|

WELCOME

Weekly selected highlights in flow control, treatment and combustion from the many McIlvaine publications.

· Dry Scrubber Design-Construct-Guide-Maintain Market to reach $9.6 billion in 2020

· Cement Combust, Flow and Treat (CFT) Market will Exceed $50 billion in 2025

Dry Scrubber Design-Construct-Guide-Maintain Market to reach $9.6 billion in 2020

Traditionally wet scrubbers have been used for removing SO2, HCl and other acid gases. But recently owners have favored the newer dry scrubbing technologies. The capital cost is much lower and there is no wastewater disposal problem. The disadvantage is the higher use of reagents. However with new monitoring and data analytics tools the reagent use can be optimized and the total cost of acid gas capture reduced.

The big beneficiaries are the lime and other reagent suppliers. Their revenues will reach $6.4 billion in 2010.

|

|

Coal Fired Power

$ mil

|

Waste Combustion

$ mil

|

Kilns and Furnaces, Misc.- $ mil

|

|

Hardware And Construction

|

300

|

350

|

420

|

|

Consumables And Repair Parts

|

200

|

280

|

320

|

|

Lime, Sodium, Trona

|

1600

|

2100

|

2700

|

|

IIoT And Remote O&M Potential

|

360

|

460

|

500

|

|

Total -Design-Construct-Guide-Maintain

|

2460

|

3190

|

3940

|

|

Total

|

9590

|

The total design-construct-guide-maintain market will exceed $9 billion in 2020. The largest purchase will be the reagent. Increasingly process management software, wireless transmitters and data analytic will be utilized to most efficiently operate these systems. Some combination of SO2, HCl, SO3 and mercury often needs to be reduced. Multiple reagents e.g. lime and activated carbon may be needed.

There are a range of dry scrubbing technologies being utilized. Dry sorbent injection is the least capital intensive. Other technologies utilize vessels. One vessel type is the spray drier, another is a fluidized bed. A third design utilizes concurrent flow and recirculation of a portion of the reagent.

Fabric filters are typically used to capture the reacted product as well as the particulate.

Electrostatic precipitators are less frequently used due to their lower absorption efficiency.

Applications include coal fired boiler, cement, glass, biomass, steel and waste to energy plants.

More details on the automation of these systems is found in N031 Industrial IOT and Remote O&M

Detailed forecasts by country for all applications except coal fired boiler are found in N008 Scrubber/Adsorber/Biofilter World Markets

Forecasts for dry scrubbers in coal fired boiler applications are found at N027 FGD Market and Strategies

For more information contact Bob Mcilvaine at rmcilvaine@mcilvainecompany.com 847 784 0012 ext. 122.

Cement Combust, Flow and Treat (CFT) Market will Exceed $50 billion in 2025

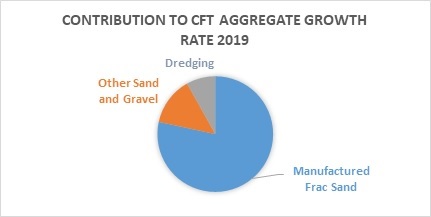

The cement industry has invested $400 billion to produce 4 billion tons of cement per year. Cement revenues are likely to grow at 6 %/yr over the next six years to reach $700 billion in 2025. Annual expenditures for combust, flow and treat products and services will exceed $50 billion per year.

The cement industry is one of the largest purchasers of air pollution control equipment and services. Historically plants needed only to comply with particulate emission regulations. Now HCl, SO2, VOCs and mercury are being regulated. The kerogen in the feed limestone along with other constituents vary within individual limestone deposits. As a result the quantity of pollutants to be removed varies from hour to hour. This is a challenge to operators.

Cement plants have transitioned to dry processing over the years. As a result the major purchases, are kilns, granular material handling and sizing, fans, dampers, dust collectors, and storage facilities. The valve purchases are mostly for air control purposes. Analyzer needs are to measure free flowing solids. The requirements for pumps and liquid analyzers are minimal.

The large cement producers operate many plants Holcim- Lafarge operates 220, Heidelberg operates 141 and Cemex operates 61. The fact that companies operate a number of plants in remote locations makes it desirable to centralize total cost of ownership evaluations of combust, flow, and treat equipment. It also makes IIoT and Remote O&M very cost effective.

The world cement industry is anticipating volume increases of 6% per year in the next three years versus less than 3% per year over the last three years. Profitability in 2018 was down due to overcapacity, rising cost of fuel and other factors.

The industry is steadily increasing its investment in IIoT. Instrumentation can instantly communicate the particle size distribution to the process management system which can then adjust the grinding regime to balance energy consumption and cement product quality.

The cost of capturing particulate is being reduced with bag designs which require less energy consumption. The need to also remove NOx and VOCs can be met with catalytic bags. Dry sorbent injection can be used ahead of the catalytic filter to remove acid gases. This reduces capital cost and energy consumption as compared to separate removal devices.

The cement industry can contribute to total pollution reduction with the combustion of sewage sludge, and other waste materials. This reduces the fossil fuel energy requirement and also results in better air pollutant capture as compared to technology often used for incinerating waste. The use of multiple fuels in varying amounts creates additional operational challenges and further justifies the investment in IIoT.

The industry continues to be dominated by China. India is the next largest producer. Forecasts of CFT purchases by the cement industry are provided in the following reports

N007 Thermal Catalytic World Air Pollution Markets

N008 Scrubber/Adsorber/Biofilter World Markets

N018 Electrostatic Precipitator World Market

N021 World Fabric Filter and Element Market

N027 FGD Market and Strategies

N035 NOx Control World Market

N056 Mercury Air Reduction Market

N031 Industrial IOT and Remote O&M

5AB Air Pollution Management

N026 Water and Wastewater Treatment Chemicals: World Market

N024 Cartridge Filters: World Market

N020 RO, UF, MF World Market

N019 Pumps World Market

N006 Liquid Filtration and Media World Markets

N005 Sedimentation and Centrifugation World Markets

|