plant in the United Kingdom, we deployed our newest

wireless system to collect data,” Gasparri explains. “My colleague went

on-site and in 20 minutes, the wireless sensors transferred data on our

Cloud platform. We started monitoring the pumps and on December 23rd, just

before Christmas, we saw a sudden increase in the vibrations on the pump. We

immediately informed the customer, and they realized that they were

operating the boiler at an increased temperature to normal operating

conditions, and this caused the higher-than-expected temperatures in the

pump. The system was able to collect these changes in the behavior of the

pump. We recommended that the customer switch off this pump and utilize the

standby pump. This allowed the customer to operate the power plant without

any trouble during the Christmas break. No permanent damage has occurred in

this episode. Without our demonstration kit with RedRaven technology, they

wouldn’t have been able to detect the problem and they would have continued

to operate the same pump until a major failure occurred.”

Flowserve’s RedRaven technology includes these features:

·

Predict equipment behavior. Respond to problems quickly and minimize

disruptions and downtime. Use trend analysis data to make informed decisions

about plant-wide reliability improvements.

·

Refocus maintenance efforts. Focus on those assets that require attention,

therefore avoiding unplanned downtime and optimizing maintenance efforts so

you spend less time evaluating healthy equipment.

·

Enhance equipment efficiency. By knowing where all your assets are on their

respective pump operating curve, you can optimize for maximum efficiency.

·

Reduce costs. Reduce total cost of ownership by easily recognizing when to

schedule equipment maintenance and reducing spare part inventories.

·

Improve safety. By alerting technicians to a problem and what the failure

mode might be, the RedRaven platform helps them respond to performance

issues quickly, limiting the time they spend in hazardous environments.

RedRaven sensors are certified to be installed in any area of a refinery or

chemical plant—even in areas that are classified as potentially highly

explosive. A signal can be sent with a wireless, fully encrypted

transmission at more than a one-mile distance in a plant. With exceptional

cybersecurity protocols, data can be communicated to a user’s home with

trends and alerts built-in.

With 30-minute data intervals, batteries of the remote devices can last for

four years. However, if a problem exists, data can be transmitted every five

minutes, depending on the severity of the issue.

The predictive analytics are based on engineered algorithms to model the

behavior of the pump. As soon as the system is installed, it will start to

analyze the predictive data.

https://empoweringpumps.com/flowserves-redraven-collects-wisdom-knowledge-clarity/

|

Market and TCO Factors |

||

|

Market |

Solutions |

Expands pump market revenues |

|

Market |

Pump life |

Lengthens and reduces market |

|

Market |

Pump repairs |

Less repair reducing market |

|

Market |

Net |

Slight increase in pump supplier revenues |

|

TCO

Factor |

More reliable generation |

Provides value to electricity customers |

|

TCO

Factor |

Lower cost of operation |

Reduces electricity costs |

|

LTCO |

Sulzer has unique offering |

Increases TCO differential to competitors |

|

Pump profits |

Sulzer can charge more |

Should increase pump profits |

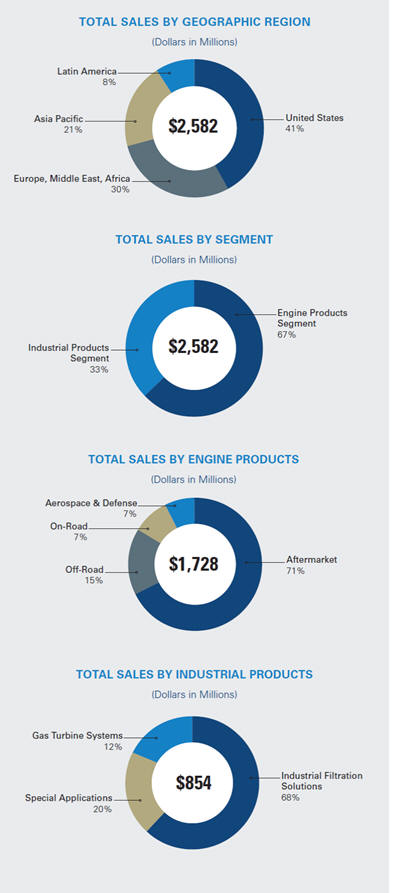

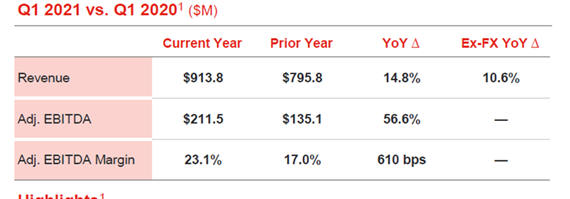

Donaldson Sales to the Stationary Power Industry Are Around $130 Million/Yr

Donaldson

reported third-quarter revenue and earnings above expectations. Sales

increased 22% year-over-year, to $765 million, well ahead of the consensus

estimate of $708 million. Excluding the 4% favorable impact from foreign

exchange, revenue increased 17% compared to the prior-year quarter. Engine

products revenue increased 26% year over-year, driven by continued strength

in off-road and aftermarket, coupled with a strong recovery in on-road

business. Industrial products revenue increased 12% year-over-year and 8%

sequentially from the second quarter, driven by growth in industrial

filtration and special applications, partly offset by a decline in gas

turbines business.

On a geographic basis, revenue growth was led by strength in Latin America,

particularly with increased demand for on-road and off-road products.

Adjusted EPS of $0.66 were ahead of the consensus estimate of $0.58.

Guidance. Management raised revenue and earnings guidance for full-year

fiscal 2021. Revenue is now expected to increase 9%-11% year-over-year, up

from prior guidance of 5%-8%. The revenue guidance, which includes a

foreign-currency tailwind of approximately 3%, translates to a range of

$2.81 billion to $2.86 billion, above the consensus estimate (before the

release) of $2.75 billion. Engine sales are now projected to increase

12%-14% (previously 8%-12%) for the full year, and industrial sales are

expected to be up 3%-5% (previously down 2% to up 2%). Considering the

revised revenue guidance for fiscal 2021, fourth-quarter revenue is now

expected to be around $759 million at the midpoint, implying growth of 23%

year-over year. The consensus estimate heading into the release incorporated

fourth-quarter revenue of $723 million. For the balance of the year, in the

engine segment, growth in the off-road business is expected to be driven by

increased demand for construction and agriculture equipment, coupled with

heightened mining activity. On-road sales growth should be led by

improvement in global heavy-duty truck production rates and improved global

equipment utilization is expected to drive growth in the aftermarket

business.

Management expects a decline in the aerospace and defense business due to

softer demand in the commercial aerospace market. For the industrial

segment, increased demand for industrial dust collection products is

expected to drive growth in Donaldson’s industrial filtration business.

Donaldson also expects slight improvement in the gas turbines business, but

softer market demand for disk drive products is anticipated to weigh on the

special applications business

Sales in 2020 included $100 million for gas turbines. The company sells PTFE

media for power plant dust collectors and sells the smaller collectors for

coal dust, but this was likely well less than $30 million.