Mobile Devices and Route Maps Will Enrich Your Chem Show Experience

If you will be attending the Chem Show, you can participate in discussions on

many subjects. If you are an exhibitor, also be sure we have the best

reference material. If you are a visitor, make sure we have your e-mail and

contacts for networking.

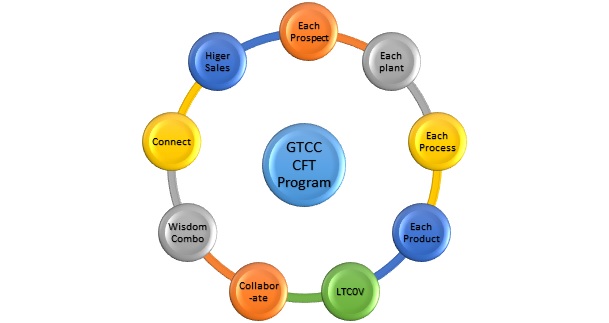

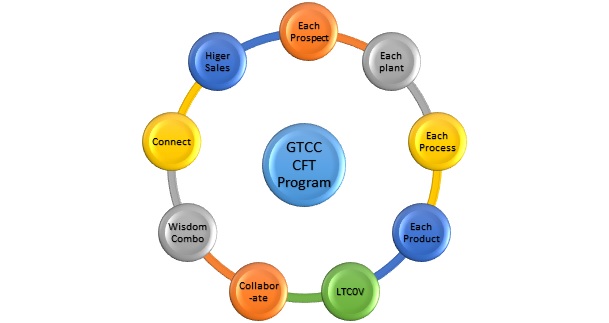

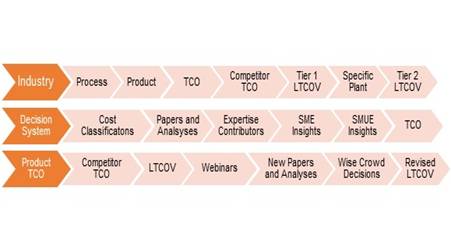

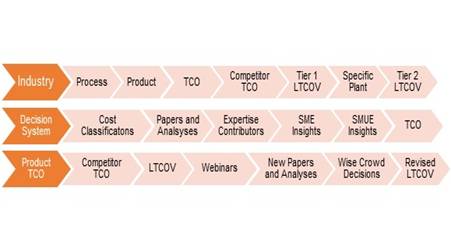

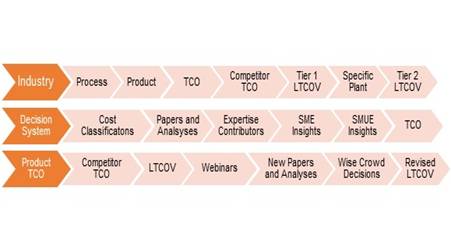

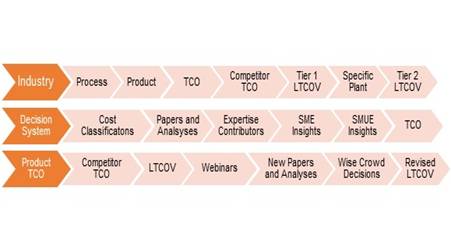

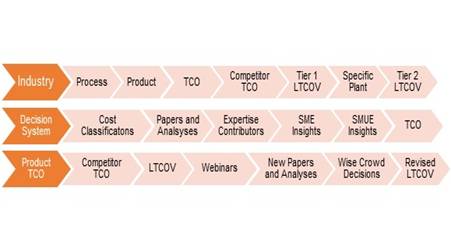

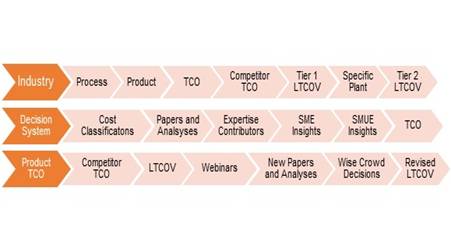

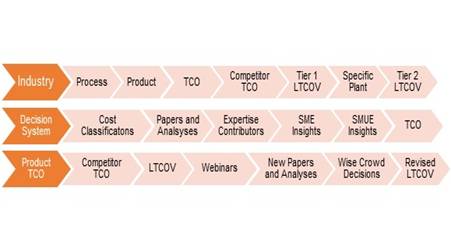

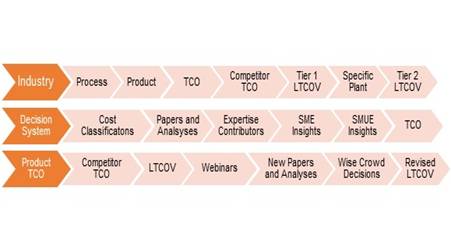

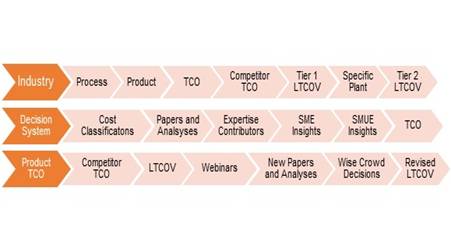

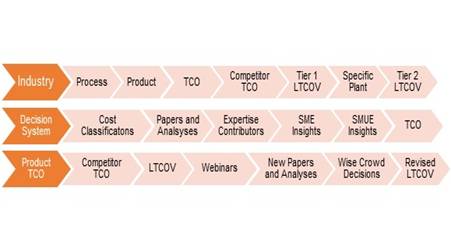

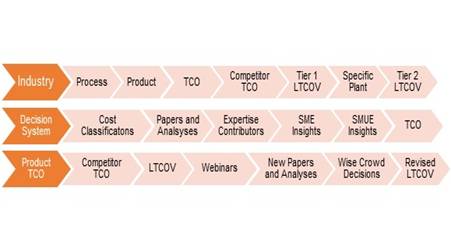

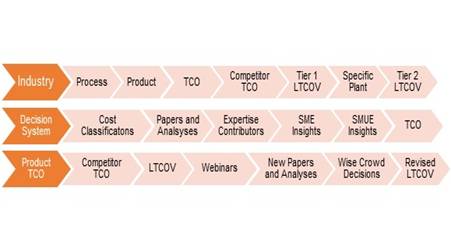

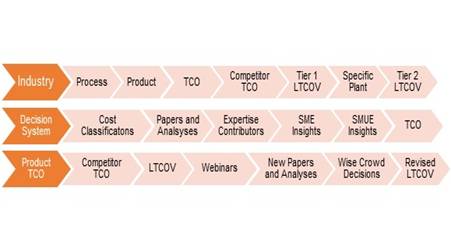

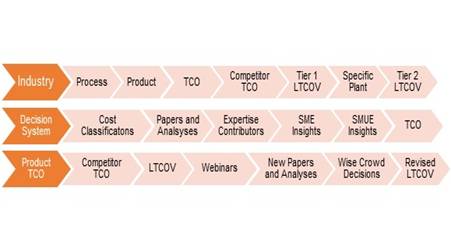

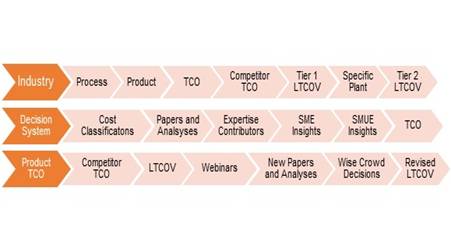

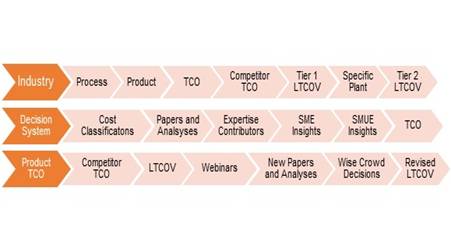

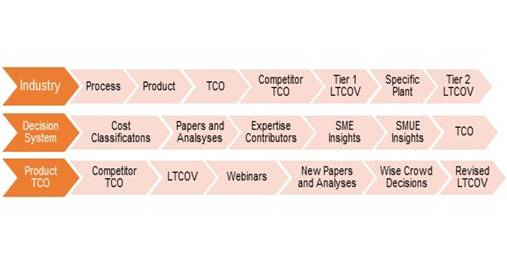

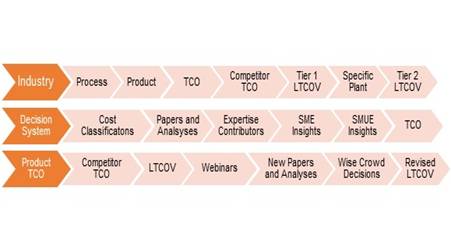

Route maps and mobile devices are allowing exhibition visitors to make much

better use of their time. McIlvaine is integrating these tools as part of

an ambitious effort to allow flow and treatment purchasers access to much more

comprehensive information. The entire concept is explained at:

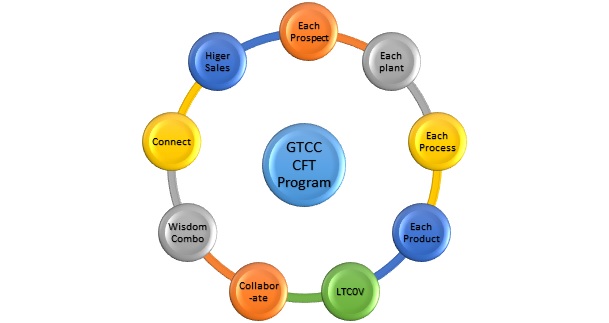

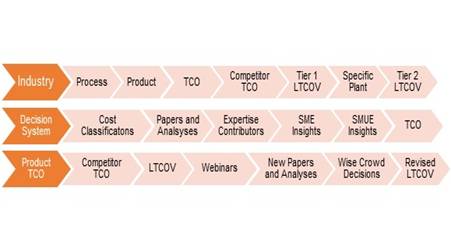

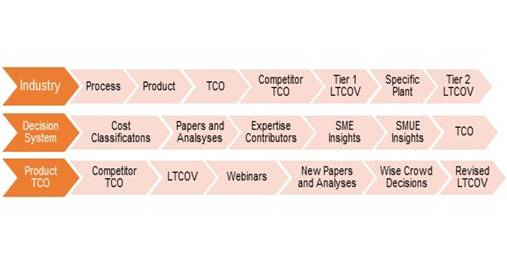

Global Decisions Positioning System™ (GDPS)

At two shows last week visitors could quickly determine who they wanted to see

and make advance contact to ensure a trip to the stand was worthwhile.

GDPS Mobile Links for November shows:

Filtration 2013 Filters

– Coal

Turbine Air

HVAC

Oil and Gas

Power Gen 2013 MATS

Turbine Air

CCR/ELG

Drives

Pumps

Valves

The Chem Show is being held December 10-12, 2013 in NYC. The route maps

will be particularly useful to attendees because the show covers a number of

different industries which are only vaguely related under the chemical industry

umbrella.

Some flow and treatment needs are unique and some are common. Power,

intake water treatment, cooling water treatment and HVAC air treatment are

common. However, the wastewater, air exhausts and process flow and

treatment needs are likely to be substantially different from one plant to

another.

There are hundreds of different categories of plants under the chemical industry

umbrella used by the Chem Show organizers. McIlvaine has a two record

identifier for each shown at: Application

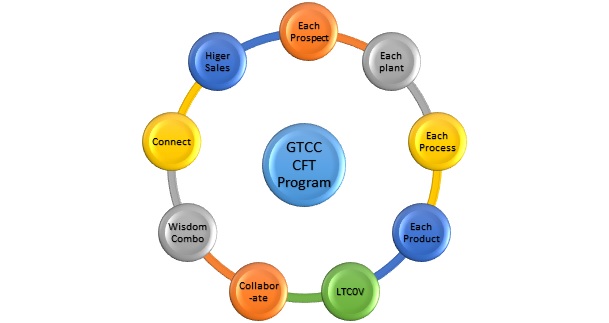

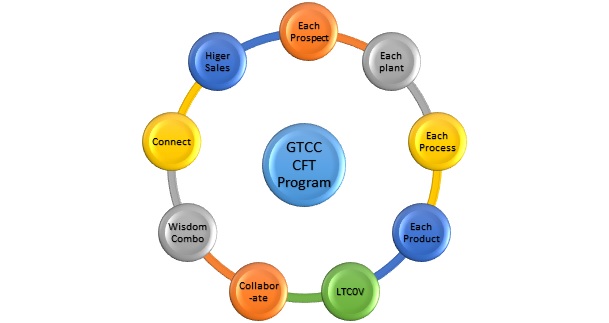

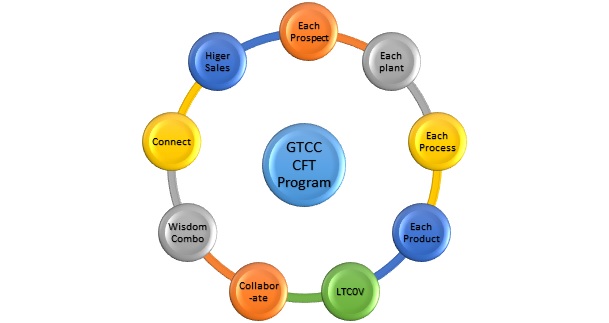

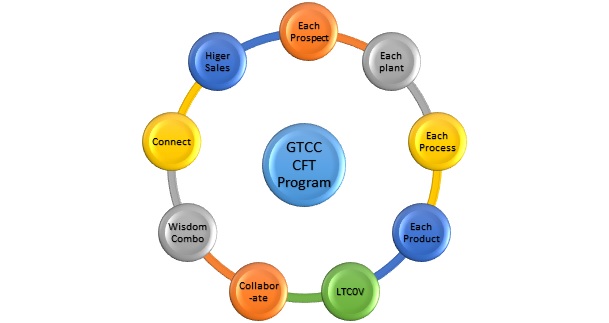

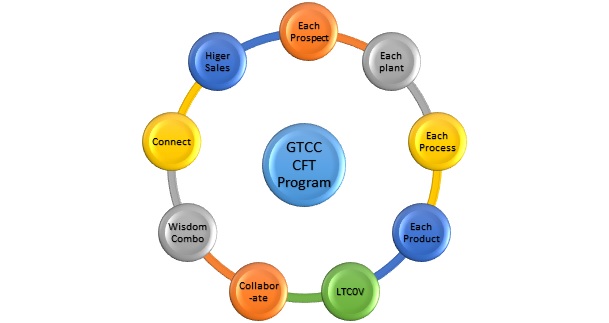

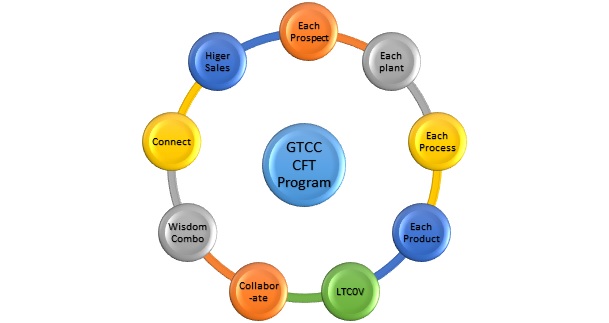

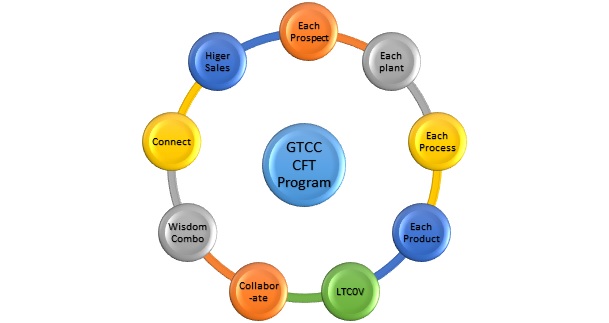

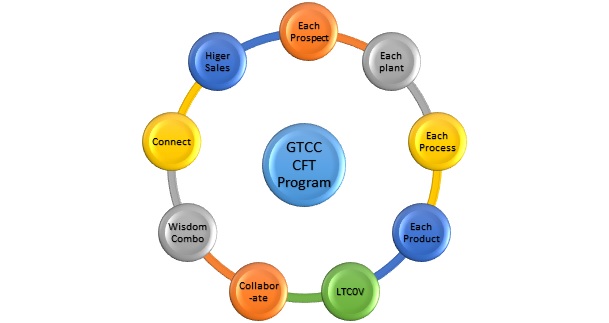

The Chem Show industries can be broadly divided into four main categories as

shown below. There are significant numbers of exhibitors in each of nine product

categories:

Flow and Treatment Route Maps and Decision Stops for the Chem Show

|

|

Process Fluids/Gases and

Wastewater

|

Common Processes

|

|

Product

|

Food

/Beverage

|

Pharma-

ceuticals

Cosmetics

|

Organic,

Petro

Chemicals

|

Inorganic

Chemicals

|

Power/

Cogen

|

Intake/

Cooling

Water

|

|

Thermal Treatment

|

|

|

|

|

|

|

|

Scrubbers/

|

|

|

|

|

|

|

|

Adsorption/Recovery

|

|

|

|

|

|

|

|

Particulate Removal

|

|

|

|

|

|

|

|

Distillation/

Evaporation/

Heat Exchange

|

|

|

|

|

|

|

|

Pumps

|

|

|

|

|

|

|

|

Valves

|

|

|

|

|

|

|

|

Liquid-Solid Separation

|

|

|

|

|

|

|

|

Instrumentation

|

|

|

|

|

|

|

There will be a decision stop for each product in each of the vertical road

maps. Discussion groups will also be encouraged and reported. Here

is an example:

Decision

Stop: Food - Thermal Treatment

Decision

Stop: Food - Thermal Treatment

Exhibitors

Durr, stand #610 name, e-mail, mobile

http://www.durr-cleantechnology.com/news-events/news/news-details/environmental-engineering-firm-takes-a-bite-out-of-odor/

Megtec, stand #337 name, e-mail, mobile

http://www.megtec.com/odor-control

Eisenman, stand #827 name, e-mail, mobile

http://www.eisenmann.us.com/ethanol-industry/

Decision

Stop: Organic Chemicals - Thermal Treatment

Decision

Stop: Organic Chemicals - Thermal Treatment

Exhibitor

Durr, stand #610

http://www.durr-cleantechnology.com/application-range/chemical/

Megtec, stand #337 name, e-mail, mobile

http://www.megtec.com/petrochemical

Eisenman, stand #827 name, e-mail, mobile

http://www.eisenmann.us.com/environmental-technology-chemical-processing/

Decision

Stop: Pharmaceuticals - Thermal Treatment

Decision

Stop: Pharmaceuticals - Thermal Treatment

Exhibitor

Megtec stand #337 name, e-mail, mobile:

http://www.megtec.com/chemical-pharmaceutical

Power-Cogen Route Map

Chemical plants with boilers must meet the new MACT standards by 2016. Scrubbers

and particulate upgrades will be needed at most plants burning coal.

The route map will lead you to those exhibitors with solutions.

Decision

Stop Scrubbers for Power-Cogen

Decision

Stop Scrubbers for Power-Cogen

Exhibitor

Korea Cottrell Stand #

Contact: Mike Widico e-mail

cell

(Link to GSA power point presentation)

Discussions

Industrial Boiler Air Pollution Control Systems and Components

Day time Location Korea Cottrell Stand # contact: Mike

Widico e-mail cell

Participants will include xxx of KC on scrubbers, xxx of KC on precipitators xxx

of XXX on scrubber nozzles xxx of xxx on stainless housing materials, xxx of xxx

consulting on system design and MACT.

Magazine Integration into the Route Maps

A number of influential magazines will have stands. Typically the key

personnel are roaming and the stand is primarily to supply free samples. We will

include mobile contacts for the roaming personnel and links to relevant articles

in the publications related to specific decision stops.

Decision

Stop Organic Chemicals - Liquid/Solid Separation

Decision

Stop Organic Chemicals - Liquid/Solid Separation

Exhibitor

Water & Wastewater Digest stand # 810

Don Heidkamp

dheidkamp@sgcmail.com

Cell: 847-858-5840

http://www.wwdmag.com/membranes-ultrafiltration/russian-refinery-employs-ge-technology-wastewater-treatment-plant

Decision

Stop Organic Chemicals - Distillation/Evaporation

Decision

Stop Organic Chemicals - Distillation/Evaporation

Exhibitor

Chemical Engineering stand #113

http://www.che.com/processing_and_handling/sep_liquid_liquid_and_gas_liquid/distillation/Troubleshooting-and-Solving-a-Sour-Water-Stripper-Problem_11171.html

Troubleshooting and Solving a Sour-Water Stripper

Problem

The science of droplets

An economical way to distill large volumes of products

Decision

Stop: Pharmaceuticals: Thermal Treatment

Decision

Stop: Pharmaceuticals: Thermal Treatment

Exhibitor

Durr stand #610 name, e-mail, phone

http://www.durr-cleantechnology.com/application-range/pharmaceutical/

Petro-Chemicals

Scrubber

Petro-Chemicals

Scrubber

Exhibitor

Andritz stand #126 contact xx e-mail xx

mobile xxx

http://atl.g.andritz.com/c/com2011/00/01/04/10473/1/1/0/929716576/se-references-kerteh.pdf

Organic/Petrochemicals

–Liquid Solid Separation

Organic/Petrochemicals

–Liquid Solid Separation

Exhibitors

Andritz stand #126 contact xx e-mail xx

mobile xxx

http://reports.andritz.com/2011/index/business-areas/ba-se/ba-se-business-year-2011.htm

GEA Filtration stand #319 name, e-mail, mobile

http://www.geafiltration.com/applications/industrial_applications.asp

Inorganic

Chemicals - Liquid Solid Separation

Inorganic

Chemicals - Liquid Solid Separation

Exhibitor

Andritz stand # 126 contact xx e-mail xx

mobile xxx

Agrochemicals, soda ash, ammonium sulphate, ammonium chloride, citric acid,

other chemicals

Krauss Maffei Supplies Three Systems to Zeneca Agrochemicals (McIlvaine

newsletter)

Pharmaceuticals/Cosmetics-

Liquid Solid Separation

Pharmaceuticals/Cosmetics-

Liquid Solid Separation

Exhibitors

Andritz stand #126 contact xx e-mail xx

mobile xxx

Antibiotics, vitamins, intermediates, other pharmaceuticals

GlaxoSmithKline Installs Krauss Maffei Peeler (McIlvaine newsletter)

GEA Filtration stand #319 name, e-mail, mobile

http://www.geafiltration.com/applications/pharmaceutical_applications.asp

Food

Industry – Liquid Solid Separation

Food

Industry – Liquid Solid Separation

Exhibitors

Andritz stand #126 contact xx e-mail xx

mobile xxx

http://www.dairyfoods.com/ext/resources/Spotlights/2013-Supplier-Spotlights/Andritz.pdf

FG Separation & Filtration Systems stand #240 name, e-mail

http://fgseparationfiltration.com/filtration/filter-press/

Flottweg Separation stand #340 name, e-mail, mobile

http://www.flottweg.de/usa/applications/beverages/beverages.html

http://www.flottweg.de/usa/applications/edible-fats-and-oils-biofuels/edible-fats-oils-and-biofuels.html

GEA Filtration stand #319 name, e-mail, mobile

http://www.geafiltration.com/applications/food_beverage_applications.asp

Pharmaceutical

Industry – Instrumentation

Pharmaceutical

Industry – Instrumentation

Exhibitor

Mettler Toledo stand #308 name, e-mail, mobile

http://us.mt.com/us/en/home/supportive_content/news/po/pro/3029_DO_InPro6860i.html

Intake,

Cooling Water - Pumps

Intake,

Cooling Water - Pumps

Exhibitor

Peerless Pump stand #112

http://www.peerlessxnet.com/documents/B-1270.pdf

If you are a supplier and want some content added, please provide it along with

your contact information. If you are a visitor and would like to network

on any of these subjects during the show, please indicate which decision stop

and provide your mobile number and e-mail. Send these to:

rmcilvaine@mcilvainecompany.com. (Bob at: 847-784-0012)

Investment of $790 Billion in Fossil and Nuclear Plants This Year

Fossil and nuclear power plants will invest $790 billion on new equipment and

repair parts in 2013. Fifty-six percent of the investment will be in

coal-fired power plants. This is the latest finding in Fossil & Nuclear Power

Generation: World Analysis & Forecast published by the McIlvaine Company. (www.mcilvainecompany.com)

2014 Fossil-fired and Nuclear Power Generation Market

|

Technology

|

Units

|

Coal-fired

|

Nuclear

|

Gas Turbine

|

|

|

|

Existing

|

New

|

Existing

|

New

|

Existing*

|

New*

|

|

Capacity

|

GW

|

2,300

|

100

|

474

|

20

|

1,300

|

100

|

|

Total Investment

|

$ Billions

|

240

|

200

|

100

|

80

|

70

|

100

|

|

Combined New and Existing

|

$ Billions

|

440

|

180

|

170

|

* Added industrial gas turbines which were not included in previous forecast.

Despite the virtual moratorium on new coal-fired power plants in the U.S., the

rest of the world will spend $200 billion on new coal-fired power plants in

2014. This contrasts with only $100 billion for gas turbine systems. Repair

parts and upgrades of existing coal-fired power plants will generate revenues of

$240 billion. Chinese and U.S. power plants have major pollution control

programs.

The future competition among these three major fuels will be shaped by a number

of factors. The greatest variable is the quantity of shale gas which can be

economically produced. The U.S. has potentially enough shale gas to meet

present requirements for thirty years. China has even greater reserves, but they

are located deeper and will be more expensive to extract. Furthermore, the

Chinese shale gas industry is in its infancy. Even with its most ambitious plan,

China’s gas production would only be eight percent of that in the U.S. in 2020.

The efforts to reduce greenhouse gases will virtually eliminate new coal-fired

power plants as an option in certain countries. This sets up a chain of

events whereby production of products requiring lots of energy input will be

increased in countries which burn the cheaper coal. As a result, the fleet of

world coal-fired power plants will keep growing.

Nuclear generation growth will also be highly regionalized. Some countries will

not only avoid building new nuclear power plants, but will phase out existing

ones. Other countries will be big investors in nuclear power. Nevertheless, this

fuel option will continue to remain in third place far behind coal.

For more information on

Fossil & Nuclear Power Generation: World Analysis & Forecast,

click on:

http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/113-n043.

Power Plant Operators Will Spend $8.5 Billion on Precipitators Next Year

Operators of coal-fired power plants will spend $4.5 billion on new

electrostatic precipitators in 2014 and $4 billion for upgrades and repairs.

This is the latest forecast in the continually updated Electrostatic

Precipitator World Market published by the McIlvaine Company.

(www.mcilvainecompany.com)

2014 Fossil-fired and Nuclear Power Generation Market

|

Technology

|

Units

|

Coal-fired Power

Plant Investment

|

Precipitator Expenditures

|

|

|

|

Existing

|

New

|

Existing

|

New

|

|

Capacity

|

GW

|

2,300

|

100

|

2,200

|

90

|

|

Total Investment

|

$ Billions

|

240

|

200

|

4

|

4.5

|

|

Combined New and Existing

|

$ Billions

|

440

|

8.5

|

For the last decade, China has led the world in precipitator purchases. It is

continuing to build new coal-fired power plants and for the present is investing

tens of millions of dollars for precipitators at each power plant. However, new

regulations limiting particulate emissions will very possibly force operators to

purchase fabric filters instead of precipitators in the future.

It is not all bad news for precipitator suppliers. Upgrades to existing

precipitators can make them much more efficient. So, while the new

equipment market will stagnate in coming years, the market for upgrades and

repairs will continue to steadily grow.

For more information on:

Electrostatic Precipitator World Market,

click on:

http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/111-n018

Renewable Energy Briefs

GM Gets Steamy with Detroit Renewable Energy

General Motors and Detroit Renewable Energy announced a renewable energy project

to turn solid municipal waste from Metro Detroit into process steam that will be

used to heat and cool portions of GM’s Detroit-Hamtramck assembly plant.

When the project is operational, 58 percent of the plant’s energy needs will

come from renewable energy, making Detroit-Hamtramck the top GM facility in the

world by percentage of renewable energy used.

“We have 107 landfill-free facilities across the globe that recycle or reuse

their waste, with some of it turned into energy,” said Rob Threlkeld, GM’s

global manager of renewable energy. “It made sense to explore this option with

DRE at Detroit-Hamtramck, given their quality work in helping us manage our

energy use at some of our other GM plants.”

Detroit Renewable is able to process more than 1 million tons of municipal solid

waste into electric power and steam while also recycling nearly 40,000 tons of

metal annually.

The steam will travel 8,300 feet through a pipe originating at Detroit Renewable

Power and ending at the Detroit-Hamtramck plant.

The steam pipe will provide 15.8 megawatts of renewable energy to the plant,

which equates to 12 percent of GM’s overall goal of putting 125 megawatts of

renewable energy into its energy portfolio by 2020.

Construction of the new steam line and associated energy infrastructure will

begin later this month and become operational next spring.

Scuderi Group, Inc. and ECS Sign Agreement for Hydro Powered Generation and

Energy Storage System

Scuderi Group, Inc. announced the signing of a Memorandum of Understanding with

Agawam, MA-based environmental consultants ECS to build and install a combined

heating and power (CHP) generation system with compressed air energy storage

(CAES) capabilities in an effort to lower energy costs at its Nonotuck Mill

property. This will be the first Scuderi Engine to be designed and built to

utilize hydropower.

According to the agreement, Scuderi Group will build a CHP and energy storage

unit to be installed at ECS's headquarters, a 150,000 square-foot revitalized

mill property that also houses a dozen environmental-based businesses and

organizations. Taking advantage of the adjacent Mill River, the system will be

designed to provide heating and power. The energy storage capability will enable

ECS to store power efficiently during the night, and then provide less costly

electricity to during the day when the building's power demands are very high.

The unit will also act as a backup generator.

The Scuderi Split-Cycle Engine incorporates a unique and highly efficient power

generation and compressed air energy storage capability that combines the energy

of the high-pressure compressed air with the kinetic energy of the fuel to

create a significant efficiency gain. When applied to properties with large

power demands, the system has the capability to reduce electricity consumption

up to 20 percent.

Google & KKR Partner to Invest in Portfolio of Solar PV Projects from Developer

Recurrent Energy

Google, KKR and Recurrent Energy announced that Google and KKR are making an

investment in six solar photovoltaic (PV) facilities that are currently being

developed and will be managed by Recurrent Energy. The solar facilities, located

in California and Arizona, have a combined production capacity of approximately

106 megawatts (MW) and will provide clean electric power to local utilities and

municipal offtakers under long-term Power Purchase Agreements (PPAs).

Capital for the projects was provided by equity investments from Google and KKR,

as well as debt financing.

The three companies made a similar announcement in December of 2011, when Google

and KKR invested in four utility-scale solar facilities near Sacramento, CA,

developed by Recurrent Energy.

The solar facilities include five projects in Southern California and one in

Arizona and will provide power to three offtakers, including Southern California

Edison. In aggregate, the facilities will generate enough clean solar

electricity to power over 17,000 U.S. homes. The six projects are expected to be

operational by January 2014.

This is Google's 14th renewable energy investment; to date the company has

committed over $1 billion to renewable energy across a wide range of

technologies, from off-shore transmission to the world's largest wind and solar

power projects.

ReneSola Wins 53.5 MW Utility Scale Project in Southern Texas

ReneSola Ltd. announced it will deliver more than 178,000 PV modules, which will

be used in a 53.5 MW project being developed by leading solar PV project

developer, OCI Solar Power. The modules will be installed in a project named

Alamo II in San Antonio and another upcoming Texas development approximately two

hours west of San Antonio.

The multi-stage project will total 400 MW and provide power to CPS Energy, the

municipal utility for the City of San Antonio, upon completion in 2016. A

portion of the large-scale solar project will include ReneSola's 300W

high-efficiency polycrystalline modules.

ITT’s Goulds Pumps Brand to Equip Stanford University Sustainability Program

Twenty-five large double-suction pumps from ITT's Goulds Pumps brand will

provide Stanford University's innovative new energy facility with the

high-efficiency pumping required by the Stanford Energy System Innovations

(SESI) program, a $438 million investment to enable the university to have one

of the most energy-efficient power systems of any major research university in

the world.

Three different Goulds Pumps brand models were selected by Stanford as part of a

comprehensive district heating plan that will replace a current natural

gas-powered cogeneration plant with an electricity-powered heat recovery plant.

Studies have shown that the campus can recover up to 70 percent of the heat now

discharged from the cooling system to meet at least 80 percent of simultaneous

campus heating demands, significantly reducing fossil fuel and water use in the

process.

Scheduled for completion in 2015, Stanford's facility will be key to reducing

campus carbon emissions by up to 50 percent, lowering its water use by up to 18

percent and saving an estimated $300 million over the next 35 years. The 125,000

gross-square-foot facility will allow the university to regenerate the waste

heat that the cogeneration plant discarded. Capturing and distributing the heat

requires high-efficiency pumping systems and replacement of about 20 miles of

piping across the campus.

For more information on Renewable Energy Projects and Update

please visit:

http://www.mcilvainecompany.com/brochures/Renewable_Energy_Projects_Brochure/renewable_energy_projects_brochure.htm

Headlines for the November 15, 2013 – Utility E-Alert

UTILITY E-ALERT

#1151– November 15, 2013

Table of Contents

COAL – US

-

Groundwater Contamination from Coal Ash at TVA Power Plants

-

TVA to Shut Two Units at Paradise, Five Units at Colbert and One

Unit at Widows Creek

-

LG&E settles Complaints about Coal Ash and Scrubber Sludge

Handling

-

Indiana Michigan Power gets permission to use DSI at Rockport

Power Plant

-

62 MW Fair Station in Iowa Closed

COAL – WORLD

-

Bin Qasim 3 and 3 to be converted to Coal-firing

-

Bid submission Dates for Odisha, Tamil Nadu UMPPs (India)

extended

-

Construction to begin on 3,239 MW of New Power Plants in

Bangladesh

-

Kenya: 980 MW of Power expected from Kitui’s Mui Basin

GAS/OIL – US

-

600 MW Marshalltown has Siting Certificate

GAS/OIL – WORLD

-

Siemens to deliver 20 SGT-800 Gas Turbines to Thailand

COMBUSTION TECHNOLOGIES/BOILER

EFFICIENCY

EFFICIENCY

-

Emerson to modernize Control Systems at Belchatów 2

-

Emerson to automate Two 1,050 MW Ultra-supercritical Units at

Taean Power plant in South Korea

BIOMASS

-

10 MW Heat and Power Plant in Babina Creda, Croatia

NUCLEAR

-

Comanche Peak Nuclear Power Plant expansion put on Hold

-

Vietnam plans Eight More Nuclear Power Plants by 2030

-

Egypt to issue Tender for Dabaa Nuclear Power Plant in January

2014

-

Horizon pushing ahead with Wylfa Newydd Nuclear Power Plant in

UK

BUSINESS

-

URS offers SBS Injection for SO3 and Mercury Control

-

Emerson and Mitsubishi Power Systems Americas extend Alliance

for Turbine Retrofit Projects

-

Touring Power-Gen and Filtration this Week with the McIlvaine

Mobile GDPS Route Maps

-

Mercury Removal Market Could Grow from Less than $1 Billion/Yr

to Over $10 Billion in the Coming Years

-

Air Pollution Control Supplier Revenues to Exceed $44 Billion in

2014

HOT TOPIC HOUR

-

“Wet vs. Dry ESP” is the “Hot Topic Hour” on Thursday, November

21, 2013 at 10:00 a.m. CST

-

Upcoming Hot Topic Hours

For more information on the Utility Tracking System, click on:

http://home.mcilvainecompany.com/index.php/databases/2-uncategorised/89-42ei

“Application of U.S. Mercury Control Technology in Other Countries” is the

Free “Hot Topic Hour” on Thursday, December 5, 2013

On December 5, McIlvaine will offer a free Hot Topic Hour covering the

potential for ROW to adopt the mercury control technologies developed to meet

the MACT and MATS rules in the U.S. There are two segments which will be

addressed:

·

Timing and size of the market in other countries

·

Routes to market

The potential at power plants, industrial facilities, mines, waste-to-energy

plants and other emission sources will be addressed. Particular attention

will be paid to the large potential Chinese market in the utility power,

industrial power and cement sectors.

U.S. based companies have developed technologies which are unique. So there is a

rare opportunity to pursue the international markets without local competition.

In order to assure that ROW understands the U.S. technology as well as its cost

and performance advantages, McIlvaine is offering a free Mercury Decisions

System to any power, cement, or industrial plant operator. The content of

this system will be reviewed with attendees. Ramifications including the

acceleration of regulations in other countries will also be discussed.

Other tools to help U.S. companies pursue this market will be covered. For

example, a numerical system is used to identify potential purchasers. The reason

is that there are multiple spellings of many non-English names and, therefore,

uncertainty as to exactly who the prospect is.

To register for the free December 5, 2013 “Hot Topic Hour” on

“Application of U.S. Mercury Control Technology in Other Countries” at 10:00

a.m. CST, click on:

http://www.mcilvainecompany.com/brochures/hot_topic_hour_registration.htm.

McIlvaine Hot Topic Hour Registration

On Thursday at 10:00 a.m. Central time, McIlvaine

hosts a 90 minute web meeting on important energy and pollution control

subjects. Power webinars are free for subscribers to either

Power Plant Air Quality Decisions or Utility Tracking System. The

cost is $125.00

for non-subscribers.

Market Intelligence

webinars are free to McIlvaine market report subscribers and are $400.00

for non-subscribers.

|

DATE

|

Non-Subscribers Cost

|

SUBJECT

|

Webinar Type

|

|

December 5, 2013

|

FREE

|

Application of U.S. Mercury

Control Technology in Other

Countries

|

Power

|

|

December 12, 2013

|

$125.00

|

Update on Gasification Projects

and Technology

|

Power

|

|

December 19, 2013

|

$125.00

|

Selecting FGD Scrubber

Components

|

Power

|

|

January 9, 2014

|

$125.00

|

Air Preheaters & Heat Exchangers

|

Power

|

|

January 16, 2014

|

$125.00

|

Corrosion Issues and Materials

for APC Systems

|

Power

|

|

January 23, 2014

|

$125.00

|

Co-Firing Sewage Sludge, Biomass

and Municipal Waste

|

Power

|

|

January 30, 2014

|

$125.00

|

Impact of Ambient Air Quality

Rules on Fossil Fueled Boilers

and Gas Turbines

|

Power

|

|

February 6, 2014

|

$125.00

|

Review of EUEC

|

Power

|

|

February 13, 2014

|

$125.00

|

NOx Catalyst Performance on

Mercury and SO3

|

Power

|

|

February 20, 2014

|

$125.00

|

CFB Technology and Clean Coal

(Update on CFB Reactor

Technology)

|

Power

|

|

February 27, 2014

|

$125.00

|

Dry FGD: Spray Dry vs. CFB vs.

DSI

|

Power

|

|

March 6, 2014

|

$125.00

|

Update on IGCC (Integrated

Gasification Combined Cycle)

|

Power

|

|

March 13, 2014

|

$125.00

|

Update on Oxy-Fuel Combustion

|

Power

|

|

March 20, 2014

|

$125.00

|

Improving ESP Performance

|

Power

|

|

March 27, 2014

|

$125.00

|

Mercury Control and Removal

|

Power

|

|

April 3, 2014

|

$125.00

|

HRSG Design, Operation and

Maintenance Considerations

|

Power

|

|

April 10, 2014

|

$125.00

|

Measurement and Control

Instrumentation for Power Plants

|

Power

|

|

April 17, 2014

|

$125.00

|

Measurement and Control of PM2.5

|

Power

|

|

April 24, 2014

|

$125.00

|

Status of Carbon-to-Liquid

Projects and Technology

|

Power

|

|

May 1, 2014

|

$125.00

|

Renewable Energy, Status,

Options, Technology Update

|

Power

|

|

May 8, 2014

|

$125.00

|

Valves for Power Plant Steam and

Cooling Water

|

Power

|

|

May 15, 2014

|

$125.00

|

Water Treatment During Gas and

Oil Production

|

Power

|

|

May 22, 2014

|

$125.00

|

Advances in Coal Blending

|

Power

|

|

May 29, 2014

|

$125.00

|

Clean Coal Technologies

|

Power

|

|

June 5, 2014

|

$125.00

|

Material Handling in Fossil

Fueled Power Plants

|

Power

|

|

June 12, 2014

|

$125.00

|

Industrial Boiler MACT - Impact

and Control Options

|

Power

|

|

June 19, 2014

|

$125.00

|

Multi-emissions Control

Technologies

|

Power

|

|

June 26, 2014

|

$125.00

|

Next Generation of Coal

Combustion Technologies

|

Power

|

|

July 10, 2014

|

$125.00

|

Compliance Strategies for PM2.5

|

|

To register for the “Hot Topic Hour”, click on:

http://www.mcilvainecompany.com/brochures/hot_topic_hour_registration.htm.

----------

You can register for our free McIlvaine Newsletters at:

http://www.mcilvainecompany.com/brochures/Free_Newsletter_Registration_Form.htm.

Bob McIlvaine

President

847-784-0012 ext 112

rmcilvaine@mcilvainecompany.com

www.mcilvainecompany.com

191 Waukegan Road Suite 208 | Northfield | IL 60093

Ph: 847-784-0012 | Fax: 847-784-0061