Coronavirus Technology Solutions

July 29, 2020

Proactive HVAC Suppliers can Boost Revenues by $60 Billion

Lydall Aiming to Dominate the Mask Filtration Media Market

Johnson Controls is a COVID Solutions Provider with Many Relevant Products and a World Reach

Trane Revenues Down but Could Increase with COVID Initiatives

____________________________________________________________________________

Proactive HVAC Suppliers can Boost Revenues by $60 Billion

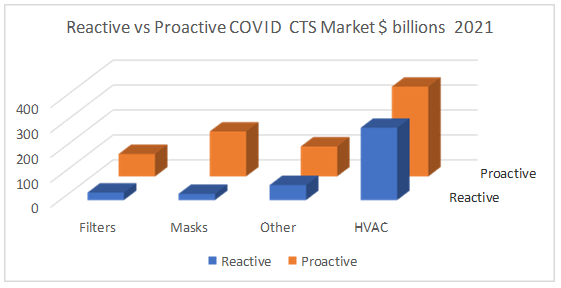

2019 HVAC revenues were $300 billion. 2020 revenues are down due to the impact of COVID. With a reactive HVAC program revenues could slump to $290 billion in 2021. With a proactive program to increase air changes per hour in combination with other techniques revenues would increase to $360 billion in 2021.

It is recommended that homes receive 0.35 air changes per hour (ACH) but not less than 15 cubic feet of air per minute (cfm) per person. Isolation rooms in hospitals utilize 6 air changes per hour. Recommended ACH for malls is 6 to 10 and 4 to 10 for municipal buildings.

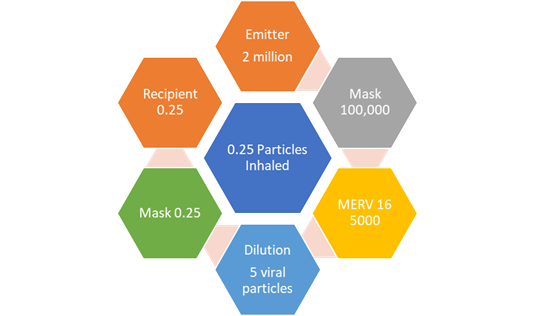

In a mall setting the recommended air changes per hour will be a function of the number of emitters and their viral load, the mask type worn by the emitters, the efficiency of the HVAC filters, the dilution which is a function of air changes per hour, and the masks worn by the recipient. Masks can make a 90% reduction at very low cost. Increasing filter efficiency can result in another 90% reduction. Dilution can cause a 99.9% reduction or more but the cost is very substantial.

Viral Particle Discharge from Sequential Removal Devices

An ACH increase is only effective if the air flow patterns are beneficial. This means ductwork changes and other investments.

The greatest ROI is in the masks. There is a high ROI in the HVAC filter upgrades. Dilution through increasing the ACH is the most expensive. In the above example if the emitter is wearing an N30 mask the virus load entering the HVAC will be 1.4 million. Even with a 95% efficient filter the discharge would be 70,000 viral particles. To reduce that to 5 would require a dilution rate of 14,000 or 14 times as much as if the high efficiency mask is used.

Another consideration is the amount of outdoor air utilized. Some infiltration of outdoor air is needed to keep CO2 levels lower than 1000 ppm and closer to the 480 ppm which is the average for ambient air.

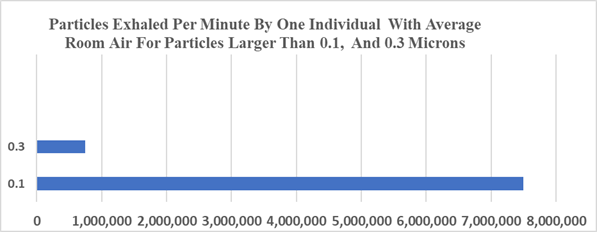

The quality of outdoor air must be considered. An individual will inhale and exhale 7.8 million 0.1 micron or larger particles every minute in standard air. If the equivalent of a MERV 16 filter is installed in the HVAC the individual will inhale a few hundred thousand particles per minute. The loading on the filter will be a function of the particulate concentration in the outdoor air and particulate generated in the space. On the average day in Delhi, India the individual will inhale 178 million particles larger than 0.1 micron each minute.

The COVID load in the outdoor air may not be zero but in most cases it an be assumed to be so low as not to be a consideration.

The ROI for the investment in HVAC should take into account the removal of air pollutants along with COVID. In Beijing, Delhi, and other polluted cities the investment can be justified just on the improvement in air quality.

The temperature and humidity of outdoor air also impact the cost of infiltrating outdoor air. In the summer in the Southern U.S., the cost of treating outside air is substantial.

The 2019 market for HVAC worldwide was $300 billion. A proactive COVID mitigation program could increase sales to $360 billion in 2021 versus $290 billion with a reactive program and a virus which disrupts the economy for several more years.

Lydall Aiming to Dominate the Mask Filtration Media Market

This is the headline in the July 25 Union Leader in regard to the presentation by Lydall CEO Sara Greenstein.

Kimberley Haas, Union Leader correspondent, reported that a company in Rochester NH is positioning itself to be the largest site for meltblown filtration media production in North America and arguably the world.

The media produced at Lydall is a critical layer of N95 respirators and surgical face masks, which health care workers and emergency responders need to protect themselves from COVID-19.

Employees at the Chestnut Hill Road facility worked 60 straight days with no time off to ramp up production of the materials when the virus hit the United States. During a groundbreaking ceremony Friday for two new production lines and a center of excellence, CEO Sara Greenstein personally thanked them and reminded those in attendance of the importance of their work in the midst of a global pandemic.

“Today is a huge day for Lydall. It really represents a turning point for our organization and solidifies our position as the leading media filtration provider in the world,” Greenstein said.

By May 2021, when both new production lines are operational, Lydall will be able to support U.S. production of 140 million N95 respirators, or 540 million surgical masks per month.

It is estimated by health officials that 3.5 billion face masks will be required to fight COVID-19 domestically. Greenstein said having these items produced in the United States is important because countries that typically make personal protective equipment, such as China, may focus primarily on their own citizens during a health crisis.

Geoff Crosby is helping to oversee the expansion and said even if the need for N95 respirators and surgical masks declines in two to three years, they will be working with businesses to ensure their HVAC systems are upgraded with the best levels of protection. Up until recent months, that was their primary focus.

“Our plan now for this through 2025 is pretty much all face masks, but we’re also working on a lot of next-generation stuff so what happens is when face mask demand slips, what are we going to do about HVAC for buildings? How are we going to improve hospital performance? How are we going to improve hotel performance?” Crosby said of the questions their engineers are working to solve.

Crosby said businesses on the national and international level are trying to determine what they need for enhanced filtration to ensure the safety of their patients, customers and students when airborne diseases such as COVID-19 are being spread throughout the population they serve.

Last month, Lydall officials signed a $13.5 million contract with the Department of Defense to support the two new meltblown filtration media production lines.

Johnson Controls is a COVID Solutions Provider with Many Relevant Products and a World Reach

In one of our first CTS Alerts we covered the supply of controls and room air purifiers to provide isolation in a new hospital in Wuhan. Johnson Controls accomplished this in a matter of weeks.

The McIlvaine Coronavirus Solutions is a holistic approach which addresses Johnson Controls strengths such as a building's heating, ventilation, and air conditioning (HVAC) infrastructure. Johnson Controls can help building owners and operators identify strategies to increase outdoor air circulation, filtration options to provide better air quality, optimal temperature settings to slow the flow of airborne pathogens and the use of ultraviolet C (UV-C) lighting solutions to kill viral organisms.

"Keeping people safe and secure in buildings has always been at the heart of our mission for 135 years, and as we look at a fundamental transformation how buildings operate, even the simplest of upgrades to full building retrofits will be important to reduce the transmission of disease," said Mike Ellis, executive vice president and chief digital & customer officer, Johnson Controls. "The new normal means being prepared for the unexpected."

Even before the outbreak of the COVID-19 pandemic, the Johnson Controls annual Energy Efficiency Indicator found a desire by owners and operators to maintain healthy buildings. Although the current economic environment has changed dramatically, as the economy rebounds, owners and operators are expected to make further investments on behalf of the people who live and work in their buildings.

This energy efficiency indicator can be integrated with safety metrics based on increased filter efficiency and air dilution which increase energy use but reduce infection. This is discussed at Program to Make the Best Coronavirus Decisions Should Implemented Now and Then Continuously Improved

Johnson Controls has a range of products and solutions to create healthier air in buildings:

- York Air Handling Units: To reduce airborne pathogens within a building, mixed-air HVAC systems should focus on increasing outdoor air ventilation. York air handling units allow customers to maximize outside air to displace contaminated air and increase ventilation and air change rates.

- Koch® Filters: Effective air filters are intrinsic to a successful infection control plan. Koch's clean air solutions include high efficiency air filters, HEPA filters, and portable HEPA solutions for increased building flexibility.

- Critical Environment Controls: Room pressurization, air change rates, humidity, and temperature are vital components in reducing airborne contaminants and preventing cross contamination within healthcare and laboratory facilities. The Johnson Controls line of Critical Environment Controls includes the broadest suite of products in the industry.

- UV-C Lighting: Disinfectant lighting solutions are necessary to reduce pathogens both on surfaces and in the air. Johnson Controls offers a comprehensive suite of disinfecting lighting products, including retrofit options to keep facility disruptions and installation costs to a minimum.

By integrating HVAC, lighting and security systems into a single digital platform like Johnson Controls Metasys® building automation system, building owners and operators can easily troubleshoot issues and implement system changes.

This automation system can be augmented with software such as discussed in the McIlvaine UCSD and qlAir interviews to meet the safety goals with minimum cost.

Johnson Controls has seen about a 50% increase in the demand for its air sensors as COVID-19 response efforts continue in the health care industry, according to the company's general manager controls specialty products Tyler Smith.

“Room pressurization, air change rates, humidity, and temperature all play an integral role in mitigating airborne contaminants to provide a healing space for patients while also providing a high level of protection for health care personnel.”

Johnson Controls acquired Triatek’s assets in 2018. Triatek® provides airflow solutions for critical environments such as healthcare facilities and laboratories, where rigorous air quality requirements take place.

The strategic move adds to Johnson Control’s portfolio a wide range of airflow control systems and allows the company to offer critical spaces HVAC solutions from beginning to end, according to Smith.

Environments where critical treatments or research are conducted, like healthcare facilities and laboratories, need to meet stringent air quality requirements,” said Smith. “With the acquisition of the Triatek portfolio we are able to bundle Triatek products with our current building automation and HVAC products and services to provide complete end-to-end solutions for critical spaces.”

Triatek CEO Jim Hall (left) with Tyler Smith of Johnson Controls

The Triatek product line includes air valves, fume hood controls, and room pressure controllers, in addition to the FlowSafe® line of fume hoods and fume hood retrofit solutions. All products are designed to seamlessly integrate into a facility’s building automation system, helping to increase energy efficiency, minimize utility costs, improve ease of maintenance, and enhance the overall safety of critical environments.

Trane Revenues Down but Could Increase with COVID Initiatives

“The COVID-19 pandemic continues to present the world with complex challenges and great uncertainty as we move through 2020," said Mike Lamach, chairman and chief executive officer.

“Our experienced leadership team is strategically and decisively executing our recession playbook through this crisis, with agility and care for our people and customers and with a focus on emerging an even stronger pure play climate control company. Despite continued challenging end markets, strong execution by our global teams in the second quarter enabled us to continue our stranded cost reduction and transformation-related margin improvement programs while maintaining high levels of business reinvestment for the future. At the same time, we outperformed our end market conditions and effectively managed deleverage within our gross margin target levels.”

Lamach continued, “We continue to serve customer needs with the latest technologies for indoor air quality, energy management and precision temperature control for safe movement of food, medicines and vaccines. Looking forward, we remain in an exceptionally strong financial position, which enables us to continue to play offense through the downturn by investing heavily in our people and in accretive investment opportunities. This will further strengthen Trane Technologies and our ability to compete, to win and to thrive both today and as business conditions improve and new market opportunities arise.”

Playing offense can be interpreted by McIlvaine as taking the proactive approach which is discussed in an earlier article in this Alert. Here are 2nd quarter highlights.

· The continuing effects of the COVID-19 pandemic impacted global bookings and revenue growth in the quarter.

· Enterprise reported and organic bookings were both down 7 percent.

· Enterprise reported and organic revenues were both down 13 percent.

· GAAP operating margin was down 220 basis points, adjusted operating margin was down 100 basis points, and adjusted EBITDA margin was down 80 basis points. Enterprise deleverage was approximately 23 percent.

Americas Segment:

|

$, millions |

Q2 2020 |

Q2 2019 |

Y-O-Y Change |

Organic Y-O-Y Change |

|

Bookings |

$2,559 |

$2,701 |

(5)% |

(5)% |

|

Net Revenues |

$2,456 |

$2,834 |

(13)% |

(13)% |

|

GAAP Operating Income |

$413.3 |

$503.8 |

(18)% |

|

|

GAAP Operating Margin |

16.8% |

17.8% |

(100 bps) |

|

|

Adjusted Operating Income |

$419.1 |

$513.3 |

(18)% |

|

|

Adjusted Operating Margin |

17.1% |

18.1% |

(100 bps) |

|

|

Adjusted EBITDA |

$470.5 |

$560.6 |

(16)% |

|

|

Adjusted EBITDA Margin |

19.2% |

19.8% |

(60 bps) |

· Americas was heavily impacted by the COVID-19 pandemic in the second quarter.

· Americas reported and organic bookings were both down 5 percent.

· Reported and organic revenues were both down 13 percent. Commercial HVAC organic revenues were down mid-single digits. Residential HVAC distributor sell-through was down mid-single digits. Transport revenues were down more than 40 percent.

· Despite COVID-19 pandemic-related building closures and reduced building occupancy, service revenues declined at a slower pace than equipment.

· GAAP operating margin declined 100 basis points, adjusted operating margin declined 100 basis points and adjusted EBITDA margin declined 60 basis points. Strong execution and productivity partially offset COVID-19 pandemic-related inefficiencies to deleverage within gross margins on lower revenues and mix shift from Transport to Commercial.

Europe, Middle East and Africa (EMEA) Segment:

|

$, millions |

Q2 2020 |

Q2 2019 |

Y-O-Y Change |

Organic Y-O-Y Change |

|

Bookings |

$377 |

$483 |

(22)% |

(20)% |

|

Net Revenues |

$373 |

$449 |

(17)% |

(15)% |

|

GAAP Operating Income |

$42.4 |

$62.3 |

(32)% |

|

|

GAAP Operating Margin |

11.4% |

13.9% |

(250 bps) |

|

|

Adjusted Operating Income |

$48.3 |

$64.6 |

(25)% |

|

|

Adjusted Operating Margin |

12.9% |

14.4% |

(150 bps) |

|

|

Adjusted EBITDA |

$59.3 |

$69.4 |

(15)% |

|

|

Adjusted EBITDA Margin |

15.9% |

15.4% |

50 bps |

· EMEA was heavily impacted by the COVID-19 pandemic in the second quarter.

· EMEA reported bookings were down 22 percent and organic bookings were down 20 percent.

· Reported revenue was down 17 percent and organic revenue was down 15 percent. Commercial HVAC organic revenues were down high-single digits and Transport revenues were down more than 20 percent.

· Despite COVID-19 pandemic-related building lockdowns, service revenues declined at a slower pace than equipment.

· GAAP operating margin declined 250 basis points, adjusted operating margin declined 150 basis points and adjusted EBITDA margin improved 50 basis points. Strong execution and productivity partially offset COVID-19 pandemic-related inefficiencies to deleverage within gross margins on lower revenues and mix shift from Transport to Commercial.

Asia Pacific Segment:

|

$, millions |

Q2 2020 |

Q2 2019 |

Y-O-Y Change |

Organic Y-O-Y Change |

|

Bookings |

$333 |

$349 |

(5)% |

(2)% |

|

Net Revenues |

$309 |

$335 |

(8)% |

(5)% |

|

GAAP Operating Income |

$52.9 |

$47.4 |

12% |

|

|

GAAP Operating Margin |

17.1% |

14.2% |

290 bps |

|

|

Adjusted Operating Income |

$54.3 |

$49.0 |

11% |

|

|

Adjusted Operating Margin |

17.6% |

14.6% |

300 bps |

|

|

Adjusted EBITDA |

$60.1 |

$54.0 |

11% |

|

|

Adjusted EBITDA Margin |

19.4% |

16.1% |

330 bps |

· Asia Pacific was heavily impacted by the COVID-19 pandemic in the quarter.

· Asia Pacific reported bookings were down 5 percent and organic bookings were down 2 percent.

· Reported revenue was down 8 percent and organic revenue was down 5 percent as revenue growth in China was more than offset by revenue declines in the rest of Asia.

· GAAP operating margin improved 290 basis points, adjusted operating margin improved 300 basis points and adjusted EBITDA margin improved 330 basis points. Strong execution and productivity offset COVID-19 pandemic-related inefficiencies to expand margins in the quarter.