DC Water Begins $1.4 Billion Blue Plains WWTP Environmental Project

The District of Columbia Water and Sewer Authority (DC Water) is set to begin work on two environmental projects at the Blue Plains Advanced Wastewater Treatment Plant, the world’s largest facility of its kind. Blue Plains processes an average of 370 MGD of wastewater.

DC Water will be the first in North America to use thermal hydrolysis for wastewater treatment. When completed, it will be the largest thermal hydrolysis plant in the world. Though the practice has been employed in Europe, the water sector in North America has not yet adopted this technology. Industry leaders across the continent eagerly await the results of DC Water’s undertaking.

The process "pressure-cooks" the solids left over after wastewater treatment to produce combined heat and power—generating 13 MW of electricity ($10 million savings annually). These vessels can also ingest scraps, fats and grease to generate power ($400 million project).

"DC Water is the largest consumer of electricity in the District, and the digesters should cut our consumption by a third," said General Manager George S. Hawkins. "That’s enough to power 8,000 homes. We’re also saving $10 million in trucking costs and reducing our carbon emissions by cutting the amount of solids at the end of the process in half."

Enhanced Nutrient Removal Facilities (ENR) will reduce the amount of nitrogen in effluent to meet the new U.S. EPA and Chesapeake Bay Program goals of 4.7 million pounds per year or less in 2014—one of the most stringent requirements in the world ($1 billion).

These projects are slated for completion in 2014.

For more information visit:

www.dcwater.com

EPA Orders Secondary Treatment for 2 Chicago WWTPs

The U.S. EPA sent a letter to the state of Illinois demanding that it require operators of Chicago's sewage treatment system to disinfect the waste they discharge into city waterways from two of its three primary sewage treatment plants.

The move could be the first step in re-reversing the flow of the Chicago River so it once again flows into Lake Michigan instead of the Mississippi River basin. The idea, spawned by the threat of an Asian carp invasion of Lake Michigan, is to rebuild the natural separation between Lake Michigan and the carp-infested Mississippi River basin. The Chicago canals destroyed that separation over a century ago. The once-radical concept now enjoys widespread bipartisan support, and the U.S. Army Corps of Engineers is in the midst of a study looking at what it would take to rebuild the natural barrier.

The Mississippi-bound canals, expressly built to carry sewage plant discharges, have allowed Chicago a distinction among U.S. cities: It does not employ a bacteria-killing phase at its main sewage treatment plants.

The U.S. EPA has delegated enforcement of the Clean Water Act to the state of Illinois, and Illinois has essentially given the Metropolitan Water Reclamation District of Greater Chicago a pass on normal requirements of the law because its sewage treatment plants discharge into man-made waterways never intended for recreation. The result is that signs line the banks of city waterways warning residents that the flows below are "not safe for any human body contact. " Despite those warning signs, canoeists, anglers and even high school crew teams have descended on Chicago waterways in recent years. Now the federal government wants some of those waters cleaned up to the point that people could actually swim in them.

"The U.S. (EPA) has determined that new or reviewed water quality standards that protect recreation in and on the water are necessary for certain segments of the (Chicago waterways)," Nancy Stoner, acting assistant administrator for the EPA, wrote in a May 11 letter to Illinois officials "EPA expects Illinois to expeditiously adopt new or revised water quality standards consistent with this determination. If Illinois fails to do so, EPA will promptly do it itself." The U.S. EPA proposal does not require the reclamation district's largest wastewater treatment plant to disinfect because it discharges into an area of the canal system that gets very little recreational use.

The estimated cost to add bacteria killing equipment to North Side and Calumet wastewater treatment plants: $26-$72 million.

Headlines in North American Municipal Wastewater Updates for June 1, 2011

The preceding articles were included in the bi monthly updates issued as part of North American Municipal Wastewater Plants and People

http://www.mcilvainecompany.com/brochures/water.html#62ei.Here are all the headlines for the two week period:

ARKANSAS

Conway to Discuss WWTP Projects

Davis Requesting Bids for WWTP Project

Vacaville Bids come in Low for $30 Million Wastewater Improvement Project

DISTRICT OF COLUMBIA

DC Water Begins $1.4 Billion Blue Plains WWTP Environmental Project

FLORIDA

Islamorada Mulls Wastewater Treatment Agreement with Key Largo

Davenport Plans Wastewater Treatment Project

ILLINOIS

EPA Orders Secondary Treatment for 2 Chicago WWTPs

Libertyville Plans Future Wastewater Upgrades

INDIANA

Evansville Contactor to Identify Inefficiencies at Water Treatment Plant

Morristown Requesting Bids for Wastewater Treatment Project

Huntertown Plans New $11.2 Million WWTP

IOWA

Wilton Considers WWTP Upgrade

Waterloo Plans $9 Million WWTP

MARYLAND

Salisbury Plans WWTP Upgrade

MASSACHUSETTS

Concord Requesting Bids for Wastewater Project

$21.9 Million for North Attleboro WWTP Upgrade

MICHIGAN

Detroit Plans WWTP Improvements

Petoskey Considers $2.8 Million WWTP Upgrade

MINNESOTA

Mankato is Requesting Bids for Water/Wastewater Improvements

Paynesville Requesting Bids for Wastewater Treatment Improvements

MISSOURI

DNR Pressures Ashland to Correct Lagoon Problems

Monroe City to Discuss Improvements at WWTP

MONTANA

Billings Plans $58 Million WWTP Upgrade

NEW HAMPSHIRE

Exeter Tackles Water/Sewer Issues

NEW MEXICO

Lordsburg Requesting Bids for Wastewater Rehab Project

NEW YORK

$14 Million for Dansville Wastewater Treatment Plant Upgrade

Norfolk’s $5.5 Million Wastewater Upgrade Approved

NORTH CAROLINA

Winston-Salem Needs $160 Million WWTP Upgrade

NORTH DAKOTA

Dickinson Discusses New Wastewater Treatment Facility

OHIO

Lorain County, Agencies Consider Regional Wastewater Treatment System

Coshocton to Consider Ordinances Regarding Water Line Project and Sludge Handling

Chickasaw Requesting Bids for WWTP Lagoon Expansion

Grant Enables Good Hope to Build Wastewater System

PENNSYLVANIA

Annville is Requesting Bids for WWTP Improvements

Gettysburg Begins Work on Wastewater Treatment Plant

SOUTH DAKOTA

Mount Vernon Plans on Rebid of Wastewater Project

TEXAS

Hidalgo Receives $6 Million for Wastewater Plant

Victoria Seeks Permit for Odem Street Wastewater Treatment Plant

Boerne Awards WWTP Contract

VIRGINIA

Charlottesville Plans Major Water/Wastewater Projects

WASHINGTON

Pierce County Planning $305 Million Expansion of WWTP

WEST VIRGINIA

Martinsburg Plans $45 Million WWTP Improvement Project

WISCONSIN

$5 Million for South Beloit Wastewater Improvements

De Soto Seeks Wastewater Plant Upgrades

CANADA

Halifax WWTP Getting $61 Million Upgrade

Peak Engineering Awarded WWTP Contract

Toronto Chooses UV over Chemicals to Disinfect Wastewater

Atikokan to Upgrade Wastewater Treatment Plant

New Chemicals Bid Tracking Included in Databases and Market Reports

A new bid tracking system allows you to select a particular wasewater treatment chemical and then view the bid requests and bid reviews. This system is included in water related Mcilvaine market reports and in the North American Municipal Wastewater Plants and People. The bid reviews often include pricing of many different bidders. Here is an example:

Bid Tracking for Polymers

Bottom of Form

·

Anacortes, Water, 01/11 thru 12/12, Bid Review·

Ashland, Water & Wastewater, 07/10 thru 06/11, Bid Review·

Carlsbad, Wastewater, 07/10 thru 06/11, Bid Request·

Carlsbad, Wastewater, 07/11 thru 06/12, Bid Request·

Corona, Water, 07/11 thru 07/12, Bid Request·

Fort Lauderdale, Wastewater, 09/10 thru 09/11, Bid Review·

Fort Smith, Water & Wastewater, 08/10 thru 08/11, Bid Review·

Lake Charles, Wastewater, 06/11 thru 06/12, Bid Request·

Mt. Pleasant, Water, 01/11 thru 12/11, Bid Request·

Ozark, Wastewater, 05/11 thru 04/12, Bid Request

Global Wastewater Updates for April 2011

Here are the headlines relative to municipal wastewater activity world wide. The complete documents are provided in the Mcilvaine market water related market reports

AFRICA

·

South Sudan: New Nation Provides Opportunity for Wastewater Infrastructure Development·

Tanzania: EU and Germany Funding WWTP in Mwanza to Clean up Lake VictoriaASIA

·

Australia: CST Wastewater Solutions Introduces Packaged Headworks System·

India: New Effort to Clean Yamuna River in Delhi and Haryana·

India: Aquatech Awarded Wastewater Recycle Project at Mumbai Airport·

Japan: WWTPs Damaged by Tsunami Discharging Partially Treated Wastewater·

Philippines: Pöyry Awarded €1.2 Million Contract for Two Feasibility Studies·

Singapore: Black & Veatch Selected for Changi Water Reclamation Plant Expansion·

Taiwan: Wastewater Recycling Plant Opens in Kaohsiung CityEUROPE

·

Belgium: European Commission Orders Small Towns to Comply with EU Wastewater Law·

Ireland: Plans for WWTP in Dublin Reinstated After Failed Water Quality Tests·

Italy: Abruzzo Region Urged to Comply with EU Wastewater Law·

Romania: Abengoa Wins €20 Million Contract to Upgrade Two WWTPs·

Romania: EBRD Approves €22 Million Loan for Wastewater System Improvements in Iasi·

Serbia: Leskovac to Build €23 Million WWTP with EU and Dutch Funding·

UK: Scottish Water Announces £11 Million River Tweed Project·

UK: Wessex Water Begins £26 Million Project to Improve Coastal Water Quality·

UK: Human Waste Powers New CHP Boiler at LancasterMIDDLE EAST

·

Infrastructure Standards for "Heat-Sand-Dust" Being Promoted·

UAE: Dubai and Hitachi Explore Use of Treated WW to Replenish AquiferNORTH AND SOUTH AMERICA

·

Brazil: Cesan to Invest $173 Million to Increase Wastewater Coverage in Vitória·

Peru: Sedapar Relaunches Tender for La Escalerilla WWTP·

Peru: Israeli Company to Pilot Biological Treatment Process at Lima WWTP

UAE: Dubai and Hitachi Explore Use of Treated WW to Replenish Aquifer

The Municipality of Dubai has entered into a joint venture with Hitachi Plant Technologies (HPT) to explore the use of treated wastewater to replenish underground aquifers. Diminishing natural groundwater is a serious threat to water security in the UAE where desalination plants are the primary source of drinking water. Environmental experts highlight the need for an underground water reservoir as a backup water supply in the event desalination plants are damaged for any reason.

If the pilot project is successful, the 182 million m3/year of wastewater generated in Dubai could potentially be used to replenishing groundwater. Mohammed Abukaff, an environmental expert with the Municipality of Dubai, said that about 70 percent of wastewater is already being reused after treatment. The remaining 30 percent is discharged into the sea after purification. "Our goal is to make 100 percent use of the wastewater," he added. The pilot project will use a membrane bioreactor technology developed by HPT to biologically remove the nutrients in the wastewater and make treated sewage safe for industrial use. Phase Two of the project will investigate the possibility of using the treated water for aquifer recharge.

Singapore Selects Black & Veatch for Expansion of the Changi Water Reclamation Plant

PUB, the national water agency of Singapore, has selected Black & Veatch to provide consultancy services for the expansion of the Changi Water Reclamation Plant. Black & Veatch will provide engineering design, procurement and construction management (EPC) services for the addition of a membrane filtration treatment process. The addition will expand the current 800,000 m3/day (211 MGD) capacity of the plant by up to 60,000 m3/day (16 MGD) of reclaimed water.

Pentair (Norit) X-Flow UF Membranes Chosen in Abu Dhabian Wastewater Polishing Plant

Pentair (Norit) X-Flow has been selected to supply

XIGA membranes to treat wastewater for re-use to the Al Wathba Enhanced Treated

Sewage Effluent (TSE) Treatment Project in Abu Dhabi to Boustead Salcon Water

Solutions for the Abu Dhabi Sewerage Services Company (ADSSC). The new

wastewater recycling plant project, which is the first of its kind in the United

Arab Emirates (UAE), will have a capacity of approximately 27,712 cubic metres

(6 million gallons) per day.

The UAE is dependent on desalination as its main source of water supply. By

focusing on wastewater re-use, the UAE is responding to the need to ensure

security for its long-term water supply. In 2010, Abu Dhabi introduced new

wastewater regulations, by which the Emirate established itself as the regional

leader in the water re-use sector.

Singapore-based Boustead Salcon Water Solutions, a specialist in water and

wastewater engineering, is responsible for the design, engineering, and

construction of the water recycling plant for the enhanced treatment of TSE.

Norit X-Flow will participate in this sustainable water initiative of the UAE by

supplying XIGA membranes to the Al Wathba TSE polishing plant, expected to start

up in the beginning of 2011. In addition to the ultrafiltration (UF)

polishing of the TSE, the plant will include strainer and ultra-violet

protection processes. An estimated 95% of the TSE supplied to the plant will be

recycled and recovered. The water produced will be used for agricultural

irrigation and horizontal landscaping.

The Al Wathba TSE polishing plant is important in terms of setting the trend for

wastewater re-use in the UAE where UF membranes are employed for tertiary

filtration of the treated sewage. It provides a credible and proven alternative

to the desalination of seawater for non-potable applications.

Montreal Chooses Ovivo Linear Electro-Dewatering to Solve Sludge Problem

The RAEBL municipal wastewater treatment plant in Montreal has an average daily flow of 17 MGD, producing about 100 wet tons of residual sludge per day, 5 days a week. Three (3) Belt filter presses dewater the waste-activated sludge to 14.5%TS. The level of pathogens contained in the residuals rule out land application or soil remediation, and the high water content disqualified sound energy scenarios. Consequently, the sludge is hauled to a landfill and beneficial re-use is not possible. With stringent state regulations, disposal costs were expected to increase by 14 percent to over $84(CAD) per wet ton, starting October 1st, 2010. The plant’s management team sought long term solutions to overcome this financial burden while investigating alternatives for beneficial re-use of their cake. Obtaining P-1 product classification (similar to Class A grade in the US) offers attractive options for land application or soil amendment. Weight reduction also evidently revealed economy potential for the plant’s overall disposal cost. After reviewing commercially available solutions, Ovivo’s CINETIK® advanced dewatering technology (Linear Electro-Dewatering) was selected.

Linear Electro-Dewatering provides improved solid/liquid phase separation over mechanical technologies. Ovivo’s CINETIK® equipment uses electro-osmosis to allow mechanically dewatered cake to reach high dryness levels by applying a continuous current to electrodes sandwiching the porous media. Current causes the transfer of cations from the positive (anode)

to the negative (cathode) pole. The cations drive the bulk water molecules towards the cathode, where water is drained out. By changing the operating parameters, a final dryness of 30-50 percent can be achieved, and weight is usually reduced by more than 50 percent.

WRI is Working with Tsinghua University on Plan to Reduce Chinese Nitrogen and Phosphorous

China’s strategy for controlling water pollution focused first on reducing the discharge of oxygen-demanding substances. The 11th Five Year Plan (FYP), adopted in 2006 contained binding targets for reducing these discharges. A water quality parameter known as Chemical Oxygen Demand (COD) that measures the oxygen demand of the organic matter present in a water sample is used to quantify these discharges and the 11th FYP targets are expressed in terms of reducing COD discharges to receiving waters. Reducing the discharge of untreated municipal and industrial wastewater is the best way to reduce COD levels and China has made great progress in collecting and treating municipal wastewater over the past decades.

4 To achieve the mandatory COD reduction targets, both Central and local governments have adopted a variety of measures, including closing heavily polluting companies, accelerating the construction of new wastewater treatment plants (WWTPs), and upgrading existing WWTP to meet stricter effluent standards (Class I-A).5 These actions also served to greatly reduce the discharge of pathogens to surface waters.While upgrading additional WWTPs to meet the higher effluent standards would result in additional reductions in COD discharges, it might be better to instead focus on increasing the rate of sewage collection and treatment. There is still a significant amount of uncollected and untreated wastewater being discharged by Chinese cities, and reducing the amount may be more cost-effective than upgrading existing WWTPs.

Controlling COD and pathogens is not enough. The discharges of nitrogen, phosphorus and sediments are now the most serious sources of water pollution. These emissions must be reduced in order to improve water quality to acceptable levels. The central government has recognized this and has taken the first step by including ammonia reduction targets in the 12th Five Year Plan. Ammonia is a form of nitrogen that is mainly discharged from agricultural runoff, municipal and industrial wastewater, and emissions to the air from agricultural operations and factories. It exerts an oxygen demand and it can also be toxic to aquatic life, so reducing ammonia discharges will have many benefits. While it is an important first step, setting targets for ammonia reductions must be followed by reducing total nitrogen and total phosphorus discharges, as well as sediment discharges. Otherwise, few water bodies in China will meet the desired water quality standards.

Reducing nitrogen, phosphorus, and sediment discharges will require new strategies and cannot be achieved merely through building or upgrading wastewater treatment plants or closing polluting factories. The main sources of nutrient pollution are nonpoint in nature, with agriculture being the biggest source. The costs of controlling nutrient pollution can be high and attention must be paid to the cost-effectiveness of all proposed measures. Comprehensive strategies that address all sources and sectors, and that consider cost-effectiveness in selecting reduction mechanisms, are needed.

In order to evaluate the cost-effectiveness of various nutrient pollutant reduction opportunities, the World Resources Institute (WRI) is working with Tsinghua University, supported by ADM

Capital Foundation, and other partners to carry out a specific project in municipalities within the Tai Lake basin. The goals are to develop an analytical approach and decision-support tool to help Chinese decision-makers select the cost-effective options to reduce ammonia, nitrogen and nutrient discharges into the water environment, thus helping to improve the water quality of lakes and rivers in China at lower cost and more effectively.

Cooling Tower Recirculation and Sewage Treatment Are the Big Growth Segments in the $150 Billion Liquid Flow Control and Treatment Market

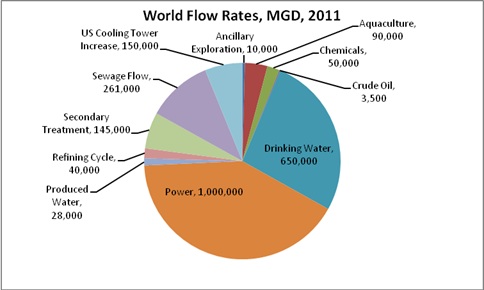

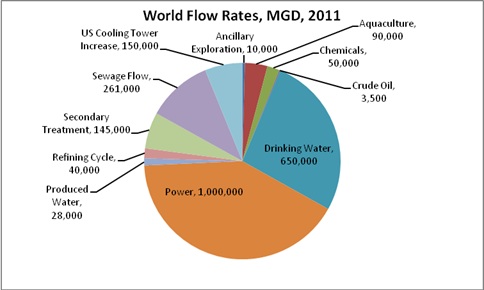

This year purchases of liquid flow control and treatment equipment and chemicals will exceed $150 billion. Sales will continue to grow at more than 5 percent annually over the next five years. Two segments which will expand the most are cooling water and sewage treatment. This is the conclusion reached by the McIlvaine Company as a result of its latest forecasts in a group of water related market reports.

The world power industry uses more than one trillion gallons of water per day (1 million MGD) far outstripping other industries. The amount of crude oil extracted around the world each day is only 3,500 MGD. Granted that the cost per gallon treated is far higher for extraction and refining of oil than for power plant cooling water, nevertheless, the disparity in flow rates is more than the disparity in unit treatment costs. It is, therefore, highly valuable to compare flow rates.

World Flow Rates, MGD, 2011

Ancillary Exploration 10,000

Aquaculture 90,000

Chemicals 50,000

Crude Oil 3,500

Drinking Water 650,000

Power 1,000,000

Produced Water 28,000

Refining Cycle 40,000

Secondary Treatment 145,000

Sewage Flow 261,000

TOTAL 2,309,000

U.S. Cooling Tower Increase 150,000

Ancillary exploration involves both oil and gas and the various fluids which are used and recycled in the oil and gas extraction process. Because of the many steps in the refining process, the flow rate is 40,000 MGD. Various chemical processes involve flow of liquid raw product and separation of solids from liquids or liquids from liquids.

Water is used in many ways besides human consumption. For every gallon of crude oil, eight gallons of water are extracted along with it. The treatment and use of this water rather than disposal in deep wells makes this a growth sector. However, despite the 8 percent growth rate, the quantity is only 28,000 MGD.

Municipal drinking water is the second largest use category. Chemical costs per gallon are substantial, but the flow and physical treatment costs are relatively low.

Most of the world’s residences are not connected to sewers. 261,000 MGD of sewage is transported today, but 85,000 MGD is pumped into the sea or other waterways directly. Only 145,000 MGD receives secondary treatment. Only 31,000 MGD receives primary treatment.

Aquaculture is one of the more promising areas based on its size and growth rate. Most fish and seafood is now supplied by farming. Further, there is the trend toward tank farming and more investment in flow and treatment.

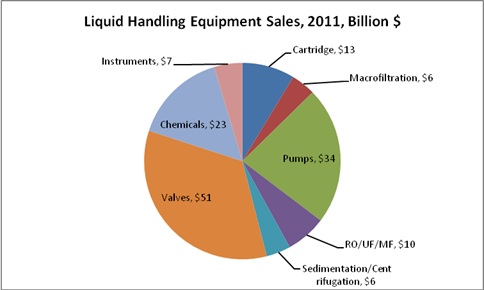

The $150 billion market as segmented in McIlvaine reports reveals that pumps and valves comprise more than half the total

Liquid Handling Equipment Sales, 2011, ($ Billion)

Cartridge $13

Macrofiltration $6

Pumps $34

RO/UF/MF $10

Sedimentation/Centrifugation $6

Valves $51

Chemicals $23

Instruments $7

TOTAL $150

For each of these segments the U.S. proposed rules on power plant discharges represent the biggest near-term opportunity. Three hundred and forty three fossil plants representing 231,942 MW and 42 nuclear plants representing 60,582 MW combine for a total of 385 plants with 292,524 MW of capacity which could have to install cooling towers and recirculate 150,000 MGD after the final rules are issued next year.

The magnitude of this number can be compared to hot market – produced water. Even if new equipment were purchased to treat 10 percent of the world’s produced water, the total would be only 2800 MGD. Aquaculture is another hot market, but even with an investment to treat 10 percent of this flow, the total would only be 9000 MGD.

The longer-term potential for sewage treatment is shown by the disparity between drinking water treatment of 650,000 MGD and secondary treatment of 145,000 MGD. This means that there is a potential for 505,000 MGD of secondary treatment just to serve the population which now has drinking water. This does not include the large numbers of people who do not even have access to municipal drinking water.

The sewage treatment potential is bigger by far than that for cooling water, but this market will be slower to develop. In addition to a sudden increase in cooling water of 150,000 MGD in the U.S., there is an additional large market for cooling water treatment for all the new coal-fired power plants being built in Asia. Many along the coasts will use once-through water. Some of the inland plants in arid areas will use dry cooling but many will install wet cooling towers and will need all the treatment products and consumables.

For more information on McIlvaine water-related market reports, click on:

www.mcilvainecompany.com

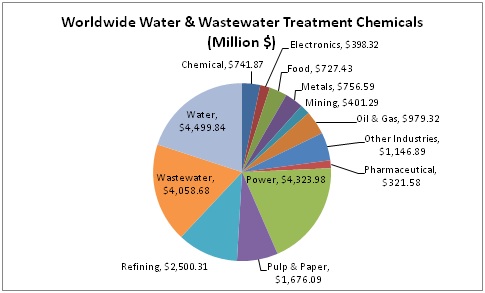

Water & Wastewater Chemical Sales to Exceed $22 Billion This Year

Purchasers in the municipal water, municipal wastewater and power industries will account for more than 50 percent of the $22 billion which will be spent worldwide this year for chemicals to treat water and wastewater. This is the conclusion reached in the latest revision to the online Water & Wastewater Chemicals World Market report published by the McIlvaine Company.

The municipal water (drinking water) plants around the world will spend just under $4.5 billion this year for a wide range of chemicals including coagulants and disinfectants. Power plants will be the second largest purchasing group. They require corrosion inhibitors, coagulants, anti-scalants, chelants, ion exchange resins and many other chemicals. These totals do not include the limestone and lime used in power plant scrubbers or the ammonia injected for NOx control.

Refineries and the oil and gas industry are also major purchasers. The Gulf Oil spill last year temporarily boosted the market in the oil sector. The growth in unconventional sources for gas such as the Marcellus shale region in PA will expand the market in this segment.

The markets can also be generally segmented by use. Treatment of incoming water, cooling of recycled plant water, process water treatment and wastewater treatment are the four main categories. The market for chemicals for cooling water treatment in U.S. power plants is expanding due to new rules which limit the thermal discharges to rivers and other waterways.

When plants recirculate water, solids percentages rise due to evaporation. Therefore, chemicals need to be added to limit scaling and other problems.

For more information on: Water & Wastewater Treatment Chemicals: World Market

http://www.mcilvainecompany.com/brochures/water.html#NO26

Upcoming Conferences and Exhibitions

|

Title: UK Anaerobic Digestion & Biogas 2011, Hall 10 of the NEC in Birmingham, UK, July 6-7, 2011 |

The Anaerobic Digestion and Biogas Association (ADBA) has been established to represent all businesses involved in the anaerobic digestion and biogas industries, to help remove the barriers they face and to support its members to grow their businesses. Its principal aim is to enable and facilitate the development of a mature anaerobic digestion industry in the UK within 10 years. UK AD & Biogas 2011 offers: The ONLY Trade Show in the UK focusing exclusively on Anaerobic Digestion and Biogas 2 Day High Profile Conference 'The Life Cycle of an AD Plant' FREE Seminars & Workshops THE AD Industry Gala Dinner of the year Over 100 Exhibitors

Company

·

Atlas Copco·

Boerger UK·

Hiller·

ITT Water & Wastewater·

KSB·

Netzsch·

Paques·

Pumpenfabrik Wangen·

Seepex·

Veolia Water Solutions & Technologies·

Vogelsang

You can register for our free McIlvaine Newsletters at:

http://www.mcilvainecompany.com/brochures/Free_Newsletter_Registration_Form.htm

Bob McIlvaine

President

847 784 0012 ext 112

|

SERVICES & PRODUCTS - Market Research - Consulting - Sales Leads

- Webinars - InterWEBviews ™ - Knowledge Based Sales

|

|

|

|

Copyright © 2011 McIlvaine Company. All Rights

Reserved Ph: 847-784-0012 | Fax; 847-784-0061 Click here to un-subscribe from this mailing list |