INDUSTRIAL IoT & REMOTE O+M

NEWSLETTER

June 2022

No. 511

Table of Contents

MARKETS

·

AWE Knowledge Ebbs and Flows

When it Should be Advancing

·

Acquisition Tracking in AWE

Markets

APPLICATIONS

·

B&W Online Monitoring System

Optimizes Cooling Tower and Heat

Exchanger Operation

·

B&W Provides Systems For

In-Furnace Processes Measurement

·

Siemens Acquires Senseye -

Predictive Maintenance and Asset

Intelligence for Industrial

Companies

·

ABB Boosts Orders 20% in 2021

·

ABB Predicting Increased

Profitability in the Energy

Sector

·

Baker Hughes Collaborates With

C3 AI, Accenture, and Microsoft

on Industrial Asset Management

Solutions

·

Valmet Will Supply Automation

For UK WTE Plant

·

B&W Targeting Up to $120 Million

in EBITA For Fiscal 2022

ACQUISITIONS

·

Ametek Is Shaped By 80

Acquisitions

·

Ametek Bought Magnetrol and Two

Other Companies Last Year

·

Ametek Magnetrol

is a Leader in Hot Market

Niches Such as SMR and Hydrogen

·

CD&R Buys Pumps and Flow Control

Businesses of Roper

·

Nitto Buys Bend

·

Dover Buys Malema, a Flow

Measurement Company With $45

Million In Revenue

AWE Knowledge Ebbs and Flows

When it Should be Advancing

There is a strong argument to be

made that AWE knowledge needs to

be organized into an “Internet

of Wisdom.” Consider:

·

AWE intelligence gathering ebbs

and flows depending on

regulations and government

funding

·

Those who develop the

technologies retire and

decisions are made by people

without the experience

·

New process developments receive

the attention of top management

whereas most AWE decisions are

made by those with more to lose

by making the wrong decisions

than by failing to make one

which is an improvement

·

There has to be strong evidence

to sway a purchaser to pick a

new and better AWE product

The history of lime FGD is an

example of the failure to

benefit from experience.

McIlvaine was president of

Environeering which was

partnering with Combustion

Engineering (CE). CE was

devoting a huge amount of

research in the mid-sixties to

the SO2 problem.

Environeering had successful

lime scrubbers in a number of

applications. But CE decided

that by adding limestone to the

coal one would eliminate the

need for a lime kiln. The 125-MW

demo at Union Electric quickly

proved that gypsum deposits

would eliminate this option.

There was tremendous pressure to

solve the SO2 problem

quickly. The time it would take

to build additional lime kilns

and coordinate this approach was

substantial.

On the other hand, if you just

grind limestone and use it

rather than lime in the scrubber

you can solve the problem.

What was overlooked was the need

for sophisticated chemistry

control. There was also no

consideration that the

efficiency requirements might

change from 80% to 98%.

Limestone FGD is still the

choice even with the 98%

efficiency requirements.

However,

many studies show that

the extra cost of the lime is

offset by capital cost,

operational and product sales

benefits. The National Lime

Association paid both McIlvaine

Company and Sargent & Lundy to

conduct studies showing the

advantages

of lime. However, at the

time these studies appeared, the

industry was committed to

limestone.

Over the years there has been a

huge investment to overcome some

of the problems caused by

limestone. Even so, it is likely

that a regional plan using lime

is a better choice.

The Utility E-Alert last week

covered an order in India for

Ducon using Ventri-Rod

technology. India is the first

country to make this option an

alternative to spray towers.

Ventri-Rod is a label created by

Bob Mcilvaine in 1966 to convey

the fact that two parallel pipes

form a venturi-like orifice. It

has taken more than 50 years for

this technology to become an

acceptable alternative despite

cost and design flexibility

advantages.

However, 50 years is not the 130

years since the Austrians

invented venturi scrubbers for

town gasifiers. Then, as soon as

oil and natural gas eliminated

gasifiers, the world forgot

about the invention.

It can be argued that the spray

towers used today are a result

of solving mistakes rather than

progress.

The first commercial FGD

scrubbers were mobile with ping

pong balls and marbles. The

utilities managed to melt the

plastic balls and shatter the

glass ones. So many

plants just took out the balls

and operated the vessels as

spray towers.

The transfer of Ventri-Rod

technology resembles the flight

of a pinball and includes

Environeering, Combustion

Engineering, Riley, Ashland Oil,

and finally Ducon

A few years ago, Andritz

introduced similar technology

but was seemingly unaware of

commercial installations at Duck

Creek and elsewhere.

Huge amounts of money have been

spent to make spray towers

perform better. As a result,

they are reliable and meet the

requirements. They maintain

laminar flow for long distances

and are in contact with

uniformly falling drops.

However, as was found with the

venturi approach, tearing

droplets apart with turbulence

greatly extends the mass

transfer area.

This is an example that

once a technology becomes

standard, it is optimized and

the chance for a better

technology is diminished.

An” Internet of Wisdom” will

ensure that valuable technology

is not lost, and that important

knowledge is not overlooked.

Acquisition Tracking in AWE

Markets

McIlvaine has been tracking

acquisitions for more than 20

years in

·

Air Filtration

·

Fabric Filters

·

Scrubbers and Absorbers

·

Electrostatic Precipitators

·

Flue Gas Desulfurization

·

DeNOx

·

Sedimentation and Centrifugation

·

Liquid Microfiltration

·

Liquid Cartridges

·

Crossflow Membranes

·

IIoT and Remote O&M

·

Cleanrooms

·

Pumps

·

Valves

In each of these market reports

we will be adding a tab labeled

“Acquisitions” with periodic

updates. A database will link to

the analysis as per the

following example for fabric

filters.

Fabric Filter Acquisitions 2002

- Present

|

Yr |

Mo |

Acquirer |

Acquired |

Subject |

|

2022 |

4 |

CECO |

Index Water |

New Market |

|

2022 |

2 |

Micronics |

National Filter Media |

Filter Elements |

|

All |

All |

Searches back to 2002 online and to 1976 in printed version. |

||

|

2016 |

7 |

Micronics |

Midwesco |

Aeropulse, Southern, CPE |

CECO Environmental Acquires

Index Water - April 2022

CECO Environmental Corp.,

announced the acquisition of

substantially all of the assets

of Index Water,

expanding its water treatment

solutions portfolio serving

the Middle East region. Terms of

the deal were not disclosed.

CECO's deep experience in

high-efficiency, processing,

separation, and filtration

solutions is further enhanced

with the addition of Index

Water's intellectual property,

technologies, and other assets

that support systems including

process and potable water

treatment, ultrafiltration,

desalination, and

demineralization technologies,

in addition to effluent and

sewage water treatment including

biological and reuse

technologies.

Over the last three years, CECO

has been aggressively expanding

its presence in the produced

water, process and potable

water, effluent and sewage and

wastewater treatment markets.

Through organic innovation and

acquisition, CECO has quickly

become a technology leader in

liquid coalescing, de-aeration,

ferrate-based advanced

oxidation, dissolved gas

flotation, reverse osmosis, and

several other produced and

process water technologies.

Micronics Engineered Filtration

Group Announces Strategic

Acquisition of

National Filter Media

(NFM) February 2022

The Micronics Engineered

Filtration Group announced the

acquisition of filtration

industry leader, National Filter

Media (“NFM”).

The strategic acquisition of

National Filter Media

significantly expands Micronics’

portfolio of engineered

filtration solutions to better

serve customers’ advanced

filtration needs.

“I am excited to welcome NFM and

FilterFab to the Micronics

family of trusted wet and dry

filtration brands! I am very

much looking forward to working

with our talented new NFM and

FilterFab teammates as we bring

our combined talents and

capabilities to our valued

global customers,” said Chris

Cummins, President, and CEO of

the Micronics Engineered

Filtration Group. Mr. Cummins

will head up the newly combined

company going forward.

“Together, we bring over 400

years of combined expertise to

the marketplace. I am fully

confident that we will offer our

global customers an unparalleled

combination of problem-solving

along with filter media,

advanced filtration equipment,

filtration services, and

aftermarket parts,” Mr. Cummins

added.

With the addition of National

Filter Media, The Micronics

Engineered Filtration Group now

combines strong, trusted wet and

dry filtration brand names

including Micronics, Southern

Filter Media (“SFM”), C.P.

Environmental (“CPE”), United

Process Control (“UPC”),

AeroPulse, National Filter Media

(“NFM”), FilterFab, Midwesco

Filter Resources (“Midwesco”),

and Fabricated Filters.

Added filter media that the

Micronics Engineered Filtration

Group will now manufacture

in-house with the addition of

NFM include Belt Press

Dewatering Belts, Pressure Leaf

Filter Media, Horizontal Vacuum

Belt Filter Media, Rotary Vacuum

Drum Filter Media, Rotary Vacuum

Belt Filter Media, Rotary Vacuum

Disc Filter Media, and Vacuum

Pan/Table Filter Media.

________________

The fabric filter database has

acquisitions going back more

than 20 year on line and 42

years with the older printed

versions.

To understand the Micronics-NFM

significance it is good to see

the past acquisitions such as.

Micronics Dry Filtration Group

Acquires Certain Assets of

Midwesco Filter Resources - July

2016

The Micronics Engineered

Filtration group — consisting of

leading wet and dry engineered

filtration companies including

Micronics, Inc., Southern Filter

Media (SFM), C.P. Environmental

(CPE), United Process Control

(UPC) and AeroPulse — is pleased

to announce the acquisition of

certain filter media production

equipment and product inventory

assets of Midwesco Filter

Resources (MFRI)/

From 1978 through 2012, both CPE

and UPC supported MFRI’s

customers with industry-leading

baghouse services

including: inspections, field

maintenance, mechanical

repair/rebuild services,

changeouts, troubleshooting and

baghouse parts and accessories.

CPE and UPC’s expert service

crews executed some of the

largest bag installation,

maintenance, and service

projects — under the Midwesco

name — for a host of customers

across North America. Their

service crews and sales

professionals have extensive

experience servicing the

utility, coal-fired power

plants, industrial boilers,

steel, energy-from-waste,

cement, lime, coatings,

chemicals, and food, to name a

few industries served.

“Our dry filtration companies

have provided products and

services for many of Midwesco’s

customers for many years,

whether through our services at

CPE and UPC or with high-quality

filter bags outsourced to SFM by

Midwesco,” according to Don

Eldert, President, Micronics Dry

Filtration Group & Executive VP,

Micronics Filtration Holdings,

Inc. “These purchases further

underscore the commitment of the

Micronics Engineered Filtration

family of companies to

continuing the legacy of

providing industrial

baghouse/dust collector

customers across North America

with unrivaled dry filtration

product and service offerings,”

said Mr. Eldert.

In 2014 and 2015, CPE, UPC,

AeroPulse and SFM all joined the

Micronics Engineered Filtration

family and collectively

strengthened its dry filtration

offerings to better serve

customers’ pollution control

needs.

SFM has designed and produced

high-quality filter bags for

baghouses in North America since

1973. SFM produces

high-temperature felts,

fiberglass, polyester, and

polypropylene filter media in a

variety of finishes including

ePTFE membrane, all in a

state-of-the-art bag

manufacturing facility.

Over the last 30+ years, SFM has

produced thousands of bags of

MFRI to ensure that MFRI could

meet the delivery and quality

expectations of their customers.

SFM continued to support MFRI’s

production needs up until the

day they closed their doors (in

June 2016); SFM recently shipped

the last orders they received

from MFRI.

____________________

Other useful data: The

searchable database also has

hundreds of technical, articles

and news about orders from the

companies now part of Micronics.

The only time that much of the

data on revenues, employees, and

market value is provided is at

the time of an acquisition. So

20 year old information still

has value but is difficult to

find.

The BHA Example: The

fabric filter industry has been

built by small companies. When

Choppy Reinfrank called

McIlvaine 40 some years ago he

proposed the novel idea of

creating a third party company

to sell bags directly. Success

seemed implausible. 20 some

years later he sold BHA to GE

for $240 million. The company

then became part of Clarcor and

now with the

Clarcor acquisition by Parker

it is part of a multibillion

dollar operation.

The basis for BHA success was

use of computers to help owners

decide when they needed to

replace bags and to be able to

provide bags for any design. The

personal knowledge and high

level contacts also were

important. BHA executives dealt

directly with top management at

Cemex and other large bag

purchasers. Regular training

courses were conducted for

personnel at cement and other

user companies.

With new condition monitoring

software this approach can be

expanded to supply bags as

needed and to provide remote

O&M. The knowledge of the early

efforts is very valuable in

pursuing this IIoT and Remote

O&M opportunity.

APPLICATIONS

B&W

Online Monitoring System

Optimizes Cooling Tower and Heat

Exchanger Operation

B&W SPIG is committed

to continually help

customers optimize their plant

performance. This led B&W

engineers to develop the UNICO

online monitoring system. This

unique global service monitors

and analyzes critical

performance data on Cooling

Towers and Air Cooled Heat

Exchangers in operation. This

patented continuous monitoring

system is suitable to analyze

and process many parameters and

equipment condition. B&W SPIG’s

UNICO online monitoring system

assures cooling plant

efficiency, reduction of

maintenance costs, timely site

expert action and avoids

unexpected failures.

The system is based on a network

of localized smart units that

collect data and converts them

into digital form, sending them

to a supervisory system using

wireless technology. The

supervisory system validates and

integrates the data in a single

database. The system processes

the acquired information to

check process parameters

variability and equipment

reliability. It also detects

potential problems, generates

alarms, and determines

counteractions that prevent loss

of plant performance.

The unique UNICO online

monitoring system can yield

direct improvements to the plant

in the following areas:

·

production output

·

avoidance or reduction of the

number of unscheduled shutdowns

·

reduction of secondary damage

resulting from the failure of

any one component of the cooling

system

·

enhancement of spare parts

inventory control

·

maximum utilization of the

investment with the overall

resulting improvement in health

and safety standards

Customers can also benefit from

the following:

·

continuous vibration monitoring

·

gear box oil temperature

diagnoses

·

ambient temperature monitoring

With the acquired data, early

planning can be secured for

onsite expert actions, technical

support, preventive maintenance,

and quick and simple

installation. Having real-time

access and control of your

cooling plant’s operating

condition, maintenance costs can

be reduced, and equipment

performance is optimized.

B&W Provides Systems For

In-Furnace Processes Measurement

Since 1946, Babcock & Wilcox

(B&W) has supplied

state-of-the-art technology that

allows plant operators to

accurately view and monitor

internal furnace and process

applications. B&W was the first

company to provide industrial

viewing systems and remain

committed to meeting the needs

of customers for reliable

products and services.

Diamond Electronics monitoring

products include high definition

visible and infrared light

cameras (fixed and portable),

process gas temperature

measuring pyrometers,

temperature measurement

software, and site service and

in-house repair services.

B&W provides service, parts and

troubleshooting for all Diamond

Electronics components and

systems from the facility

located in Lancaster, Ohio, USA.

Siemens Acquires Senseye -

Predictive Maintenance and Asset

Intelligence for Industrial

Companies

Siemens is further expanding its

portfolio in the field of

innovative predictive

maintenance and asset

intelligence with the

acquisition of Senseye. The

global industrial analytics

software company is

headquartered in Southampton, in

the UK. Senseye is a leading

provider of outcome-oriented

predictive maintenance solutions

for manufacturing and industrial

companies. Senseye’s predictive

maintenance solution enables a

reduction in unplanned machine

downtimes by up to 50%,

increased maintenance staff

productivity by up to 30%.

Furthermore, Senseye solutions

support an improvement in

corporate sustainability through

increased asset lifetime and

waste reduction. Since June 1,

2022, Senseye is a 100 percent

subsidiary of Siemens Holdings

plc in the UK. The company is

assigned organizationally to

Siemens Digital Industries and

part of the Customer Services

Business Unit.

“Senseye’s AI based solutions

complement our digital services

portfolio driving efficient and

scalable predictive maintenance.

This will allow us to offer

highly flexible solutions to

help our customers across many

industries to determine the

future condition of their

machinery and hence, increase

their overall equipment

effectiveness,” says Margherita

Adragna, CEO of Customer

Services for Digital Industries,

Siemens AG.

Simon Kampa, CEO of Senseye,

adds: “Together we can multiply

the full potential of Senseye’s

innovative predictive technology

and deep expertise. Siemens’

global presence and extensive

industrial knowledge will ensure

that our current and future

customers benefit from

innovative, seamlessly

integrated Industry 4.0

solutions to drive measurable

business outcomes.”

Since its inception in 2014,

Senseye has focused on scalable

and sustainable asset

intelligence

Software-as-a-Service (“SaaS”)

solutions. Senseye uses

state-of-the-art, purpose-built

machine learning and artificial

intelligence to provide a

globally-scalable solution that

enables predictive maintenance,

helping to reduce unplanned

downtime and improve

sustainability. It integrates

seamlessly with existing and new

infrastructure investments,

using machine, maintenance, and

maintenance operator behavior

data to understand the future

health of machinery and what

requires human attention. The

solution is designed for

maintenance operators and

requires no previous background

in data science or traditional

condition monitoring.

ABB Boosts Orders 20% in 2021

In 2021 ABB experienced a 20%

increase in orders and an 11%

increase in revenues. EBITA

increased by 42%.

|

$ in millions, unless otherwise indicated |

FY 2021 |

FY 2020 |

US$ |

|

Orders |

31,868 |

26,512 |

+20% |

|

Order backlog (end December) |

16,607 |

14,303 |

+16% |

|

Revenues |

28,945 |

26,134 |

+11% |

|

Income from operations |

5,718 |

1,593 |

+259% |

|

Operational EBITA (1) |

4,122 |

2,899 |

+42% |

ABB Predicting Increased

Profitability in the Energy

Sector

ABB is raising long-term

profitability by enabling

industrial customers to manage

the energy transition to a more

sustainable future. This will be

done through integrating its

leading automation systems,

industry-specific anchor

products, sensing equipment, and

sophisticated digital solutions.

One of the biggest challenges

facing industry today is the

shift of approximately 30

percent of energy from fossil

fuels to low-carbon sources by

2050, while meeting the

increasing demand for a broad

variety of products to satisfy

consumer requirements. Process

Automation supports industries

that address a wide range of

essential needs — from supplying

energy, water, and basic

materials, to manufacturing

goods and transporting them to

market. Its customers include,

among others, the hydrocarbon

sector, chemicals, mining,

metals and minerals, cement,

pulp and paper, power

generation, and marine and

ports. These sectors are taking

great steps to improve energy

and resource efficiency while

reducing harmful emissions.

Delivering on its strong organic

strategy for its digital

business, Process Automation

today already generates

approximately $500 million in

orders from industrial software

and digital services and expects

continued double-digit growth in

this area. The digital offering

is centered around value pillars

that capture the biggest value

creation potentials to be

achieved for customers through

advanced analytics and

artificial intelligence. The

suite of solutions helps

customers across industries

predict maintenance, optimize

energy, improve cybersecurity,

and increase operational

efficiency.

“We are at the heart of some of

the most important shifts in

society at this very moment,”

said Peter Terwiesch, President

of the business area Process

Automation. “We can make a real

difference through our product

and systems portfolio, all

aligned with ABB’s purpose to

transform industries to address

the world’s energy challenges

through leading technology.

Apart from becoming more

sustainable, our technology also

helps our customers to

continually improve productivity

and run safer operations, which

is very important, given that

they operate some of the most

essential and complex

infrastructures on the planet.”

At the core of such operations,

orchestrating the production

process and optimizing energy

management, is ABB’s automation

system offering. Its Distributed

Control System (DCS) has been

the number one player in its

field for the last 22

consecutive years according to

an independent report. ABB has

maintained a leading share of

around 20 percent in 2021 in a

market worth more than $14

billion and has built the

largest DCS installed base and

service business in the

industry. The services provided

to customers throughout the long

system lifecycle, often decades,

keep assets updated with latest

technology, and the intimacy

with customers’ operations

allows ABB to continually

improve production efficiency.

Alongside its comprehensive

portfolio, the business area is

presenting its financials and

how it has already lifted the

profitability of all its

divisions to double-digit

margins through exiting non-core

activities, tightening project

selectivity, and strengthening

execution. The business area now

aims to improve further through

pricing, bolt-on acquisitions,

and continuous strict cost

management.

ABB is currently planning to

exit its Turbocharging division,

now called Accelleron, which is

part of the business area.

Without this division, the

business area would have

achieved revenues of $5.5

billion, an operating margin of

11.1 percent in 2021, net

working capital of below zero,

and a return on capital employed

(ROCE) of ~20 percent, with

about 20,000 employees in four

divisions worldwide.

Baker Hughes Collaborates With

C3 AI, Accenture, and Microsoft

on Industrial Asset Management

Solutions

Energy technology company Baker

Hughes is collaborating with C3

AI, Accenture, and Microsoft on

industrial asset management

(IAM) solutions for clients in

the energy and industrial

sectors.

The collaboration will focus on

creating and deploying Baker

Hughes IAM solutions that use

digital technologies to help

improve the safety, efficiency,

and emissions profile of

industrial machines, field

equipment, and other physical

assets. Applying their

individual strengths, the four

companies will collaborate on

Baker Hughes IAM capabilities

that help optimize plant

equipment, operational

processes, and business

operations through improved

uptime, increased operational

flexibility, capital planning,

and energy efficiency

management.

The solutions will be designed

for industries including oil and

gas; renewable energy and

thermal power generation; metals

and mining; chemicals; and pulp

and paper.

Baker Hughes, C3 AI, Accenture,

and Microsoft will also explore

collaborating on solutions that

help achieve net-zero carbon

emissions and decarbonize energy

and industrial sectors,

including emissions management.

“This collaboration accelerates

our growth strategy to provide

differentiated IAM solutions

that enhance our customer’s

industrial operations by

optimizing the performance of

industrial equipment and

processes,” said Lorenzo

Simonelli, Baker Hughes chairman

and CEO. “IAM connects

industrial data to

domain-specific insights for

improved efficiencies and

lowered energy use and

emissions. We see this as an

important step to support the

industry’s net-zero targets.”

Baker Hughes, C3 AI, Accenture,

and Microsoft have a history of

strategic collaboration, and

each company brings specific

expertise to accelerate IAM

solution development for energy

and industrial applications.

Baker Hughes will provide

domain-specific digital

expertise and technology for

industrial customers, including

leading condition-monitoring

software for mission critical

machinery, industrial asset

strategy advisors, proven

machine and equipment edge

sensor and related controls

capabilities, enterprise AI

capabilities from

the BakerHughesC3.ai

alliance for oil and gas and

industrial applications, and

proprietary original equipment

manufacturer (OEM) analytics.

Baker Hughes’ IAM portfolio also

includes the recent acquisition

of ARMS Reliability and a

strategic alliance with Augury.

C3 AI will provide a flexible

artificial intelligence (AI)

application development platform

that complements Baker Hughes

technologies as well as

extensive experience developing

and deploying applications at

scale for a wide range of

equipment used across

industries.

Accenture will help drive

product innovation, design and

development and provide

strategic support and systems

integration at scale, drawing on

its experience to transform

asset management across

industries to help improve

profitability and reduce risk.

Microsoft will provide secure

cloud infrastructure for big

data, advanced Microsoft Azure

services including AI, Internet

of Things (IoT), high

performance computing (HPC) as

well as modern work and business

applications.

“This is an important effort,

and we’re excited to participate

in providing the core Enterprise

AI technology,” said C3 AI

Chairman and CEO Thomas M.

Siebel. “Enterprise AI software

is critical for increasing

performance and ROI from

industrial assets management

solutions.”

“Through this unique

collaboration, we are helping

companies embed intelligence

across their operations to

increase performance and safety,

advance decarbonization goals,

and drive greater innovation and

competitiveness,” said Julie

Sweet, chair and CEO of

Accenture.

Valmet Will Supply Automation

For UK WTE Plant

Valmet will supply automation to

the new Slough Multifuel

energy-from-waste plant close to

London, UK. The order was placed

by Hitachi Zosen Inova AG (HZI),

the engineering, procurement,

and construction contractor for

the facility.

This is the seventeenth time

that HZI has chosen Valmet’s

automation technology for its

energy-from-waste plant

projects. The plant is owned by

a joint venture between a UK

energy company SSE Thermal,

and Copenhagen Infrastructure

III K/S, a fund managed

by Copenhagen Infrastructure

Partners (CIP).

The order was included in

Valmet’s orders received of the

first quarter 2022. The value of

the order will not be disclosed.

The deliveries will take place

from early September 2022 to

January 2023. The automation

system will be taken over by the

end customer in late November

2024.

“We benefit from the experience

gained in Valmet’s latest UK

projects and can implement it in

the Slough project. Valmet has

been proactive in supporting,

answering, and giving ideas to

the project,” says Aristeidis

Charitos, Technical Project

Manager, Slough Project, HZI.

“The current global

semiconductor chip shortage is a

burden for all our projects. Due

to the fact that Valmet DNA

Automation System offers three

different models of process

stations, Valmet is able to

deliver the solution within the

project time schedule,”

says Adrian Hiemann, DCS System

Engineer, Slough Project, HZI.

“The end customer has been

satisfied with our Valmet DNA

system at the Ferrybridge 1 and

2 energy-from-waste plants

delivered in 2012 and 2016. HZI

has been our customer since

2008. The cooperation was good

this time as well, and we were

able to fulfill the technical

requirements. For Valmet, this

project is important as it

continues and expands our market

share on the UK

energy-from-waste market,”

says Rene Neubert, Sales

Director, Automation, Valmet,

Austria.

After starting full operation in

2024, the Slough Multifuel plant

will process around 480,000 tons

of residual waste from the

Greater London Area per year and

will cover the annual power

consumption equivalent to

approximately 100,000

households.

Valmet’s delivery consists of

a Valmet DNA Automation System,

a protection system, integrated

controls for 11 kV distribution,

large screens, an extensive

operator interface for the

control room, an electrical

control system, 3,200 hardwired

signals as well as more than

7,300 links and data points.

“Together, we have a tremendous

opportunity to deliver

cloud-based technologies across

customers’ industrial operations

that enable them to reduce costs

and increase efficiencies while

advancing their net zero goals,”

said Judson Althoff, Microsoft’s

executive vice president and

Chief Commercial Officer.

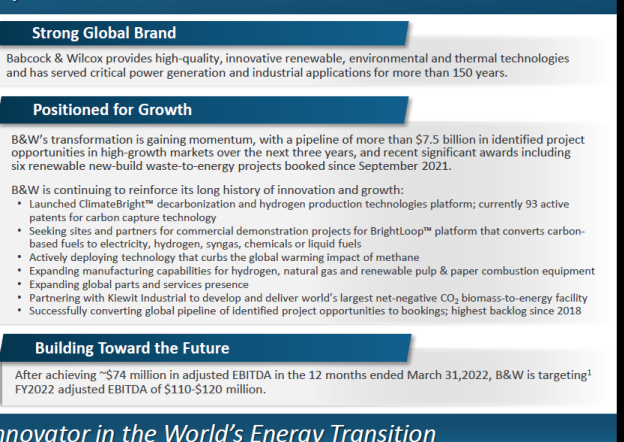

B&W Targeting Up to $120 Million

in EBITA For Fiscal 2022

Babcock & Wilcox is making the

transition from reliance on

coal-fired power generation to

a range of energy

technologies.

One of the biggest opportunities

is in the conversion of biomass

to power, liquid fuels, or

plastics using biomass and then

sequestering the CO2.

McIlvaine believes that this is

the only practical carbon

negative option. Direct

separation involves capturing

400 ppm of CO2 from 1

million ppm of air

and is therefore very

expensive. CO2 from

fossil fuel combustion is over

120,000 ppm of CO2.

With B&W oxycombustion the CO2

increases to over 700,000 ppm.

The recent B&W order for a 200

MW biomass combustor with

oxycombustion is part of a

biomass to liquid fuels project.

The oxycombustion

technology benefited from

DOE funding for a pilot demo at

an Illinois power plant.

Management provided the

following summary of the

progress B&W has made.

Here are the 12 month

financials.

|

($ in Millions) |

Twelve Months Ended March 31, 2022 |

|

Revenue |

$ 759.2 |

|

Operating Income (loss) |

$ 20.5 |

|

Net Income (loss) |

$ 38.3 |

|

Net Income (loss) attributable to stockholders of common stock |

$ 25.3 |

|

Adjusted EBITA |

$ 74.0 |

|

EBITA Margin % |

9.8% |

B&W has survived despite very high obstacles.

For decades it competed with Combustion

Engineering to dominate coal-fired power in the

world. Combustion Engineering moved from owner

to owner as coal-fired power profits shrank.

European boiler makers also did not survive

although Babcock Contractors became part of

Doosan.

The only supplier to have remained healthy is

Mitsubishi. McIlvaine is compiling a database of

acquisitions as shown in the next article.

The B&W acquisition history shows that the most

recent round of acquisitions and divestitures

has left the company in a position to capitalize

on its basic strength which is the combustion of

solid fuels at large scale.

ACQUISITIONS

Ametek Is Shaped By 80 Acquisitions

AMETEK has acquired 80 companies,

including 18 in the last 5 years. A total of 37

acquisitions came from private equity firms. It

has also divested 2 assets. Many of these

acquisitions are companies with leadership in

niche markets where there is growing potential

for IIoT and Remote O&M. The knowledge of these

applications by Ametek companies will be

valuable to the IIOT and Remote O&M system

providers who will also be potential clients and

collaborators. One such company is Magnetrol who

supplies level control in tough applications

where solid fuels are converted to hydrogen,

liquids, or syngas.

Ametek Bought Magnetrol and Two Other Companies

Last Year

AMETEK completed three acquisitions in 2021 –

Magnetrol International, Crank Software and EGS

Automation (EGS). Approximately $270 million was

deployed on these acquisitions which have

combined annual sales of approximately $120

million.

“We are pleased to welcome the Magnetrol, Crank

Software and EGS teams to AMETEK,” commented

David A. Zapico, AMETEK Chairman and Chief

Executive Officer. “Each of these businesses

provide AMETEK with unique capabilities which

strategically expand our presence in attractive

growth areas. We continue to strengthen our

portfolio through the acquisition of

market-leading businesses with innovative,

advanced technology solutions. We are pleased

with this recent acquisition activity and

continue to manage an active deal pipeline with

exciting opportunities for growth.”

Magnetrol and Crank Software join AMETEK as part

of its Electronic Instruments Group (EIG) – a

leader in advanced analytical, monitoring,

testing, calibrating, and display instruments.

EGS Automation joins AMETEK’s Electromechanical

Group (EMG) – a differentiated supplier of

thermal management systems, and automation and

engineered solutions.

Headquartered in Aurora, Illinois, Magnetrol is

a leading provider of level and flow control

solutions for challenging process applications

across a diverse set of end markets including

medical, pharmaceutical, oil and gas, food, and

beverage, and general industrial. Magnetrol’s

portfolio of mission-critical products are

designed to optimize processes, maximize yields,

and ensure safety.

“Magnetrol is an excellent acquisition for

AMETEK and nicely complements our Sensors, Test

and Calibration (STC) business,” added Mr.

Zapico. “Combined, Magnetrol and STC become an

industry leading, differentiated sensor platform

with a broad range of level and flow measurement

solutions.”

Headquartered in Ottawa, Canada, Crank

Software is a leading provider of embedded

graphical user interface (GUI) software and

services. Storyboard – the company’s flagship

offering – is a premier, innovative solution

that enables the design and development of

customized user experiences in a wide range of

embedded products. Crank Software also offers a

unique and customizable set of professional

services that takes customers from concept to

completion in their GUI design and development

cycle.

“Crank Software is an exciting acquisition for

AMETEK and an excellent addition to our growing

portfolio of software solutions,” continued Mr.

Zapico. “Their award-winning Storyboard platform

and service capabilities are positioned well to

capitalize on the accelerating demand for smart,

digitally enabled devices across a variety of

end markets.”

Headquartered in Donaueschingen, Germany, EGS is

an automation solutions provider that designs

and manufactures highly engineered, customized

robotic solutions used in critical applications

for the medical, food and beverage, and general

industrial markets.

“EGS nicely complements our AMETEK Dunkermotoren

business with highly customizable engineering

design and automation capabilities,” commented

Mr. Zapico. “The combination of EGS and

Dunkermotoren provides a broader suite of

automation solutions and expands our presence in

this attractive market.”

AMETEK is a leading global manufacturer of

electronic instruments and electro- mechanical

devices with annual sales in 2020 of more than

$4.5 billion. The AMETEK Growth Model integrates

the Four Growth Strategies — Operational

Excellence, New Product Development, Global and

Market Expansion, and Strategic Acquisitions —

with a disciplined focus on cash generation and

capital deployment. AMETEK's objective is

double-digit percentage growth in earnings per

share over the business cycle and a superior

return on total capital. The common stock of

AMETEK is a component of the S&P 500.

Ametek Magnetrol

is a Leader in Hot Market Niches Such as

SMR and Hydrogen

Magnetrol is a market leader in level

measurement of condensed liquids in tanks used

in various

solid fuels to liquids and gases

processes. It is also a market leader in a

number of other niche applications.

Eight articles in the IIoT Newsletter provide

insights on the Magnetrol niche market pursuit.

The October 2018 issue has analysis of the

magazine advertising by IIoT companies for that

year. Magnetrol ran full page level control ads

in Processing Magazine. It ran full page

ads in Pipeline and Gas Journal and

PTQ Quarterly.

Ametek had no ad in Processing but had

ads in Chemical Engineering and

Hydrocarbon Processing. It had only a

half-page ad in PTQ Quarterly compared to

two pages for Magnetrol.

The IIoT Newsletter continues with

“One revelation from an analysis would be the

substantial amount of advertising by Magnetrol

on level control measurement. These five pages

of advertisements appear in a number of

industry-focused magazines and reveal a

multi-industry marketing approach. The large

investment in advertising is an indicator of the

“pull” rather than “push” marketing approach.

This further indicates a company selling based

on lowest total cost of ownership. It also

indicates a company which seeks to understand

the processes and industries where its product

is used.

This advertising leads to the website where the

use of level controls in various specific

industries and processes is discussed. The

following link is to the Magnetrol brochure on

coal-fired boilers. It has good process flow

diagrams to accompany the product descriptions

for each application.

http://us.magnetrol.com/Literature/1/41-191.2_Coal_Fire_Power_Brochure.pdf.

Some of the advertisements are general and

reference a number of products. DuPont for

example has a full page advertisement with

coverage of EDV scrubbers, sulfur recovery

processes and several other products. (This

group is now part of Wynnchurch). By contrast,

the A-T advertisement is only on one type of

lining for one type of valve.

The advertising and exhibition activity can be a

function of initiatives to gain market share

rather than just keep it. Therefore, tracking

this activity over time is useful. For example,

one chemical company had the largest stand at

WEFTEC a few years ago and did not have a stand

this year.

One of the newsletters references an article in

the McIlvaine intelligence system from 1999 but

is still relevant.

MO 99 09 40 "Thermal Mass Flow Transmitters" by

Wayne Shannon, Magnetrol, Downers Grove,

IL. FC. July/August 1999, 6 p.

When it comes to low flow measurement of air and

gases, the inherent benefits of thermal

dispersion technology are worth reviewing,

according to the author. One type of sensor is

frequently referred to as an insertion sensor

and is appropriate for low velocity measurement

in pipes and ducts. This sensor is the type

discussed in this article.

McIlvaine identifiers: 330 FLOW MEASUREMENT, C

MAGNETROL, 489 SENSORS

The importance of creating an Internet of Wisdom

around flow measurement technology was

illustrated in 1990 when EPA promulgated a rule

for power plant stack flow measurement without

the understanding of comparative strengths and

weaknesses of ultrasonic, thermal, and pressure

differential approaches.

There was consensus that immediate changes had

to be made. McIlvaine conducted three multi hour

webinars with utilities, suppliers, EPA, and

state agencies. These discussions resulted in a

workable change to the rule.

CD&R Buys Pumps and Flow Control Businesses of

Roper

Roper Technologies Inc. has agreed to sell a

majority stake in its industrial businesses,

including its entire Process Technologies

segment and the industrial businesses within its

Measurement & Analytical Solutions segment, to

affiliates of private investment firm Clayton,

Dubilier & Rice LLC (CD&R). Roper will receive

total upfront, pre-tax cash proceeds of

approximately US$2.6 billion while retaining a

49% minority interest in a new standalone

entity.

The transaction includes the Cornell, FMI, and

Roper Pump businesses, as well as Alpha, AMOT,

CCC, Dynisco, FTI, Hansen, Hardy, Logitech,

Metrix, PAC, Struers, Technolog, Uson and

Viatran. Together, these businesses generated

approximately US$940 million of revenue and

US$260 million of EBITDA in 2021.

“This is the final step in Roper’s divestiture

strategy to reduce the cyclicality and asset

intensity of our enterprise,” said Neil

Hunn, Roper Technologies’ president and CEO.

“Selling a majority interest in these industrial

businesses will provide Roper with significant

upfront cash, while maintaining the ability to

receive additional cash proceeds from the future

exit of our minority interest.”

“We are excited to partner with CD&R given their

track record of successful corporate

partnerships. Operating as a standalone entity

will enable these businesses to build on their

niche-leading strategies and continue creating

value for their customers and shareholders,”

added Hunn.

John Stroup, operating advisor to CD&R Funds,

will lead the standalone entity when the

transaction closes.

Nitto Buys Bend

Nitto develops new products and services by

strategically devoting resources to Nitto’s

three focus domains: Information Interface,

Next-generation Mobility, and Human Life. The

acquisition of Bend will also accelerate

innovation in these domains.

The flexible sensor developed by Bend

simultaneously measures “bend,” “stretch” and

“force” at high accuracy, in addition to having

excellent flexibility and durability. The

flexible sensor is expected to meet the evolving

technical demands in various fields, including

automation in the automotive field and remote

monitoring in the digital healthcare field.

Through this acquisition, Nitto aims to create

new businesses by combining Nitto’s global

foundation and core technologies, such as

adhesive technology and flexible printed circuit

technology, with Bend’s sensor device

technology. Besides expected applications in the

ever-changing automotive and healthcare fields,

Nitto also anticipates these technologies to be

utilized in fields such as sports and robotics.

Furthermore, Nitto considers building a platform

to accumulate sensor-acquired data and deploying

services utilizing the acquired data.

Dover Buys Malema, a Flow Measurement Company

With $45 Million In Revenue

Dover announced that it has entered into a

definitive agreement to acquire Malema

Engineering Corporation ("Malema"), a designer

and manufacturer of high-precision,

mission-critical flow-measurement and control

instruments serving customers in the

biopharmaceutical, semiconductor, and industrial

sectors. Malema will become part of the PSG

business unit within Dover's Pumps & Process

Solutions segment.

Malema's products will expand Dover's biopharma

single-use production offering, which already

includes Quattroflow pumps, CPC connectors, and

em-tec flowmeters. Based in Boca Raton, FL, and

with facilities in San Jose,

CA, Singapore, South Korea, and India, Malema

expects to generate approximately $40-45 million

in revenue during the full year 2022 and has a

robust growth outlook.

Over the past four decades, Malema has

cultivated a loyal base of blue-chip customers,

OEMs, and end-users with substantial aftermarket

and recurring revenue streams. Malema's

first-of-its-kind single-use flow sensor using

Coriolis technology offers superior

flow-measurement performance and accuracy versus

alternative technologies, reducing the potential

for measurement error and eliminating the need

for calibration in time-sensitive and

contamination-intolerant environments.

Speaking about the market opportunity for Malema,

PSG's President, Karl Buscher, said, "We see a

tremendous long-term growth opportunity in the

bioprocessing industry driven by a strong and

growing pipeline of effective novel biologic

drugs, biosimilars, protein therapies, non-COVID

mRNA vaccines, as well as budding cell & gene

therapies. Additionally, the growing adoption of

more efficient single-use production processes

supports a robust outlook for our offerings of

single-use components to end-customers. We

believe that pairing Malema's technology with

our existing portfolio of single-use pumps for

biopharma processing will greatly enhance the

accuracy and value proposition of our solutions

to our customers."

"We are methodically building out our biopharma

platform through proactive capacity additions,

new product development, and opportunistic

acquisitions of highly-attractive niche

component technologies," said Richard J. Tobin,

President, and Chief Executive Officer of Dover.

"Malema represents a strategic and

highly-complementary flow-control and sensing

technology and further strengthens our sensor

portfolio with new proprietary technology. In

addition to attractive biopharma applications,

we expect strong growth in the semiconductor

space on the capacity expansion and re-shoring

tailwinds."

The purchase price is comprised of $225

million in cash at closing, subject to customary

purchase price adjustments, and up to $50

million in contingent consideration dependent on

the achievement of certain financial objectives

over a two-year period. The transaction is

expected to close in the second quarter and is

subject to the satisfaction of customary closing

conditions, including applicable regulatory

approvals.

Dover is a diversified global manufacturer and

solutions provider with annual revenue of

approximately $8 billion. We deliver innovative

equipment and components, consumable supplies,

aftermarket parts, software and digital

solutions, and support services through five

operating segments: Engineered Products, Clean

Energy & Fueling, Imaging & Identification,

Pumps & Process Solutions, and Climate &

Sustainability Technologies. Dover combines

global scale with operational agility to lead

the markets we serve. Recognized for our

entrepreneurial approach for over 65 years, our

team of over 25,000 employees takes an ownership

mindset, collaborating with customers to

redefine what's possible. Headquartered

in Downers Grove, Illinois, Dover trades on the

New York Stock Exchange under "DOV."

PSG is a global pump solution expert and leading

manufacturer of pumps, systems, and related

flow-control technology for the safe and

efficient transfer of critical and valuable

fluids and materials. Headquartered in Oakbrook

Terrace, IL, PSG is comprised of several

world-class brands, including Abaque®, All-Flo®,

Almatec®, Blackmer®,

Ebsray®, em-tec®, Griswold®,

Hydro Systems™, Mouvex®,

Neptune™, Quantex™,

Quattroflow®, and Wilden®.

PSG products are manufactured in three

continents – North America, Europe, and

Asia – in state-of-the-art facilities that

practice lean manufacturing and are

ISO-certified. PSG is part of the Pumps &

Process Solutions segment of Dover Corporation.