WELCOME

Weekly selected highlights in flow control, treatment and combustion from the

many McIlvaine publications.

Brief Insights

In

the following article we define WOM as Wisdom based Obtainable Market.

This greatly expands the Serviceable Obtainable Market (SOM) and will

also impact market shares. Wisdom

comes from the interconnection of knowledge and people.

All our many services complement one another and provide a platform for

wisdom to flourish.

Our February 28th webinar is on offshore oil and gas WOM opportunities.

It is important not only to those pursuing this market but for anyone

interested in remote monitoring and control.

The challenge of operating valves, pumps and other flow and treat

products in the deep ocean is leading to cutting edge technologies which will be

useful in many applications.

Some of the WOM wisdom comes from decision systems.

We are presently examining all the options for improving aeration

efficiency in municipal wastewater treatment.

You can obtain a free three-month access to this system.

So just communicate your interest and we will provide access.

Advanced Forecasting Maximizes Profitable Growth in the Combust, Flow and Treat

(CFT) Markets

The avalanche of digital information now engulfing us can either bury us or be

utilized to maximize profits through "Advanced Forecasting". Market

research has in the past been used not as a guide but as an indicator to

opportunities. "Advanced Forecasting" makes use of this digital

information avalanche to guide capital investments as well as set up promotional

budgets and sales quotas.

Markets can be divided into four categories including the three traditional ones

and a new one created by the sea change in the business environment.

Most typical $4,000 reports are based on top-down research and provide only

"Possible TAM". Top-down means that the report is based on interviews,

annual reports and broad indicators. However, annual reports and

interviews tend to reflect the conclusions from the top down reports. This

creates an illusionary consensus. The volatility of the stock market is in

part based on peaks caused by illusionary consensus and valleys caused by

reality.

Many companies which understand the importance not only of SAM but SOM spend

orders of magnitude more for custom market research than for a multi-client

report. These large contracts allow very capable individuals to interview the

most knowledgeable people and to spend lots of time sifting through the

avalanche of data. They also have the funding to acquire multiple top down

reports. The problem is that the results are likely to be greatly impacted

by the illusionary consensus.

For a much more insightful analysis of SOM you need a bottoms up approach.

Such an approach could cost millions of dollars. Fortunately, for many CFT

subjects Mcilvaine has made this investment reflected in continuously updated

reports compiled over the last 44 years.

Some of these reports are in the form of databases with specific project details

and purchasing forecasts for the 1000 customers who buy most CFT. These

bottoms up reports are then used in the multi-client market reports to provide

bottoms up market forecasting.

This SAM effort leads the way to cost effective SOM forecasts. These

analyses for very specific products in each industry in each territory can

include several million specific forecast cells. In the case of a new product

launch it may be desirable to provide even further segmentation. One

example would be forecasts for ball valves for gas pipelines segmented by valve

size, geography, large purchasers, trunnion vs floating and side entry vs top

entry.

WOM expands Advanced Forecasting to include revenues based on supplemental IIoT

products and services and revenues for expanded markets and increased margin in

existing markets.

Reliable bottoms up SOM forecasts can contribute greatly to increasing profits

through best allocation of capital, personnel, R&D and sales promotion.

WOM forecasting will provide even greater rewards.

Mcilvaine can provide cost effective and reliable SOM and WOM forecasts.

More details are available from Bob McIlvaine at 847-784-0012 ext. 112

rmcilvaine@mcilvainecompany.com

The bottoms up approach includes multi-client market reports listed at

http://home.mcilvainecompany.com/index.php/markets

It includes databases listed at

http://home.mcilvainecompany.com/index.php/databases

There is a five step WOM program to leverage Advanced Forecasting explained at

www.mcilvainecompany.com

Shale Boom is Boosting IIoT Revenues

The booming U.S shale market is a major contributor to the increasing revenues

for IIoT products and services.

Guide revenues which include process management and subject matter

expertise will grow at 10 percent per year during the next 5 years to reach

$3.36 billion by 2022. Revenues for control and measurement will be rising at 7

percent per year.

McIlvaine conducted a webinar on February 7 with two slide decks.

This webinar was recorded, and the recording is available free of charge.

The actual slide decks are only available to subscribers to the McIlvaine

IIoT and Remote O&M report.

Here is the table of contents to the webinar.

Shale Slide Deck One: Markets,

Processes, Players

MARKETS

Introductory Note

Shale Oil Markets

Oil Price Trends

Oil Price Factors

Gas Supply and Demand

U.S. as Net Exporter

Shale Gas Market Overview Map

Shale Gas Market Overview Reserves

Shale Gas Market Observations

Shale Gas Market Asia

Shale Gas Market Factors

Shale Oil and Gas Reserves by Country

Compressor, Valve and Pump Opportunities Graph

PROCESSES

Shale Gas Extraction, Processing, Transportation Diagram

Shale Gas Reserves by Basin

Crude Oil Pipelines

Shell Ethane Cracker Project

Shell Ethane Cracker Process Diagram

Natural Gas Processing Well Head to Customer Diagram

Tank Vapor Recovery System Diagram

LNG Liquefaction Process

Compressor Station Equipment and Process Flow Diagram

SHALE OIL AND GAS PRODUCERS

Top 10 Producers

Largest Shale-Focused Companies

Shale Slide Deck Two: Combust, Flow, and Treat Options Related to IIoT

PROCESS MANAGEMENTT

Accenture Uber for the Field

WiPro Integrated Agility

Rejuvenated Shale Industry Will Leverage Digital

Shell has Worldwide Enterprise Agreement with OSIsoft

OSIsoft Penetration of the Oil and Gas Industry

Infosys Centers of Excellence

Futura optimizes Fracking Truck Performance

MONITORING AND CONTROL

If Gas Leakage Exceeds 3% Methane Emissions are Greater than with Coal

Hydraulic Actuator Position Feedback for Control and Shut Off Valves- Balluff

Danfoss Components in Fracking Operations

Valve Applications in Emergency Shut Down in Shale Operations - Emerson

Solar Powered Rotork Actuator replaces Bleed Gas in Shale Produced Gas System

Butterfly Valves are a Cost-Effective choice for Shale Fugitive Emissions

Bentek Pump Controls

Emerson Asset Management and Predictive Measurement

Emerson Instruments in Shale

Emerson provides Solution for Emergency Shutdown with Gas Containing H2S

Pump and Truck Suppliers

New Approach to Reduce Frac Sand Costs with Sand Pods

Gardner Denver offers Five Different Pump Models

EPIX is Weir, Rolls Royce Joint Venture

U.S. IIoT Opportunities in Oil and Gas

To view the free recording click on

https://youtu.be/UxZCfMhBJ7k

For more information on the IIoT & Remote O&M report click on

N031 Industrial IOT and Remote O&M

Market Webinars

The following webinars are free to anyone. The power points are only available

to subscribers of the relevant market reports. Each webinar discusses

market size and identifies the largest companies who are responsible for more

than 50 percent of the purchases. The impact of IIoT & Remote O&M in

creating a new route to market for combust, flow and treat products is analyzed.

|

DATE |

HOT TOPIC HOUR

SCHEDULE |

|

February 28, 2018 |

|

|

March 28, 2018 |

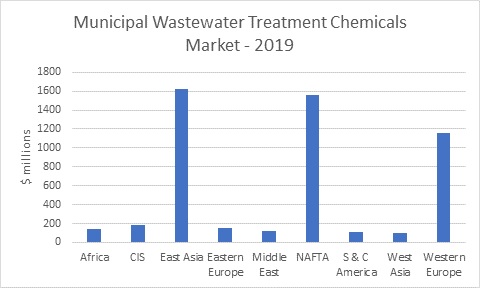

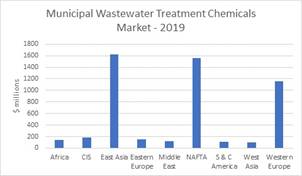

Municipal Wastewater Markets and

Decisions

This

will be a follow up and

expansion of the discussion of

the Water and Wastewater IIoT

webinar of April 6, 2017.

You can view the table of

contents and listen to the

previous recording from the

links below this

will include market forecasts

for municipal wastewater

combust, flow and treat products

and services but also cover the

municipal wastewater decisions

system with specific emphasis on

aeration blower options.

Markets for pumps, valves,

chemicals, filters and

instruments impacted by IIoT

will also be covered. |

|

April 25, 2018 |

Coal Fired Power IIoT and Remote

O&M An

update of the webinar conducted

on March 2, 2017 will provide

the latest S.E. Asia projects

along with conclusions being

reached in Coal fired boiler

Decisions and specifically dry

scrubber options. It will

also cover the markets for

systems and components and the

impact of IIoT. |

|

May 23, 2018 |

Gas Turbine, Reciprocating

Engine IIoT and Remote O&M

An

update of the webinar conducted

on February 2, 2017 will cover

the markets and projects for gas

turbine and reciprocating engine

systems and components

worldwide. The impact of

IIoT and the booming third party

remote monitoring and O&M will

be analyzed. There will also be

coverage of Gas Turbine

Decisions and challenging issues

such as desuperheater

reliability and maintenance.

|

Click here to Register for the Webinars