Evidence Based, Forecast Driven Strategy for

Pump Suppliers

Introduction

The evidence based, forecast driven sales

approach can maximize profits for pump

companies.

There are two variations of the approach based

on whether the pump is in general or high

performance service.

The capital investment and sales decisions are

different for the two performance

classifications. The evidence needed is also

different with one based on logistics and the

other based on product performance. (1)

Pump performance categories are

·

Severe service

·

Critical service

·

Unique service

·

General service

Severe service includes abrasive, corrosive,

high temperature and high pressure applications.

Critical service includes sanitary and

other applications where performance is

important to product quality or safety. Unique

includes special pumps designs for a specific

customer. General includes pumps which are

purchased based more on cost and delivery and

less on performance.

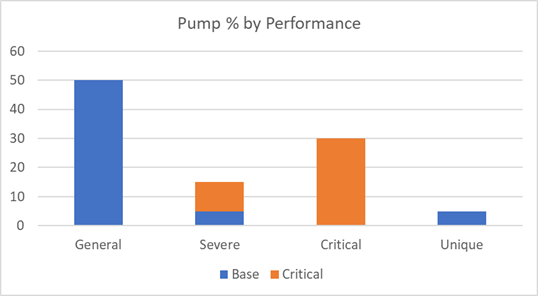

Figure 1 shows the market share percentage for

each type of pump. The critical service category

excludes critical pumps which are also in severe

service.

The severe service, critical and unique, are

high performance service categories. In high

performance service the performance is more

important than price or delivery.

General service includes pumps sold more as a

commodity. So in a food processing plant the

pumps on the municipal water intake pipeline

would be in the general category. The ones

moving food products would be critical. The ones

on the high pressure steam would be severe

service.

From a profitability strategy perspective it is

advantageous to contrast the high performance

and general performance important business

factors. The comparison in Figure 2 shows which

type produces higher results

|

|

High Performance |

General |

|

EBITA % per unit sold |

X |

|

|

EBITA per product total |

|

X |

|

Engineering expense per unit |

X |

|

|

R&D expense per unit |

X |

|

|

Capital Investment |

|

X |

|

Direct Sales |

X |

|

|

Corporate Influence & TCO Analyses |

|

|

|

Sales Volatility |

X |

|

|

Distribution Chain Value |

|

X |

|

Importance of Manufacturing Location |

|

X |

|

Value of Evidence Based Approach |

X |

|

High performance pumps can be sold at higher

prices because of their unique qualities. So

high EBITA can be achieved for a relatively

small number of pumps.

Many general pumps are sold in large

quantities. So EBITA based on total revenue is

higher than for

a small niche market.

EBITA can also be increased with lower

production costs than the competition. This is

more likely with large volume general

performance products.

Engineering and R&D expenses per unit sold are

greater for high performance products to develop

the unique features.

Engineering and R&D for general performance

pumps can be substantial if the focus is

reducing manufacturing costs. But the cost per

unit sold would be low due to the high volume.

Capital investment will typically be higher for

general performance pumps due to the likelihood

that the pumps are produced in a supplier owned

facility. High performance pumps are likely to

include castings and components supplied by

others.

Sales of high performance pumps depend on

conveying knowledge of the superiority. Direct

sales by knowledgeable individuals is important.

General purpose pumps can be purchased with the

simple total cost of ownership analysis based on

price. The purchase of a high performance pump

warrants a total cost of ownership analysis. One

large steel company found that local purchases

tended to be based on price and experience.

This precluded consideration of new and better

pumps.

Corporate staff took over the high performance

pump decision making for all the plants.

The result was a considerable reduction

in total cost of ownership.

A large

chemical company has a corporate staff assigned

to pumps and valves and strives to take

advantage of all the improvements as they occur.

There tends to be volatility in the sales of

high performance pumps. For example the market

for pumps for fracking fluctuates considerably.

The market for pumps used in water intakes in

plants is relatively steady.

The manufacturing location is typically

important for general purpose pumps where

freight costs and delivery time are more

important than for high performance pumps.

Importance of Detailed and Current Forecasts

Very detailed forecasts for general and high

performance pumps are needed. Segmentation of

high performance opportunities by critical,

severe and unique is needed in order to

determine the most profit potential.

In the case of high performance pumps this

forecast will guide R&D and engineering efforts.

In the case of general performance pumps the

forecast will guide manufacturing investment.

Due to the Russian invasion of Ukraine, and the

Chinese lockdown the pump markets are rapidly

changing.

So continuous forecasts are necessary.

The most profitable market can be a large number

of small niches. IDEX is an example of a company

with close to 30% EBITA and fairly large volume.

However the company consists of a number of

independent divisions each pursuing a unique

niche. Identifying these profitable niches

requires much more detailed market analysis than

is typically pursued by pump companies.

|

Niche Forecast Needs |

|||

|

Segment |

TAM |

SOM |

MPM |

|

Countries |

80 |

80 |

180 |

|

Industries |

10 |

15 |

200 |

|

Service |

x |

4 |

4 |

|

Years |

10 |

10 |

10 |

|

Types |

8 |

8 |

40 |

|

Processes |

x |

x |

50 |

|

Total |

64,000 |

384,000 |

28,800,000 |

|

Typical Relevant Niches |

5,000 |

15,000 |

40,000 |

|

Typical Relevant % |

8 |

4 |

1 |

There are various levels of forecasting. The

Total Available Market (TAM) includes all the

opportunities whether or not they can be

serviced and whether or not they are obtainable.

The Serviceable Obtainable Market (SOM) reflects

the market which can be pursued. However much of

this market will not be very profitable. A much

more detailed forecast is needed which analyzes

all the niches and determines where the most

profit can be achieved.

The ability to calculate any of 128 million

niches relies on top down, bottoms up and

horizontal iteration. It would be prohibitively

expensive to conduct for just one category such

as valves. But if the expense is diluted by

including forecasts of equipment using valves

plus complimentary air, water, energy products

the cost for the valve analysis is reduced.

A typical example would be a company of medium

size who would be involved in

5000 niches or 8% of the TAM. With

further segmentation in SOM the number expands

to 15,000. The percentage drops to 4.

The most profitable market may involve 40,000

niches or just 1% of the total. If competitor

market shares and sales quotas for territories

are also included, the number can rise

significantly.

This effort will be relatively expensive but as

part of an evidence based sales program

the benefits far outweigh the costs.

Evidence Based Strategy

The same evidence needed to select the most

profitable market niches is also what is needed

to convince purchasers in those niches that a

pump is superior.

This evidence includes understanding the process

needs in each industry.

Once the most profitable market is determined,

the evidence can be used to validate the lower

total cost of ownership.

This requires analysis of the competitors pumps

and determining the comparative costs.

There is a sequence

to the evidence gathering process

1.

Raw data

2.

Predicate evidence

3.

Disputed evidence

4.

Claims based on the evidence

5.

Rebuttal to counter claims made by competitors

Suppliers have the opportunity to accomplish

steps

2-5 in advertisements, magazine articles,

exhibition activities, white papers and webinars.

It is not enough to prove the lower total cost

of a pump it is necessary to convince the

customers with solid evidence. This is a

challenge but a rewarding one with the potential

to greatly increase revenues and EBITA

(1) Pumps: World Markets published by the

McIlvaine Company