|

||||||||||||||

|

||||||||||||||

∑ Macro Trends in Oil and Gas

∑ Oil and Gas Sales Intelligence

∑ $61 Billion Flow Control and Treatment Market in 2016 in the Energy Sector

∑ DCS, SIS, PRM, FOUNDATIONô Fieldbus Instruments and OTS Installed at Thailandís First LNG Terminal

Macro Trends in Oil and Gas

MACRO TREND #1: North American Shale Gas

∑ Current Situation

o Near-historical low prices for natural gas, completely out-of-sync with world oil and energy prices ($2 to $4/MBtu vs. formerly $14/MBtu)

∑ Likely Developments (Opportunities)

o Growth in North American LNG production for world export to higher priced world energy markets

o Growth in natural-gas-fired power plants (coal conversions and CCGT)

o Growth in downstream infrastructure for CNG for motor fuel in North America

o Growth in North American fertilizer and petrochemical production using shale gas feedstock

o Possible growth in GTL facilities in North America

∑ Risk Factors

o Staying power of shale gas supplies over long term (25 years or more to justify costly infrastructure investments)

o Instability in price of natural gas

o Difficult permitting process for LNG processing plant construction

MACRO TREND #2: North American Shift to Heavy/Sour Crude, Shale Oil and NGLís

∑ Current Situation

o Development of shale oil and Canadian tar sands, plus NGLís associated with shale gas have increased availability of domestic crude

o Greater need for desulfurization units to address higher sulfur content of sour crude, and to meet EPA requirements for low-sulfur fuels

o Smaller fraction of heavy crude available for gasoline, with higher output capacity for diesel and other distillates

∑ Likely Developments (Opportunities)

o Growth in North American refinery capacity for hydro treaters to produce low sulfur fuels

o Growth in North American refinery capacity for hydrogen production to support hydro- treaters and hydro cracking

o Growth in North American refinery capacity for cokers to process heavy residuals

o Growth in North American refinery capacity for diesel fuels, which are preferred in the rest of the world for higher efficiency

∑ Risk Factors

o Staying power of shale gas supplies over long term (25 years or more to justify costly refinery infrastructure investments)

o Continued supply of wet gas and NGLís

MACRO TREND #3: Continued Trend For Middle East Expansion in Downstream Refinery Operations and Expansion of Asian Refinery Operations

∑ Current Situation

o There is currently work in process for additional refinery capacity in Saudi Arabia, Qatar, UAE, Iraq, China, Cambodia and other countries, even as European production capacity is scaled back

∑ Likely Developments (Opportunities)

o Increased refinery equipment sales in these regions (pumps, valves, compressors, etc)

o Increased activity specifically for hydro treating equipment for low-sulfur fuels for export to Europe and Asia

∑ Risk Factors

o Regional instability in Middle East

o Continued demand growth in Asia

MACRO TREND #4: Eventual Export of Fracking and Horizontal Drilling Technology to Australia, China, and Latin America for Shale Gas Development

∑ Current Situation

o Export of the technology is already happening

∑ Likely Developments (Opportunities)

o Export opportunities for suppliers of fracking pumps, multi-phase flow meters, etc.

∑ Risk Factors

o Assimilation of technology by local suppliers, cutting out the early adopters/innovators in North America

These trends are extracted from Oil, Gas, Shale, Refining Markets and Projects. For more information on this service, click on: http://www.mcilvainecompany.com/brochures/energy.html#n049.

Oil and Gas Sales Intelligence

(Listed by most current date)

∑ GE to Supply Equipment and Services for Refinery Upgrade in Turkey (Article Dated: 12/28/2012)

∑ Petrotrin Awards Two-year Refinery Contract to GE Water (Contract Dated: 12/28/2012)

∑ KNPC Awards Foster Wheeler PMC Contract for Kuwait $500 Mln Clean Fuels Refineries Project (Contract Dated: 12/27/2012)

∑ Pakistan State Oil Unveils Major Development with Plans for New Refinery (Article Dated: 12/27/2012)

∑ Intergraphģ SmartPlantģ Enterprise Selected for Ichthys LNG Project (Project Dated: 12/27/2012)

∑ Jacobs Selected for Upstream Santos GLNG Project In Australia (Project Dated: 12/27/2012)

∑ Alfa Laval Wins Compact Heat Exchangers Order for Australia LNG Plant (Product Description Dated: 12/27/2012)

∑ Cameron LNG Files Federal Permit Application to Expand Its Existing LNG Terminal (Project Dated: 12/27/2012)

∑ Cheniere and Total Sign LNG SPA for LNG Exports that Commences with Fifth Train at Sabine Pass (Article Dated: 12/27/2012)

∑ BHP Agrees to Sell Browse LNG Stake to PetroChina for US$1.63 Bln (Project Dated: 12/26/2012)

∑ Gorgon LNG will Add Fourth Train (Project Dated: 12/26/2012)

∑ RINA Group Wins Greek LNG Terminal Expansion Contract (Contract Dated: 12/26/2012)

∑ Linde AG to Build LNG Terminal for Skangass near Gothenburg, Sweden (Project Dated: 12/26/2012)

∑ Singapore Exploring Construction of Second Regas Facility while Malaysia Develops Pengerang Terminal (Article Dated: 12/26/2012)

∑ Arctic Yamal LNG Ahead of Schedule According to Officials (Project Dated: 12/26/2012)

∑ PETRONAS Awards Linde Major Contract for Malaysia LNG Plant (Contract Dated: 12/26/2012)

∑ Abu Dhabi's Dolphin Energy Awards $250 MLN EPC Contract to Larsen & Toubro for Ras Laffan Expansion (Contract Dated: 12/21/2012)

∑ CB&I Receives $550 Mln Esso Longford Gas Conditioning Plant Contract (Contract Dated: 12/21/2012)

∑ IEA Says Iraq's Oil Output to Double this Decade (Analysis Dated: 12/21/2012)

∑ Exxon, BHP to Spend over $1 Bln for New Gas Conditioning Plant at Longford Facility (Project Dated: 12/21/2012)

∑ FMC Technologies Receives $152 Mln Subsea Equipment Order for Statoil's Oseberg Delta 2 Project (Project Dated: 12/21/2012)

∑ FMC Technologies Receives $39 Mln Subsea Equipment Order for Statoil's Tyrihans Field (Project Dated: 12/21/2012)

∑ Technip Secures EPCI Contract from BG International for Starfish Field (Contract Dated: 12/21/2012)

∑ CB&I Awarded $110 Mln Storage Contract in the Middle East (Contract Dated: 12/21/2012)

∑ Fluor CEO Sees Shale Gas Reviving U.S. Industries (Article Dated: 12/20/2012)

For more information on Oil and Gas Sales Intelligence contact Bob McIlvaine at: rmcilvaine@mcilvainecompany.com or 847-784-0012 ext 112.

$61 Billion Flow Control and Treatment Market in 2016 in the Energy Sector

The power, refining and oil and gas industries will combine to purchase pumps, valves, instrumentation, filters, clarifiers, separators scrubbers, dust collectors and other air and liquid treatment equipment totaling $61 billion in 2013. This is the conclusion in Air/Gas/Water/Fluid Treatment & Control: World Markets published by the McIlvaine Company.

|

Flow Control and Treatment Revenues World 2013 ($ Millions) |

|||

|

Equipment Type |

Oil & Gas |

Power |

Refining |

|

Cartridge |

284 |

210 |

70 |

|

Chemicals |

1,027 |

4,647 |

2,592 |

|

Macrofiltration |

50 |

633 |

50 |

|

Membrane |

111 |

748 |

109 |

|

Mixers, Aerators, UV Ozone |

700 |

3,150 |

1,750 |

|

Other |

2,730 |

12,285 |

6,825 |

|

Pumps |

1,000 |

3,467 |

1,000 |

|

Sedimentation & Centrifugation |

30 |

1,983 |

30 |

|

Valves |

5,000 |

7,237 |

3,000 |

|

Total |

10,932 |

34,360 |

15,426 |

Purchases of flow control and treatment equipment will rise significantly in the U.S. due to the activity in non-conventional fuels. Extraction of gas and oil through hydraulic fracturing involves substantial amounts of water as well as fuels. New regulations impacting the release of gases during completion will boost air treatment revenues.

Refineries are being upgraded to produce higher quality lower polluting fuels. In the U.S. investments are being made to handle the liquids generated from the non-conventional gas extraction. The processing of oil sands in Canada will require substantial new treatment and flow investments.

In the power sector, the biggest markets will be in Asia where an ambitious program to expand electricity generation through construction of coal-fired power plants will continue. Many of these power plants will use treated municipal wastewater or reclaimed water from other sources. The use of scrubbers to capture the SO2 from these plants results in substantial movement of slurries and investment in air pollution control equipment.

This forecast includes air pollution control, water pollution control, processing of liquid fuels such as chemicals, and any application where the movement or control of air, gases, liquids or fluids or the treatment of these substances is involved.

For more information on: Air/Gas/Water/Fluid Treatment and Control: World Markets, click on: http://home.mcilvainecompany.com/index.php?option=com_content&;view=article&id=71.

DCS, SIS, PRM, FOUNDATIONô Fieldbus Instruments, and OTS Installed at Thailandís First LNG Terminal

PTT LNG Company Limited, Rayong, Thailand

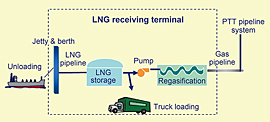

Natural gas is Thailandís primary fuel source and is absolutely essential to the countryís industries, particularly the power sector: two thirds of the countryís electricity is generated at gas-fired power plants. Much of Thailandís natural gas comes from gas fields in the Gulf of Thailand. It is transported throughout the country via a network of offshore and onshore pipelines built by the national gas and oil company, PTT Public Company Limited (PTT PCL). In 2005, due to economic growth and the resulting shortfall in the supply of natural gas, the countryís National Energy Policy Board resolved to begin importing LNG.

In anticipation of this policy shift, PTT PCL established PTT LNG Company

Limited (PTTLNG) in 2004 and tasked it with building and operating the countryís

first LNG import terminal at Map Ta Phut, a deepwater port 220 km southeast of

Bangkok. They send out gas to the adjacent Map Ta Phut industrial estate, which

is one of Thailandís most important industrial areas and home to a number of

petrochemical, oil refining, steel, and fertilizer plants. Gas also is

transported via the PTT pipeline system to power companies and other important

industrial customers throughout the country.

Construction of the first terminal commenced in early 2008 and was completed in

2011, and the terminal began commercial operation later that year when it

received its first shipment of LNG from Qatar. This terminal includes a jetty

capable of receiving LNG carriers with capacities up to 264,000 m3,

two 160,000 m3 full containment LNG tanks, a 5 million ton/year

regasification (vaporizer) train, a boil-off gas recondensor, a send out

station, and an LNG pump.

To control key terminal facilities, PTTLNG went with a Yokogawa solution

consisting of the CENTUM VP production control system, ProSafe-RS safety

instrumented system, OmegaLand operator training system (OTS), asset management

package - Plant Resource Manager (PRM), and FOUNDATION

fieldbus field digital technology. Work on this project was executed by

Yokogawa, which functioned as main automation contractor (MAC).

PTT LNG terminal overview

The Challenges and the Solutions

1. Safe, uninterrupted operations

Customers all over the country rely on receiving a regular supply of gas from

this LNG import terminal, which operates 24/7. It is thus absolutely essential

to prevent any shutdowns or other problems that would interrupt this supply. A

key asset that makes this possible is the OmegaLand OTS. In preparation for the

arrival of each LNG carrier, operators in the central control room (CCR) run

simulations of all key terminal processes such as offloading and regasification

on the OTS. This reduces the likelihood of any mistakes and ensures smooth and

safe terminal operations.

While configuring this fully integrated control system solution for PTTLNG,

Yokogawa strictly followed the following safety standards:

|

- |

NFPA59A (National Fire Protection Association) standard on production, storage, and handling of LNG |

|

- |

EN1473 (European Norm) standard on onshore installation and equipment design for LNG |

|

- |

SIGTTO (Society of International Gas Tanker and Terminal Operations Limited) operating standard and best practices for gas tanker and terminal operations |

Once all personnel are all fully trained and gain sufficient experience in

operating this terminal, the plan is for it to operate with just six personnel

on each 12 hour shift: one supervisor, one board operator, and four field

operators.

2. Asset maximization

The transmitters, flowmeters and control valves throughout this terminal are all

FOUNDATION

fieldbusenabled and can be continually monitored using the PRM solution. Alarms

are issued before any device fails completely, enabling predictive maintenance

that reduces maintenance costs throughout the facility lifecycle. The complete

integration of all systems including those at the jetty substation, laboratory,

fire station, and truck loading administration room as well as 10 other

subsystems via Modbus communications allows operators at the CENTUM human

interface stations (HIS) in the CCR complete real-time access to information on

operations throughout the terminal. This ensures that they have all the

information needed to make the right decisions at the right time. PTTLNG is thus

able to make maximum use of all of this terminalís assets.

3. Effective operator training

As this LNG import terminal is the first of its type in Thailand, it is

absolutely essential from the safety and efficiency standpoints for its

operators and engineers to always be fully trained on all system operations and

procedures. By using the OmegaLand OTS for its operation familiarization

training programs, PTTLNG is able to give its personnel repeated training for a

full range of operational procedures as well as all situations that they can

expect to encounter while operating and maintaining this terminal.

4. Quality control

Quality control is also essential at this terminal. The results of gas quality

analysis and all associated data are entered into the laboratory instrument

management system (LIMS) server in the laboratory room and all data are

transferred to the CENTUM system, which generates a laboratory report allowing

each operator to confirm their operating procedures and make any required

adjustments to maintain high quality production.

5. Truck loading

A portion of the LNG arriving at this terminal is transported in trucks to local

LNG terminals. A terminal automation system (TAS) keeps track of all essential

custody transfer data such as the truck number, destination, LNG amount, date

and time, and customer name, and this data is all recorded and fed back to the

production control system. So operators can recognize the total LNG amount

versus gasification amount and they can easily visualize the total efficiency of

this plant.

----------

You can register for our free McIlvaine Newsletters at: http://www.mcilvainecompany.com/brochures/Free_Newsletter_Registration_Form.htm.

Bob McIlvaine

President

847 784 0012 ext 112

rmcilvaine@mcilvainecompany.com

191 Waukegan Road Suite 208 | Northfield | IL 60093

Ph: 847-784-0012 | Fax; 847-784-0061

Click here to un-subscribe from this mailing list