AWE MANAGEMENT

The "Air Pollution Management" Newsletter

January 2022

No. 524

Table of Contents

MARKETS

·

Winning Orders at the 1000 Largest Pharma

Companies

·

IIoW Collaboration will Result in Huge Benefits

for Suppliers and Purchasers of AWE Products

·

HVAC Filter Markets Shaped by Cost Perceptions

·

Blood Plasma Fractionation as an Example of a

Path to Greater Profits for Air, Water and

Energy (AWE) Suppliers

COAL – U.S.

·

US EPA Steps Up Enforcement Over Coal Ash Dams

·

Five Imperatives to Thrive in a Hydrogen Future

·

B&W Thermal Awarded Equipment Installation

Contracts with Large U.S. Utility Totaling More

Than $18 Million

·

IHS Has a New Analysis on Decarbonization

Challenges

COAL – WORLD

·

Ducon to Provide Coal Clean Technology For 2 x

600 MW Singareni Thermal Power Plant in India

·

1,000 MW Coal-fired Power Plant in China is Now

Online

·

Indian Government to Require 100% Reuse of

Flyash

·

Thermax Bags Rs. 545.6 Crore Order for Two Flue

Gas Desulfurization (FGD) Systems

·

Andritz to Supply the 12th High-Efficiency

Powerfluid Circulating Fluidized Bed Boiler to

Japan

·

Valmet to Supply a Biomass Power Boiler and a

Flue Gas Cleaning System

·

AWE Exhibitors at PowerGen

CO2

·

Four Principles to Guide Decarbonization

Decisions

·

Industry Support for Large-Scale Carbon Capture

and Storage Continues to Gain Momentum in

Houston

BIOMASS

·

Biomass Must Come From Sustainable Sources

·

Bain Helps Clients Manage and Report Carbon

Footprint

·

45 TWh of BECCS by 2050

·

Biomass Must Come From Sustainable Sources

·

Bain Helps Clients Manage and Report Carbon

Footprint

HYDROGEN

·

Trillions Should be Invested in Long Duration

Energy Storage

BUSINESS

·

ErgonArmor announces Changes to Sales, Marketing

and Distribution Program for Pennguard™ Block

Chimney Lining System

·

Lots of Differences Between Stated Policies and

Plans For Net Zero

·

Editor of Power Sees Lots of Bright Spots on the

Horizon

·

PowerGen Moved to May Which Allows Time For IIoW

Causation Loops to be Prepared

MARKETS

Winning Orders at the 1000 Largest Pharma

Companies

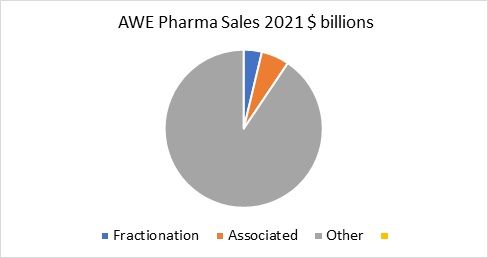

Pharma Prospects provides

suppliers of air, water, and energy (AWE)

products with the ability to directly pursue the

1,0000 largest pharmaceutical prospects. This

service can be furnished as part of a bigger

initiative to win the orders. An example is

plasma fractionation. This niche accounted for

just under 10% of the AWE product sales to the

industry of $35 billion in 2022.

·

The plasma fractionation market is growing at

more than 6% per year. CSL and Grifols generate

over 40% of the industry revenues. Takeda,

Octapharma, and Kedrion are also among the top

ten suppliers. The air, water, energy product

opportunities at each company have to take into

consideration other products and also contract

manufacturing.

·

Most of the $8 billion in revenues generated by

CSL are tied to fractionation products. On the

other hand Takeda with revenues of $32 billion

is a larger AWE product purchaser even though

their fractionation related sales are less than

$3 billion.

·

The opportunity is also continually shaped by

technology advances. GEA has a new separator.

Filter press suppliers are automating to

decrease total cost of ownership. The future

market for each of these competing products

needs to be continually assessed with a lowest

total cost of ownership (LTCO) analysis.

·

The LTCO analysis is being created in an

Industrial Internet of Wisdom (IIoW) Causation

Loop. This includes fractionation articles

appearing in many magazines as explained at http://home.mcilvainecompany.com/index.php/other-services/free-news/news-releases/47-uncategorised/news/1692-nr2678

·

Pharma Prospects provides

suppliers of Air, Water, Energy Products with

analyses of the purchasers along with semiweekly

project and market news. The extensive profiles

are updated periodically. A convenient

search displays all the recent news on any of

the purchasers.

·

This service is part of a bigger program which

provides detailed forecasting of each product at

each major prospect. Products and industry

segments are shown at http://home.mcilvainecompany.com/index.php/other-services/free-news/news-releases/47-uncategorised/news/1688-nr2674

·

For more information on Pharma Prospects click

on http://home.mcilvainecompany.com/index.php/databases/83ai-pharma-prospects

·

Bob McIlvaine can answer your questions at rmcilvaine@mcilvainecompany.com.

His cell is 847 226 2391.

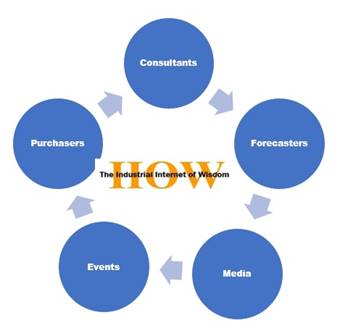

IIoW Collaboration will Result in Huge Benefits

for Suppliers and Purchasers of AWE Products

Suppliers of high-performance air, water, and

energy (AWE) products could raise revenues by

$50 billion and purchasers could reduce total

cost of ownership by $100 billion if there was

coordination to create an Industrial Internet of

Wisdom (IIoW)

Management consultants can expand to provide

continuous support for their clients to achieve

this goal.

·

Market analysts will need to make accurate

forecasts in each niche based on reliable cost

of ownership factors.

·

Media and event organizers will need to expand

their scope to provide the basis for decision

making and purchase and not just education and

problem solving.

·

For example a plasma fractionation manufacturer

is facing the confusing choice between depth

filtration and centrifugation. An IIoW program

is making this choice easier.

·

The Non-wovens Industry Association (INDA), International

Filtration News (IFN), FiltXPO and

McIlvaine are creating an Industrial Internet of

Wisdom on Plasma Fractionation Filtration.

·

The next issue of IFN will include an

article on the cost of ownership factors for

fractionation processes requiring filtration and

purification. There is a link to a background

document with extensive analysis by consultants

and others.

·

An effort is underway to create a route map on

plasma fractionation at FiltXPO in Miami at the

end of March. It will connect speakers,

exhibitors, and attendees. McIlvaine has created

route maps at previous FiltXPO, PowerGen, and

WEFTEC exhibitions.

·

McIlvaine and IFN have teamed to

provide a True Cost analysis in each issue of

the magazine. In the case of HVAC filters IFN has

been providing extensive coverage in articles

which are easily retrieved.

·

With IIoW there is the connection to these past

articles. The links along with a summary of the

important cost of ownership insights have been

prepared and are explained at http://home.mcilvainecompany.com/index.php/other-services/free-news/news-releases/47-uncategorised/news/1693-nr2679

·

Management consultants have the opportunity to

provide continuous rather than periodic support

for their clients (suppliers or purchasers). The

technology, politics, and competition can

quickly obsolesce the best of studies.

Continuing guidance on IIoW is needed.

·

Forecasters such as McIlvaine need to provide

analysis of the cost of ownership factors of

each product in each niche and even to the level

of individual larger purchasers and groups of

small purchasers.

·

Purchasers need to be active participants.

General purpose product purchase decisions can

be made at the plant level. But buying a higher

priced product with the lowest total cost of

ownership requires lots of effort. IIoW reduces

the effort. Many companies have found that in

house expertise and centralized decision making

is necessary. Intel, BASF, and Arcelor Mittal

are examples of companies with individuals

assigned to insuring Lowest Total Cost of

Ownership LTCO purchases.

·

The value of the IIoW initiative by purchasers

was demonstrated by BHE Energy and McIlvaine http://www.mcilvainecompany.com/BHPG/subscriber/Default.htm

·

For IIoW to achieve maximum effectiveness it

needs to be structured in the same manner as

IIoT. This entails the adoption of commonly used

and accepted segmentation.

·

Relative to applications, the starting point can

be the NAICS codes. The challenge comes in

agreeing on the second level of segmentation.

Should it be sugar or should cane and beet sugar

have equal status with plasma fractionation, and

green hydrogen. McIlvaine efforts on this are

shown at http://www.mcilvainecompany.com/Decision_Tree/subscriber/Tree/Default.htm

·

The identification of supplier companies is

complicated by name changes and unique names for

some divisions. It is further complicated by

language. Therefore McIlvaine developed a unique

number for each supplier.

·

The segmentation by product is challenging.

Associations such as Hydraulic Institute (pumps)

and Valve Users along with exhibition organizers

such as Achema, IFAT, and Filtech can

collaborate to create product segmentations

which are granular enough to describe specific

products in each process and application.

·

IIoW is all about connection of clearly defined

segments. There has been extensive collaboration

to create IIoT. The same level of collaboration

is needed to create IIoW for AWE products and

services.

·

Bob McIlvaine is available to discuss ways

various companies can collaborate in this

initiative. You can contact him at 847 226

2391 or rmcilvaine@mcilvainecompany.com

HVAC Filter Markets Shaped by Cost Perceptions

The importance of indoor air quality has risen

greatly with COVID and now the Omicron variant.

Demand for higher efficiency air filters has

taxed suppliers. Questions relative to expansion

are necessarily based on the course of the

disease and technology developments. McIlvaine

is continually seeking knowledge relative to

HVAC filters in order to predict the markets.

Sources include conferences, publication,s and

insights from researchers on every continent.

Tyler Smith of Johnson Controls was a speaker at

a recent WFI conference where he emphasized

rating HVAC performance compared to outdoor air.

This performance based evaluation was the

reason Bob Burkhead, a filter testing company

CEO invested in a recirculating room system

which tests performance over time.

Cleanroom experts have a unique perspective.

They would say “why not rate performance

compared to an ISO 9 cleanroom”. This definition

is precise in terms of the number of allowable

particles of various sizes.

The semiconductor industry has unique insights.

They require air 100 times cleaner than a

pharmaceutical facility and 500,000 times

cleaner than typical ambient air.

There are two magazines and two upcoming

exhibitions where substantial insights will be

gained. The exhibitions are

·

Filtech slated for Cologne, Germany March 8-10.

There are 450 exhibitors making it the largest

display for HVAC filters and media.

·

FILTXPO will be held in Miami, FL March 29-30.

At previous events McIlvaine has prepared route

maps to allow people to arrange visits to booths

and speeches. One on HVAC filters is now in

preparation.

·

Filtration and Separation has

a very powerful article retrieval system with

163 articles on HVAC. https://www.filtsep.com/search?query=HVAC

·

International Filtration News (IFN) is

a publication of INDA. McIlvaine has written a

true cost column in every issue in the last

several years.

The article in the July 2021 issue is on a

decision guide to HVAC filters https://www.filtnews.com/the-value-of-hvac-filters-has-risen/

This guide relies on information from previous

issues. There is a link to a summary McIlvaine

prepared of past HVAC articles.

http://home.mcilvainecompany.com/images/Products_and_Services/IFN_HVAC_TCO_Factors_06-25-21.pdf

This summary has an abstract and a link to each

article in IFN. There is also the

following takeaway by McIlvaine.

·

Lowest total cost of ownership needs to include

the total cleanliness effect on the space. It

will be cumulative and can involve multiple

filters.

·

The deterioration in the electrostatic charge

over time is a Total Cost of Ownership (TCO)

factor which is debated based on time and dust

loading as well as specific media

characteristics.

·

Recognizing when a prefilter is required and

equally important, when you can go without one,

is a key to improving your TCO.

·

A database of energy costs in each country and

in major regions of the U.S. would be very

beneficial. This could be a uniform basis for

determination of cost of ownership.

·

The balance between pressure drops and

dust-loading capacities must be considered,

assuming the filters are similarly priced.

·

Some of the same Lowest Total Cost of Ownership

(LTCO) advantages for nanofibers in mobility

applications can also be the case for stationary

HVAC applications.

·

Are the LTCO factors for cabin air also valid

for HVAC Filters?

·

Low pressure drop and no fiber shedding. This is

important for cleanrooms but how important is

fiber shedding in HVAC?

·

The Well Health Safety Seal assigns a value to

life quality in the total cost of ownership.

QELD developed by McIlvaine is a unique metric

for better determining life quality impacts.

·

The cost of upgrading filters can include major

system modifications.

·

Perceived life quality is improved with HEPA

HVAC filters. If the installation costs and

energy consumption are low, then the higher

first cost is not significant.

·

In the future greater weight will be placed on

the negative costs of air filter ownership (life

quality benefits which offset costs).

·

Lowest total cost of ownership can be achieved

by a filter supplier who provides sensors and a

solution for the life of the filter instead of

just offering the filter.

·

How useful is the MERV-A rating in LTCO

evaluations?

·

Electrostatic charging methods differ. This

impacts both the variety of media which can be

charged and the effectiveness.

·

Improvements in melt blown and other media need

to be continually assessed.

·

Can nanofibers offer superior efficiency while

comparing in durability and energy consumption?

As can be seen from these articles there are

many factors to consider in filter selection.

The best decision today may not be the best one

tomorrow as variables such as new virus

variations and technology improvements develop.

The magazines and conferences are an invaluable

resource for decision making. The challenge is

to make the information accessible and utilized.

The main goal for the McIlvaine Company is to

fully understand the TCO factors in each niche

in order to make market forecasts.

However, unless the end user also relies on the

same TCO factors as McIlvaine, the forecasts

will be inaccurate.

Therefore, McIlvaine will continue to

collaborate with the media to establish a common

set of TCO factors in each niche. There are

1000s of such air, water, energy niches.

Information establishing common TCO factors in a

number of niches is shown on the Holistic

Marketing Program page at http://home.mcilvainecompany.com/index.php/30-general/1658-holistic-content-marketing-program

More information on specific reports is found

under “Markets” at the top of www.mcilvainecompany.com

Bob McIlvaine can answer your questions at rmcilvaine@mcilvainecompany.com.

His cell is 847 226 2391

Blood Plasma Fractionation as an Example of a

Path to Greater Profits for Air, Water and

Energy (AWE) Suppliers

Lowering the total cost of ownership for AWE

products used in blood fractionation can

increase supplier EBITA. The McIlvaine

initiative explaining this may be found at http://home.mcilvainecompany.com/index.php/other-services/free-news/news-releases/47-uncategorised/news/1691-nr2677

McIlvaine’s primary role is to generate

the millions of AWE forecasts and competitor

analyses needed by suppliers. This is only

possible with the Industrial Internet of Wisdom

(IIoW), which relies on knowledge generated by

the media, associations and conference

organizers.

Blood Plasma is a significant AWE market with

innovation driving higher EBITA.

Revenues are approaching $40 billion per year.

The top 10 producers account for more than 50

million liters per year.

Products include immunoglobulins, coagulation

factor concentrates, albumins, protease

inhibitors, and other products.

Processes include fractionation, concentration,

pre- and post-virus inactivation, purification

and buffer production, storage, and

distribution.

CRB, a provider of integrated systems for the

biotechnology industry, has given a number of

AWE insights to pursue including

·

Pre-built cleanroom wall systems and

prefabricated pipe racks for hygienic piping

·

Alternative separation choices

o

Centrifuges (disc or other)

o

Depth filters (filter press, cartridge, rotating

disc)

o

Chromatography

Instrumentation revenues are affected by

equipment choices but can also drive them. For

example CRB believes that better automated

filter presses will gain market share from

centrifuges.

IIoT & Remote O&M includes guide, control, and

measure products. It provides the needed total

cost of ownership factors for components and

consumables. It therefore should be used

for purchasing decisions.

New developments need continuous assessment. GEA

has introduced its fully automatic separator,

the hycon®, which enables one-touch

production for separation of blood plasma and

plasma proteins in cleanroom applications.

Filtration media choices are crucial. Depth

filters are the first choice for the separation

of precipitates and clarification processes in

dedicated fractionation steps according to

Eaton. Because proteins and process parameters,

such as ethanol concentration and pH vary

throughout the process, it is essential to

choose the right filter media for the

appropriate process.

EMD Millipore recommends Single-Pass Tangential

Flow Filtration (SPTFF) for concentrating a

plasma-derived Immunoglobulin G (IgG) solution

from 10% to 20%. Alternative filter choices have

different pressure requirements. This affects

pump and valve selection.

Pall tangential cross flow filtration is a

popular option.

The pursuit of wisdom for blood fractionation

AWE will be pursued on a continuing basis. It

will include articles to be published.

Articles: February - March 2022

·

International Filtration News:

True Cost of Filters, Separators and Media for

Plasma Fractionation (McIlvaine True Cost

articles appear in each issue)

·

Valve World Americas:

Process and CIP Valves for Plasma Fractionation

·

Pump Engineer:

Pumps for processing, cooling and CIP in Plasma

Fractionation

·

Hose & Coupling:

H&C for processing, cooling and CIP in Plasma

Fractionation

·

Stainless Steel World Americas:

Stainless Steel for processing, cooling and CIP

in Plasma Fractionation

Exhibitions: March

FILTEXPO, March 29-31, Miami. Route map to

speakers, exhibitors and attending experts who

have wisdom relative to plasma fractionation

filters and media.

Articles and Exhibitions: April 2022 and

subsequently.

There are plans for additional articles in

cleanroom and pharmaceutical magazines. Mark

Allen Group through Filtration and

Separation is a sponsor of FILTEXPO. It

also owns World Pumps and will be

contacted for future articles.

The IIoW approach for bioethanol is explained

at http://home.mcilvainecompany.com/index.php/other-services/free-news/news-releases/47-uncategorised/news/1690-nr2676

The niches in the pharmaceutical industry are

listed at http://home.mcilvainecompany.com/index.php/other-services/free-news/news-releases/47-uncategorised/news/1688-nr2674

For more information on this program contact Bob

McIlvaine at rmcilvaine@mcilvainecompany.com

cell 847 226 2391

COAL – U.S.

US EPA Steps Up Enforcement Over Coal Ash Dams

The US Environmental Protection Agency (EPA) has

proposed rejecting requests to continue to

dispose of coal ash in unlined dams at three

major coal-fired power plants. The coal-fired

power plants are the 1304 MW Clifty Creek plant

in Indiana, the 2600 MW James M. Gavin plant in

Ohio and the 726 MW Ottumwa plant in Iowa. The

EPA determined the continued use of coal ash

dams at the three plants should not be allowed

as defects in their proposed management could

prevent adequate groundwater cleanup.

The EPA proposed conditional approval for the

operation of the coal ash dam at the 1371 MW

H.L. Spurlock Power Station plant in Kentucky,

subject to rectifying groundwater monitoring

issues.

Current EPA regulations require most of the

estimated 500 unlined coal ash dams to begin

closure by April 2021 but allow utilities to

apply for an extension. The EPA is considering a

further 48 requests for an extension on the

closure deadline. Earthjustice and the Southern

Environmental Law Center welcomed the EPA

decisions as a strong signal that power

utilities cannot continue to operate leaking,

unlined ash dams.

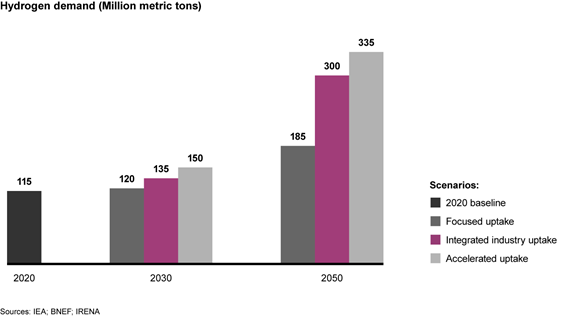

Five Imperatives to Thrive in a Hydrogen Future

Aaron Denman, Mark Porter, Peter Parry, and

Peter Meijer of Bain outline the steps to a

hydrogen future;

-

Hydrogen is emerging as a

viable, low-carbon energy source

for some industrial and

transportation uses.

-

Depending on incentives and

uptake, the demand for hydrogen

could nearly triple by 2050.

-

Hydrogen producers,

infrastructure players, and

customers should be looking at

where hydrogen is likely to play

a role in their business and

work back to understand the

value chain and its linkages.

Most will need to build new

capabilities to take best

advantage of the opportunity.

The most plausible scenarios point to the

emergence of an attractive market, so it would

be a strategic misstep for companies to take a

backseat position. Across industries, executives

should be looking at the potential applications

for hydrogen and working back through the value

chain to determine which are most feasible—and

where to place their bets. To give executives a

better view of the possibilities, Bain analyzed

the potential market and identified five

no-regrets actions to take in order to position

your company for success in the hydrogen market

of the future.

Bain researched several scenarios for the growth

of the hydrogen market, taking into

consideration the full range of potential future

applications, hydrogen’s ability to play a

meaningful role against zero-emission

alternatives, based on whether hydrogen is the

right solution, as well as factors such as cost

competitiveness, and the readiness of technology

and supply to meet demand. As renewable energy

becomes more cost competitive, green hydrogen

will become less expensive to produce.

Supporting technologies, such as carbon capture

and electrolyzers, will become less expensive as

they are built out. Increases in carbon prices

and taxation will further improve hydrogen’s

competitiveness, and government subsidies will

act as a catalyst to accelerate learning and

cost decline.

The Bain base case scenario, an integrated

industry, points toward a global market of 300

million metric tons (Mtons) by 2050 with the

potential to establish a profit pool of more

than $250 billion This would represent an

initial period of modest growth from 2020 to

2030, with demand accelerating after that.

In this scenario, Bain assumes most major

industries will increase their use of hydrogen,

some more than others. For example, in

transportation Bain expects battery electric

vehicles to become the standard for most vehicle

categories, and hydrogen to play a role in

specific vehicle classes like heavy-duty trucks,

or for specific applications where hydrogen has

an advantage over alternatives—for example,

where batteries would be too heavy. In this

scenario, we assume transportation and

industrial applications will make up 80% of the

demand, with power, heat, and other uses making

up the rest. Since some of these high-potential

applications will require significant

investments in infrastructure (for example,

hydrogen fuel stations for transportation) or

process changeovers (such as replacing

traditional blast furnaces to enable a direct

reduced iron process in steel production),

short-term opportunities may be found in other

industrial or power applications.

We could also see an accelerated uptake scenario

in which, for example, hydrogen plays a role as

fuel for power production or energy storage for

renewables, depending on the decarbonization

plans of major power utilities. However, given

the uncertainties in the uptake of technologies

and relative competitiveness of hydrogen,

adoption could be much slower, which would

result in something closer to the focused uptake

scenario with an estimate of 185 Mtons by 2050.

Both blue and green hydrogen (that is, hydrogen

from low-carbon and zero-carbon sources) make up

less than 1% of total hydrogen production today.

Significant advances in technology and

experience will have to occur to make these

competitive, along with more renewable energy,

infrastructure for the transport and storage of

hydrogen, and a large installed base of

industrial applications to nurture growth.

Public investments will be required to create

the right initial opportunities and catalyze

market growth until hydrogen, blue or green, can

be competitive at scale on its own.

Winning in the hydrogen value chain

Hydrogen will

need to be cost competitive against other low-

or zero-carbon solutions. Here, adoption speed

will depend on factors like the availability of

low-cost renewable energy to make green hydrogen

and the availability of alternative supply chain

infrastructure for hydrogen

The complete article is available at

https://www.bain.com/insights/five-imperatives-to-thrive-in-a-hydrogen-future/

B&W Thermal Awarded Equipment Installation

Contracts with Large U.S. Utility Totaling More

Than $18 Million

Babcock & Wilcox (B&W) announced that its B&W

Thermal segment has been awarded contracts

totaling more than $18 million to install

equipment to improve the operating efficiency,

performance, and increase availability for two

power plants for a large U.S. utility. B&W’s

subsidiary, Babcock & Wilcox Construction Co.,

LLC (BWCC), will install waterwall panels,

reheater tubes, and other technologies.

“BWCC provides field construction, construction

management, and maintenance services for

projects of all sizes for utilities and

industrial customers, including for renewable

energy, environmental, and decarbonization

projects,” said B&W Chief Operating Officer

Jimmy Morgan. “Our goal is always to help our

customers maintain and improve their plants’

operation, efficiency, and availability so that

they can continue to reliably serve their

customers.”

BWCC provides outage services, installation,

refurbishment, mechanical repair, and

maintenance services for a variety of

industries, equipment, and plant installations,

regardless of the original manufacturer. Some

industries served include power utility, oil &

gas, oil sands, chemical and petrochemical, pulp

& paper, biomass, waste-to-energy, and general

manufacturing.

IHS Has a New Analysis on Decarbonization

Challenges

Some highlights were summarized by

Etienne

Gabel and

Xizhou Zhou.

Should the power sector indeed lead a

full-fledged global energy transition effort,

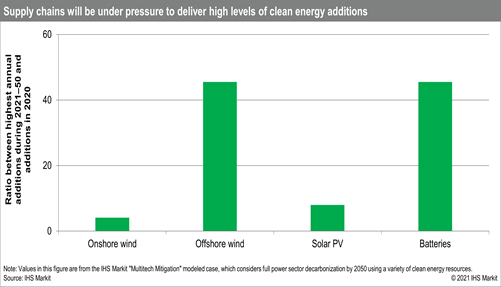

then, according to one of the IHS Markit deep

decarbonization scenarios, over 2021-50 the

world may need to add about 28,000 GW of clean

generation capacity, or 5.5 times more per year

than was added annually over the past 10 years.

This represents a total future investment of

approximately $30-40 trillion. On a

comparative basis it is a big scale up in

offshore wind and batteries.

The ability to achieve this will depend on the

level of commitment. A good example is

the European Commission, which has committed to

building 60 GW of offshore wind capacity by 2030

and 300 GW by 2050.

The report can be found at

Decarbonizing electric power: Key challenges and

opportunities after the 2021 global energy

crunch and COP26 climate negotiations | IHS

Markit

COAL – WORLD

Ducon to Provide Coal Clean Technology For 2 x

600 MW Singareni Thermal Power Plant in India

Ducon Infratechnologies Limited

will provide its proprietary Coal Clean

Technology, Fuel Gas Desulphurization (FGD)

system for a 2x600 MW Thermal Power Plant, of

the Singareni Collieries Company Ltd., awarded

to an EPC organization Ducon has partnered with.

This project was jointly bid by Ducon’s

affiliate, Ducon Technologies Inc., USA with a

leading EPC organization in the Indian

subcontinent and utilizes Ducon’s proprietary

and most advanced Limestone Flue Gas

Desulfurization technology. Ducon will provide

its LFGD execution expertise to the project from

concept to commissioning. The anticipated value

of the order for Ducon will be in the range of

INR 150 – 200 Crore. This is the Third Coal

Clean Technology / FGD project being secured by

Ducon in the current financial year. The other

two Coal Clean Technology/FGD projects, where

orders are still awaited, are from NTPC for 2 x

250 MW Barauni Thermal Power Station, Stage-II

and 2 x 195 MW Muzaffarpur Thermal Power

Station, Stage-II with an order values in the

range of INR 500-600 Crore and INR 100 to 150

Crore respectively.

With over 200 GW of Coal-Fired

Power/Steel/Cement and other plants, India’s

commitment on Green Energy/Emission standards

and strict regulatory mandates, Indian companies

will spend an approximate US$ 20 billion on

Fossil Fuel Clean Technologies/Greening of

Fossil Fuels and Green Energy sources expanding

the Fossil Fuel Clean Technology market

exponentially in the next 2-3 years.

1,000 MW Coal-fired Power Plant in China is Now

Online

Guodian Power Shanghaimiao Corp., part of the

state-owned China Energy Investment Corp,

reported that the new 1,000 MW Unit 1 of the

Shanghaimiao power plant is online after a

168-hour testing period. The facility is the

largest coal-fired power plant currently being

built in China. A recent report from researchers

at China’s State Grid Corp. said the country’s

need to satisfy increased demand for electricity

could bring development of up to 150 GW of new

generation capacity by year-end 2025. That would

put China’s known coal-fired generation capacity

at about 1,230 GW. More details are shown at

First 1-GW Unit of Major China Coal-Fired Plant

Comes Online (powermag.com)

Indian Government to Require 100% Reuse of

Flyash

Recently, the Centre government drafted the new

fly ash utilization rule for Thermal Power

Plants(TPPs), bringing them to mandatory utilize

100% of fly ash within three

to five years. Existing provisions allow TPPs to

fully utilize fly ash in a three-year

cycle in

a staggered manner.

What does that mean? The choices are compliance

or fines.

It introduced fines of Rs. 1,000 on

non-compliant plants under the ‘polluter pays

principle’, taking into account utilization

targets with immediate effect. The

'polluter pays'

principle is the commonly accepted practice that

those who produce pollution should bear the

costs of managing it to prevent damage to human

health or the environment.

Under this, the collected fines will be

deposited in the designated account of the

Central Pollution Control Board (CPCB) and shall

be used towards the safe disposal of the

unutilized ash.

Unutilized accumulated ash (legacy ash) where

TPPs will have to utilize it within 10 years

from the date of publication of final

notification in a staggered manner. If not

complied, a fine of Rs 1000 per ton will be

imposed on the remaining unutilized quantity

which has not been fined earlier.

Thermax Bags Rs. 545.6 Crore Order for Two Flue

Gas Desulfurization (FGD) Systems

Thermax Limited has concluded an order of Rs.

545.6 crore from an Indian power public sector

company to set up flue gas desulfurization (FGD)

systems for their two units of 500 MW capacity

each in the state of Uttar Pradesh, India.

The FGD systems will be installed at their plant

to cut down SOx emissions and comply

with the air quality standards set for the power

plants.

In the current financial year, this is our

second FGD order. "Our proven technological

capabilities in the area of air pollution and

gaseous abatement, especially FGD, where we are

already executing a few large orders, led to

this competitive win. In addition to supporting

the customer in meeting statutory compliance

related to industrial pollution norms, the

project reinforces our commitment to the

environment," says Ashish Bhandari, MD & CEO,

Thermax Limited.

The scope of supply includes design,

engineering, manufacturing, civil work,

construction, and commissioning of the FGD

systems. The project is slated to be completed

in 30 months.

Andritz to Supply the 12th High-Efficiency

Powerfluid Circulating Fluidized Bed Boiler to

Japan

Andritz has received another order from

Toyo Engineering Corporation

in Japan to supply a 50-MWe PowerFluid

circulating fluidized bed (CFB) boiler on an EPS

basis. The boiler will be part of the biomass

power plant in Tahara-shi, Aichi Prefecture, in

Japan. Start-up is planned for 2025.

The

Andritz PowerFluid boiler will be integrated

into a biomass-fired power generation facility

that will be fueled by wood pellets. With its

high efficiency and state-of-the-art technology,

it is the perfect solution to meet greenhouse

gas reduction targets and contribute towards

carbon neutrality in Japan.

The biomass power plant will be capable of

supplying power for roughly 110,000 households

in Japan.

Valmet to Supply a Biomass Power Boiler and a

Flue Gas Cleaning System

Valmet will supply a biomass power boiler and a

flue gas cleaning system to Tahara Biomass Power

LLC in Tahara, Japan. The new CFB (circulating

fluidized bed) boiler will enable the customer’s

power plant to achieve a stable power supply at

high thermal efficiency while significantly

reducing CO2 emissions. This is

already the sixth order received for Valmet's

CFB boiler to the Japanese market since 2016.

The order was included in Valmet's orders

received in the third quarter 2021. The value of

this kind of order is typically around €70

million. The installation work is scheduled to

start in 2023, and the plant will start

commercial operation during 2025.

The project will be delivered in cooperation

with the Japanese company JFE Engineering

Corporation. JFE Engineering will be the EPC

(Engineering, Procurement and Construction)

contractor for the Tahara Biomass Power Plant.

"We are proud to supply one of the largest

biomass-fired boiler plants in Japan with a

maximum biomass combustion capacity. This is

also our sixth boiler plant order in a row with

JFE Engineering Corporation, which is a proof of

our long and trustful cooperation," says Jari

Niemelä, Director, Boilers and Gasifiers, Energy

business unit, Valmet.

AWE Exhibitors at PowerGen

The following is coverage of the exhibitors with

AWE products. Details are found at

https://www.powergen.com/

AVS USA Inc.

- Booth #2472

Advanced Valve Solutions USA is a worldwide

provider of Hora and Persta Control Valves for

the Power industry. We can help you upgrade your

power Stations from Baseload to Cycling

operations. We provide Hp, IP, LP Bypass,

Feedwater control, Attemperator, OTC (GE/Alstom

GT24,GT26 units), Drain and Main Steam Stop

valves in Gate, Globe and Check valves.

Brands: Advanced

Valve Solutions USA Inc, Hora, Persta. HP

Bypass, Attemperation, Feedwater Control, OTC

(GE/Alstom GT24,GT26), Drain and Main Steam Stop

Valves. Gate, Globe and Check

AeriNOx

- Booth #5837

AeriNOx is an environmental engineering company.

Our strength is helping customers comply with

federal and local emission regulations targeting

process machines, marine vessels, offshore rigs,

stationary diesel and natural gas engines and

turbines. Come see us at booth #5837

Brands: SCR,

Catalyst, NOx, PM, HC, Emissions, Oxidation

Babcock Power -

Booth - MR-5665

Babcock Power, Inc., provides customers with

safe, efficient, environmentally responsible

generation solutions worldwide. Its extensive

portfolio includes patented technology,

equipment, and aftermarket services for heat

exchangers, HRSGs, steam generators, boilers,

and environmental AQCS; for the global power

generation, combined cycle, industrial,

environmental, refinery, petrochemical, solar,

biomass, and waste-to-energy markets. Babcock

Power subsidiaries: Vogt Power International

Inc., Thermal Engineering International (USA)

Inc., Babcock Power Services Inc., Riley Power

Inc., Boiler Tube Company of America, TEi

Construction Services Inc., Babcock Power

Environmental Inc., and GSI Geo-Synthetics

Systems.

Brands: HRSG;

harps; pressure parts; construction, outage &

maintenance services; condensers; heat

exchangers; geosynthetics; retrofits; studies;

rebuild; field engineering; inspections;

fabrication.

Bray

- Booth #4356

Bray International, Inc. has a global presence

in over 60 countries. Bray's product portfolio

includes butterfly valves (resilient seated,

high performance, triple offset and PFA lined),

ball valves (floating, PFA lined, severe service

and trunnion), knife gate valves, check valves,

pneumatic and electric actuators, and control

accessories.

Brands: Bray,

Bray International, Bray Controls, Flow-Tek,

Bray/Rite, Bray/VAAS, Ultraflo, Amresist

Buffalo Pumps

- Booth #5301

Buffalo Pumps is a custom manufacturer of

centrifugal pumps for demanding and critical

applications. It states that it is the leader in

supplying heavy duty, cost competitive lube oil

pumps to the power generation industry since

1950.

Catalytic Combustion

- Booth #5944

Emission control design, development, and

manufacturing.

Catalytic Combustion Corporation is an emission

control Technology company developing and

manufacturing products that remove harmful

substances and noise from process exhaust.

Products range from systems to control emissions

from large manufacturers and power generating

operations to small catalysts that control

emissions from household appliances and most

every application in-between.

Champion Valves

- Booth #5810

Champion Valves, Inc. has a complete range of

high-quality and competitively priced industrial

check valves. It maintains a large inventory of

finished valves, backed by decades of experience

and exceptional customer service.

Brands: CVR

Dual Disc Wafer Check SDR Single Disc Wafer

Check NZ Axial Flow Nozzle Globe Check NZW Axial

Flow Nozzle Wafer Check SCW Silent Wafer Check

SCG Silent Globe Check SCT Silent Threaded Check

Chicago Valves and Controls -

Booth #3837

Conval Booth

– Booth #5038

Conval is a designer and manufacturer of severe

service valves for a wide variety of

high-pressure/temperature applications for the

power industry.

Clampseal globe valves, Camseal top-entry ball

valves and SwivlDisc gate valves

are designed for tough applications.

Brands: Clampseal

Y- Pattern, T-Pattern and Angle Pattern Globe

and Check valves Camseal high

pressure/temperature MSBV's SwivlDisc gate

valves Whisperjet pressure control

Doosan

- Booth #5035

Doosan owns core technologies and ongoing

performance with the key components of the power

generation business. Doosan is also making

substantial inroads into the eco-friendly power

generation business including ESS(Energy Storage

System) and microgrid.

Endress & Hauser

- Booth #3944

Flexitallic

– Booth #5438

Manufactures industrial static sealing products.

Flexitallic also offers custom engineering

solutions for toughest applications. The newest

product line is the Change Gasket.

Brands: Change

Gasket, Thermiculite, Sigma, Flexpro, Spiral

Wound Gaskets, DJs, PTFE, SEL Graphite

Flo-Tite

- Booth #5831

Flo-Tite Inc. is a manufacturer of high quality

ball valves and actuation equipment. Products

range from standard commercial type Ball Valves

to high-pressure metal seated Control Valves.

Flo-Tite Inc. is a manufacturer of high quality

ball valves and actuation equipment. The company

maintains an inventory of standard valves in

Carbon, Stainless, Steel and Alloy 20.

GEA

- Booth #5755

Centrifugal separators from GEA are used in

power plants to treat fuel oils and lube oils

for turbines and diesel engines. Precision

separation is essential to the smooth operation

of generators. The result is a reliable,

cost-effective supply of energy and efficient

use of natural resources. An uninterrupted power

supply requires systems that operate

trouble-free, efficiently, and reliably in all

load ranges.

Treatment systems from GEA are designed to

assure constantly high availability. In all

these fields of application, the OSE separator

generation is entering a new dimension. GEA

offers

·

Fuel oil treatment for diesel engines and gas

turbines

·

Lube oil treatment

·

Treatment of oil-water-solids mixtures

Brands: Fuel

& Lube Oil Treatment; Fuel Oil Conditioning;

Wastewater & Sludge Treatment; Cat Fines Removal

GKN Hydrogen

- Booth #4134

GKN Hydrogen, a division of GKN Powder

Metallurgy, is pioneering safe, emission-free

green hydrogen storage to help organizations and

societies around the world achieve their carbon

neutrality goals. We are bringing to market a

range of modular hydrogen storage solution based

on metal hydrides.

Brands:

Energy Storage, Hydrogen, Metal Hydrides, Green,

Safe, Compact

Hilliard Booth

- #5145

The HILCO® Division of The Hilliard

Corporation, cost-effectively brings fluid

contamination problems under control. Products

help reduce the cost of new oil purchases,

decrease disposal costs, lessen component wear,

reduce downtime, and curtail environment

contamination. HILCO® has supplied

thousands of liquid fuel filters, coalescers,

and systems to OEM turbine and engine

manufactures to maintain fuel cleanliness to

their specifications. Striving for continuous

improvement in testing of vessel designs,

cartridge configuration, and cartridge media,

Hose Master

- Booth #4607

Hose Master engineers and manufactures high

quality corrugated metal hose and expansion

joint solutions for Utility and Power Generation

industries. Wherever high temperatures, extreme

pressures and vibration are encountered, Hose

Master products are trusted for the most

critical applications including hoses and

expansion joints for steam piping, HRSG

penetration seals, and turbine crossovers.

Brands: Corrugated

Metal Hose Stripwound Metal Hose Expansion

Joints Annuflex Masterflex ChemKing PressureFlex

HP PressureMax HP Interflex Ultraflex

Hug Engineering

- Booth #5849

Hug produces systems for diesel and gas engines

used in Marine, Power Generation and Mobile

applications. The company provides efficient

solutions and customized concepts for exhaust

gas cleaning.

Brands: SCR,

NOx reduction, oxidation, diesel particulate

filter, DPF, catalysts, emissions control,

emissions after-treatment, low to zero emissions

Kennedy Valve

- Booth #5656

American Made UL Listed FM Approved fire

protection valves, fire hydrants, and

accessories. 24" and down gate valves, as well

as indicator posts and wall posts. We also offer

the industry's only factory installed OS&Y

tamper switch. 12" and down supervised butterfly

valves, and UL-FM check valves.

Brands:

Kennedy Valve, G365 Guardian, K17

KSB

– Booth #4716

KSB SupremeServ provides the power industry pump

service, repairs, spare parts, and engineering

on all brands & types. Our service centers,

strategically located throughout North America,

are ready to serve with

installation and commissioning of your

equipment, maintenance and repair, customized

service concepts, spare parts, or replacement.

Brands: Pump Service, Repair, Commissioning,

Custom parts, Reverse Engineering

Leistritz

- Booth #5408

Leistritz manufactures rotary screw pumps for

fuel oil injection, unloading and transfer

applications, as well as gearbox and bearing

lubrication. In addition, our line of

Re-Engineered pumps can replace obsolete

equipment without piping modifications. Flow

rates up to 10,000 gpm and pressures up to 2200

psi.

Brands: Screw Pumps

Miratech

– Booth #5539

Miratech is a leading provider of

cost-effective, reliable, emission and acoustic

solutions for Natural Gas and Diesel

Reciprocating Engines, and oxidation catalysts

for Gas Turbines. The products are used in Power

Generation, Energy Infrastructure, Industrial,

and Marine applications.

Brands: Screw Pumps

Montrose

- Booth #5565

The premier provider of environmental services

Montrose Environmental Group offers unsurpassed

Air Quality Measurement, Environmental

Laboratory, Engineering and Regulatory

Compliance Services throughout the United States

and abroad. We strive to achieve optimal

environmental performance in a way that

effectively complements our clients’ operations.

Brands: Emissions Testing, EPA Compliance, RATA,

MACT/NESHAP, NAAQS, Engineering

NANO

- Booth #4725

•

NH SCR CATALYST (NANO HONEYCOMB TYPE SCR

CATALYST)

글로벌

1위

마린

SCR

촉매

공급업체...

More Info

•

NP SCR CATALYST(NANO PLATE TYPE SCR

CATALYST)

Korea No.1 Plate Catalyst Maker... More Info

•

NL SCR CATALYST (NANO LAYERED TYPE SCR

CATALYST)

NEL

– Booth #4129

Nel Hydrogen offers hydrogen gas solutions for

power plants

Nel is a global, dedicated hydrogen company,

delivering optimal solutions to produce, store &

distribute hydrogen for applications ranging

from grid-level support for renewable energy

storage to electric generator cooling in power

plants.

Brands: The Leader in On-site Hydrogen

Generation, HOGEN, PEM

Parker

- Booth #5125

Advanced Motion and Control Technologies and

Systems

As a collaborative partner, we work one-on-one

with you to create cleaner more efficient

energy. Whether for nuclear, coal-fired, gas

turbine, and combined cycle plants…or biomass,

hydroelectric, waste-to-energy, geothermal,

wind, and solar our solutions reduce costs and

optimized performance.

Brands: EGT, Tube Fittings, Veriflo, RACOR,

CleanDIESEL Velcon, Tube Fittings, Seal-Lok

Xtreme, GreenMAX, NitroDry, SensoNODE, HAS,

Intellinder

Reverso Pumps

- Booth #5740

Reliable Diesel Filtration for Reliable Engines

Manufactures Automatic Fuel Polishing Systems

for diesel fuel bulk storage tanks and day

tanks. Featuring Separ Filter 5-stage

filtration, the systems remove 99.9% of water

and particulate from fuel to increase engine

reliability and prevent expensive repairs.

Brands: Reverso, Separ Filter

Victaulic

- Booth #5044

Victaulic is designed to provide full system

solutions to meet the rigorous demands and

challenging environments of the power generation

industry across all plant types and scopes of

work. We are proud to be a part of the planning,

design, and construction of power and energy

facilities throughout the globe.

Brands: Victaulic, pipe fittings, pipe couplings

CO2

Four Principles to Guide Decarbonization

Decisions

COP26 has increased the pressure on public and

private organizations to escalate and accelerate

their sustainability commitments. In this

webinar recording, Bain partners Marc Lino,

Torsten Lichtenau, and Debra McCoy are joined by

Tim Mohin, chief sustainability officer and

executive vice president at Persefoni, in a

webinar to discuss actions companies can take to

manage and mitigate climate change, while still

creating value along the way.

Among the achievements that they found most

encouraging were the strong commitments and

international agreements, such as the more than

100 countries representing the lion’s share of

the world’s forests pledging to halt

deforestation by 2030. Parties agreed to update

2030 targets in 2022 rather than in five years,

and they also closed loopholes around some

legacy, poor-quality carbon credits. (For more,

see “Four

Myths about Carbon Offsets.”)

Some accomplishments were thwarted by disregard,

such as the commitment to reduce methane that

wasn't signed by several key emitters or the

pledge to end investment in new coal power

generation that failed to garner support from

countries representing 70% of the world’s coal

production.

But whatever happens on the policy side, much of

the real work of the climate transition will be

driven by finance and private companies, which

were at the table in a serious way for the first

time.

In the Bain work with large companies that are

acting on their ambitions and starting to reduce

their emissions, four specific principles are

guiding decisions that are making a real

difference.

Make carbon transition a pillar of strategy.

Ambitions to reduce emissions should guide

decisions about where to compete and allocate

resources.

Get more bang from your net-zero buck. Measure

the carbon transition like the rest of the

business and find ways to monetize investments

in carbon reduction.

Embed carbon transition into the fabric of the

business. Price carbon internally, link

compensation incentives to transition goals, and

track greenhouse gas emissions as you would

costs.

Avoid the hourglass effect. Senior managers and

new hires may be enthusiastic supporters, but

the transition needs buy-in from the middle

managers who must implement change successfully.

The webinar can be viewed at

https://www.bain.com/insights/beyond-cop-twenty-six-Implications-for-private-equity-webinar/

Industry Support for Large-Scale Carbon Capture

and Storage Continues to Gain Momentum in

Houston

Three additional companies have announced their

support for exploring the implementation of

large-scale carbon capture and storage (CCS)

technology in and around the Houston industrial

area. Air Liquide, BASF and Shell are joining

Calpine, Chevron, Dow, ExxonMobil, INEOS, Linde,

LyondellBasell, Marathon Petroleum, NRG Energy,

Phillips 66, and Valero to collectively evaluate

and advance emissions reduction efforts in and

around the Houston industrial area. This

announcement increases the momentum for CCS and

aligns with efforts to reduce emissions around

the world.

The 14 companies are evaluating how to use safe,

proven CCS technology at Houston-area

facilities that provide energy and products for

modern life, including power generation and

advanced manufacturing for plastics, motor fuels

and packaging. In December

2021, the companies held a series of

workshops at the University

of Houston to discuss collaboration and

activation of this important, large-scale

emissions-reduction effort.

Together, these companies and others in the

region could capture and safely store up to 50

million metric tons of CO2 per year

by 2030 and about 100 million metric tons per

year by 2040, helping to significantly reduce

emissions in the Houston region.

These efforts have already gained broad support

in the Houston region,

including from Houston Mayor Sylvester

Turner, the Harris

County Commissioners' Court, the Greater

Houston Partnership, and the Center for Houston's Future.

"Large-scale carbon capture and storage in the Houston region

will be a cornerstone for the world's energy

transition, and these companies' efforts

are crucial toward advancing CCS development to

achieve broad scale commercial impact," said Charles

McConnell, director of University

of Houston's Center for

Carbon Management in Energy and former assistant

secretary in the U.S. Department of Energy. "As

the energy capital of the world, Houston has

the expertise and leadership—including industry,

academia, and policymakers—to realize a low

carbon, reliable and affordable energy future. I

look forward to working alongside these 14

companies to make Houston the global leader in

CCS."

Wide-scale, affordable deployment of CCS in the Houston area will

require the support of industry,

communities, and government. If

appropriate policies and regulations are put in

place, CCS could help the

United States and Houston reach

net-zero goals while generating new jobs and

protecting existing jobs that are important to Houston's economy.

CCS could also promote long-term economic growth

in Southeast Texas and

beyond.

CCS is the process of capturing CO2 from

industrial activities that would otherwise be

released into the atmosphere and injecting it

into deep underground geologic formations for

secure and permanent storage. CO2 from

the Houston industrial area could be stored

in nearby on- and offshore storage sites. An

analysis of U.S Department of Energy estimates

shows the storage capacity along the U.S. Gulf

Coast is large enough to store about 500 billion

metric tons of CO2, which is

equivalent to more than 130 years of industrial

and power generation emissions in the

United States, based on 2018 data.

CCS is one of the few proven technologies that

could enable some industry sectors that are

difficult to decarbonize, such as manufacturing

and heavy industry, to decrease greenhouse gas

emissions. The International Energy Agency

projects that CCS could mitigate up to 15% of

global emissions by 2040, and the U.N.

Intergovernmental Panel on Climate Change

estimates global decarbonization efforts could

be twice as costly without the technology.

Discussions continue with other companies that

have industrial operations in the Houston

region, potentially increasing the projected

total CO2 that can be captured and

safely stored.

HYDROGEN

Trillions Should be Invested in Long Duration

Energy Storage

The Long Duration Energy Storage Council hired

McKinsey to determine future markets. Here is

the summary of a report which can be

viewed thorough the link provided.

Many LDES technologies currently exist, but they

are at different levels of maturity. Some have

been deployed commercially, some are still at

the pilot phase. Projections show that LDES need

to be scaled up dramatically over the next 20

years to build a cost-optimal net-zero energy

system. For LDES to be cost optimal, costs must

decrease by 60%. However, even greater cost

reductions have already occurred in other clean

technologies like solar and wind.

Between 2022–40, USD 1.5 tr–3.0 tr of total

investment in LDES will be required. The total

investment over this period is comparable to

what is invested in transmission and

distribution networks every 2–4 years. This

investment has the potential to create economic

and environmental benefit. The business cases

for LDES can often be positive if sufficient

mechanisms are in place to monetize the value.

By 2040, LDES need to have scaled up to ~400x

present day levels to 1.5–2.5 TW (85–140 TWh).

10% of all electricity generated would be stored

in LDES at some point. Present-day LDES

deployment is low, but momentum in LDES is

growing exponentially.

This McKinsey report focuses on the relatively

nascent mechanical, thermal, chemical, and

electrochemical storage technologies, instead of

Li-ion batteries, dispatchable hydrogen assets,

and large-scale aboveground pumped storage

hydropower.

Mechanical LDES

The most widespread and mature storage

technology is PSH, a form of mechanical storage

that accounts for 95 percent of the total energy

storage capacity worldwide. New versions of this

established technology are emerging to reduce

its dependence on geographical conditions, For

example, geomechanical pumped hydro, which uses

the same principles as aboveground PSH but with

subsurface water reservoirs. Other emerging

mechanical energy storage solutions include

compressed air energy storage (CAES) and

gravity-based energy storage. The first stores

energy as compressed air in pressure-regulated

structures (either underground or aboveground).

In its adiabatic form, CAES also includes

thermal storage to store the heat that is

generated during compression and reuse it in the

discharge cycle. Gravity-based energy storage is

another promising form of mechanical storage,

which stores energy by lifting mass that is

released when energy is needed. This technology

is in an earlier stage of commercial

development. Lastly, mechanical LDES can also

take the form of liquid CO2, which

can be stored at high pressure and ambient

temperature and then released in a turbine in a

closed loop without emissions. Liquid air energy

storage (LAES) works similarly to CAES by

compressing air but uses electricity to cool and

liquify the medium and store it in cryogenic

storage tanks at low pressure. For this reason,

LAES is sometimes classified as mechanical

storage and sometimes as thermal storage.

Thermal LDES

Thermal energy storage technologies store

electricity or heat in the form of thermal

energy. In the discharge cycle the heat is

transferred to a fluid, which is then used to

power a heat engine and discharge the

electricity back to the system. Depending on the

principle used to store the heat, thermal energy

storage can be classified into sensible heat

(increasing the temperature of a solid or liquid

medium), latent heat (changing the phase of a

material), or thermochemical heat (underpinning

endothermic and exothermic reactions). These

technologies use different mediums to store the

heat such as molten salts, concrete, aluminum

alloy, or rock material in insulated containers.

Likewise, the charging equipment options are

diverse, including resistance heaters, heat

engines, or high temperature heat pumps among

others. The most widespread thermal LDES

technology are molten salts coupled with

concentrated solar power (CSP) plants, however,

this technology is different from other novel

LDES as it presents different characteristics

(e.g. it cannot be widely deployed as it is not

modular, the CSP plant has a large footprint and

is only effective in regions with high solar

radiation). Nonetheless, molten salts can

effectively be used in novel thermal LDES to

store electricity independently of CSP plants.

Thermal LDES technologies can discharge both

electricity and heat, supporting the

decarbonization of the heat sector, which

accounts for around 50 percent of the global

final energy consumption (compared to 20 percent

by the electricity sector in 2019). Of the total

heat consumption, it is estimated that only

around 10 percent is supplied by LDES could

support the decarbonization of this sector

through the provision of zero-emissions high

grade heat to energy-intensive industries—that

rely on fossil fuels and have few

decarbonization alternatives—and other heat

applications (such as district heating

networks).

Chemical LDES

Chemical energy storage systems store

electricity through the creation of chemical

bonds. The two most popular emerging

technologies are based on power-to-gas concepts:

power-to-hydrogen-to-power, and power-to-syngas

(synthetic gas)-to-power. In the first case,

electricity is used to power electrolyzers,

which produce hydrogen molecules that can be

stored in tanks, caverns, or pipelines. The

energy is discharged when the hydrogen is

supplied to a hydrogen turbine or fuel cell. If

the hydrogen is combined with CO2 in

a second step to make methane, the resulting

Net-zero power: Long duration energy storage for

a renewable grid | LDES Council, McKinsey &

Company gas—known as syngas—has similar

properties to natural gas and can be stored and

later burned in conventional power plants.

Similarly, hydrogen can be converted to ammonia

for direct combustion.

Electrochemical LDES

Different batteries of varying chemistries are

emerging to provide long duration flexibility.

Electrochemical flow batteries store electricity

in two chemical solutions that are stored in

external tanks and pushed through a stack of

electrochemical cells, where charge and

discharge processes take place thanks to a

selective membrane. These batteries are suited

for long-duration applications where low

chemical and equipment costs are possible.

Emerging metal air batteries rely on low-cost,

abundant earth metals, water, and air – meaning

they have the potential for high scalability and

low installed system costs. Furthermore, many of

these solutions do not suffer from thermal

runaway, making them safe to install and

operate. Where a hydrogen technology

demonstrates very similar behaviors and cost

profiles to other LDES it has been included

(such as solid oxide fuel cells). There are also

hybrid flow batteries with liquid electrolytes

and a metal anode which combine some of the

properties of conventional flow batteries and

metal-anode systems. Li-ion, hydrogen turbines,

and large-scale aboveground PSH This report

distinguishes between LDES and Li-ion as the

scaling up of costs for a long-duration

flexibility range makes Li-ion uncompetitive for

a long-duration flexibility range.

Hydrogen-based storage and reconversion to power

via turbines (and fuel cells) can serve a role

for long-duration storage but are called out

separately in the report due to dissimilar cost

performance at lower storage durations and the

specific interest that has evolved around

hydrogen in the energy community. Large-scale

aboveground PSH are not included in the

considered technology space as the deployment

benefits and economics of novel LDES

technologies, including novel PSH, are expected

to outcompete these plants and LDES have fewer

geographical limitations.

BIOMASS

Biomass Must Come From Sustainable Sources

UK legislation on biomass sourcing states that

operators must maintain an adequate inventory of

the trees in the area (including data on the

growth of the trees and on the extraction of

wood) to ensure that wood is extracted from the

area at a rate that does not exceed its

long-term capacity to produce wood. This is

designed to ensure that areas where biomass is

sourced from retain their productivity and

ability to continue sequestering carbon.

Ensuring that forestland remains productive and

protected from land-use changes, such as urban

creep, where vegetated land is converted into

urban, concreted spaces, depends on a healthy

market for wood products. Industries such as

construction and furniture offer higher prices

for higher-quality wood. While low-quality,

waste wood, as well as residues from forests and

wood-industry by-products, can be bought and

used to produce biomass pellets.

A report by Forest 2 Market examined the

relationship between demand for wood and

forests’ productivity and ability to sequester

carbon in the US South, where Drax sources about

two-thirds of its biomass.

The report found that increased demand for wood

did not displace forests in the US South.

Instead, it encouraged landowners to invest in

productivity improvements that increased the

amount of wood fiber and therefore carbon

contained in the region’s forests.

A synthesis report, which examines a broad range

of research papers, published in Forest

Ecology and Management in March of 2021,

concluded from existing studies that claims of

large-scale damage to biodiversity from woody

biofuel in the South East US are not supported.

The use of these forest residues as an energy

source was also found to lead to net GHG

greenhouse emissions savings compared to fossil

fuels, according to Forest Research.

Importantly the research shows that climate

risks are not exacerbated because of biomass

sourcing; in fact, the opposite is true

with annual wood growth in the US South

increasing by 112% between 1953 and 2015.

The European Commission’s JRC Science for Policy

literature review and knowledge synthesis report

‘The use of woody biomass for energy production

in the EU’ suggests a win-win forest bioenergy

pathway is possible, that can reduce greenhouse

gas emissions in the short term, while at the

same time not damaging, or even improving, the

condition of forest ecosystems.

However, it also makes clear “lose-lose”

situations is also a possible, in which forest

ecosystems are damaged without providing carbon

emission reductions in policy-relevant

timeframes.

Win-win management practices must benefit

climate change mitigation and have either a

neutral or positive effect on biodiversity. A

win-win future would see the afforestation of

former arable land with diverse and naturally

regenerated forests.

The report also warns of trade-offs between

local biodiversity and mitigating carbon

emissions, or vice versa. These must be

carefully navigated to avoid creating a

lose-lose scenario where biodiversity is damaged

and natural forests are converted into

plantations, while BECCS fails to deliver the

necessary negative emissions.

In a future that will depend on science working

in collaboration with industries to build a net

zero future continued research is key to

ensuring biomass can deliver the win-win

solution of renewable electricity with negative

emissions while supporting healthy forests.

Bain Helps Clients Manage and Report Carbon

Footprint

Bain & Company has a strategic partnership with

and investment in Persefoni, a

leading SaaS platform that helps investors and

enterprises easily calculate, analyze, manage,

and report on their real-time carbon footprints.

This first-of-its-kind partnership will pair

Bain & Company’s expertise in carbon

transitions, as well as its deep understanding

of investors’ priorities, with Persefoni’s

cutting-edge carbon accounting platform to

deliver unprecedented solutions to Bain’s

clients on their net-zero journeys—solutions

that are actionable, trackable, linked to value

and grounded in facts.

With an initial focus on Bain’s highly

influential cadre of private equity and

institutional investor clients—and their

portfolio companies—this partnership will help

Bain’s clients to manage their carbon inventory

with the same rigor and transparency as their

financial metrics.

“Bain & Company is continuously expanding its

suite of services and tools aimed at

accelerating the carbon transition, leveraging

the latest technologies and working alongside

our clients to create a more sustainable,

responsible and profitable future,” said Torsten

Lichtenau, partner, and global head of Bain &

Company’s Carbon Transition Impact Area. “

BUSINESS

Program for ErgonArmor announces changes to

Sales, Marketing and Distribution Program for

Pennguard™ Block Chimney Lining System

ErgonArmor, a division of Ergon Asphalt and

Emulsions Inc., has announced new and sweeping

changes to the global sales, marketing, and

distribution program for its Pennguard

Block Lining System suite of products used

in coal-fired power plant chimney applications.

To better serve the diverse needs of this global

market, ErgonArmor will end its exclusive

distribution go-to-market strategy at the end of

2021. Beginning January 2022, it will offer the

Pennguard Block Lining System direct to

consumers and through select nonexclusive

distributors. This change will enhance Pennguard

Block Lining System sourcing options for

coal-fired power plant projects globally.

ErgonArmor anticipates this factory-direct

distribution model will enhance its market

position. In addition to ready access to the

premier Pennguard brand of cellulated

borosilicate glass block lining technology,

clients will find more flexible service options,

delivery timing and payment terms.

Coal-fired power plants first began using the

Pennguard Block Lining System to protect

chimneys and ducts against corrosive flue gas

condensate in the 1980s. In the years since its

commercial introduction, Pennguard has developed

a globally dominant market share and exceptional

track record of performance that clients have

come to trust. While some nations have

decommissioned coal burners in favor of

alternative energy sources, others will continue

to utilize affordable coal resources in

conjunction with modern clean coal technologies

to fuel economic growth.

“These changes will better position our

Pennguard product line to react to the evolving

coal-fired power plant market. We believe moving

ourselves one step closer to the end user will

be a welcomed change and provide a more

efficient approach to this ever-changing

landscape,” commented Christine Osborne, Vice

President of Sales and Marketing for ErgonArmor.

Lots of Differences Between Stated Policies and

Plans For Net Zero

Sonal Patel, writing in Power, listed the

eight overarching trends gleaned from the

Paris-based autonomous intergovernmental

agency’s annual outlook. She also provided three

IEA scenarios.

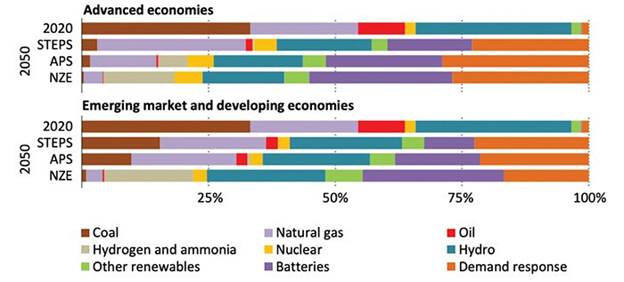

Coal and natural gas generation will remain

“cornerstones” of electricity flexibility, but

flexibility profiles are slated to change as

power generation mixes across the world

transform, the IEA suggested. This graphic shows

three IEA scenarios: the Stated Policies

Scenario (STEPS), which explores where energy

systems might go without further policy

intervention; the Announced Pledges Scenario

(APS), which assumes announced policies (as of

October 2021) will be implemented; and the

Net-Zero Emissions by 2050 Scenario (NZE).

Editor of Power Sees Lots of Bright Spots on the

Horizon

Last week Aaron Larson, editor of Power,

provided an optimistic view of the future of

power.

“Opportunities are everywhere in the power

industry these days. Not only are wind and solar

energy seeing explosive growth, but also several

other technologies are showing real signs of

promise. Battery energy storage systems and

microgrids have become mainstream grid

components. Advanced nuclear power designs and

hydrogen-based energy schemes have progressed

beyond concepts and into real brick-and-mortar

projects. The worldwide focus on climate change

has developers of carbon capture and storage

(CCS) technologies licking their chops, with

serious deployment of CCS systems almost assured

if the world is to meet goals aligned with the

Paris Agreement.”

Aaron cited a report showing that

the U.S.