|

WELCOME

Weekly selected highlights in flow

control, treatment and combustion from the many McIlvaine publications.

·

Briefs

·

FGD Market Offers Billions of Dollars of Profits

·

Determining the Market for Your Product at Every

Food Plant

·

Electrostatic Precipitator Upgrades

Briefs

The

FGD pump market worldwide including repairs and replacements will continue

to exceed $200 million per year and consist mostly of centrifugal

pumps. The big reciprocating pump market continues to be hydraulic

fracturing and will be expanding from the U.S. to China and Argentina.

Sinopec is the world’s largest pump purchaser but is also a supplier. Keep

up with this changing market at http://home.mcilvainecompany.com/index.php/markets/water-and-flow/n019-pumps-world-market

The

oil and gas opportunities keep shifting with tariffs, changing fuel prices,

and other variables. Does China gasify more coal or purchase more LNG? How

successful are fracking programs outside the U.S.? Where are all the

LNG projects and what is their status? All this is covered in http://home.mcilvainecompany.com/index.php/markets/energy/n049-oil-gas-shale-and-refining-markets-and-projects

There

are growing opportunities for disk centrifuges, macrofilters, valves,

pumps, cross flow membranes, cartridges and instrumentation in the fast

growing biopharm market. Will it maintain double digit growth? See some of

the answers at

The

Future of Biopharmaceuticals will Depend on Perceived Value vs Cost

Cannabis

is also a fast growing market for centrifuges and cleanrooms. We are

providing custom research in this area.

The

scrubber market is growing due to activity in sugar cane conversion to

solid fuel and ethanol, marine shipping, refining, mining, steel and

petrochemicals. Forecasts for absorbers and adsorbers are included in

http://home.mcilvainecompany.com/index.php/markets/air/n008-scrubber-adsorber-biofilter-world-markets

Activity

at chemical, steel, mining, pulp & paper and cement plants is

tracked along with profiles of each major purchaser at http://home.mcilvainecompany.com/index.php/databases/n032-industrial-plants-and-projects

FGD Market

Offers Billions of Dollars of Profits

More

than $50 billion per year will be spent on the systems, parts, consumables

and services by power companies to build and maintain flue gas

desulfurization (FGD) systems. If these systems are not meeting SO2

emission limits the power plant must cease operations. All the elements of

severe service are present: corrosion, temperature, and abrasion. As a result power companies are focused

on buying products with the lowest true cost. This translates into billions

of dollars of potential profits for suppliers.

These

profits are achievable by identifying the potential for each customer, providing

evidence of the lowest true cost and then convincing the customer

(validating the claims).

A

cost effective program is available.

FGD Most Profitable Market

Program costs less than $10,000 per year. It includes customized forecasts for each

country and each purchaser for any one of the following.

|

Chemicals

|

Ball Mills

|

Instrumentation

|

|

Compressors

|

Lime

|

Scrubbers -

Wet

|

|

CEMS

|

Valves

|

Pumps

|

|

Filters

|

Mist

Eliminators

|

Scrubbers -

Dry

|

|

Filter Belts

|

Nozzles

|

Stainless

Alloys

|

|

Fans

|

Limestone

|

Remote

Monitoring

|

|

Filter Bags

|

Controls

|

Pneumatic

Conveying

|

This

is an extension of http://home.mcilvainecompany.com/index.php/markets/air/n027-fgd-market-and-strategies

Identification

of each purchaser and weekly project tracking is included in http://home.mcilvainecompany.com/index.php/databases/42ei-utility-tracking-system

The

validation process with customers is accomplished through http://home.mcilvainecompany.com/index.php/silobusters/44i-coal-fired-power-plant-decisions

This

service allows the purchasers to conclude which products have the lowest

true cost. Here is a link to one of

the recent webinars https://youtu.be/1GSbwSiTZrE

The

broader Most Profitable Market Program is detailed at www.mcilvainecompany.com

Bob

McIlvaine can answer your questions at rmcilvaine@mcilvainecompany.com direct 847 784 0013 and cell 847 226

2391

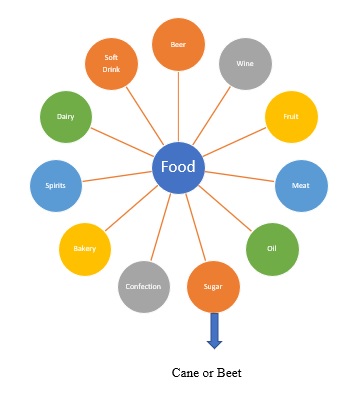

Determining

the Market for Your Product at Every Food Plant

A

program to help suppliers of flow and treat products sell to food producers

has been introduced by the McIlvaine Company. It predicts the purchases of

any product based on the tons of a specific food produced for the next five

years. It provides enough technical details and process flow diagrams so

that suppliers can craft lowest total cost of ownership (true cost) white

papers. A route to the decision makers is also provided. The general program is explained at www.mcilvainecomany.com under Most Profitable Market Program.

Specific

forecasts are available for each type of air pollution control, liquid

filter or separator, pumps, valves, dryers, heat exchangers,

instrumentation, software, steam and electricity generators e.g. for

bagasse. Analyses of the potential

from each producer also takes into account byproducts or finished products

which are manufactured. For sugar this would include alcohol, ethanol and

power generation. Here are the major food segments analyzed

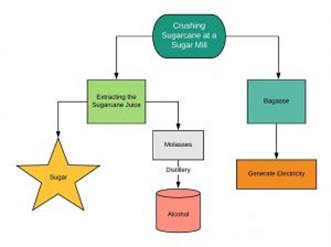

Cane

sugar is being used as an example. It involves a number of flow and treat processes.

The

quantity of crushed cane or bagasse is more than the amount of sugar

produced. The bagasse is a good fuel. Sugar mills are combusting it to

generate steam for their use and electricity for use and for sale. They are

also major producers of alcohol and ethanol. Therefore companies such as

Cosan and Tereos, who are major cane sugar producers are bigger prospects

than large beet sugar producers in Europe and the U.S.

Flow

and treat analyses and forecasts are based on the present and future

production in each country and for each significant producer. Here is an

example of production forecasts for total sugar production through

2024. We also have these for the cane

and beet sugar segments.

|

Sugar Production

- 1000 MT

|

|

|

|

2016

|

2017

|

2018

|

2019

|

2020

|

2021

|

2022

|

2023

|

2024

|

|

Afghanistan

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

|

Albania

|

4

|

5

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

|

Algeria

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

|

Angola

|

40

|

55

|

65

|

60

|

60

|

61

|

63

|

64

|

66

|

|

Argentina

|

2060

|

2050

|

1870

|

1665

|

1680

|

1726

|

1773

|

1821

|

1871

|

|

Armenia

|

3

|

3

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

|

|

|

|

|

|

|

|

|

|

|

The

data is also available for the 250 largest sugar producers. We provide

profiles and not only sugar production but also co-products such as

ethanol.

Sao

Martinho

Sao

Martinho is a well-established Brazilian company that can trace its roots

back as far as 1938. Sao Martinho was initially formed in a series of

corporate take overs in which sugar mills were purchased and incorporated

into the main corporate structure of Sao Martinho. Prior to 2006, Sao

Martinho was known as Companhia Industrial e Agrícola Ometto. Today, Sao

Martinho is one of the largest sugar companies in Brazil. Like the other

major companies, it does not solely produce sugar, but also produces sugar

ethanol as well as other sugar cane products. Sao Martinho currently has

two mills dedicated to sugar and sugar ethanol production.

These mills are known as the Iracema Mill and Sao Martinho Mill.

It expects to process 8% more

sugarcane in 2019/20 compared with the prior crop year. The company sees

its cane crush rising to 22 million tonnes thanks to “better weather

conditions and projects aimed at increased productivity, However, the

amount of sugar derived from each tonne of cane will fall slightly. Sao

Martinho said the total recoverable sugars are expected to be 139 kilograms

per tonne, a 2% decrease from the previous season.

Sao Martinho predicted it

would produce between 1.055 million to 1.4 million tonnes of sugar and 915

million to 1.1 billion liters of ethanol in the 2019/20 season.

Here are sugar

production forecasts for 2019 for some of the companies.

|

Company

|

Location

|

Production

1000 tons 2018

|

Market share %

|

|

COSAN LIMITED

|

Brazil

|

4,000 (plus ethanol)

|

2.1

|

|

Sudzucker

|

Germany

|

4,800

|

2.5

|

|

Tereos

|

France, Brazil

|

2900

|

1.5

|

|

Nordzucker

|

Denmark,

Germany

|

2500

|

1.3

|

|

Wilmar

|

Australia

|

2000

|

1.0

|

|

British Sugar

|

UK

|

1500

|

0.7

|

|

Mitr Phol

|

China

|

1300

|

0.6

|

|

American Sugar

|

Chalmette LA

Refinery

|

1,000

|

0.5

|

|

E.I.D.-PARRY (INDIA) LTD. .

|

India

|

1600

|

0.8

|

|

American Crystal Sugar

|

Beet in Upper

Mid-west

|

1500

|

0.7

|

|

Rogers Sugar Inc.

|

Vancouver Only

|

240

|

0.1

|

|

Nanning Sugar.

|

China

|

700

|

0.4

|

We

analyze important product developments such as manufacture of cellulosic

ethanol.

Raizen completed

construction of its first cellulosic ethanol plant where the ethanol will

be produced from sugarcane residue. The company invested R$237 million in

the plant that will produce 40 million liters of ethanol from sugarcane

residue. The plant is located in the city of Piracicaba in the state of Sao

Paulo and right next door to one of Raizen's sugar mills that makes sugar

and ethanol from sugarcane.

The sugarcane residue

from the sugar mill is currently being burned to generate electricity to

run the mill with the excess electricity sold back into the electrical

grid. The company is now going to divert some of the sugarcane residue to

its new facility to produce ethanol. The company feels there are a lot of

saving and synergies by placing both plants next door to each other.

Raizen originally

estimated that its company-wide ethanol production would increase 50% by

producing second generation ethanol. The company had planned to construct

seven more cellulose ethanol plants in Brazil by 2024. All of the

facilities would be built next door to their existing first generation

ethanol plants that use sugarcane. All of the new plants combined could

produce up to one billion liters of cellulosic ethanol. However, technical

and economic factors have slowed that development. These problems have now

been resolved and the company expects cellulosic ethanol to be an important

revenue source.

We

search for data which will help determine the true cost of a product such

as a filter belt or drum filter.

Cordoba

belt filters at the Raizen Costa Pinto plant are shown in the YouTube video

https://www.youtube.com/watch?v=EZtc_QaR0lw

The

following paper is an example of gathering all the evidence. In an effort

to compare belt filters with rotary drum filters several areas of interest

were investigated over the 2012 and 2013 crops. These included pol losses,

bagacillo ratio (bagacillo % feed/mud solids % feed), filter retention (mud

in filter cake/mud in feed), filter capacity (filter cake production and

removal of mud), belt wash water loss and flocculant usage.

The

pol % filter cake average of 3.47. Pol % filter cake from drum filters

ranged from 1.00 to 7.36 and averaged 4.08% pol. Belt filters had an

average pol % filter cake of 2.36 with a range of 0.46 to 5.86%.

Crop

flocculant usage averaged 0.022 lbs./ton cane. Belt filters used a little

more flocculant (0.024) on average than drum filters (0.020). On average

5.21 lbs. pol/ton of cane are lost in filter cake for rotary drum filters.

Belt filters lost on average 2.71 lbs. pol/ton cane. This included losses in

the belt wash water based on a rate of 100 gallons per minute. The overall

average filter cake production was 1443 lbs./hr./ft. width. Drum filters

averaged 1080 lbs. filter cake and ranged from 128 to 2606 lbs. filter

cake/hr./ft. width. Belt filters averaged 2781 lbs./hr./ft. width, almost

three times the amount for drums, and ranged from 1509 to 4027 lbs./hr./ft.

width.

Regarding

belt filters only, the capacity seems to be very high with sugar losses

comparable to that of drums. Maintenance costs have yet to be determined.

Options for disposal of belt wash water should be considered. https://www.lsuagcenter.com/MCMS/RelatedFiles/%7BBB9E504C-EEAD-4D0C-8249-C67F42F775AA%7D/2014.pdf

A

sales program can be constructed with the detailed knowledge of the future

purchases at each plant. the best

contacts are easily determined through a LinkedIn initiative. Raizen has over 11,400 contacts. But if you want to talk about belt

filters at the Costa Pinto plant you can start with the 18 people involved

in filtration or the 185 people at the Costa Pinto plant.

|

Raizen LinkedIn Contacts

|

|

Subject

|

# of people

|

|

Total on

LinkedIn

|

11,400

|

|

Centrifuge

|

2

|

|

Filtration

|

18

|

|

Pumps

|

69

|

|

Environment

|

1000

|

|

Pollution

|

13

|

|

Costa Pinto

|

185

|

|

Engineering

|

3748

|

|

Vice President

|

189

|

|

Cellulosic

Ethanol

|

22

|

For

more information on the flow and treat program for the food industry

contact Bob McIlvaine at rmcilvaine@mcilvainecompany.com or 847 784 0013 or cell 847 226 2391.

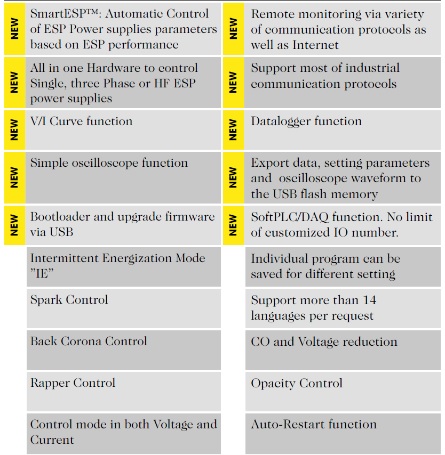

Electrostatic

Precipitator Upgrades

Discussions

about precipitator power supplies at PowerGen will take place at various

stands as well as in pre-arranged and impromptu discussions on the exhibit

floor and conference area. Paul Leanza and Dan Holt of KraftPowercon have

volunteered to help maximize the discussion value and activity. A recorded

interview with them can be the foundation of some of the discussions.

Sessions: None of the sessions will directly

address the precipitator upgrade question but Babcock Power has one speech

which is tangentially relevant.

Exhibitors: CECO

- AVC supplies precipitator controls. Doosan

provides precipitator control systems. Hamon

provides precipitators and control systems. R&R Beth provides precipitators and control systems.

Southern Environmental

provides precipitators and control systems.

Wood acquired Wheelabrator which supplies

precipitators and controls.

We will

continually be creating the following

directory of attendees, exhibitors and speakers who are interested

in discussing precipitator upgrades.

KraftPowercon presented their

line of precipitator control, power, and safety products in a recorded

interview. It is accessed at https://youtu.be/d_pVvdIYJHc. The

slides accompanying the presentation are shown at

http://www.mcilvainecompany.com/Decision_Tree/subscriber/Tree/DescriptionTextLinks/HV_productsolutions_Sept_2019.pdf

Paul Leanza and Dan Holt discussed their product

capabilities and how they have seen them applied effectively. The

discussion of each new item and its technical merits continues to circle

back to how to apply each effectively at best cost. This 52 minute

interview provides good coverage of the options of supplies and controls

which are available. It can be addressed by other suppliers as a reference

point for hearing all sides of the issues.

Dan is a former pulp mill engineer. Paul owned a

precipitator consulting company, which merged with KraftPowercon. Both

demonstrated the process knowledge, which allows the company to provide

solutions and not just products.

KraftPowercon offers all variations of power

supply. Dan and Paul explained that

single phase TR sets are reliable and modest in cost. But they do not

deliver the high efficiency needed in many applications.

Single-phase

TR unit

• 120 Hz current ripple

• Results in ˜ 35-45 %

ripple voltage on an ESP load

• Voltage peaks limits the

current into the ESP

The 3 phase TR set is more efficient but also more costly

3-phase TR unit

• 360 Hz current ripple

• Results in ˜ 0.5-1.5 %

ripple voltage on an ESP load

• 30–40% higher current into the ESP

compared to single-phase TR

Switch Mode Power supplies are efficient with low installation cost.

Maintenance has been an issue with this technology being applied to ESPs.

High frequency SMPS

• 24kHz current ripple

• Results in < 1 % ripple voltage on an

ESP load

• 30–40 % higher current

into the ESP compared to single-phase TR

To rectify the problems with SMPS KraftPowercon

introduced a version with features to make it more reliable.

|

SmartKraft

DC

|

Competitor

|

|

Oil Cooled

|

Air Cooled

|

|

12 IGBTs

|

4-6 IGBTs

|

|

Aluminum Tank

|

Steel Tank

|

|

Amplitude Control

|

Frequency Control

|

KraftPowercon

also points to improvements in controls.

NWL

NWL

is a major supplier of power supplies around the world. NWL states that its

unique integrated design, places the power supply and control system on a

common assembly. The NWL PowerPlus™ has been installed on precipitators in

many different industries and applications throughout the world. This

product is claimed to provide the

following benefits to its users:

- Increased

collection efficiency

- Decreased

kVA for the same amount of power applied to the field

- Faster

spark response with less wasted spark current

- Higher

Reliability

- Significantly

higher power factor when compared to a conventional TR

- Lower

initial installation cost

- Reduced

space requirement with integrated design

- Able

to facilitate buss and guard or cable for HV connection

B&W

B&W has supplied thousands of precipitators. The most common way

to improve the performance of an ESP, wherever it is located says B&W

is to boost its corona power. The relationship between specific corona

power (watts/1,000 acfm of gas flow) and collection efficiency is well

understood and is a common upgrade. Other ESP efficiency improvements are

possible, such as reconfiguring compartment geometry, increasing plate

area, or adding additional fields, although each upgrade usually requires

replacing or upgrading existing power supplies. The best option is to

select a power supply that can efficiently boost corona power output and

maintain high operating reliability.

The single-phase power supply design has limited upgrade potential

to meet MATS, so Babcock & Wilcox (B&W) began the process of

identifying better power supply options.

The increase

in corona power from a low ripple power supply can be achieved with several

different technologies (HFPS, TPPS, MFPS).

Integrating

all components into one package (HFPS) has the advantage of the most

compact configuration. This can have the disadvantage of placing the

control section for the power supply in a harsh environment which affects

service life and maintenance.

Providing a

separate transformer and control cabinet (MFPS, TPPS) has the advantage of

placing the electronic controls in a controlled environment and allows for

duplicate sources of supply. This has the disadvantage of the need for a remote

control cabinet and larger size and weight.

MFPS and TPPS

use passive cooling while HFPS designs require active cooling. The increase

in components and complexity for active cooling increase cost and

maintenance. HFPS designs provide low ripple at higher cost, lower

reliability, but in a smaller, lighter integrated package. MFPS and TPPS provide low ripple at lower

average cost, higher reliability, but in a larger, heavier package with a

separate control cabinet.

The HFPS,

MFPS, and TPPS provide the lowest ripple voltage on an ESP load. A field

test showed the TPPS produced an average 50% higher power in the ESP

compared to the single-phase precipitator power supply. This suggests that

like other low ripple power supplies, the TPPS can produce higher ESP

collection efficiencies. More than 900 installations of TPPS have

demonstrated reliability. The availability of all sections of an ESP allows

plant owners to achieve maximum PM reduction

Capital cost is also a significant consideration in the selection

process of ESP power supplies, and the differences are significant. For

example, if the single-phase power supply cost is 1.0, then the relative

cost for a like-sized high-frequency SMPS ranges from 1.49 to 2.31. A

like-size low-frequency three-phase power supply’s relative cost is only

1.12 to 1.17.

The predicted reliability of a power supply is difficult to

quantify. The reliability track record of the single-phase ESP power supply

is excellent, and many installations have been in service for over 40 years.

This is a reliability benchmark that low-ripple power supply designs must

match. Anecdotal evidence finds that high-frequency power supplies have

experienced a poor reliability record; although it has improved in recent

years, it remains lower than for single-phase designs.

Field test results at Duke Power

confirmed that the three-phase power supply typically produced 50%

more corona power delivered to the ESP than from a conventional power

supply (average three-phase power/average single-phase power) with low

total harmonic distortion. The installation costs were on par with a

standard single-phase power supply. There were no failures of the

three-phase power supply during the six-month test run.

https://www.powermag.com/choosing-an-esp-power-supply-for-improved-particulate-control/?pagenum=4

and https://www.babcock.com/-/media/documents/resources/gated-content/br-1941.ashx?la=en&hash=ABB2C7B1FFAF56483BB8CDF68D2E29CEF3DD6A07

CECO

CECO is an exhibitor and will be displaying systems,

dampers and precipitator controls. AVC Specialists brand Powercon™ 900 Automatic Voltage

Controller is the latest of its precipitator Automatic

Voltage Controller systems. It is designed to be a simple upgrade

for older models, as well as a

replacement for most older competitor’s models.

With color touch screen display, and easy-to-use

operator HMI, all functions can be controlled, edited, and troubleshot,

without ever having to open the door, which can be a time consuming problem

at most facilities. the operator interface offers easy access to status,

parameter settings, fault history, and tuning screen, including a built-in

oscilloscope.

Hamon

Hamon

is an exhibitor and arguably the

world’s first supplier (Research Cottrell Precip for a cement plant 100

years ago) HR-C works with selected

suppliers to provide advanced microprocessor controls and the latest in

transformer/rectifiers and switch mode power supplies to maximize

performance. So they can offer third

party analysis of the options.

Doosan

Doosan is an exhibitor. Doosan Lentjes can rely on the

experience accumulated in one of the largest precipitator databases

throughout the world due to the fact that over 6,000 electrostatic

precipitators (ESP) have been built to date.

R&R Beth

The company is an exhibitor and has supplied

precipitators for many different industries in many locations of the

world. It uses high voltage power

supplies and its views on the options will be sought.

Southern Environmental

It is an exhibitor and part of the SEI-Group comprised of three

operating units: Southern Environmental, Inc. Southern Erectors, Inc.

and Thermal Systems Group. Internationally, SEI-Group has performed

projects in Antarctica, Argentina, Bolivia, Brazil, Canada, China, India,

Mexico, Qatar, Russia, Singapore, South Korea, Sweden, Taiwan and

Thailand. SEI started as a

specialist in maintenance and repair of precipitators but started designing

and building new precipitators some years ago. Its perspective on controls

will be a valued addition.

Wood

Wood acquired Wheelabrator from Foster Wheeler. It is an

exhibitor and also exhibited at POWERGEN Asia in September

in Kuala Lumpur, Malaysia. It has been supplying air pollution control

equipment for more than 50 years. Precipitator projects have ranged up to 5 million

cfm. Its views on power plant

supplies will be welcomed due to its extensive experience.

Click here

to un-subscribe from this mailing list

|