|

|||||||

|

|

|||||||

|

· Air Quality IX October 21-23 Will Aid In Your MATS Decisions

· Liquid and Air Filter Element Sales Will Exceed $34 Billion This Year

· The World Market for Electrostatic Precipitator (ESP) Systems, Repair Parts and Service Will Exceed $16 Billion in 2014

· Renewable Energy Briefs

· Headlines for the September 13, 2013 - Utility E-Alert

· “Multi-Pollutant Control Technology” Is The “Hot Topic Hour” On Sept. 26th and Sept. 27th

· McIlvaine Hot Topic Hour Registration

Air Quality IX October 21-23 Will Aid In Your MATS Decisions

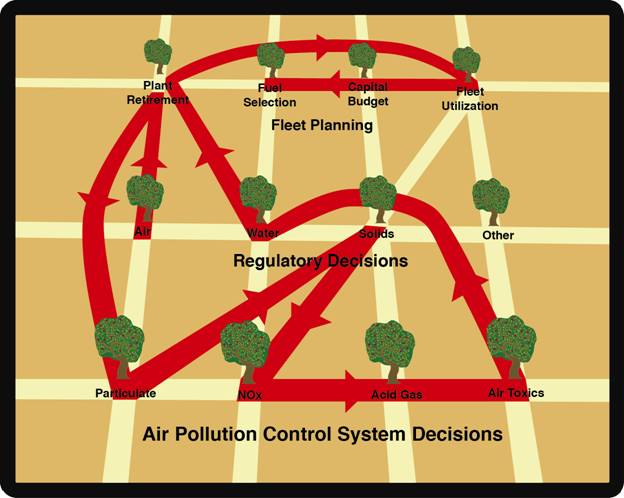

Air Quality IX will be very helpful to power plants grappling with the complex decisions generated by MATS. Here is a road map to help utilities organize their time at the conference. The MATS Global Decisions Positioning System (GDPS) can be used to determine which stands and which papers will be of importance.

Decisions on removing HCl, mercury and other toxic metals impact many other decisions relative to the power plant. Speeches, exhibits and posters to be presented at the Crystal Gateway Marriott in Arlington, Va. have been listed in such a way to conform to the new McIlvaine Global Decisions Positioning System™ (GDPS)

There is information arranged by each decision tree stop. Let’s skip to the 4th decision tree stop relative to NOx control technology. NOx is not addressed in MATS, but the choices for NOx control will affect air toxic removal. There are exhibits, speeches on catalysts which oxidize mercury while reducing NOx. Improving boiler efficiency not only reduces NOx but reduces mercury and HCl per kWh.

4th Decision Tree Stop: NOx Control Technology

Exhibitors:

BASF - Catalyst

Breen - Efficiency Upgrades

FMC - NOx Capture with Hydrogen Peroxide

Fueltech - SNCR, SCR Systems

CEMS will be displayed by the following:

CAE (testing)

Mac (moisture analyzers)

M&C, (conditioning)

Midac

Ohio Lumex

Sick

Spectrum

Thermo

Speeches:

Tues. – 1:55 PM: NOx and SOx Removal, Yuval Davidor, Lextran

2:45PM: (A) Mercury Speciation, Scott Hinton, W.S. Hinton

2:45 PM: (B) PerNOxide, Robert Crynak, FMC

3:40 PM: Evolution of SCR, Nicholas Pollack, Coalogix

Wed. - 10:10 AM: Catalyst-Mercury Oxidation, Christopher Reeves, Cormetech

10:35 AM: Catalyst Co-benefits, Kyle Neidig, Hitachi

11:25 AM: HG Oxidation with New Catalyst, Tobias Schwaemmle, Univ. of Stuttgart and A. Hartun, IBIDEN Porzellanfabrik

Posters:

Low Temperature SCR, Jinrui Fang, China Building Materials Academy

All the exhibitor displays, speeches and posters are displayed under the relevant decision trees. This will not only aid the visitors in planning their time but provides an organized approach of adding new material to the GDPS system. Some of the topics such as the new catalyst have not been previously incorporated into the decision system. Depending on what we learn during the presentation we may want to include this as another alternative. A low temperature SCR, if effective, could allow NOx capture after particulate removal and would change the approach to mercury capture as well.

This GDPS classification of all the speeches, exhibits and posters at a conference such as Air Quality not only aids the visitor but provides an important evaluation step in upgrading the entire system.

A detailed GDPS analysis of the entire program is found at:

http://www.mcilvainecompany.com/Decision_Tree/airqualityIXOctober21-23.htm

More information on the conference can be found at:

Liquid and Air Filter Element Sales Will Exceed $34 Billion This Year

Sales of filter element to separate particles from air, gases, water, oil and other liquids will exceed $34 billion in 2013. This is the latest forecast in the McIlvaine Air/Gas/Water/Fluid Treatment and Control: World Markets. (www.mcilvainecompany.com)

|

Filter Element Revenues $ Millions 2013 |

|||

|

Application |

Liquid |

Air |

Total |

|

Power Generation |

100 |

1,500 |

1,600 |

|

Fluid Power |

2,200 |

400 |

2,600 |

|

Mobile |

5,000 |

3,000 |

8,000 |

|

Municipal |

800 |

40 |

840 |

|

Residential/Commercial |

7,000 |

5,000 |

12,000 |

|

Oil and Gas |

300 |

400 |

700 |

|

Industrial, Other |

5,000 |

4,000 |

9,000 |

|

Total |

20,400 |

14,340 |

34,740 |

The largest single segment is the residential/commercial. This includes furnace, refrigerator and other air and water filters used in residences, office buildings and other governmental and commercial enterprises. Carbon block, membranes and non-woven filter media are used.

The industrial sector is the next largest. Filter element used in stack gas purification comprises the bulk of the air applications. Membrane and non-woven filter element used in pharmaceutical applications account for nearly 40 percent of the liquid portion of the industrial sector.

Mobile includes on-road as well as off-road vehicles, ships, rail locomotives and airplanes. Applications include filtration of fuel, coolant and intake air. Cabin air and components requiring lubrication. Fluid power includes both pneumatic and hydraulic filters.

The oil and gas sector uses extensive numbers of coalescing filter element to remove entrained droplets from gases. Liquid filter elements are used on a variety of applications.

Clarcor and Donaldson are two companies whose products are available in most of the sectors. Affinia concentrates just on the fluid power and mobile aftermarket. Cummins is primarily in the mobile sector. Parker Hannifin offers products for many sectors. However, unlike Donaldson and Clarcor, it does not offer the stack gas cartridges.

A number of media companies such as Ahlstrom, Lydall and Hollingsworth & Vose have products in all the sectors.

For more information on Air/Gas/Water/Fluid Treatment and Control: World Markets, click on: http://home.mcilvainecompany.com/index.php?option=com_content&view=article&id=71.

The World Market for Electrostatic Precipitator (ESP) Systems, Repair Parts and Service

Will Exceed $16 Billion in 2014

The market for ESP repair and service will be $8.4 billion in 2014, whereas, the new systems market will exceed $7.6 billion. This is the conclusion in the latest update of Electrostatic Precipitators: World Markets published by the McIlvaine Company. (www.mcilvainecompany.com)

|

2014 Electrostatic Precipitator Sales Revenues ($ Millions) |

|||

|

Segment |

New Systems |

Repair and Upgrade |

Total |

|

World |

7,600 |

8,400 |

16,000 |

|

Africa |

200 |

130 |

330 |

|

America |

800 |

1,200 |

2,000 |

|

Asia |

5,700 |

5,770 |

11,470 |

|

Europe |

900 |

1,300 |

2,200 |

East Asia will be the largest market for new systems as well as for repair parts and service. China will install nearly 50,000 MW of new precipitators for utility power plants in 2014. With an installed price of $50/kW, this will result in an investment over $2.5 billion. China will also be installing precipitators on industrial boilers and other sources.

In NAFTA and Western Europe, the new system market will be small compared to repair and service. The reason is that both regions have very large installed bases of precipitators but small markets for new coal-fired generators, steel mills and pulp/paper plants. Furthermore, new power plants in both these regions are more likely to be equipped with fabric filters than electrostatic precipitators.

India is buying large numbers of precipitators for coal-fired power plants. This is creating a much larger market for new systems than for repair and service. However, the ash in Indian coals is abrasive and there is a high ratio of ash to total coal burned. This creates special maintenance problems.

Chinese suppliers dominate the market for new precipitators in Asia. Alstom is the market leader in Europe and North America. Major suppliers are also based in Japan and Korea.

The biggest challenge for precipitator suppliers is the more stringent regulatory environment. Precipitators are sensitive to the type of particulate being captured. So, when fuels change, the precipitator performance changes. Fabric filters are not sensitive to the dust characteristics and are, therefore, more likely to be selected when the mandated emission limits are low.

The competition between precipitators and fabric filters injects a variable factor relative to forecasting. Precipitator suppliers are making improvements to achieve higher efficiency. On the other hand, new regulations in China limiting emissions to 20 MG/NM3 raise doubts about the ability of precipitators to meet the requirements. The new air toxic regulations in the U.S. use particulate as a surrogate for heavy metals and, therefore, require very low emissions.

For more information on Electrostatic Precipitators: World Market, click on: http://home.mcilvainecompany.com/index.php/component/content/article?id=48#no18.

Renewable Energy Briefs

EDF EN Canada Commissions 150 MW Lac-Alfred Phase 2 in Quebec

EDF EN Canada Inc., a subsidiary of EDF Energies Nouvelles, announced that the second phase of the Lac-Alfred Wind Project (150 MW) in Quebec was declared for commercial operation on August 31, 2013.

Lac-Alfred represents one of the seven wind energy projects in total awarded to the company in 2008 and 2010 through Hydro-Quebec Distribution calls for tenders. By the end of 2015, EDF EN Canada will have developed and built a total of 1,003.2 MW in the province.

The Lac-Alfred Wind Project is located in the municipalities of Saint-Cléophas, Sainte-Irène, Saint-Zénon-du-Lac-Humqui and the unorganized territory (UT) of Lac Alfred in the MRC de La Matapédia and in the municipality of La Rédemption and UT Lac-à-la-Croix in the MRC de La Mitis. The 300 MW project was constructed in two phases, 150 MW each, comprising of a total of 150 wind turbines supplied by REpower and made with regionally-manufactured blades, towers and converters. Lac-Alfred Phase 1 was commissioned in January 2013.

FirstEnergy Ohio Utilities Launch Request for Proposal for 2013 Solar and Renewable Energy Credits

FirstEnergy Corp. announced that a Request for Proposal (RFP) will be issued to purchase both In-State and All-State Solar Renewable Energy Credits (SRECs) and both In-State and All-State Renewable Energy Credits (RECs) for its Ohio utilities — Ohio Edison, Cleveland Electric Illuminating and Toledo Edison — to help meet the 2013 renewable energy targets established under Ohio's alternative energy law.

SRECs and RECs sought in this RFP must be produced by renewable generating facilities that are either certified by the Public Utilities Commission of Ohio (PUCO) or are in the process of being certified by the PUCO. The SRECs and RECs must be generated between January 1, 2011, and December 31, 2013. The following amounts and locations are being sought:

100 SRECs generated in Ohio;

6,500 SRECs generated in Ohio or states contiguous to Ohio;

120,000 RECs generated in Ohio; and

145,000 RECs generated in Ohio or states contiguous to Ohio.

The RFP is a competitive process conducted by Navigant Consulting, Inc., an independent evaluator and a global consulting firm with expertise in energy markets, renewables and competitive procurements. Based on the RFP results, the Ohio utilities will enter into agreement(s) with winning suppliers to purchase the necessary quantities of RECs and SRECs.

One SREC represents the environmental attributes of one megawatt hour of generation from a solar renewable generating facility qualified by the PUCO. One REC represents the environmental attributes of one megawatt hour of generation from a PUCO-qualified renewable generating facility. The cost of the RECs is recovered from utility customers through a monthly charge filed quarterly with the PUCO.

No energy or capacity will be purchased under the RFP.

Scatec Solar Grid-Connects South Africa’s First Renewable IPP Project

Scatec Solar, the global solar energy provider, had its 75 MW solar PV plant, Kalkbult, in the Northern Cape region connected to the regional grid September 13, three months ahead of schedule, making the power plant the first REIPPPP project to be grid connected and operational in South Africa.

Scatec Solar was awarded the Kalkbult project under the first round of the South African Renewable Energy Independent Power Producer Procurement Program (REIPPPP). The construction commenced immediately after the financial close in November last year. The completed plant consists of more than 312 000 solar panels mounted on 156 km of substructure, inverters, transformers and a HV sub-station. The power from the grid-connected PV plant will be sold through a 20 year Power Purchase Agreement with Eskom, the national utility company.

Solar Thin Films, Inc. Announces Signing of Contract to Build Solar Fields

Solar Thin Films, Inc. announced that it has signed a contract, effective September 13, 2013, for the design, supply and construction of three photo-voltaic (PV) solar fields in West Virginia.

As previously announced, the agreement is with property owner Tri-State Solar/Wind Energy LLC (Tri-State). There are a total of three properties to be developed, as follows:

1) Sam Black Church Rd. Crawley, WV (Site # 1)

2) Wolf Creek Rd. Fayetteville. WV (Site # 2)

3) Muddy Creek Rd. Alderson. WV (Site # 3)

Sites #1 and #2 are to have 8-10 MW in solar electrical production capacity, while site #3 is to have capacity for 15-20 MW. The anticipated value of the contract is $124-$160 million.

Tri-State will be responsible for, and is in the process of obtaining financing to complete the three projects, and clearing and preparing each property in preparation for the installation of the solar panels. The company has agreed to use its expertise to assist Tri-State in the negotiation and execution of Power Purchase Agreements with the local power utility company.

Ocean Power Technologies Awarded $1.0 Million by U.S. Department of Energy

Ocean Power Technologies, Inc. announced that it has won a $1.0 million funding award from the U.S. Department of Energy to enhance the commercial viability of its PowerBuoyR wave-energy systems through mechanical component design changes to maximize power-to-weight output ratios and reduce overall installed capital costs.

Under the award the company will evaluate alternative designs for the PowerBuoy's float and spar, which account for about half of the system's mass, to optimize their geometry, materials used, power output, manufacturability, durability and handling. The process will include structural analysis, power output and load evaluations, and cost modeling using simulations as well as wave tank tests. The optimal designs will then be incorporated into the PowerBuoy product line.

For more information on Renewable Energy Projects and Update please visit

Headlines for the September 13, 2013 – Utility E-Alert

UTILITY E-ALERT

#1142 – September 13, 2013

Table of Contents

COAL – US

§ DOJ wants to add Belle River 1, 2, Monroe 1, 3 and Trenton Channel 9 to NSR Lawsuit

§ Cabot Norit to provide Two ACI Systems

§ Cayuga conversion to Natural Gas is up to $924.3 less Costly than Power Line Upgrades

§ OG&E asks Court to dismiss EPA’s NSR Lawsuit against Muskogee and Sooner

§ Virginia Electric and Power Bremo Power Plant to convert to Natural Gas-firing

COAL – WORLD

GAS/OIL – US

GAS/OIL – WORLD

NUCLEAR

BUSINESS

HOT TOPIC HOUR

For more information on the Utility Tracking System, click on: http://home.mcilvainecompany.com/index.php?option=com_content&view=article&id=72.

“Multi-pollutant Control Technology” will be the Hot Topic on Thursday September 26, 2013 and again on Friday September 27, 2013 both starting at 10 a.m. CDT

NOTE: Because of the strong interest in Multi-pollutant Control Technology and the number of persons that desired to make presentations, this webinar has been divided into two sessions – one on Thursday, September 26th and the second on the following day Friday, September 27th, both starting at 10a.m. CST. Persons that register for the first session will automatically be registered for the second session on Friday.

With the Utility MATS, Boiler MACT, Cement MACT, pending CSAPR and proposed GHG rules along with the various Federal and State rules in force and pending regarding water use and wastewater discharge, operators of coal- and oil-fueled boilers are faced with real economic challenges if they need or want to keep their boilers operating. In many cases, boilers currently operating with no or minimum air pollution controls may not be economically viable. But those with some controls could meet the new pollution limits with minimal capital cost.

Fortunately, in anticipation of the flood of new air and water pollution regulations affecting fossil-fueled power and industrial boilers as well as cement plants, the manufacturers of air pollution control (APC) systems and equipment have invested to improve the performance of existing systems and develop new technology to address multi-pollutants. Existing APC systems that were originally designed to control a single pollutant, such as SCRs originally focused on NOx and ESPs originally focused on particulates, are now capable of reducing or enhancing the removal of other pollutants such as mercury or HCl. This means that a boiler operator could potentially simply modify an existing APC device and perhaps add a sorbent injection at minimal cost and meet the new emission limits.

The following speakers will discuss the multi-emission control technologies available and under development for use with SCRs, ESPs, FGDs and other existing APC systems with their applicability, capabilities, limitations, capital cost and affect on power or steam generation.

Presenters for Multi-pollutant Control Technology on Thursday, September 26, 2013

Suzette Puski, Technical Product Manager at Babcock Power Environmental

John Pavlish, CATM Director at EERC-CATM (Center for Air Toxic Metals), will present “Cost Effective Measurement of Halogens and Metals Emissions Using a Sorbent Trap Approach.” More frequent measurement of halogens and metals is now required by the Mercury and Air Toxics Standard (MATS). The EPA reference methods that are available involve a series of wet impingers containing hazardous chemicals. The Energy & Environmental Research Center’s (EERC) Center for Air Toxic Metals® (CATM®) has developed and is in the process of field testing a new multi-element sorbent trap (ME-ST)-based method that shows promise to serve as an alternative to EPA Methods 29 (metals) and 26A (HCl).

Andy Carstens, manager in Sargent & Lundy's Environmental Services Group, will present “Industry Status of “Novel” Multi-Pollutant Technologies.”

To maintain competitiveness in today’s challenging market, utilities have been trying to squeeze every last drop of pollution control from existing air pollution control equipment. So what is happening with “novel” multi-pollutant control technologies that have been under development, in some cases for years? This presentation will provide a high-level review of “novel” multi-pollutant technologies and their current status in the industry.

Presenters for Multi-pollutant Control Technology on Friday, September 27, 2013

Peter Spinney, Director, Marketing & Technology Assessment at NeuCo, Inc.

Rod Gravley, Technology Director at Tri-Mer, Corp., will discuss the UltraCat ceramic filter system. The Tri-Mer UltraCat ceramic filter system has multi-pollutant removal capability. The filters remove PM at state-of-the art levels. The catalyst embedded in the filter walls is capable of destroying NOx with very high efficiency. The catalyst also destroys the Organic HAPS targeted in the Cement NESHAP and the dioxins targeted by the incinerator CISWI MACT. The filter system can be configured with integrated dry sorbent injection for the removal of SOx and HCl. For mercury removal powdered activated carbon (PAC) is injected. For the Boiler MACT, EPA glass regulations and many other state and federal rules, the Tri-Mer UltraCat system is an all-in-one solution.

Jon Norman, Manager, Sales & Technology at United Conveyor Corporation, will discuss using dry sorbent injection (DSI) for multi-pollutant removal. Specifically, he will share how sodium sorbents or hydrated lime can be used for simultaneous removal of SO2, SO3, and HCl, while mercury is removed with various activated carbon or non-carbon products. The presentation will emphasize how to avoid interactions between the sorbents and choose the best injection locations for optimum removal of each pollutant. Actual test data will be used to illustrate each of the major points.

Sterling Gray, Business Development and Technology Manager, URS Corporation, will present “Combined Hg and SO3 Removal Using a Single Sorbent.” The MATS regulation requires that mercury emissions be reduced from all coal-fired power plants in the U.S. However, the presence of SO3 in the flue gas can interfere with mercury capture on native unburned carbon or injected activated carbon. The SBS Injection process can effectively remove both SO3 and mercury using just the native unburned carbon normally found in flyash. The process can also permit operation of the APH at lower exit gas temperatures, further promoting the efficient capture of mercury. Results from recent full-scale testing will be presented.

To register for the September 26th and 27th “Hot Topic Hour” on “Multi-pollutant Control Technology” at 10 a.m. CDT, click on: http://www.mcilvainecompany.com/brochures/hot_topic_hour_registration.htm.

McIlvaine Hot Topic Hour Registration

On Thursday at 10 a.m. Central time, McIlvaine hosts a 90 minute web meeting on important energy and pollution control subjects. Power webinars are free for subscribers to either Power Plant Air Quality Decisions or Utility Tracking System. The cost is $125.00 for non-subscribers. Market Intelligence webinars are free to McIlvaine market report subscribers and are $400.00 for non-subscribers.

|

DATE |

Non-Subscribers Cost |

SUBJECT |

Webinar Type |

|

September 26 and 27th, 2013 |

$125.00 |

Multi-pollutant Control Technology |

Power |

|

October 3, 2013 |

$125.00 |

Update on Coal Ash and CCP Issues and Standards |

Power |

|

October 17, 2013 |

$125.00 |

Air Pollution Control in China |

Power |

|

October 31, 2013 |

$125.00 |

Chinese FGD/SCR Program and Impact on the World |

Power |

|

November 21, 2013 |

$125.00 |

Wet vs. Dry ESP |

Power |

|

December 5, 2013 |

$125.00 |

Update on Gasification Projects and Technology |

Power |

|

December 12, 2013 |

$125.00 |

Selecting FGD Scrubber Components |

Power |

|

December 19, 2013 |

$125.00 |

Application of U.S. Mercury Control Technology in Other Countries |

Power |

On Thursday at 10 a.m. Central time, McIlvaine hosts a 90 minute web meeting on important energy and pollution control subjects. Power webinars are free for subscribers to either Power Plant Air Quality Decisions or Utility Tracking System. The cost is $125.00 for non-subscribers. Market Intelligence webinars are free to McIlvaine market report subscribers and are $400.00 for non-subscribers.

To register for the “Hot Topic Hour”, click on:

http://www.mcilvainecompany.com/brochures/hot_topic_hour_registration.htm.

----------

You can register for our free McIlvaine Newsletters at: http://www.mcilvainecompany.com/brochures/Free_Newsletter_Registration_Form.htm.

Bob McIlvaine

President

847 784 0012 ext 112

rmcilvaine@mcilvainecompany.com

191 Waukegan Road Suite 208 | Northfield | IL 60093

Ph: 847-784-0012 | Fax; 847-784-0061