|

Markets Shaped by Coronavirus Technology and Pharmaceutical Solutions

All the air, water, energy and cleanroom markets for which McIlvaine forecasts future revenues will be greatly affected by the Coronavirus. There are two specific solutions which will mitigate the impact and allow return to a new normal. One is Coronavirus Technology Solutions. This service with Daily Alerts is showing a path for safe resumption of near normal activities with filtered air, masks, monitoring, decontamination and other PPE.

Coronavirus Pharmaceutical Solutions analyzes the vaccines, therapies, reagents, and test kits which will also have major impact on the return to near normal. The first step is to find products which will solve the problem but an equally big challenge is to produce the hundreds of millions of doses which would be necessary.

McIlvaine has been publishing Cleanroom Projects for many years. This service will help analyze the production quantities of new vaccines and therapies. It will also forecast the timing for effective use. The initial research and trials being carried on by hundreds of pharmaceutical companies need to be analyzed and determinations made about the future success of these products. Detailed tracking of each major product and the company or companies producing it is provided. Click here for a sample profile of Gilead and remdesivir.

Going forward all the McIlvaine market reports will rely on these two analyses to help predict future markets. Despite the claims that we can resume normal routines even if millions die from COVID McIlvaine believes that this will not be the case. So near normal activity will return only with some combination of the two solutions.

Example: McIlvaine is analyzing the impact on media suppliers such as Berry Global. The company has over $12 billion in global sales with home, health and personal care accounting for 30% of the total. Consumer packaging and other businesses are hurt by the pandemic.

Under a base case where the situation continues to slowly improve the relative magnitude on normal business could be a negative 14 whereas growth opportunities would be a positive 10. Air filtration media will be needed to capture the virus. On the other hand, the Merv 8 market may be reduced by the selection of more efficient media. There will be reduced purchases in some of the air filter segments associated with industrial activity. There will be minor positive impact on liquid filtration media. A large number of vaccine and therapy plants will be built. They will use cartridges. But this revenue will be offset by slowdown in food, chemical, and energy which are major cartridge consumers. Reemay cartridges are also used in the pool and spa markets which are being negatively impacted.

Berry is expanding mask media production in France, Germany, and the U.S. A big initiative is a new mask for the general population. The newly introduced Synergex ONE provides a multilayer nonwoven composite product in a single sheet, as an alternative to traditional face mask layer structures. This new material will be manufactured in Europe and serve the European market and is available immediately. the near-term potential is modest but longer term this product could be a leading revenue generator for the company. If three billion people average mask purchases of $10/yr the market would be 60 billon or five times greater than the present sales of Berry.

More gown media will also be sold. There will be a greater positive than negative effect on wipes. Consumer packaging and other business will be negatively impacted by an amount which will offset any gains from coronavirus related activities. The Berry analysis is shown at: http://home.mcilvainecompany.com/images/berry_2020-05-19.pdf

For all the companies supplying air, water, cleanroom, and energy products the future depends on the answer to few questions. To what extent does coronavirus travel like cigarette smoke long distances and retain viability over time? When will successful vaccines and therapies be available? Will outbreaks reoccur each year? Will people take advantage of the technology solutions? Every market forecast needs to make assumptions about the answers to these questions.

Continuously Updated Contacts at facilities needing COVID Protection

Coronavirus Technology Solutions includes contact lists for end users with COVID mitigation needs

Meat Processing Plants with COVID Outbreaks

Healthcare Architects and Planners

The World Valve Market in the Pandemic Era

The world valve market is going to shrink in 2020 and will not return to 2019 levels for several years. The impacts of COVID 19 will be substantial. Many aspects are difficult to predict now. Therefore market forecasts will need to be updated continuously.

There are many difficult applications for valves. High temperatures, abrasive solids, corrosive fluids, and rapid cycling are just some of the conditions which challenge the industry. Both isolation and control valves must be designed appropriately. The valve industry has referred to these applications as “Severe Service.” This segment of the market will be impacted to even a greater degree than the market as whole.

On the other hand, severe service is part of a high-performance segment which includes valves in critical services. So certain of the critical service valves segments will be growing. Specifically, this includes valves for pharmaceutical applications to deal with COVID. This includes vaccines, therapies, and reagents for test kits. Unique butterfly valves with mating flanges allow these pharmaceutical operations to take place without exposure of the product to the environment. The product moves from one process to another after the two valves are engaged and opened.

The oil and gas industry accounts for a large part of the severe service market. With demand falling and the pricing policies of Russia and Saudi Arabia the activity in the shale regions of the U.S will be sharply curtailed. However, in a few years when the corrections set in the U.S. will again become the leading producer.

Oil and gas exploration and production companies, or E&Ps, are slated to lose $1 trillion in revenues in 2020, according to analysts. The E&P industry, which includes oil majors, made $2.47 trillion in revenues globally in 2019. But this year it’s projected to bring in $1.47 trillion, reflecting a 40% decline year-on-year.

Returns for 2021 are now also projected lower, at $1.79 trillion compared to a forecast of $2.52 trillion before the pandemic.

Large oil majors such as Exxon Mobil initially slashed 2020 capital spending budgets by 30 percent or more and with the falling prices are continuing with further cuts.

Many smaller oil companies are expected to seek bankruptcy protection in the coming months after having spent years borrowing billions of dollars to extract and move crude.

Oil companies generally employ service companies to do their drilling and fracking, and so the downturn is particularly painful for those businesses — Halliburton, Baker Hughes and Schlumberger. Service companies have slashed payrolls and budgets.

On the other hand, the investment in automation will accelerate in coming years due to the high cost of labor. The cost per labor hour will rise substantially due to coronavirus prevention and healthcare costs. These automated systems will require substantial numbers of valves. Also, existing manual valves will be automated.

Valve revenues for the 2019 through 2022 period have been forecasted using a relative metric. World valve sales in 2019 are represented as 100 percent. All other numbers are percentages of this 2019 total.

|

Percent of the 2019 Market Held by Each Industry

|

|

Industry

|

2019

|

2020

|

2021

|

2022

|

|

Total

|

100

|

91

|

88

|

102

|

|

Chemical

|

10

|

9

|

9

|

10

|

|

Food

|

3

|

3

|

5

|

6

|

|

Metals

|

5

|

4

|

4

|

5

|

|

Mining

|

1

|

1

|

1

|

1

|

|

Oil & Gas extraction

|

11

|

8

|

5

|

8

|

|

Oil and gas transmission

|

8

|

7

|

6

|

6

|

|

Other Industries

|

5

|

5

|

5

|

6

|

|

Petrochemicals

|

8

|

7

|

6

|

8

|

|

Pharmaceutical

|

5

|

6

|

7

|

8

|

|

Power

|

10

|

9

|

7

|

7

|

|

Pulp & Paper

|

7

|

7

|

6

|

7

|

|

Refining

|

12

|

11

|

10

|

12

|

|

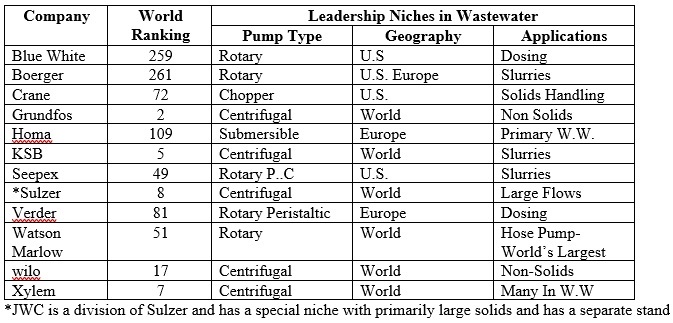

Wastewater

|

9

|

10

|

10

|

11

|

|

Water

|

6

|

6

|

7

|

7

|

There are many variables which will continue to impact the forecasts. Only time will tell whether COVID 19 returns in the fall of 2020. McIlvaine is helping to create a protocol to allow industry to safely return to work. If this is successful and or a vaccine is quickly created and produced the impact of the virus will not be so severe.

Details on the reports are available at www.mcilvainecompany.com

For more information contact Bob McIlvaine at rmcilvaine@mcilvainecompany.com 847 226 2391

|