|

· Complexities of Selling Flow and Treat Products to Food Processors

· Pump Forecasts for Every Market Niche

· The Merits of Indoor Mask Wearing

Complexities of Selling Flow and Treat Products to Food Processors

The food industry has thousands of market niches where there are unique cost of ownership factors for flow and treat products. Soft drink flow and treat product decisions would be different from those for sugar.

Cane sugar and beet sugar have processes which are unique. However, it is helpful to start with ten major segments and then move on to sub segments.

The major differences are in the process segments of the plants. There are less differences in treating utility water, wastewater and cooling. Many food companies have their own power plants. The flow and treat product cost of ownership would be mostly tied into boiler fuel types rather than the type of food product.

The flow and treat market is $20 billion/yr and growing at a CAGR of 5%.

The food industry is moving toward extensive use of IIoT. McIlvaine has provided details at http://home.mcilvainecompany.com/images/Industry_End_Uses/Food.pdf

The type of flow and treat product needed can be determined by segmenting the market into utilities, waste treatment, cooling, and various general processes such as drying or purification. The broad segmentation of flow and treat is filtration/separation; air pollution control, pumps, valves, and IIoT. This includes instruments and controls for gases, air, water, liquids and free flowing solids.

|

Process

|

Sub process

|

Filt & Sep

|

APC

|

Pumps/Valves

|

IIoT

|

|

Utility

|

Heat and Power

|

|

FF, SR, PP

|

P/V

|

x

|

|

Utility

|

Water

|

TC, S C M

|

|

P/V

|

x

|

|

Waste Treat

|

Incinerate

|

|

FF, SR, PP, TO

|

P/V

|

x

|

|

Waste Treat

|

Water

|

TC. S C L M

|

S C

|

P/V

|

x

|

|

Cooling

|

Wet

|

TC, S C L

|

|

P/V

|

x

|

|

Process

|

Size Reduction Dry

|

Screen

|

FF

|

V

|

x

|

|

Process

|

Size Reduction Wet

|

Screen

|

|

P/V

|

x

|

|

Process

|

Pneumatic Conveying

|

|

FF

|

V

|

x

|

|

Process

|

Purify

|

S C L M

|

FF, SR

|

P/V

|

x

|

|

Process

|

Ferment

|

S C L M

|

|

P/V

|

x

|

|

Process

|

Dry

|

|

FF, SR

|

P/V

|

x

|

|

Process

|

Mix

|

S C L M

|

FF, SR

|

P/V

|

x

|

|

Heat

|

Heat Ex

|

|

|

P/V

|

x

|

See the chart below for explanation of these abbreviations

This has implications for flow and treat suppliers who want to sell products based on the lowest total cost ownership.

· More solid evidence of the cost of ownership is available from the data analysis

· The cost of ownership of an individual product is a function of how it operates in a system. A superior valve which cannot be as easily controlled as that of a competitor is at a disadvantage.

· The routes to market are impacted. A system supplier with the ability to remotely monitor and advise the owner can be in a position to provide the replacement flow and treat products.

There are a relatively small number of companies with such a strong presence in the world wide food industry that they impact the market for all flow and treat products.

Alfa Laval and GEA were founded based on cream separators. Their food presence is strong compared their presence in other industries. Danaher and Andritz have moved into the food space but their greatest strength is in other industries.

The company strengths regarding specific flow and treat products are indicated below. (1) indicates they are a market leader. (2) indicates that they are in the top 10 and (3) indicates that they are in the top 20.

|

Full Name

|

Abbreviation

|

Andritz

|

GEA

|

Danaher

|

Alfa Laval

|

|

Heat/Power

|

|

1

|

2

|

|

|

|

Incinerate

|

|

1

|

|

|

|

|

Cool

|

|

|

|

|

|

|

Size Reduc. Dry

|

|

2

|

2

|

|

2

|

|

Size Reduc. Wet

|

|

1

|

2

|

|

2

|

|

Conveyor

|

|

2

|

1

|

|

1

|

|

Dryer

|

|

1

|

1

|

|

1

|

|

Mixer

|

|

|

1

|

|

1

|

|

Ferment

|

|

|

1

|

1

|

1

|

|

Heat Ex

|

|

1

|

1

|

|

1

|

|

Treatment

Chemical

|

TC

|

|

|

1

|

|

|

Sed

Centrifugation

|

S

|

1

|

1

|

|

1

|

|

Cartridge

|

C

|

|

|

1

|

|

|

Cross Flow

Membrane

|

M

|

1

|

2

|

1

|

2

|

|

Liquid Macro

Filtration

|

L

|

1

|

2

|

|

2

|

|

Fabric filter

|

FF

|

1

|

2

|

3

|

|

|

Scrubber

|

SR

|

2

|

2

|

|

2

|

|

Precipitator

|

PP

|

1

|

3

|

|

|

|

Thermal Oxidizer

|

TO

|

|

|

|

|

|

IIoT

|

|

2

|

2

|

1

|

2

|

|

Pump

|

P

|

1

|

1

|

|

1

|

|

Valve

|

V

|

2

|

1

|

|

1

|

These four companies supply process equipment as well as flow and treat products. GEA is a leader in spray driers. Andritz offers several dryer types. Alfa Laval is a major heat exchanger supplier.

Their strengths relative to specific flow and treat products differ considerably. Danaher acquired Hach and is the only one of the four companies with a wide range of measurement devices.

Alfa Laval and GEA are by far the market leaders in food centrifuges. But their market share is less than 15%. This means that pump and valve suppliers still have 85% of the OEM market to pursue. Also since much of the pump and valve market is replacement, there is opportunity in the aftermarket.

McIlvaine offers flow and treat market forecasts for each of the products listed above. Details are found under markets at the top of the page at www.mcilvainecompany.com

Content Marketing support based on lowest total cost of ownership is available and explained at http://home.mcilvainecompany.com/index.php/30-general/1658-holistic-content-marketing-program

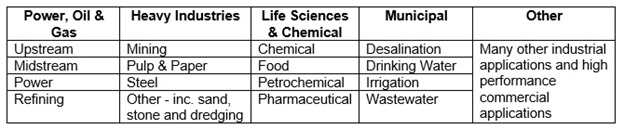

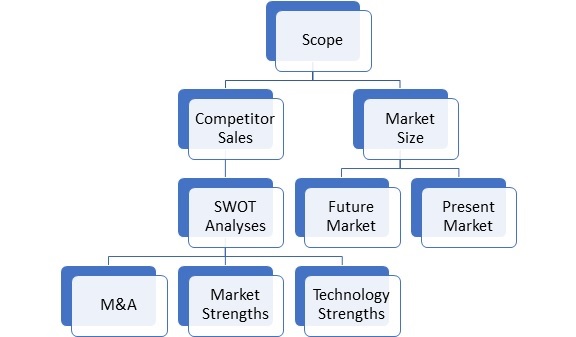

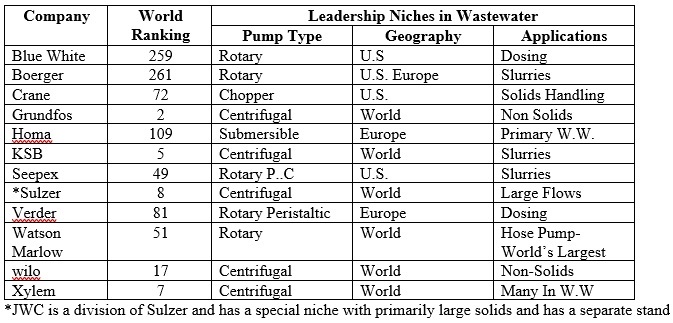

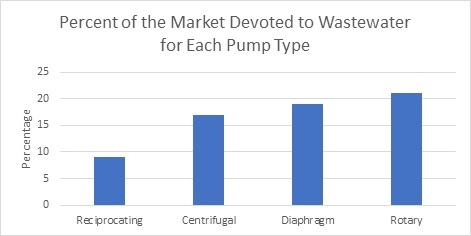

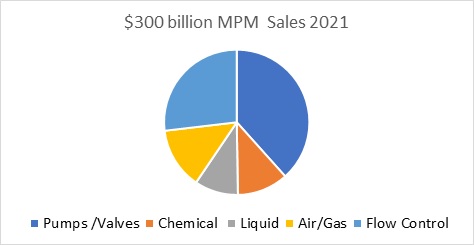

Pump Forecasts for Every Market Niche

Why has the Pump World Market Report expanded to include 272,000 individual forecasts and many hundreds of thousands of additional aggregates?

The reason is that each number represents a unique combination of total cost of ownership (TCO) factors.

For each pump type, there are forecasts for 80 countries and sub regions further segmented by 17 applications. Forecasts are provided for future years through 2025 and historical revenues from 2016.

Now there is further segmentation by four performance factors.

The performance segments are general, severe, critical and unique. Each has a different set of TCO factors.

Profit is maximized by focusing on the niches where the lowest TCO can be achieved. For most companies, these niches are even smaller than provided in the basic report.

The major pump types can be further divided into many sub segments.

The 17 industries each have individual segments with unique TCO factors. Large countries such as the U.S. often need to be segmented by State or Province.

McIlvaine can provide these more detailed forecasts to supplement the basic report

Details on the basic report are found at:

http://home.mcilvainecompany.com/index.php/markets/water-and-flow/n019-pumps-world-market

Bob McIlvaine can answer your questions at 847 226 2391 or rmcilvaine@mcilvainecompany.com

The Merits of Indoor Mask Wearing

The chances of dying from COVID over the last year were 0.17%. Your chances of dying in a car accident were 1/20 of that number or 0.008%.

We could avoid riding in cars but the quality of life benefits outweigh the risks. With a risk level of COVID continuing throughout your life you statistically will lose 14 years of life. In contrast avoiding automobile travel would only add 6 months to your statistical life. In principle people could choose solitary confinement and a rigid health regime and live to be 100. But no one would choose this option compared to living to 80 and enjoying life.

Before the Delta variant became dominant and while we thought we could achieve the 70-80% totally vaccinated rate the expectation was that we would reduce the risks to less than 6 months of life reduction.

We now have to assess the situation in light of the variant and half the population not being vaccinated. There is one risk for vaccinated people and one for unvaccinated. For the unvaccinated the potency of the Delta variant offsets the benefits of the 50% vaccination rate.

This means that in an indoor setting the unvaccinated will continue to face a statistical life reduction of 14 years. The vaccinated person has 90% protection so without masks he still faces a risk of 1.4 year life reduction.

Another way to look at this is by living a normal life rather than one in solitary you lose 20 years. Another 1.4 years is not an enormous amount. However, the 20 year sacrifice covers all the good food, social activity, and benefits of modern living.

It would be a small comparative reduction in life quality to wear a highly efficient mask in public indoor settings. This would add another 90% in protection and reduce the risk to 0.14 years.

Normal pleasures reduce life expectancy from 100 to 80. But this added risk for the unvaccinated reduces expectancy to 66 years. On the other hand, if you are vaccinated and wear a mask indoors and in public spaces you only reduce life expectancy by two months.

This is a minimal risk and should not impact normal business and social activity for those who take the precautions. For the unvaccinated it will be important to mandate masks which would also bring down risks to the 1.4 year loss level.

This comparison has been based on a whole life led at a given risk level. So the 20 years of normal life lost is an accumulation of thousands of desserts, years of driving, and many other hours of enjoyment.

If one focuses instead on whether to attend a single event such as a wedding or parade a different picture is created. The risk could be 800 times greater than that of a normal day. Some events are worth the high risk. Millions of soldiers have died with this belief. Astronauts willingly take high risks.

A complicating factor is risk to others. Small children cannot be vaccinated and are at risk if adults are not vaccinated.

The risks of COVID are continually assessed in Coronavirus Technology Solutions. It covers the impact of masks and air filters http://home.mcilvainecompany.com/index.php/databases/82ai-coronavirus-market-intelligence

Custom consulting is also available. Bob McIlvaine can answer your questions at 847 226 2391.

|