|

WELCOME

Weekly selected highlights in flow control, treatment and combustion from the many McIlvaine publications.

· Combust, Flow, and Treat Technology is a Major Geopolitical Force

· Fracking Market Perspective

· Value of Weir Pump and Valve Division and Colfax Howden Fan and Compressor Division positively impacted by Reservoir of Subject Matter Ultra Expertise

Combust, Flow, and Treat Technology is a Major Geopolitical Force

Improvement and adoption of advanced combust, flow and treat technologies is changing the geopolitical order. North Korea hopes to avoid energy dependence by converting its coal to liquid and gaseous fuels. Oil prices in the U.S. might be $150/barrel if it were not for oil shale fracturing. China has a big coal to liquids/gases program designed to reduce LNG and oil imports. China has bigger shale reserves than the U.S. It realizes that even though the domestic shale presents more difficult challenges than some shale regions in the U.S it can become competitive by developing better flow and treat technologies.

China has an economy equal to the U.S. It is growing at nine percent per year compared to less than three percent in the U.S. It is the largest operator of coal fired boilers in the world with four times the capacity of the U.S. coal fired fleet. However, its lack of indigenous liquid and gaseous fuels has been a deterrent to growth.

North Korea presently exports 25 million tons of coal. It would need to liquefy only 6 million tons to meet its needs.

Because of the 1974 oil embargo, the U.S. accelerated its coal to liquids program. When the embargo was lifted the program was eliminated. China has taken advantage of everything the U.S learned and has a large number of coal to chemical complexes. One plan involves a $30 billion pipeline constructed by Sinopec to deliver clean coal gas from Northern China to cities throughout the country.

Homeowners and industry have switched to gas in anticipation of a low cost supply. Actual usage is up 19 percent in 2018 which far exceeds the 10 percent predicted. Much of the new demand will be served by imported LNG. Exxon Mobil Corp is placing big bets on China’s soaring liquefied natural gas (LNG) demand, coupling multi-billion dollar production projects around the world with its first mainland storage and distribution outlet.

Its gas strategy is moving on two tracks: expanding output of the super-cooled gas in places such as Papua New Guinea and Mozambique, and creating demand for those supplies in China by opening Exxon’s first import and storage hub, according to an Exxon manager and people briefed on the company’s plans.

The program is being expanded to serve local industrial facilities. Air Products and Chemicals will build, own and operate an air separation, gasification and gas cleanup processing facility in Hohhot, China. The plant will supply syngas to Jiutai New Material Co.

“This facility will be the first plant 100 percent owned by Air Products and is a prime example of a gasification strategy focused on building, owning and operating the facilities and supplying syngas under long-term onsite contracts," said Air Products Chairman, President and CEO Seifi Ghasemi.

Air Products will invest about $650 million in the facility and will receive a fixed monthly fee under the long-term contract.

The company said the project is expected to be ready for operation in the fourth quarter of fiscal year 2021 and add more than $0.20 to Air Products' earnings per share beginning in fiscal year 2022.

In the past fuels were created by drilling holes in the right places and watching the oil or gas gush out. Coal liquefaction and gasification , conversion of gas to LNG, and shale fracturing all require combust, flow and treat components to withstand extreme temperatures, corrosion, and abrasion. The cost of the produced fuels is dependent on these components.

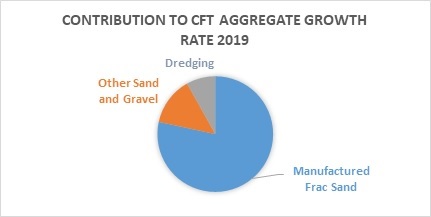

Some of the biggest current recent improvements are in shale technology. The operating life of pumps used to inject slurry at high pressures has been extended with noticeable cost improvements. The proppants needed to fracture shale with extended horizontal drilling are being improved. One of the cost reductions has been to manufacture high quality proppants from locally available sand rather than rely on natural sand from the upper Midwest. These improvements are making the U.S. a low cost producer.

Low cost needs to be more closely defined. In the case of tight oil and gas from the U.S. the term is straight forward. However, for countries where oil and gas is easily extracted by natural pressures, the cost is a political calculation. The selling price has to be high enough to support the population. In the past Mid East suppliers have controlled pricing to drive out competitors. They no longer can do so thanks to the U.S. combust flow and treat technologies.

Energy related combust flow and treat markets are covered in

N007 Thermal Catalytic World Air Pollution Markets

N008 Scrubber/Adsorber/Biofilter World Markets

N018 Electrostatic Precipitator World Market

N021 World Fabric Filter and Element Market

N035 NOx Control World Market

N031 Industrial IOT and Remote O&M

N028 Industrial Valves: World Market

N026 Water and Wastewater Treatment Chemicals: World Market

N024 Cartridge Filters: World Market

N020 RO, UF, MF World Market

N019 Pumps World Market

N006 Liquid Filtration and Media World Markets

N005 Sedimentation and Centrifugation World Markets

Markets and projects for oil, gas, and refining are covered in

N049 Oil, Gas, Shale and Refining Markets and Projects

For more information contact Bob McIlvaine at rmcilvaine@mcilvainecompany.com

Fracking Market Perspective

Hydraulic fracturing has increased in many parts of the world as other energy sources such as coal bed methane production stagnates or decreases. Shale gas fracking provides a valuable source of energy for countries that effectively make use of it. However, due to a variety of geographical, political, and technological factors, certain countries and regions find fracking more accessible and available than others.

The United States remains a leader in fracking. However, according to the 2018 BP Energy Outlook, while the U.S. will continue to lead production of shale gas, it will not be as significant in exports due to its own high consumption needs. U.S. oil and gas production is projected to increase to about 18 percent of global production by 2040, up from 12 percent in 2016. U.S. oil and gas exports, however, are projected to only make up about nine percent of the global market by 2040.

The U.S. produces the most natural gas. According to the 2018 BP Energy Outlook, In 2040, the U.S. is projected to produce 24 percent of the gas produced worldwide. Russia is projected to produce 14 percent of gas produced worldwide and, as the largest exporter of oil and gas, is projected to export 780 Mtoe of gas and oil in 2040 whereas the U.S. is projected to export 360 Mtoe of gas and oil in 2040

Saudi Arabia, the second-largest producer of oil, is projected to control about 13 percent of the oil production market, by comparison. The Middle East and CIS are each projected to produce about 20 percent of the global gas in 2040.

In 2040, BP projections indicate that gas will account for around 25 percent of energy globally. At that time, natural gas is projected to account for a greater share of energy than coal and a similar share as oil. Natural gas is expected to increase by 1.6 per annum through 2040.

According to EIA data, as of January 1, 2016, the U.S. has 2,462.3 trillion cubic feet of technically recoverable shale resources, most of which are located onshore. Drilling costs for shale gas are expected to decrease by 1 percent per year in the U.S. Actively developing areas are expected to increase by 1 percent per year and areas that have yet to be developed are expected to increase by 3 percent per year in the U.S.

IEA data reflects the dominance the U.S. has maintained in fracking. Shale gas production in the United States has increased significantly from 23.092 billion cubic meters in 2000 to 378.771 billion cubic meters in 2014. Shale gas production in the U.S. surpassed coal bed methane production by 2007 and surpassed tight gas production in 2010.

In recent years, other countries have made strides in fracking, utilizing shale gas as an effective energy source to compensate for decreases or stagnation of other energy sources. According to a Sept. 2018 MarketWatch press release, hydraulic fracturing will increase greatly in the coming years, with Canada’s production of shale gas is expected to grow. Argentina’s hydraulic fracturing is also projected to increase, partly due to a political environment designed to foster commercial growth.

According to IEA data, shale gas production in Argentina has risen from 0.002 billion cubic meters in 2011 to 0.305 billion cubic meters in 2014. In comparison, the total unconventional gas production has fallen from 3.482 billion cubic meters in 2011 to 2.511 billion cubic meters in 2014.

Shale gas production in Canada has risen from 0.803 billion cubic meters in 2009 to 5.935 billion cubic meters in 2014. Tight gas production and total unconventional gas production have steadily increased while coal bed methane production has stagnated during the same time period.

Newer to the shale gas market, Poland began shale gas production in 2014, producing 0.001 billion cubic meters. Over the course of the previous decade, tight gas production and total unconventional gas production have increased while coal bed methane production has remained consistently about 0.250 billion cubic meters.

In an October 2018 Wall Street Journal article, Russell Gold states that due to international political developments including Iranian sanctions, as well as limits on resource availability, shale production will not continue to meet increased demand, resulting in increased prices and less market stability. The increase in shale production over the past decade has served as a buffer against oil market instability, but this cannot be counted on indefinitely.

According to an April 2018 Hexa Research market research report, the market for hydraulic fracturing will rise to 13.91 billion USD by 2025.

According to an October 2018 S&P Global article, hydraulic fracturing in the UK, specifically in Northwest England, is taking place for the first time in seven years. This shale gas production, if successful, could reduce the high amount of gas imports necessary for the UK to meet its energy demands. The UK government’s current policies are in favor of shale gas production after combining three separate regulators into one.

In terms of equipment, according to an April 2017 Grand View Research market research report, horizontal drilling is surpassing vertical drilling due to its greater access to gas and oil as well as its efficiency. Breakers and cross-linkers are also utilized to a greater degree in stabilizing fracking fluid in a variety of environmental conditions.

The use of compressor stations is likely to increase because their placements are periodically necessary along the increasing pipeline and because they are effective in separating the gas from outside materials. Gas processing plants are also likely to increase as they increase remove outside materials and elements from the gas.

Fracking markets globally remain largely dependent on the conditions and circumstances of each of the individual nations involved in the process. That being said, fracking is likely to increase over the following years for the countries that produce and export oil and gas. The U.S. in particular is likely to continue to dominate the industry as its production of such energy allows the country to decrease dependence on energy imports.

Author, Hailey Ardell

Contributing Editor

Value of Weir Pump and Valve Division and Colfax Howden Fan and Compressor Division positively impacted by Reservoir of Subject Matter Ultra Expertise

Weir has its pump and valve divisions up for sale while Colfax is offering to sell its Howden air and gas handling equipment division. Both of these companies have unique process expertise in difficult applications. The challenges in power, mining, steel, and other industries are abrasion, corrosion, and temperature excursions.

It can be argued that the value of this retained expertise has not been fully leveraged. However this will change in the new digital world. IIoT and Remote O&M will be empowered by the Industrial Internet of Wisdom (IIoW). This initiative will connect people, knowledge and things. Most importantly individuals such as specialists at pump, valve, and fan companies will utilize IIoW to create a new level of wisdom. They will become subject matter ultra-experts (SMUEs). This breed will not only advise on the initial purchase decision but throughout the life of the component.

The purchase decision is the most important in the life of the component. Many wastewater plants have purchased one large aeration blower to handle all conditions including wet weather. Since the normal needs are less than 50 percent of wet weather conditions, the blower operates inefficiently. The energy consumption of the large inefficient blower will substantially impact treatment costs. Initially two blowers should have been purchased with one running normally and two in wet weather.

Over the life of the plant repairs and replacement will cost much more than the new blower. Energy consumption during the life of the plant will be the biggest cost. In most countries the cost is 1.5 to 2 times that in the U.S. So minimizing energy consumption is critical. Operation of the blower in the optimum manner is the best way to reduce energy consumption. Systems which control the blower based on ozone levels in the wastewater optimize performance.

Designing pumps for FGD recycle slurry is difficult due to the very large size, abrasive conditions and corrosion potential. The FGD scrubber designs differ. One type requires twice the slurry but less pressure drop than the other. The spray tower flow is so large that only a few pump companies can supply the slurry pumps. The rod deck design can utilize less expensive pumps while only slightly impacting fan cost. So it is important to understand the capabilities of pump and fan suppliers. The successful system will be one with the collaboration of both the pump and fan SMUEs.

For equipment suppliers such as Weir and Colfax-Howden it will be difficult to leverage this subject matter ultra-expertise unilaterally. These companies can collaborate with suppliers who design, build and then virtually operate and maintain the systems. Alternatively they can acquire or be acquired by companies or investment groups who are offering the total systems solutions capability.

Historically the equipment providers have outperformed the system suppliers in terms of long term growth and profitability. However IIoT empowered by IIoW will change the dynamics. System suppliers in the past have made very high profits in the boom times and lost money during the slow downs. With total solutions the sales revenue will become consistent. More importantly subject matter ultra-expertise has a higher R.O.I. than any other product.

Therefore the opportunities to purchase the Weir and Colfax –Howden divisions should be considered in light of how the very valuable subject matter ultra-expertise will be leveraged.

Details of this analysis are found in N031 Industrial IOT and Remote O&M

For more information contact Bob McIlvaine at rmcilvaine@mcilvainecompany.com 847 784 0012 ext. 122

Click here to un-subscribe from this mailing list

|