|

|

|

|

|

Power Air Quality Insights

|

|

|

|||

|

|

|

|

|||||||

|

|

|

|

|

Power Air Quality Insights

|

|

|

|||

|

|

|

|

|||||||

·

FGD Upgrades Will Assure a $5 Billion Annual Market

·

Renewable Energy Briefs

·

Utility E-Alert Headlines –August 1, 2014

·

“Industrial Boiler and Cement

MACT Timing and Compliance Options” is the Hot Topic on August 14th

FGD Upgrades Will Assure a $5 Billion Annual Market

Revenues for FGD suppliers will average about $5 billion per year over the next

five years. This will be split between upgrades of existing systems and new

systems. This is the latest forecast in McIlvaine

FGD Market and Strategies

. (www.mcilvainecompany.com)

Traditionally, most of the market has been for new systems. The maturity

of the market is established with the even split between new systems and

upgrades by 2020.

|

FGD Supplier Revenues ($

Billions) |

||

|

Segment |

2015 |

2020 |

|

New Systems |

4 |

2 |

|

Upgrades |

2 |

2 |

The major markets for new FGD are now in Asia. More than 70 percent of the

new FGD orders in 2015 will be placed for Chinese power plants.

There is a large market developing to upgrade existing FGD systems. The

biggest upgrade market will be China. The government has identified

100,000 MW of FGD which must be upgraded. Adding an extra spray section

will be one of the upgrade measures.

This forecast does not include consumables such as lime and limestone.

Expenditures for these consumables have risen steadily and will continue to do

so at a rate of approximately 5 percent per year until 2020. After

2020, consumables expenditure growth will slow as the number of new coal-fired

power plants built each year will be reduced and there will be increasing

retirements of coal-fired power plants in Europe and the U.S.

This forecast is based on the assumption that a greenhouse gas reduction

program is implemented. There are mixed signals regarding the future of

this program. The U.S. has proposed a carbon trading program for

coal-fired power plants which will result in retirement of nearly 50,000 MW of

coal-fired capacity (20% of the existing fleet). Australia has just

repealed its carbon tax citing the high cost and lack of perceived benefits.

This forecast is also based on the continued success of the program to extract

gas from shale. As long as gas prices remain at around $4-5/MMBtu, gas will be

the preferred fuel for new power plants. The U.S. is likely to generate

all the gas it needs internally and will be able to export some quantity.

China has launched a big program to produce gas from coal. This gas will

be transported across the country and will fuel gas turbine plants in Eastern

cities.

The Chinese gas-to-coal program will have the effect of reducing the longer

range traditional FGD market. However, a very large air pollution market

will be created to capture the H2S and particulate caused by the coal

gasification process.

For more information on

FGD Market and Strategies,

click on:

http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/107-n027

Renewable Energy Briefs

SCE to

Buy More Than 1500 MW of Renewable Power

Southern California Edison (SCE) has signed contracts with solar and geothermal

energy producers representing more than 1,500 megawatts of clean, renewable

power. Signed contracts include the purchase of more than 1,300 megawatts of new

solar power and the re-contracting of 225 megawatts with an existing California

geothermal energy project.

"SCE is

committed to continuing to bring renewable power resources to our customers and

helping achieve California's environmental goals," said Stuart R. Hemphill, SCE

Senior Vice President, Power Supply and Operational Services. "These agreements

will help us maintain diversity in our renewable energy portfolio."

These

contracts resulted from an open and competitive process for all renewable

resources designed to promote market development, contain costs, diversify power

sources and help to meet the state's 33 percent Renewables Portfolio Standard

goals. While solar is one of the fastest-growing renewable types and becoming a

larger part of the state's renewable mix, SCE and other utilities have large

portions of their renewable energy in the form of geothermal and wind

generation. SCE's re-contracting with an existing geothermal project reflects

the utility's commitment to cost effective and diverse renewable energy.

SunPower Breaks Ground on 135 MW Quinto Solar Plant

SunPower Corp. announced it has started construction on the 135-megawatt Quinto

Solar Project in Merced County, CA. The system will generate power for Southern

California Edison's customers, under a long-term power purchase agreement.

In accordance with the company's recently announced holdco strategy, SunPower

expects to own and operate the solar power plant during construction.

Including the Quinto power plant, SunPower has more than 500 megawatts of

residential, commercial and utility solar assets under contract around the world

that it may choose to own for a period of time before a strategic sale or

continue ownership post-construction during the operational phase of the

project. Under this holdco strategy, SunPower expects to improve project margins

and drive higher shareholder returns by capturing the material benefit of its

lower system degradation rates, long term project life as well as benefitting

from distributions from the project as an equity owner.

SunPower anticipates that about 295 jobs will be created during peak

construction of the project, with approximately $80 million in local economic

impact. The company estimates that more than $5 million of tax revenues will

also be generated as a result of the project. After completion, which is

scheduled for late 2015, the Quinto project is expected to generate enough

electricity for 40,000 homes.

SunPower is constructing a SunPower® Oasis® Power Plant system at the

approximately 1,000- acre site. Oasis is a fully-integrated, modular solar power

block that is engineered to rapidly and cost-effectively deploy utility-scale

solar projects while optimizing land use.

CBD

Energy Secures 64 MW Solar Project in Thailand

CBD

Energy Limited, a diversified clean energy company and leading global provider

of solar systems, announced an agreement with Environmental Engineering Group

Thailand (EEG) to construct a 64 MW solar park with a projected development cost

of approximately $112,000,000. The project is supported by a 25-year power

purchase agreement with the Thai Provincial Electricity Authority.

Everbright International Introduces a New Era of “Complete Incineration and No

Landfills” in Suzhou City

China

Everbright International Limited announced that the expansion project of Phase

III of the Suzhou Waste-to-Energy Project passed the “72 +24” hour trial

operation assessment on January 14, 2013, two and half months ahead of the

scheduled commercial operation date, introducing a new era of household waste

“Complete Incineration and No landfills” to the Suzhou Municipality.

Mr.

Chen Xiaoping, Chief Executive Officer of Everbright International, said “With

the Suzhou Phase III Project starting commercial operation, the Suzhou Project

has a total daily waste processing capacity of 3,550 tons and is the nation’s

largest waste-to-energy plant with the highest operational standards.

PG&E

Celebrates 30 Years of Operations at Helms Pumped Storage

Pacific

Gas and Electric Company (PG&E) marks 30 years of commercial operation at Helms

Pumped Storage Project (PSP). The hydroelectric facility was considered an

engineering marvel when it was built and came on line in 1984, and continues to

play a vital role today as well in California’s clean energy future.

Helms

operators can take the plant from an idle state to full generation in eight

minutes. That ability to quickly ramp up and down plays a key role in

integrating intermittent renewable resources such as wind and solar onto the

power grid, said John Conway, PG&E Senior Vice President for Energy Supply.

Nestled

high in the Sierra Nevada Mountains about 50 miles east of Fresno, Helms

features two reservoirs and three hydro pump-generators. The generators can

produce a total of 1,212 megawatts of electricity.

During

times of high electric demand, water flows downhill from Courtwright Lake at the

higher elevation (8,200 feet) through the powerhouse. When there is excess

generation online, the pumps can be reversed, pushing the water uphill from Lake

Wishon at the lower elevation (6,500 feet) to recharge the upper reservoir.

For more information on Renewable Energy Projects and Update,

please visit:

Headlines for Utility E-Alert – August 1, 2014

UTILITY E-ALERT

#1185 – August 1, 2014

Table of Contents

COAL – US

COAL – WORLD

GAS/OIL

– WORLD

CO2

NUCLEAR

·

Vermont Yankee

Nuclear Power Plant may shut down December 29

·

Westinghouse

hopes for Nuclear Power Plant deal in Bulgaria

·

Rosatom signs

MOU to build Floating Nuclear Power Plants with China

BUSINESS

·

Berkshire

Hathaway Application to buy AltaLink receives Preliminary Approval

·

Mitsubishi

Hitachi Power Systems to merge with Babcock-Hitachi

·

URS and Mobotec

bring Proven NOx Control Technology to the US Coal-fired Power

Industry

·

Mercury Removal from Natural Gas and

Industrial Stacks will generate Billions of Dollars in Annual Revenues for

Solutions Providers

·

Upgrading Coal Plants around

the World is the Best and Quickest Way to Reduce CO2

HOT TOPIC HOUR

·

Many Mercury Sorbent Options discussed in

Hot Topic Hour July 31

·

“MATS Timing and Technology Options” is the

Hot Topic on August 7, 2014

·

Upcoming Hot

Topic Hours

For more information on the Utility Tracking System, click on:

http://home.mcilvainecompany.com/index.php/databases/2-uncategorised/89-42ei

“Industrial Boiler and

Cement MACT Timing and Compliance Options” is the Hot Topic on August 14th

Operators of cement kilns and industrial boilers are in the process of making

final decisions relative to mercury, HCl and toxics reductions. This webinar

will help these operators compare the many options which are available.

The webinar will explore technology options including some very recent

developments. The catalytic filter and the post scrubbing mercury module

are two newly proven technologies. The decisions on upgrading

precipitators or installing fabric filters, using dry or wet scrubbers, and

whether to use sorbent traps or mercury CEMS all have to be made.

Another question is how much time is left to make these decisions? There

is also the uncertainty regarding future regulations and whether to adopt

technologies which provide flexibility. One flexible approach is to invest

in lower cost technology with the potential to upgrade. Australia just

abolished its carbon tax while the U.S. administration is talking about more CO2

reductions. So the strategy for MACT compliance has to factor in the regulatory

uncertainties.

The webinar will be collaborative. A series of questions will be

discussed. The program will be enhanced and initiated with a few short

presentations by experts. The sequence will be based on a unique concept which

compares the decision process to travel through a maze.

The large number of uncertainties makes it difficult to determine a course of

action to deal with the Cement and Industrial Boiler MACT Standards. You

may initially reject plant retirement as a solution, but as the cost of the

compliance options mount, you may have to revisit that decision. You may

make a tentative decision to use wet scrubbing, but then find that the water

pollution control costs make this unattractive. A dry scrubber may look

attractive until you evaluate the restrictions on flyash sales and landfill

costs. The result is that the MACT decision process is complex and can be

likened to a maze.

The upcoming webinar will provide the equivalent of a GPS system to negotiate

the maze. It could be called the MACT Global Decisions Positioning System™

(GDPS).

MACT GDPS

GETTING STARTED

The first step is to identify all the resources to help you in the decision

making. McIlvaine has a number of free sites which explain each of the

control options. They are displayed at

Continuous Analyses.

Another good resource is the Council of Industrial Boiler Owners (CIBO).

They have some valuable summaries of the requirements. All the information

on issues is shown at:

http://www.cibo.org/issues.htm.

The comparisons for proposed and final limits for each pollutant are shown at:

·

Comparison of Proposed, Final and Reproposed Emission Limits for Existing CISWI

Units

·

Comparison of Boiler GACT LimitsCOMPARISON

OF December 2012 FINAL to December 2011 Reproposal and FINAL March 2011 BOILER

MACT LIMITS and June 2010 PROPOSED BOILER MACT LIMITS

There have been good presentations in McIlvaine webinars

Third Time's the Charm? By Mack McGuffey, Troutman Sanders - Hot Topic Hour

March 22, 2012.

Mack reviewed the history of Industrial Boiler MACT which shows that there have

been substantial changes in the proposed limits each time the proposed rule has

been revised.

CEMENT MACT - The Portland Cement Association (PCA) has also been active in

analyzing the regulatory impact of the cement rule. This rule was

litigated

in an April 18, 2014 opinion

authored by Judge Kavanaugh, the D.C. Circuit upheld Environmental Protection

Agency (EPA) emission standards for Portland cement plants but struck down the

rule’s codified affirmative defense for violations that result from

malfunctions, at least as applied to civil penalties assessed in citizen suits.

http://www.velaw.com/resources/DCCircuitStrikesDownAffirmativeDefenseWhileUpholdingPortlandCementMACTRules.aspx

PCA staff have been among the presenters at McIlvaine Cement MACT webinars.

These can be found in the McIlvaine Global Decisions Orchard at

327310 - Cement Manufacturing

水泥生产.

Trinity Consultants has provided a good summary of

the rule at:

http://www.trinityconsultants.com/Templates/TrinityConsultants/News/Article.aspx?id=2992

START THROUGH THE MAIZE

Plant retirement is the first consideration. Capital investment to meet

MACT will be substantial. An old plant may only be valued at $500/kW.

Expenditures to meet MACT may, in an extreme case, be $400/kW, so you are nearly

doubling your investment. Will it be worthwhile? Here are some of

the factors to be considered.

1st

Decision Tree Stop: Plant Retirement Decision Tree

1st

Decision Tree Stop: Plant Retirement Decision Tree

|

Factors Favoring Retirement |

Factors Favoring Retention |

|

|

Excessive Regulatory Cost |

Alternative

Options |

Factors Favoring

MATS Investment |

|

MACT |

GTCC |

Demand Growth |

|

CCR And Effluent |

Wind |

High Gas Prices |

|

Ambient Air Quality |

Solar |

Technology To Make MATS Lower

Cost |

|

Carbon Tax |

Demand Reduction |

Marginal Coal Plants Retired

Instead |

A study for CIBO showed that the average industrial boiler operator would have

to pay as much as a $4/MMBtu premium to have access to natural gas. The capital

cost of new gas turbine combined cycle plants is higher than the retrofit

options whose capital cost is shown at

CIBO Estimated Capital Costs For Air Pollution Control Equipment For Coal-Fired

Industrial Boilers.

PCA expects only 20 cement plants to retire as a result of the MACT rule. This

year cement production is expected to grow by over 6 percent.

Production will grow another 6 percent in 2015. So the demand will be

high. Most plants will opt to consider the capital investment to meet

MACT. Retirement is the initial stop in the maze, but will need to be revisited

as the cost of the MACT compliance option is further developed.

Particulate:

The decision to upgrade to meet MACT has to start with particulate control.

The MACT rule allows the operator to either meet a very low PM2.5

limit or to separately measure toxic metals. Due to the difficulty in measuring

toxic metals, virtually all plants will opt for the lower particulate limit.

2nd

Decision Tree Stop: Particulate Decision

2nd

Decision Tree Stop: Particulate Decision

|

Keep The Existing Precipitator |

Change To Fabric Filter |

|

New downstream scrubber will

obtain additional particulate

removal. |

Can be inserted into existing

precipitator casing. |

|

Can add a wet ESP after the

scrubber. |

Will be used in conjunction with

dry scrubbing or DSI. |

|

Upgrade the existing

precipitator. |

Reduce the sorbent injection for

mercury control. |

|

|

Hot Gas Filtration for all MATS

requirements—See McIlvaine

Website

Hot Gas Filters - Continuous

Analyses |

There are proposed regulations in the U.S. dealing with coal combustion residues

and effluent water quality. Dry scrubbers create combustion residues and

wet scrubbers create effluent. So MACT decisions have to take these future

standards into consideration.

Many cement plants already have fabric filters. They may need to upgrade

to membrane bags to meet MACT. In the mercury webinar in July, W.L. Gore

pointed out that the leakage of activated carbon through the bags was more

likely due to the seam failure than bag inefficiency.

3rd

Decision Tree Stop: Solids Regulations and Flyash Salability

3rd

Decision Tree Stop: Solids Regulations and Flyash Salability

|

Choice of dry scrubbers with

fabric filter for both

particulate control and SO2

capture will result in unsalable

flyash. |

|

Activated carbon in ash may make

flyash unsalable. |

|

New CCR regulations can impact

the MACT choice. |

|

Ramifications of CCR and

effluent analyzed on McIlvaine

website: |

Industrial boiler owners are less concerned about flyash sales than the utility

owners. However, it can be a consideration.

Cement plants are concerned with Clinker Kiln Dust (CKD) quality

The majority of CKD is recycled back into the cement kiln as raw feed. In

addition, new technology has allowed the use of previously landfilled CKD to be

used as raw feed stock. Recycling this byproduct back into the kiln not

only reduces the amount of CKD to be managed outside the kiln, it also reduces

the need for limestone and other raw materials, which saves natural resources

and helps conserve energy. Another principal use of CKD is for various

types of commercial applications. These applications depend primarily on the

chemical and physical characteristics of the CKD. The major parameters that

determine CKD characteristics are the raw feed material, type of kiln operation,

dust collection systems and fuel type. Since the properties of CKD can be

significantly affected by the design, operation and materials used in a cement

kiln, the chemical and physical characteristics of CKD must be evaluated on an

individual plant basis.

4th

Decision Tree Stop: NOx Control Technology

4th

Decision Tree Stop: NOx Control Technology

|

Many plants will have to meet

new NOx limits as a

result of Federal or State

rules. SCR is a big investment

and takes up lots of space, so

you will want to integrate NOx

and MATS decisions. |

|

NOx catalysts can

also oxidize mercury and allow

the wet scrubber to capture more

mercury. |

|

Hot Gas Filtration for all MATS

requirements—See McIlvaine

Website

Hot Gas Filters - Continuous

Analyses |

There are a number of options for industrial boiler and cement plant owners. The

advantages and disadvantages of each are:

|

DeNOx Decisively

Classified Options For Coal,

Cement, Incineration |

||

|

Option |

* |

Details |

|

SCR |

E |

Ammonia injection followed by a

catalytic reactor |

|

|

A |

High efficiency and accepted by

regulatory authorities |

|

|

D |

Cost, catalyst plugging, space |

|

SNCR |

E |

Urea injection in the furnace |

|

|

A |

Low cost, low maintenance, space |

|

|

D |

Low efficiency, ammonia slip |

|

Ozone

Oxidation |

E |

Ozone injection followed by

scrubber |

|

|

A |

Little space if scrubber already

in place |

|

|

D |

Ozone cost, efficiency |

|

Hydrogen

Peroxide |

E |

Chemical injection converts to

NO2 followed by

scrubbing |

|

|

A |

Low capital cost if scrubber

already in place |

|

|

D |

Chemical cost |

|

Catalytic Filter |

E |

Fabric filter has embedded

catalyst |

|

|

A |

Lower footprint with

combination, lower capital and

operating cost |

|

|

D |

Lack of experience |

|

* E=explanation

A=advantages

D=disadvantages |

||

HCl -

There is a requirement in MACT to reduce HCl. EPA says much of the benefit

of MACT is the SO2 reduction which will coincidently take place with

HCl capture.

5th

Decision Tree Stop: Select FGD Type and Reagent

5th

Decision Tree Stop: Select FGD Type and Reagent

One McIlvaine website covers the wet option

Wet Calcium FGD - Continuous Analyses.

Another McIlvaine website covers DSI, spray driers and circulating dry scrubbers

Dry Scrubbing - Continuous Analyses.

Hot Gas Filtration for all MACT requirements—See McIlvaine Website

Hot Gas Filters - Continuous Analyses.

6th

Decision Tree Stop - Air Toxics

6th

Decision Tree Stop - Air Toxics

Three air toxics addressed in MACT are mercury, HCl and toxic metals. The

HCl reduction is tied into the FGD. The toxic metals will be removed by

the particulate collector, so that leaves mercury as the remaining contaminant

to address. McIlvaine has covered all the options for mercury reduction at

Mercury Removal - Continuous Analyses

There have been some new developments. W.L Gore has successfully piloted

their sorbent polymer composite on cement kilns. It follows the baghouse

and cooling system and functions at about 220oF. Non-carbon

bentonite and kaolin based sorbents are also providing competition to activated

carbon.

Panelists for Industrial Boiler and Cement MACT Timing and Compliance Options

Daryl Lipscomb,

Global Business Manager, Environmental Division and Jon Miller

Albemarle Sorbent Technologies Corporation Albemarle Corporation

Keith Moore,

President, Castle Light Energy Corporation

Nathan Schindler,

Product Manager, Combustion Components Associates, Inc.

Mike Widico,

Vice-President Business Development, KC Cottrell,

Inc.

Melissa Patasnick,

Marketing Manger and Joshua Allen, Natronx Technologies, LLC

Peter Spinney,

Director, Marketing & Technology Assessment, NeuCo, Inc.

The webinar on August 14th is free to plant operators and McIlvaine

subscribers. There is a charge for others.

To register for the “Hot Topic Hour”, click on:

http://home.mcilvainecompany.com/index.php/component/content/article?id=675

McIlvaine Hot Topic Hour Registration

On Thursday at 10 a.m. Central time, McIlvaine hosts

a 90 minute web meeting on important energy and pollution control subjects. Power

webinars are free for subscribers to either Power Plant Air Quality

Decisions or Utility Tracking System. The cost is

$300.00 for

non-subscribers.

See below for information on upcoming Hot Topic Hours. We welcome your input

relative to suggested additions.

|

DATE |

SUBJECT |

|

|

||

|

|

August |

||||

|

|

14 |

Industrial Boiler and Cement

MACT Timing and

Compliance Options |

|||

|

|

21 |

MEGA Symposium |

|||

|

|

28 |

Demineralization and

Degasification |

|||

|

|

September |

||||

|

|

4 |

Hot Gas Filtration |

|||

|

|

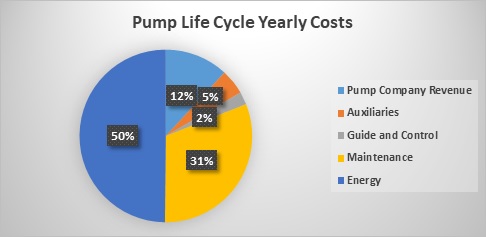

11 |

Power Plant Pumps |

|||

|

|

18 |

Power Water Monitoring |

|||

|

|

25 |

Power Plant Water Treatment

Chemicals |

|||

Click here for the

Subscriber and Power Plant

Owner/Operator Registration Form

Click here for the

Non-Subscribers Registration Form

Click here for the Free

Hot Topic Hour Registration Form

----------

You can register for our free McIlvaine Newsletters at:

http://home.mcilvainecompany.com/index.php?option=com_rsform&formId=5

Bob McIlvaine

President

847 784 0012 ext 112

rmcilvaine@mcilvainecompany.com