|

WELCOME

Weekly selected highlights in flow control, treatment and combustion from the many McIlvaine publications.

|

- Forecasting Valve Purchases by each Major Owner

- Fifty Companies buy Half the Electrostatic Precipitator Systems and Parts

- Frac Sand Plants will spend more than $45 million for Flocculants by 2025

Forecasting Valve Purchases by each Major Owner

Most valves are purchased by large multi-plant companies. It is more important to predict the purchases by these companies than it is to forecast purchases by country. These forecasts are included in

N028 Industrial Valves: World Market.

Sixteen companies home based in France and Germany each spend more than $50 million per year for valves. Five spend over $100 million per year.

|

Valve Purchases by Large Companies

Home Based in France and Germany - 2019

|

|

Company

|

Home

|

Industry

|

$ millions

|

|

Air Liquide

|

France

|

Chemical

|

84

|

|

EDF

|

France

|

Power

|

583

|

|

Engie

|

France

|

Oil & Gas

|

143

|

|

LaFarge Holcim

|

France

|

Stone

|

72

|

|

Sanofi

|

France

|

Pharma

|

50

|

|

Schlumberger

|

France

|

Oil & Gas

|

57

|

|

Total Refineries

|

France

|

Refinery

|

235

|

|

Total SA

|

France

|

Oil & Gas

|

339

|

|

BASF

|

Germany

|

Chemical

|

311

|

|

Covestro

|

Germany

|

Chemical

|

65

|

|

Evonik

|

Germany

|

Chemical

|

73

|

|

Heidelberg

|

Germany

|

Stone

|

36

|

|

Linde

|

Germany

|

Chemical

|

82

|

|

Merck

|

Germany

|

Pharma

|

50

|

|

Uniper

|

Germany

|

Power

|

51

|

The steel industry is a good example of both offshore ownership and centralized purchasing. The world steel industry will spend over $1.7 billion this year for valves, parts, and service. In the case of ArcelorMittal, the majority ownership is by an Indian individual but the decisions regarding valve purchases may be made in Luxembourg which is the company headquarters. ArcelorMittal is a major valve purchaser. Its valve purchases for steel and mining applications are just under $100 million per year of which $84 million is for steel applications.

For more information click on N028 Industrial Valves: World Market or contact Bob McIlvaine at rmcilvaine@mcilvainecompany.com 847 84 0012 ext. 122.

Fifty Companies buy Half the Electrostatic Precipitator Systems and Parts

Sales of electrostatic precipitator (ESP) systems and repair parts for coal-fired power plants will reach $9 billion in 2019. This represents 70 percent of the ESP purchases by stationary sources. Seven companies will account for 44 percent of the purchases by coal-fired power plants and 31 percent of the purchases by all stationary sources.

|

Coal-fired ESP Purchases as Part of $10 Billion 2019 Market

|

|

# Of Corp

|

ESP Capacity For Each MW x 1000

|

Total MW 1000

|

% of Total Coal-fired Installed Base

|

ESP Purchases $ millions

|

% of Total

|

Examples

|

|

7

|

Over 50

|

575

|

44

|

3,100

|

31

|

Big 5 Chinese Corp.

|

|

10

|

10-50

|

150

|

12

|

840

|

8

|

AEP, TVA, Duke, Enel, EON

|

|

15

|

5-10

|

105

|

8

|

560

|

6

|

NRG, Xcel, Tokyo Electric, Chubu Electric

|

|

20

|

3-5

|

80

|

6

|

320

|

3

|

AES, EPDC, RWE, CEZ

|

|

52

|

Sub total

|

910

|

70

|

4,820

|

48

|

|

|

350

|

0-3

|

390

|

30

|

2,100

|

22

|

U.S., Europe, China

|

|

402

|

Total

|

1,300

|

100

|

6,920

|

70

|

|

The five largest Chinese suppliers are among the top seven ESP system operators in the world. These seven companies will buy 31 percent of the ESP products. The next 10 companies, most of whom are U.S.-based, will account for 12 percent of the ESP purchases by power plants and 8 percent of all the ESP purchases by stationary sources.

ESP owners are facing substantial investments to upgrade or replace ESPs to meet new emission limits. These limits ratchet down the allowable emissions. Emissions are measured not only over long periods, but typically each hour. This means that electrodes, rappers and other parts which continue to operate but cause emission increases over time now have to be replaced more often.

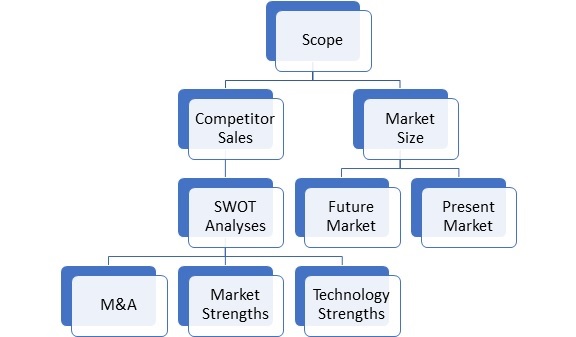

The concentration of ESP purchases by this small group of companies means that suppliers can sell directly throughout the world. There are efficiency, reliability and other unique features which allow suppliers to obtain higher prices and margins. McIlvaine has developed a program to help suppliers focus on the large purchasers. Detailed Forecasting of Markets, Prospects and Projects.

This program combines the following:

N018 Electrostatic Precipitator World Market

42EI Utility Tracking System

44I Power Plant Air Quality Decisions

Industrial Air Plants and Projects

Frac Sand Plants will spend more than $45 million for Flocculants by 2025

Frac sand plants around the world will increase their flocculant consumption over the next five years. Presently 90 percent of the $17 million spent on flocculants is by U.S. based plants. U.S plants will double their purchases by 2025 and other regions will spend more than $9 million.

The two most common flocculants are polyacrylamide and polydimethyldiallyammonium chloride (polyDADMAC). Although other types of flocculants are in use, these chemicals currently make up a majority of the flocculant use. Polyacrylamide anionic flocculants are commonly used to enhance settling of solids in the clarifier associated with the wet plant.

PolyDADMAC cationic coagulants are commonly used to enhance the performance of the belt press associated with wash plants.

There is the need to recycle water in the Permian basin where water is scarce. The growing markets in China and other countries are also in areas of water scarcity. There are increasing quantities of sand used per gallon of oil recovered. Furthermore the cost of extracting oil from shale is proving to be the lowest cost option. Chevron, ExxonMobil and other major gas and oil companies are greatly increasing their shale investments. Argentina is in the early stages of shale development. Saudi Arabia is looking to shale to supply gas. This gas will be used in power plants and will replace the oil presently used.

More details on the markets for flocculants in this and other industries are found in N026 Water and Wastewater Treatment Chemicals: World Market

|