Insights of the Week

Coal will continue to be used at only a slightly lower rate in the U.S. if the

Clean Power plan is nullified. But new coal plants are unlikely due to a 60 year

shale gas supply and no guarantee that Republicans will hold sway for the long

term.

Thursday is the Valve IIoT webinar followed a week later by the IIoT in Oil and

gas. See the schedule at

Weekly IIoT Webinars

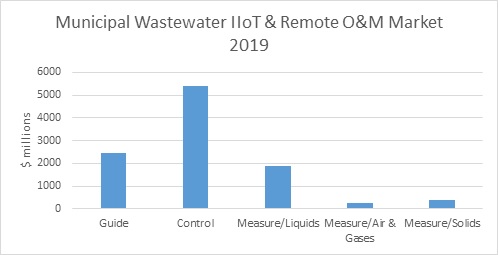

Suez has acquired GE Water to pursue the 95 billion Euro industrial market which

Suez believes is bigger than the municipal market it now serves. This

acquisition will pave the way for Suez to become a major player in IIoT and

Remote O&M. Suez opened a monitoring center in France

which provides intelligent management solutions for sanitation as well as water

facilities around the world. In Chile Suez operates 40% of the municipal

wastewater facilities. Will Suez leverage IIoT to make a big move in the

industrial arena?

Decision guides for high performance valves are now being compiled on a

collaborative basis. It is part of the Mcilvaine effort to empower IIoT

with IIoW (Wisdom). Valves for severe, critical, or unique service in oil

and gas and power are being analyzed.

High Performance Valves and IIoT

The digital rapidity of IIoT has to be duplicated in IIoW. One route is to

record your sales power point presentations and make them accessible.

InterwebviewsT

$168 Billion Oil and GAS IIoT and Remote O&M Market by 2030

The oil and gas market opportunity for IIoT & Remote O&M will rise to $168

billion in 2030. $110 billion will be onsite expenditures by the oil and

gas companies but $58 billion will be for remote monitoring and support

including Software as a Service (SaaS) and data analytics. Data analytics

in turn will include IIoW (Industrial Internet of Wisdom). This in turn

will foster Sourcing as Service activities.

NAFTA will be the largest segment with oil and gas IIoT & Remote O&M revenues

rising from $13 billion in 2016 to $83 billion by 2030.

The NAFTA projections are based on the 2017 EIA reference forecast predictions

for energy pricing and consumption. Key assumptions are:

|

EIA Assumptions for the Year

2040 |

|||

|

|

Reference |

High |

Low |

|

Oil Price $/bbl. |

109 |

226 |

49 |

|

N.G. Henry Hub $/million BTU |

5 |

10 |

3 |

|

U.S. GDP % CAGR |

2.2 |

2.6 |

1.6 |

|

Energy Net Trade BTU Quads |

2 |

25 |

-11 |

Since July 2016, there has been a 20% increase in oil rig counts. Oil producers

have also increased their exports to India. These trends are showing the

rejuvenation of U.S. shale oil. The shale oil market is expected to gain

momentum from mid-2017.

Tight oil makes the biggest contribution to crude oil production with a 50%

growth from 4 million bbl./day now to 6 million bbl./d by 2040.

The oil and gas industry is already ahead of other industries in the use of

IIoT.

More than half of the oil and gas companies are deploying IIoT-enabled

technology for remote monitoring. Asset reliability and energy efficiency round

out the top three non-product use cases (LNS Research).

Source: LNS Research

Some of the biggest opportunities will be created by regulations restricting

flaring in the U.S.

Honeywell and Aereon will collaborate on solutions to help industrial customers

boost the safety, efficiency and reliability of their operations by leveraging

Honeywell's Industrial Internet of Things (IIOT) ecosystem.

Aereon provides air emissions solutions for the complete oil and gas sector,

from the wellhead to the gas station. It offers products for flare systems,

enclosed combustion systems, high efficiency thermal oxidizers and vapor/gas

recovery units. "Aereon's fundamental strength is its wide array of

fit-for-purpose combustion and vapor recovery products supported by in-house

expertise to design, manufacture and support its field-installed base," said

Mark Zyskowski, Senior Global Vice President, Aereon. "We are pleased to be able

to bring our expertise to the IIoT ecosystem that Honeywell is developing to

help customers around the globe maximize value from their operations by tapping

into the power of the IIoT."

There will be a high ROI from automating remote operations. Well drilling and

completion is becoming increasingly complex while the reservoir of field

expertise is not growing to keep pace. Automation and monitoring of remote

operations leverages the expertise of the industry, decreases on site personnel

time and improves safety.

The complete analysis of IIoT & Remote O&M opportunities is provided in LINK TO

NO31

Details on the markets and project in oil and gas are found in LINK TO OIL, GAS,

REFINING MKTS PROJECTS

Various IIoW support activities offered by McIlvaine include:

High

Performance Valves and IIoT

4S01 Berkshire Hathaway Energy Supplier and Utility Connect

44I Coal Fired Power Plant Decisions

59D Gas Turbine and Reciprocating Engine Decisions

$11.5 billion Opportunity for High Performance Valves in IIoT and Remote O&M

The Industrial Internet of Things (IIoT) is a powerful new force shaping the way

valves will be purchased. The demand for valve automation and communication of

valve health and performance will be driven by IIoT advances. With the rapid

reduction in the cost of high quality sensors and the introduction of wireless

technology smart valves will be communicating with remote operators on an

accelerated basis.

Emerson, Flowserve, Pentair, GE and other valve companies are already pursuing

this market and generating revenues of $7 billion. This includes smart

valve revenues plus valves sold through IIoT decision makers. Some are

third party operators. In other cases, they are corporate entities with many

plants and centralized IIoT based valve selection. One important segment is

repair part inventory and replacement.

The world industrial valve revenues will grow from $62 billion in 2017 to $88

billion in 2025

|

World Industrial Valve Revenues

$ millions |

||

|

Segment |

2017 |

2025 |

|

Traditional route to

market |

55 |

71 |

|

New route to market |

4 |

10 |

|

New smart revenues |

3 |

7 |

|

Total |

62 |

88 |

|

IIoT Impacted Market |

7 |

17 |

The traditional market will grow at 3% per year. However, the new route to

market through remote O&M will grow at 13%/yr. as will the additional revenues

generated by smarter valves.

|

World High Performance Valve

Revenues $ billions |

||

|

Segment |

2017 |

2025 |

|

Traditional route to

market |

30 |

42 |

|

New route to market |

2 |

5 |

|

New smart revenues |

1.5 |

6.5 |

|

Total |

33.5 |

53.5 |

|

IIoT Impacted Market |

3.5 |

11.5 |

High performance valves comprise 55% of the total market today but with IIoT and

remote O&M will represent 60% of the market in 2025. High performance valves

include those in:

·

severe service

·

critical service

·

unique service

If general purpose valves are the foot soldiers of IIoT then high performance

valves belong in the armoured division. Their performance is much more

critical to the outcome of the battle to improve plant performance.

Not only can valve companies boost Capex revenues for smart valves and Opex

revenues for service and parts but they can acquire process data to help them

design better valve products for specific applications. This proliferation of

information about valve performance will serve as a giant resource of valve

white papers. Proof of lowest total cost of ownership will be automatic.

The valve companies who best leverage this process and valve performance

knowledge will be the most profitable. Those focused on IIoT will achieve profit

gains of 45% in the high-performance segment and 32% overall, while those who

miss the boat will suffer profit decreases of 10%.

|

Valve % Profit in 2025 due to the Impact of IIoT

and Remote O&M |

||||

|

|

High Performance Segment |

Total

(general and high performance) |

||

|

Factor |

IIoT focused Valve Companies |

Others |

IIoT focused Valve Companies |

Others |

|

Increased Market Share |

15 |

-15 |

10 |

-10 |

|

Smart Revenues |

10 |

0 |

7 |

0 |

|

Increased Base Prices with Better Products |

20 |

0 |

15 |

0 |

|

Profitability Impact |

45 |

-15 |

32 |

-10 |

McIlvaine has coined the term Industrial Internet of Wisdom (IIoW). The

rate of progress can be viewed as 1 x IIoT + 2 x IIoW. Transmitting all

this data to better manage assets is only 1/3 of the opportunity. 2/3 of the

opportunity is the improvement of assets and operations. Valve companies will be

the source of Valve IIoW but only if they understand the new market paths.

IIoT promises to revolutionize industry but only if it is accompanied by IIoW

(Industrial Internet of Wisdom). Decisive classification of high performance

valve applications, designs, and materials is critical to IIoT success.

Analysis of performance and comparison of results is important. Mcilvaine

has four services to support Valve IIOW.

N031 Industrial IOT and Remote O&M

High Performance Valve Decisions

4S01 Berkshire Hathaway Energy Supplier and Utility Connect

N028 Industrial Valves: World Market

Bob McIlvaine

President

847-784-0012 ext. 112

rmcilvaine@mcilvainecompany.com

www.mcilvainecompany.com