WATER & WASTEWATER TREATMENT CHEMICALS WORLD

MARKET UPDATE

March 2019

McIlvaine Company

Forecasting the Most Profitable Market - Kemira

Example

The McIlvaine Water & Wastewater Treatment

Chemicals: World Markets forecasts a market

of $30 billion next year of which municipal

wastewater is $5 billion. Pulp and Paper and Oil

& Gas forecasts are more modest. They exclude

some of the products supplied by the treatment

chemical companies but which involve processes

and not typical water treatment. This

continuously updated report with 50,000

forecasts is arguably the best source for a

multi-client estimate of the Total Available

Market (TAM). However this should be only the

starting point in preparation of the Most

Profitable Market (MPM). This is the market

which will yield the biggest profit given the

supplier’s capabilities. For more details on the

program Click

Here

This market is impacted by new developments such

as proppants for hydraulic fracking. It is

impacted by product quality and cost. An

important element is validation of a lower total

cost of ownership (LTCOV) in the minds of

purchasers. Kemira will be used as an example of

how to create the MPM. Two of the most

challenging aspects are to

1.

Accurately assess the large new opportunities

e.g. phosphorous removal, hydraulic fracturing

and total solutions

2.

Create a validation path which is economically

effective

Kemira Assessment

Kemira sales in 2018 were € 2.6 billion. EBITA

was € 323 million for a margin of 12.5%. Net

profit was € 95 million. 41% of the sales were

outside pulp and paper but the other 59% were in

pulp and paper. Some of the largest customers

are municipalities such as Shanghai, Paris,

London and New York. Other major customers are

oil field suppliers such as Haliburton and

Schlumberger. International Paper is also a

customer.

Kemira expects increased demand in water

treatment chemicals due to water reuse and

phosphorous recovery from wastewater. Revenue

growth has averaged 3% over the last 5 years

while the EBITA CAGR has been above 5%.

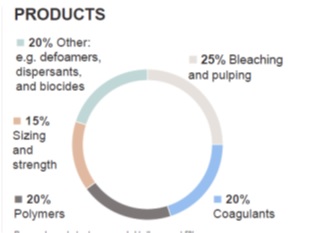

Five products each account for more than 15% of

revenue.

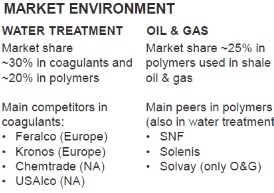

Kemira has large market shares in both water

treatment and oil and gas.

It estimates its pulp and paper market share at

16%. This puts it in second place behind

Solenis. Kemira is looking to the oil and gas

market including shale and EOR to be a

contributor to profitability improvement. It is

expanding polymer capacity in the U.S. A

Chemical Enhanced Oil Recovery (CEOR) polymer

expansion is underway in the Netherlands with a

start up in the second half of 2019. Shale

fracking accounts for 65 % of the oil and gas

revenues with 20% in oil sands and CEOR.

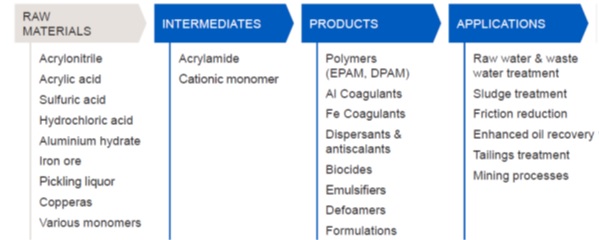

The raw materials, intermediates, products and

end uses are shown below.

Opportunity #1 Hydraulic Fracking

In Hydraulic Fracturing Markets McIlvaine is

predicting a big change to the previous

forecasts for treatment chemicals. ExxonMobil

and Chevron are planning to invest heavily in

shale fracturing. The result will be twice the

chemical consumption which was derived from IEA

and OPEC forecasts. U.S. liquids production will

reach 25 million b/d in 2025 in the new

scenario. There is reason to believe that

polymer chemical investment per barrel will also

rise. Since Kemira is targeting this market it

will be critical to make detailed assessments of

the purchases in the U.S. and also in the

developing markets such as Argentina. The

Hydraulic Fracturing Market report Hydraulic

Fracturing MPM and N026

Water and Wastewater Treatment Chemicals: World

Market plus

day to day coverage in N049

Oil, Gas, Shale and Refining Markets and

Projects will

provide insights to make this forecast more

accurate.

Opportunity 2 Total Solutions

Kemira KemConnectTM gives full

visibility to chemistry applications, 24/7.

Because it constantly gathers data it supplies

up-to-date insights needed for better decision

making, faster troubleshooting, smarter chemical

management, and improved cost efficiency.

Kemira’s has provided a remote plant operation

solution to Nestlé Puljonki. This food

manufacturer in Finland uses a dissolved air

flotation process to pre-treat the wastewater

from production before it is passed on for

further treatment at the on-site plant. The

sludge generated by the treatment process is

dried in a screw press.

In January 2018 Kemira assumed responsibility

for managing the wastewater treatment plant,

while the customer was responsible for operation

and monitoring with support from Kemira experts.

After planning and implementing upgrades to the

plant automation, the groundwork was in place

for Kemira to assume full responsibility for the

remote management of the wastewater treatment

process at Nestlé Puljonki.

For a fixed monthly fee, Kemira takes care of

all aspects relating to the operation,

management, and support of the wastewater

treatment process through the Kemira Operon

turnkey service concept, which is based on

specific key performance indicators agreed

together with the customer. Using Kemira’s

KemConnect platform, all relevant performance

parameters at the plant can be monitored in real

time by experts at Kemira’s Lapinlahti control

center over 150 kilometers away.

Kemira has the potential to generate billions of

dollar in revenues with this total solutions

approach. More importantly it could double

EBITA. This opportunity including recorded

webinars with Kemira and other chemicals

companies is covered in N031

Industrial IOT and Remote O&M.

The webinar with a presentation by Kemira and

other chemical producers is available at https://www.youtube.com/watch?v=YD5C93c6ujw&feature=youtu.be

Opportunity # 3 Phosphorous Removal

Struvite formation is a common challenge for

wastewater treatment plants that utilize

anaerobic sludge digestion. At the Miami-Dade

plant, heavy struvite build-up had continued for

years and it was starting to cost them more time

and money. It impeded their dewatering operation

and forced them to clean their systems on a

weekly basis. This was time-consuming, resource

hungry, and caused unnecessary downtime. Worse,

the struvite was also damaging their

centrifuges, leading to frequent repairs and yet

more downtime.

Their approach was not only to apply the right

chemical but to work with the customer for a

complete value-adding solution,” explains

Tafadzwa “Tee” Mariga, Application Manager at

Kemira. Kemira’s team recognized quickly that

the amount of ortho-phosphorus in the sludge

needed to be decreased. Utilizing wastewater

treatment expertise, the right solution was

identified through laboratory testing.

The solution was based on Kemira’s enhanced

solids management program, powered by

KemConnect™ real-time process monitoring and

performance optimization.

McIlvaine tracks the individual wastewater plant

activity in 62EI

North American Municipal Wastewater Treatment

Facilities and People Database which

is being expanded for international coverage.

This information provides a detailed bottoms up

market assessment as well as a vehicle to

validate the lowest total cost of ownership by

Kemira or a competitor.

Creating a Validation Path which is Economically

Effective

The Most Profitable Market only includes real

revenue opportunities. This means not only

creating products with lowest total cost of

ownership but continually validating their

superiority. This validation in turn requires

evidence and a way to organize the evidence and

communicate it to the purchaser. The McIlvaine

thesis is that there is enough evidence

available from on line sources and it can be

readily organized to provide the validation. As

an example McIlvaine selected the “struvite”

subject and used the WEFTEC conference last fall

to show that an attendee armed with the

available evidence could attend the show and

make decisions at a very high level. The

approach was chronicled in Municipal

Wastewater Services.

An update was sent to potential attendees with

the struvite focus Municipal

Wastewater Treatment Update.

This update linked to many articles already

available on line about struvite from specific

exhibitors including consultants, separation and

pump companies. It identified available articles

on struvite from each of the publishers who was

exhibiting. It included abstracts of speeches to

be given at WEFTEC. Phosphorous recovery is an

option being pursued by some plants. So this

impacts the market for chemicals. The extent of

struvite problems with pumps and centrifuges

helps quantify the value of a chemical to solve

the problem.

So just gathering the evidence available at one

event demonstrates how a company such Kemira can

validate a LTCO product.

The Most Profitable Market forecast can be the

foundation of the business program. The MPM

includes the impact of R&D and product

improvement to lower cost of ownership. It

includes the intelligence from the sales

department on competitor designs and market

share. It can be used to set realistic targets

for regional sales directors and even the local

salesmen. Since these chemicals are continuously

consumed, the purchases at each plant can be

predicted. The program is a systematic route to

maximize profits.

Frac Sand Plants will spend more than

$45 million for Flocculants by 2025

Frac sand plants around the world will increase

their flocculant consumption over the next five

years. Presently 90 percent of the $17 million

spent on flocculants is by U.S. based plants.

U.S plants will double their purchases by 2025

and other regions will spend more than $9

million.

The two most common flocculants

are polyacrylamide and

polydimethyldiallyammonium chloride

(polyDADMAC). Although other types of

flocculants are in use, these chemicals

currently make up a majority of the flocculant

use. Polyacrylamide anionic flocculants are

commonly used to enhance settling of solids in

the clarifier associated with the wet plant.

PolyDADMAC cationic coagulants are commonly used

to enhance the performance of the belt press

associated with wash plants.

There is the need to recycle water in the

Permian basin where water is scarce. The

growing markets in China and other countries are

also in areas of water scarcity. There are

increasing quantities of sand used per gallon of

oil recovered. Furthermore the cost of

extracting oil from shale is proving to be the

lowest cost option. Chevron, ExxonMobil and

other major gas and oil companies are greatly

increasing their shale investments. Argentina is

in the early stages of shale development. Saudi

Arabia is looking to shale to supply gas. This

gas will be used in power plants and will

replace the oil presently used.

Chemical

Displays at OTC

A number of chemicals will be exhibited May 6-9

at the Offshore Technology Conference.

There will be 2000 exhibiting Companies

representing 40+ countries (including divisions

and subsidiaries) and 23 international

pavilions. Exhibit net square feet is 500,000+

sq. ft., including outdoor exhibits. Attendance

is expected to be 60,000+

representing 100+ countries (includes

exhibit personnel). There will be

350+ technical presentations, 22 topical

breakfast and luncheons, and 11 panel sessions.

Gumpro Drilling Fluids

is a manufacturer of specialty drilling fluids

based in India, offers various Drilling and

completion Fluids for Water and Oil Based Mud

systems. Gumpro also provides mud testing

equipment and Lab Housing for sale and lease.

Gumpro has ISO certified R & D Centre which

provides services to the industry for R & D and

QA.

India

http://www.gumprodf.com

Jiahua American LLC,

Yorker chemicals is a global company providing a

broad range of high-quality and innovative

chemicals to meet technical challenges in

drilling, cementing, stimulation, production and

EOR applications. Yorker chemicals (US

subsidiary of Jiahua Chemical Inc.) has a strong

and state of the art manufacturing base in

China, Vietnam, and USA to produce more than

720,000 MT of chemicals.

United

States

http://www.yorkerchem.com

Landoil Chemical Group

is a professional manufacturer of Polyanionic

Cellulose (PAC) and Carboxymethyl Cellulose

(CMC), focusing on drilling fluid & drilling

mud. As a

leading enterprise in the cellulose industry,

with unique advantages and excellent

performances (low filtration, high viscosity,

etc.) products are certified by

API 13A and ISO9001. PAC LV, PAC R, PAC

HV, CMC HV, CMC LV.

China

http://www.landoilchem.com

Qingdao Green Chemicals Co., Ltd.,

is a manufacturer and supplier of drilling

fluids, cementing, frac materials for oil & gas

in China. Being the strategic supplier of

Halliburton, MI-Swaco, Baker Hughes,

Weatherford, Scomi for more than 9 years, they

can supply best quality, prompt shipment,

competitive price, and professional service.

China

http://www.grchem.com

Qinhuangdao Jinjia Petrochemical Co., Ltd

is a high and new-tech integration enterprise of

science, industry and trade, which was

established in 2001 in Qinhuangdao city, with

floor area of 50,000 square meters. Focusing on

Friction Reducer Powder and Emulsion.

China

http://www.jinjia-petrochemaical.com

Sahara Chemical Solutions SCS,

SAPESCO provides a broad range of high-quality

chemicals to help operator and service companies

meet technical challenges. Providing full scale

of chemical solutions including laboratory

testing and site implementation. Supporting

operators and service companies to keep up with

the industry's overall drive for optimum

efficiency and productivity.

Egypt

http://www.sapesco.com

Shandong Ruihai Mishan Chemical Co., Ltd.,

introducing themselves as chemical group company

since 2006 in China with the registered capital

of CNY 100 million. The company assets are more

than CNY 300 million, and annual sales reached

CNY 700 million in 2018. The company is

specialized in research and develop of

acrylamide series chemicals.

China

http://www.mxchem.cn

Shanghai Smart Chemicals Co., Ltd.,

established in 1991, Shanghai Smart Chemicals

Co. Ltd is a specialized supplier in China for

oilfield chemicals. Products include drilling,

cementing, acidizing, fracturing, stimulation

chemicals etc. Their plants and research center

can offer customized solutions at your special

request, which enables us an effective solution

designer.

China

http://WWW.HEBEISMART.COM

Shenzhen Esun Industrial Co., Ltd,

established in 2002, Shenzhen Esun Industrial

Co., Ltd is a high-tech enterprise dedicated to

industrialization of environmentally friendly

material, specializing in R&D of Biomaterials,

green solvent. ESUN is a leading manufacturer of

polycaprolactone and polycaprolactone polyol in

China. Main polyurethane raw materials are:

polycaprolactone polyol, polylactide polyol and

bio-solvent.

China

http://www.brightcn.net

Solvay

offers the largest

selection of high-performance polymers and

composite materials with outstanding chemical

resistance, retention of mechanical properties

and very low permeation. Products include PEEK,

PPS and fluoropolymers for fluid/gas transport

and anti-corrosion coatings, fluoroelastomers

for seals, and fluorinated fluids for drilling

operations, as well as UD CF reinforced tapes.

United States

http://www.Solvay.com

Zhongke Bosson (Beijing) Technology Co. Ltd.

an integrated solution provider of oil field

chemicals. The service package covers drilling

fluid slurry and cementing slurry system

building and evaluation; High waxy crude oil

transportation scheme optimization; Chemical

products supply.

China

http://WWW.BOSSONOIL.COM

PTQ Quarterly Advertising 3rd quarter

2018 includes water chemical ads

17 advertisers displayed a range of combust,

flow, and treat products covering 18.5 pages of

text.

|

PTQ Q3 (Jul, Aug Sept) 2018 Advertising |

||||

|

Company |

Pages |

Subject |

Service |

|

|

AMETEK Grabner |

0.5 |

On Line Sulfur Analysis |

IIoT |

|

|

Aqseptence |

1.0 |

Johnson Screens |

Liquid Filtration |

|

|

DuPont |

1.0 |

Scrubbers, desulfurization |

Scrubber/Adsorber |

|

|

DeLoach |

1.0 |

Scrubbers, Pumps |

Scrubbers, Pumps, Liquid Filtration |

|

|

Honeywell UOP |

3.0 |

Integrated Solutions |

IIoT |

|

|

John Zink |

1.0 |

Combustion Systems |

Thermal/Catalytic |

|

|

Jonell Nowata |

1.0 |

Filter Elements |

Liquid Filtration |

|

|

Kurita |

1.0 |

Chemicals, Wastewater Treatment |

Chemicals, Liquid Filtration |

|

|

LumaSense |

1.0 |

Flare Stack Monitoring |

IIoT |

|

|

Magnetrol |

2.0 |

Level control |

IIoT |

|

|

Metso |

1.0 |

Valves |

Valves |

|

|

Nalco |

1.0 |

Chemicals |

Chemicals, Liquid Filtration |

|

|

OHL Valves |

0.5 |

Valves |

Valves |

|

|

Prognost |

1.0 |

Monitoring |

IIoT |

|

|

Sulzer |

1.0 |

Scrubbers |

Scrubbers |

|

|

Weka |

0.5 |

Level Measurement |

IIoT |

|

|

Zwick |

1.0 |

Valves |

Valves |

|