REQUEST FOR HYDROGEN VALVE VALUE PROPOSITION

30% EBITDA and 20% market share is achievable in

narrow niches.

This entails validation of each niche

value proposition. In this regard Mcilvaine is

writing feature articles in many magazines. In

Valve World Americas an article this month

covers the HYDROGEN VALVE market and the

potential in various niches. In September a

number of value propositions submitted by valve

companies will be published. We are inviting you

to submit a proposition with no more than four

sentences. The relevant application codes and

valve types should be included as per the

examples.

Please submit your value proposition by August

1.

Bob Mcilvaine is available to answer questions

on this at 847 226 2391.

rmcilvaine@mcilvainecompany.com

Here are the details and the market article.

Examples of Hydrogen valve niche value

propositions

|

Company |

Application |

Valve type |

Value Proposition |

|

KSB Sisto |

PELE, FG, FL |

Check |

Swing check valves have special coatings. |

|

ITT Habonim |

PSMR, PPO, FL, SM, SW, SC, SW, UGT, TP, TS, UCO, UW, URE, UCH, UST, USH |

ball |

Cryogenic ball valves are designed for performance in the most demanding applications. The Total HermetiX Integrity package provides emission prevention tested and certified stem sealing, Fire safe certified design, and superior body and inline sealing at deep cryogenic temperatures. |

|

Bray |

PELE, SW |

Butterfly |

The McCannalok double offset butterfly valve) features an innovative design that offers rugged reliability and extremely easy maintenance in the field |

|

Swagelok |

UTC |

needle |

A bottom-loaded stem design reduces any potential stem blowout, offering enhanced safety. |

|

Ampo |

PSMR, FCG, FL |

Ball valve |

Hypercentric ball valve with its proven sealing concept combines the strength and integrity of metal-to-metal trunnion ball valve with positive sealing performances of the triple offset butterfly valve. Its friction free design and metal-to-metal sealing extends valve’s life. |

|

Velan (Flowserve) |

PELE, PSMR, FL, SM, , SC,URE, UCH, USH |

Butterfly |

In the double offset, an exceptionally tight shut-off is achieved with eccentric disc rotation combined with a unique sealing system, VELFLEX. This patent technology overcomes even high temperature fluctuations. |

Hydrogen Applications

|

Abrev. |

Prouction Methods |

Abrev. |

Transportation |

|

PELE |

Eletrolyzers |

TP |

pipeline |

|

PSMR |

Steam methane reformation |

TR |

road |

|

PPO |

Partial oxidation |

TS |

ship |

|

PO |

other |

TT |

train |

|

|

Form |

S |

Storage |

|

FG |

gas |

|

Use |

|

FCG |

Compressed gas |

UGT |

Gas turbines |

|

FL |

Liquid |

UIC |

IC Engines |

|

FA |

ammonia |

UCO |

Coal fired boilers |

|

|

Sources |

UW |

Waste to Energy |

|

SM |

methane |

URE |

refineries |

|

SW |

water |

UCH |

Chemical Plants |

|

SC |

coal |

UST |

Steel |

|

SW |

Waste and biomass |

USH |

ships |

Additional application details can be included

in the proposition. There can be sub-niches or

niches just within a sub process.

For example, Isolation Valves for Severe

Service within SMR

encounter temperatures and pressures which can

reach or exceed 1,500°F and 1,500 psig,

respectively. These elevated temperatures and

pressures are prevalent throughout various

modules of and applications within the SMR

process, including:

• Reformer

• Boiler Feed Water

• Feed Gas Lines

• Steam Drum Bridles

• Purging Applications

• Blowdown Applications

Each is a sub-niche and can be combined in a

niche which will be most profitable.

So, this additional granularity should be

included in the value proposition as well as the

niche forecasts.

The valve type is part of the value proposition.

It is part of the market share calculation. So,

standardization is a goal. Any input relative to

improving the listings will be considered.

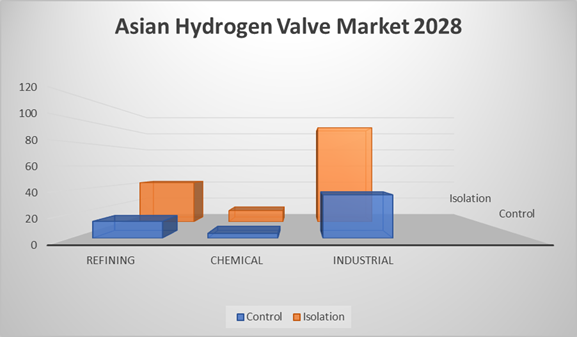

Isolation versus control is one division.

Mcilvaine also has four service

categories: severe, critical, unique and

general.

|

Valve type |

Sub 1 |

Sub 2 |

Sub 3 |

|

Ball |

Floating/Trunnion |

Rising stem |

Metal seated |

|

Butterfly |

Double Offset |

Triple Offset |

|

|

Check |

|

|

|

|

Diaphragm |

weir |

Full bore |

|

|

Gate |

Parallel/Wedge |

Rising stem |

Knife gate |

|

Globe |

|

|

|

|

Plug |

|

|

|

|

Pressure relief |

Safety relief |

|

|

|

Solenoid |

|

|

|

|

Needle |

|

|

|

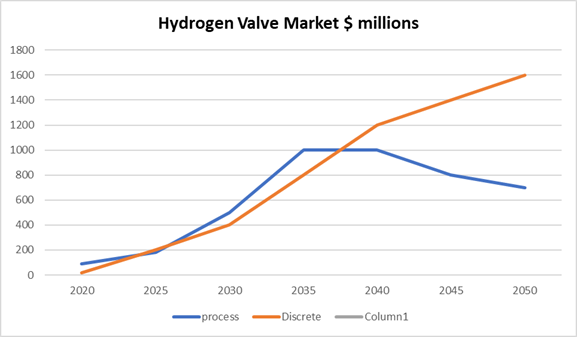

Latest Developments in the Hydrogen Valve Market

A number of governments, operators and suppliers

are betting on hydrogen as a major tool to meet

greenhouse gas goals.

In terms of valves, there are two markets:

discrete and process.

The discrete market includes small valves

used with fuel cells in mostly mobile

applications.

Many automotive companies are moving

forward with hydrogen fueled vehicles.

Discrete is defined as a valve associated with a

piece of equipment.

Swagelok furnishes check valves for

vehicle fuel cells.

These are small valves and are sold to

vehicle or fuel cell manufacturers.

Process includes the production and transport of

hydrogen as well as use in processes such as

steam generation or compression or heat

generation using combustion with hydrogen as the

primary or secondary fuel. Process also includes

the creation of chemical products.

Since the discrete market involves small valves

and a unique set of customers, the suppliers are

not the same companies furnishing the larger

process valves.

The process market preceded the discrete market.

But presently much of the activity is in

the discrete segment.

Over the next 15 years the process

expansion will outstrip discrete.

However, by 2040 the discrete market will

be advancing while the process market slows

down.

A detailed analysis has been made for the

process valve market for hydrogen through 2028

(1)

Coverage includes:

|

Production Methods |

Transportation |

|

Eletrolyzers |

Pipeline |

|

Steam methane reformation |

Road |

|

Partial oxidation |

Ship |

|

Other |

Train |

|

Form |

Storage |

|

Gas |

Use |

|

Compressed gas |

Gas turbines |

|

Liquid |

IC Engines |

|

Ammonia |

Coal fired boilers |

|

Sources |

Waste to Energy |

|

Methane |

Refineries |

|

Water |

Chemical Plants |

|

Coal |

Steel |

|

Waste and biomass |

Ships |

Coverage included gray, green, blue and yellow

hydrogen. Much of the near-term valve potential

is in gray and blue hydrogen. The gray hydrogen

includes the valves for partial combustion and

also for purification processes such as pressure

swing adsorption.

For molecular sieve switching metal

seated ball valves compete with triple offset

butterfly valves.

The potential for yellow hydrogen is

substantial.

Environmentalists have recognized the

need for carbon negative processes.

Biomass combustion with carbon capture

and sequestration (BECCS) is the only

cost-effective carbon negative option.

The conversion from gray to blue hydrogen

entails carbon capture and sequestration. The

many valves in the absorption and separation as

well as liquefaction and transport are included.

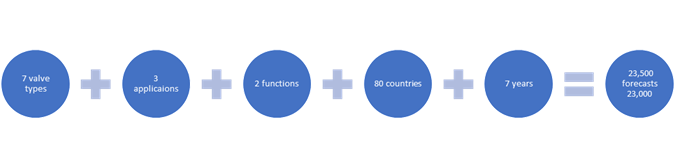

23,000

forecasts by country, valve type, function and

application for the 2022-28 were created.

There was also an analysis by region.

Analysis of the valve companies and the products

which they are supplying for hydrogen

applications shows that acquisitions are

positioning some valve companies to improve

their market share.

ITT has purchased Habonim. Atlas Coco and

Ingersoll Rand have combined valves with

compressors and other complementary products to

pursue markets such as hydrogen.

The hydrogen process valve market is highly

dependent on the mix of fuels for the power

industry.

An electric car plugged into an electrical

outlet can be using fossil fuel.

The fuel cell eliminates this route. To

the extent hydrogen replaces coal or gas for

combustion there is not an increase in valve

revenues.

Valve expenditures per kWh can be compared.

If solar or wind is used to make hydrogen which

then is used in fuel cells, the valve purchases

could range from 20 to 70% of a coal fired plant

when you consider both production and use.

|

Relative valve costs /kWh |

|

|

Coal |

1 |

|

BECCS |

2.5 |

|

Green hydrogen |

0.2-0.7 |

|

Nuclear |

1.2 |

|

Hydro |

0.3 |

|

Wind |

0.02 |

|

Combined Cycle |

0.5 |

|

Geothermal |

0.7 |

|

Solar |

0.01 |

Hydrogen use is only one of the variables in

determining valve sales to the power industry.

Yellow hydrogen using biomass will have niche

uses. But BECCS is just as yellow (carbon

negative). This option requires the most valves.

So, the extent to which BECCS is adopted the

valve market will increase.

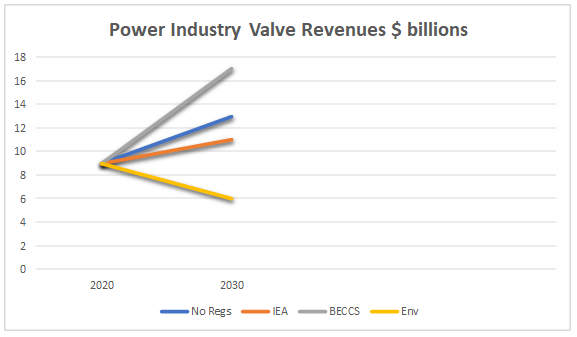

Present yearly valve sales to the power industry

around the world are $9 billion. (1)

There will be robust growth under the BECCS

based strategy outlined here. If countries do

not continue to strive for GHG emissions to meet

the Paris agreement (No Regs) there will be

modest growth in line with GDP. With a mix of

technologies such as envisioned by IEA to meet

net Zero there will be low growth. If the

environmentalists were to dictate a mix heavily

dependent on solar and wind (Env), there would

be significant revenue reduction over the next

10 years.

Electrolysis

Today, electrolyzers, the devices used in

production typically utilize one of two

technologies: low-pressure electrolysis or

high-temperature electrolysis. Technological

development has already seen us move up to

large-scale 20MW electrolyzers, but 100MW units

are not too far in the future. Several valve

manufacturers are confident that they have the

valves to fulfill the requirements of

electrolysis applications for the PEM, AWE or

SOEC electrolyzers of both today and tomorrow.

Capital costs of electrolyzers uninstalled range

from $1000 to $1500 /kw. Lifetime is estimated

at 75,000 hours.

For every kg of hydrogen produced, 9 kg of water

must be consumed. Therefore, 2.3 Gt of hydrogen

requires 20.5 Gt, or 20.5 billion m3, per year

of freshwater, which accounts for 1.5 ppm of

Earth’s available freshwater. Most applications

for hydrogen require it to be combusted or

pumped through a fuel cell, which converts

hydrogen gas into electricity and water, but

while most water can be recovered, it is not

generally returned to the original body of water

and will be treated as consumed. The only sector

in which the use of hydrogen does not regenerate

the entirety of the water feedstock by fuel cell

or combustion is chemical synthesis, which will

account for 540 Mt of hydrogen, using at most

4.8 billion m3 or 0.3 ppm of global freshwater

annually.

In the Norwegian industrial estate of Porsgrunn,

a major German engineering contractor in the

technical gases industry is currently building a

24 MW electrolysis plant for producing green

hydrogen as a feedstock for green ammonia, which

is required in fertilizer production. The

necessary hydrogen is to be generated by means

of electrolysis using hydropower.

in 2022, the KSB Group supplied pumps and valves

for this plan.

Luxembourg-based valve manufacturer Sisto

Armaturen S.A., which is part of the KSB Group,

supplied its Sisto-RSK swing check valves

equipped with a special coating.

Much of the process valve market will be

generated through fossil fuels using SMR and

other technologies.

At lower temperatures and pressures,

torque-seated gate valves, often equipped with

either solid Stellite® or Stellite®- welded

overlay trims, may suffice for applications that

do not require tight shutoff. Torque-seated

valve designs involve the application of

substantial forces to the valve components to

adequately seal against line pressure.

Over time, these forces wear down the critical

sealing components of the valve, resulting in

shortened product longevity versus those of

position-seated valve designs.

As temperatures and pressures rise, gate valves

are often replaced by Y-pattern globe valves,

similarly equipped with either solid Stellite®

or Stellite®- welded overlay trims, to achieve

improved shutoff performance at initial

installation. Unfortunately, the improved

shutoff performance of globe valve is offset by

the following disadvantages:

• Substantial pressure drop across the valve

• Short product longevity

To address the underperformance of globe valves

in severe-service applications, companies

engineer and manufacture quarter-turn,

metal-seated floating ball valves (‘MSBVs’) that

can achieve a ‘bubble-tight’ seal per ANSI FCI

70.2 Class VI shutoff – or better. The quarter

turn mechanics of a MSBV not only eliminates

packing leaks, but also enables the usage of low

emissions packing that complies with prevailing

fugitive emissions certifications, such as API

STD 641.

Forecasting the valve revenues in the short term

is challenging.

Forecasts to 2050 include so many

variables that constant adjustments will be

required.

(1)

Hydrogen Valves, published by the Mcilvaine

Company