Market For Industrial Cross-flow Membrane Products Will Exceed $10 Billion Next

Year

Municipalities and industrial facilities will spend over $10 billion in 2017 for

reverse osmosis (RO), nanofiltration, ultrafiltration and microfiltration. This

includes the equipment and the replacement membranes. This does not include the

residential or commercial market for the small filters.

The largest investment will be for desalinating seawater. The fastest growing

geographical market will be China which is embarked on a massive program to

provide desalinated drinking water to arid areas from coastal treatment

facilities.

Microfiltration is taking market share away from granular media filters in the

purification of drinking water due to the reduction in waterborne illnesses with

this technology.

The pharmaceutical market continues to grow at a pace exceeding GDP. Cross-flow

filtration is used to separate product from broth as well as for provision of

ultrapure water for injection in products which will be injected into humans.

For more information on N020 RO, UF, MF

World Market click on:

http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/120-n020

Here are the some headlines from the Utility E-Alert – April 15, 2016

UTILITY E-ALERT

#1268 – April 15, 2016

COAL – US

COAL – WORLD

§

Natural Draft Cooling Tower Order for 450 MW Turow awarded to Hamon

§

China's Harbin and Saudi ACWA near Loan for Dubai Clean Coal Power Plant

§

EPTL’s Power Plant Project

The

41F

Utility E-Alert

is issued weekly and covers the coal-fired projects, regulations and other

information important to the suppliers. It is $950/yr. but is included in the

$3020

42EI

Utility Tracking System

which has data on every plant and project plus networking directories and

many other features.

International Strategy is Critical for Survival in the Flow Control and

Treatment Industries

Whether you sell pumps, valves, filters, fans, compressors, treatment chemicals,

scrubbers or centrifuges, you cannot focus on just the U.S., China, or EU

market. Here are some examples of major opportunities elsewhere:

|

Industry |

Country |

|

Aquaculture |

Indonesia |

|

Bauxite |

Kazakhstan |

|

Cement |

Turkey |

|

Coal-fired power |

Vietnam |

|

Coal mining |

Columbia |

|

Copper |

Chile |

|

Desalination |

Israel |

|

Flat Panels |

South Korea |

|

Gas Extraction |

Nigeria |

|

Iron Ore |

Ukraine |

|

LNG |

Australia |

|

Pharmaceuticals |

India |

|

Petrochemicals |

Saudi Arabia |

|

Phosphate |

Morocco |

|

Pulp/Paper |

Brazil |

|

Potash |

Canada |

|

Refineries |

Algeria |

|

Semiconductors |

Taiwan |

|

Steel |

UAE |

The U.S. has placed a moratorium on new coal-fired power plants but China will

build far more than the EU or that the U.S. will retire. Vietnam, Indonesia

and Myanmar are building power plants with a combined capacity of 150,000 MW.

China is the largest fish farming country, but Indonesia is also large. The

industry is moving to sophisticated recirculating systems with a big investment

in flow control and treatment equipment.

Australia, a leader in iron ore and coal mining, has become a recent player in

LNG with successful conversion of coal bed methane.

Individual projects can measurably impact the market in a given year. There are

nine large Canadian potash projects underway with a combined capital investment

of over $30 billion. The largest project will require a $4 billion investment.

Algeria’s state-owned Sonatrach

has let a

series of contracts to Amec Foster Wheeler to provide front-end engineering and

design (FEED) for three grassroots refineries that will add a total of 15

million tons/year in refining capacity in the country. These few

projects represent a significant percentage of the yearly flow control and

treatment revenues for the worldwide industry.

Coal-fired projects in Indonesia could result in an investment of over $100

billion. Vietnam is vacillating on plans which would require a coal-fired power

plant investment of over $200 billion. Delay or cancellation of large projects

can materially affect the revenues of the flow control and treatment suppliers.

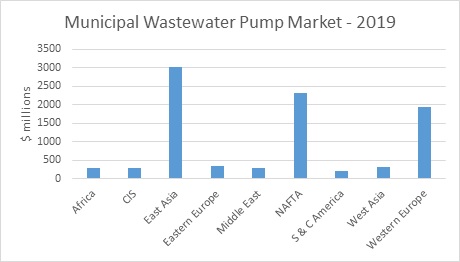

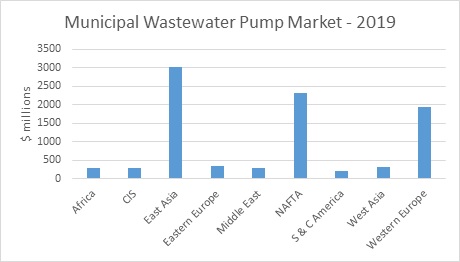

Flow control and treatment companies need to pursue the world market. There are

196 countries with more than 50 major industries who purchase flow control and

treatment equipment. Many of these countries are quite small. McIlvaine

forecasts divide the world into 80 purchasing entities which include 72 separate

countries and 8 country groups. The pump forecast example below shows pump sales

in Pakistan will be $216 million in 2021, but sales will only be $22 million in

a group of countries labeled “Other Western Europe.”

|

Industrial Pump 2021 Revenues |

|

|

Country or Entity |

Revenues

$ Billions |

|

New Zealand |

69.51

|

|

Nigeria |

411.34

|

|

Norway |

283.79

|

|

Other Africa |

775.41

|

|

Other CIS |

198.22

|

|

Other East Asia |

89.62

|

|

Other Eastern Europe |

108.45

|

|

Other Middle East |

825.15

|

|

Other South & Central America |

462.79

|

|

Other West Asia |

14.15

|

|

Other Western Europe |

21.90

|

|

Pakistan |

216.54

|

|

Peru |

165.93

|

|

Philippines |

260.63

|

|

Poland |

377.89 |

The countries aggregated in the Other Western Europe category are Andorra, Faroe

Islands, Gibraltar, Greenland, Guernsey, Iceland, Isle of Man, Jersey,

Lichtenstein, Luxembourg, Malta, Monaco, San Marino and Vatican.

The average for the 80 entities in a $60 billion annual market is 0.75 percent.

While, as individual countries, many in the “other” category are insignificant,

as a group they are relevant. This is particularly true for the Other Africa

group which accounts for 0.75 percent of the total market and the Other Middle

East group which in the aggregate is bigger than the average.

McIlvaine has created a program to help international flow control and treatment

suppliers maximize the global opportunity. It is described at:

Detailed Forecasting of Markets, Prospects and Projects

Bob McIlvaine is available to answer your questions and can be reached at:

847-784-0012 ext. 112

rmcilvaine@mcilvainecompany.com.

Flow Control and Treatment Companies will benefit from a Digital Crystal Ball

The digital age has created the ability to make fortune telling a reality. The

real life version of a crystal ball is the wealth of information available to

predict markets, projects and identify decision makers. This information can be

used to change the way flow control and treatment products are marketed.

Long range purchasing plans can be determined by an organized analysis of

information which can be obtained directly from available documents or through

individuals who have specific insights.

|

Minutes of municipality meetings

documenting engineering study

authorization |

Consultant reports advising

course of action for companies

under public scrutiny |

Permit applications for

construction or upgrading |

|

Submittals to the World Bank and

other lending institutions |

|

Five Year Plans for China and

other countries |

|

Recent and pending regulations

which will impact the market |

LinkedIn, blogs and various

online groups with willing

volunteers of information |

Google and other search engines |

The local salesman can make a call on a municipal wastewater treatment plant but

would be unlikely to provide the same value gained from the directors meeting

minutes which outline the failure of the competitor’s equipment and his proposal

to fix it.

The power plant modification permit request which details the cost and

performance of various options provides the needed insights on product and

timing for a potential supplier.

One way suppliers take advantage of the availability of information is to

purchase sales leads. Typically the

company spends lots of money on these leads and not on market research.

In one sense, the leads are the market research.

In fact, published studies purport to link the number of sales leads to

the size of future markets.

This approach has a number of undesirable aspects:

1.

The large expenditure for sales leads draws funds away from critical market

research.

2.

Sales leads are not qualified. High

margins and order conversion result from picking and choosing projects.

3.

Since the sales lead is also being viewed by the competitors, there will be

pricing pressure and lower success rates.

4.

The timing of sales leads is often right if you are selling a commodity, but if

you are selling based on your product differentiation, you are too late.

5.

Many companies have distributors and representatives who are being paid to

uncover leads. Sales lead expense

is justified based on evaluating distributor performance rather than on boosting

sales.

If you are selling a commodity, product and price is the basis of success then

the sales lead route is probably still the best option. But, if you sell a

product based on lowest cost of ownership and not initial price, then you should

consider a whole new route using the digital crystal ball.

Detailed Forecasting of Markets, Prospects and Projects

is your digital crystal ball because:

1.

Forecasts can be provided for the precise product at the State and province

level.

2.

Project alerts provide the time to convince the customer to consider total cost

of ownership and to issue bid specifications accordingly.

3.

The large end users, OEMs, and AEs are identified.

Since they purchase more than 50 percent of the flow control and

treatment equipment, the focus on them is critical.

4.

The opportunity to connect with the end user through white papers and webinars

improves the margin and success potential.

5.

The ability to demonstrate lowest cost of ownership is the secret to success in

the global market.

For more information on this program contact Bob McIlvaine 847-784-0012 ext. 112

rmcilvaine@mcilvainecompany.com

Bob McIlvaine

President

847-784-0012 ext. 112

rmcilvaine@mcilvainecompany.com

www.mcilvainecompany.com