DETAILED FORECASTING OF MARKETS, PROSPECTS AND PROJECTS

It is now possible to precisely segment and predict markets, identify the

prospects, and track the most important projects.

A few hundred companies make most of the flow control and treatment purchasing

decisions. McIlvaine is identifying them and reporting on their

activities.

Detailed forecasting of markets, prospects and projects provides the following

benefits:

Improve decisions on allocation of direct sales, promotion and development

expenditures

Increase orders cost effectively

Review strategy with better insights as to improvement

Find out the details with:

300 Large Oil and Gas Projects Account For 80 Percent of the Flow Control

and Treatment Purchases

Some oil and gas projects include hundreds of millions of dollars of pumps,

valves, filters, compressors and other flow control and treatment equipment.

The top 300 projects each year account for more than 80 percent of the

purchases. McIlvaine tracks these in the bi-weekly Oil, Gas, Shale,

Refining E-Alert.

|

October 30 Oil and Gas E

Alert covering two week period |

||||

|

Project Name |

Description |

Total Amount

$ Millions |

Flow

Control

Treat

$ Millions |

Order

Yr

20+ |

|

Enbridge |

Canadian pipeline |

38,000 |

300 |

16-19 |

|

Odebrecht |

Pipeline in Peru |

4,000 |

40 |

17-19 |

|

Golar |

FLNG off Cameroon |

8,000 |

90 |

17 |

|

Saudi Arabia's PetroRabigh |

Petrochemical and refining

complexes |

10,000 |

200 |

16-18 |

|

Dung Quat Refinery |

New refinery in Vietnam |

4,000 |

90 |

16 |

|

Rosneft |

New refining and petrochemical

complexes in Eastern Russia |

10.000 |

200 |

17-19 |

|

10 additional large projects |

LNG, refining, extraction |

50,000 |

1,000 |

16-19 |

|

Total |

|

124,000 |

1,920 |

|

Sixteen projects reported in the latest bi-weekly issue account for close to $2

billion of purchases of flow control and treatment equipment. The scope

includes oil and gas extraction, LNG, gas-to-liquids processing, and tar sands

processing.

The Alert is available separately but is also available as part of

N049 Oil,

Gas, Shale and Refining Markets and Projects, which

provides a complete program for detailed market, prospect and project

forecasting. For more information on Oil, Gas, Shale, Refining

E-Alert: click on:

http://home.mcilvainecompany.com/index.php/databases/28-energy/991-71ei.

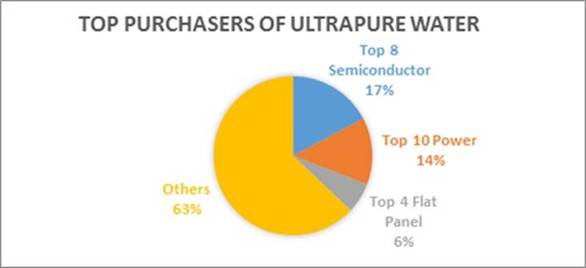

Purchases of Ultrapure Water Cross-flow Membranes by Just a Few Companies Total

$600 Million

Cross-flow membrane systems play a major role in providing ultrapure water

(UPW). In semiconductor plants, the water for chip washing is purified in

cross-flow membrane systems. Typically microfiltration or ultrafiltration

will be followed by reverse osmosis (RO). Cross-flow membranes are used in

the ultrapure water systems to provide water for injection (WFI) in the

pharmaceutical industry. Systems to provide the pure water needed for

steam generation in the power industry also utilize cross-flow membranes.

Power plants, electronics manufacturers and pharmaceutical producers will spend

$600 million in 2015 on RO, microfiltration and ultrafiltration systems and

replacement modules for their UPW applications. Detailed forecasts are

included in N020 RO, UF, MF World Market.

The purchases will be concentrated among relatively few companies. The top 20

companies will purchase 37 percent of the total cross-flow membranes and the top

50 companies will average more than one percent each ($6 million).

The top eight semiconductor companies will account for purchases of $204

million. The top ten power generator purchases will total $84 million. The

top four flat panel and other electronics manufacturers will spend $36 million.

The Top 10 Purchasers Will Be

|

# |

Company |

Semi |

Other Electronic |

Power |

|

1 |

Samsung |

x |

x |

|

|

2 |

Intel |

x |

|

|

|

3 |

TSMC |

x |

|

|

|

4 |

EDF |

|

|

x |

|

5 |

LGE |

|

x |

|

|

6 |

Sony |

x |

x |

|

|

7 |

SK Hynix |

x |

|

|

|

8 |

Micron |

x |

|

|

|

9 |

China Datang |

|

|

x |

|

10 |

China Guodian |

|

|

x |

Pfizer is the top pharmaceutical purchaser but is only ranked #23 on the list of

the 40 largest purchasers.

The large ultrapure water cross-flow membrane purchasers are moving toward

global sourcing for several reasons. One is the importance of the products

to the plant operations. A single small particle can cause rejection of a

$300 chip. Contaminated drugs are one of the biggest concerns of

pharmaceutical companies. The ultra supercritical power plants which are

now under construction require water purity levels far greater than the sub

critical power plants which they are replacing.

The second reason for global sourcing is to facilitate evaluations on total cost

of ownership. The high cost of these evaluations is spread out among a number of

purchases. The benefits of buying the best rather than lowest price cross

flow membranes far outweigh the costs.

The combination of concentration of buying power and emphasis on highest quality

products creates a new and major opportunity for cross-flow membrane providers.

McIlvaine has created a new route to market to take advantage of this

opportunity. It combines

N020 RO,

UF, MF World Market

with other McIlvaine services to provide detailed forecasting of Markets,

Prospects and Projects.

For more information contact Bob McIlvaine at

rmcilvaine@mcilvainecompany.com.

Purchases of Ultrapure Water Cartridges by Just a Few Companies Total $300

Million

Cartridges play a major role in providing ultrapure water (UPW). In

semiconductor plants, the water is first purified in cross-flow membrane systems

but then sent long distances to tools. Cartridges located at the tools

ensure that any contamination generated in transport is removed.

Cartridges are used in ultrapure water systems to provide water for injection

(WFI) in the pharmaceutical industry. Systems to provide the pure water

needed for steam generation in the power industry also utilize cartridges.

Power plants, electronics manufacturers and pharmaceutical producers will spend

$300 million in 2015 on non woven, membrane, ceramic and metal cartridges for

their UPW applications. Detailed forecasts are included in N024

Cartridge Filters: World Market.

The purchases will be concentrated among relatively few companies. The top

20 companies will purchase 37 percent of the total cartridges and the top 50

companies will average more than one percent each ($3 million).

The top eight semiconductor companies will account for purchases of $51 million.

The top ten power generators will each spend $42 million. The top four flat

panel and other electronics manufacturers will spend $18 million.

The Top 10 Purchasers Will Be

|

# |

Company |

Semi |

Other Electronic |

Power |

|

1 |

Samsung |

x |

x |

|

|

2 |

Intel |

x |

|

|

|

3 |

TSMC |

x |

|

|

|

4 |

EDF |

|

|

x |

|

5 |

LGE |

|

x |

|

|

6 |

Sony |

x |

x |

|

|

7 |

SK Hynix |

x |

|

|

|

8 |

Micron |

x |

|

|

|

9 |

China Datang |

|

|

x |

|

10 |

China Guodian |

|

|

x |

Pfizer is the top pharmaceutical purchaser but is only ranked #23 on the list of

the 40 largest purchasers.

The large ultrapure water cartridge purchasers are moving toward global

sourcing for several reasons. One is the importance of the products to the plant

operations. A single small particle can cause rejection of a $300 chip.

Contaminated drugs are one of the biggest concerns of pharmaceutical companies.

The ultra supercritical power plants which are now under construction require

water purity levels far greater than the sub critical power plants which they

are replacing.

The second reason for global sourcing is to facilitate evaluations on total cost

of ownership. The high cost of these evaluations is spread out among a number of

purchases. The benefits of buying the best rather than lowest price

cartridge far outweigh the costs.

The combination of concentration of buying power and emphasis on highest quality

products creates a new and major opportunity for cartridge providers.

McIlvaine has created a new route to market to take advantage of this

opportunity. It combines

N024

Cartridge Filters: World Market

with other McIlvaine services to provide detailed forecasting of Markets,

Prospects and Projects.

For more information contact Bob McIlvaine at

rmcilvaine@mcilvainecompany.com.

McIlvaine Hot Topic Hours and Recordings

McIlvaine webinars offer the opportunity to view the latest presentations and

join discussions while sitting at your desk. Hot Topic Hours cater to the end

users as well as suppliers while the Market Updates cater to the suppliers and

investors. Since McIlvaine records and provides streaming media access to

these webinars there is a treasure trove of value only a click away. McIlvaine

webinars are free to certain McIlvaine service subscribers. There is a charge

for others. Hot Topic Hours are free to owner/operators. Sponsored

webinars provide insights to particular products and services. They are

free. Recordings can be immediately viewed from the list provided below.

|

DATE |

UPCOMING HOT TOPIC HOUR |

UPCOMING MARKET UPDATES |

|

Nov. 12, 2015 |

Dry Scrubbing |

|

|

Dec. 3, 2015 |

NOx Reduction |

----------

You can register for our free McIlvaine Newsletters at:

http://home.mcilvainecompany.com/index.php?option=com_rsform&formId=5

Bob McIlvaine

President

847-784-0012 ext 112

rmcilvaine@mcilvainecompany.com

www.mcilvainecompany.com