The First IIoT Webinar is Thursday - February 16, 2017

The Industrial Internet of Things (IIoT) and remote operation and maintenance

will combine to create a market worth $1.4 trillion in 2030 according to the

latest forecasts in

N031 Industrial IOT and Remote O&M Market Report published by the

McIlvaine Company.A series of nine webinars will provide some of the conclusions

from the report. The presentations will be followed by a discussion period where

participants can share their views and ask questions. Each webinar will be

scheduled on a Thursday at 10:00 a.m. CDT. Participation is free.

February 16 - IIoT and Remote O&M Markets:

Questions to be addressed include:

Why combine IIoT and Remote O&M forecasts? Why will this market grow at 13%/yr.?

What are the major markets segmented by industry, region, and product? What are

the limiting factors to growth? How do suppliers best take advantage of the

opportunity? To register click on

$22 Billion Sedimentation and Centrifugation Market will take many Potential

Purchasing Routes

Due to the rapid development of the Industrial Internet of Things (IIoT) it is

clear that there will be a large sedimentation and centrifugation market, but it

is less clear who will be the purchasers. Centrifuge manufacturers are well

positioned to take a leading role due to the challenging maintenance

requirements for this high-speed equipment. Many centrifuge manufacturers

already have remote monitoring programs. Centrysis wireless remote monitoring is

web-based and tracks 32 key parameters. It includes alerts, reports and service.

Alfa Laval has several remote monitoring initiatives including decanter

centrifuge condition monitoring at the Metropolitan Wastewater Reclamation

District of Chicago. Vibration is monitored and controlled through a X20 PLC

from B&R Industrial Automation. A custom I/O module has reduced costs and made

remote monitoring attractive.

Alfa Laval has expanded the concept to related remote monitoring and service.

The Octopus biosolids dewatering centrifuge autopilot monitors and controls all

aspects of the dewatering process. This includes material feed, polymer dosing

and internal decanter settings. Infrared sensors analyze performance and

automatically make the necessary adjustments.

GEA is using SAP HANA software as part of a predictive maintenance and service

program for food processors. The program also is geared toward optimizing the

performance of decanters and separators. The program opens the door to modular

service-level agreements, warranted availabilities and insurance for customers.

A similar program called GEA IO provides remote operation of separators on

merchant ships and ferries. Performance on lube oil purification and water

treatment is optimized. The operation is seamlessly integrated into the central

digital control system for the ship. GEA is pointing to a future of autonomously

operated ships. The elimination of the crew reduces operating costs by 20

percent. The first prototypes have already successfully completed test runs. A

team of operators remotely monitors operations and if necessary can take

control.

Level control is fundamental to any sedimentation process. With the advent of

microprocessors, ultrasonic technology moved into the level instrumentation

mainstream where today it is one of the most common and favored techniques in

use at wastewater treatment plants. Many of the characteristics unique to

ultrasonics can be managed automatically by signal processing algorithms

programmed into each instrument. Today's operators can take successful

performance of an ultrasonic instrument for granted assuming the instrument is

properly applied and installed.

The Drexelbrook CCS4000 Multi-Channel Sludge Blanket Level Monitor helps keep

track of effluent quality in up to four separate water and wastewater treatment

clarifiers and thickeners. The system uses ultrasonic technology to measure the

compacted sludge level, the lighter rag material above the interface, and

clarity loss in the water above the blanket and rag levels. The monitor

eliminates worry about the adverse effects of denitrification, septic sludge,

washouts, and mechanical breakdown of rakes. Compacted sludge tracking ensures

that only dense sludge is withdrawn from the vessel, reducing pumping and

disposal costs. At the same time, the lighter rag layer can be tracked to

monitor the settling characteristics of the vessel, and the output can be used

to control the use of chemical additives.

The heart of any clarifier or thickener drive unit is the main gear and bearing.

One of the most obvious design features of the DBS drive unit is its torque

gauge. DBS has used a large diameter stainless steel gauge that accurately

indicates torque in foot-pounds or Newton-meters. The DBS torque gauges can be

fitted with 4-20 mA torque transducer for remote monitoring and control. This

information allows industrial users to increase the throughput and efficiency of

their process.

IIoT and Remote O&M developments will help boost sedimentation and

centrifugation revenues to just under $15 billion by 2026.

|

Sedimentation and Centrifugation

Revenues ($Millions) |

|

|

Segment |

2026 |

|

Centrifuge Equipment |

4,000 |

|

Service On-Site |

1,000 |

|

Remote Service and Monitoring |

1,800 |

|

Sedimentation Equipment |

5,800 |

|

Service On-Site |

940 |

|

Remote Service and Monitoring |

1,200 |

|

Total

|

14,740 |

The projected remote O&M revenue is $3 billion which is in addition to just

under $2 billion in onsite service.

There are pump, valve, treatment chemical, and related operation and maintenance

revenues which are not included in the narrower definition of sedimentation and

centrifugation but are part of the total revenue potential. There is an

additional $8 billion in potential revenue for third party suppliers.

|

Third Party O&M with

Sedimentation and Centrifugation

($Millions) |

|

|

Segment |

2026 |

|

Equipment |

9,800 |

|

Service on Site |

1,940 |

|

Remote Service and Monitoring |

3,000 |

|

Potential Third Party

Purification Process Revenues |

8,000 |

|

Total |

22,740 |

The move toward third party O&M will create an annual market potential of $22.7

billion by 2026. This includes $8 billion which would otherwise be in plant

expenditures but will be instead provided by third parties.

There is likely to be both sharing and competition among suppliers. Companies

such as Accenture, Genpact, and Wipro are offering digital process management

systems which have procurement as a service component. It is possible that

Accenture could purchase the water treatment chemicals, pumps, and valves. SAP

is already partnering with GEA and has Asset Intelligence Network with a

registry of components such as pumps with cloud-based support to provide details

on parts. Nalco and other water treatment chemicals companies have 24/7 remote

monitoring centers up and running.

The other type of competition will come from companies, such as Suez, that are

offering total operation and maintenance of the purification systems. Such

companies are already operating municipal water and wastewater plants. The

build, own, operate concept can be applied to industrial water and wastewater

treatment systems as well. With IIoT and specifically digital process

management, the elimination of operators makes third party contracts much more

attractive.

Suppliers of sedimentation and centrifugation equipment can take bigger or

smaller pieces of the pie. In the case of GEA which already supplies complete

food processing systems, the role of third party O&M will be a natural

transition. For many suppliers, it will be important to partner with companies

who have the best potential to capture market share.

Ultimately there will be much more awareness and reward for those companies

supplying products with the lowest cost of ownership. With sensors providing

performance and maintenance data on a continuous basis there is clarity as to

superior products. Some sedimentation and centrifugation suppliers have the

opportunity to invest in better products and leave the remote O&M to others. The

path for each company is likely to be unique and challenging due to the rapid

evolution of what McIlvaine coins as IIoT empowered by IIoW (Wisdom). McIlvaine

is providing a strategic planning package which includes some consulting and

access to both the following reports.

N005 Sedimentation and Centrifugation World Markets

N031 Industrial IIoT and Remote O&M. (Formerly Air and Water Monitoring)

click on:

http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/106-n031

Ultrapure Water Market Bolstered by IIoT will exceed $12 Billion in 2026

The market for ultrapure water systems and components will exceed $12 billion in

2026 according to the latest McIlvaine forecasts. This includes $2 billion of

IIoT related products and services supplied by ultrapure water system and

product manufacturers. In addition, $2 billion of ultrapure water products

previously sold directly to operators will now be sold to third party O&M

companies. As a result, there will be a $4 billion market shaped by IIoT.

|

Ultrapure Water System and

Component Market 2026

($ Billions) |

||

|

|

Total Market |

IIoT Related

Market |

|

Power |

5 |

|

|

Electronics |

4 |

|

|

Pharmaceutical and Other |

2 |

|

|

Additional IIoT Revenues |

2 |

2 |

|

Rechanneled Revenues |

|

2 |

|

Total |

13 |

4 |

A supplier of pumps, filters, valves, piping, treatment chemicals, or

instrumentation has the opportunity to boost revenues. A smart pump or valve

needed to communicate with the cloud is worth more than a dumb one. Suppliers of

water treatment chemicals such as Nalco can boost sales with remote monitoring

services.

These suppliers will also find that part of their market once served directly

will now be served through third parties, so identification of new potential

purchasers and specifiers is important.

System suppliers are one potential revenue source. MHPS, Siemens, and GE already

have remote O&M services for turbines. It is very likely that one or more will

expand into O&M for the related ultrapure water systems. Suppliers of

pharmaceutical and semiconductor manufacturing equipment will also expand their

offerings with IIoT.

A UPW supplier may also move into the broader O&M role. Danaher is moving

aggressively into IIoT. The company supplies Pall filters, Hach water monitoring

and Chemtreat treatment chemicals, so it could take on a larger role and

possibly partner with valve and pump companies to provide integrated O&M.

3M is another candidate. 3M products for

ultrapure water, include Pre-RO, Resin Trap, Point-of Use Pre-Filtration, and

Point-of-Use Final Filtration. Degasification membranes are also supplied.

3M has installed sensors on its ScaleGard Blend Series of water filtration

products. ScaleGards are typically used at restaurants to purify the water for

soda machines. By digitizing the water systems, the restaurant managers receive

alerts on their computers or mobile phones when a part on the machine needs to

be replaced. The system also automatically sends an alert to 3M channel

partners, letting them know when to deliver the replacement part.

3M's Active Safety software lets plant managers track safety issues on the

production line. They attach an RFID tag to each piece of personal protection

equipment, so managers can keep tabs on who's wearing what device, whether they

are properly trained and if the equipment is in compliance with regulations. So,

expansion into a broad IIoT role is a possibility.

Another group are O&M specialists. There are a number of such companies offering

O&M services for gas turbines.

The digital process management companies are still another set of contenders.

They offer analytics and Procurement As A Service (PAAS) as part of their

packages. Accenture, Wipro, and Genpact are examples.

Some of the specific players are filtration companies such as GE Water and

Ovivo. Pump companies include Flowserve, and Sundyne, a division of Accudyne.

Both provide other products and would have the depth to play a larger role.

Danfoss is another pump supplier. Its complimentary products include drives and

HVAC equipment used in pharma and chip manufacturing.

Prochem, Hach, Mettler Toledo and other instrument suppliers offer remote

monitoring including input from:

Kurita has a remote monitoring system and since it supplies water treatment

chemicals it can include its chemicals supply as part of the program.

Veolia supplies complete UPW systems. The Orion package

features Reverse Osmosis (RO) membranes, integral recovery RO and concentrate

recycle along with purified water.

Orion includes TFT HMI with the options of Siemens and Allen Bradley PLC units.

This updated HMI technology displays key sustainable parameters such as CO2, water

and energy savings. The latest Integrated Smart Module (ISM) sensors have also

been used for monitoring and control aspects. The Orion can be linked to the new

Veolia technology, Vision. This customer portal is a private, secure web-based

platform that allows access to all information regarding Orion, its products and

services. Vision Air also allows for remote monitoring, giving further control

and enabling access to real-time encrypted performance data, including alarms

and equipment status.

Large semiconductor tool makers could also expand into UPW O&M.

A leading-edge fab might contain >1,000 tools,

with several dozen key sensors on each tool, and each wafer may see as many as

1,400 process steps. Huge streams of information are coming from fab tools,

wafers, GDS (design) files, and facility systems such as chillers. Applied

Materials is a major tool provider but also provides IIoT services.

Applied's technology-enabled services go beyond the maintenance-driven

relationships Applied has with chipmakers. Most

large manufacturers

are already collaborating with the company on data-driven analysis projects,

drawing upon Applied's E3 performance-tracking and data-mining software, as well

as libraries and models. Applied engineers record vibration data, wafer

placement images, optical emissions, and other sets of information to help

enrich analysis models.

An aspect of the IIoT in pharma is the modularization of pharmaceutical

production plants. IIoT infrastructure allows modular automation to scale

production up or down according to market needs. This enables faster

time-to-market for pharmaceutical products in accordance with the regulations

and required approvals for specific markets and regions.

The challenge for the future of pharmaceutical manufacturing is to be highly

flexible with adaptable automated production. Today, there are still many manual

processes in drug substance and drug product preparation. Managing the data and

being able to make automatic adjustments or decisions based on the data implies

advances which IIoT promises to deliver. Cloud based systems can also integrate

the important UPW data and make the UPW system as flexible as the rest of the

manufacturing operation.

The impact of IIoT and Remote O&M will be substantial. The path to success

will be complex. McIlvaine has two services to help guide the suppliers:

IIoT and Remote O&M

N031 Industrial IoT and Remote O&M

UPW World Markets

N029 Ultrapure Water: World Market

Utility Tracking System has Automation as well as Upgrade Projects

The Utility E Alert and Utility Plans database are tracking automation as well

as environmental upgrades. In the U.S. there will be a surge in automation

projects due to the likelihood that existing coal plants will be allowed to

operate for the next decade or two. The capital investment is relatively low

compared to the cost savings in fuel. The greater reliability also adds

significant benefit.

In India there is a big retrofit program for FGD and NOx control. In

other Asian countries there are many new coal-fired boilers underway.

Information on this service is found at

42EI Utility Tracking System.

IIoT will add $20 Billion to Valve Revenues by 2025

The Industrial Internet of Things (IIoT) is predicted to add $20 billion/yr to

valve manufacturer revenues by 2025(1).

This addition will be a function of:

IIoT will be the catalyst to improving valve performance. Sensors which monitor

the health of every valve focus management's attention on making better choices

in the future. They also focus supplier attention on the subject and provide

guidance on choices with the lowest total cost of ownership.

The convergence of purchasing and other IIoT functions is expressed in the

Genpact characterization of itself as providing "digitally powered business

process management". One aspect is strategic purchasing while another is

optimization of operations. For Duke Energy, it integrated remote monitoring

from several different wind turbine OEMS into a comprehensive digital program

for improving wind generation operations.

So a supplier of smarter valves for wind turbine operations will find that

companies such as Genpact, Accenture, and IBM focused on digitally powered

business process management will be an important influence on valve selection.

McIlvaine has created a beta website for BHE

(2).

It has data on the components including valves for the hundreds of coal, gas,

wind, solar, hydro, and biomass generation facilities owned by this Berkshire

Hathaway subsidiary. The BHE operations also include gas transmission companies

who have more than 70 compressor stations. There are lubrication valve details

for pumps, pulverizers, fans, compressors, engines, turbines (steam, gas, and

wind).

With IIoT BHE would be able to continuously monitor the performance and health

of these valves and to make purchasing decisions with a great deal more

knowledge than it would have absent IIoT.

The strategic sourcing consultants and end users all emphasize that lowering

costs is not a specific objective. Amgen has three pillars for procurement:

Lowering cost may be part of the operational efficiency strategy, but with smart

valves the opposite will be true. Pay more for "smarter valves" and improve

efficiency.

Saudi Aramco has its own strategic procurement division. It tested 75,000 valves

for four major projects and found an average of 3.3% of the valves had defects.

For one project the number was over 10%. Shell has expressed concern about valve

defects and the inability of valve manufacturers to extend warranties if Shell

were to take the repair on itself. With IIoT and remote monitoring the valve

supplier and Shell can be well informed about the condition of each valve. This

shared knowledge will make it easier to decide how to repair it without loss of

guarantees.

With access to a cloud based system valve suppliers, plant purchasing, plant

operations, system suppliers, and outside strategic procurement consultants will

all have access to the valve health and performance data on every valve. In the

past remote monitoring, usually has been applied only to control valves. With

IIoT remote monitoring of all valves will be economically justifiable.

Valve suppliers have the opportunity with remote monitoring to change

maintenance procedures to prescriptive rather than predictive. Considerable cost

savings are achieved when only the valves in need of repair are opened. The

anticipation and avoidance of problems can have a large operational payback.

Automation suppliers and consultants acknowledge the need for subject matter

expertise but do not give it the highest priority. The recipe for Tiger soup can

be more easily obtained than the tiger. Subject matter expertise is a "very

tough" tiger.

The IIoT Pyramid

It can be argued that the rate of progress depends more on new ways to develop

and utilize subject matter expertise than IIoT. McIlvaine coined the term IIoW

(Industrial Internet of Wisdom) to cover the systematic leveraging of subject

matter expertise.

|

Rate of Progress = 1 x IIoT + 2 x IIoW |

||

|

|

IIoT |

IIoW |

|

Data |

Physical parameters and status of each component |

Google, blogs, news |

|

Information |

Historian, Edge Computing, SCADA |

Papers, presentations, Valve World magazines,

and conferences |

|

Knowledge |

PLC, Data Analytics

Remote monitoring with alarm system

|

Association white papers, structured LinkedIn

discussion groups |

|

Wisdom |

Digitally

powered process management |

Leveraging subject matter expertise by plant,

industry, product, process, and niche expert |

Plant specific information:

In the beta site for BHE the background data such as air and water

permits, white papers, and articles all are displayed and linked to specific

plants and processes. Every week hundreds of useful bits of BHE information

become available.

Industry specific information:

The BHE site also has links to

Coal Fired Power Generation, and Gas

Turbine Combined Cycle Decisions which also include valve decision guides

for individual processes, e.g. HRSG. Input gained from coffee breaks at a

PowerGen convention can be categorized as "data". Papers presented at the

conference can be grouped under "information". EPRI studies can be grouped under

"knowledge". But it takes a cloud type integration to create wisdom.

Product specific information:

One of the Amgen pillars of procurement includes not only supplier access

but innovation. Conferences and magazines on valves such as published by KCI are

extremely valuable. However, this data needs to be organized and analyzed.

McIlvaine Decision Guides on molecular sieve and choke valves are examples.

There are innovations which change the options in both applications. The

decisive classification of valve types and the numerical identification of

Chinese suppliers are further examples.

Process specific information:

There is little communication among industries. BHE now is testing a NOx

control process in a coal-fired plant based on revelations in a McIlvaine

webinar relative to success in the refining industry. The hard coating

innovations which are improving valve performance in one process in one industry

need to be considered by operators of similar processes in other industries.

Niche expert utilization:

Every year the industry loses five to ten percent of its expert

knowledge. The 30-year veteran has 10 times the experience of the employee on

board for just three years. When the retiree becomes a consultant, he is quickly

diverted from his main field of expertise. The large consulting companies are

reluctant to employ anyone who is not generating billable hours.

Suppliers are not organized to leverage niche expertise. Robert Buckman wrote a

best seller in the 1990s on a 'Knowledge Driven Organization". He, as CEO, and

all his staff started the day by reading the requests from the hundreds of

salesmen selling water treatment chemicals and then were tasked to provide

expertise where applicable. With IIoT it is now possible to identify and utilize

the niche expertise in a very efficient way.

IIoT combined with IIoW promises to change the way valves are purchased and also

the profitability and market dynamics. It is not an exaggeration to conclude

that this combination is very likely the most important variable in the future

of the valve industry.

(1)Industrial IoT and Remote O&M published by McIlvaine Company

(2)Berkshire Hathaway Energy Supplier and Utility Connect published by McIlvaine

Company

Nine Free Webinars on IIoT and Remote O&M

The Industrial Internet of Things (IIoT) and remote operation and maintenance

will combine to create a market worth $1.4 trillion in 2030 according to the

latest forecasts in

N031 Industrial IOT and

Remote O&M Market Report published by the McIlvaine Company. A

series of nine webinars will provide some of the conclusions from the

report. The presentations will be followed by a discussion period where

participants can share their views and ask questions. Each webinar will be

scheduled on a Thursday at 10 a.m. CDT. Participation is free.

Schedule

February 16 - IIoT and Remote O&M Markets

Questions to be addressed include:

Why combine IIoT and Remote O&M forecasts? Why will this market grow at

13%/yr.? What are the major markets segmented by industry, region, and product?

What are the limiting factors to growth? How do suppliers best take

advantage of the opportunity?

February 23 - Gas Turbine, Reciprocating Engine IIoT and Remote O&M

This industry segment has made the most progress in leveraging IIoT for remote

O&M services. Turbine and component suppliers have remote monitoring centers

operating around the clock. This session will explain why a 2030 forecast of $30

billion is predicted. It will answer the question as to how established

technologies such as remote vibration analysis will be combined with analytics

and decision making relative to all components in the balance of the plant.

March 2 - Coal-Fired Power IIoT and Remote O&M

This session will build on nine hours of webinars recently conducted on

optimizing NOx emissions, 42 years of data analysis in

Coal-fired Power Plant Decisions and a previous McIlvaine report

entitled Information Technology in Electricity Generation. It will

discuss the basis for an $80 billion 2030 forecast for coal-fired IIoT and

remote O&M with a focus on the potential for utilities in developing countries

to take advantage of the world's expertise through services from international

consortia.

March 9 - Pump IIoT & Remote O&M

The potential for pump suppliers to add $20 billion of annual revenue and create

new market routes for pumps valued at $25 billion will be discussed along with

the evolution from vibration and lube oil monitoring to maximizing efficiency

and minimizing maintenance costs. Based on the research in

N019 Pumps World Market

the session will discuss the various routes to market (system suppliers, third

party O&M providers, and direct to end users).

March 16 - Industrial Valve IIoT & Remote O&M

The role industrial valves will play in expanding the market to $1.4 trillion

while generating $20 billion in additional valve revenues and carving new routes

for valve sales worth $30 billion will be explained. Insights from

N028 Industrial Valves:

World Market

will be leveraged to predict the evolution of smart valves, valve inventory

management programs such as being offered by GE, integration with third party

programs and the role for subject matter experts.

March 23 - Oil and Gas IIoT and Remote O&M

McIlvaine predicts this market will grow to $168 billion by 2030.

Insights from

N049 Oil, Gas, Shale and

Refining Markets and Projects

will be used to describe the present disparate programs and the eventual

amalgamation to interactive systems using open platform software. Safety,

security, maintenance, environment, and efficiency will be considered. The

webinar will include uses in the upstream, midstream and downstream segments of

the industry.

March 30 - Filtration and Separation IIoT and Remote O&M

The basis for a $350 billion 2030 market will be provided. The broad range of

applications as delineated in many market reports "Markets"

will be analyzed. This includes thousands of applications including

ones as diverse as vibration monitoring and polymer dosage for centrifuges to

filter condition monitoring for stationary IC engines. Clarcor already provides

a total filtration solution package which includes replacing of all filters in a

plant as needed. Donaldson offers a filter program for off road engines.

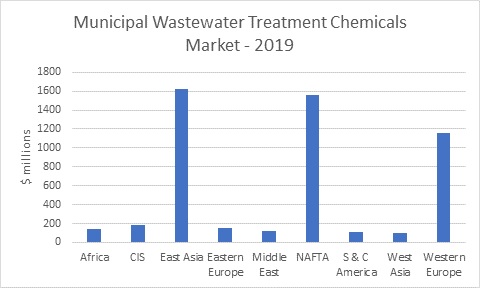

April 6 - Water & Wastewater IIoT and Remote O&M

Municipal water and wastewater treatment systems are challenged by long

pipelines subject to leakage, corrosion, odors and blockages as well as by

maintaining valves and pumps in remote locations. New wireless technologies are

already enthusiastically embraced. McIlvaine will provide insights based on

several of its services:

62EI North American

Municipal Wastewater Treatment Facilities and People Database

and

67EI North American

Public Water Plants and People

as well as on ongoing private studies on subjects such as aeration compressors.

This market is projected to reach $168 billion in 2030.

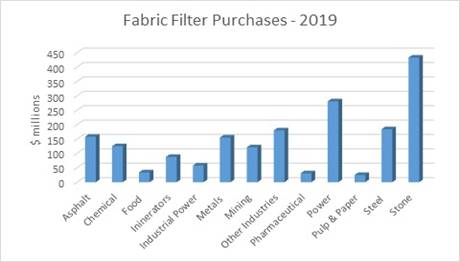

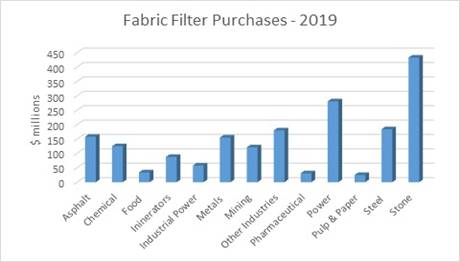

April 13 - Air Pollution Control

The basis for a $60 billion 2030 IIoT forecast will be explained. Continuous

emissions monitoring systems are now required in many industries in many

countries. Typically minute by minute emissions of each pollutant are

transmitted to owners as well as enforcement agencies. There is a huge potential

to integrate the information from these systems with combustion and other

process optimization systems to operate plants based on both total economic and

environmental cost of ownership.

McIlvaine will be providing insights based on included in

N027 FGD Market and

Strategies,

N035 NOx Control World

Market,

N021 World Fabric Filter

and Element Market,

N018 Electrostatic

Precipitator World Market.

Remote

operation and maintenance of electrostatic precipitators is

well established and successful. This success is a model for other IIoT

initiatives and will therefore be examined in detail.

Subsequent webinars

The following subjects will be included in future IIoT webinars:

Brief analyses of these opportunities are found at:

Recorded Interviews

Periodic recorded webinars with suppliers, consultants and end users will be

linked from this page as well as being displayed in Hot Topic Hour

recordings. Much of the future sensor input will be related to environmental

performance. This in turn is tied to the regulations. Recently, we conducted an

interview with Patricia Scroggin of Burns & McDonnell. You can view it at

Meeting the new ELG and CCR requirements- options explained by Patricia

Scroggin (Interview Dated: 1/20/2017).

To register for the webinars, click on:

Hot Topic Hour Schedule and Recordings

For details on the report click on:

N031 Industrial IOT and

Remote O&M

Participate in the LinkedIn Discussion Groups

If you are a subscriber to

44I Coal-fired Power Plant Decisions, you

are eligible to participate in the following LinkedIn discussions. (If you are

just a tracking system subscriber you can add the 44I for just $800 plus

$80/additional user/yr. You can add application and technical information or any

other information which will help power plants select the lowest total cost of

ownership products. The discussions are a bridge between the webinars and the

intelligence system which includes the database. So, you can also send us case

histories and white papers. The postings will be monitored to eliminate

commercial messages which are not constructive. The service is free of charge to

any power plant in the world. So, keep in mind that viewers might be from Asia

or Africa. To join one of the discussion groups just click on the LinkedIn group

and ask to join.

Power plant high

performance pumps

Coal combustion residues

and wastewater emissions

Mercury removal from

exhaust gas

Coal-fired power plant

instrumentation and controls

Bob McIlvaine

President

847-784-0012 ext. 112

rmcilvaine@mcilvainecompany.com

www.mcilvainecompany.com

Click here to un-subscribe from this mailing list