Regulatory Drivers: Power Sector

1/9/12 Draft

CHINA

Revisions to China’s Water Law in 2008, together with environmental

commitments in China’s 12th Five-Year Plan (2011-15) will drive

greater investments in water and wastewater treatment equipment in the power

sector.

Opportunities for Xylem:

· Water and wastewater treatment

· Water re-use (northern China)

· Alternative sources for cooling water (northern China)

· Energy efficient equipment

· Synergistic co-location

China’s Water Quality Laws

Big Change Beginning in 2008 in Approach to Water Quality. Historically, China’s water policy has focused on flood control, and the country developed an extensive system of canals and dikes. However, nearly every water body in China is now polluted due to rapid industrialization. Polluted discharges from world-renowned companies, such as Apple, Nike and Adidas, were highlighted in the press, particularly just prior to the 2008 Olympics in Beijing. Beginning in 2008, China has made significant changes in its approach to water pollution and water quality, including:

· Enforcement of Laws. China adopted extensive revisions to its Water Pollution Prevention and Control Law (Water Quality Law) in 2008, with particular emphasis on stronger enforcement.

· Environmental Protection as a National Priority. Environmental protection has become a top priority in China’s 12th Five-Year Plan (2011-15). The previous Five-Year Plan focused primarily on economic growth.

· Energy Efficiency as a National Priority. Energy efficiency is also a top priority in China’s 12th Five-Year Plan. China also committed to reduce energy intensity (energy use for each unit of GDP) by 16 percent from 2011-2015 as a result of international climate change negotiations.

· Industrial vs. Municipal. Industrial water and wastewater will be of primary concern over the next five years. Sanitation was a top priority for the previous Five-Year Plan (2005-10) and China invested nearly US$50 billion to increase the municipal wastewater treatment rate from 51 percent to 75 percent.

· Water vs. Air. The 12th Five-Year Plan adds a target for greenhouse gas emissions and clean-car development, but otherwise does not place a priority on the country’s massive air pollution problems. Water is the current environmental concern, along with a politically-driven attempt to address greenhouse gas emissions.

· Water Conservation. China has begun to recognize the scarcity of its fresh water resources and is focusing more on water conservation. China has 22% of the world’s population but only 5% of the world’s water resources. Water is particularly scarce in northern China and the country has committed US$62 billion for the massive “south to north” water diversion project. China has also committed US$5 billion to water re-use and recycling initiatives over the next five years.

Overview of Water Quality Laws. China’s Water Quality Law is structured as outlined below. Significant changes to the enforcement and accountability provisions in 2008 have given “teeth” to the law for the first time.

1. Point Source Discharge Limits. Discharge standards for point sources have been developed over the last 20 years. There are approximately 40 industry-specific effluent limitation standards established in terms of maximum allowable concentrations. Recent changes to Class 1A discharge standards for municipal wastewater impose strict limits on nitrogen and phosphorus, creating demand for biological denitrification and phosphorus removal technologies. Some industrial facilities have adopted Class 1A standards for their discharges.

2. Water Quality Standards. Water bodies are classified as Level I-V based on their intended use. Concentration-based water quality standards have been established for each of the five levels.

3. Total Control Targets. “Total control targets” are unique to China’s central planning approach to environmental protection. For example, the total control target for COD (chemical oxygen demand) for 2010 was 12.73 million tons. This nation-wide target is then allocated on a watershed or water-body basis, followed by further allocations at regional and local levels. Until 2011, there was only one national Total Control Target for wastewater discharges - for COD. The 12th Five-Year Plan adds three new targets: Ammonium nitrate (to address fertilizer use), nitrogen oxide (to address coal use) and fine heavy metals (to address toxic discharges).

4. Enforcement. Unlike the U.S., China does not have a central environmental enforcement authority, at either the national or state/province level. Enforcement is by local authorities, leading to a number of problems:

· Implementation is inconsistent due to vastly different interpretations and approaches.

· Local officials tend to favor and protect local industries (“local protectionism”).

· Local officials are vulnerable to corruption.

· Performance evaluations for local officials have been based on their ability to increase production; they have not been held accountable for environmental performance.

The 2008 Water Quality Law amendments are significant because local officials are now held accountable for meeting environmental targets as part of their performance reviews. An official’s future career advancement will now depend on his or her ability to enforce water quality objectives, as well as increase productivity.

Five-Year Planning Process and the “Magic Seven” Industries

Central planning in China is conducted through five-year planning cycles. Each cycle contains an overall objective or strategy. The primary strategy for the 11th Five-Year Plan (FYP) for 2005-10 was rapid economic growth. For the 12th FYP (2011-15), it is “balanced growth,” with priorities placed on energy efficiency, environmental protection and social inequity, along with more moderate targets for GDP growth. Consistent with this “balanced growth” objective:

· Spending on energy efficiency and environmental protection will more than double, from RMB 1,375 billion (US$215 billion) during the 11th FYP to RMB 3,100 billion (US$490 billion) over the next five years.

· China will restructure the economy by focusing on the “Magic Seven” Strategic Emerging Industries (SEIs), as follows:

|

Old Pillar Industries |

New “Magic Seven” Strategic Emerging Industries |

|

National Defense |

Energy Efficiency and Environment Protection |

|

Telecom |

Next Generation IT |

|

Electricity |

Biotechnology |

|

Oil |

High-end Manufacturing |

|

Coal |

New Energy |

|

Airlines |

New Materials |

|

Marine Shipping |

Clean-energy Vehicles |

EUROPEAN UNION

Every river basin or water body in the 27 EU countries must attain “good” water quality status by 2015, which will drive greater investments in wastewater treatment systems. Water conservation will be driven by laws in Spain, and the UK could limit the use of fresh water for cooling towers by 2015. Restrictions on landfilling of municipal sewage sludge will continue to encourage synergistic co-location of municipal sewage plants and power plants.

Opportunities for Xylem:

· Water and wastewater treatment

· Water re-use (Spain)

· Alternative sources for cooling water (Spain and UK)

· Energy efficient equipment

· Synergistic co-location

EU’s Water Quality Laws

In 2000, the EU passed its landmark water quality law, the Water Framework Directive (WFD). This law did not set new standards per se, but created a framework for integrating all of the EU’s water-related directives into a single effort, and established a process for managing water quality or a river basin or water body basis. Under the EU’s Water Framework Directive, every river basin or water body must attain “good” water quality status by 2015. Implementation plans (referred to as River Basin Management Plans) to achieve “good” status were to be adopted by each member country, and for each water body, by December 2010. A survey of plans indicates that nutrients remain the primary water quality issue throughout the EU.

Water Conservation. Water re-use, recycling and conservation initiatives in the EU are voluntary and driven primarily by climate change concerns. The fear is that a warming climate will reduce the availability of fresh water resources. However, mandatory water conservation and re-use initiatives in Spain and the UK could drive greater investments in water and wastewater treatment equipment in the power sector:

1. Water Re-use in Spain. Spain is more vulnerable to water shortages than most EU member countries due to its relatively arid climate and huge demand for water for agriculture purposes. Spain embarked on a massive desalination initiative in 2004 to provide an alternative source of water for irrigation. However, the technology proved to be costly and the initiative has since come to a halt. Instead, Spain has turned to the re-use of treated wastewater for agricultural and industrial purposes. In 2007, Spain adopted a Water Reuse Decree, with the goal of doubling the re-use of water from 414 million m3 in 2009 to nearly one million m3 in 2015.

2. Limits on Sources of Cooling Tower Water (UK). The UK is not generally considered a “water-poor” country, but experienced a severe drought in 2011. In December, the British government issued a white paper suggesting that restrictions on fresh water use for cooling towers at power plants may be in place by 2015. The white paper, entitled “Water for Life,” sets a framework for reforming the municipal water sector, but also sets the stage for addressing industrial water uses beginning in 2013. The government plans to focus first on water used by the power generation industry, and on cooling tower make-up water in particular.

Energy Efficiency and Sustainability

In 2008, the European Union launched the “20-20-20 Plan” for 2020, which would increase renewable energy to 20 percent of the mix, reduce greenhouse gas emissions 20 percent below 1990 levels, and increase energy efficiency 20 percent compared to business-as-usual projections. The first two targets are legally binding, but the energy efficiency goal is not. EU member countries were on track to increase energy efficiency just 10 percent by 2020, which prompted the European Commission to intervene with a plan to raise it another 10 percent. In June 2011, the EU proposed binding national targets for increasing energy efficiency. A final Directive, to be issued in late 2012 or early 2013, is expected to offer incentives such as tax rebates, require mandatory energy audits and set energy efficiency standards for industrial equipment.

Co-location of Municipal Sewage and Power Plants

[To be added later]

UNITED STATES

Three regulatory developments could drive greater investments in water and wastewater equipment in the power sector (with compliance dates noted):

1. Cooling Water Intake Rulemaking (2015-20)

2. Power Plant FGD Wastewater Rulemaking (2016)

3. Sustainability and Energy Efficiency Initiatives

Opportunities for Xylem:

· Alternative sources for cooling water

· Variable speed pumps and drives for cooling water systems

· Wastewater treatment (FGD waste streams)

· Energy efficient equipment

· Synergistic co-location

1. Cooling Water Intake Rulemaking

Cooling water intake standards are mandated by §316(b) of the Clean Water Act. The proposed rule was issued on March 28, 2011, and the final rule must be issued by July 27, 2012, according to terms of a consent decree. Compliance will be required in 2015-2020, depending on a facility’s permit cycle.

The purpose of the cooling water intake rule is to reduce harm to aquatic life through: a) impingement, where organisms are trapped against the outer part of a screening device of an intake structure and are unable to escape; and b) entrainment, where organisms pass through a screening system and become entrained in the cooling system. The proposed rule would apply to facilities that withdraw more than 2 MGD of water and use at least 25% of the withdrawn water for cooling purposes. EPA estimates the rule will impact:

o 671 power plants, representing 45% of the nation’s electricity generating capacity

o 591 manufacturing plants in five primary industrial categories

Power plants are, by far, the biggest water users, representing 90% of the total design intake flow of all of the impacted facilities.

Table 1: Facilities Impacted by Proposed Cooling Water Intake Rule

|

Industry |

Estimated Number of Facilities |

Total Design Intake Flow (MGD) |

Average Design Intake Flow (MGD) |

|

Pulp & Paper |

227 |

11,944 |

69 |

|

Chemicals |

185 |

12,400 |

126 |

|

Steel and Aluminum |

95 |

9,444 |

131 |

|

Petroleum Refineries |

39 |

3,259 |

96 |

|

Food Processing |

38 |

2,073 |

52 |

|

Other Manufacturing |

7 |

353 |

81 |

|

Total Manufacturers |

591 |

39,473 |

95 |

|

Electric Generators |

671 |

370,126 |

555 |

|

Total |

1,262 |

409,600 |

434 |

Source: U.S. Environmental Protection Agency

The majority of facilities affected by the proposed Cooling Water Intake Rule are located in the eastern half of the United States.

Figure 1: Map of Facilities Subject to Proposed Cooling Water Intake Rule

Source: U.S. Environmental Protection Agency

Phase 2 Generator: Large electricity generator, withdrawing 50 MGD or more of water

Phase 3 Generator: Small electricity generator, withdrawing less than 50 MGD

Compliance Options: The proposed rule would require: a) enhancement of intake structure screens or a lower intake velocity to reduce “impingement,” and b) a case-by-case review based on Best Professional Judgment (BPJ) to reduce “entrainment.” EPA decided not to require closed-loop systems for existing units and identifies the following options for consideration in a case-by-case review using BPJ:

· Cooling tower optimization measures

· Variable speed pumps/variable frequency drives

· Seasonal flow reductions (based on spawning periods or other biologically important time periods)

· Water re-use (such as re-using cooling tower water as process water in manufacturing)

· Alternative cooling water sources, such as effluent from a municipal wastewater treatment plant

2. Power Plant FGD Wastewater Rulemaking

The existing effluent limitation guidelines (ELGs) for steam electric power plants were first adopted in 1974 and were last revised in 1982. EPA conducted a detailed study of wastewater streams from steam power plants in 2009, largely as a reaction to the ash impoundment failure at a TVA power plant in December 2008. As a result of the study, EPA decided to revise ELGs for steam power plants, focusing on two specific wastewater streams that are often stored in impoundments:

· Flue gas desulfurization (FGD) wastewater

· Wastewater from coal combustion residues (CCR)

The proposed rule is expected to be issued in July 2012, with a final rule by January 2014.

The proposed rulemaking would regulate FGD wastewater streams as separate, “internal” waste streams. FGD wastewaters are currently mixed with other wastewater streams for treatment (often in an impoundment) prior to discharge. Few, if any, power plants treat FGD wastewater separately. Furthermore, many existing power plants may be space-constrained, requiring a compact solution for FGD wastewater treatment. This rule, then, could create a significant market for package or compact FGD wastewater treatment technologies.

Affected Facilities. The rule would apply only to coal-fired units with wet scrubber systems. Table 2 indicates that at least 162 GW of generation capacity, or 50% of the coal-fired capacity in 2010, would be affected by an FGD wastewater rule.

Table 2: Scrubbers on Coal-Fired Units in the U.S.

|

Type of Unit |

Existing Capacity 2010 (GW) |

Projected Capacity (2020) (GW) |

|

Units with Wet FGD |

162 |

231 |

|

Units with Dry FGD |

22 |

37 |

|

Units without Scrubbers |

134 |

103 |

|

Total Coal-Fired Units |

318 |

371 |

Source: EPA’s 2009 Steam Electric Wastewater Study

In the 2009 report, EPA estimated that the number would increase to 231 GW or 62% of coal-fired capacity in 2020. However, the study pre-dates two other final rules which will require scrubbers on nearly every coal-fired power plant in the country: the Cross-State Air Pollution Rule (CSAPR) finalized on July 7, 2011, and the Utility MACT rule, finalized on December 21, 2011. The combined impact of these two air rules will mean that fewer units will be able to operate in 2020 without a scrubber. Consequently, we estimate that 290 – 300 GW of wet scrubbers will be in place in 2020, roughly 25 percent more than EPA suggests.

FGD Wastewater Characteristics. FGD wastewater is generated from sludge dewatering and scrubber blowdown. Some metals and other constituents will be removed by a fabric filter or electrostatic precipitator located ahead of the FGD system. Other metals and pollutants will be transferred to the scrubber slurry and leave the FGD system via the scrubber blowdown. The primary pollutants of concern in FGD wastewater are:

Power plants typically have a permit which establishes effluent limitations at the point of discharge. FGD wastewater quantities represent a small fraction of a plant’s overall wastewater, so pollutants in FGD wastewater streams become highly diluted, frequently below detection limits, at the point of discharge. In this rulemaking, EPA would regulate individual FGD wastewater streams as “internal discharge streams” prior to dilution by other plant wastewaters.

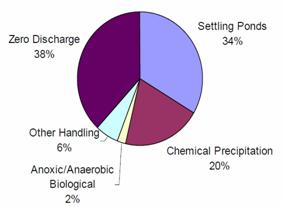

FGD Wastewater Treatment: FGD wastewater is currently treated as shown in Figure 2. EPA suggests that physical/chemical treatment combined with a biological treatment stage will be proposed.

Figure 2: FGD Wastewater Treatment Systems

Among Plants Operating Wet FGD Systems

Source: EPA’s 2009 Steam Electric Wastewater Study

FGD Wastewater Markets. An FGD wastewater regulation would require a wastewater treatment solution for the 34 percent of existing wet FGDs that rely solely on settling ponds, and for the additional 20 percent that use some form of chemical precipitation. Consequently, the market for FGD wastewater solutions would correspond to 87 GW of 2010 capacity.

Table 3: Wet Scrubbers on Coal-Fired Units in the U.S.

|

Type of Treatment |

Existing Capacity 2010 (GW) |

|

Zero Discharge (38%) |

62 |

|

Settling Ponds (34%) |

55 |

|

Chemical Precipitation (20%) |

32 |

|

Anoxic/Anaerobic Biological (2%) |

4 |

|

Other Handling (6%) |

9 |

|

Total Units with Wet FGD |

162 |

New wet FGD units are likely to be installed on an additional 128 GW of capacity in the next decade, assuming a total installed wet FGD capacity of 290 MW in 2020. EPA’s 2009 Steam Electric Wastewater Study calculated a normalized scrubber purge flow rate of 578 gpd of FGD wastewater per megawatt. Using that figure, the potential amount of FGD wastewater purge flow impacted by an FGD rule is summarized in Table 4.

Table 4: Market for FGD Wastewater Solutions (2010-2020)

|

|

Capacity (GW) |

Purge Flow (MGD) |

|

Retrofit Existing Wet FGD Wastewater |

87 |

50.3 |

|

New FGD Wastewater Systems |

128 |

74.0 |

|

Total |

215 |

124.3 |

3. Energy Efficiency and Sustainability Initiatives

At least 27 states have established energy efficiency targets, with California leading the way in energy efficiency and sustainability initiatives. Since 2008, California has been working with Lawrence Berkeley National Laboratory to evaluate energy efficiency and demand response opportunities at industrial wastewater treatment facilities in four industrial sectors (food processing, petroleum refining, electronics and cement). A 2009 report identifies equipment efficiency options including:

o Variable speed and higher efficiency pumps

o Variable speed drives for blowers

o Fine bubble diffusers

Demand response is an internet-based method of managing a customer’s consumption of electricity in response to peak supply or market price conditions. The 2009 report identifies demand response strategies for industrial wastewater treatment, including:

o Over-oxygenation, so that a treatment plant reduces aeration needs during a peak power demand period

o Storage of untreated wastewater for processing during off-peak hours

o Rescheduling processes, such as biosolids dewatering or filter backwashing, for off-peak hours