|

WELCOME

Weekly selected highlights in flow

control, treatment and combustion from the many McIlvaine publications.

·

Briefs

· World Centrifuge Market Controlled by Fewer than

Fifty Companies

·

Most Profitable Market Program for Flow and Treat

Companies in the Power Industry

Briefs

India’s

Growth has Slowed. GDP growth in India has slowed from 9%

three years ago to just 4.5% this year. Nevertheless with a population

destined to be the world’s largest in the coming years and with a

capitalistic structure it continues to be an attractive flow and treat

market. McIlvaine is working with

Mission Energy who hosts important conferences such as Flyash Utilization

scheduled for Goa in February http://flyash2020.missionenergy.org/. The Indian flow and treat market relative to coal

fired boilers will be very large over the next few years and in terms of

amounts of equipment purchased exceed the U.S. at its height. However, the lower prices reduce this

potential somewhat. Nevertheless it

is an attractive market which we cover weekly in http://home.mcilvainecompany.com/index.php/databases/42ei-utility-tracking-system

Tariff

and Trade Problems continue to Impact

the Flow and Treat Industry. This conflict is not good for the flow

and treat industry but is spurring internationalism. The U.S. will purchase

a continually smaller share of flow and treat products. So protection of

this shrinking domestic market pales in importance to pursuing the increasing

opportunities around the world. The result is therefore going to be less

rather than more production in the U.S.

Pharmaceutical

Flow and Treat Growth to Average 5% in the U.S.

The cleanroom industry in the U.S. will continue to benefit from a

growing market for pharmaceuticals. The biopharmaceutical segment is

growing even faster than the industry as a whole. The need for flexible and

small production facilities is leading to innovations in single use, closed

systems and restricted access barrier systems. The impact is analyzed in http://home.mcilvainecompany.com/index.php/markets/other/n6f-world-cleanroom-markets

Projects are tracked in http://home.mcilvainecompany.com/index.php/databases/80a-world-cleanroom-projects

World Centrifuge Market Controlled by Fewer than Fifty Companies

Thousands

of new forecasts relative to the market for centrifuges have just been

posted to http://home.mcilvainecompany.com/index.php/markets/water-and-flow/n005-sedimentation-and-centrifugation-world-markets.

Centrifuges are highly engineered devices which require substantial

capital investment to design and manufacture. It is not surprising that

fewer than fifty companies have captured seventy percent of the market.

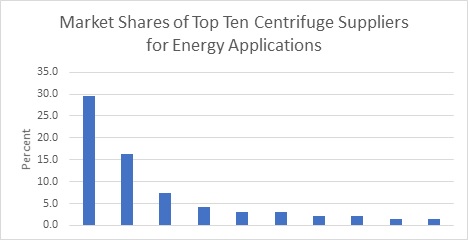

The energy segment includes stationary power, shipboard fuel oil treatment,

oil, gas, and refining. The top

supplier has nearly 30 percent of the market.

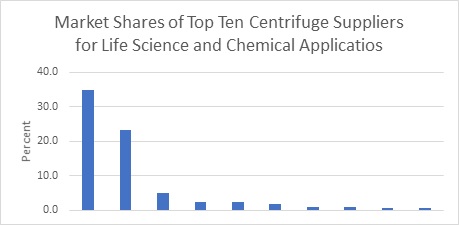

The

life science and chemical segment includes food, pharmaceuticals, and chemical

processes.

The

two top producers share sixty percent of the market.

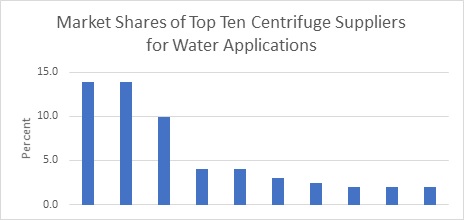

The

water segment includes municipal water and wastewater as well as

desalination. There is no clear

leader. The top three suppliers have

less than a third of the market.

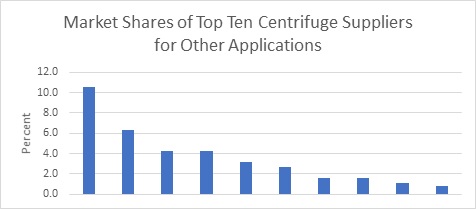

The

other segment includes mining, iron and steel and many other

industries. Many smaller companies

pursue niches which are overlooked by larger competitors. The top four suppliers account for only

twenty-five percent of the market.

There

are relatively few exhibitions around the world with extensive displays of

centrifuges. ACHEMA stands out with 25 exhibitors. However, this event is tri annual. When

annualized it is only 8/yr. WEFTEC is a U.S. municipal wastewater

conference and exhibition which is held yearly. So even though it has only

has eight centrifuge exhibitors it is comparable to ACHEMA.

By

contrast IFAT in Germany competes with WEFTEC but is triannual. When annualized this is a smaller event

for centrifuge suppliers than Offshore Technology Conference held annually

in Houston. The U.S. SME Mining show next year will have four centrifuge

exhibitors as well.

It

is surprising that Interphex in the U.S. and PowerGen in New Orleans had no

centrifuge exhibitors. There are hundreds of small exhibitions attached to

specialized conferences. Andritz

participated in 50 such exhibitions in 2019. The focus on many of these

were Andritz products other than centrifuges.

|

Company

|

Number of Centrifuge Exhibitors

|

|

|

|

|

Achema 2018

|

25

|

|

|

WEFTEC 2019

Chicago

|

8

|

|

|

IFAT,

Munich, 2018

|

7

|

|

|

OTC 2019

|

4

|

|

|

SME Mining

2020

|

4

|

|

|

FI-Foodtec

2019

|

3

|

|

|

Interphex

Japan 2020

|

2

|

|

|

Beer X 2020

|

1

|

|

|

China Coal

and Mining

|

1

|

|

|

Dairytec UK

2020

|

1

|

|

|

Frac Sand

2019

|

1

|

|

|

Interphex

NYC 2019

|

0

|

|

|

PowerGen

2019 New O.

|

0

|

|

This

market report http://home.mcilvainecompany.com/index.php/markets/water-and-flow/n005-sedimentation-and-centrifugation-world-markets.

is continually updated and includes decanter, disc, and other

centrifuge forecasts for each industry in each country.

Bob

McIlvaine can answer your questions at

Direct: 847 784 0013, Cell: 847 226 2391 or you can email him at rmcilvaine@mcilvainecompany.com

Most

Profitable Market Program for Flow and Treat Companies in the Power

Industry

Market

research has been used as a peripheral tool by power plant flow and treat

product providers. Now it can be the foundation of a program to

successfully pursue the Most Profitable Market (MPM). There is already

enough information available through media, associations, conferences and

internet resources to determine the best prospects and then convince them

that the supplier has a better product.

McIlvaine can provide the market forecasts which can be used to

pursue this unique new approach based on customer knowledge and not sales

leads.

|

Activity

|

Present

Approach

|

MPM

|

|

Sales Initiation

|

Sales Leads and Reps

|

Predicted Prospects

|

|

Market Research

|

Peripheral

|

Foundation of Approach

|

|

Sales Promotion

|

Unstructured and Reactive

|

Structured and Proactive

|

|

Sales Success

|

Persuasion

|

Lowest Cost of Ownership Evidence and Delivery

|

McIlvaine

can provide the market research. Suppliers can promote their products in a

structured and proactive manner by working with the media, conference

organizers, consultants, and associations with a structured approach which

breaks down traditional silos. Here is an example.

At

PowerGen International in New Orleans Clarion introduced new approaches to

organizing knowledge and connecting the seekers and those with the answers.

There were Knowledge hubs and arranged meetings with programs called

“Connect” and “Match” McIlvaine

contributed with organized knowledge access in a number of areas as

explained at

http://www.mcilvainecompany.com/PowerGen_2019/MPM/powergen_and_the_most_profitable.htm

One

successful example of the structured

proactive started with PowerGen Connect and ended with a brief meeting at a

consultant stand. Speakers and exhibitors shared thoughts on flyash

reclamation and reuse in the U.S. and India. Another example utilized articles in Power Engineering plus the knowledge of treatment chemical experts

to analyze a very promising technology for improving efficiency of

limestone scrubbers. While this may

be a minor opportunity in the U.S it is a huge opportunity in India and should

continue to be pursued at PowerGen India and in conferences organized by

Mission Energy who also has an upcoming 2020 flyash utilization conference

in India.

There

were a number of valve exhibitors identified in the McIlvaine PowerGen tour

guide. A very narrow application “turbine bypass valves” was selected to

demonstrate the value of pursuing each niche. McIlvaine is working with IVAMA (Indian

Valve Manufacturers Association) and writes more than one feature article

on valves each month for major publications. There are a number of good

articles on valves archived in Power

Engineering.

The

support of utility associations such as EPRI, VGB, Mission Energy and others

can be pursued because the MPM for suppliers is the lowest total cost of

ownership solution for the operators.

McIlvaine

tracks all the major power projects and has analysis of every coal fired

power plant operator in the world with more than 1000 MW of installed or

planned capacity.

http://home.mcilvainecompany.com/index.php/databases/42ei-utility-tracking-system .

McIlvaine

tracks GTCC projects http://home.mcilvainecompany.com/index.php/markets/air/gas-turbine-and-reciprocating-engine-supplier-program as well as nuclear and renewable.

For

40 years it has sought to provide organized access to the information on

coal fired flow and treat technology with http://home.mcilvainecompany.com/index.php/silobusters/44i-coal-fired-power-plant-decisions

McIlvaine

standard market reports provide the Total Available Market at each major

prospect. With MPM this is expanded to identify and then convince those

customers who will provide the company with the greatest profits.

McIlvaine

needs assistance to forecast the

most profitable markets. The supplier also needs this crucial

information. It can be obtained in

an organized approach where knowledge is shared.

|

Determination Needs

|

Knowledge Sharing

|

|

Product use in each power process by fuel type

|

Knowledge networks providing access to media,

conference and association resources

|

|

Determine the market for each process

|

Free flowing solids includes coal, limestone,

gypsum, ash; liquids include water, slurries, process liquids and gases

would include steam (all being forecast by McIlvaine in each country)

|

|

Determine the use for the product in each

process

|

Knowledge networks providing access to media, conference and

association resources

|

|

Determine the purchases by each major customer

|

Analysis already available for coal, nuclear,

GTCC, and renewables generators with 95% of capacity. It is customized

for a specific offering with

knowledge networks.

|

|

Analyze competitor market share and offerings

|

This includes analysis of all advertising and

exhibition activity including niche as well as major events. Media can provide this data to

advertisers.

|

|

Compare lowest total cost of ownership

|

Knowledge networks providing access to media, conference and

association resources are supplemented by webinars.

|

|

Pursue markets where high margins are not offset

by high sales costs

|

Associations, media, and conferences can be leveraged in an

organized market campaign which can include collaboration with other

divisions or with complimentary product suppliers

|

|

Develop new and better solutions

|

Access to all the available information is

necessary to determine what is needed.

|

The

starting points for the program are the standard or customized market

reports described at www.mcilvainecompany.com

- Markets. The Most

Profitable Market Program is also explained in detail from a home page

link.

Bob

McIlvaine can answer your questions at rmcilvaine@mcilvainecompany.com

direct 847 784 0013 cell 847 226 2391

Click here

to un-subscribe from this mailing list

|