Join us on August 23 to Discuss the Guide, Control, and Measurement Markets in

Pulp and Paper

In 2018 the pulp and paper industry will spend an estimated $1.1 billion for

guide, control, and measure products and services.

This is the latest forecast in

IIoT and Remote O&M published by the McIlvaine Company.

The "guide" category includes automation consulting, software and

services. This will generate

revenues of $330 million. Control which includes automation products will result

in purchases of $550 million. $220

million will be spent on measurement including analyzers.

The report provides forecasts for 550 companies in 12 industries including 50 in

the pulp and paper segment.

For more information on this report click on

http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/106-n031

You can register for the August 23 pulp and paper IIoT and Remote O&M webinar.

at

Weekly IIoT Webinars

For more information contact Bob Mcilvaine at 847-784-0012 ext. 112: email

rmcilvaine@mcilvainecompany.com

Hundreds of Product Forecasts for 550 Largest Combust, Flow and Treat Purchasers

In the new IIoT environment purchases and specifications will increasingly be

made at the corporate home office and not in the plants.

These decisions will be based on a flow of knowledge from remote

monitoring at the plant sites. This

requires a new marketing approach shown at

Marketing Program for Combust, Flow and Treat.

Product decisions will be greatly impacted by the IIoT environment at each of

the 550 companies. Eight automation

companies will have an impact on purchases at just under 10% of the purchases.

|

Sales of IIoT and Process

Equipment to the Pulp and Paper

Industry 2018 - $ millions |

||||

|

Product |

Total Product Revenues |

IIoT Impact |

||

|

All suppliers |

8 companies |

All suppliers |

8 companies |

|

|

Guide |

330 |

25 |

330 |

25 |

|

Control |

550 |

45 |

550 |

45 |

|

Measure |

220 |

20 |

220 |

20 |

|

Total Direct IIoT |

1100 |

90 |

1100 |

90 |

|

Valves |

1500 |

65 |

150 |

7 |

|

Air Pollution Control Systems |

300 |

10 |

40 |

2 |

|

Pumps |

1200 |

30 |

150 |

3 |

|

Water Treatment |

2000 |

50 |

200 |

5 |

|

Wastewater Treatment |

1000 |

30 |

100 |

3 |

|

Variable speed drives and motors |

1800 |

120 |

200 |

12 |

|

Turbines, Fans, and Compressors |

3500 |

600 |

350 |

60 |

|

Other Process Equipment,

Chemicals, and Services |

10,000 |

140 |

1000 |

14 |

|

Indirect IIoT |

21,300 |

1045 |

2190 |

106 |

|

Ratio of Indirect to Direct

|

19 |

12 |

2 |

1.2 |

The eight automation companies will have a direct IIoT market in pulp and paper

of $90 million. They will also sell

another $1 billion of combust, treat, and flow products and services to this

industry. By making these products

smarter they can boost revenue by $106 million.

With better collaboration between the divisions, the eight companies can use

their direct IIoT products to increase market share for all their products. With

a 10% increase in market share along with the higher product revenue they could

boost revenue by $212 million.

Product suppliers who are not starting to leverage IIoT will lose market share

and the potential to increase revenues per unit of product with better and

smarter offerings.

Only two of the 8 companies (Emerson and GE) are major valve suppliers. The

other six can be pursued for purposes of collaboration.

GE could be a formidable competitor in air pollution control with the Alstom

acquisition. Siemens sold

Wheelabrator. So, the other seven are collaboration prospects.

|

Sales of IIoT and Process

Equipment to Specific Pulp and

Paper Producers 2018 - $

millions |

||||

|

All Producers |

International Paper |

Nine Dragon |

Stora Enso |

|

|

Guide |

330 |

16 |

8 |

6 |

|

Control

|

550 |

33 |

16 |

12 |

|

Measure

|

220 |

11 |

5 |

2 |

|

Total Direct IIoT |

1100 |

60 |

29 |

20 |

|

Valves |

1500 |

90 |

45 |

30 |

|

Air Pollution Control Systems |

300 |

18 |

9 |

6 |

|

Pumps |

1200 |

72 |

36 |

24 |

|

Water Treatment |

2000 |

120 |

60 |

40 |

|

Wastewater Treatment |

1000 |

60 |

30 |

20 |

|

Variable Speed Drives and Motors |

1800 |

108 |

54 |

36 |

|

Turbines, Fans, and Compressors |

3500 |

210 |

105 |

70 |

|

Other Process Equipment,

Chemicals, and Services |

10,000 |

600 |

300 |

200 |

|

Indirect IIoT |

22,800 |

1278 |

639 |

426 |

|

Ratio of Indirect to Direct

|

21 |

21 |

21 |

21 |

Forecasts of sales for specific products to each of 50 pulp and paper producers

as well as 500 manufacturers in 11 other industries will provide a basis for

collaboration among divisions within multi product companies as well as for

setting up sales programs for each.

The IIoT & Remote O&M report has the forecasts for guide, control and three

measurement segments for each of 550 companies x 3 continents = 8250 forecasts.

The Valve report has forecasts for 550 companies' x 8 control valve types plus 8

on/off valve types x 3 continents = 26,400 forecasts.

The scrubber, fabric filter, precipitator, thermal/catalytic, liquid filtration,

cartridge, RO/UF/MF, ultrapure water, cleanroom, sedimentation and

centrifugation market reports also have detailed forecasts for the 550

companies.

Custom forecasts are available for the other products.

·

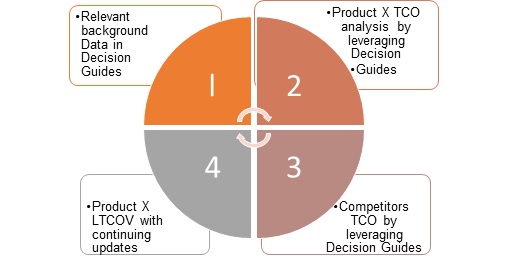

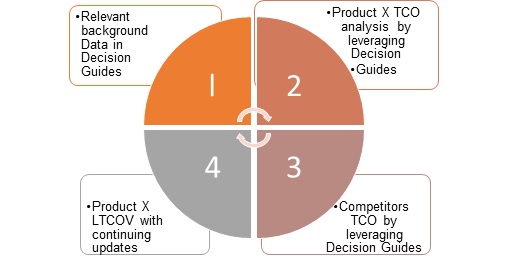

Level 1 in the program is the IIoT and

Remote O&M report with forecasts for guide, control, and measure for each of

the 550 companies.

http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/106-n031

·

Level 2 is the market reports with the forecasts of each product for the 550

companies.

Markets

·

Level 3 is the industry analyses with profiles of each of the 550 companies and

continuing project information on each. Oil/gas/refining/petrochemicals is one

report. Pharmaceutical, semiconductor and food are in another.

Municipal water and wastewater are in one service. The other profiles are

in the N031 report.

Details are found at

Databases

·

Level 4 would be a knowledge system for each of the 550 purchasers funded by the

suppliers.

The beta site is

4S01 Berkshire Hathaway Energy Supplier and Utility Connect

For more information contact Bob Mcilvaine at 847 784 0012 ext. 112: email

rmcilvaine@mcilvainecompany.com