IRON AND STEEL UPDATE

JANUARY 2015

MCILVAINE

COMPANY

November

2014 World Steel Production

Global Stainless Steel Production Up 9% in First Nine

Months of 2014

U.S. Steel Imports Decline for First Time in Three

Months

Iron Ore Price Surges 5% on Chinese Stimulus Measures

U.S. Steel Idles Ohio Plant That Makes Pipes for Oil

Exploration, Drilling

Magnetation Announces First Production at New Iron Ore

Concentrate Plant

Minnesota Pellet Project on Track for 2015 Production

Cliffs Closes Bloom Lake Iron Ore, Sells Coal Assets

Thyssenkrupp Metallurgical Concludes Off Take Agreement

with Niocorp

Nucor Completes Acquisition of Gallatin Steel Company

SAIL Seeks Odisha Government's Support to Expand

Capacity for Rourkela Plant

Hebei Looks to Relocate Its Largest and Most Polluting

Industries Abroad

ArcelorMittal Invests $7m for New Dust Filters at

Zenica Steel Plant

ArcelorMittal Provides 310,000 Tonnes of Steel for Gas

Pipeline to Europe

Italian Government Steps in to Save Ilva Steel Plant

Tosyali and Toyo Kohan Break Ground for USD 500m Steel

Unit in Turkey

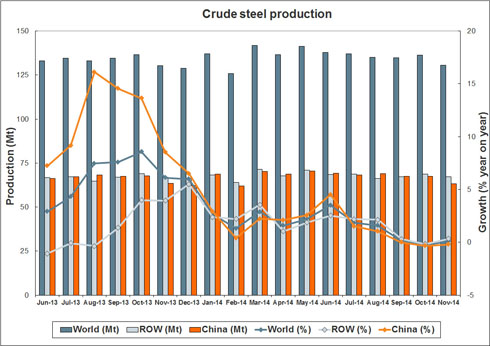

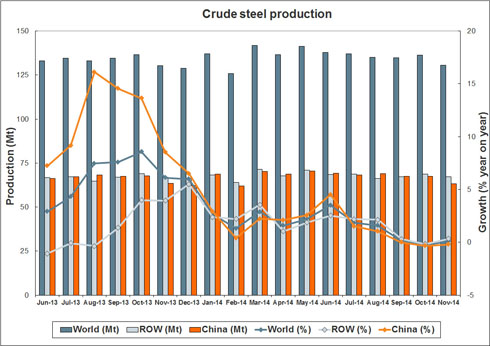

World crude steel

production for the 65 countries reporting to the World Steel Association (worldsteel)

was 131 million tonnes (Mt) in November 2014, a 0.1% increase compared to

November 2013.

China’s crude steel production for November 2014 was 63.3

Mt, a slight decrease of -0.2% compared to November 2013. Elsewhere in Asia,

Japan produced 9.2 Mt of crude steel in November 2014, a decrease of -1.1%

compared to November 2013. South Korea produced 5.9 Mt of crude steel in

November 2014, up by 5.5% on November 2013.

In the EU, Germany produced 3.6 Mt of crude steel in

November 2014, a decrease of -1.9% compared to November 2013. Italy produced 1.9

Mt of crude steel, down by -13.9% on November 2013. France’s crude steel

production was 1.4 Mt, an increase of 5.8% compared to November 2013. Spain

produced 1.2 Mt of crude steel, down by -1.9% compared to November 2013.

Turkey’s crude steel production for November 2014 was 2.8 Mt, down by -8.6% on

November 2013.

In November 2014, Russia produced 5.8 Mt of crude steel, up

by 5.8% over November 2013. Ukraine produced 1.8 Mt of crude steel, a decrease

of -28.6% compared to the same month 2013.

The US produced 7.2 Mt of crude steel in November 2014, an

increase of 1.5% compared to November 2013.

The crude steel capacity utilisation ratio for the 65

countries in November 2014 was 73.5%. It is -2.5 percentage points lower than

November 2013. Compared to October 2014, it is -1.2 percentage points lower.

The International Stainless Steel Forum (ISSF) has released

figures for the first nine months of 2014 showing that stainless steel melt shop

production increased by 8.9% year–on–year to 30.9 million metric tons.

Production increased in all regions except for Central and Eastern Europe.

Stainless and heat-resisting melt shop steel production

[‘000 metric tons]

|

Region |

Quarter |

+/- % |

9 Months |

+/- % |

|||

|

|

1/2014 |

2/2014 |

3/2014 |

q-o-q |

2013 |

2014 |

y-o-y |

|

Western Europe/Africa |

2,164 |

2,111 |

1,682 |

-20.3% |

5,683 |

5,958 |

4.8% |

|

Central/Eastern Europe |

71 |

72 |

70 |

-2.3% |

215 |

213 |

-1.0% |

|

The Americas |

670 |

717 |

711 |

-0.8% |

1,824 |

2,097 |

15.0% |

|

Asia (w/o China) |

2,234 |

2,216 |

2,161 |

-2.5% |

6,487 |

6,611 |

1.9% |

|

China |

5,084 |

5,603 |

5,336 |

-4.8% |

14,176 |

16,022 |

13.0% |

|

Total |

10,223 |

10,718 |

9,960 |

-7.1% |

28,385 |

30,900 |

8.9% |

U.S. steel

imports fell by more than 18% in November, marking the first decline in three

months, according to analysis from the American Institute for International

Steel (AIIS).

While November’s

3.63 million net tons of imports were 18.2% lower than the October total, they

were still more than 40% higher than in November 2013. Imports from Brazil

showed the largest decline from October, falling nearly 39% to 396,000 net tons.

The United States’ North American Free Trade Agreement (NAFTA) partners also

recorded decreases, almost 26% to 263,000 net tons from Mexico, and nearly 14%

to 471,000 net tons from Canada. Imports from both countries remained above

their levels from a year earlier, though. China, Russia, and South Korea also

showed sharp month-to-month decreases while staying above the levels of a year

earlier. Imports from the European Union, however, increased 17.3% from October

– and 70.6% from last November – to 713,000 net tons.

Notwithstanding

the November dip, year-to-date imports of 40.64 million net tons are more than

37% higher than the first 11 months of 2013. Imports from Russia have led all

countries in growth, with purchases of steel from that nation swelling more than

two-and-a-half-fold to 4.31 million net tons this year. Imports from the E.U.

have jumped 45.6% to 6.46 million net tons, while South Korea has sold 44% more

steel to the U.S. this year, bringing its total to 5.06 million net tons.

Imports from China are up 68.5% on the year, Brazil 21.5%, Mexico 17.4%, and

Canada 9%.

Semi-finished

imports increased 11.4% over last November to 756,000 net tons. Year-to-date,

they are up by nearly one-third to 8.91 million net tons.

No one should be

surprised that the United States is importing much more steel this year, AIIS

said. As The Wall Street Journal noted on 24 December 2014, the economy is

gaining momentum, growing at a 5% seasonally adjusted annual rate in the third

quarter, its most robust advance in 11 years. Economic growth spurs demand for

steel. With domestically produced steel selling at much higher than global

prices, expansion-minded companies naturally are looking to buy beyond the

border. This value-oriented approach maximizes efficiency, frees up more money

for capital investment, job growth, and wage increases, and promotes continued

economic expansion, AIIS said.

The iron ore price roared ahead at the end of 2014 with

Northern Chinese import prices surging nearly 5% on an improving outlook for the

Chinese economy in 2015. Iron ore lost 50 per cent of its value in 2014, falling

below $67 (U.S.) a tonne, attributable to weak demand from China and a supply

surplus. The world’s biggest producers, Rio Tinto Group, BHP Billiton Ltd., Vale

SA and Fortescue Metals Group continued to increase production, despite the low

prices for the steel-making ingredient.

The 62% Fe benchmark import price including freight and

insurance at the port of Tinjian tracked by The SteelIndex added $3.30 or 4.9%

to $71.20 a tonne, the highest since November 18. The price of the steelmaking

raw material has now climbed back 8.5% since hitting levels last seen May 2009.

Despite the slowest growth rate since 1990, China would still be adding

some $700bn to GDP in 2015.

Iron ore's resurgence is thanks to stimulus measures

announced by the People's Bank of China over the weekend that is set to free up

some $800 billion in funds available for loans at commercial banks. On top of

the new lending and bank deposition rules, interest rates in the world's second

largest economy is also on course for further cuts in the new year while the

scrapping of housing purchase limits targets the troubled property sector

directly.

China imports more than two-thirds of the global seaborne

trade expected to hit 1.4 billion tonnes in 2015 and forges nearly as much steel

as the rest of the world combined.

The country's decades long urbanization push and

construction boom has made it the driving force behind commodity price rises

over the last decade or more.

But growing fears of a property bubble and overinvestment

in infrastructure, coupled with a flood of new iron ore supply, have seen prices

slide 47% since the start of the year.

Beijing is attempting to accelerate the slowest GDP growth

rate in decades, expected to hit 7% in 2015. Despite the tepid economy, the

country would still be adding some $700 billion to gross domestic product in

2015 (excluding Hong Kong).

Citing the collapse in global oil prices, U.S. Steel Corp.

will idle its plant in Lorain, Ohio, laying off 614 workers, a company

spokeswoman said in January, the Wall Street Journal reports.

The plant makes steel pipe and tube for oil-and-gas

exploration and drilling. With oil prices currently around $50 a barrel, their

lowest level since 2009, energy companies have far less incentive to drill for

new supply, reducing demand for the plant’s products.

“The company has suddenly lost a great deal of business

because of the recent downturn in the oil industry,” Tom McDermott, president of

United Steelworkers local 1104 wrote to workers, in a letter reviewed by The

Wall Street Journal. “What appeared just a few short weeks ago as being a

productive year, [with new hires in December and extra turns going on], has most

abruptly turned sour.”

Layoffs will begin on March 8, “with additional layoffs

occurring through May 2015,” a U.S. Steel official wrote to the union.

The so-called oil country tubular goods, or OCTG, industry

has been built up massively in the past few years to provide pipe and tube for

the boom in drilling for shale gas and new oil in the Gulf of Mexico.

U.S. Steel, which is trying to reverse five straight years

of losses, has bet heavily on OCTG. The company’s tubular division posted an

operating profit of $140 million during the first nine months of 2014, up from

$23 million over the same period in 2010.

Oversupply in the market has been exacerbated by huge flows

of steel imports into the U.S. Overall steel imports rose 35% to 38 million tons

during the first 10 months of 2014, according to Global Trade Information

Services.

Last summer, U.S. Steel and others won import tariffs on

imports of OCTG from South Korea and other exporting countries. But that won’t

be enough to prop up the industry amid falling oil prices.

Magnetation LLC has successfully produced its first iron

ore concentrate at its new plant, Plant Four, located near Grand Rapids, Minn.

Magnetation said the new plant has begun operations one quarter ahead of

schedule and three quarters ahead of the original project schedule.

"The Plant Four

design and construction effort is one of the finest project executions I have

seen in my 40 years in the industry. Despite significant weather and engineering

challenges, the Plant Four team along with our contractor partners has achieved

first concentrate production less than ten months after the first concrete pour.

The project was completed in world class speed with no lost time accidents,"

said Larry Lehtinen, CEO of Magnetation.

"Plant Four will be our largest concentrate production plant and we

expect that it will also be our lowest cost concentrate operation.

We anticipate it being a flagship operation providing high paying jobs on

the Iron Range for many decades to come."

Plant Four will

have a production capacity of 2.0 million metric tons of concentrate per year

once it's fully operational. The

iron ore concentrate from Plant Four will supply Magnetation's new pellet plant

facility located in Reynolds, Ind., which began operating in September 2014.

Magnetation now employs approximately 500 people between its Minnesota

and Indiana operations.

Magnetation LLC is a joint venture between Magnetation Inc.

(50.1% owner) and AK Steel (49.9% owner).

Magnetation LLC recovers high-quality iron ore concentrate from

previously abandoned iron ore waste stockpiles and tailings basins.

Magnetation LLC owns three iron ore concentrate plants located in

Keewatin, Bovey, and Grand Rapids, Minn., and a 3.0 million metric ton per year

iron ore pellet plant in Reynolds, Ind.

Essar Steel Minnesota reported in late October that

construction of its 7-million-mt/y iron-ore mining, crushing, and pelletization

project near the town of Nashwauk on the western end of the Mesabi Iron Range in

northern Minnesota was 50% complete and remained on schedule to start pellet

production in the second half of 2015. When completed, the $1.8 billion project

will include an open-pit iron ore mine; crushing, concentrating and pelletizing

facilities; and a rail line and train-loading system.

Essar Steel Minnesota is a subsidiary of Essar Steel, a

multinational steelmaker headquartered in Mumbai, India. The Minnesota project

has an aggregate of approximately 2 billion mt of measured, indicated, and

inferred magnetite iron resources, of which approximately 1.7 billion mt are

classified as proven and probable reserves.

Essar Steel Minnesota stated that it expects to be the

lowest-cost producer of taconite pellets in North America and will be the only

pellet producer in the United States to have the flexibility and production

capability to produce standard blast furnace pellets as well as fluxed and DR

grade pellets. Through firm long-term off-take agreements in place with

ArcelorMittal USA and Essar Steel Algoma, Canada, Essar Steel Minnesota already

has customers committed over the long-term to purchase its entire 7 million mt/y

of planned production.

The Essar Steel Minnesota project has access to rail lines

serviced by Burlington Northern Santa Fe Railway and Canadian National Railway.

In addition, the project has the option to export to customers in the future via

the Atlantic Ocean by transshipping through the St. Lawrence Seaway to the

ocean-loading port of Quebec City.

The Essar Steel Minnesota project area totals approximately

19,000 acres, of which 4,360 acres are mineral lease land. Environmental permits

are in place for construction and operation of the project.

Cliffs Natural Resources (NYSE:CLF) announced recently that

active production at its Canadian Bloom Lake iron ore mine has completely ceased

as the firm continues its plans to exit Eastern Canada.

The company, which is the U.S.’s biggest iron ore miner,

also said it has conclude the sale of part of its struggling coal division for

$174 million, in cash, to Coronado Coal II LLC.

The Cleveland-based miner's move aims to fully exit

higher-cost operations to focus only on its iron ore business in the U.S. As

most of its peers, Cliffs has been struggling as a consequence of tumbling

prices for iron ore and metallurgical coal, triggered by a slowdown in the

Chinese steel industry.

ThyssenKrupp Metallurgical Products last month has expanded

its product portfolio and concluded an off take agreement for ferro niobium, a

rare heavy metal, with NioCorp Developments Ltd.

Under the 10 year agreement, ThyssenKrupp Metallurgical

Products will purchase 3,750 tonne of ferroniobium per year, which equates to

approx. 50% of NioCorp's total production. Niobium is mainly used in metallurgy

in the manufacture of special steels and to improve weldability.

This off take agreement makes the raw material trading

experts the exclusive European distribution partner to NioCorp, which is

developing the only primary niobium deposits in the USA at its Elk Creek project

in Nebraska. The term of the agreement is scheduled to begin in 2017 when

production starts.

With the conclusion of the off take agreement, ThyssenKrupp

Metallurgical Products has also acquired the unilateral option of purchasing

warrants for USD 5 million at the current price of CAD 0.67 each within 1 year.

Kai-Norman Knotsch, chairman of the Management Board of

ThyssenKrupp Metallurgical Products said, “As there are very few suppliers of

niobium and NioCorp is developing the only deposits in the USA, this is a highly

attractive product for us. We are looking forward our future cooperation and

hope to develop new sales markets in Europe as a result.”

Mark Smith, CEO of NioCorp said, “We are extremely pleased

to have one of the world's leading commodity trading companies as a significant

customer. Our team looks forward to building a long-term and mutually beneficial

relationship with ThyssenKrupp Metallurgical Products.”

Nucor Corporation (NYSE: NUE) announced recently that it

has closed on its purchase of all the equity of Gallatin Steel Company for

approximately $770 million.

"We are pleased to welcome the Gallatin team to the Nucor

family. This addition will allow us to better serve our customers by offering

them a wider range of products and further enhancing our reliability," said John

Ferriola, Chairman, CEO and President of Nucor Corporation. "The timing of the

closing is beneficial as it enables us to capitalize on synergies between the

two companies during the current contract negotiation season for raw materials,

alloy and consumables and steel sales."

Nucor Steel Gallatin has an annual capacity of

approximately 1,800,000 tons, increasing Nucor's total flat-rolled production to

about 13 million tons annually. The

acquisition strengthens Nucor's position serving flat-rolled customers in the

growing pipe and tube segment.

The mill's location on the Ohio River expands Nucor's

footprint in the Midwest market, which is the largest flat-rolled consuming

region in the U.S, and gives the company access to all the key markets on the

U.S. river system. The mill also

complements Nucor's raw materials strategy with its ability to receive DRI from

the company's plant in Louisiana.

John Farris has been named Vice President and General

Manager of Nucor Steel Gallatin.

Farris previously served as Vice President and General Manager of Nucor Steel

Texas, a bar mill in Jewett.

Adjusting for the net present value of the anticipated tax

benefits, the realized effective purchase price for Nucor is approximately $630

million. The purchase is expected to be immediately accretive to cash flow and

accretive to earnings after working through purchase accounting-valued finished

goods inventories.

Nucor and affiliates are manufacturers of steel products,

with operating facilities primarily in the U.S. and Canada. Products produced

include: carbon and alloy steel -- in bars, beams, sheet and plate; steel

piling; steel joists and joist girders; steel deck; fabricated concrete

reinforcing steel; cold finished steel; steel fasteners; metal building systems;

steel grating and expanded metal; and wire and wire mesh. Nucor, through The

David J. Joseph Company, also brokers ferrous and nonferrous metals, pig iron

and HBI/DRI; supplies ferro-alloys; and processes ferrous and nonferrous scrap.

Nucor is North America's largest recycler.

With an aim to expand the capacity of its Rourkela Steel

Plant (RSP), SAIL has sought Odisha government's support for its raw material

requirements in the coming days. "We have plans to invest Rs 30,000 crore to Rs

35,000 crore for expansion of RSP's capacity from 4.5 mtpa to 10 mtpa by

2025-26. Therefore, we require adequate iron ore and seek support of the Odisha

government," SAIL Chairman CS Verma told reporters after attending the review

meeting by Union Steel Secretary Rakesh Singh.

The Maharatna PSU has already undertaken expansion of its 2

mtpa steel plant at Rourkela to 4.5 mtpa by investing Rs 12,000 crore, Verma

said, adding that it plans to further expand the capacity of RSP, which has the

biggest blast furnace of 460 cubic meter capacity in the country.

SAIL, which already has two major iron ore reserve clusters

at Balani and Barsuan, now seeks more such raw material linkage in view of its

proposed expansion. Replying to a question, Verma said the company is presently

working out how much more iron ore would be required after expansion of its RSP

project. "We hope the state government will support and provide the required

amount of raw material," he said.

The steel and mines department of Odisha government has,

however, estimated that iron ore mines with SAIL have the total reserve of 512

mt against its requirement of 480 mt over 30 years after expansion of RSP's

capacity to 10 mtpa.

On SAIL's proposed acquisition of Nilachal Ispat Nigam

Limited at Kalinga Nagar in Odisha, Verma said the company is keen to acquire

the facility. "The major stake lies with MMTC under the Ministry of Commerce. If

SAIL is given adequate stake, it would be able to run NINL," he said.

Hebei Province is attempting to shift its heavy industries

overseas, Global Times recently reported. With larger steel production capacity

than Japan, Hebei is home to the most polluted cities in China.

China's largest overseas iron and steel project was

officially launched this September, when China's biggest steel maker, Hebei Iron

& Steel Group (HBIS), and South Africa's Industrial Development Corporation

signed a memorandum of understanding in Beijing.

The project, with HBIS's expertise and ability to operate

steel-making facilities, says it will be located in South Africa's Limpopo

province and supply steel at competitive prices in South Africa's downstream

steel processing industry, currently constrained by uncompetitive steel prices

and a lack of certain steel products.

By 2017, the iron and steel facility in South Africa is

expected to churn out 3 million tons in production each year. Two years later,

the production capacity will grow to 5 million tons.

Yu Yong, CEO of HBIS, said at the signing ceremony, "We

will try to make the international market a new growth point for the company."

The project is just the latest indication of the northern

province of Hebei's ambitious plans to relocate steel, cement and glass

factories to countries in Africa, South America, East Europe and the rest of

Asia, pressured by overcapacity in the domestic market and growing concerns over

industrial pollution.

According to a Hebei Province government notice issued last

month, by 2017, it plans to move capacity for 5.2 million tons of steel, 5

million tons of cement and 3 million units of glass abroad. The targets for 2023

is more ambitious, with capacity for 20 million tons of steel, 30 million tons

of cement and 10 million units of glass waiting to be relocated abroad.

Many projects are already underway. In the following two

years, Hebei's State-run companies will help set up a 600,000 ton steel project

in Thailand, a 350,000 ton capacity steel facility in Indonesia and a 1.5

million ton iron powder factory in Chile. On the cement front, two one-million

ton capacity projects, one in South Africa and one in Myanmar, will be

established with investments from the Tangshan-based Jidong Development Group

and its local partners.

HBIS's acquisition of a controlling stake in Swiss-based

steel trader Duferco this November is another sign that the province will expand

overseas investment.

The choice of going abroad is largely driven by China's

domestic production cut after years of overproduction and a glut in the market

that has seen steel prices fall to drastic new lows.

China now produces half of the steel in the world.

According to a report by the World Steel Association, China produced 779 million

tons of crude steel in 2013, accounting for 48.5 percent of the world's total.

"Steel production is China's most competitive industry in

the global market. From planning to production to management, every step of the

industry is highly efficient," said Li Xinchuang, deputy secretary general of

the China Iron and Steel Association and head of the China Metallurgical

Industry Planning and Research Institute.

Hebei produces the most steel in China. The province

produced a quarter of the country's crude steel in 2013, statistics from the

Hebei Metallurgical Industry Association shows. That's more than the entire

production of Japan, the second largest steel producing country in the world

after China.

Apart from steel, cement and glass production have also

been the driving forces of Hebei's economy. The three industries contribute to

almost a third of the province's GDP, part of China's construction-fuelled

decades of growth.

But they are also regarded as major sources of pollution in

China's highest emitting province. According to Hebei's Department of

Environmental Protection, steel, electricity, cement and glass industries

account for 65 percent of the province's sulfur dioxide emissions and 61 percent

of its smoke and dust emissions.

Last September, China's environmental department, along

with five other national authorities, issued detailed rules on fighting

pollution. Hebei, home to the most polluted cities in China, was its main

target. According to the rules, Hebei should cut 60 million tons' production of

steel, 61 million tons' production of cement, 40 million tons' coal and 36

million weight cases of glass by 2017. The amount is about a third of Hebei's

annual production. In an interview with China Central Television, Zhang Qingwei,

governor of Hebei Province, said, "If an extra ton of steel is produced, local

officials will have to take responsibility and be sacked."

Hebei's economy is already feeling the power of Beijing's

campaign. Since last year, a province-wide campaign has seen over 8,000

companies closed, 35,000 coal-burning furnaces demolished and cement production

to shrink by 22 million tons. "For each 10 million tons' cut of steel

production, steel companies lose 30 billion yuan and thousands of people lose

their jobs," Zhang Qingwei told People's Daily this June.

In the first half of this year, Hebei's annual economic

growth was a mere 5.8 percent, last but one of China's 31 provinces and regions.

Guo Bing, environment professor at Hebei University of

Science & Technology and a member of Hebei's Chinese People's Political

Consultative Conference, is a staunch supporter of Hebei factories going abroad

and said the economic downturn from the steel cut can be partially made up by

the international investment of Hebei's factories.

"The 60 million ton cut in steel production is going to

have a profound impact on Hebei's economic development. The space for

development in Hebei is small due to environmental constraints. And yet as one

of the most important industries in Hebei, we cannot allow it to stop

developing," he said. "This applies to the cement and glass industries as well."

"This is why we have to let them go abroad, to countries

where this production is most needed."

Guo said moving factories to countries in Africa and East

Europe also saves shipping costs for iron ores and other raw materials, since

China previously had to import them from these countries for the production of

steel.

ArcelorMittal Zenica, the steel producer located in Bosnia

and Herzegovina (B&H), recently announced the start of a major project to

install advanced new dust filters in its basic oxygen furnace (BOF) Steel Plant.

Using “Best Available Techniques”, the BOF secondary

de-dusting system is the latest in a series of technical investments aimed at

reducing the ecological impact of the plant, which was restarted in 2008

following almost two decades of disuse after the conflict of the 1990s. Work on

the new filters is expected to be completed by early 2016.

The BOF Steel Plant project follows the successful

completion in November 2013 of a US$8m investment in filters at the site’s blast

furnace, and brings the company’s total investments in ecological projects at

Zenica to more than US$6m since 2005.

When fully operational, the BOF secondary de-dusting system

will meet all relevant B&H and EU standards and eliminate visible ‘red dust’

emissions from the plant. More than 95% of fumes from production operations will

be captured and cleaned in the bag filter, which will result with dust emissions

below 10 mg/Nm3.

To enable the construction of one of the largest oil and

gas pipelines in the world – the Trans Anatolian Natural Gas Pipeline (TANAP) –

ArcelorMittal is providing 310,000 tonnes of hot rolled coils from its

production site in Bremen, Germany, more than one third of all the hot rolled

coils needed for the TANAP project. It is also the largest order ever placed

with ArcelorMittal Europe – Flat Products, by a company in the oil and gas

industry.

TANAP is a 2000km natural gas pipeline that will cross

Turkey, from the Shah-Deniz field in Azerbaijan to the European border, helping

to secure the supply of energy to Europe.

Construction is expected to be complete by 2018, at a total

cost of around US$7bn. Once complete, the new pipeline will be able to transport

more than 16 billion cubic metres of natural gas a year.

"We have provided steels for the global oil and gas

pipeline industry for more than 30 years. ArcelorMittal has a proven track

record in this field ensuring proximity to the customer and continuous technical

support - in combination with the high quality products provided by our mill in

Bremen", said Stéphane Tondo, chief marketing officer for packaging and energy

pipes at ArcelorMittal Europe - Flat Products.

"This is an exciting and challenging project for us.

Deliveries will start in 2015 and last for two years. It is the largest single

order ever for Bremen - it shows our ability to supply the required high quality

products, and to ensure punctual delivery. It also underlines ArcelorMittal`s

commitment to Bremen", added Dietmar Ringel, CEO of ArcelorMittal Bremen.

The TANAP pipeline will be subject to very high operating

pressures and atmospheric conditions along its route. The latest technologies

have therefore been applied on this project, using ArcelorMittal`s innovative

steel products. The steel used is an X70, high-end grade for pipeline

applications that has a very high thickness - Bremen is one of the few mills in

the world that can make this product.

The Italian government is intervening in the management of

Europe's biggest steel plant, in an attempt to reform the beleaguered business.

A commissioner will be appointed to manage the site in Taranto and could have

the task of preparing its sale.

Ilva, which is a major employer in southern Italy, has

faced criticisms over its environmental record. Toxic emissions from the Ilva

plant have been blamed for unusually high rates of cancer in the area.

Privately-owned by Gruppo Riva, Ilva is Europe's biggest

steel plant in terms of output capacity and employs at least 14,000 people. The

plant has been making a loss for years and was placed in special administration

last year.

The European Commission said in October that the Tamburi

area of the town in particular was contaminated and urged the government to take

action. Italy's Prime Minister Matteo Renzi said that the government would

consider nationalising the plant and selling it on, if a buyer could be found

who promised to protect jobs.

The international steel giant ArcellorMittal has reportedly

expressed an interest in acquiring Ilva.

The plant, owned by the Riva family, was partially closed

in 2012 because of the high levels of pollution.

Hurriyet Daily News reported that Turkey’s Tosyalı Holding

and Japan’s Toyo Kohan held the ground breaking ceremony for a new flat steel

production facility in the southern province of Mersin on January 3, in an

investment worth over USD 500 million.

Some 51% of the huge new facility is owned by Tosyalı

Holding and 49% by Toya Kohan. The facility, which covers an area of 250,000

square meters in the organized industrial zone of the Osmaniye district in

Mersin, is Tosyalı Holding’s 17th such facility, after recent investments in

Montenegro and Algeria. The group aims to create a total of 10,000 jobs over the

next three years.

The production of Turkey’s highest added value flat steel

will start in 20 months.

Tosyalı Holding Chairman Mr Fuat Tosyalı said “Our aim is

to decrease Turkey’s dependency on foreign countries in high tech steel

products. We plan to produce such products with higher added value in Turkey.

We’ll be creating over USD 300 million of additional annual export income to

Turkey after the facility is completed.”

He added that the products made at the facility will

primarily be for the electronic and electrical sectors, followed by the

construction and mechanical sectors.

Tosyalı Holding made exports worth a total of around USD

550 million in 2014 and aims to reach USD 805 million in exports in 2015

McIlvaine Company

Northfield, IL 60093-2743

Tel:

847-784-0012; Fax: 847-784-0061

E-mail: editor@mcilvainecompany.com

Web

site: www.mcilvainecompany.com