China Air Pollution Control was the Subject of the Hot Topic Hour March 20

At times recently the air in Beijing has been so bad as to create a political crisis. The concentration of PM2.5 on one occasion was 268 micrograms per cubic meter, or 11 times the recommended exposure limit set by the World Health Organization.

The basic problem is only partially topography. The majority of China’s energy use is based on coal, whose burning, besides being the major cause of air pollution in the country, warming. China has surpassed the United States as the largest emitter of greenhouse gases and the biggest coal consumer in the world. The country’s coal production increased slightly in 2013 to 3.7 billion tons. Consumption was 3.61 billion tons, or 2.6 percent higher than the previous year.

The growth in other basic industries is also substantial. With the potential pollution growing and the citizens increasingly insisting on clean air China needs to spend and will spend more than any other country in new air pollution control equipment.

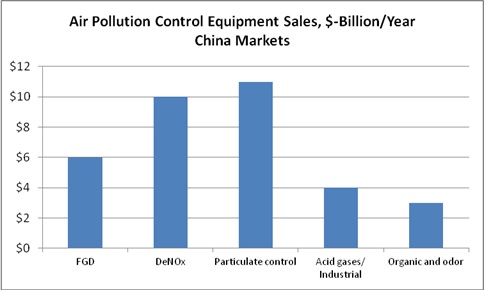

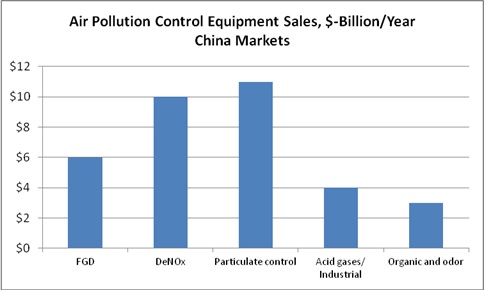

Over the next decade, China will spend $34 billion/yr. for new air pollution control equipment and systems. This is the conclusion reached by the McIlvaine Company in Air Pollution Management and several more specific market reports.

Particulate control will require an annual investment of $11 billion. The biggest single purchasing segment will be coal-fired power plant operators. There are tough new particulate regulations which existing precipitators cannot meet. Cement plants, steel mills and the chemical industry will also be big purchasers of fabric filters and precipitators.

The DeNOx market will be greater than $10 billion/yr in the first five years and lower in the subsequent five years. In the current five year plan, selective catalytic reduction (SCR) will be added to 450,000 MW of existing power plants and 250,000 MW of new power plants. There will be FGD systems on each new power plant plus 100,000 MW of upgrades in just the next five years.

Acid gases from waste-to-energy plants, smelters, refineries and the chemical industry will be addressed primarily with scrubbers and adsorbers. Oil and gas extraction is another big market for acid gas removal.

China has not kept up with more developed countries in the removal of organics. These compounds are partially responsible for the substantial smog problems in Beijing and other areas. Catalytic and regenerative thermal incineration will be widely applied in the coming decade. Odor control at sewage treatment and food plants will be increasingly applied due to citizen complaints

There are lenient mercury regulations in place but this is going to change. Bobby Chen of Shaw reports that

§ A program to reduce mercury will be promulgated in the next Five Year Plan starting in 2016.

§ The target is for power plants to install equipment to make a 70 percent reduction in mercury.

§ Research is being undertaken now to confirm the costs and technology.

§ Several RFQs have been issued.

§ Some suppliers, such as Albemarle, are already pursuing this market.

The question for international suppliers is whether they can participate in this market and then how do they participate. To date there is mixed success. There are many positive narratives and some which are negative. However, there is an even bigger question. Will he who controls the Chinese market control the world market? Given the size of the Chinese market for FGD and SCR this is a very legitimate question. McIlvaine has initiated a new service for power plant operators. There are a number of specialized websites each dealing with a technology e.g., dry scrubbing. These sites are accessed through Continuous Analyses. Power plant operators throughout the world will be able to access this site free of charge. Continuing analyses of options will enable operators to utilize the advice of the world’s experts. It will also facilitate the selection of the lowest life cycle cost product.

Dry Scrubbing is the Hot Topic Next Week

On March 27th we will be comparing SDA, CFB and other CDS designs including NID and GSA. We will be reviewing every aspect in which the designs differ and discuss the merits of these differences. Webinar registrants will have access to the information posted in the intelligence system. Dry Scrubbing - Continuous Analyses

The format will be a series of questions which are first addressed by the panelists and then the other participants. We have panelists who are third party experts on dry scrubbers. They are:

One task will be to try to come to agreement relative to decisive classification and the specific nomenclature. We have selected the first split at Chamber vs. In-duct. Maybe better words are vessel and DSI but, in any case, we will be trying to resolve the nomenclature issues in the webinar next week.

We will be focused on the comparison of the major alternatives. If the chamber options are circulating dry scrubbers and SDA, how do they compare? Paul Farber has contributed several good papers and will be a panelist next week. Here is how we summarized one of his analyses of SDA and CDS:

§ SO2 Capture Capability - advantage to CDS

§ Fuel Flexibility - advantage to CDS

§ Load Flexibility - advantage to SDA

§ Utilities Consumption - slight advantage to SDA

§ Waste Production - advantage to SDA

There is still the need to breakdown CDS. What is the next level among CFB, GSA, NID, etc? How many segments should be at one level and should there be sub segments? We are looking at dual fluid nozzles vs. rotary atomizers, the size of NIDS nozzles, air slides vs. screw conveyors and many other components. We are focusing right now on the chamber segment but we already have a great deal of DSI information on the site.

China has opted for wet limestone scrubbing for the most part. However, there is almost as much dry scrubbing capacity as exists in the U.S. Most has been installed under license but there are also some original designs. In fact MET has licensed a Chinese design for sale in the U.S.

Chinese Dry Scrubbing Experience

|

Capacity of Flue Gas Desulfurization Units for Coal-Fired Power Plants (MW) |

|

|

|

|

|

Installed Through 2012 |

||

|

COMPANY NAME |

SDA |

CFB |

NID |

|

Beijing Guodian Longyuan Environmental Engineering Co. |

|

115 |

|

|

Fujian Longking Environmental Engineering Co. |

|

9,193 |

|

|

Wuhan Kaidi Electric Power Environmental Protection Co., Ltd. |

|

3,412 |

413 |

|

CPI Yuanda Environmental Protection Co., Ltd. |

|

463 |

|

|

Shandong Sanrong Environmental Protection Co., Ltd. |

|

948 |

|

|

Zhejiang Atmosphere Environmental Protection Group Co., Ltd. |

|

1,120 |

|

|

Zhejiang Feida Environmental Protection Technology Co., Ltd. |

|

|

1,421 |

|

Guangzhou Tianci Sanhe Environmental Protection Engineering Co., Ltd. |

1,169 |

|

|

|

Shandong Electric Power Engineering Consulting Co., Ltd. |

|

16 |

|

|

China Lantian Environmental Engineering Co., Ltd. |

|

2,106 |

|

|

Shandong Shanda Energy & Environment Co., Ltd. |

|

1,480 |

|

|

Zhangjiagang Xinzhong Environmental Protection Equipment Co., Ltd. |

|

124 |

|

|

TOTAL |

? |

20,000 |

5000 |

This site is free to one and all although the webinars and continuing analyses are more restricted. Let us know what you think of this very different new approach.

To register for the webinar, click on: http://home.mcilvainecompany.com/index.php/component/content/article?id=675