Coronavirus Technology Solutions

April 17, 2020

Millions of People

in Food Manufacturing and Distribution will Need

COVID Protection

Weld County Health

Officials Shut Down the JBS plant in Colorado

but Kentucky Plant Remains in Operation

China to Build New

Meat Processing Plants with Coronavirus

Protection

Billion Dollar Meat Processing Virus Mitigation

Market

Pandemic Impact on the Filter and Mask Market

____________________________________________________

Millions of People

in Food Manufacturing and Distribution will Need

COVID Protection

Twenty-one million people work in the U.S. food

chain.

Human labor is a central component at every step

of the chain, which includes production,

processing, distribution, retail, and service.

Food workers include laborers in fields and

fisheries (production), bakers and

slaughterhouse workers (processing), drivers and

warehouse workers (distribution), grocery store

cashiers and stockers (retail), and restaurant

servers, cooks, dishwashers, and street vendors

(service). While some of these workers routinely

interact with consumers, many of them—and their

job site conditions—remain hidden, whether in

remote agricultural fields, behind the closed

doors of processing facilities, or in the back

of restaurants and retail stores.

Animal slaughtering and processing employs over

500,000 in the U.S. of which there are 331,000

production workers.

|

Occupation |

Number |

|

16,430 |

|

|

Assemblers and Fabricators |

3,430 |

|

Assemblers and Fabricators, All Other, Including Team Assemblers |

3,350 |

|

Food Processing Workers |

227,900 |

|

Butchers and Other Meat, Poultry, and Fish Processing Workers |

196,350 |

|

8,570 |

|

|

117,970 |

|

|

69,810 |

|

|

Miscellaneous Food Processing Workers |

|

|

Food and Tobacco Roasting, Baking, and Drying Machine Operators and Tenders |

2,290 |

|

7,990 |

|

|

6,450 |

Weld County Health

Officials Shut Down the JBS plant in Colorado

but Kentucky Plant Remains in Operation

"While the Greeley beef facility is critical to

the U.S. food supply and local producers, the

continued spread of coronavirus in Weld County

requires decisive action," said Andre Nogueira,

the U.S. CEO of JBS: "As a leading member of

this community, we believe we must do our part

to support our local health professionals and

first responders leading the fight against

coronavirus."

The company closed its plant in Pennsylvania

last week because management employees there

were showing flu-like symptoms, according to a

company spokesperson.

State and Weld County health departments said

that reopening the plant depends on a testing

program must include a symptom and exposure

screening as well as ongoing testing and

monitoring for employees that test negative.

About 3,400 people work at the meat packing

plant, which is considered an essential business

under Colorado’s stay-at-home order because it

is part of the food supply chain. A variety of

measures were taken at the plant to protect

workers, said Tim Schellpeper, president of

JBS’s Fed Beef division. He said the plant had

increased cleaning crews and sanitation,

screened workers for elevated temperatures, put

up dividers on cafeteria tables so workers are

separated into individual eating stations,

provided some employees with face masks or

shields, and encouraged social distancing by

staggering breaks and increasing the space

available for breaks, among other precautions.

The plant in Louisville, KY continues to operate

with extensive sanitation procedures plus

staggered breaks and other means for social

distancing.

Officials say they are also requiring employees

to have their temperatures checked using

hands-free thermometers and thermal imaging

technology before entering the plant.

China to Build New

Meat Processing Plants with Coronavirus

Protection

China is likely to restructure its meat

production and distribution system by doing away

with smaller producers in favor of large-scale

animal farming once the coronavirus outbreak

recedes, according to analysts at Jefferies.

Producers of plant-based meat substitutes could

benefit too, it said.

The government is approaching some meat

importers and offering them the opportunity to

set up state-of-the-art meat and animal

processing factories on the mainland, the

analysts said in the February 10 report, citing

sources. It is also bringing in specialists in

setting up meat processing production lines to

advise on international best practices for food

safety, the report added.

“We expect that in the wake of recent issues,

the government will make further announcements

ending, once and for all, the practice of

butchering animals in cities/markets,” its Hong

Kong-based analysts wrote. This will put protein

production “in the hands of large corporations

and SOEs.”

The thinking follows a series of health scares

that have plagued the nation’s meat supply and

security, with the latest coronavirus epidemic

adding to recent outbreaks of African Swine

Fever and Avian Flu. Five Chinese provinces have

temporarily closed live poultry trading and

slaughtering locations, according to Jefferies,

while the swine fever has forced the government

to cull most of its hog herd in 2019, stoking

inflation.

“We believe that the current senior party

officials do not want this to be seen as their

legacy,” according to the Jefferies report.

Jefferies said large corporations and

state-owned enterprises such as WH Group, Wens,

Muyuan and COFCO, would be the chief

beneficiaries of the plan. The shift is also

likely to quicken the acceptance of plant-based

protein, Jefferies said. That has a big

implication for Hong Kong, which imported all of

its fresh pork and 94 per cent of its fresh beef

from mainland China.

Billion Dollar Meat Processing Virus Mitigation

Market

Meat processing plants have been deemed

essential and yet much of the production has

been terminated due to the coronavirus. There is

a need to introduce the latest and best

mitigation technologies to help these plants

resume operations.

McIlvaine Company has a program to help

suppliers and purchasers select the best

products and services for safe but cost

effective operations.

The global meat market was slated to pass the

trillion dollar sales level this year but

revenues will be down due to the virus. Meat

companies could justify spending 0.1% ($1

billion) to 1%

($10 billion) of the revenues annually to

insure that workers are safe and production

continues. An initial capital investment of $20

billion or more with a 20 year depreciation

period can be justified.

The U.S. market exceeds $200 billion/yr

justifying an initial investment of $4 billion

and annual expenses of $200 million to $2

billion per year to provide an alternative to

periodic lockdowns.

To put the potential into perspective with other

opportunities, there are 3.8 million nurses in

the U.S and 19 million worldwide. Twenty-one

million people work in the U.S food chain or

seven times the number of nurses.

Over 500,000 people work in the animal

slaughtering and processing industry in the U.S.

331,000 are in production.

The top 100 U.S. based meat processing

companies employ more than 500,000 people but

many are not in the plants. Nevertheless office

workers will need to be protected as well.

|

Top 5 U.S. Based Meat Processing Companies |

|||

|

Company |

Sales $ billions |

Plants |

Employees |

|

JBS |

38 |

44 |

73,000 |

|

Tyson |

38 |

111 |

122,000 |

|

Cargill |

20 |

36 |

28,000 |

|

SYSCO |

16 |

17 |

1,200 |

|

Smithfield |

15 |

50 |

60,000 |

These processors have been deemed essential and

have continued to operate.

However many of the plants are now

temporarily closed due to COVID-19 outbreaks.

Over 600

workers at the Smithfield plant in South Dakota

have contracted the virus. Crowded locker and

lunchrooms allowed widespread transmission.

The industry is facing a huge problem but has

the opportunity to be proactive and not only

allow safe working conditions for employees but

to reduce risk of product contamination. An

additional benefit is to improve product

quality. Studies have shown that cleaner

environments can result in the extension of pork

shelf life by 12 days. Here are some of the

mitigation technologies which can be employed.

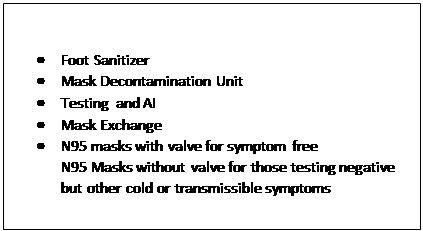

Plant

Entrance

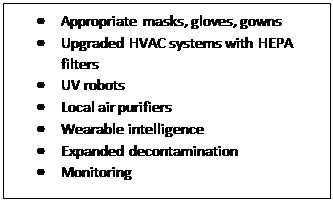

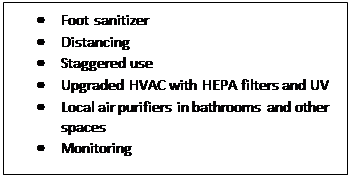

Plant

Offices, Lunch and Locker Rooms

Suppliers should keep in mind that there are

many new technologies which will find widespread

use. Nanofiber membranes offer higher efficiency

and comfort in masks.

Robots can monitor conditions as they

move throughout the plant. Viruses have been

proven to be transmitted by shoe soles. So there

are now foot sanitizers.

Suppliers will not only have to deal with new

technologies offered by their competitors but to

international competition. China has decided

that it must modernize and revamp the meat

processing industry. It is offering incentives

to develop improved and safer processing

solutions.

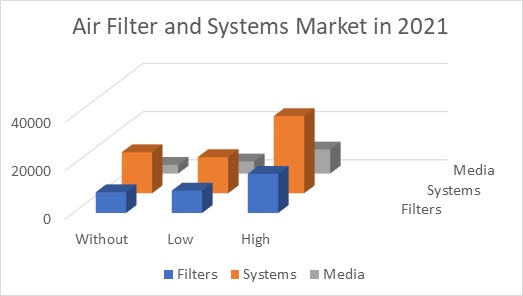

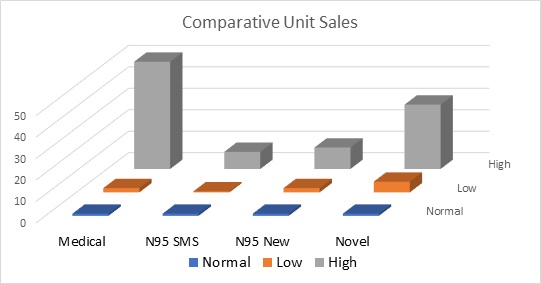

Pandemic Impact on the Filter and Mask Market

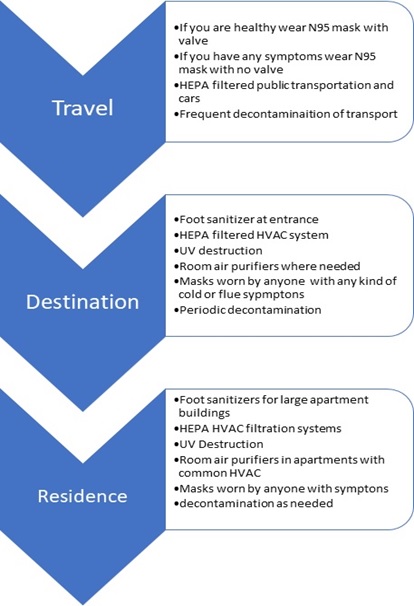

The world needs to address the pandemic with a

solution which is safe but allows near normal

functioning of business and society. McIlvaine

believes that using the latest cleanroom and

hospital mitigation technologies this Distancing

and Sheltering Alternative can be safely cost

effective.

The extent to which it will be employed has

major implications for the filter and mask

markets. It could triple the media market and

double the filter equipment sales.

The potential to change the mask market is even

greater. In any case the market will be much

larger. In addition meltblown media may be

largely replaced with new washable and more

efficient nanofiber membranes. New mask

designs built around a permanent washable

structure with replaceable filtration media

inserts could capture market share.

The distancing and sheltering alternative

involves the following technologies in

combinations in which optimize the life quality

costs. Each technology will be used to the

extent that benefits outweigh the costs

Air Filters and Systems: Here are some factors

which will determine whether the air filter

market boost will be modest or very large

·

The ability of viruses to travel long distances

including through HVAC systems

·

The ability of HEPA filters to capture the

COVID-19 viruses

·

Percentage of world population who will contract

the disease

·

The ability of the virus to reappear in areas

previously impacted

·

Willingness of governments to support the

investment in filtration systems to address the

problem

·

Coordination in a proactive program which

combines air filtration technology with personal

protective equipment and operating practices

·

Acceptance of a common metric to measure the

life quality impacts as well as economic costs

of alternative strategies (McIlvaine has

prepared analyses based on Quality Enhanced Life

Days)

·

Education of governments, industries, and

individuals relative to the science and impacts

Masks: The market for face masks will soar over

the next few years. Suppliers need to

continually seek answers to the following

questions.

·

How big will the market be in the short term?

·

Will demand drop when a coronavirus vaccine is

in wide use?

·

How much will people pay for a mask?

·

What will be the ratio of masks to protect

wearers vs the public or both?

·

What will be the ratio of disposable vs

reusable?

·

What materials are most compatible with various

decontamination methods?

·

What will be the role of nanofibers and other

materials to compete with spunbond, meltblown

laminates?

·

What will be the market segmentation between do

it yourself, medical masks, surgical masks, N95,

N95 medical, elastomeric reusable, novel

designs?

Geography: There are separate analyses which

need to be applied to each country

·

Projected infection rate

·

Population

·

Mitigation Policies

·

Existing healthcare and business structure

·

GDP and ability to undertake an effective

program

Associated Technologies: A number of associated

technologies will shape the market.

·

Masks can be decontaminated and reused

o

What are the economics of H2O2 vs alcohol, vs

ozone, UV, heat etc.?

o

What is the existing equipment which can be

used?

o

What is the cost of new equipment?

·

Rooms and HVAC systems can be treated with UV

light

Competition: A number of competitive factors

will shape the market for the individual

suppliers

·

Regional demand fluctuation. The large surge of

mask demand and production in China will have

implications for the worldwide market

·

Innovative technology:

o

The use of membranes in filters and masks is

likely to greatly influence the markets.

o

There are major developments in filter and mask

designs