Oil, Gas, Refining, Monthly Analysis for CFT

Suppliers

June 2019

This monthly analysis is included in the Oil,

Gas, Shale, Refining report.

The projects segment is updated daily.

There is a summary and links to more

comprehensive data.

The additions for the month are included

below following the Overview

Overview

LNG is a Most Profitable Market for CFT

Suppliers

Combust, flow, and treat (CFT) products are

important components in liquefaction of natural

gas, the transport of those liquids by ship or

land and their regasification prior to use. It

is desirable for a CFT supplier to assess this

opportunity based on the basis of the profit

which can be obtained by pursuing it. This Most

Profitable Market (MPM) can be defined as the

market which yields the highest profit given the

resources available.

The LNG market creates high profit opportunities

for CFT companies due to

·

High growth

·

Challenging applications

·

Relative few decision makers

·

Purchaser desire to buy based on lowest total

cost of ownership

·

Ability to validate lowest total cost of

ownership

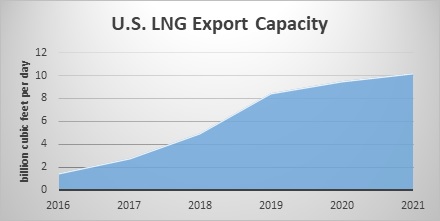

High Growth:

High growth markets have less competition and a

bigger profit opportunity. LNG will be

experiencing rapid growth. Over the next few

years the U.S. will lead in liquefaction

construction. Regasification facilities will be

constructed in many countries. LNG represents

just under 10 percent of the global gas supply.

LNG continues to be the fastest-growing gas

supply source. The expected world compound

annual growth rate is 4 percent a year between

now and 2035. However growth in the next 5 years

will exceed 7 percent.

2018 liquefaction capacity was 370 million tons

per annum (mtpa). 875 mtpa of new liquefaction

capacity is proposed. 92 mtpa is under

construction. Global regasification capacity is

851 mtpa. There are 478 LNG vessels with more

than 20 new vessels per year being commissioned.

In 2023 Australian capacity will exceed 80 mtpa

compared to 100 mtpa in Qatar and 65 million

mtpa in the U.S. The U.S. will experience the

fastest growth from a base of 20 mtpa in 2017.

|

Name |

Location |

Completed |

|

Sabine Pass 1 |

Louisiana |

2016 |

|

Sabine Pass 2 |

Louisiana |

2016 |

|

Sabine Pass 3 |

Louisiana |

2017 |

|

Sabine Pass 4 |

Louisiana |

2017 |

|

Cove Point |

Maryland |

2018 |

|

Sabine Pass 5 |

Louisiana |

2018 |

|

Corpus Christi 1 |

Texas |

2018 |

|

Cameron 1 |

Louisiana |

2019 |

|

Elba Island 1-6 |

Georgia |

2019 |

|

Cameron 2 |

Louisiana |

2019 |

|

Freeport 1 |

Texas |

2019 |

|

Corpus Christi 2 |

Texas |

2019 |

|

Elba Island 7-10 |

Georgia |

2019 |

|

Freeport 2 |

Texas |

2019 |

|

Cameron 3 |

Louisiana |

2019 |

|

Freeport 3 |

Texas |

2020 |

|

Corpus Christi 3 |

Texas |

2021 |

Challenging Applications:

The CFT opportunity is more than $3 billion per

year. Of this total more than 60 percent of the

applications are considered high performance.

These are components subject to severe or

critical service.

Relatively Few Decision Makers:

Frequently a sale can exceed $20 million with

very few decision makers.

Purchaser Desire to Buy Based on Lowest Total

Cost of Ownership:

Due to the severity and criticality of the

service there is a big incentive to buy the

product which is not necessarily lowest in cost

to handle the extreme requirements surrounding

cryogenics, thermal dynamics and velocity

control.

Ability to Validate Lowest Total Cost of

Ownership:

Due to the need for high performance it is

relatively easy to engage decision makers in

discussions relative to cost of ownership.

However a convincing case has to be made based

on evidence not only of a product’s cost saving

features but, on its performance, relative to

competitor options.

The LNG market will be a Most Profitable Market

for many CFT suppliers due to its size, rapid

growth and challenging applications. A

relatively few decision makers are incentivized

to select products with the lowest total cost of

ownership. They have the background evidence to

evaluate the conflicting claims of various

suppliers. The result is that they are willing

to pay higher prices for the better products.

This in turn results in greater profits for the

supplier.

The Most Profitable Market Program is described

at www.mcilvainecompany.com

New Petrochemical Forecast

The report has a new comprehensive analysis of

the Petrochemical industry.

Here are some of the highlights.

Petrochemicals represents one of the largest

markets for Combust, Flow and Treat (CFT)

suppliers. This report helps suppliers identify

the most profitable opportunities at each

potential large prospect. Overviews, plant

analyses and project data are supplied for each

large prospect. This continuing flow of

information facilitates continuous forecasting

of the Most Profitable Markets. The foundation

of the analyses are present in projected

production. Ethylene is a major petrochemical.

Forecasts are provided for future production in

each country.

Ethylene Forecasts (1000TPY)

|

|

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|

Austria |

596 |

631 |

669 |

709 |

752 |

797 |

845 |

895 |

949 |

|

Belgium |

2930 |

3106 |

3292 |

3490 |

3699 |

3921 |

4156 |

4405 |

4670 |

|

Finland |

393 |

417 |

442 |

468 |

496 |

526 |

558 |

591 |

626 |

|

France |

4407 |

4671 |

4951 |

5249 |

5563 |

5897 |

6251 |

6626 |

7024 |

|

Germany |

6836 |

7247 |

7681 |

8142 |

8631 |

9149 |

9698 |

10279 |

10896 |

Present production at each major plant is also

gathered.

|

Ethylene Production in France |

||

|

Location |

Company |

1000 tpy |

|

Berre (Aubette) |

LyondellBasell |

470 |

|

Dunkerque |

Versalis |

380 |

|

Feyzin |

A.P. Feyzin |

250 |

|

Gonfreville |

Total |

525 |

|

Lavera |

Naphtachimie |

740 |

|

NDG |

ExxonMobil |

425 |

Detailed information is compiled for the

producers comprising most of the market. Here

are excerpts on LyondellBasell.

Overview

LyondellBasell manufactures in 24 countries. Net

income in 2018 was $4.7 billion. Enterprise

value exceeds $40 billion. It is the #1 supplier

of polypropylene in Europe and the U.S. It is

the # 1 supplier of polyethylene in Europe and

the # 1 supplier of propylene oxide worldwide.

LyondellBasell recently expanded capacity at

three of its facilities in La Porte, Corpus

Christi and Channelview, increasing its annual

ethylene production capacity by 2 billion

pounds. It is now completing a $700 million

facility at its La Porte complex with the annual

capacity of more than 1 billion pounds of

high-density polyethylene, the world’s most

common plastic.

The company also plans to build the world's

largest propylene oxide and tertiary butyl

alcohol plant at its Channelview complex to

produce chemicals for furniture, automobiles,

adhesives and other uses. The $2.4 billion

project, the company’s largest investment to

date, is based on its belief of the U.S.

petrochemicals retaining a competitive edge in

the global market.

Project Information

Plant and project information is added

continually to the report

LyondellBasell Boosts Corpus Christi Ethylene

Capacity by 50 Percent

LyondellBasell has completed its 800 million

pounds-per-year ethylene expansion project at

its Corpus Christi, Texas, facility, the company

announced January 19. "As we look to meet

growing, global demand for our products, we

continue to seek the right opportunities that

ensure we are well positioned for the longer

term," stated Bob Patel, LyondellBasell CEO and

chairman of the management board, in a press

release. "By expanding ethylene capacity in the

U.S. through debottlenecks rather than long and

costly greenfield developments, we quickly added

substantial capacity for significantly less than

the cost of a new plant." LyondellBasell noted

the expansion allows the Corpus Christi facility

to now produce 2.5 billion pounds-per-year of

the basic chemical building block ethylene,

which is used in housewares, construction

materials, automotive parts, food packaging and

personal care products. The Corpus Christ

project wraps up a multi-year initiative by the

company to add 2 billion pounds of U.S. ethylene

production capacity. Over the past 5 years,

LyondellBasell has spent approximately $2

billion on U.S. Gulf Coast expansions and plans

to invest another $3 billion in the region, the

company noted. Later this year, it plans to

begin construction on a high density

polyethylene (HDPE) plant in LaPorte, Texas,

targeted for a 2019 start-up. Also, the company

reported that it is making progress on

development of a world-scale propylene oxide and

tertiary butyl alcohol (PO/TBA) plant at its

Channelview, Texas, facility.

Revision Date: 2/9/2017

Tags: 325110 - Petrochemical Manufacturing

石化产品生产,

LyondellBasell, Expansion, Production Capacity,

USA

LyondellBasell Breaks Ground on Texas PE Project

(T17)

LyondellBasell said May 16 that it has begun

construction on the first Hyperzone polyethylene

(PE) plant at its complex in La Porte, Texas.

"Today represents the launch of our latest

innovation in plastics technology,"

LyondellBasell CEO Bob Patel stated in a press

release. "The new Hyperzone PE plant will

produce a better plastic that advances solutions

to modern challenges, like protecting the purity

of water supplies through stronger and more

versatile pipes and ensuring the freshness of

bulk foods by providing tough, crack-resistant

containers for storage. This is truly a global

effort developed by an international team, built

to serve worldwide markets." According to

LyondellBasell, the project will create up to

1,000 jobs at the peak of construction and 75

permanent positions during operations. Created

by LyondellBasell research and development teams

in Italy, Germany and the U.S., Hyperzone PE

technology facilitates the production of

cost-effective, lightweight plastics that are

strong, durable and recyclable, the company

stated. In addition, the technology reportedly

enables the manufacture of a broad spectrum of

high density PE (HDPE) products in just one

plant rather than multiple plants.

LyondellBasell said the new Hyperzone plant will

more than double the LaPorte Complex's annual PE

capacity to 2 billion pounds (900,000 metric

tons). The company anticipates a 2019 startup,

and it plans to make the PE process technology

available for licensing in the future.

Separately, LyondellBasell said that development

of a world-scale propylene oxide and tertiary

butyl alcohol (PO/TBA) plant at its Channelview,

Texas, site is progressing. The company

anticipates a final investment decision for the

PO/TBA project in the second half of this year.

Revision Date: 5/23/2017

Tags: 325110 - Petrochemical Manufacturing

石化产品生产,

LyondellBasell, Construction, USA

LyondellBasell Advances $2.4 Bln Gulf Coast

Petchem Project (08, T18)

LyondellBasell Industries NV has reached final

investment decision on its previously proposed

plan to build what it is calling the world’s

largest propylene oxide (PO) and tertiary butyl

alcohol (TBA) plant at the company’s

Houston-area complex in Channelview, Tex.

Revision Date: 11/13/2017

Tags: 325110 - Petrochemical Manufacturing

石化产品生产,

LyondellBasell, Facility, Project, Production,

Investment Decision, Construction, USA

LyondellBasell Breaks Ground on the World’s

Largest PO/TBA Plant (08)

LyondellBasell broke ground on what will be the

largest propylene oxide (PO) and tertiary butyl

alcohol (TBA) plant ever built. The $2.4-B

project represents the single-largest capital

investment in the company’s history.

Revision Date: 9/18/2018

Tags: 325110 - Petrochemical Manufacturing

石化产品生产,

LyondellBasell, Steel, Equipment, Cables,

Concrete, Instruments, Piping, Project,

Downstream, Investment, Construction, Processing

Capacity, USA

Details on Existing Plants

Details on existing plants around the world are

also provided.

Clinton, Iowa With approximately 400 employees

and contractors, and covering an area of almost

239 acres, the Clinton Complex is one of the

largest chemical plants in Iowa. Using natural

gas liquids as a feedstock, the plant

manufactures ethylene which is then converted

into polyethylene plastic resins.

Morris, Illinois: Approximately 400 employees

and contractors work on the site which covers an

area of almost 700 acres. Using natural gas

liquids as a feedstock, the plant manufactures

ethylene, which is then converted into

polyethylene plastic resins.

Channelview, Texas: The plant, about 20 miles

east of downtown Houston, has been in operation

since 1957. Today, the Channelview Complex

comprises an area of 3,900 acres with two large

manufacturing facilities and a workforce of more

than 2,000 people. Two olefin units at the north

side facility manufacture ethylene, propylene,

butadiene and benzene. The south side facility

uses many of these products to produce propylene

oxide, styrene monomer and other derivatives and

gasoline-blending products.

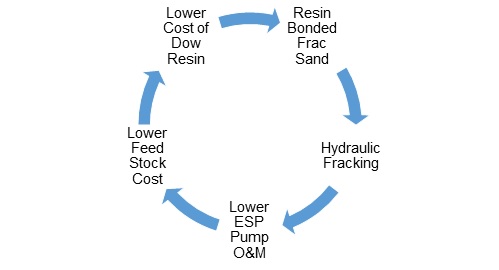

The Lowest Total Cost of Ownership Cycle for Oil

and Gas CFT Products

The Most Profitable Market (MPM) Program entails

identifying markets where products with lower

total cost of ownership can be developed and

then evaluating the market potential. This is

better done holistically. This approach involves

knowledge of the processes and the products in

each process. The silos between industries need

to be penetrated and collaboration among

disparate suppliers encouraged. A good case in

point is the use of resin bonded sand for

hydraulic fracturing. Dow Chemical introduced a

new resin for sand coating in 2014. The

polyurethane offers more elasticity than

phenolics. As a result the fractures do not

collapse. Collapsing leads to sand particles in

the product. As the product is transported by

the electric submersible pump, the sand abrades

the impellers. Pumps with an initial cost of

over $100,000 can experience life cycles

measured in months.

This life has been extended when resin coated

sand is utilized. The overall cost of oil

extraction is lessened. With lower feedstock

costs, the resin is less costly to manufacture.

This can lead to lower resin prices and even

more reason to select resin coated over uncoated

sand.

This cycle can be useful to pump companies such

as Veretek. They cite a case where their new V

pump lasted for one year whereas the original

ESP pump lasted only three weeks. In other cases

the difference in pump life has been less. How

much more can the owner afford to pay for the

Veretek pump? The evaluation of the resin bonded

sand alternative has to also be considered. The

market potential for Veretek is impacted by the

resin bonded sand effect on pump erosion and by

the additional cost of the resin coated sand.

Preferred Sands partnered with Dow in the

introduction of the Dow coating. How much more

can they charge for resin coated sand? Are the

purchasers fully aware of the cost of sand

erosion on pumps or the ability of the Preferred

Sands proppant to reduce that cost?

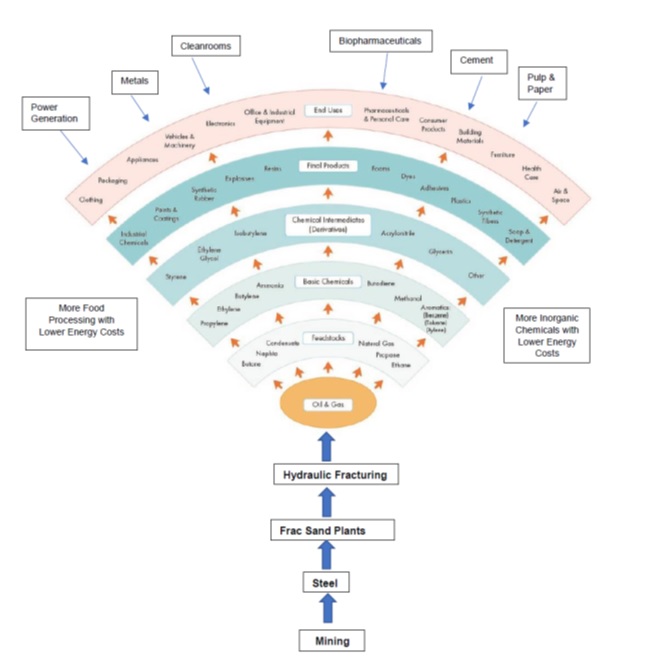

Low Cost Oil and Gas will Boost the U.S.

Combust, Flow and Treat Market

The 2025 market for combust, flow, and treat

(CFT) products will be much larger in many

industries because of cheap oil and gas in the

U.S. McIlvaine is revising its long range

forecasts for all CFT products based on an

anticipated surge of U.S. oil and gas production

in the 2021-25 period. The petrochemical

industry will show growth of 8 percent per year

while the natural gas processing and transport

growth will be even higher. There will be

impacts on final products such as plastic and

synthetic fibers and then in the industries

which finally use those products. This includes

building materials, appliances, pharmaceuticals

and coatings.

There will be a broader impact on the CFT

components due to lower energy costs. The U.S.

will be more competitive in energy intensive

industries such as cement, inorganic chemicals,

mining, steel, pulp & paper and food processing.

Based on the new U.S. oil and gas production

estimates McIlvaine is adjusting its 2025

forecasts in each service by from a -5 percent

change in flue gas desulfurization to a 30

percent increase for pumps.

|

Service |

2025 Forecast Adjustment % |

|

Fabric Filter |

10 |

|

Scrubber/Adsorber |

20 |

|

Flue Gas Desulfurization |

-5 |

|

Electrostatic Precipitator |

3 |

|

Liquid Filtration including Filter Presses and Bag Filters |

24 |

|

Cartridges |

14 |

|

Reverse Osmosis, Ultrafiltration Microfiltration |

20 |

|

IIoT & Remote O&M including Guide, Control, Measure |

25 |

|

Thermal and Catalytic Oxidation |

20 |

|

Valves |

24 |

|

Pumps |

30 |

|

Cleanrooms |

12 |

|

Water, Wastewater Treatment Chemicals |

24 |

The steel industry will benefit due to the fact

that it is a major energy user and will be more

competitive with lower oil and gas prices.

It also supplies products to many industries

which will directly benefit from the expanded

oil and gas production. For example a large

investment in steel is required for the

construction of a hydraulic fracking

manufactured sand plant.

A few industries will experience smaller

markets. The coal fired power and specifically

the flue gas desulfurization system market will

actually shrink as more U.S. coal fired plants

are retired than would have occurred with higher

gas prices.

U.S. Petrochemical Companies will increase IIoT

and Remote O&M Purchases by 8%/yr through 2025

U.S. petrochemical producers are increasing

their IIoT and Remote O&M investments per ton of

product at the same time they are accelerating

the construction of new plants to take advantage

of the low cost feedstocks in the U.S. Just

within the last few months the major oil

companies have made clear their intention to

invest a higher percentage of capital on U.S.

shale oil and gas extraction. Chevron believes

that it can extract oil at a cost as low as $15

per barrel. ExxonMobil believes it can be

profitable with $30/bbl oil. Both companies are

expecting the U.S. liquids production to be 25

million bl/d by 2025. This compares to IEA and

OPEC forecasts for the U.S. production at just

half this amount.

The impact on the petrochemical industry will be

substantial. The availability of cheap and

abundant feedstocks such as ethane make the U.S.

Shale Crescent in the East and the Permian basin

in the Southwest ideal locations for new

production facilities. The U.S. Congress just

received a report from the Secretary of Energy

which predicts that the Eastern U.S. will become

a petrochemical and plastics manufacturing hub.

A detailed analysis by the McIlvaine Company

built on specific projects and plans concludes

that the U.S. petrochemical IIoT and remote O&M

market will grow by 8%/yr vs 6.5%/yr for the

rest of the world.

|

World Petrochemical Combust, Flow, Treat IIoT and Remote O&M Revenues |

|||||

|

Product |

U.S. |

ROW |

Total |

MPM |

Total MPM |

|

$ billions |

% |

$ billions |

|||

|

IIoT and Remote O&M - Total |

1.9 |

7.1 |

9.0 |

51 |

4.6 |

|

Guide |

0.5 |

1.9 |

2.4 |

70 |

1.7 |

|

Control |

0.9 |

3.5 |

4.4 |

40 |

1.8 |

|

Measure - Liquids |

0.2 |

0.8 |

1.0 |

50 |

0.5 |

|

Measure - Gases |

0.2 |

0.6 |

0.8 |

50 |

0.4 |

|

Measure - Solids |

0.1 |

0.3 |

0.4 |

50 |

0.2 |

The U.S IIoT and Remote O&M opportunity will

approach $2 billion per year by 2025. There is a

Most Profitable Market (MPM) segment which

includes those products where a clear lowest

total cost of ownership can be established.

The total U.S. IIoT market in 2025 will be $1.9

billion but the MPM market will be close to $1

billion.

The guide segment will account for 25 percent of

the total as petrochemical companies continue to

accelerate purchases of process management

software systems. Nearly $500 million will be

spent on instrumentation.

There will be a number of technical challenges

as shale gases with varying percentages of

ethane and other natural gas liquids are

converted into ethylene and other petrochemical

products. In recent years the automaton market

growth in the U.S. has been less than in Asia.

This has handicapped suppliers whose primary

strengths lie outside Asia. The opportunity to

maximize profits in the U.S. market is therefore

unique. Many of the automation markets such as

coal fired boilers are mature. This reduces the

profit potential because of the emphasis on

price to sustain revenues. A growing market is

much more likely to result in maximum profits.

The McIlvaine N031

Industrial IoT and Remote O&M provides

forecasts for five product categories in every

country in every industry. This analysis

provides the basis for determining the Most

Profitable Market in a program explained at http://home.mcilvainecompany.com/index.php/component/content/article/30-general/1469-most-profitable-market-program

Hydraulic Fracturing Presents a Most Profitable

Market Opportunity for Pump Manufacturers

The hydraulic fracturing pump market is one of

the Most Profitable Markets (MPM) for pump

suppliers. It is large and will grow at close to

double digit rates in the next few years. The

application is extremely challenging. This

creates a situation where a better designed pump

can be sold at a much higher price. The

repair part market is bigger than the new

equipment market. So this creates a large

combined market.

There are a few major purchasers each of whom

will spend more than $50 million per year on

pump hardware, repairs and services. This

makes direct sales possible. Without sales

commissions or distributor markup the gross

profit will be higher.

It is recommended that pump companies invest in

very detailed market forecasting which is

focused on increasing profits and not just

revenues. This forecast can be described

as the “Most Profitable Market” (MPM). The $70

billion industrial pump market is the Total

Available Market (TAM).

The Serviceable Obtainable Market (SOM) is the

market which can be addressed with the lowest

priced product at even small unit margins. The

Most Profitable Market (MPM) is the one for

which the supplier can most profitably supply

its products and services given its capital and

knowledge resources.

Hydraulic fracturing offers a large and fast

growing MPM for pump manufacturers. New

developments in the last month will cause a

large increase in fracking pump sales. It

now is a good bet that the U.S. could be

producing 25 million bbl/day of liquids by 2025.

The oil companies are saying that OPEC and IEA’s

more pessimistic forecasts are wrong. They are

setting their capital budgets on this premise.

For more information on the MPM forecasts for

hydraulic fracturing and other pump applications

click on N019

Pumps World Market

Projects

The global hydrocarbon processing industry (HPI)

continues to expand and modernize to efficiently

meet growing demand for energy, transportation

fuels and petrochemicals. At present,

Hydrocarbon Processing’s Construction Boxscore

Database is tracking more than $1.6 T in active

projects around the world. These investments

include projects that have been announced or are

in the planning, engineering or construction

phases.

Shell and

Partners Start Deep-Water Production at Lula

North in Brazil

Royal Dutch Shell plc, through its subsidiary

Shell Brasil Petróleo Ltda. ("Shell"), announced

February 1, with consortium partners, the start

of production at the Lula North deep-water

project in the Brazilian Santos Basin.

Production at Lula North is processed by the

P-67 floating production and storage offloading

vessel (FPSO) and is operated by Petrobras. The

production hub is the seventh FPSO deployed at

Lula and the third in a series of standardized

vessels built for the consortium. It is designed

to process up to 150,000 barrels of oil and 6

million cubic meters of natural gas per day.

Shell and its partners began production at Lula

Extreme South with the P-69 FPSO in October

2018. Shell has a 25 percent stake in the Lula

consortium, operated by Petrobras (65 percent).

Galp, through its subsidiary Petrogal Brasil,

holds the remaining 10 percent interest.

Discovered in 2006, Lula is the largest

producing field in Brazil and accounts for 30

percent of the country's oil and gas production.

Sempra Energy announced January 31 it received

the Final Environmental Impact Statement (FEIS)

from the Federal Energy Regulatory Commission

(FERC) to construct the Port Arthur LNG natural

gas liquefaction-export project in Jefferson

County, Texas, as well as the Texas and

Louisiana connector pipeline projects that will

deliver natural gas to the new export facility.

Texas COLT

Submits Application with MARAD for Deepwater

Port Project

Texas COLT, a proposed joint venture among

Enbridge Inc., Kinder Morgan, Inc. and

Oiltanking, announced January 31 that it has

submitted an application with the U.S. Maritime

Administration (MARAD) to construct and operate

a deepwater crude oil export port located off

the coast of Freeport, TX. The Texas COLT

Project includes an offshore platform and two

offshore loading single point mooring buoys

capable of fully loading a 2-million-barrel Very

Large Crude Carrier (VLCC) in approximately 24

hours. The offshore facilities will be connected

by a 42" pipeline to an onshore tank farm that

will have up to 15 million barrels of storage

capacity. Today's submittal with MARAD begins

the application process for Texas COLT which is

planned to be in-service by 2022.

Total Makes

Major New Gas Discovery in the North Sea

Total announced a new significant discovery in

the North Sea offshore U.K., on the Glengorm

prospect located in the Central Graben.

Mcdermott

Awarded EPCI Subsea Contract from LLOG

McDermott International said it was awarded a

contract award by LLOG Exploration Company, for

a deep-water subsea pipeline project off New

Orleans, Louisiana. As part of the contract,

McDermott will work on tiebacks and structures

from the Stonefly development to the Ram Powell

platform, the company said in a statement. The

scope of work includes project management,

installation engineering, subsea structure and

spoolbase stalk fabrication, and subsea

installation of the subsea infrastructure to

support a two well subsea tieback from the

Stonefly development site to the Ram Powell

platform via a 60,000 foot 6-inch pipeline at

water depths ranging from 3,300 to 4,100 feet.

McDermott will also design, fabricate and

install a steel catenary riser, a pipeline end

manifold and two in-line sleds.

“This award demonstrates McDermott’s commitment

to helping LLOG safely and competitively deliver

the Stonefly development,” said Richard Heo,

McDermott’s senior vice president for North,

Central and South America. “McDermott’s proven

track record of project execution in the Gulf of

Mexico, combined with our industry-leading

subsea capabilities and integrated business

model, will help drive efficiency while

maintaining our uncompromising commitment to

safety and quality.” The Stonefly development

includes the Viosca Knoll 999 area where

McDermott is scheduled to use its 50-acre

spoolbase in Gulfport, Mississippi, for

fabrication and reeled solutions.

McDermott is scheduled to install the subsea

tiebacks and structures using its North Ocean

105 vessel in the third quarter of 2019.

Structure design and installation engineering

began in January 2019 in McDermott’s Houston

office. The lump sum contract award will be

reflected in McDermott’s first quarter 2019

backlog. The Ram Powell tension leg platform is

located in 3,200 feet of water in Viosca Knoll

Area, Block 956, and is capable of processing

60,000 barrels of oil per day and 200 million

cubic feet of gas per day.

Chevron to Buy

$350 Mln Texas Refinery from Petrobras

Chevron Corp said it has agreed to purchase a

refinery in Pasadena, Texas for US$350 million

from Brazil’s Petrobras. The deal to acquire

Petrobras subsidiary Pasadena Refining Systems,

which along with the 110,000-barrel-per-day

(bpd) refinery, includes a 466-acre complex

housing storage tanks with capacity for 5.1

million barrels of crude oil and refined

products and 143 acres of additional land, the

company said. “This expansion of our Gulf Coast

refining system enables Chevron to process more

domestic light crude, supply a portion of our

retail market in Texas and Louisiana with

Chevron-produced products, and realize synergies

through coordination with our refinery in

Pascagoula,” said Pierre Breber, executive vice

president of Chevron downstream & chemicals. The

acquisition will add to the refining network of

CUSA, which includes a refinery in Pascagoula,

Miss., two facilities in California, in El

Segundo and Richmond, and the Salt Lake refinery

in Utah. Once approved by regulators, the

acquisition will become the second Gulf Coast

refinery operated by Chevron and its only one in

Texas. Chevron has said it wants a second Gulf

Coast facility to handle crude and better supply

its retail gasoline network. The plant produces

mostly gasoline and distillates such as diesel.

MGX Minerals

Announces Successful Commissioning of Alberta

Oilsands Wastewater Treatment System

MGX Minerals Inc. and engineering partner

PurLucid Treatment Solutions ("PurLucid") are

pleased to report commissioning results from its

commercial-scale 5m3 per hour (750 barrel per

day) NFLi-5 advanced wastewater treatment

system.

System, Evaporator Blowdown Water, Evaporation,

Nanofloatation Technology, Wastewater Treatment,

Steam Assisted Gravity Drainage, Extraction,

Canada

Greenkote PLC (greenkote.com), global provider

of high-performance anti-corrosion metal

coatings, announced that its Chinese licensee

has won a major contract to supply 1200 tons of

coated hex-bolts for construction of the new

Amur Gas Processing Plant (AGPP) in the Amur

region of Siberia. When completed, AGPP will be

the second largest facility of its type in the

world, designed to process 42 billion cubic

meters of gas per year. The Greenkote licensee,

Shanghai Premier Tension Control Bolts Co., Ltd.

is a joint venture of Tension Control Bolts Ltd.

(TCB) of the UK, Shanghai High Strength Bolts

Plant Ltd. (SHS) and Shanghai Yan Yan Trading

(YYT). Shanghai Premier operates a full

state-of-the-art Greenkote coating line and has

added significant new capacity to fill the AGPP

contract. The company's Greenkote-coated preload

bolts, both tension control bolts (TCB) and hex

bolts, all meet the most stringent international

standards including ISO C5-M which addresses

very highly corrosive marine environments.

Greenkote® is a proprietary family of

high-performance zinc-based coatings that can be

applied to ferrous metals and alloys by a

patented thermal diffusion process — for

fasteners and many other applications. Greenkote

replaces many older processes such as hot-dip

galvanizing, zinc plating, sherardizing and

metal flake coating. In addition to its superior

anti-corrosion qualities Greenkote also provides

improved adhesion and longer wear, and it

eliminates hydrogen embrittlement. Greenkote is

also eco-friendly, from which its name derives.

Unlike many other anti-corrosion coatings,

Greenkote processing is totally free of

pollutants. It is fully compliant with ASTM

A1059/A1059M, an industry standard specification

for zinc alloy coatings. Notably, in 2016,

Greenkote-coated bolts (provided by

Greenkote-licensee TCB of the UK), were also

selected for use in constructing the New Safe

Confinement Shelter over the Chernobyl nuclear

power plant site — another world-class

application in an extremely harsh environment.

Middle East Oil

Spend to Rise in 2019

Middle East oil investments are likely to rise

in 2019 on back of Saudi Arabia shallow water

brownfield expansions, while North Africa will

see a decline, Wood Mackenzie says in its 2019

outlook report.

Honeywell

Technology and Controls Selected for Largest

Petrochemicals Project in China

Honeywell announced January 17 that Zhejiang

Petrochemical Co. Ltd. (ZPC) will use a range of

process technology from Honeywell UOP, the

world's leading licensor of refining and

petrochemical process technology, for the second

phase of an integrated refining and

petrochemical complex in Zhoushan, Zhejiang

Province. The complex is one of several new

large industrial sites that are part of China's

current national economic development plan.

Alfa Laval Wins

SEK 180 Mln Pumping Orders

Alfa Laval has won two orders to supply Framo

pumping systems; to an oil facility in the

Middle East – and to an FPSO (Floating

Production, Storage and Offloading) vessel to be

built in China. The orders have a total value of

approximately SEK 180 million and were booked

late December in the Pumping Systems unit of the

Marine Division, with deliveries scheduled for

2019. The orders comprise pumping systems for

crude oil in a cavern – and for crude oil

offloading, slop and ballast pump duties. "I am

pleased to announce these two large orders for

our Framo pumping systems. These pumping systems

are used in a variety of duties, all with heavy

demands on safety and reliability, where they

provide an optimized performance," says Peter

Leifland, President of the Marine Division.

Framo pumping systems are used in three main

areas: cargo, oil and gas production and

offshore supply and recovery. There are also

special pumps for crude stored in underground

caverns.

FERC Staff

Issues the DEIS for the Annova LNG Brownsville

Project (CP16-480-000)

Issued: December 14, 2018 The staff of the

Federal Energy Regulatory Commission (FERC or

Commission) has prepared a draft environmental

impact statement (EIS) for the Annova LNG

Brownsville Project (Project) proposed by Annova

LNG Common Infrastructure, LLC; Annova LNG

Brownsville A, LLC; Annova LNG Brownsville B,

LLC; and Annova LNG Brownsville C, LLC

(collectively Annova). Annova requests

authorization under Section 3(a) of the Natural

Gas Act and Part 153 of the Commission’s

regulations to site, construct, and operate a

liquefied natural gas (LNG) terminal (LNG

terminal) to liquefy and export natural gas at a

proposed site on the Brownsville Ship Channel in

Cameron County, Texas. The Project consists of

the following facilities: • pipeline meter

station; • liquefaction facilities; • two LNG

storage tanks; • marine and LNG transfer

facilities; • control room,

administration/maintenance building; • site

access road; and • utilities (power, water, and

communication systems).

TechnipFMC and

MMHE Sign Long-Term Offshore Agreement with

Saudi Aramco

TechnipFMC, in consortium with MMHE (Malaysia

Marine and Heavy Engineering Sdn Bhd), has

signed a Long-Term Offshore Agreement with Saudi

Aramco. This agreement, valid for 6 years,

covers engineering, procurement, fabrication,

transportation and installation of offshore

facilities for the development of Saudi Aramco’s

offshore projects. This agreement builds on the

long-term relationship between TechnipFMC and

Saudi Aramco, as well as the strong partnership

between TechnipFMC and MMHE which has a proven

track record of successful project execution and

delivery. In support of this project, TechnipFMC

will continue hiring and training Saudi

engineers, supporting the on-going Saudization

initiative.

BP Energy

Partners Purchases Controlling Interest in

Cryopeak LNG Solutions

BP Energy Partners, LLC announced it has

purchased a controlling interest in Cryopeak LNG

Solutions Corp ("Cryopeak"), a customer-centric

liquified natural gas (LNG) solutions company.

Cryopeak will become a portfolio company in

BPEP's second private equity fund, BP Natural

Gas Opportunity Partners II, LP. In addition to

the controlling interest acquisition, BPEP will

also commit additional capital to Cryopeak to

support its continued growth throughout North

America. Cryopeak is focused on providing

industrial customers and utilities with access

to clean and reliable natural gas in locations

where natural gas pipeline services are

unavailable, limited or unreliable. Based in

Vancouver, Cryopeak's engineering, design and

procurement expertise makes it one of the

leading liquified natural gas ("LNG") virtual

pipeline providers in North America. The company

provides safe and reliable LNG virtual pipeline

services including LNG procurement, LNG

transportation and LNG onsite equipment and

support. "It is great to have BP Energy Partners

as a major investor in Cryopeak," says Calum

McClure, Chief Executive Officer of Cryopeak.

"BP Energy Partners' investment provides

Cryopeak the capital to grow the business

providing our customers with a cleaner, lower

cost fuel. The team at BP Energy Partners has

great experience in energy investments and we

look forward to Cryopeak continuing to grow as a

leader in the small-scale LNG industry."

TechnipFMC

Awarded Integrated EPCI Contract for BP Atlantis

Phase 3 Project in GOM

TechnipFMC has been awarded a significant (1)

integrated Engineering, Procurement,

Construction and Installation (iEPCI™) contract

by BP for the Atlantis Phase 3 project.

Following final investment decisions from all

partners, TechnipFMC will manufacture, deliver

and install subsea equipment, including subsea

tree systems, manifolds, flowline, umbilicals

and subsea tree jumpers, pipeline end

terminations, subsea distribution and topside

control equipment. This contract also includes

provisional services for tooling and personnel

required to install the hardware. It is

scheduled to come on stream in 2020. Arnaud

Pieton, President Subsea, commented: “We are

very pleased TechnipFMC has been awarded an

iEPCI™ contract for the Phase 3 development of

the BP Atlantis project. This award reinforces

TechnipFMC’s position as the market and

technology leader for subsea equipment and

demonstrates the added value of iEPCI™ - our

unique integrated offering. We look forward to

extending our successful relationship with BP on

the Atlantis project in the Gulf of Mexico.” The

Atlantis Phase 3 field is located approximately

150 miles south of New Orleans at a water depth

of roughly 2,100 meters (6,800 feet) and will be

tied back to the existing platform. (1) For

TechnipFMC, a “significant” contract is between

$75 million and $250 million.

Shell and PGGM

Explore Potential Joint Acquisition of Eneco

Shell and PGGM have joined forces to explore the

opportunity to bid for the sustainable energy

provider Eneco in the Netherlands. In December

2018 Eneco and its shareholders’ committee

announced the start of the privatisation

process. In a statement, Shell said both firms

would combine the knowledge, ambitions and

financial commitment to build on Eneco’s

sustainable strategy and are determined to

competitively grow the renewable energy products

and services offer for millions of customers in

North West Europe. Shell believes that Eneco

will be a platform for growth, operating from

Rotterdam, with potential investments inside and

outside of the Netherlands. “The energy

transition offers good opportunities for

long-term investments in a more sustainable

economy and we think Eneco can play a central

role in realising the consortium’s shared

ambitions. PGGM and Shell bring complementary

experience and expertise across Eneco’s

activities, which will support the delivery of

affordable sustainable energy to a growing

number of customers in North West Europe,” said

Frank Roeters van Lennep, Chief Investment

Officer Private Markets PGGM. The consortium

partners understand that Eneco will be brought

to the market via a controlled auction, subject

to shareholder approval. PGGM and Shell realise

this process is at an early stage and respect.

Australia’s

Victoria State Slows AGL LNG Import Project with

Environmental Review

Plans by Australia’s AGL Energy to start

importing liquefied natural gas from 2021 will

be delayed after the state of Victoria called

for the company and its pipeline partner to

submit a full environmental assessment of their

project. The review process typically takes nine

to 12 months, which means AGL will not be able

to reach a final investment decision on the

A$250 million ($178 million) jetty project by

June 2019, as it had hoped.

Salt Creek

Midstream to Partner with Noble Midstream on

Crude Oil Pipeline and Gathering System

Salt Creek Midstream, LLC, a portfolio company

owned by funds managed by the Private Equity

Group of Ares Management, L.P. and by ARM Energy

Holdings, LLC in October announced that it has

entered into a letter of intent with Noble

Midstream Partners LP to form a 50/50

partnership on a crude oil pipeline and

gathering system in the Delaware Basin.

Penspen Wins

FEED Contract for Nigeria to Morocco Gas

Pipeline

UK's Penspen has been awarded a contract by

Morocco's Office National des Hydrocarbures et

des Mines (ONHYM) and the Nigerian National

Petroleum Corporation (NNPC) to execute the

First Phase of the FEED of the 5,700 km gas

pipeline proposed to run from Nigeria to

Morocco. The award is a follow-up on the

feasibility study completed by Penspen in July

2018. Work has already started and is being

executed from Penspen’s Abu Dhabi office. The

FEED Phase I consists of a detailed review of

the feasibility study results and in-depth

evaluation of the gas demand and supply study.

Further design of the pipeline system, in

addition to the execution of an Environmental

and Social Impact Assessment (ESIA), will then

be carried out with the aim of optimising the

proposed pipeline route and project economics.

Penspen will also support the client in

marketing and promoting the pipeline project to

potential stakeholders showcasing the wider

benefits of its development. At the end of the

study, key detailed outcomes will help the

client prepare for the second phase of the FEED

(FEED Phase II) which is expected to lead to a

Final Investment Decision (FID). Penspen will be

utilising the skills and capabilities of Dar

Al-Handasah, Crestech and Control Risk to

conduct a number of special studies required for

the FEED services, environmental impact

assessment, Nigeria gas supply study and risk

study respectively.

Argentina’s YPF

to Invest Over $30 Bln to Improve Oil and Gas

Output

YPF, which is already Argentina’s leading energy

company, aims to increase oil and gas output by

5% annually through 2022 to 700,000 barrels of

oil equivalent a day. The company plans to focus

on conventional output by drilling more than

1,600 wells.

BP Approves

Atlantis Expansion in Gulf of Mexico

UK's BP has approved a major expansion at the

Atlantis field in the U.S. Gulf of Mexico as the

oil giant plans for significant growth in

deepwater projects in the Gulf of Mexico.

Energy Transfer

Partners Gauges Interest for Boosting Dakota

Access Capacity

The developer of the Dakota Access pipeline is

gauging shippers' interest in a possible

expansion of the volume of crude oil moved

through the pipeline from 500,000 barrels to

570,000 barrels per day, despite ongoing tribal

efforts to shut the pipeline down.

Reliance Plans

Expansion at Jamnagar Refinery

Reliance Industries Inc. (RIL), Mumbai, is

evaluating a plan to expand one of the two

refineries that form part of its nameplate 1.729

million-b/d integrated refining and

petrochemical complex at Jamnagar in Gujarat,

India. The expert appraisal committee of India’s

Ministry of Environment, Forest, and Climate

Change (EFCC) will consider environmental

clearance for RIL’s project in a 2-day meeting

scheduled for Dec. 19-20, according to the EFCC

meeting agenda. The project proposes to expand

production capacity of the 551,000-b/d Special

Economic Zone (SEZ) refinery of the Jamnagar

complex to about 823,400 b/d from its current

production capacity of about 706, 900 b/d, the

EFCC agenda said. Details regarding the proposed

project and whether it also will impact crude

processing capacity at the site have yet to be

revealed.

Woodside Awards

4 FEED Contracts for Scarborough Project

Australia’s Woodside Petroleum has awarded four

contracts for front-end engineering design

activities for the proposed Scarborough gas

project offshore Australia. The contracts are

for engineering activities related to the

upstream development’s floating production unit,

the export trunkline and the subsea umbilical

risers and flowlines.

Cogent Midstream

Lets Contract for Midland Basin Gas Plant

Cogent Midstream LLC, Dallas, has let a contract

to Honeywell UOP LLC for the previously

announced expansion of natural gas processing

capacity in the lower Midland basin of West

Texas that will add a refrigerated cryogenic

processing plant at the same location as its

existing Big Lake gas plant in Reagan County,

TX. As part of the contract, Honeywell UOP will

provide a proprietary UOP Russell 200-MMcfd gas

processing plant to extract NGLs from natural

gas produced from several counties in the

Wolfcamp formation of the Permian basin in

Texas, the service provider said. Honeywell

UOP’s scope of work on the project will include

design and supply of the UOP Russell modular

cryogenic plant with refrigeration and

dehydration units.

Pertamina Plans

to Build Two Grassroots Integrated Refining and

Petrochemical Complexes

Alongside revitalization projects at its

existing refineries, Pertamina said in early

2018, it plans to build two grassroots

integrated refining and petrochemical complexes,

each of which will cost $15-16 billion to

complete. The first project, a joint venture

with Russia’s PJSC Rosneft, to be built at Tuban,

in East Java, would involve construction of a

300,000-b/sd refinery configured to process

imported volumes Russian ESPO and Iraqi Basrah,

as well as other medium to heavy, sulfurous

crude imports to produce feedstock for an

associated petrochemical complex, the partners

said (OGJ Online, May 27, 2016). The Tuban

refinery and integrated petrochemical plant are

currently due to begin operation in 2024,

Pertamina said.

Mexico Plans New

Refinery, Rehab Work

President Andres Manuel Lopez Obrador of Mexico

has announced a plan to rehabilitate six

refineries and build a 340,000-b/d refinery. The

new refinery at Dos Bocas in the Gulf Coast

state of Tabasco would be the seventh and

biggest refinery in Mexico. It would be capable

of producing 340,000 barrels per day.

Construction contracts could be awarded in

March, officials said. After upgrade, the

combined capacities of existing Petroleos

Mexicanos (Pemex) refineries at Cadereyta,

Madero, Minatitlan, Salamanca, Salina Cruz, and

Tula will be 1.54 million b/d, according to the

plan. Lopez Obrador took office in December.

Pemex Chief Executive Officer Octavio Romero

said Lopez Obrador’s National Refining Plan aims

at rescuing the national oil industry and

achieving energy independence. “There will be no

more privatization or dismantling of facilities,

nor will the workers of the energy sector in our

country be displaced to perform other

activities,” Romero said. The Dos Bocas refinery

is to produce 170,000 b/d of gasoline and

120,000 b/d of ultralow-sulfur diesel.