|

|||||||

|

|

|||||||

|

· MATS, CCR, EGC, Gas Turbine Air Treatment and Power Plant Drives Coordination at Power-Gen

· $13 Billion Market for Gas Turbine Air Treatment In 2014

· Municipal Wastewater Plants Will Spend $1.6 Billion for Air and Water Monitoring Equipment Next Year

· Renewable Energy Briefs

· Headlines for the October 18, 2013 - Utility E-Alert

· Chinese FGD and SCR Program and Impact on the World Will Be ‘Hot Topic” Next Week

· McIlvaine Hot Topic Hour Registration

MATS, CCR, EGC, Gas Turbine Air Treatment and Power Plant Drives Coordination at Power-Gen

The McIlvaine GDPS route maps, e-mail cell, phones and twitter will help utilities obtain insights in four important areas. Visiting all the exhibits and attending all the speeches relevant to your upcoming decisions is impossible, so a little help can go a long way. McIlvaine has picked four subjects which are high on many attendee lists. They are:

· Meeting the new MATS rule

· Gas turbine air treatment

· Drive technology improvements

· How to address the CCR and effluent standards

McIlvaine is preparing route maps which will allow attendees to organize their time to obtain the best answers to questions on these subjects.

McIlvaine personnel will use e-mail, twitter and cell phones to facilitate meetings during the show. Utility personnel can ask McIlvaine to help them obtain specific answers at the show and ensure when they arrive at a stand that the right person is available.

McIlvaine will need the cell phones and e-mail addresses of suppliers who want to participate and utilities who want this assistance. Coordination is also needed with supplier experts who are not at the show. This is especially true for consulting companies. In one of excerpts below, we cover a speech by several Sargent & Lundy people relative to drives for pneumatic conveying. In another excerpt, we quote a Sargent & Lundy presenter in our CCR webinar. If utilities have an interest in further discussing these subjects at the show, then the Sargent & Lundy people at the show can be in contact with the authors and make sure they can answer the potential client questions. Also, there are a number of S&L speeches on the decision tree stops in MATS.

E-mails and tweets conveying insights from on and off site participants can maximize the exchange of good information.

Here are some draft segments of the program which will be sent out early next week and continually updated prior to and during the show.

Power-Gen 2013 Will Aid In Your MATS Decisions

Power Gen 2013 will be very helpful to power plants grappling with the complex decisions generated by MATS. Here is a road map to help utilities organize their time at the conference. The MATS Global Decisions Positioning System™ (GDPS) can be used to determine which stands and which papers will be of importance.

MATS GDPS

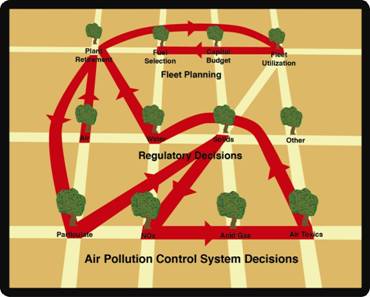

Decisions on removing HCl, mercury and other toxic metals impact many other decisions relative to the power plant. Speeches, exhibits and posters to be presented in Orlando have been listed in such a way to conform with the new McIlvaine MATS Global Decisions Positioning System (GDPS).

1st Decision Tree Stop: Plant Retirement Decision Tree

Speeches

Speeches

Tues: 1:30 p.m. Determining the most cost effective Compliance Plan, Karen Burchardt, Burns & McDonnell cell# email ------------

Xxxxxxxxx

Xxxxxxxxxxx

Xxxxxxxxxxxxx

Xxxxxxxx

5th Decision Tree Stop: Select FGD Type and Reagent

xxxxxxx

5-1 Wet Limestone

Exhibitors

Alstom Stand #

Power Gen 2013 Will Aid In Your Gas Turbine Air Treatment Decisions

Power Gen 2013 will be very helpful to gas turbine operators who are making decisions about air treatment. Here is a road map to help utilities organize their time at the conference. The Gas Turbine Air Treatment Global Decisions Positioning System™ (GDPS) can be used to determine which stands and which papers will be of importance.

|

Decision Tree |

Gas Turbine Air Treatment Products and Services |

|

|

Equipment |

Components |

|

|

1 |

Intake Housing |

|

|

2 |

Weather Protection |

|

|

3 |

Conditioning |

Nozzles |

|

4 |

Pre-filtration |

Filters |

|

5 |

Coalescers |

Coalescers |

|

6 |

Final Filtration |

Filters |

|

7 |

Tempering Air System (Single Cycle) |

Dampers, Drives, Fan Parts, Seals |

|

8 |

Duct Burner (Combined Cycle) |

Burner Parts |

|

9 |

Ammonia Injection Grid |

Nozzles, Ammonia |

|

10 |

CO Reactor |

Catalyst |

|

11 |

SCR |

Catalyst |

|

12 |

Process Controls |

Sensors, Valves, Seals, Gaskets |

|

13 |

CEM |

Rata Testing, Protocol Gases, Instruments |

|

14 |

Silencer |

Silencer Parts |

|

15 |

Stack |

|

1st Decision Tree Stop: Air intake housing

The intake housing is often sold as a complete unit with items in decision trees 1-6

Xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

3rd Decision Tree Stop: Conditioning

There is a range of conditioning systems from just fogging nozzles to packed columns to complete air conditioning systems. Nozzles are an important component.

Exhibitors:

Fogging Systems

Mee

Complete air conditioning Systems

Baltimore Air Coil

Nozzles

Air Filter Efficiency Discussion at Power –Gen

A European Turbine Network Working Group 3 consisting of Tumbull of AAF, Clement of Donaldson and Ekberg of Camfil Farr has put together the position paper “Gas Turbine Combustion Air Filtration” its impact on compressor efficiency and hot end component life.

As you can see from the following table, they conclude that by spending two to four times as much for filters you end up reducing annual costs. If they can verify these results, then it changes the decision making for the power plant operators. So it will be desirable for people at the air filter stands to be able to address this finding.

Power-Gen 2013 Will Aid in Your Drive Selection Decisions

Power-Gen 2013 will be very helpful to power plants who want to make better drive choices in order to improve efficiency, operational flexibility and reliability. Here is a road map to help utilities organize their time at the conference. The Power Plant Drives Global Decisions Positioning System™ (GDPS) can be used to determine which stands and which papers will be of importance..

As a plant operator you will have a chance to visit with exhibitors, speakers and fellow attendees about drives. They would include:

System suppliers

Rotary equipment suppliers

Consultants

Drive suppliers

Other utility personnel

The venue can be:

Exhibition stands

Speeches

Discussions with other attendees including other utility personnel

System suppliers using drives

|

Conveyors |

Feeders |

Sorbent And Flyash Pneumatic Conveying |

Cooling Towers |

#

Speeches:

Wednesday 9:30 a.m. Benefits of applying direct drive fan motor technology for process cooling.

Robbie Mcilveen - Baldor Electric

Insights

Variable Speed Drives Needed For Activated Carbon Injection

A variety of complications have arisen from the installation of first generation ACI systems. CPS Energy is currently installing ACI on its two largest units. CPS and Sargent & Lundy reviewed experiences of operating ACI systems and developed specifications building on lessons learned, Kevin Schaefer and Holly Hills of Sargent & Lundy and Shane Bemis of CPS Energy told the Electric Power 2013 audience.

Process issues involved -------------------Equipment issues include blower type, blower size and speed, rotary valves, gravimetric feeders, eductors, diverter valves. Distance must be considered between the silo and injection point in determining the blower. Variable-frequency drives on the blower give better control and reduce PAC consumption. For rotary valves, ---------------------------------------------------------------------------------------------maintenance

Special Gear Drives for Wet And Hybrid Cooling Towers

The trickling of water in wet cooling towers is selectively controlled by the cooling tower drive. Usually two-stage bevel-helical gear units are used in addition to the motor. FLENDER gear units are specially designed for use in wet and hybrid cooling towers. As a major design criterion, the fan speed is optimized by using the most diverse transmission ratios. If any special transmission ratios are needed, these can also be provided. The resulting reactive forces of the fan can be absorbed directly by the gear unit.

As the motor is situated outside the cooling tower, the gear unit located in the middle is driven externally by a long composite coupling which is also included in the Siemens product portfolio. Siemens stand # name cell e-mail

Geothermal Plants Have Special Cooling Needs

-----------------For example, a 22 MW geothermal plant requires the same size cooling tower as a 50 MW natural gas steam plant. U.S. Geothermal VP of Project Development Kevin Kitz says this is why reducing operation and maintenance costs of the heat rejection system are critical to the economic success of low-temperature geothermal plants like Neal Hot Springs. When Kitz learned about Baldor’s direct drive cooling tower motor, which replaces the traditional and maintenance-prone gearbox

Rotary Equipment Suppliers Using Drives

|

Fans |

Compressors |

Pumps |

Rotary Heat Exchangers |

Pulverizers |

|

Chicago Blower Stand No |

xxxxx |

xxxx |

SPX Stand # |

Alston Stand # |

|

Howden |

xxxxx |

xxxxx |

Howden Stand |

B*W Stand |

|

xxx |

xxxx |

xxxx |

SPX Stand # |

Babcock |

|

xxx |

xxx |

xxx |

xxx |

FW |

|

|

|

|

|

|

Xxxxxxxxxxxxxx

Drive Suppliers

|

Frequency Converters |

Gears |

Couplings |

Motors |

Power-Gen 2013 Will Aid in Your CCR and Effluent Guidelines Decisions

Power-Gen 2013 will be very helpful to coal-fired power plant operators who are making decisions about how to meet the propped CCR and Effluent standards. Here is a road map to help utilities organize their time at the conference. The CCR and Effluent Global Decisions Positioning System™ (GDPS) can be used to determine which stands and which papers will be of importance.

The proposed Effluent Guideline rule and the proposed CCR rule have to be viewed together. Douglas J. Dahlberg PE, Project Associate II at Sargent & Lundy LLC, in a recent McIlvaine webinar anticipates a final rule to classify CCRs under Subtitle D, Resource Conservation and Recovery Act (RCRA), similar to Municipal Waste. The June 7, 2013 Code of Federal Regulations, Effluent Limitations Guidelines (ELG) and Standards for the Steam Electric Power Generating Point Source Category Proposed Rule stated: “reliance on (current) data….. coupled with the ELG proposed requirements could provide strong support for a conclusion that regulation of CCR disposal under Subtitle D would be adequate.” Speculation on final regulation publishing timing ranges from October 2013 to the end of 2014.

Whether your current disposal operation is wet or dry bottom/flyash/FGD byproducts, above or below grade, permanent disposal or transfer, your basic choices include:

Close and cap your current disposal operation

Transition the existing site to comply with new requirements

Develop a separate new compliant disposal facility. Regardless of whether your existing disposal site is lined, monitored or impacts groundwater, the best option may be to combine the disposal options.

Doug made a convincing argument that you can maximize the use of your existing site by depositing the new waste over the one which has already been covered and capped.

There are various technology solutions to the bottom ash problem. Ron Grabowski, Vice-president Business Development at Clyde Bergemann Power Group Americas, Inc., Materials Handling Product Division, discussed the handling of bottom ash.

He explained all the options including one which eliminates the use of any water:

· Divert the flow of the existing bottom ash slurry piping to new dewatering bins.

· Divert the flow of the existing bottom ash slurry piping to a remote submerged scraper conveyor (RSSC) system (ASHCON™).

· Replace the bottom ash hopper system with a submerged scraper conveyor (SSC).

· Replace the bottom ash hopper system with a dry ash conveyor (DRYCON™).

Dale Timmons, R.G., Business Development Program Manager at NAES Corporation, discussed the Circumix Dense Slurry System (DSS) technology. NAES Corporation and GEA EGI have teamed to deploy DSS technology in North America. DSS is a proven and commercially deployed technology that uses wastewater (including FGD water) to stabilize ash products.

Ash Handling Exhibits:

· Clyde Bergmann stand #

· United Conveyor stand #

We encourage you to reply to this e-mail and indicate which of the four topics is of interest and also provide your contact details.

$13 Billion Market for Gas Turbine Air Treatment In 2014

New gas turbine air treatment systems revenues will be $10 billion in 2013 while replacement filters, catalysts, ammonia and other consumables will total $3 billion with a $13 billion total expenditure. This is the latest forecast in Gas Turbine Air Treatment Market and Knowledge Bridge published by the McIlvaine Company. (www.mcilvainecompany.com) The following items are included in the capital revenues:

|

Gas Turbine Capital Items 2014 |

|

Intake Housing |

|

Weather Protection |

|

Conditioning |

|

Pre-filtration |

|

Coalescers |

|

Final Filtration |

|

Tempering Air System (Single Cycle) |

|

Duct Burner (Combined Cycle) |

|

Ammonia Injection Grid |

|

CO Reactor |

|

SCR |

|

Process Controls |

|

CEM |

|

Silencer |

|

Stack |

Total $10 Billion

The large quantities of ambient air which is used by gas turbines require significant expenditures for purification prior to contact in the combustion zone. Due to varying weather conditions, various conditioning technologies are incorporated. This can range from simple fogging nozzles to expensive chillers.

The air intake filtration requirements are the same for both single cycle and combined cycle power plants. Stack gas treatment capital requirements are actually greater for a single cycle power plant than a combined cycle power plant. This is due to either the use of tempering air or high temperature catalysts. On the other hand, fewer single cycle power plants are required to use highly efficient SCR systems to reduce NOx. This is because these power plants are often used for peaking service and may only operate 1,000 hrs. per year.

One of the biggest consumable items is the air intake filter. The expenditures for these filters are rising due to the upgrading of the industry. HEPA filters with four times the annual cost of lower efficiency filters are becoming more popular. Increased production and lower washing costs justify the larger expenditure.

|

Gas Turbine Operating and Maintenance Items 2014 |

|

Nozzles |

|

Filters |

|

Coalescers |

|

Filters |

|

Dampers, Drives, Fan Parts, Seals |

|

Burner Parts |

|

Nozzles |

|

Ammonia |

|

Catalyst |

|

Sensors, Valves, Seals, Gaskets |

|

RATA Testing, Protocol Gases, Instruments |

|

Silencer Parts |

Total $3 Billion

For more information on Gas Turbine Air Treatment Market and Knowledge Bridge, click on:

http://home.mcilvainecompany.com/index.php/markets/28-energy/610-59ei.

Municipal Wastewater Plants Will Spend $1.6 Billion for Air and Water Monitoring Equipment Next Year

Municipal wastewater plants will spend $1.6 billion for instruments and controls to monitor air and water pollutants next year. This is the latest forecast in Air & Water Pollution Monitoring World Markets published by the McIlvaine Company. (www.mcilvainecompany.com)

Revenues ($ Millions)

|

World Region |

2014 |

|

Africa |

74 |

|

CIS |

71 |

|

East Asia |

571 |

|

Eastern Europe |

39 |

|

Middle East |

78 |

|

NAFTA |

259 |

|

South & Central America |

120 |

|

West Asia |

209 |

|

Western Europe |

213 |

|

Total |

1,634 |

East Asia will be the largest purchaser and account for more than one third of the total. This is due to the many new treatment plants being built to accommodate the urban migration in the region.

In the U.S. and Western Europe, most of the expenditures are related to efforts to automate and increase plant performance. For example, instruments to measure sludge dryness are allowing operators to reduce polymer costs along with providing a more consistent sludge. This results in lower fuel consumption in the sludge incinerator.

Municipal wastewater plants are served with sewer systems often stretching for many miles. Remote monitoring provided by Pentair Environmental and other suppliers helps avoid plugging, overflow and other problems. Monitoring is utilized for:

· Wastewater network investigations

· Pump station control

· Pipeline condition assessment

· Overflow alarming

· Source tracing

· Leak detection

Most of the investment will be in water-related monitoring. However 10 percent of the total will be for air monitoring. Odor control is a major problem for wastewater plants. This requires periodic monitoring of the air emissions. Sewage sludge incinerators are equipped with stack gas continuous emissions monitors.

For more information on Air & Water Pollution Monitoring World Markets, click on: http://home.mcilvainecompany.com/index.php?option=com_content&view=article&id=106extsup1.asp.

Renewable Energy Briefs

Waste Management to Build Renewable Natural Gas Facility

Waste Management announced it is building a facility that will create pipeline-ready natural gas from its Milam Landfill in Fairmont City, IL.

The processed renewable natural gas will be injected into the pipelines of Ameren Illinois for withdrawal at other locations, including some Waste Management facilities. Once there, it will be used to fuel truck fleets and other equipment that run on compressed natural gas, or CNG. Waste Management is calling the plant the Renewable Natural Gas Facility and expects it to begin delivering gas to the pipelines in late summer 2014.

At the landfill, on-site emissions will be reduced by the Renewable Natural Gas Facility. Since the gas will be treated, rather than burned onsite, Waste Management anticipates about a 60 percent reduction in emissions of carbon monoxide, nitrogen oxides, and particulate matter.

The facility will be designed to process approximately 3,500 standard cubic feet per minute (SCFM) of incoming landfill gas, equivalent to 105 million British thermal units per hour. This is as much gas as it takes to fuel about 400 of Waste Management’s CNG collection trucks each day and represents more than ten percent of the natural gas that is used in Waste Management’s entire existing CNG fleet. Waste Management of Illinois currently has more than 100 CNG trucks in its fleet displacing about one million gallons per year of diesel fuel.

NaturEner’s Rim Rock Wind Facility Achieves Milestones in Energy Delivery and Industry-Leading Eagle Protection Measures

NaturEner, a leading renewable energy producer, announced that it is finalizing preparations to begin delivering energy over the newly commissioned Montana-Alberta Tie-Line (MATL) transmission line that runs between Great Falls, Montana and Lethbridge, Alberta. With MATL online, NaturEner will be able to deliver up to 189 megawatts (MW) of clean, renewable energy from its Rim Rock wind farm located in Glacier and Toole counties in Montana, which is enough to power approximately 60,000 homes per year.

As NaturEner reaches this milestone, it is also launching industry-leading wildlife conservation measures at the Rim Rock project to significantly reduce the already low risk of potential harm to eagles and other birds. These measures include the installation of innovative radar detection systems for eagles, and the positioning of trained avian biologists at different locations with the ability to immediately pause wind turbine operations, in coordination with NaturEner’s 24/7 real-time Operations Center, if there is even a slight risk of potential harm to an approaching eagle. NaturEner is also further developing the radar detection systems so that they can eventually be operated automatically and remotely once the systems are refined and adjusted to the topography and specific characteristics of the Rim Rock project.

First Solar to Build 250 MW Power Plant in California for NextEra Energy Resources

First Solar, Inc. announced it has entered into an agreement to construct a 250 megawatt (MW) AC solar power plant in Riverside County, CA, for a subsidiary of NextEra Energy Resources, LLC.

The McCoy Solar Energy Project will be located on approximately 2,300 acres of mostly public land provided by the Bureau of Land Management (BLM) approximately 13 miles northwest of Blythe, CA. Under the agreement, First Solar will provide Engineering, Procurement and Construction services, using First Solar's cadmium telluride (CdTe) photovoltaic thin-film modules.

The project is located near the 550MWAC Desert Sunlight Solar Farm, jointly owned by a subsidiary of NextEra, GE Energy Financial Services, and Sumitomo Corporation of America, currently under construction by First Solar. An affiliate of NextEra Energy Resources also previously purchased two projects built by First Solar in Canada.

JinkoSolar Signs Strategic Agreement for 120 MW with the Local Authority in Electromechanical Industrial Park, Zhenjiang New Area in Jiangsu Province

JinkoSolar Holding Co., Ltd. announced that it has signed a strategic agreement with the local authority in Electromechanical Industrial Park, Zhenjiang New Area, Jiangsu Province, to develop 120 MW distributed PV power plant within 3 years. It will be the largest distributed PV power plant in China upon its completion.

With a total investment of more than RMB 1 billion, the project covers an area of approximately 1.2 million square meters and is designed for commercial and residential rooftop installations in Zhenjiang New Area, Jiangsu Province. JinkoSolar will be responsible for project declaration, investment, EPC, operation and maintenance. Following completion, the rooftop's owners will be able to self-generate and consume the energy and allow for excess power to be sold back to the state grid with the distributed on-grid power tariff.

Southern Company Subsidiary Turner Renewable Energy Partnership’s Largest Tracking Solar Plant Enters Service

The largest tracking solar plant acquired by Southern Company subsidiary Southern Power in partnership with Turner Renewable Energy, the Spectrum Solar Facility, has begun commercial operation. The 30-megawatt (MW) solar photovoltaic (PV) installation utilizes tracking technology that enables greater operating efficiency by optimally directing solar panels to track the sun as it moves across the sky. Both the Spectrum Solar Facility and the partnership's second-largest tracking solar plant — the 20-MW Apex Solar Facility — are located in Clark County, NV

The 311-acre site was built and will be operated and maintained by SunEdison, a leading global provider of solar technology and services. Southern Power and Turner Renewable Energy acquired the project from SunEdison in September 2012.

Ted Turner, owner of Turner Renewable Energy, teamed with Southern Company through a subsidiary in January 2010 to form a strategic alliance to pursue development of renewable energy projects in the United States. The partnership has primarily focused on acquiring solar PV projects where solar resources are most favorable.

For more information on Renewable Energy Projects and Update please visit

Headlines for the October 18, 2013 – Utility E-Alert

UTILITY E-ALERT

#1147– October 18, 2013

Table of Contents

COAL – US

§ Dynegy acquisition of Ameren’s Illinois Power Plants still Contingent on Variance for Emissions Controls

§ Supreme Court to weigh EPA’s Greenhouse Gas Emissions Rule for New Power Plants

§ Luminant to use Martin Lake 3 as Seasonal Power Plant

COAL – WORLD

§ Aboitiz Power to build 2x150 MW Power Plant in Davao, Philippines

§ Invitation for Preliminary Bids for 4000 MW Surguja Power Project (Chattisgarh, India) Withdrawn

§ 300 MW Maamba Power Project in Zambia has Loan

§ Pre-bid Conference for Bhedabahal and Cheyyur Ultramega Power Projects attracts Crowd

§ Foster Wheeler to supply CFB Boiler to 50 MW Tychy in Poland

§ Pakistan to Convert Oil-fired Power Plants to Coal-firing

§ JBIC, South Korea’s EximBank to finance 1,000 MW Coal-fired Power Plant Expansion in Cirebon, Indonesia

§ Malaysian Environmentalists alarmed over Possible Reviving of 300 MW Sabah Coal-fired Power Project

GAS/OIL – US

GAS/OIL – WORLD

NUCLEAR

BUSINESS

HOT TOPIC HOUR

For more information on the Utility Tracking System, click on: http://home.mcilvainecompany.com/index.php?option=com_content&view=article&id=72.

Chinese FGD and SCR Program and Impact on the World Will Be ‘Hot Topic” Next Week

At 10 a.m. on October 31, McIlvaine will chair a discussion on the impact of the huge Chinese FGD and SCR program. There are two main subjects for review. One is the impact on the air pollution market and the other is the impact on world air quality.

The impact on the market will be huge. China will be installing more FGD and SCR than the rest of the world combined. By 2020, China will also have an installed base close to half the world total in both technologies. This means that half the limestone market and half the catalyst market will be in China. The suppliers of the systems are mostly joint ventures or licensor relationships. The hands on experience gained by the Chinese engineers will be an invaluable knowledge base for international activities by the larger Chinese air pollution companies. The question is not whether there will be Chinese competition in Asia and Africa, but whether the Chinese will also be strong in Europe and the U.S.

The impact of world air quality will also be significant. China will be increasing CO2 emissions faster than the rest of the world decreases them. This week the newspapers were showing the smog photos in Harbin. This creates a challenge for China. Reducing CO2 is a costly option. On the other hand, maximizing the pollutant reduction (particulate, NOx, SO2, toxics) from power plants and other industry stacks is relatively cheap. So is it not likely that China will opt to have some of the world’s most stringent emission regulations to counter balance the program which increases CO2. All these issues will be presented and discussion encouraged.

To register for the “Hot Topic Hour” on October 31, 2013 at 10 a.m. CDT, click on:

http://www.mcilvainecompany.com/brochures/hot_topic_hour_registration.htm.

McIlvaine Hot Topic Hour Registration

On Thursday at 10 a.m. Central time, McIlvaine hosts a 90 minute web meeting on important energy and pollution control subjects. Power webinars are free for subscribers to either Power Plant Air Quality Decisions or Utility Tracking System. The cost is $125.00 for non-subscribers. Market Intelligence webinars are free to McIlvaine market report subscribers and are $400.00 for non-subscribers.

|

DATE |

Non-Subscribers Cost |

SUBJECT |

Webinar Type |

|

October 31, 2013 |

$125.00 |

Chinese FGD/SCR Program and Impact on the World |

Power |

|

November 21, 2013 |

$125.00 |

Wet vs Dry ESP |

Power |

|

December 5, 2013 |

$125.00 |

Update on Gasification Projects and Technology |

Power |

|

December 12, 2013 |

$125.00 |

Selecting FGD Scrubber Components |

Power |

|

December 19, 2013 |

$125.00 |

Application of U.S. Mercury Control Technology in Other Countries |

Power |

|

January 9, 2014 |

$125.00 |

Improving ESP Performance |

Power |

|

January 16, 2014 |

$125.00 |

Corrosion Issues and Materials for APC Systems |

Power |

|

January 23, 2014 |

$125.00 |

Co-Firing Sewage Sludge, Biomass and Municipal Waste |

Power |

|

January 30, 2014 |

$125.00 |

Impact of Ambient Air Quality Rules on Fossil Fueled Boilers and Gas Turbines |

Power |

|

February 6, 2014 |

$125.00 |

Review of EUEC |

Power |

|

February 13, 2014 |

$125.00 |

NOx Catalyst Performance on Mercury and SO3 |

Power |

|

February 20, 2014 |

$125.00 |

CFB Technology and Clean Coal (Update on CFB Reactor Technology) |

Power |

|

February 27, 2014 |

$125.00 |

Dry FGD: Spray Dry vs. CFB vs. DSI |

Power |

|

March 6, 2014 |

$125.00 |

Update on IGCC (Integrated Gasification Combined Cycle) |

Power |

|

March 13, 2014 |

$125.00 |

Update on Oxy-Fuel Combustion |

Power |

|

March 20, 2014 |

$125.00 |

Air Preheaters & Heat Exchangers |

Power |

|

March 27, 2014 |

$125.00 |

Mercury Control and Removal |

Power |

|

April 3, 2014 |

$125.00 |

HRSG Design, Operation and Maintenance Considerations |

Power |

|

April 10, 2014 |

$125.00 |

|

Power |

|

April 17, 2014 |

$125.00 |

Measurement and Control of PM2.5 |

Power |

|

April 24, 2014 |

$125.00 |

Status of Carbon-to-Liquid Projects and Technology |

Power |

|

May 1, 2014 |

$125.00 |

Renewable Energy, Status, Options, Technology Update |

Power |

|

May 8, 2014 |

$125.00 |

Valves for Power Plant Steam and Cooling Water |

Power |

|

May 15, 2014 |

$125.00 |

Water Treatment During Gas and Oil Production |

Power |

|

May 22, 2014 |

$125.00 |

Advances in Coal Blending |

Power |

|

May 29, 2014 |

$125.00 |

Clean Coal Technologies |

Power |

|

June 5, 2014 |

$125.00 |

Material Handling in Fossil Fueled Power Plants |

Power |

|

June 12, 2014 |

$125.00 |

Industrial Boiler MACT - Impact and Control Options |

Power |

|

June 19, 2014 |

$125.00 |

Multi-emissions Control Technologies |

Power |

|

June 26, 2014 |

$125.00 |

Next Generation of Coal Combustion Technologies |

Power |

|

July 10, 2014 |

$125.00 |

Compliance Strategies for PM2.5 |

On Thursday at 10 a.m. Central time, McIlvaine hosts a 90 minute web meeting on important energy and pollution control subjects. Power webinars are free for subscribers to either Power Plant Air Quality Decisions or Utility Tracking System. The cost is $125.00 for non-subscribers. Market Intelligence webinars are free to McIlvaine market report subscribers and are $400.00 for non-subscribers.

To register for the “Hot Topic Hour”, click on:

http://www.mcilvainecompany.com/brochures/hot_topic_hour_registration.htm.

----------

You can register for our free McIlvaine Newsletters at: http://www.mcilvainecompany.com/brochures/Free_Newsletter_Registration_Form.htm.

Bob McIlvaine

President

847 784 0012 ext 112

rmcilvaine@mcilvainecompany.com

191 Waukegan Road Suite 208 | Northfield | IL 60093

Ph: 847-784-0012 | Fax; 847-784-0061