WELCOME

Weekly selected highlights in flow control, treatment and combustion from the

many McIlvaine publications.

Brief Insights

The Offshore Markets and IIoT webinar on February 28 is one of a long series of

recorded webinars which include the recent Shale Gas webinar, the Refinery

webinar and one a year ago on the broader Oil and Gas Market and the Impact of

IIoT.

You can register for the offshore webinar at

Free Market Webinars

View the Shale Gas Webinar at

https://youtu.be/UxZCfMhBJ7k

View the Refinery Webinar at

https://youtu.be/N0CgrGcfMAU

View the Oil and Gas Webinar at

https://youtu.be/o7kJSXixFHs

Large Combust, Flow and Treat

Purchases by Offshore Oil and Gas Operators Will Accelerate Starting in 2019

The offshore oil and gas industry even at its low point this year will invest

over $150 billion. While total

investment has been falling the investment in IIoT and Remote O&M has been

increasing. With total investment

moderately increasing through 2022 coupled with accelerated IIoT investment,

this market will be significant for combust, flow and treat suppliers.

One reason it will be very important is that cutting edge IIoT and remote

monitoring technologies are needed due to the remote surface locations of rigs

and the difficult challenges of subsea operation.

Rystad Energy believes global offshore investments will bottom out at $155

billion in 2018, and then investments grow steadily year by year going forward.

This growth comes from high offshore activity, driven mainly by an increasing

oil price and companies' ability to cut costs to improve the profitability of

their projects. These two factors are resulting in companies actually deciding

to go through with more investments, compared to the last three years. Several

large projects demanding significant investments in the upcoming years, with Mad

Dog Phase 2, ACG, and Bonga Southwest as the most important. Another factor

explaining the investment growth is the increased share of ultra-deep-water

projects, defined as assets in waters deeper than 1,500 m.

At a country level, the picture is mixed. Both in the years before and after the

downturn, the five most important countries, in terms of offshore investments,

were the US, Norway, Brazil, Australia and the UK. These countries' offshore

investments summed up to $155 billion in peak year 2014, nearly half of the

global total. However, Rystad sees slightly different developments after the

price collapse and going forward. Norway and Brazil follow the global trend,

with investments dropping roughly 50% before recovering to about 70% of 2014

peak investments. The US and UK investments were hit a bit harder, down roughly

65%, and only managed to recover to 60% (US) and 42% (UK) of 2014 levels.

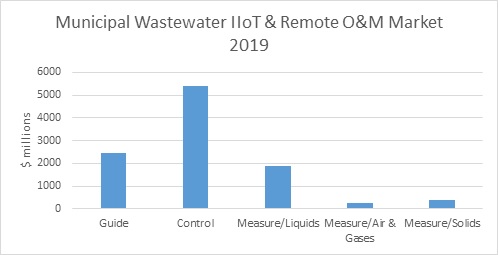

The market for guide, control and measure will grow faster than the total

offshore capital expenses.

Choke Valves in Offshore Oil and Gas

The choke valve market ranges between $250 million and $400 million per year

depending on the definition and where we are in the oil and gas cycle. A

significant portion of choke valve sales are to oil and gas companies. The

definition also has a major effect on the revenue determination. The terms

choke, control and axial are used in different ways. With some

definitions, the market is much larger than with others. Here are some ways the

term is defined:

With remote monitoring and IIoT evaluation of choke valve performance it is

important that the relevant decisive classification of applications, valve

types, and materials be clarified. This is an ongoing project. To

view the questions and present status click on:

Subsea platforms for oil and gas extraction provide a lot of advantages compared

to floating fabrication - first and foremost in terms of cost savings and

reduced environmental impact. The high-pressure pump is the heart of the Subsea

Hydraulic Power Unit, required to work non-stop 24/7 with outstanding

reliability.

Danfoss offers chemical liquid pump solutions designed according to the API 674

and 675 standards and optimized for subsea applications, operating smoothly at

depths up to 3,000 meters. The pumps for subsea applications are delivered in

Super Duplex. The compact and lightweight pump unit guarantees constant

operation for six years without service and maintenance. The only lubricant

needed is the pumped fluid that keeps the pump running subsea, cycle after

cycle.

Subsea applications are characterized by limited space and an extremely harsh

environment. In the Danfoss product portfolio you will find chemical liquid

pumps fulfilling all requirements to subsea systems. The axial piston technology

delivers powerful performance and reduces the pump size and weight to a minimum.

The use of high-grade stainless steel and carbon-reinforced PEEK from surface to

core of the pump ensures complete corrosion resistance when submerged.

To register for the February 28 webinar click on

Free Market Webinars

For information on the Guide, Control, and Measure Market click on

N031 Industrial IOT and Remote O&M

For information on the Oil and Gas Markets, Profiles, and Projects click on

N049 Oil, Gas, Shale and Refining Markets and

Projects

Impact of IIoW Empowered IIoT on the Combust, Flow and Treat Market

There is a sea change in the obtainable combust, flow and treat market.

Those companies leveraging the Industrial Internet of Wisdom (IIoW) to

empower the Industrial Internet of Things (IIoT) will generate both higher

revenues due to higher margins per unit sale but also increased market share.

An example would be condition monitoring at the dozens of BASF plants

around the world. The process

management system is built around use of Samson valves and E+H instrumentation.

At the very least Samson and E&H have expanded their market share at all the

BASF plants around the world. to

the extent that the sales include edge computer software built upon product and

process knowledge the unit sales are also increased.

Markets can be divided into four categories including the three traditional ones

and a new one created by the sea change in the business environment.

·

TAM or Total Available Market is the total market demand for a product or

service.

·

SAM or Serviceable Available Market is the segment of the TAM targeted by your

products and services which is within your geographical or asset reach.

·

SOM or Serviceable Obtainable Market is the portion of SAM that you can capture.

·

WOM or Wisdom-based obtainable market is the bigger opportunity created by a sea

change in the route to market.

Two pump companies will be substantially impacted by the sea change.

One embraces it and one does not.

|

Revenues Before and After IIoW

Empowered IIoT |

||||

|

Company |

Before

|

After- Based on SOM |

After - Impacted by WOM |

After - Total |

|

A |

$$ |

$$$ |

$ |

$$$$ |

|

B |

$$ |

$ |

(Loss of Market Share) |

$ |

In this example two pump companies had equal sales before the sea change. After

the sea change one company loses half its market while the other one doubles

revenues. The unit revenues for Company A are up 50% ($$ to SSS). This is

because the customers will buy from the company with WOM capability. Due to WOM

edge computer and controls additions the revenues per unit of sales add another

$ to the total.

The impact of IIoW will be more important than that of IIoT.

Steps to leverage IIoW can be taken immediately independent of eventual

edge computing process development.

In fact the edge computing process management product will be based on IIoW

initiatives. These initiatives

include greater knowledge of how products present and future can improve

specific processes for specific customers.

This wisdom in turn is based on interconnection of people and knowledge.

The five-step program to leverage IIoW is found at

www.mcilvainecompany.com.

Scrubber

Adsorber Knowledge System Covers Industrial Gas Purification.

Here are the headlines for the February Scrubber Adsorber newsletter which is

part of the Knowledge Network described at

2ABC Scrubber/Adsorber/Biofilter Knowledge Systems

SCRUBBER/ADSORBER

NEWSLETTER

February 2018

No. 524

Table of Contents

MARKETS

·

Detailed Forecasting of IIoT by Country and Company

in the IIoT and Remote O&M Report

IRON AND STEEL

·

ArcelorMittal Kryvyi Rih Wins All-Ukrainian

Environmental Competition

ODOR CONTROL

·

Maintenance the Key to Maintaining Performance of

Pig House Scrubbers

·

New Scrubber Planned for Washington, MO Treatment

Works

SHIP EMISSIONS

·

Yara Marine has been Granted a Patent for their

Exhaust Gas Cleaning Scrubber Technology

·

HHI Develops Scrubber Technology with Smaller

Footprint

REFINERY

·

New Scrubber Online at Utah's Largest Refinery

BIOGAS

WELCOME

Weekly selected highlights in flow control, treatment and combustion from the

many McIlvaine publications.

Brief Insights

The Offshore Markets and IIoT webinar on February 28 is one of a long series of

recorded webinars which include the recent Shale Gas webinar, the Refinery

webinar and one a year ago on the broader Oil and Gas Market and the Impact of

IIoT.

You can register for the offshore webinar at

Free Market Webinars

View the Shale Gas Webinar at

https://youtu.be/UxZCfMhBJ7k

View the Refinery Webinar at

https://youtu.be/N0CgrGcfMAU

View the Oil and Gas Webinar at

https://youtu.be/o7kJSXixFHs

Large Combust, Flow and Treat

Purchases by Offshore Oil and Gas Operators Will Accelerate Starting in 2019

The offshore oil and gas industry even at its low point this year will invest

over $150 billion. While total

investment has been falling the investment in IIoT and Remote O&M has been

increasing. With total investment

moderately increasing through 2022 coupled with accelerated IIoT investment,

this market will be significant for combust, flow and treat suppliers.

One reason it will be very important is that cutting edge IIoT and remote

monitoring technologies are needed due to the remote surface locations of rigs

and the difficult challenges of subsea operation.

Rystad Energy believes global offshore investments will bottom out at $155

billion in 2018, and then investments grow steadily year by year going forward.

This growth comes from high offshore activity, driven mainly by an increasing

oil price and companies' ability to cut costs to improve the profitability of

their projects. These two factors are resulting in companies actually deciding

to go through with more investments, compared to the last three years. Several

large projects demanding significant investments in the upcoming years, with Mad

Dog Phase 2, ACG, and Bonga Southwest as the most important. Another factor

explaining the investment growth is the increased share of ultra-deep-water

projects, defined as assets in waters deeper than 1,500 m.

At a country level, the picture is mixed. Both in the years before and after the

downturn, the five most important countries, in terms of offshore investments,

were the US, Norway, Brazil, Australia and the UK. These countries' offshore

investments summed up to $155 billion in peak year 2014, nearly half of the

global total. However, Rystad sees slightly different developments after the

price collapse and going forward. Norway and Brazil follow the global trend,

with investments dropping roughly 50% before recovering to about 70% of 2014

peak investments. The US and UK investments were hit a bit harder, down roughly

65%, and only managed to recover to 60% (US) and 42% (UK) of 2014 levels.

The market for guide, control and measure will grow faster than the total

offshore capital expenses.

Choke Valves in Offshore Oil and Gas

The choke valve market ranges between $250 million and $400 million per year

depending on the definition and where we are in the oil and gas cycle. A

significant portion of choke valve sales are to oil and gas companies. The

definition also has a major effect on the revenue determination. The terms

choke, control and axial are used in different ways. With some

definitions, the market is much larger than with others. Here are some ways the

term is defined:

With remote monitoring and IIoT evaluation of choke valve performance it is

important that the relevant decisive classification of applications, valve

types, and materials be clarified. This is an ongoing project. To

view the questions and present status click on:

Subsea platforms for oil and gas extraction provide a lot of advantages compared

to floating fabrication - first and foremost in terms of cost savings and

reduced environmental impact. The high-pressure pump is the heart of the Subsea

Hydraulic Power Unit, required to work non-stop 24/7 with outstanding

reliability.

Danfoss offers chemical liquid pump solutions designed according to the API 674

and 675 standards and optimized for subsea applications, operating smoothly at

depths up to 3,000 meters. The pumps for subsea applications are delivered in

Super Duplex. The compact and lightweight pump unit guarantees constant

operation for six years without service and maintenance. The only lubricant

needed is the pumped fluid that keeps the pump running subsea, cycle after

cycle.

Subsea applications are characterized by limited space and an extremely harsh

environment. In the Danfoss product portfolio you will find chemical liquid

pumps fulfilling all requirements to subsea systems. The axial piston technology

delivers powerful performance and reduces the pump size and weight to a minimum.

The use of high-grade stainless steel and carbon-reinforced PEEK from surface to

core of the pump ensures complete corrosion resistance when submerged.

To register for the February 28 webinar click on

Free Market Webinars

For information on the Guide, Control, and Measure Market click on

N031 Industrial IOT and Remote O&M

For information on the Oil and Gas Markets, Profiles, and Projects click on

N049 Oil, Gas, Shale and Refining Markets and

Projects

Impact of IIoW Empowered IIoT on the Combust, Flow and Treat Market

There is a sea change in the obtainable combust, flow and treat market.

Those companies leveraging the Industrial Internet of Wisdom (IIoW) to

empower the Industrial Internet of Things (IIoT) will generate both higher

revenues due to higher margins per unit sale but also increased market share.

An example would be condition monitoring at the dozens of BASF plants

around the world. The process

management system is built around use of Samson valves and E+H instrumentation.

At the very least Samson and E&H have expanded their market share at all the

BASF plants around the world. to

the extent that the sales include edge computer software built upon product and

process knowledge the unit sales are also increased.

Markets can be divided into four categories including the three traditional ones

and a new one created by the sea change in the business environment.

·

TAM or Total Available Market is the total market demand for a product or

service.

·

SAM or Serviceable Available Market is the segment of the TAM targeted by your

products and services which is within your geographical or asset reach.

·

SOM or Serviceable Obtainable Market is the portion of SAM that you can capture.

·

WOM or Wisdom-based obtainable market is the bigger opportunity created by a sea

change in the route to market.

Two pump companies will be substantially impacted by the sea change.

One embraces it and one does not.

|

Revenues Before and After IIoW

Empowered IIoT |

||||

|

Company |

Before

|

After- Based on SOM |

After - Impacted by WOM |

After - Total |

|

A |

$$ |

$$$ |

$ |

$$$$ |

|

B |

$$ |

$ |

(Loss of Market Share) |

$ |

In this example two pump companies had equal sales before the sea change. After

the sea change one company loses half its market while the other one doubles

revenues. The unit revenues for Company A are up 50% ($$ to SSS). This is

because the customers will buy from the company with WOM capability. Due to WOM

edge computer and controls additions the revenues per unit of sales add another

$ to the total.

The impact of IIoW will be more important than that of IIoT.

Steps to leverage IIoW can be taken immediately independent of eventual

edge computing process development.

In fact the edge computing process management product will be based on IIoW

initiatives. These initiatives

include greater knowledge of how products present and future can improve

specific processes for specific customers.

This wisdom in turn is based on interconnection of people and knowledge.

The five-step program to leverage IIoW is found at

www.mcilvainecompany.com.

Scrubber

Adsorber Knowledge System Covers Industrial Gas Purification.

Here are the headlines for the February Scrubber Adsorber newsletter which is

part of the Knowledge Network described at

2ABC Scrubber/Adsorber/Biofilter Knowledge Systems

SCRUBBER/ADSORBER

NEWSLETTER

February 2018

No. 524

Table of Contents

MARKETS

·

Detailed Forecasting of IIoT by Country and Company

in the IIoT and Remote O&M Report

IRON AND STEEL

·

ArcelorMittal Kryvyi Rih Wins All-Ukrainian

Environmental Competition

ODOR CONTROL

·

Maintenance the Key to Maintaining Performance of

Pig House Scrubbers

·

New Scrubber Planned for Washington, MO Treatment

Works

SHIP EMISSIONS

·

Yara Marine has been Granted a Patent for their

Exhaust Gas Cleaning Scrubber Technology

·

HHI Develops Scrubber Technology with Smaller

Footprint

REFINERY

·

New Scrubber Online at Utah's Largest Refinery

BIOGAS

·

California Utilities Issue Draft Solicitation for

Dairy Biomethane Pilot Projects

·

Valmet to Supply a Flue Gas Cleaning System to

Vantaan Energia's Biopower Plant in Martinlaakso

·

Valmet to Supply an Extensive Automation and Data

Collection Solution to Gasum's Biogas Plants

RESEARCH

·

PNNL Demonstrates Tiny Porous Materials Can

Economically Separate Xenon Gas out of Waste Streams

·

California Utilities Issue Draft Solicitation for

Dairy Biomethane Pilot Projects

·

Valmet to Supply a Flue Gas Cleaning System to

Vantaan Energia's Biopower Plant in Martinlaakso

·

Valmet to Supply an Extensive Automation and Data

Collection Solution to Gasum's Biogas Plants

RESEARCH

·

PNNL Demonstrates Tiny Porous Materials Can

Economically Separate Xenon Gas out of Waste Streams