|

· CHP will be an Important Component of a Net Zero Policy

· Bottoms Up Marketing Strategy for High Performance Pumps

CHP will be an Important Component of a Net Zero Policy

Combined heat and power can make a big contribution to achieving net zero CO2 emissions.

When applied with coal firing CHP has lower net CO2 emissions than a gas turbine as shown in the following table.

Many CHP plants are fired with gas turbines or reciprocating engines. Here is a DOE analysis for the U.S.

Many of the CHP plants are using biomass. So their net contribution is negative. This is due to the reduction in CO2 emissions from facilities being heated or cooled.

A few CHP plants are moving forward with carbon sequestration. This makes them the most carbon negative option. Whereas wind and solar are net zero BECCS with CHP would be a negative 1.3 tons of CO2 per unit of energy.

A coal plant is plus 1. If it is converted to biomass and CCS it would be reducing CO2 at a faster rate than it formerly was producing. So in 20 years converted plants could reduce CO2 emissions by the amount they emitted in the last 28 years.

GE predicted a few yeas ago that CHP would replace large scale generation. The basis for this idea is the huge increase in efficiency and the elimination of small CO2 sources such as gas heaters.

The CHP Alliance held a conference on hydrogen and CHP last week. Speakers from Siemens and other large turbine companies were optimistic about hydrogen fueled CHP.

Another potential is commercial greenhouses. The 12 largest in the U.S. have a 680 MW capacity. Most commercial growers use some of the CO2 produced to inject into the ambient air in the greenhouse. At 1000 ppm many crops grow up to 40% faster.

In Europe biomass fired CHP plants are supplying a large amount of power and heat. Several have also added CO2 capture and sequestration.

CHP plants around the world can be identified and the potential analyzed. They all have detailed permits with information not only on the boilers but also the processes. Any process which has the potential to emit air or water pollutants is identified.

Databases and project tracking are found at http://home.mcilvainecompany.com/index.php/databases/42ei-utility-tracking-system

Bottoms Up Marketing Strategy for High Performance Pumps

A marketing strategy focusing on the specific needs of each customer can double EBITA for suppliers of high performance pumps and improve operations for pump purchasers.

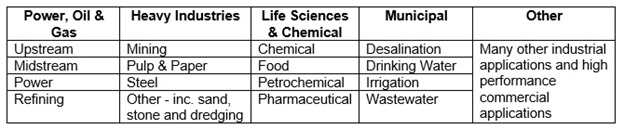

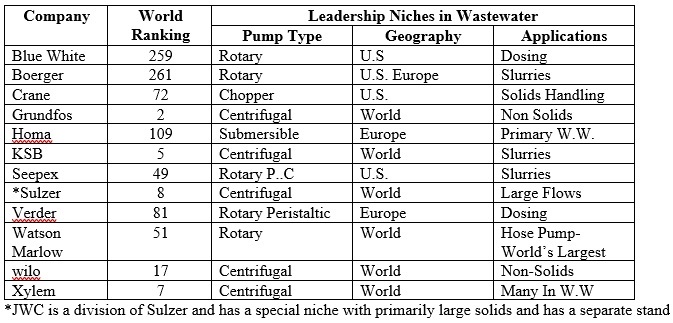

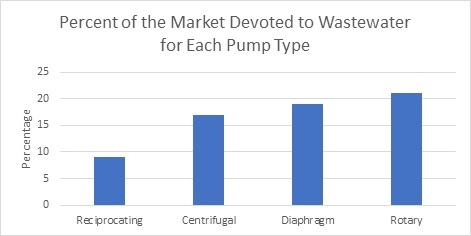

7500 companies will each spend more than $1 million for pumps this year. Sixty percent of the purchases will be based on performance and not just price and delivery. These pumps will be used in hundreds of unique applications.

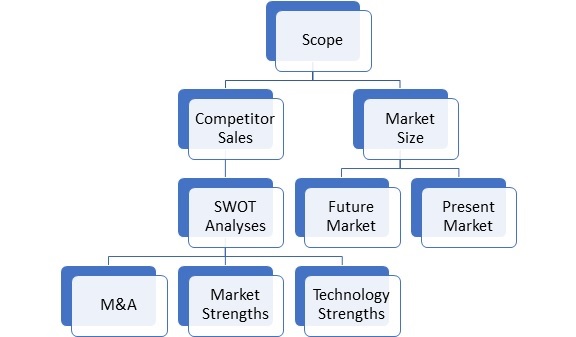

Decisions will be based on dozens of total cost of ownership (TCO) factors. Some are unique to an application. Others such as electricity are unique to a location. There are many different pump types with hundreds of unique features offered by manufacturers. As a result there are many competitors and many analyses needed of the unique pump features of each. The bottoms up strategy has to iterate all of these factors.

A bottoms up marketing strategy can double EBITA from the average of less than 15% to more than 30%. In one respect it is simple. Just determine cost of ownership factors for each plant and application and then supply the best pump for that specific need.

In another respect this program requires a huge amount of knowledge. Fortunately this knowledge is being made accessible http://home.mcilvainecompany.com/index.php/30-general/1658-holistic-content-marketing-program

The starting point is the 272,000 forecasts in the pump report http://home.mcilvainecompany.com/index.php/47-uncategorised/news/1671-nr2657

This report also has the forecast of purchases by the top 100 companies. More effort is then needed to calculate the market for others and to determine the TCO factors.

One hundred thirty-three companies will each spend more than $50 million for pumps this year. This warrants a special direct effort for each one of them.

Seven hundred thirty three companies will spend more than $10 million on pumps this year. A direct effort or at least careful tracking of the success at each of these plants is warranted.

One thousand seven hundred thirty-three companies will spend $5-10 million for pumps. It is recommended that these companies at least be identified individually and decisions then made as to how to approach them.

Four thousand seven hundred thirty-three companies will spend $1-10 million for pumps this year. At the very least the cumulative projected purchases of these companies should be determined for each sales territory.

For the largest pump companies it will be advantageous to pursue a large portion of these opportunities. However, the 30% EBITA is more readily attainable by focusing on special niches. An example is IDEX. Here is the example for a dozen Japanese prospects for IDEX

http://home.mcilvainecompany.com/index.php/other-services/free-news/news-releases?id=1488:nr2499&catid=7:news

The potential EBITA from any specific application at any plant can best be determined by a cost of ownership analysis taking into account the unique aspects of the industry, plant, and application. http://home.mcilvainecompany.com/index.php/other-services/free-news/news-releases/47-uncategorised/news/1668-nr2654

The bottoms up strategy is successful to the extent that it improves the operations of the pump purchasers. So both pump supplier and customer will benefit from this approach.

Bob McIlvaine can answer your questions. You can reach him at 847 226 2391 or rmcilvaine@mcilvainecompany.com

|