|

WELCOME

Weekly selected highlights in flow

control, treatment and combustion from the many McIlvaine publications.

·

Selling to the 500 Coal Plant Owners who make 99

percent of the Purchases

·

India will be a

Major Purchaser of Dry Scrubbers

· Coal Fired Power

Plant Silobusters

·

MBR will be the McIlvaine Silobuster at WEFTEC

·

Monthly Overview of the World Air Pollution Markets

and Technology

·

June 2019 Cleanroom Market Updates

·

Weekly Updates

to Oil, Gas, Shale and Refining

Selling to the 500 Coal Plant Owners

who make 99 percent of the Purchases

Suppliers of Combust, Flow, and Treat

(CFT) products and services for coal fired power can now develop sales

programs focused on each individual owner. Coal fired power represents one

of the largest markets for CFT product suppliers. In the last 20 years an

average of 50,000 MW per year of new coal fired power plants have been

added to the world generation capacity. Over the next ten years 40,000 MW

per year of new capacity will be added. This will be partially offset by

retirement of 13,000 MW per year of existing capacity.

Annual new plant investment will exceed

$160 billion per year. The installed base of plants has now reached 2

million MW and will increase by 270,000

MW over the next decade. The investment in the installed base exceeds $4

trillion. Potential for third party upgrades, repair, service, and remote

operation will exceed $200 billion per year. This includes major environmental

upgrades in India and other countries in Asia, Eastern Europe, and Africa.

McIlvaine

has compiled enough information on each process at each plant to enable

relatively precise forecasting as per the following example for valves.

|

Corporate Name: EVN

|

Unit size: MW 660

|

|

Plant Name: Genco 3 Vinh Tan 2

|

Vinh Tân

commune, Tuy Phong district, Bình Thu?n province. Vietnam

|

|

Unit

# 1

|

Specific

product purchases 2019 $1000

|

|

Forecasts can be supplied for

sixteen types of valves, four types of pumps, actuators, limestone, lime,

precipitator internals, dust bags, gas instrumentation, liquid

instrumentation, controls, treatment chemicals, ammonia, urea, catalyst,

cartridges, dewatering filter belts, membrane modules, linings, nozzles,

mist eliminators, fans, air compressors, oxidation compressors, motors,

VFD, seals, packing, hose, couplings, compressed air filters, lubrication

filters

|

Ball

valves $170,000

|

|

Butterfly

Valves: $120,000

|

|

Globe

Valves $190,000

|

|

Plug

Valves: $100,000

|

|

Gate

Valves: $150,000

|

Seventy

percent of the purchasing decisions for existing plants are made by 27

companies with more than 10,000 MW of capacity. However, 150 owners are

making the decisions for 70 percent of the new plants. Five hundred owners

will purchase 99 perent of CFT

products for new and existing plants.

|

Coal Fired Capacity for Individual Owners

|

|

Above MW

|

Planned Cumulative #

|

Operating

Cumulative #

|

|

80,000

|

|

1

|

|

60,000

|

|

2

|

|

50,000

|

|

3

|

|

40,000

|

|

3

|

|

30,000

|

|

8

|

|

20,000

|

2

|

10

|

|

10,000

|

8

|

27

|

|

5000

|

25

|

63

|

|

3000

|

50

|

110

|

|

2000

|

70

|

164

|

|

1500

|

90

|

196

|

|

1000

|

150

|

255

|

|

700

|

200

|

307

|

|

500

|

250

|

379

|

|

300

|

300

|

491

|

|

200

|

350

|

570

|

|

100

|

400

|

710

|

|

?

100

|

|

900

|

Country

Forecasts are based on aggregating forecasts for individual owners.

|

Coal

Plants by Country (MW) Installed Base

|

|

|

|

|

|

Country

|

2018

|

2019

|

2020

|

2021

|

2022

|

2023

|

2024

|

|

|

Albania

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

|

|

Argentina

|

350

|

350

|

350

|

350

|

350

|

350

|

350

|

|

|

Australia

|

24,442

|

24,442

|

24,442

|

24,442

|

24,442

|

24,442

|

24,442

|

|

|

Austria

|

635

|

635

|

635

|

635

|

635

|

635

|

635

|

|

|

Bangladesh

|

525

|

1,200

|

2,500

|

5,500

|

8,000

|

10,000

|

12,000

|

|

|

Belarus

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

|

|

Belgium

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

|

|

Bosnia & Herzegovina

|

2,073

|

2,073

|

2,073

|

2,073

|

2,073

|

3,000

|

4,000

|

|

|

Botswana

|

600

|

600

|

732

|

732

|

732

|

1,200

|

1,200

|

|

|

Brazil

|

2,804

|

2,804

|

2,804

|

2,804

|

2,804

|

3,400

|

3,400

|

|

|

·

EON

|

|

|

|

|

|

|

|

|

|

·

EDP

|

|

|

|

|

|

|

|

|

|

·

Electrobas

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brazil

Plant Details

|

Unit

|

Sponsor

|

Parent

|

Capacity

(MW)

|

Year

|

City

|

State

|

|

MPX Itaqui power project

|

Eneva

|

E.ON, EBX Group

|

360

|

2013

|

Itaqui

|

Maranhão

|

|

Porto do Pecém I Unit 1

|

Eneva, EDP Energias do Brasil

|

Eneva, EDP

|

365

|

2012

|

São Gonçalo do Amarante

|

Ceará

|

|

Porto do Pecém I Unit 2

|

Eneva, EDP Energias do Brasil

|

Eneva, EDP

|

365

|

2013

|

São Gonçalo do Amarante

|

Ceará

|

|

Porto do Pecém II Unit 1

|

Eneva

|

E.ON, Eneva

|

365

|

2013

|

São Gonçalo do Amarante

|

Ceará

|

|

Porto do Pecém-1Unit 1

|

EDP Energias do Brasil

|

EDP

|

365

|

2012

|

São Goncalo do Amarante

|

Ceará

|

|

Porto do Pecém-1 Unit 2

|

EDP Energias do Brasil

|

EDP

|

365

|

2013

|

São Goncalo do Amarante

|

Ceará

|

|

Porto do Pecém-2 Unit 1

|

Eneva

|

E.ON, EBX Group

|

365

|

2013

|

São Goncalo do Amarante

|

Ceará

|

|

Presidente Médici-A Unit 1

|

Companhia de Geração Térmica de Energia Elétrica

|

Eletrobras

|

63

|

1974

|

Candiota

|

Rio Grande do Sul

|

|

Presidente Médici-A Unit 2

|

Companhia de Geração Térmica de Energia Elétrica

|

Eletrobras

|

63

|

1974

|

Candiota

|

Rio Grande do Sul

|

|

Presidente Médici-B Unit 1

|

Companhia de Geração Térmica de Energia Elétrica

|

Eletrobras

|

160

|

1986

|

Candiota

|

Rio Grande do Sul

|

|

Presidente Médici-B Unit 2

|

Companhia de Geração Térmica de Energia Elétrica

|

Eletrobras

|

160

|

1987

|

Candiota

|

Rio Grande do Sul

|

|

Presidente Médici-C

Unit 1

|

Companhia de Geração Térmica de Energia Elétrica

|

Electrobras

|

350

|

2010

|

Candiota

|

Rio Grande do Sul

|

High

quality forecasts now allow a supplier to project purchases for each owner.

A large percentage of coal plant CFT products are purchased based on

decisions of a group and a consensus built up over time. Therefore the continuous pursuit rather

than response to a sales lead is more productive The larger purchasers can

be pursued differently than those in the middle or those at the bottom.

Here are utilities in the middle with 6000 – 9000 MW range of

existing and planned capacity. J Power is the only company appearing

on both lists.

|

Planned Coal Fired

|

|

Company

|

MW

|

|

Power Finance Corporation

|

8,000

|

|

Egyptian Electricity Holding

Company

|

7,920

|

|

KEPCO

|

7,698

|

|

China Resources

|

7,035

|

|

NLC India

|

6,700

|

|

TANGEDCO

|

6,640

|

|

J-POWER

|

6,356

|

|

Eskom

|

6,352

|

|

UPRVUNL

|

6,270

|

|

|

|

|

Operating Coal Fired

|

|

Company

|

MW

|

|

E.ON

|

8,772

|

|

J-POWER

|

8,482

|

|

Inter RAO

|

8,372

|

|

Vedanta Resources

|

8,327

|

|

Xcel Energy

|

7,915

|

|

Henan Investment Group

|

7,840

|

|

Beijing Energy Group

|

7,772

|

|

Engie

|

7,387

|

|

Damodar Valley Corporation

|

7,240

|

|

AES

|

7,025

|

The

CFT purchases can all be related to existing and new MW. Details on each

process for each owner also are important.

McIlvaine has details on FGD, SCR, precipitators, fabric filters,

and other components in databases which have been compiled and augmented

since the 1970s.

The

combustion segmentations are by boiler design e.g. fluid bed or pulverized

coal. Also the efficiency division: subcritical, supercritical, and

ultra-supercritical is important.

China is upgrading more than 100,000 MW of sub critical and

supercritical to ultrasupercritical.

Intake

water, boiler feedwater, type of cooling, wet FGD, and wastewater treatment

can be identified. A number of plants are improving their wastewater

treatment and often opting for zero liquid discharge and maximum water

reuse.

Solid

waste is a challenge due to increasingly stringent standards. Switching

from wet to dry flyash handling and dewatering ponded flyash are major

opportunities. Byproduct sales potential is also a driver.

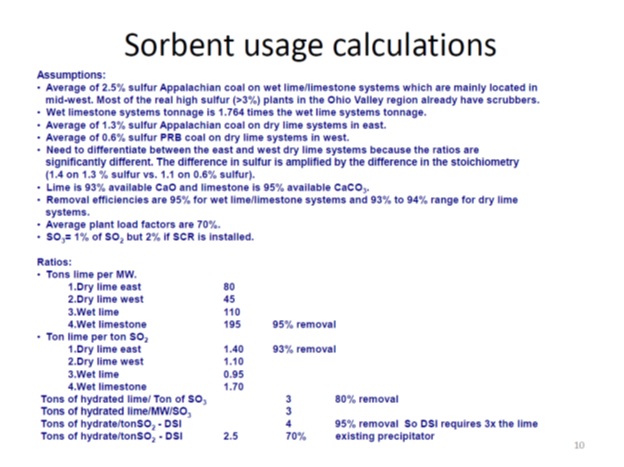

Various

air pollution control approaches are used for reducing SO2, NOx,

particulate, mercury, VOCs and even CO2 (sequestering). It is impossible to make precise determinations for each plant

because of variations in the fuel and other site specific factors. Rules of

thumb provide a relatively accurate way of forecasting as per the following

sorbent example.

The

coal fired power industry is unique in that relatively few companies make

nearly all the purchases. Details on their operations are available. This

means that a CFT supplier can structure his sales program around these

specific companies and pursue the most profitable markets. This program is

explained at www.mcilvainecompany.com.

Details

on coal plants by country and on the individual plants are tabulated in 42EI

Utility Tracking System.

Bob

McIlvaine can answer your questions at 847 784 0013, cell 847 226 2391,

email rmcilvaine@mcilvainecompany.com

India will be

a Major Purchaser of Dry Scrubbers

India

is predicted to purchase dry scrubbers to clean 180 million cfm over the

next five years. This is the

latest forecast in N027 FGD

Market and Strategies. The bulk of the investment will be for

coal fired power plants. There will be some installations in waste to

energy, cement, steel and other industrial applications.

India

will join China and the U.S. as the leading three dry scrubber purchasers.

Dry scrubbing includes semi dry scrubbers, circulating dry scrubbers and

direct sorbent injection. United Conveyor Corporation has an order for 4 x

250 MW direct sorbent injection systems at the Dadri plant of NTPC.

The

market surge will be due to new rules that allow older smaller power plants

to discharge higher levels of SO2 than others. It is anticipated that 50,000 MW of

Indian power plans will be fitted with dry scrubbers over the next three

years.

Dry

scrubbers are more economical than wet scrubbers when the emission rates

are higher and the sulfur in the fuel is lower. Dry scrubbers use higher cost lime or

sodium compounds whereas wet scrubbers utilize ground limestone. However,

the capital cost of wet scrubbers is more than twice that of CDS and semi

dry scrubbers. Direct sorbent

injection is very low in capital cost but very high in reagent cost.

Direct

sorbent injection can be used to supplement other systems. DSI can be used

in conjunction with semi dry systems to maintain efficiency at higher

sulfur levels. DSI can also be used

ahead of the air heater to react with SO3 and allow the air heater

to be operated to extract more heat without corrosion.

For

more information on this report click on N027 FGD

Market and Strategies

Bob

McIlvaine can answer your questions at office 847 784 0013 cell 847 226

2391 or email him at rmcilvaine@mcilvainecompany.com

Coal

Fired Power Plant Silobusters

Busting the fifty year old knowledge silo is tough but

it can be useful. In the 1960s the U.S. utilities were operating relatively

inefficient precipitators. Suddenly there was legislation requiring SO2 reduction.

The situation is very similar to that in India today. At the time there was

technology developed to optimize the installation of FGD while improving

particulate performance. It was found that when FGD follows

inefficient precipitators it will remove substantial particulate. A

number of Indian utilities are hoping that the installation of wet FGD will

bring down particulate emissions enough to meet the new limits.

The first U.S. FGD systems replaced precipitators

because particulate limits were high. Utilities relied on a two-step

reduction when limits were tightened. Later on, when limits were tightened

again to the present levels, it was necessary to utilize precipitators or

baghouses to meet the limits.

Much of the knowledge gained at the time has been

buried. There has been little interest in the ability of FGD scrubbers to

reduce particulate. But now with the new regulations in India

this will be an important subject.

One option, which could be important is the rod deck

module. It is more efficient than a spray tower and also better at removing

particulate. It can be designed for ½ “ pressure drop per stage or in the

case of foundry cupolas, 120” pressure drop per stage depending on the

quantity and size of particulate to be removed. It acts exactly

like a venturi scrubber. To meet the 0.l lb./MMBtu limits circa

1980 Minnesota Power installed

a 15” pressure drop venturi ahead of the SO2 scrubber and

eliminated the precipitator.

Indian utilities that do not meet the particulate

standards after the installation of spray towers will have the option of

installing a rod deck in the spray tower. Many companies offer

variations on the rod deck. Andritz launched a new design rod deck design

recently

Details on this option are analyzed in 44I Coal

Fired Power Plant Decisions.

MBR will be

the McIlvaine Silobuster at WEFTEC

At WEFTEC last

year the McIlvaine Silobuster effort was all around struvite Municipal

Wastewater Services. This year the focus will be on membrane

bioreactors (MBR). Each exhibit

stand and speech will be included in

an MBR Guide. This guide will extend to all relevant components and

services. For example Microdyn Nadir

will be displaying membrane modules while Andritz will be displaying fine

screens especially designed to keep the membranes clean. Howden will be displaying the blowers to

provide the MBR aeration.

Individuals who want to offer and obtain knowledge will also be

identified along with their cell phone numbers to facilitate the silo

busting during the show.

WEFTEC will be

in Chicago September 21-25. If you want to participate in the MBR

Silobuster program contact Bob McIlvaine at 847 784 0013 or cell 847 226 2391 email: rmcilvaine@mcilvainecompany.com

Monthly

Overview of the World Air Pollution Markets and Technology

For just

$950/yr you can receive this monthly newsletter and can search past issues

for the last 20 years. It is a unique management tool.

GOLD

DUST The “Air Pollution Management” Newsletter, July 2019, No. 495

·

Join the

Debate On Insitu Rare Earth Recovery

·

Coal

By-products Including Rare Earths Will Be a Game Changer

·

U.S. Coal

Plant Environmental Upgrades to Cost More Than $50 billion

·

$10-Billion

Market for SCR Systems, Reagents and Catalyst

·

Maximizing CFT

Profits in the Coal-Fired Power Generation Industry

·

SiloBuster

Webinar Program for Combust, Flow, and Treat (CFT) Suppliers

·

Oil, Gas,

Refining Daily Project Tracking and Monthly Analysis

·

Factors

Shaping the Combust, Flow and Treat (CFT) Market

·

Innovation In

the Combust, Flow and Treat Industry Is a Product of Wisdom through

Interconnection

·

Power Market

Guidance in Weekly Twenty-Page Alert

·

Coal-fired

Power Plant Combust, Flow and Treat Purchases Will Exceed Those for Wind,

Solar, Nuclear, and Gas Turbine Plants

·

B&W

Announces Sale of Loibl Material Handling Subsidiary

·

Ultrafine Dust

Has a Big Impact on the Environment

·

EPA Finalizes

Affordable Clean Energy Rule

·

EPA Approves

Missouri SIP Plan

·

GE India

Supplies Air Pollution Control for Multiple Countries

·

Ammonia for

Chinese SCR Systems

·

MHPS Receives

Contract for Complete Renovation of Flue Gas Desulfurization System At the

Detmarovice Power Station in the Czech Republic

·

SHI FW Makes a

Strong Case for CFB Scrubbers on Indian Power Plants

·

Unique Multi

Pollution Control Approach to meet BREF

·

Dry Scrubbers

in Chile

·

Ammonia for

Chinese SCR Systems

·

Donaldson

Company Full Year Sales Forecast up 3.5 to 4.5 Percent

·

Longking is

World’s Largest APC Company

·

Dürr

Acquisition of Megtec Expands Portfolio in Exhaust Air Purification

Technology

·

CECO

Environmental Announces New $190 Million Credit Agreement

·

Babcock &

Wilcox Path to Profitability

More

information on this service is available at 5AB Air

Pollution Management

Dry Scrubber Silobusting

at DSUA, SOx-NOx India, PowerGen

U.S., PowerGen Europe

Dry

scrubbing expertise will be available at four conferences this fall. Two are in September. One is the DSUA

conference in Kansas City. Another is SOx-NOx 2019 in India. In November at

PowerGen U.S. there will be a half day session using Dry Scrubber

silobusting as an example of how to pursue the emerging markets. There also

will be a road map identifying dry scrubbers in the exhibit hall.

There

will be a Dry Scrubbing guide at PowerGen Europe a week later.

The DSUA conference will be busting the silos in four

areas. One is the retained knowledge of the soon to be retired engineers.

The conference is a path for the younger engineers into the silo.

Another silo is the new technology. While the semiconductor industry

works hard to avoid silos, the power industry is known to be

conservative. This is another way of saying that some very large silos

have to be busted in order for a new and better technology to be accepted.

A third silo is the experience in other industries.

Instrumentation, valves, nozzles and other components with unique and

valuable features may first be developed for mining or cement

applications. DSUA also provides a forum for users in waste to energy

to interface with users in power, steel and other industries. A

fourth silo is the knowledge in other parts of the world. China has the

most-dry scrubber installations in the world.

The

question is posed as to how the DSUA silo busting can be enhanced. DSUA has

a website and links to past papers. So previous attendees have access to

them. An analysis has been prepared listing the resources

supplied by DSUA and the opportunities for making a larger international

contribution to furthering the use of dry scrubbing and DSI.

http://www.mcilvainecompany.com/Decision_Tree/DSUA_Silobusting.pdf

Part of that effort could be quarterly

webinars. Another aspect would be collaboration by DSUA with media and

conference organizers. McIlvaine is an organizer of a half-day session at

PowerGen in November. The session will use dry scrubbing and DSUA silo

busting as an example to show how U.S. suppliers can expand into Asian and

other developing markets. This can be followed by discussions on the

exhibit floor with Andritz, Beth and other dry scrubber

system suppliers. It is interesting that there are more offshore dry

scrubber exhibitors than U.S.- based although Andritz is in the U.S. based

on an acquisition.

There is a SOx-NOx conference in India at the same time

as DSUA. A brief discussion relative

to DSUA could also take place. The

powering sponsor will be NTPC who is the largest Indian utility. It is installing 4 x 250 MW of DSI and is

installing a number of FGD systems.

There are a number of international organizations which could have

representatives at both conferences. United Conveyor and ENVEA will be

exhibitors at SOx-NOx. Past

participants include a number of companies who have also participated in

DSUA.

The DSUA

conference is scheduled for Sept 10-12 whereas SOx-NOx is September 12 and 13th.

Here are thoughts regarding collaboration

· An

August webinar to promote the DSUA conference could also promote SOx-NOx

from the dry scrubber perspective

· A

speech at SOx-NOx could cover DSUA activities and news from DSUA 2019 could

be circulated on the 13th to SOx-NOx attendees

· A

joint webinar between DSUA and SOx-NOx participants could take place in

October

· The

collaboration could be used as an example at the half day tutorial at

PowerGen prior to the show

· A

tour map of the DSUA related stands at PowerGen would be circulated

· PowerGen

Europe is a week later and has exhibitors such as UCC who will also be

exhibiting at SOx-NOx in India

· A

subsequent article in Power Engineering would cover both DSUA and SOx-NOx

· Additional

webinars prior to the 2020 conference could be scheduled

For more

information contact Bob McIlvaine at rmcilvaine@mcilvainecompany.com or call him at 847 226 2391

June

2019 Cleanroom Market Updates

Monthly

updates are included in N6F World

Cleanroom Markets. Here are the headlines in the latest

update.

SEMICONDUCTORS

Flow and Treat Purchases by TSMC and Other Chip

Producers

Semiconductor Leaders Strike Agreement on Global Policy

Agenda

Global Semiconductor Sales Decrease 14.6 Percent

Year-to-Year in April; 12 Percent Decrease in Annual Sales Projected for

2019

TSMC Reports Decrease in Revenues

Semiconductor Market Lurching into Worst-in-a-Decade

Downturn in 2019, IHS Market Says

First Quarter 2019 Worldwide Semiconductor Equipment

Billings Drop 19 Percent Year-Over-Year

North American Semiconductor Equipment Industry Posts

April 2019 Billings

Intel Recaptures Number One Quarterly Semi Supplier

Ranking from Samsung

Sensors/Actuators Reach Record Sales on Slower Growth

PHARMACEUTICAL/BIOLOGICAL

Biodegradable Stents Market to See 28.8 Percent Annual

Growth Through 2023

Merck to Acquire Peloton Therapeutics, Bolstering

Oncology Pipeline

Lundbeck to Acquire Abide Therapeutics

Bayer Building New Facility at West Coast Campus

WuXi Biologics Building New Manufacturing Center in

China

CONSUMER ELECTRONICS

Gartner Says Global Smart Phone Sales Declined 2.7

Percent in First Quarter of 2019

Communications IC Market to Again Surpass Computer IC

Market

U.S. – China Trade Disputes Prompt TV Makers to Cut

Display Panel Demand IHS Markit Says

Nanotechnology Market to See 12 Percent Annual Growth

Through 2023

________________

Weekly Updates

to Oil, Gas, Shale and Refining

Here was one entry

yesterday in N049 Oil, Gas,

Shale and Refining Markets and Projects

TechnipFMC Awarded Integrated EPCI Subsea Contract for the BP Thunder

Horse Expansion Project

TechnipFMC

has been awarded a significant (1) integrated Engineering, Procurement,

Construction and Installation (iEPCI™) contract by BP for the Thunder Horse

South Expansion 2 Project located in the Gulf of Mexico. TechnipFMC will

manufacture, deliver and install subsea equipment, including subsea tree

systems, manifolds, flowline, umbilicals and subsea tree jumpers, pipeline

end terminations, subsea distribution and topside control equipment. This is

the second iEPCI™ awarded to TechnipFMC by BP following Atlantis Phase 3 in

the first quarter of 2019. The Thunder Horse field is located in

Mississippi Canyon Blocks 776, 777 and 778, in the Boarshead Basin, 200

kilometers south-east of New Orleans. It is one of the largest fields in

the Gulf of Mexico and lies at a water depth of 1,830 meters. (1) For

TechnipFMC, a “significant” contract is between $75 million and $250

million.

Click here

to un-subscribe from this mailing list

|