|

WELCOME

Weekly selected highlights in flow

control, treatment and combustion from the many McIlvaine publications.

· Valve Market Share Analysis for 140 Companies

·

Relevant Pump Market Shares

· MBR Market to Exceed $5 billion in 2024

Valve Market

Share Analysis for 140 Companies

The

McIlvaine market share analysis for each valve supplier is valuable for

those companies considering acquisitions, divestiture or seeking to

increase share organically. This continually updated database and

analysis is part of Industrial

Valves: World Markets https://home.mcilvainecompany.com/index.php/markets/water-and-flow/n028-industrial-valves-world-market

There

have been a number of mergers, acquisitions, divestitures, and joint

venture agreements undertaken by valve companies in the last three

years. Emerson has been the most active. The purchase of the valve

operations of Pentair (Tyco) the largest valve producer made Emerson the #

1 producer. In the latest 12 months sales are estimated close to $3.8

billion compared to $1.6 billion for # 2 Cameron Schlumberger. The

largest divestiture was the GE sale of stock in BHGE to the now independent

Baker Hughes with valve sales of $960 million.

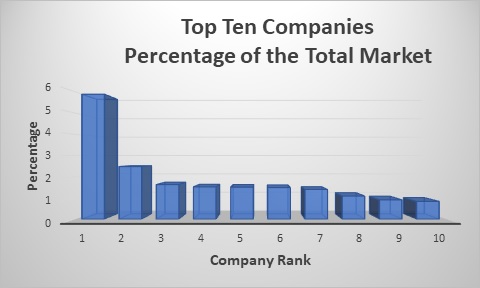

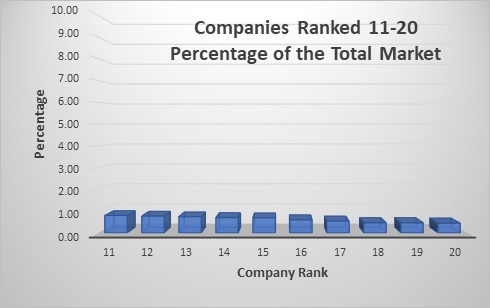

Market

shares are being continuously revised to provide worldwide rankings of

valve sales by company and further segmented by corporate location.

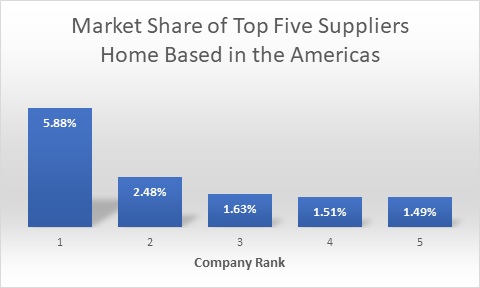

Of

the top six ranked suppliers, five are home based in the U.S. Their

sales are equal to 15 percent of the world market. There sales equal

well over 50 percent of the U.S. market. Their success has come from

penetration of the markets in the other two regions.

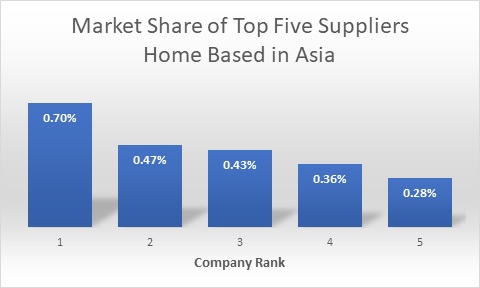

This

low percentage reflects the smaller size of the Asian valve companies.

However, their growth rate is higher and we can expect these percentages to

increase.

Emerson

is home based in the U.S. with 2019 valve sales of $3.79 billion its market

share on a worldwide basis is over 5%. However, this is equal to18% of the

market in the Americas. The fact that Emerson has penetrated the Asian and

EMEA markets has allowed the company to grow even if it would be very

difficult to achieve an 18% share on the continent in which it resides. On

the other hand, Neway has a 0.7% of the total world market. All of its

sales represent only 1.6% of the Asian market. It is growing

internationally. But even if it were not it still las lots of opportunity

in Asia.

Whether

a valve company is selling, buying, or seeking organic growth and higher

profits, the knowledge of valve company market shares is important.

· Selling: In

general, another valve company with synergisms will pay more for a valve

supplier than will a private equity investor. This continuing analysis of

market shares is a good way to select potential acquirers.

· Buying: The

analysis of market shares is very important to valve company acquirers.

This analysis should really be just the starting point. Market shares by

specific product, process, industry, and location are each

significant. While market share for all valves in Asia is part of the

report, it is possible to expand this to market share for turbine bypass

valves for coal fired power plants in India.

· Organic

growth: Sales are not made in a vacuum. Expanding sales means

taking share away from some of the existing suppliers. So, a

market share analysis is the starting point and also a continuing effort.

The competitor share knowledge is important for many throughout the

organization including the local salesperson. As competitors merge

and gain share it is important to track these changes.

· Higher

profits: The # 1 and # 2 suppliers in a given market have the

potential for higher profits due to efficient use of resources. Analyzing

the profitability of competitors provides insights on how to raise profits.

The starting point is market shares.

The

market share analysis reviews recent acquisition attempts as well as hedge

fund led divestiture attempts to compare the goals of those seeking change

to the performance of their targets.

For

more information click on Industrial

Valves: World Markets https://home.mcilvainecompany.com/index.php/markets/water-and-flow/n028-industrial-valves-world-market

Bob

McIlvaine an answer your questions at rmcilvaine@mcilvainecompany.com

847 226 2391

Relevant Pump Market Shares

Management

consultants recommend that companies consider market share as a fundamental

element of business strategy. The

problem is that most market data is unreliable or irrelevant. Knowledge of

industries and processes is necessary in order to determine market size. It

is desirable to determine market share by pump type but also in each

industry and each important market location. Market shares for each major

competitor in each niche also should be determined

Pumps: World

Markets has market

share forecasts for 400 pump companies. It also has purchase forecasts for

the largest 100 pump purchasers and 50,000 forecasts of pump markets by

industry, country and pump type http://home.mcilvainecompany.com/index.php/markets/water-and-flow/n019-pumps-world-market

This

basic report can be expanded to obtain market shares in hundreds of

industry sub segments as shown at

http://home.mcilvainecompany.com/index.php/other-services/free-news/news-releases/47-news/1536-nr2542

A

much more reliable determination of the market is possible with a market

share hierarchy analysis. FGD pumps

is an example. Increased GDP is providing the funds to build coal fired

power plants in Asia. Many countries

in this region are selecting coal as opposed to gas or renewables because

of cost and timing.

|

FGD

Pump Market Share Hierarchy

|

|

Sequence

|

Choice

|

Alternative

|

|

GDP

|

Power

|

Other

|

|

Power

|

Fossil fuels and waste

|

Hydro, wind, solar

|

|

Fossil fuel

|

Coal and waste

|

Gas turbine

|

|

SO2 removal

|

Incorporated

|

Not utilized

|

|

Absorption

|

Wet

|

Dry

|

|

Wet

|

Limestone

|

Lime, ammonia, MgO

|

|

Design

|

Spray tower

|

Tray tower

|

All

these countries are installing flue gas desulfurization systems. Dry systems require only a small

investment in pumps. Wet systems require a big investment. Other process

decisions also impact the market. It is necessary to understand the

processes and predict which will be used. The market for FGD pumps was

determined by this method.

|

FGD

Pump Market 2021 $ millions

|

|

Total Pump

|

60,000

|

|

Power

|

4,000

|

|

Fossil

|

3200

|

|

Coal

|

3,000

|

|

SO2

|

350

|

|

Wet

|

320

|

|

Wet limestone

|

300

|

|

· New

|

130

|

|

o

spray tower

|

110

|

|

o

tray tower

|

20

|

|

· Replace,

repair

|

170

|

|

o

spray tower

|

155

|

|

o

tray tower

|

15

|

There

are differences in the pump requirement depending on the reagent and the

design of the absorber. A tray tower relies on fan energy for mass

transfer. A spray tower relies on twice as much slurry for the same result

but with lower fan energy. The preference is for spray towers. However,

McIlvaine predicts that tray towers will gain market share over the next

five years.

Both

types require the same amount of limestone slurry feed. However, Chinese

plants opt for regional dry grinding rather than purchase of ball mills for

wet grinding at the plant.

Most

plants use forced oxidation and make wall board quality gypsum. Natural oxidation results in a very

difficult sludge which may require reciprocating pumps as the slurry is

mixed with lime to make a landfill product.

Market

Shares of pump companies for this application are impacted by the choice of

absorber, method of grinding, and other process choices.

|

FGD

Pump Market Shares

|

|

Type

of Process

|

Process

option A

|

Process

option B

|

|

Absorber

|

Spray

Tower

|

Tray

Tower

|

|

Absorber recycle pump with up to

500,000 gpm for set of pumps for 1000 MW plant and 98% efficiency. Tray

towers require only 50% of the slurry recycle

|

Trillium, KSB, Duechting, and 3

Chinese companies who can supply pumps to handle 50,000 gpm with largest

now 80,000 gpm

|

The companies with 50,000 gpm

pumps plus the those with flows up to 25,000 gpm such as ITT and many

others who also supply dredging and mining pumps

|

|

Grinding

|

Regional

Dry Grinding

|

Ball

Mill

|

|

Limestone slurry

|

No transport pumps

|

Pumps to transport slurry from the

ball mill to the absorber

|

|

Oxidation

|

Forced

|

Natural

|

|

Transport pumps for slurry

|

Centrifugal at modest cost

|

Reciprocating and higher cost

|

The

market shares of the pump companies provided in Pumps: World Markets can be expanded to include each relevant

niche and to include hundreds of additional competitors beyond the 400

listed.

It

is important to determine market shares in niches such as plastic lined

pumps for chemical and fertilizer applications, pumps for fruit juices,

biopharmaceuticals, lithium mining, and sewage sludge transfer in municipal

wastewater plants.

It

is also desirable to analyze market share from the process perspective. Some

pump companies are involved in the steam cycle with boiler feed water and

condensate pumps. Others are involved just with the water intakes and

wastewater for those plants. Others are involved in processes involving

fluids and slurry e.g. fracking, crude oil.

|

Industry

|

Process

|

Supplier

|

|

F

|

S

|

X

|

IT

|

U

|

I

|

G

|

B

|

5

|

|

Oil & Gas

|

Artificial

Lift or Fracking

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

5%

|

26

|

13%

|

|

Refinery

|

Intake

|

5%

|

1%

|

12%

|

4%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Refinery

|

Steam

|

8%

|

0%

|

1%

|

0%

|

1%

|

0%

|

0%

|

4

|

0%

|

|

Refinery

|

Process

|

8%

|

3%

|

1%

|

8%

|

3%

|

1%

|

0%

|

3

|

0%

|

|

Refinery

|

Wastewater

|

5%

|

3%

|

12%

|

4%

|

1%

|

0%

|

0%

|

3

|

0%

|

|

Petrochemical

|

Intake

|

5%

|

1%

|

12%

|

4%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Petrochemical

|

Steam

|

8%

|

0%

|

1%

|

0%

|

1%

|

0%

|

0%

|

4%

|

0%

|

|

Petrochemical

|

Process

|

8%

|

3%

|

1%

|

8%

|

3%

|

1%

|

0%

|

3

|

0%

|

|

Petrochemical

|

Wastewater

|

5%

|

3%

|

12%

|

4%

|

1%

|

0%

|

0%

|

3

|

0%

|

Analysis

by pump type can include designs where there are only 10-20 suppliers such

as hydraulically balanced diaphragm pumps, designs such as external gear

pumps with hundreds of suppliers or centrifugal pumps with thousands of

suppliers.

|

External Gear Pump Market Shares

83 companies analyzed

|

|

Pump Company

|

Total Corporation Pump

Sales, Mil $/Yr

|

% of Total Pump Sales

|

External Gear Pump Sales, Mil $/Yr

|

% of External Gear Pump Sales

%

|

Major Applications for EGP

|

|

AB

|

$6.0

|

0.010

|

$1.0

|

0.156

|

Machinery Lubrication

|

|

AL

|

$16.0

|

0.026

|

$9.0

|

1.406

|

Machinery Lubrication

|

|

ALC

|

$6.0

|

0.010

|

$1.0

|

0.156

|

Machinery Lubrication

|

|

AS

|

$1.5

|

0.002

|

$1.0

|

0.156

|

Machinery Lubrication

|

|

B

|

$45.0

|

0.075

|

$3.0

|

0.469

|

General

|

|

Bos

|

$18.0

|

0.030

|

$7.0

|

1.094

|

General

|

|

Bow

|

$6.0

|

0.010

|

$6.0

|

0.937

|

General

|

|

CA

|

$50.0

|

0.083

|

$4.0

|

0.625

|

Machinery Lubrication

|

|

Co

|

$640.0

|

1.060

|

$50.0

|

7.812

|

Machinery Lubrication &

Fuel Transfer

|

|

Cor

|

$1.0

|

0.002

|

$1.0

|

0.156

|

General

|

|

Cu

|

$2.0

|

0.003

|

$2.0

|

0.312

|

General

|

|

DEL

|

$20.0

|

0.033

|

$10.0

|

1.562

|

General

|

|

DELT

|

$5.0

|

.008

|

$2.0

|

0.312

|

Machinery Lubrication &

Fuel Transfer

|

|

DO

|

$19.0

|

0.032

|

$3.0

|

0.469

|

General

|

Pumps: World

Markets has the

50,000 basic forecasts to which customized analyzes can be easily added http://home.mcilvainecompany.com/index.php/markets/water-and-flow/n019-pumps-world-market

. Bob Mcilvaine can answer your

questions at rmcilvaine@mcilvainecompany.com Direct 847 784 0012 cell 847 226 2391

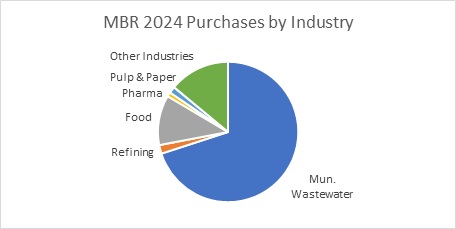

MBR Market to

Exceed $5 billion in 2024

The

market for membrane bioreactor systems will exceed $5 billion in 2024 with

more than $3 billion accounted for by wastewater treatment. This is the new forecast by the Mcilvaine

Company in http://home.mcilvainecompany.com/index.php/markets/water-and-flow/n020-ro-uf-mf-world-market.

This

material is being added as a separate segment of the RO/UF/MF service due

to the large size of the microfiltration and ultrafiltraton revenues

associated with this application.

The forecast is unique in that the revenues represent the aggregate

of what would be reported in financial statements by suppliers. This approach is preferred because

· It is the only way to iterate hard

numbers with statistical determinations

· It reflects the revenues of the

companies pursuing the MBR market

It

includes revenues of suppliers such as Suez and Beijing Origin but just for

their initial contract and not for operation revenues. In cases where the

MBR is an upgrade to existing biological treatment, the upgrade portion is

reflected. In some recent contracts the upgrade value was only 50% of a

greenfield complete system.

In

cases where there is no identifiable MBR system contractor only the

revenues for the MBR components are included. If the broader definition of

MBR installed cost were to be the criteria the market in 2024 would

exceed $7 billion.

The

report includes detailed analysis of system suppliers. In the coming months market shares for

membrane suppliers will also be added to the report.

For

more information contact Bob McIlvaine at

847 226 2391

|